Key Insights

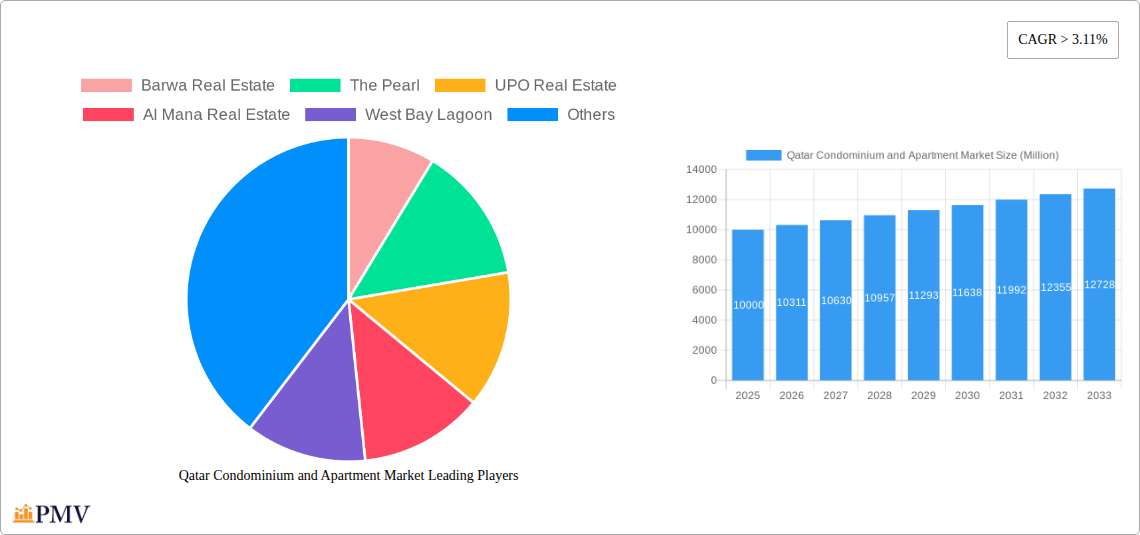

The Qatari condominium and apartment market, currently valued at an estimated $X billion in 2025 (assuming a reasonable market size based on a 3.11% CAGR from a starting point in 2019), is projected to experience robust growth, exceeding a CAGR of 3.11% through 2033. This expansion is fueled by several key drivers. Firstly, Qatar's burgeoning population, driven by both its economic growth and preparations for major events like the FIFA World Cup, necessitates a significant increase in housing units. Secondly, the influx of foreign investment and ongoing infrastructural development projects further stimulate demand for residential properties. Finally, government initiatives to enhance the quality of life and attract skilled professionals contribute to the market's upward trajectory. Key players like Barwa Real Estate, The Pearl, and Qatari Diar Real Estate Company are shaping the market landscape through the development of diverse projects, catering to a range of budgets and preferences. Growth is particularly evident in key cities like Doha and Al Wakrah, though the "Other Cities" segment also exhibits considerable potential.

However, certain factors could potentially restrain market growth. These include fluctuating global oil prices, which can affect the overall economic climate, and the availability of affordable housing options for the lower-income segments of the population. Furthermore, stringent building regulations and the high cost of construction materials may pose challenges to developers. Despite these restraints, the long-term outlook for the Qatari condominium and apartment market remains positive, driven by sustained economic growth and a growing population requiring housing. Market segmentation strategies focusing on specific demographics and localities will prove crucial for developers to capitalize on the market's growth potential. The strategic focus on sustainable building practices and affordable housing options will become critical for long-term market success.

Qatar Condominium and Apartment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar condominium and apartment market, covering the period from 2019 to 2033. It offers valuable insights into market structure, competitive dynamics, industry trends, and future growth potential, equipping investors, developers, and industry professionals with the data needed to make informed decisions. The report utilizes data from the historical period (2019-2024), with the base year set at 2025 and forecasts extending to 2033. Market values are expressed in Millions.

Qatar Condominium and Apartment Market Market Structure & Competitive Dynamics

The Qatar condominium and apartment market exhibits a moderately concentrated structure, with key players like Barwa Real Estate, The Pearl, UPO Real Estate, Al Mana Real Estate, West Bay Lagoon, Mazaya Real Estate Development, United Development Company, Gulf Avenues Real Estate, Qatari Diar Real Estate Company, Ezdan Holding Group, and Al Asmakh Real Estate holding significant market share. However, the market also features a number of smaller developers and investors, contributing to a dynamic competitive landscape.

Market share data indicates that Barwa Real Estate and Qatari Diar Real Estate Company command the largest shares, collectively accounting for approximately xx% of the market in 2024. The remaining share is distributed among other major players and numerous smaller developers.

Innovation within the sector is driven by technological advancements in construction techniques, smart home technologies, and sustainable building practices. The regulatory framework, while generally supportive of real estate development, is subject to ongoing evolution. Product substitutes, such as villas and townhouses, exist but cater to a different segment of the market. End-user trends show a growing preference for luxury apartments in prime locations, with strong demand for high-quality amenities and sustainable features. M&A activity in recent years has been moderate, with deal values totaling approximately xx Million in the period 2019-2024. Key drivers for M&A activity include the consolidation of market share and access to new technologies and expertise.

Qatar Condominium and Apartment Market Industry Trends & Insights

The Qatar condominium and apartment market is poised for significant growth, driven by several key factors. The country's robust economy, fueled by its substantial natural gas reserves and diversification efforts, is a major growth catalyst. Furthermore, the government's commitment to infrastructure development, including substantial investment in transportation, utilities, and public services, creates a favorable environment for residential real estate development. The influx of foreign investment, particularly in sectors like tourism and hospitality, also significantly increases demand for residential properties.

The Qatar World Cup in 2022 significantly impacted market dynamics, leading to a surge in construction and development activities, boosting both sales and rental markets. The long-term impact of mega-events like the World Cup contributes to growth, attracting both short-term and long-term residents. The strong population growth in Qatar is expected to further drive up demand for rental and owned accommodation. The CAGR for the market is projected at xx% from 2025 to 2033, and market penetration of luxury apartments is expected to reach xx% by 2033. The evolving consumer preference for sustainable and technologically advanced living spaces influences the design and development of new projects.

Dominant Markets & Segments in Qatar Condominium and Apartment Market

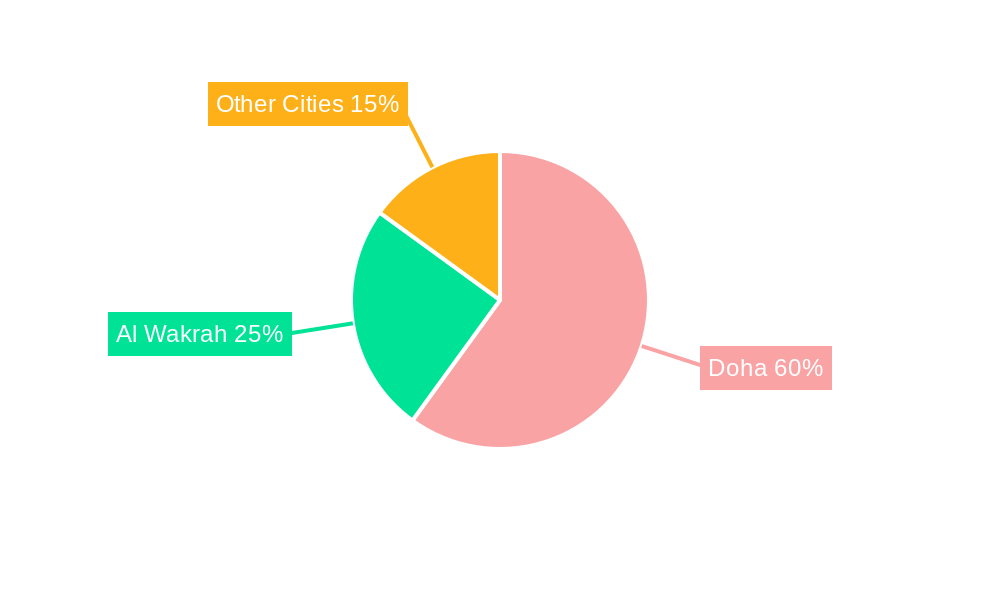

The Doha region commands the largest share of the Qatar condominium and apartment market.

- Key Drivers for Doha's Dominance:

- Economic Center: Doha is the economic and commercial hub of Qatar, attracting a significant influx of residents.

- Infrastructure: Doha boasts well-developed infrastructure, including transportation networks and utilities.

- Amenities: The city offers a wide range of amenities, including high-quality schools, healthcare facilities, and entertainment options.

- Government Policies: Government initiatives aimed at supporting real estate development and attracting foreign investment directly benefit Doha.

Al Wakrah and other cities contribute to the market, but their shares are comparatively smaller. While other cities show growth potential, particularly with government-led development projects, Doha remains the dominant market due to the factors mentioned above. The expansion of infrastructure in other cities might gradually shift market share, but Doha's established status makes it likely to retain its leading position.

Qatar Condominium and Apartment Market Product Innovations

Recent product developments focus on sustainable building materials, smart home technology integration, and the creation of high-end, luxury apartments catering to discerning buyers. Developers are increasingly incorporating green building features and utilizing technology to enhance energy efficiency and resident convenience. This focus on innovation provides a competitive advantage in attracting buyers who prioritize sustainability and technological advancements in their housing.

Report Segmentation & Scope

This report segments the Qatar condominium and apartment market based on geographic location:

Doha: This segment represents the largest portion of the market, characterized by high demand and a diverse range of price points. Growth projections are optimistic, driven by consistent economic development. Competitive dynamics are intense, with numerous developers competing for market share.

Al Wakrah: This segment shows moderate growth potential, fueled by infrastructure development and government initiatives. Competition is less intense than in Doha.

Other Cities: This segment encompasses the remaining cities in Qatar. It exhibits significant growth potential, driven primarily by government investment in infrastructure and urban development.

Each segment's market size is detailed in the full report, along with an analysis of competitive dynamics and specific growth projections for the forecast period.

Key Drivers of Qatar Condominium and Apartment Market Growth

Several factors contribute to the growth of the Qatar condominium and apartment market. The strong economy, fueled by high oil and gas revenues and government investment in infrastructure, creates sustained demand. Population growth, both domestic and from expatriates working in various sectors, increases the need for housing. Government policies promoting real estate development and attracting foreign investment, including initiatives to improve urban living, have a positive impact. Furthermore, ongoing developments in the hospitality and tourism sectors create spin-off demand for residential properties.

Challenges in the Qatar Condominium and Apartment Market Sector

The market faces challenges including the potential impact of global economic fluctuations on construction costs and consumer confidence. Competition among developers can lead to price wars. Regulatory changes and permit processes can introduce delays in project completion. Maintaining a balance between high-quality development and affordability can be a significant challenge. Supply chain disruptions affecting construction materials may also impact project timelines and costs.

Leading Players in the Qatar Condominium and Apartment Market Market

- Barwa Real Estate

- The Pearl

- UPO Real Estate

- Al Mana Real Estate

- West Bay Lagoon

- Mazaya Real Estate Development

- United Development Company

- Gulf Avenues Real Estate

- Qatari Diar Real Estate Company

- Ezdan Holding Group

- Al Asmakh Real Estate

Key Developments in Qatar Condominium and Apartment Market Sector

March 2023: The Investment Promotion Agency Qatar (IPA Qatar) announced a collaboration with Knight Frank to promote Qatar's real estate industry to international investors, signaling increased foreign investment and potentially impacting market supply and demand.

October 2022: JLL's partnership with NelsonPark Property facilitated residential transactions and supported investments across several regions, indicating increased cross-border investment and impacting market liquidity.

Strategic Qatar Condominium and Apartment Market Outlook

The Qatar condominium and apartment market presents significant long-term growth potential, driven by the country's economic strength and ongoing infrastructure development. The market is poised to benefit from continuous government support and the influx of both domestic and international investment. Opportunities exist for developers to capitalize on the increasing demand for luxury apartments and sustainable living spaces. Strategic partnerships and innovative development approaches will be crucial for success in this dynamic market.

Qatar Condominium and Apartment Market Segmentation

-

1. Cities

- 1.1. Al Wakrah

- 1.2. Doha

- 1.3. Other Cities

Qatar Condominium and Apartment Market Segmentation By Geography

- 1. Qatar

Qatar Condominium and Apartment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Higher incomes support4.; Massive industry change

- 3.3. Market Restrains

- 3.3.1. 4.; High imbalance in population versus real estate index

- 3.4. Market Trends

- 3.4.1. Increase in residential sales as purchasers take advantage of residency permit benefits

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Condominium and Apartment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cities

- 5.1.1. Al Wakrah

- 5.1.2. Doha

- 5.1.3. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Barwa Real Estate

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Pearl

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UPO Real Estate

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Mana Real Estate

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 West Bay Lagoon

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mazaya Real Estate Development

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Development Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gulf Avenues Real Estate**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qatari Diar Real Estate Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ezdan Holding Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Al Asmakh Real Estate

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Barwa Real Estate

List of Figures

- Figure 1: Qatar Condominium and Apartment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Condominium and Apartment Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Condominium and Apartment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Condominium and Apartment Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 3: Qatar Condominium and Apartment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Qatar Condominium and Apartment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Qatar Condominium and Apartment Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 6: Qatar Condominium and Apartment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Condominium and Apartment Market?

The projected CAGR is approximately > 3.11%.

2. Which companies are prominent players in the Qatar Condominium and Apartment Market?

Key companies in the market include Barwa Real Estate, The Pearl, UPO Real Estate, Al Mana Real Estate, West Bay Lagoon, Mazaya Real Estate Development, United Development Company, Gulf Avenues Real Estate**List Not Exhaustive, Qatari Diar Real Estate Company, Ezdan Holding Group, Al Asmakh Real Estate.

3. What are the main segments of the Qatar Condominium and Apartment Market?

The market segments include Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Higher incomes support4.; Massive industry change.

6. What are the notable trends driving market growth?

Increase in residential sales as purchasers take advantage of residency permit benefits.

7. Are there any restraints impacting market growth?

4.; High imbalance in population versus real estate index.

8. Can you provide examples of recent developments in the market?

March 2023: The Investment Promotion Agency Qatar (IPA Qatar) has announced a collaboration with Knight Frank, a global real estate consultancy based in the United Kingdom, to promote Qatar's real estate industry to international investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Condominium and Apartment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Condominium and Apartment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Condominium and Apartment Market?

To stay informed about further developments, trends, and reports in the Qatar Condominium and Apartment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence