Key Insights

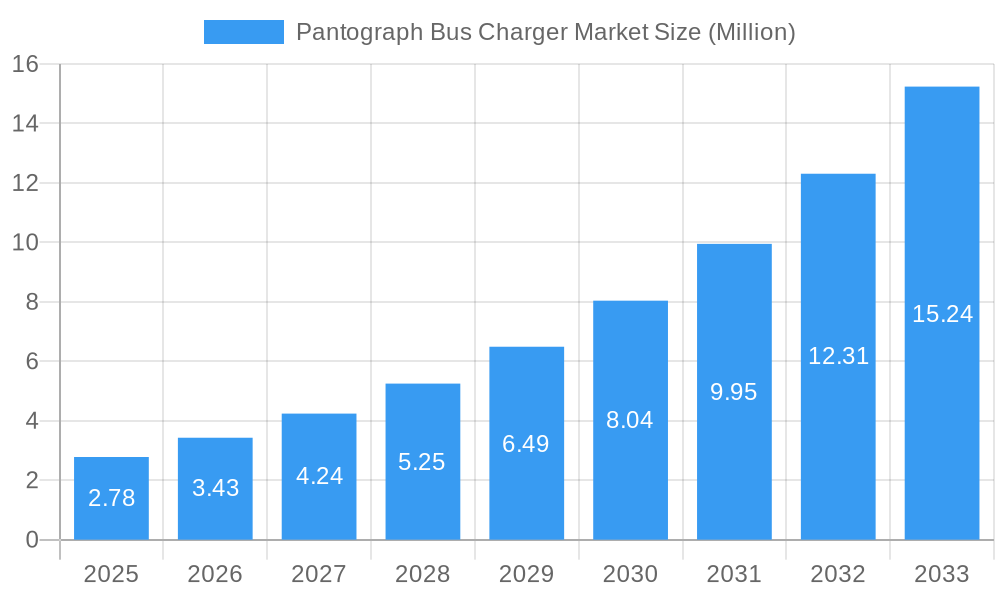

The global Pantograph Bus Charger Market is experiencing a robust expansion, projected to reach $2.78 Million with an impressive Compound Annual Growth Rate (CAGR) of 24.65%. This significant growth is primarily fueled by the accelerating adoption of electric buses worldwide, driven by stringent emission regulations and a growing environmental consciousness. Governments are actively promoting e-mobility solutions, offering incentives and mandating the transition of public transportation fleets to electric alternatives. The increasing demand for efficient and rapid charging solutions for these buses is a key driver, leading to advancements in charging technology. The market is segmented by Charging Type, with Direct Current Fast Charging (DCFC) expected to dominate due to its speed and convenience in high-utilization public transport scenarios. Component types are bifurcated into hardware and software, both critical for seamless charging operations, while Charging Infrastructure Types include Off-board top-down pantographs and On-Board Bottom-Up pantographs, with the former gaining traction for its ability to support higher power charging and faster turnaround times for bus fleets. Key players like ABB Ltd, Siemens Mobility, and Valmont Industries Inc. are heavily investing in R&D to offer innovative and scalable pantograph charging solutions.

Pantograph Bus Charger Market Market Size (In Million)

The market landscape is further shaped by several emerging trends, including the integration of smart grid technologies for optimized energy management and vehicle-to-grid (V2G) capabilities, allowing electric buses to feed power back into the grid during off-peak hours. The development of interoperable charging standards is also crucial for widespread adoption and to avoid vendor lock-in. However, certain restraints exist, such as the high initial capital investment required for charging infrastructure deployment and the need for grid upgrades to support the increased electricity demand. Concerns regarding the longevity and maintenance of pantograph systems also present challenges. Despite these hurdles, the Asia Pacific region, led by China and India, is anticipated to be a major growth engine due to extensive government initiatives for electric mobility and a massive existing bus fleet. North America and Europe are also significant markets, driven by progressive environmental policies and technological advancements in charging infrastructure. The continuous evolution of battery technology and charging speeds will further accelerate the market's trajectory in the forecast period.

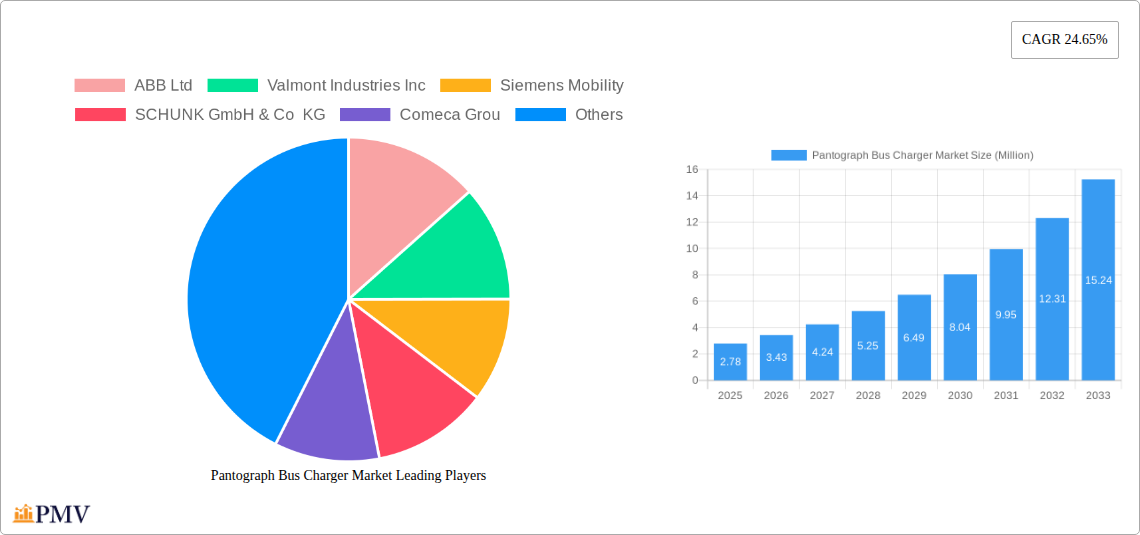

Pantograph Bus Charger Market Company Market Share

Here is the detailed SEO-optimized report description for the Pantograph Bus Charger Market:

Report Title: Pantograph Bus Charger Market: Global Forecast 2025-2033 - In-depth Analysis of Charging Technologies, Infrastructure, and Key Players

Report Description: This comprehensive report delivers a granular analysis of the global pantograph bus charger market, providing critical insights and actionable intelligence for stakeholders. Dive deep into market dynamics, growth drivers, emerging trends, and competitive strategies shaping the future of electric bus charging. Our research covers the study period 2019–2033, with a base year of 2025, and a detailed forecast period 2025–2033 building upon the historical period 2019–2024. We meticulously segment the market by charging type (Level 1, Level 2, Direct Current Fast Charging), component type (Hardware, Software), and charging infrastructure type (Off-board top-down pantograph, On-Board Bottom-Up Pantograph).

Gain unparalleled understanding of key industry developments, including significant investments by First Bus (GBP 81 million / USD 96.4 million order for 193 electric buses with 450 kW pantograph charging), the San Diego Metropolitan System's USD 8.5 million overhead charging system, and major tender processes by Transports Metropolitans de Barcelona (TMB) and Miejski Zakład Komunikacji in Grudziądz. Our analysis includes the innovative pilot project in Moscow featuring a bus-down pantograph.

Explore the strategies of leading companies such as ABB Ltd, Valmont Industries Inc, Siemens Mobility, SCHUNK GmbH & Co KG, Comeca Group, Schunk Transit Systems GmBH, Wabtech Corporation, Vector Informatik GmbH, and SETEC Power. Understand market concentration, innovation ecosystems, regulatory frameworks, and M&A activities. This report is indispensable for bus manufacturers, charging infrastructure providers, fleet operators, government agencies, and investors seeking to capitalize on the rapidly expanding electric mobility sector and the increasing adoption of zero-emission public transport.

Pantograph Bus Charger Market Market Structure & Competitive Dynamics

The pantograph bus charger market is characterized by a dynamic and evolving competitive landscape, exhibiting a moderate to high level of concentration, particularly within the hardware component segment. Leading players are investing heavily in research and development to enhance charging efficiency, speed, and safety, creating a robust innovation ecosystem. Regulatory frameworks are becoming increasingly supportive, with governments worldwide incentivizing the adoption of electric buses and the necessary charging infrastructure. Product substitutes, such as inductive charging or plug-in charging solutions, exist, but pantograph systems offer distinct advantages in terms of charging speed and automation for high-utilization fleet operations. End-user trends are firmly leaning towards electrification, driven by environmental concerns, rising fuel costs, and stricter emission standards. Mergers and acquisitions (M&A) activities are anticipated to play a crucial role in market consolidation, with strategic partnerships aimed at expanding market reach and technological capabilities. For instance, recent tender wins and significant vehicle orders for electric buses, often specifying pantograph charging capabilities, indicate robust market growth and strategic investments. Market share is largely determined by the ability to offer reliable, high-power charging solutions that integrate seamlessly with electric bus fleets. M&A deal values are expected to rise as companies seek to gain a competitive edge through technology acquisition or market access.

Pantograph Bus Charger Market Industry Trends & Insights

The global pantograph bus charger market is experiencing robust growth, propelled by a confluence of factors including stringent government regulations aimed at reducing carbon emissions, increasing environmental consciousness among urban populations, and the escalating operational cost of diesel-powered buses. The push towards electrification of public transport is a significant market growth driver, with cities worldwide investing in electric bus fleets and the associated charging infrastructure. Technological disruptions, such as advancements in battery technology and the development of faster, more efficient charging systems, are further accelerating market penetration. Consumer preferences are shifting towards cleaner, quieter, and more sustainable transportation options, making electric buses an attractive proposition for transit authorities. The competitive dynamics are intensifying as established players and new entrants vie for market share by offering innovative solutions and competitive pricing. Key industry trends include the increasing demand for high-power charging solutions, particularly Direct Current Fast Charging (DCFC) capabilities, which minimize downtime for busy bus routes. The adoption of opportunity charging at layover points and termini is also gaining momentum, enabling buses to recharge efficiently throughout the day. Furthermore, the integration of smart charging technologies and grid management solutions is becoming crucial for optimizing energy consumption and reducing strain on the electricity grid. The market penetration of pantograph bus chargers is directly linked to the deployment rates of electric buses, with significant investments being made in developing and expanding charging networks in urban centers. The projected Compound Annual Growth Rate (CAGR) for the pantograph bus charger market is robust, reflecting the ongoing global transition towards sustainable mobility.

Dominant Markets & Segments in Pantograph Bus Charger Market

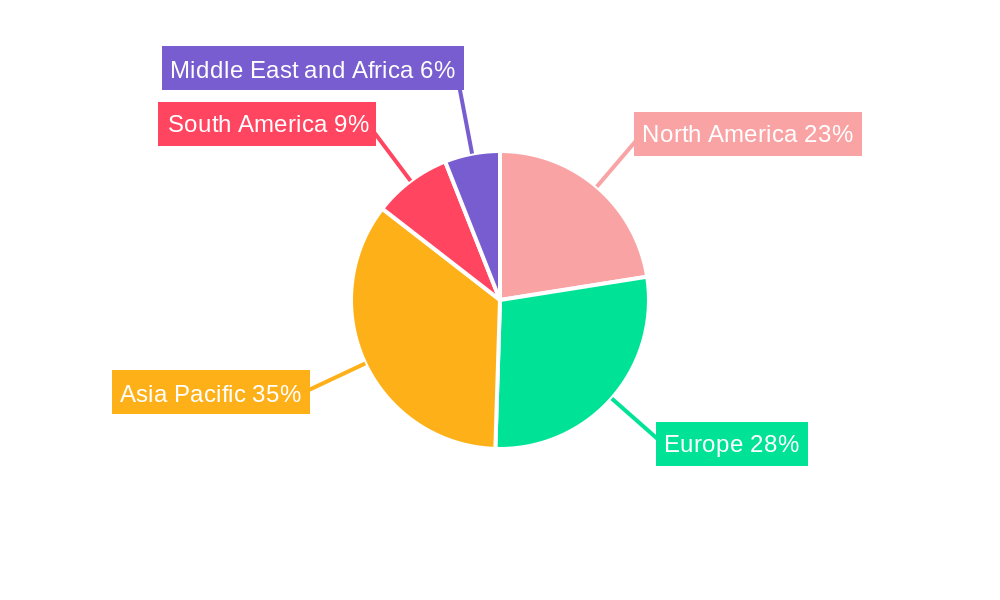

The pantograph bus charger market exhibits distinct regional dominance and segment preferences driven by various economic, policy, and infrastructural factors.

Dominant Region: Europe currently leads the pantograph bus charger market due to proactive government initiatives, stringent environmental regulations, and substantial investments in public transport electrification. Countries like Germany, the UK, and France are at the forefront, with numerous pilot projects and large-scale deployments of electric bus fleets. North America, particularly the United States, is rapidly catching up, fueled by federal and state-level incentives for zero-emission vehicles and charging infrastructure. Asia-Pacific, especially China, has also been a significant contributor, driven by its extensive manufacturing capabilities and early adoption of electric vehicles.

Dominant Charging Type: Direct Current Fast Charging (DCFC) is the most dominant charging type within the pantograph bus charger market. This is primarily due to the operational demands of public transportation fleets, where minimizing charging time is critical to maintaining service schedules. DCFC offers the rapid charging required for opportunity charging at bus depots, termini, and during mid-route layovers, ensuring high vehicle availability. While Level 1 and Level 2 charging might be used for overnight depot charging, the efficiency and speed of DCFC make it indispensable for most pantograph applications.

Dominant Component Type: Hardware constitutes the dominant component type in the pantograph bus charger market. This includes the physical pantograph mechanism itself, the charging posts, power converters, and associated electrical infrastructure. The robust demand for these physical assets to equip charging depots and transit hubs drives the hardware segment. However, the importance of Software is rapidly increasing, encompassing charging management systems, fleet management integration, remote monitoring, diagnostics, and smart grid connectivity. As the market matures, sophisticated software solutions will become increasingly vital for optimizing charging operations, managing energy costs, and ensuring system reliability.

Dominant Charging Infrastructure Type: The Off-board top-down pantograph configuration is currently the dominant charging infrastructure type. This design, where the pantograph on the bus connects to an overhead charging unit, is widely adopted in depots and at termini due to its robustness, ease of maintenance, and ability to deliver high charging power. It is particularly well-suited for opportunity charging. The On-Board Bottom-Up Pantograph is an emerging technology, often integrated into the bus design, which connects to ground-based charging infrastructure. While offering potential advantages in certain urban layouts, it is still in the earlier stages of widespread deployment and faces challenges in terms of infrastructure standardization and installation complexity compared to its top-down counterpart.

Key drivers for dominance in these segments include government subsidies for electric buses and charging infrastructure, mandates for emissions reductions, the need for quick turnaround times for public transport, and the established technological maturity of off-board top-down systems.

Pantograph Bus Charger Market Product Innovations

Product innovations in the pantograph bus charger market are primarily focused on enhancing charging speed, efficiency, reliability, and user-friendliness. Key advancements include the development of higher-power charging modules, enabling Direct Current Fast Charging (DCFC) capabilities of up to 450 kW, as seen in deployments by First Bus. Innovations in hardware components aim to improve the durability, robustness, and automatic connection reliability of pantograph systems, such as the Schunk SLS 301 series Depot Charging Pantograph known for its hands-free operation. Furthermore, advancements in software are leading to smarter charging solutions, including intelligent load management, predictive maintenance, and seamless integration with fleet management systems for optimized operational efficiency. These product developments offer competitive advantages by reducing charging times, minimizing fleet downtime, and lowering operational costs for transit authorities.

Report Segmentation & Scope

This report segments the pantograph bus charger market comprehensively to provide detailed insights into each area of growth and development.

The market is segmented by Charging Type, encompassing Level 1 (slow AC charging, less common for large fleets), Level 2 (faster AC charging, suitable for overnight depot charging), and Direct Current Fast Charging (DCFC) (high-power charging for opportunity charging, dominating the market).

Segmentation by Component Type includes Hardware, covering the physical charging apparatus, power electronics, and infrastructure, and Software, which encompasses charging management systems, control software, and data analytics.

Further segmentation by Charging Infrastructure Type distinguishes between Off-board top-down pantograph systems (overhead charging units) and On-Board Bottom-Up Pantograph systems (pantograph integrated on the vehicle connecting to ground-based chargers).

Each segment's growth projections, estimated market sizes, and competitive dynamics have been analyzed to offer a holistic view of the market's future trajectory.

Key Drivers of Pantograph Bus Charger Market Growth

The pantograph bus charger market is propelled by several significant drivers. Firstly, increasing government mandates and incentives for electrification of public transport are a primary catalyst. Initiatives to reduce urban air pollution and greenhouse gas emissions necessitate the transition from diesel to electric buses, thereby driving demand for charging infrastructure. Secondly, advancements in battery technology, leading to higher energy densities and longer ranges for electric buses, make them a more viable and attractive option for transit agencies. Thirdly, the declining total cost of ownership (TCO) for electric buses compared to their diesel counterparts, due to lower fuel and maintenance costs, incentivizes adoption. Finally, rapid technological progress in pantograph charging systems, offering faster charging speeds and greater automation, addresses the critical need for efficient charging solutions in high-utilization public transport operations.

Challenges in the Pantograph Bus Charger Market Sector

Despite its strong growth trajectory, the pantograph bus charger market faces several challenges. A significant hurdle is the high initial capital investment required for installing charging infrastructure, which can be a deterrent for some transit authorities. Grid capacity limitations in certain urban areas pose another challenge, requiring significant upgrades to accommodate the power demands of multiple fast-charging stations. Standardization issues across different manufacturers and regions can also hinder interoperability and create integration complexities. Furthermore, the availability of skilled technicians for installation, maintenance, and repair of complex pantograph charging systems is a growing concern. Finally, supply chain disruptions for critical components, as experienced recently, can impact project timelines and increase costs, affecting the overall pace of market development.

Leading Players in the Pantograph Bus Charger Market Market

- ABB Ltd

- Valmont Industries Inc

- Siemens Mobility

- SCHUNK GmbH & Co KG

- Comeca Group

- Schunk Transit Systems GmBH

- Wabtech Corporation

- Vector Informatik GmbH

- SETEC Power

Key Developments in Pantograph Bus Charger Market Sector

- August 2022: British bus company First Bus ordered 193 electric buses worth GBP 81 million (~USD 96.4 million) from Northern Irish bus manufacturer Wrightbus. The company specified DC charging power at 150 kW and optional opportunity charging at 450 kW through pantograph options.

- May 2022: The San Diego Metropolitan System began construction on an USD 8.5 million overhead electric bus charging system capable of charging 24 battery-electric buses simultaneously. The system will install the Schunk SLS 301 series Depot Charging Pantograph for quicker, hands-free charging.

- April 2022: Transports Metropolitans de Barcelona (TMB) announced a tender process to acquire up to 83 battery-powered electric buses to replace diesel vehicles. The tender includes lots for 12m buses with night load per pantograph (45 units, expandable to 63) and 18m articulated units for overnight pantograph charging or other technologies (20 units).

- April 2022: The operator Miejski Zakład Komunikacji in Grudziądz and Solaris Bus & Coach Sp. z o.o. signed a contract for 17 electric buses, including pantograph chargers, expected for delivery in Q1 2023.

- November 2021: The Department of Transport and Road Infrastructure Development of Moscow and e FSUE NAMI State Research Center launched a pilot project with an innovative charging station featuring a bus-down pantograph at Mosgortrans. Two electric buses were equipped with special contact rails for testing through the end of 2022.

Strategic Pantograph Bus Charger Market Market Outlook

The strategic outlook for the pantograph bus charger market is exceptionally positive, driven by the global imperative for decarbonization and the electrification of public transportation. Key growth accelerators include expanding government commitments to achieve net-zero emissions, leading to increased procurement of electric buses and substantial investments in charging infrastructure. Furthermore, the growing maturity of pantograph technology, offering efficient and high-speed charging, makes it the preferred solution for transit operators worldwide. Strategic opportunities lie in developing integrated charging solutions that combine hardware and software for optimized fleet management and energy consumption, as well as exploring new business models such as charging-as-a-service. The ongoing advancements in battery technology will further bolster the viability of electric buses, creating sustained demand for advanced pantograph charging systems. The market is poised for significant expansion as cities continue to prioritize sustainable urban mobility.

Pantograph Bus Charger Market Segmentation

-

1. Charging Type

- 1.1. Level 1

- 1.2. Level 2

- 1.3. Direct Current Fast Charging

-

2. Pcomponent Type

- 2.1. Hardware

- 2.2. Software

-

3. Charging Infrastructure Type

- 3.1. Off-board top-down pantograph

- 3.2. On-Board Bottom-Up Pantograph

Pantograph Bus Charger Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. South Korea

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Aegentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of the Middle East and Africa

Pantograph Bus Charger Market Regional Market Share

Geographic Coverage of Pantograph Bus Charger Market

Pantograph Bus Charger Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Vehicle Sale

- 3.3. Market Restrains

- 3.3.1. Increase in demand for Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Rising Emphasis of Government on Eco-Friendly Buses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pantograph Bus Charger Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 5.1.1. Level 1

- 5.1.2. Level 2

- 5.1.3. Direct Current Fast Charging

- 5.2. Market Analysis, Insights and Forecast - by Pcomponent Type

- 5.2.1. Hardware

- 5.2.2. Software

- 5.3. Market Analysis, Insights and Forecast - by Charging Infrastructure Type

- 5.3.1. Off-board top-down pantograph

- 5.3.2. On-Board Bottom-Up Pantograph

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 6. North America Pantograph Bus Charger Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 6.1.1. Level 1

- 6.1.2. Level 2

- 6.1.3. Direct Current Fast Charging

- 6.2. Market Analysis, Insights and Forecast - by Pcomponent Type

- 6.2.1. Hardware

- 6.2.2. Software

- 6.3. Market Analysis, Insights and Forecast - by Charging Infrastructure Type

- 6.3.1. Off-board top-down pantograph

- 6.3.2. On-Board Bottom-Up Pantograph

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 7. Europe Pantograph Bus Charger Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 7.1.1. Level 1

- 7.1.2. Level 2

- 7.1.3. Direct Current Fast Charging

- 7.2. Market Analysis, Insights and Forecast - by Pcomponent Type

- 7.2.1. Hardware

- 7.2.2. Software

- 7.3. Market Analysis, Insights and Forecast - by Charging Infrastructure Type

- 7.3.1. Off-board top-down pantograph

- 7.3.2. On-Board Bottom-Up Pantograph

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 8. Asia Pacific Pantograph Bus Charger Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 8.1.1. Level 1

- 8.1.2. Level 2

- 8.1.3. Direct Current Fast Charging

- 8.2. Market Analysis, Insights and Forecast - by Pcomponent Type

- 8.2.1. Hardware

- 8.2.2. Software

- 8.3. Market Analysis, Insights and Forecast - by Charging Infrastructure Type

- 8.3.1. Off-board top-down pantograph

- 8.3.2. On-Board Bottom-Up Pantograph

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 9. South America Pantograph Bus Charger Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 9.1.1. Level 1

- 9.1.2. Level 2

- 9.1.3. Direct Current Fast Charging

- 9.2. Market Analysis, Insights and Forecast - by Pcomponent Type

- 9.2.1. Hardware

- 9.2.2. Software

- 9.3. Market Analysis, Insights and Forecast - by Charging Infrastructure Type

- 9.3.1. Off-board top-down pantograph

- 9.3.2. On-Board Bottom-Up Pantograph

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 10. Middle East and Africa Pantograph Bus Charger Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Charging Type

- 10.1.1. Level 1

- 10.1.2. Level 2

- 10.1.3. Direct Current Fast Charging

- 10.2. Market Analysis, Insights and Forecast - by Pcomponent Type

- 10.2.1. Hardware

- 10.2.2. Software

- 10.3. Market Analysis, Insights and Forecast - by Charging Infrastructure Type

- 10.3.1. Off-board top-down pantograph

- 10.3.2. On-Board Bottom-Up Pantograph

- 10.1. Market Analysis, Insights and Forecast - by Charging Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Valmont Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens Mobility

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SCHUNK GmbH & Co KG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Comeca Grou

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schunk Transit Systems GmBH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wabtech Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vector Informatik GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SETEC Power

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Pantograph Bus Charger Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pantograph Bus Charger Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 3: North America Pantograph Bus Charger Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 4: North America Pantograph Bus Charger Market Revenue (Million), by Pcomponent Type 2025 & 2033

- Figure 5: North America Pantograph Bus Charger Market Revenue Share (%), by Pcomponent Type 2025 & 2033

- Figure 6: North America Pantograph Bus Charger Market Revenue (Million), by Charging Infrastructure Type 2025 & 2033

- Figure 7: North America Pantograph Bus Charger Market Revenue Share (%), by Charging Infrastructure Type 2025 & 2033

- Figure 8: North America Pantograph Bus Charger Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Pantograph Bus Charger Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Pantograph Bus Charger Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 11: Europe Pantograph Bus Charger Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 12: Europe Pantograph Bus Charger Market Revenue (Million), by Pcomponent Type 2025 & 2033

- Figure 13: Europe Pantograph Bus Charger Market Revenue Share (%), by Pcomponent Type 2025 & 2033

- Figure 14: Europe Pantograph Bus Charger Market Revenue (Million), by Charging Infrastructure Type 2025 & 2033

- Figure 15: Europe Pantograph Bus Charger Market Revenue Share (%), by Charging Infrastructure Type 2025 & 2033

- Figure 16: Europe Pantograph Bus Charger Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Pantograph Bus Charger Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Pantograph Bus Charger Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 19: Asia Pacific Pantograph Bus Charger Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 20: Asia Pacific Pantograph Bus Charger Market Revenue (Million), by Pcomponent Type 2025 & 2033

- Figure 21: Asia Pacific Pantograph Bus Charger Market Revenue Share (%), by Pcomponent Type 2025 & 2033

- Figure 22: Asia Pacific Pantograph Bus Charger Market Revenue (Million), by Charging Infrastructure Type 2025 & 2033

- Figure 23: Asia Pacific Pantograph Bus Charger Market Revenue Share (%), by Charging Infrastructure Type 2025 & 2033

- Figure 24: Asia Pacific Pantograph Bus Charger Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Pantograph Bus Charger Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Pantograph Bus Charger Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 27: South America Pantograph Bus Charger Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 28: South America Pantograph Bus Charger Market Revenue (Million), by Pcomponent Type 2025 & 2033

- Figure 29: South America Pantograph Bus Charger Market Revenue Share (%), by Pcomponent Type 2025 & 2033

- Figure 30: South America Pantograph Bus Charger Market Revenue (Million), by Charging Infrastructure Type 2025 & 2033

- Figure 31: South America Pantograph Bus Charger Market Revenue Share (%), by Charging Infrastructure Type 2025 & 2033

- Figure 32: South America Pantograph Bus Charger Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Pantograph Bus Charger Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Pantograph Bus Charger Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 35: Middle East and Africa Pantograph Bus Charger Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 36: Middle East and Africa Pantograph Bus Charger Market Revenue (Million), by Pcomponent Type 2025 & 2033

- Figure 37: Middle East and Africa Pantograph Bus Charger Market Revenue Share (%), by Pcomponent Type 2025 & 2033

- Figure 38: Middle East and Africa Pantograph Bus Charger Market Revenue (Million), by Charging Infrastructure Type 2025 & 2033

- Figure 39: Middle East and Africa Pantograph Bus Charger Market Revenue Share (%), by Charging Infrastructure Type 2025 & 2033

- Figure 40: Middle East and Africa Pantograph Bus Charger Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Pantograph Bus Charger Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 2: Global Pantograph Bus Charger Market Revenue Million Forecast, by Pcomponent Type 2020 & 2033

- Table 3: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Infrastructure Type 2020 & 2033

- Table 4: Global Pantograph Bus Charger Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 6: Global Pantograph Bus Charger Market Revenue Million Forecast, by Pcomponent Type 2020 & 2033

- Table 7: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Infrastructure Type 2020 & 2033

- Table 8: Global Pantograph Bus Charger Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 13: Global Pantograph Bus Charger Market Revenue Million Forecast, by Pcomponent Type 2020 & 2033

- Table 14: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Infrastructure Type 2020 & 2033

- Table 15: Global Pantograph Bus Charger Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 23: Global Pantograph Bus Charger Market Revenue Million Forecast, by Pcomponent Type 2020 & 2033

- Table 24: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Infrastructure Type 2020 & 2033

- Table 25: Global Pantograph Bus Charger Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: India Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: China Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 32: Global Pantograph Bus Charger Market Revenue Million Forecast, by Pcomponent Type 2020 & 2033

- Table 33: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Infrastructure Type 2020 & 2033

- Table 34: Global Pantograph Bus Charger Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Brazil Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Aegentina Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of the South America Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 39: Global Pantograph Bus Charger Market Revenue Million Forecast, by Pcomponent Type 2020 & 2033

- Table 40: Global Pantograph Bus Charger Market Revenue Million Forecast, by Charging Infrastructure Type 2020 & 2033

- Table 41: Global Pantograph Bus Charger Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Africa Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of the Middle East and Africa Pantograph Bus Charger Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pantograph Bus Charger Market?

The projected CAGR is approximately 24.65%.

2. Which companies are prominent players in the Pantograph Bus Charger Market?

Key companies in the market include ABB Ltd, Valmont Industries Inc, Siemens Mobility, SCHUNK GmbH & Co KG, Comeca Grou, Schunk Transit Systems GmBH, Wabtech Corporation, Vector Informatik GmbH, SETEC Power.

3. What are the main segments of the Pantograph Bus Charger Market?

The market segments include Charging Type, Pcomponent Type, Charging Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Vehicle Sale.

6. What are the notable trends driving market growth?

Rising Emphasis of Government on Eco-Friendly Buses.

7. Are there any restraints impacting market growth?

Increase in demand for Electric Vehicles.

8. Can you provide examples of recent developments in the market?

August 2022: British bus company First Bus ordered 193 electric buses worth GBP 81 million (~USD 96.4 million) from Northern Irish bus manufacturer Wrightbus. Furthermore, the company initially specifies the DC charging power at 150 kW and optional opportunity charging at 450 kW through pantograph options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pantograph Bus Charger Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pantograph Bus Charger Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pantograph Bus Charger Market?

To stay informed about further developments, trends, and reports in the Pantograph Bus Charger Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence