Key Insights

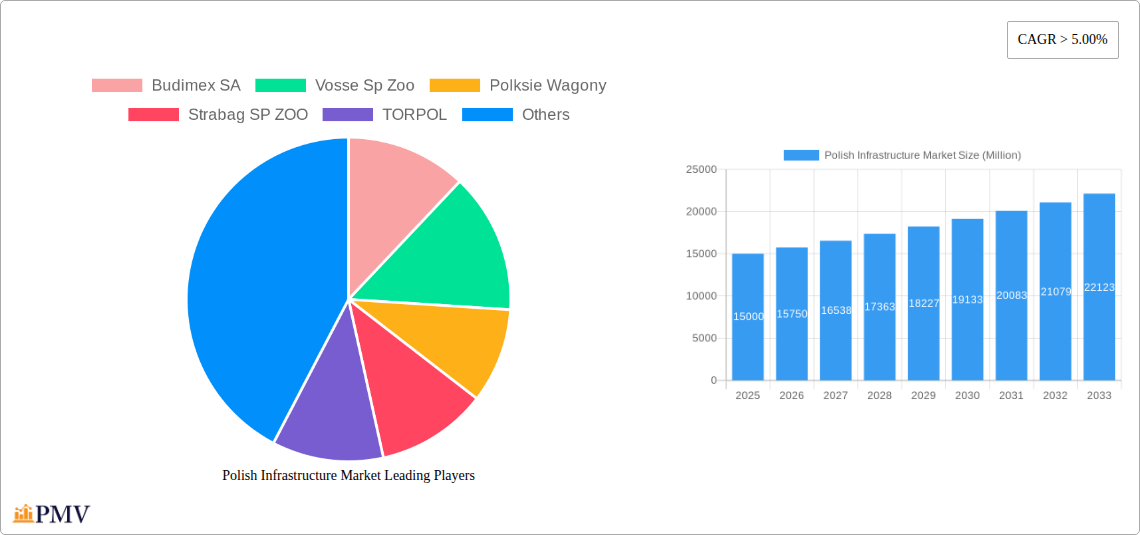

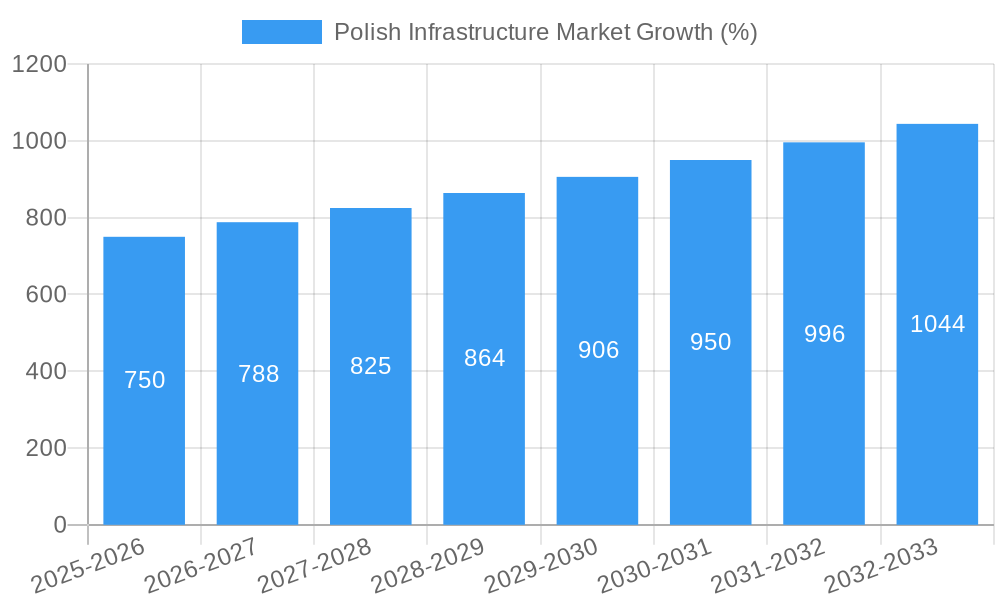

The Polish infrastructure market, valued at approximately €15 billion in 2025, exhibits robust growth potential, projected to achieve a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by significant government investments in transportation networks, driven by the need to modernize existing infrastructure and align with EU standards. Key drivers include the expansion of the national road network, rail infrastructure upgrades to facilitate efficient freight and passenger transport, and investments in modernizing ports and waterways to enhance international trade. Furthermore, increasing urbanization and the growth of e-commerce are contributing to higher demand for robust and efficient infrastructure. While regulatory hurdles and potential labor shortages could pose some challenges, the overall market outlook remains positive, supported by long-term strategic planning and continued funding from both public and private sources.

The market is segmented by mode of transportation, with roadways currently holding the largest share, followed by railways. Airways and ports/waterways also represent significant segments, each expected to witness substantial growth over the forecast period, driven by individual sectoral growth strategies and increasing globalization. Key players in the Polish infrastructure market include Budimex SA, Vosse Sp Zoo, Polskie Wagony, Strabag SP ZOO, TORPOL, Porr SA, EuroWagon, STALFA SP Z O O (LLC), Unibep SA, and InterCargo, among others. Competition is relatively high, with companies focusing on specialization and strategic partnerships to secure large-scale projects and maintain a competitive edge. Regional variations exist, with regions like Mazovia and Silesia exhibiting particularly high activity due to concentrated economic activity and population density. The market’s continued growth is closely linked to Poland's overall economic performance and its strategic commitment to developing a modern and efficient transportation system.

Polish Infrastructure Market: A Comprehensive Report (2019-2033)

This in-depth report provides a detailed analysis of the Polish infrastructure market, covering the period from 2019 to 2033. It offers crucial insights into market structure, competitive dynamics, industry trends, and future growth potential, making it an indispensable resource for investors, businesses, and policymakers. The report leverages extensive data analysis and incorporates key industry developments, providing a comprehensive and actionable overview. The base year is 2025, with forecasts extending to 2033.

Polish Infrastructure Market Market Structure & Competitive Dynamics

The Polish infrastructure market exhibits a moderately concentrated structure, with several large players and a multitude of smaller firms. Key players such as Budimex SA, Strabag SP ZOO, TORPOL, Porr SA, and Unibep SA hold significant market share, though precise figures are subject to ongoing market fluctuations and are not publicly available in a consolidated form for all companies. The market is characterized by a dynamic interplay of domestic and international companies. Innovation is driven by both governmental initiatives and private sector investment in new technologies and construction methodologies. The regulatory framework, though generally supportive of infrastructure development, presents certain challenges and complexities. Product substitution is limited, given the specialized nature of infrastructure projects. End-user trends are primarily driven by government investment priorities and the needs of a growing economy. The M&A landscape is active, evidenced by recent deals such as the PLN 405.6 Million contract awarded to Porr SA and Unibep SA for highway construction (May 2021). The total value of M&A deals in the sector from 2019 to 2024 is estimated to be around xx Million.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystem: Driven by government initiatives and private sector investments.

- Regulatory Framework: Supportive, but with certain complexities.

- Product Substitutes: Limited, given the specialized nature of infrastructure projects.

- End-User Trends: Primarily government investment and economic growth-driven.

- M&A Activities: Active, with significant deals impacting market dynamics.

Polish Infrastructure Market Industry Trends & Insights

The Polish infrastructure market is experiencing robust growth, driven by significant government investment in modernization and expansion projects. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, reflecting the ongoing need to enhance the nation's transportation networks and utilities. This growth is propelled by factors such as EU funding, increased urbanization, and the rise of e-commerce and logistics requiring improved infrastructure. Technological disruptions, including the adoption of Building Information Modeling (BIM) and advanced construction materials, are enhancing efficiency and project outcomes. Market penetration of these technologies is steadily growing, with an estimated xx% adoption rate by 2033. Consumer preferences emphasize sustainability and environmentally friendly solutions, driving demand for green infrastructure projects. Competitive dynamics are characterized by intense bidding processes and a constant drive for innovation and efficiency.

Dominant Markets & Segments in Polish Infrastructure Market

The Roadways segment currently dominates the Polish infrastructure market, fueled by extensive government investment in highway expansions and modernization. Railway infrastructure development is experiencing substantial growth, driven by the need for improved freight transport and commuter services. Airways and Ports & Waterways segments exhibit consistent growth, but their market share is comparatively smaller than Roadways and Railways.

Roadways:

- Key Drivers: Extensive government investment, EU funding, increased freight transportation, and growing urbanization.

- Dominance Analysis: Roadways account for the largest share of the market due to sustained government spending on new highway construction and improvement of existing networks.

Railways:

- Key Drivers: Increased freight transport needs, government focus on modernization, and rising commuter traffic.

- Dominance Analysis: The railway sector is undergoing a period of significant modernization and expansion, though it holds a smaller share than roadways.

Airways:

- Key Drivers: Growing passenger numbers, expansion of airports and related infrastructure.

- Dominance Analysis: A smaller, but growing, segment due to increased tourism and expanding trade relations.

Ports & Waterways:

- Key Drivers: Trade expansion, improvements to port facilities and inland waterways.

- Dominance Analysis: This segment is significant for international trade but holds a smaller overall market share compared to road and rail.

Polish Infrastructure Market Product Innovations

The Polish infrastructure market is witnessing significant advancements in product innovation. The incorporation of BIM technologies, sustainable materials, and advanced construction techniques is improving project efficiency, cost-effectiveness, and environmental performance. These innovations are enhancing the competitiveness of Polish infrastructure companies in both domestic and international markets. The adoption of these innovations is driving higher quality standards and improving market fit for the infrastructure projects in Poland.

Report Segmentation & Scope

The report segments the Polish infrastructure market by mode of transport: Roadways, Railways, Airways, and Ports & Waterways. Each segment is analyzed in terms of historical market size (2019-2024), current market size (2025), projected market size (2025-2033), growth projections, and competitive dynamics. The report provides detailed insights into the key players, market drivers, and challenges within each segment. Detailed analysis of the size and growth projection of each segment is provided separately within the full report.

- Roadways: [Growth projections and competitive dynamics detailed in full report].

- Railways: [Growth projections and competitive dynamics detailed in full report].

- Airways: [Growth projections and competitive dynamics detailed in full report].

- Ports & Waterways: [Growth projections and competitive dynamics detailed in full report].

Key Drivers of Polish Infrastructure Market Growth

Several factors are driving the growth of the Polish infrastructure market. Significant government spending, fueled by both national budgets and EU funds, is a primary catalyst. Furthermore, the country's ongoing economic expansion and increasing urbanization create a continuous demand for improved transportation networks, energy infrastructure, and water management systems. Technological advancements, such as the adoption of BIM and sustainable materials, also contribute to market growth by enhancing efficiency and project quality. Finally, EU policies promoting sustainable infrastructure development are accelerating investments in eco-friendly solutions.

Challenges in the Polish Infrastructure Market Sector

The Polish infrastructure market faces challenges such as securing sufficient funding for large-scale projects, navigating complex regulatory processes, and ensuring the timely acquisition of necessary materials and skilled labor. Supply chain disruptions can lead to project delays and cost overruns, impacting overall market performance. Furthermore, intense competition among construction companies can put pressure on profit margins. These factors contribute to the inherent complexities of managing large infrastructure projects effectively.

Leading Players in the Polish Infrastructure Market Market

- Budimex SA

- Vosse Sp Zoo

- Polskie Wagony

- Strabag SP ZOO

- TORPOL

- Porr SA

- EuroWagon

- STALFA SP Z O O (LLC)

- Unibep SA

- InterCargo

Key Developments in Polish Infrastructure Market Sector

- April 2022: Lantania's acquisition of Balzola Polska and DSV significantly expands its presence in the Polish and European railway construction markets. This deal showcases the ongoing consolidation within the sector and highlights the growing importance of railway infrastructure development.

- October 2021: SYSTRA's acquisition of SWS strengthens its tunnel design and construction capabilities, particularly within the European market. This signifies the increasing demand for specialized expertise in complex infrastructure projects.

- May 2021: Porr SA and Unibep SA's joint contract for the construction of highway section 19 demonstrates collaboration within the industry and significant investment in road infrastructure. The PLN 405.6 Million value of this deal emphasizes the scale of projects currently underway.

Strategic Polish Infrastructure Market Market Outlook

The Polish infrastructure market holds significant future potential, driven by continued government investment and ongoing economic growth. Strategic opportunities exist for companies that can innovate, leverage sustainable technologies, and efficiently manage large-scale projects. The focus on sustainable infrastructure solutions and digitalization presents further growth avenues for companies embracing these trends. The market is poised for continued expansion, driven by the nation's commitment to modernizing its infrastructure network.

Polish Infrastructure Market Segmentation

-

1. Modes

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airways

- 1.4. Ports and Waterways

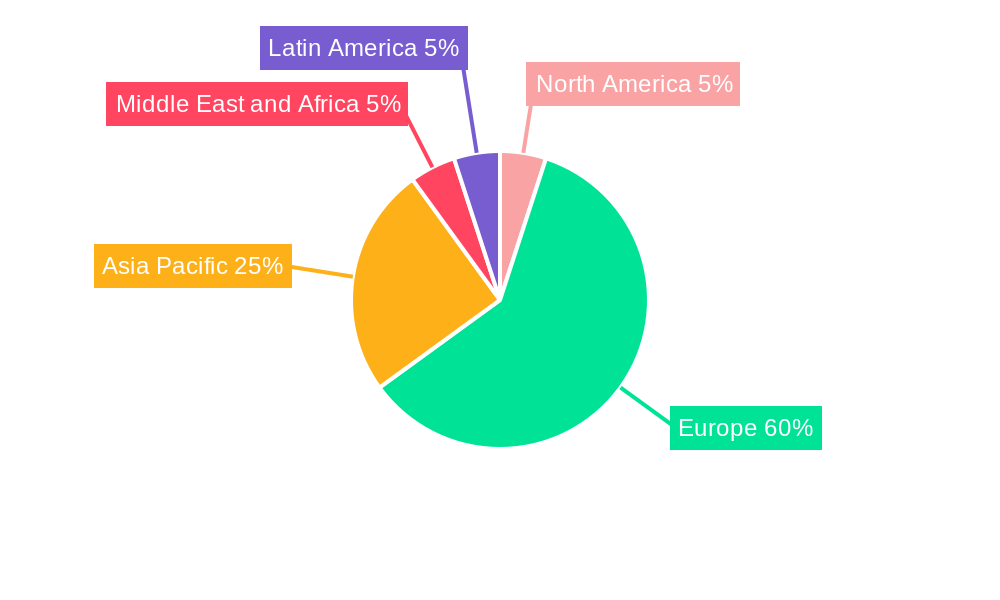

Polish Infrastructure Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Polish Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market

- 3.4. Market Trends

- 3.4.1. Increasing Government Investments for Transportation Infrastructure in Poland

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Ports and Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 6. North America Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Modes

- 6.1.1. Roadways

- 6.1.2. Railways

- 6.1.3. Airways

- 6.1.4. Ports and Waterways

- 6.1. Market Analysis, Insights and Forecast - by Modes

- 7. South America Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Modes

- 7.1.1. Roadways

- 7.1.2. Railways

- 7.1.3. Airways

- 7.1.4. Ports and Waterways

- 7.1. Market Analysis, Insights and Forecast - by Modes

- 8. Europe Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Modes

- 8.1.1. Roadways

- 8.1.2. Railways

- 8.1.3. Airways

- 8.1.4. Ports and Waterways

- 8.1. Market Analysis, Insights and Forecast - by Modes

- 9. Middle East & Africa Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Modes

- 9.1.1. Roadways

- 9.1.2. Railways

- 9.1.3. Airways

- 9.1.4. Ports and Waterways

- 9.1. Market Analysis, Insights and Forecast - by Modes

- 10. Asia Pacific Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Modes

- 10.1.1. Roadways

- 10.1.2. Railways

- 10.1.3. Airways

- 10.1.4. Ports and Waterways

- 10.1. Market Analysis, Insights and Forecast - by Modes

- 11. Asia Pacific Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 Japan

- 11.1.3 India

- 11.1.4 South Korea

- 11.1.5 Rest of Asia Pacific

- 12. North America Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 France

- 13.1.4 Russia

- 13.1.5 Rest of Europe

- 14. Middle East and Africa Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Saudi Arabia

- 14.1.2 United Arab Emirates

- 14.1.3 Qatar

- 14.1.4 South Africa

- 14.1.5 Rest of Middle East and Africa

- 15. Latin America Polish Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Mexico

- 15.1.3 Argentina

- 15.1.4 Colombia

- 15.1.5 Rest of Latin America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Budimex SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Vosse Sp Zoo

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Polksie Wagony

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Strabag SP ZOO

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 TORPOL

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Porr SA

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 EuroWagon**List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 STALFA SP Z O O (LLC)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Unibep SA

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 InterCargo

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Budimex SA

List of Figures

- Figure 1: Global Polish Infrastructure Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Polish Infrastructure Market Revenue (Million), by Modes 2024 & 2032

- Figure 13: North America Polish Infrastructure Market Revenue Share (%), by Modes 2024 & 2032

- Figure 14: North America Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America Polish Infrastructure Market Revenue (Million), by Modes 2024 & 2032

- Figure 17: South America Polish Infrastructure Market Revenue Share (%), by Modes 2024 & 2032

- Figure 18: South America Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Polish Infrastructure Market Revenue (Million), by Modes 2024 & 2032

- Figure 21: Europe Polish Infrastructure Market Revenue Share (%), by Modes 2024 & 2032

- Figure 22: Europe Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East & Africa Polish Infrastructure Market Revenue (Million), by Modes 2024 & 2032

- Figure 25: Middle East & Africa Polish Infrastructure Market Revenue Share (%), by Modes 2024 & 2032

- Figure 26: Middle East & Africa Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Polish Infrastructure Market Revenue (Million), by Modes 2024 & 2032

- Figure 29: Asia Pacific Polish Infrastructure Market Revenue Share (%), by Modes 2024 & 2032

- Figure 30: Asia Pacific Polish Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Polish Infrastructure Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Polish Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Polish Infrastructure Market Revenue Million Forecast, by Modes 2019 & 2032

- Table 3: Global Polish Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of Asia Pacific Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Russia Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Saudi Arabia Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: United Arab Emirates Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Qatar Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Africa Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Middle East and Africa Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Mexico Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Colombia Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Latin America Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Polish Infrastructure Market Revenue Million Forecast, by Modes 2019 & 2032

- Table 32: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Mexico Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Polish Infrastructure Market Revenue Million Forecast, by Modes 2019 & 2032

- Table 37: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Brazil Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Argentina Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Polish Infrastructure Market Revenue Million Forecast, by Modes 2019 & 2032

- Table 42: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United Kingdom Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Russia Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Benelux Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Nordics Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Polish Infrastructure Market Revenue Million Forecast, by Modes 2019 & 2032

- Table 53: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Turkey Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Israel Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: GCC Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: North Africa Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: South Africa Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Middle East & Africa Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Global Polish Infrastructure Market Revenue Million Forecast, by Modes 2019 & 2032

- Table 61: Global Polish Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: China Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: India Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Japan Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: South Korea Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: ASEAN Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Oceania Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Asia Pacific Polish Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polish Infrastructure Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Polish Infrastructure Market?

Key companies in the market include Budimex SA, Vosse Sp Zoo, Polksie Wagony, Strabag SP ZOO, TORPOL, Porr SA, EuroWagon**List Not Exhaustive, STALFA SP Z O O (LLC), Unibep SA, InterCargo.

3. What are the main segments of the Polish Infrastructure Market?

The market segments include Modes.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market.

6. What are the notable trends driving market growth?

Increasing Government Investments for Transportation Infrastructure in Poland.

7. Are there any restraints impacting market growth?

4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market.

8. Can you provide examples of recent developments in the market?

April 2022: Lantania grows and strengthens its dominance in the sector with the acquisitions of Balzola Polska and the Spanish railway construction company DSV. The infrastructure, water, and energy group signed the two deals, advancing its international development plan and expanding its capabilities. The acquisition of Balzola's Polish subsidiary gives the company entry into a high-potential market, while the acquisition of DSV completes and improves Lantania's capabilities in railway works.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polish Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polish Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polish Infrastructure Market?

To stay informed about further developments, trends, and reports in the Polish Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence