Key Insights

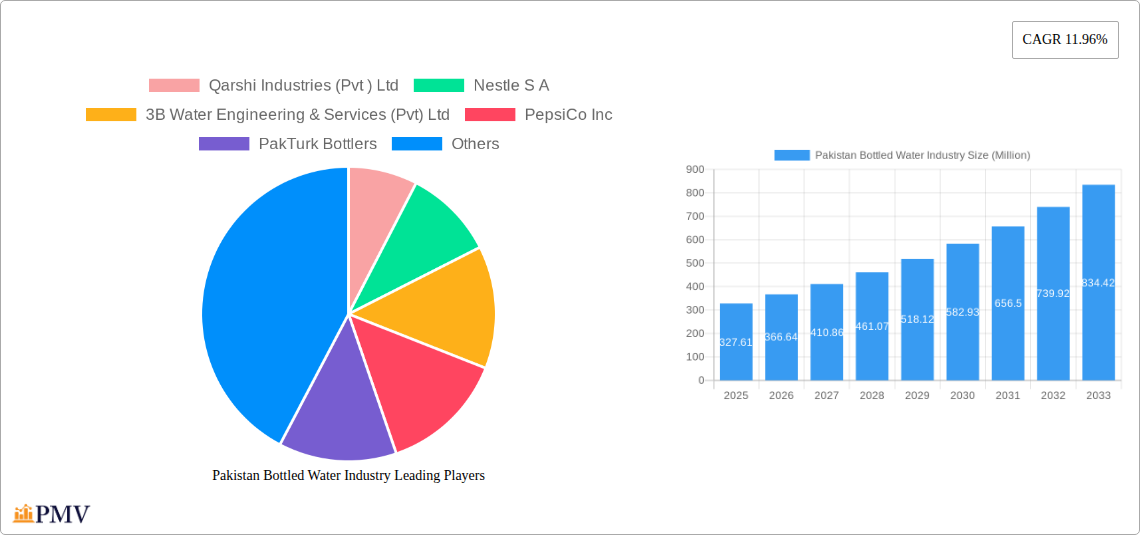

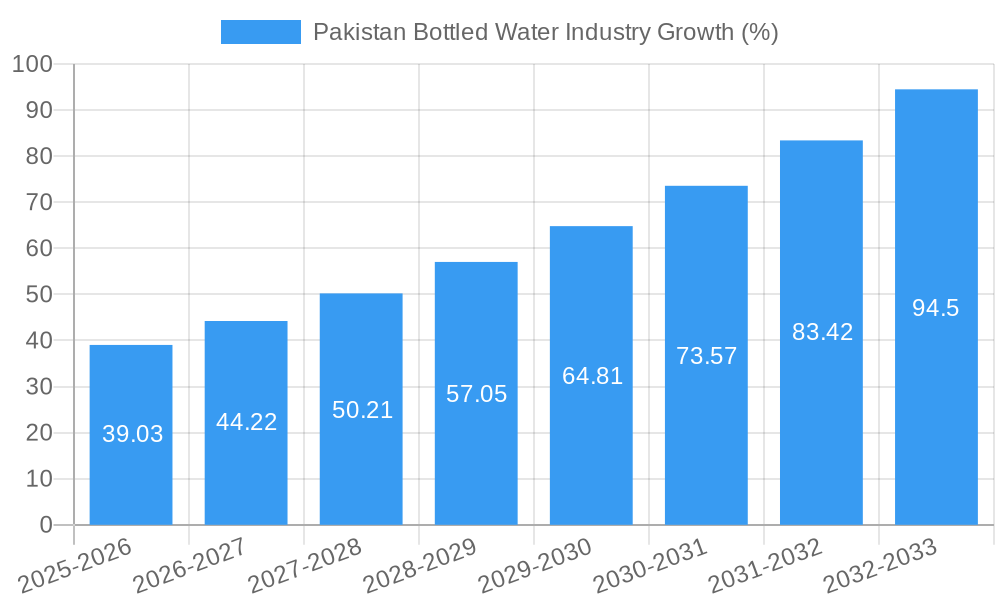

The Pakistan bottled water industry, valued at $327.61 million in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing health consciousness, and a growing preference for convenient and safe drinking water alternatives. The industry's Compound Annual Growth Rate (CAGR) of 11.96% from 2019-2024 indicates a significant upward trajectory. This growth is fueled by several factors, including urbanization leading to increased demand, the expansion of the retail and food service sectors, and heightened concerns regarding waterborne diseases. The market is segmented by water type (still and sparkling) and distribution channel (on-trade and off-trade), with the off-trade segment likely dominating due to widespread availability in supermarkets, convenience stores, and online platforms. Key players like Nestle, PepsiCo, and local brands like Qarshi Industries and Sufi Group are actively competing, driving innovation and product diversification. While challenges remain, such as fluctuating raw material prices and regulatory hurdles, the overall outlook for the Pakistan bottled water industry remains positive. The expanding middle class, coupled with targeted marketing campaigns and a focus on sustainable practices, are likely to contribute further to market expansion in the forecast period (2025-2033). The Asia-Pacific region, particularly countries like Pakistan, India, and China, is experiencing substantial growth, making it a lucrative market for both domestic and international players.

The competitive landscape is characterized by a mix of multinational corporations and local players. Multinationals leverage their established brand recognition and distribution networks, while local companies benefit from a strong understanding of local preferences and cost advantages. Future growth will likely see increased investment in sustainable packaging, premium product offerings (e.g., functional waters), and targeted marketing towards specific consumer segments. Government regulations concerning water quality and environmental sustainability will also play a significant role in shaping the industry's trajectory, pushing companies towards adopting more responsible and eco-friendly practices. The focus on health and wellness, coupled with growing consumer awareness of the importance of hydration, ensures the long-term potential of this dynamic market.

Pakistan Bottled Water Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Pakistan bottled water industry, covering market size, segmentation, competitive landscape, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The report is crucial for businesses, investors, and stakeholders seeking to understand and navigate this dynamic market. The report projects a market value reaching xx Million by 2033.

Pakistan Bottled Water Industry Market Structure & Competitive Dynamics

The Pakistan bottled water market exhibits a moderately concentrated structure, with both multinational giants and local players vying for market share. Key players include Nestle S.A., PepsiCo Inc., The Coca-Cola Company, and local companies like Qarshi Industries (Pvt) Ltd and Sufi Group of Industries. The market is characterized by intense competition, driven by factors such as product innovation, aggressive marketing, and price wars. The regulatory framework, though relatively stable, impacts production costs and distribution. Substitutes, such as filtered tap water and water purifiers, present a notable challenge. End-user trends lean towards premiumization, with consumers increasingly seeking bottled water with enhanced features like added minerals or functional benefits. M&A activity has been relatively moderate in recent years, with deal values generally under xx Million, though increased consolidation is anticipated.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystem: Emerging, with some players investing in sustainable packaging and enhanced product offerings.

- Regulatory Framework: Stable, but impacting costs and operations.

- Product Substitutes: Filtered tap water and water purifiers pose a competitive threat.

- End-User Trends: Premiumization and functional water gaining popularity.

- M&A Activity: Moderate, with potential for increased consolidation in the coming years.

Pakistan Bottled Water Industry Industry Trends & Insights

The Pakistan bottled water industry is experiencing robust growth, driven by rising disposable incomes, increasing health consciousness, and urbanization. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and a similar growth is expected to continue during the forecast period (2025-2033). Market penetration remains relatively low, indicating substantial untapped potential. Technological disruptions are impacting packaging and distribution, with e-commerce platforms increasingly influencing sales. Consumer preferences are shifting towards healthier, more sustainable options, impacting packaging choices and ingredient sourcing. Competitive dynamics are characterized by both price competition and premiumization strategies.

Dominant Markets & Segments in Pakistan Bottled Water Industry

The Pakistan bottled water market is geographically diverse, with demand concentrated in urban centers and high-population density regions. The Still Water segment dominates the market in terms of volume, owing to its affordability and broader consumer appeal. However, the Sparkling Water segment is experiencing faster growth, reflecting changing consumer preferences. The Off-Trade channel (supermarkets, convenience stores, etc.) constitutes the largest segment of the distribution channels, but the On-Trade (restaurants, hotels, etc.) channel is also seeing growth due to increased tourism and hospitality.

Key Drivers for Still Water Dominance: Affordability, wide availability, consumer familiarity.

Key Drivers for Off-Trade Channel Dominance: Convenience, widespread retail infrastructure.

Key Drivers for Urban Area Dominance: Higher disposable incomes, population density, greater accessibility.

Detailed Dominance Analysis: The larger cities such as Karachi, Lahore, and Islamabad drive a significant portion of the market due to higher population densities, increased disposable incomes, and better infrastructure compared to smaller towns and rural areas.

Pakistan Bottled Water Industry Product Innovations

Recent product innovations focus on enhanced flavors, functional benefits (e.g., added electrolytes, vitamins), and sustainable packaging materials. The trend is towards premiumization, with some brands launching high-end, imported bottled water options. These innovations cater to evolving consumer preferences for healthier and environmentally friendly products.

Report Segmentation & Scope

The report segments the Pakistan bottled water market by Type (Still Water, Sparkling Water) and Distribution Channel (On-Trade, Off-Trade). The Still Water segment is projected to maintain its market dominance, but the Sparkling Water segment is expected to experience a faster growth rate over the forecast period. Similarly, the Off-Trade channel is projected to maintain its dominance due to greater consumer access and established infrastructure. The competitive landscape within each segment varies, with some players specializing in specific types or distribution channels.

Key Drivers of Pakistan Bottled Water Industry Growth

Several factors contribute to the growth of the Pakistan bottled water industry: rising disposable incomes, increasing health awareness (particularly concerning water quality), urbanization leading to higher demand in urban centers, and a growing tourism sector. Government regulations promoting clean water access also play a supporting role.

Challenges in the Pakistan Bottled Water Industry Sector

Challenges include inconsistent water quality in certain areas, fluctuating raw material costs, and intense competition. Regulatory hurdles concerning licensing and labeling can also impact operations. Supply chain issues, including transportation infrastructure limitations, may pose a challenge in certain regions.

Leading Players in the Pakistan Bottled Water Industry Market

- Qarshi Industries (Pvt ) Ltd

- Nestle S A

- 3B Water Engineering & Services (Pvt) Ltd

- PepsiCo Inc

- PakTurk Bottlers

- Reignwood Investments UK Ltd (VOSS Water)

- Aqua Fujitenma Inc

- Danone S A

- Sufi Group of Industries

- The Coca-Cola Company

- Masafi LLC

Key Developments in Pakistan Bottled Water Industry Sector

- December 2021: Coca-Cola Beverages Pakistan Limited (CCI Pakistan) launched a water filtration plant in Haripur as part of its PAANI CSR project. This demonstrates a commitment to water access and community development, potentially enhancing brand image.

- March 2022: PepsiCo's collaboration with WaterAid for clean water access initiatives in underserved urban communities enhances brand reputation and reflects growing corporate social responsibility within the industry.

Strategic Pakistan Bottled Water Industry Market Outlook

The Pakistan bottled water market presents significant growth potential, driven by factors like rising disposable incomes and growing health consciousness. Strategic opportunities include expanding into underserved markets, investing in sustainable packaging solutions, and focusing on premium product offerings to meet evolving consumer preferences. Companies that adapt to changing consumer demands and leverage technological advancements will be well-positioned to succeed in this dynamic market.

Pakistan Bottled Water Industry Segmentation

-

1. Type

- 1.1. Still Water

- 1.2. Sparkling Water

-

2. Distribution Channel

- 2.1. On Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Home and Office Delivery (HOD)

- 2.2.5. Other Distribution Channels

Pakistan Bottled Water Industry Segmentation By Geography

- 1. Pakistan

Pakistan Bottled Water Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Concern for Quality Drinking Water; Strategic Investment by the Key Players

- 3.3. Market Restrains

- 3.3.1. Need for Stringent Regulatory Landscape

- 3.4. Market Trends

- 3.4.1. Escalating Concern for Quality Drinking Water

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Still Water

- 5.1.2. Sparkling Water

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Home and Office Delivery (HOD)

- 5.2.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Japan Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2019-2031

- 7. China Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2019-2031

- 9. Australia Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2019-2031

- 10. South Korea Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2019-2031

- 11. Thailand Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2019-2031

- 12. New Zeland Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2019-2031

- 13. Others Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Qarshi Industries (Pvt ) Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Nestle S A

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 3B Water Engineering & Services (Pvt) Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 PepsiCo Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 PakTurk Bottlers

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Reignwood Investments UK Ltd (VOSS Water)

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Aqua Fujitenma Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Danone S A

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sufi Group of Industries

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 The Coca-Cola Company

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Masafi LLC*List Not Exhaustive

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Qarshi Industries (Pvt ) Ltd

List of Figures

- Figure 1: Pakistan Bottled Water Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Pakistan Bottled Water Industry Share (%) by Company 2024

List of Tables

- Table 1: Pakistan Bottled Water Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Pakistan Bottled Water Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Pakistan Bottled Water Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Pakistan Bottled Water Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Pakistan Bottled Water Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Japan Pakistan Bottled Water Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: China Pakistan Bottled Water Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Pakistan Bottled Water Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Australia Pakistan Bottled Water Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Pakistan Bottled Water Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Thailand Pakistan Bottled Water Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: New Zeland Pakistan Bottled Water Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Others Pakistan Bottled Water Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Pakistan Bottled Water Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Pakistan Bottled Water Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Pakistan Bottled Water Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pakistan Bottled Water Industry?

The projected CAGR is approximately 11.96%.

2. Which companies are prominent players in the Pakistan Bottled Water Industry?

Key companies in the market include Qarshi Industries (Pvt ) Ltd, Nestle S A, 3B Water Engineering & Services (Pvt) Ltd, PepsiCo Inc, PakTurk Bottlers, Reignwood Investments UK Ltd (VOSS Water), Aqua Fujitenma Inc, Danone S A, Sufi Group of Industries, The Coca-Cola Company, Masafi LLC*List Not Exhaustive.

3. What are the main segments of the Pakistan Bottled Water Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 327.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Escalating Concern for Quality Drinking Water; Strategic Investment by the Key Players.

6. What are the notable trends driving market growth?

Escalating Concern for Quality Drinking Water.

7. Are there any restraints impacting market growth?

Need for Stringent Regulatory Landscape.

8. Can you provide examples of recent developments in the market?

March 2022: The global beverage and snack conglomerate PepsiCo collaborated with WaterAid in a bid to provide clean water to the masses of Pakistan. The company claimed that it is working to improve access to clean water for underserved urban communities in Pakistan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pakistan Bottled Water Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pakistan Bottled Water Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pakistan Bottled Water Industry?

To stay informed about further developments, trends, and reports in the Pakistan Bottled Water Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence