Key Insights

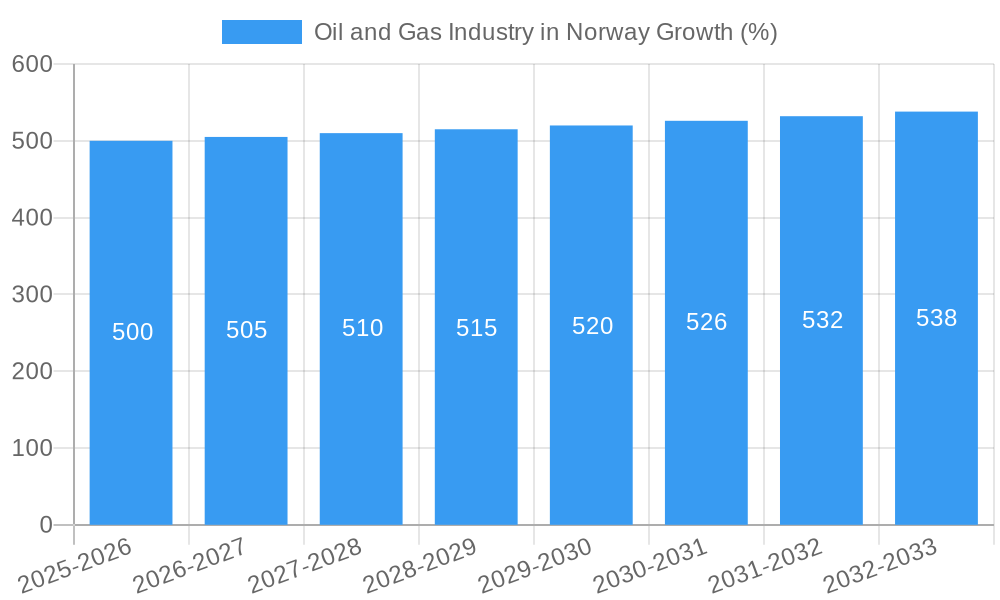

The Norwegian oil and gas industry, a cornerstone of the nation's economy, is projected to maintain a steady growth trajectory throughout the forecast period (2025-2033). While precise market size figures for 2019-2024 are unavailable, leveraging the provided CAGR of >1.00% and considering global oil and gas market trends, a reasonable estimation of the 2025 market size in Norway can be placed around $50 billion (USD). This figure accounts for fluctuating global energy prices, evolving energy policies, and the country's robust production capacity. Key drivers include ongoing exploration and production activities in mature fields, strategic investments in renewable energy integration within the oil and gas sector, and a continued global demand for natural gas, particularly in Europe. Trends indicate a strong focus on improving operational efficiency, reducing environmental impact through carbon capture and storage initiatives, and leveraging digital technologies for enhanced exploration and production. While potential restraints include volatility in global energy markets and increasing regulatory pressures for environmental sustainability, the Norwegian sector's reputation for technological advancement and responsible operations is anticipated to mitigate these challenges.

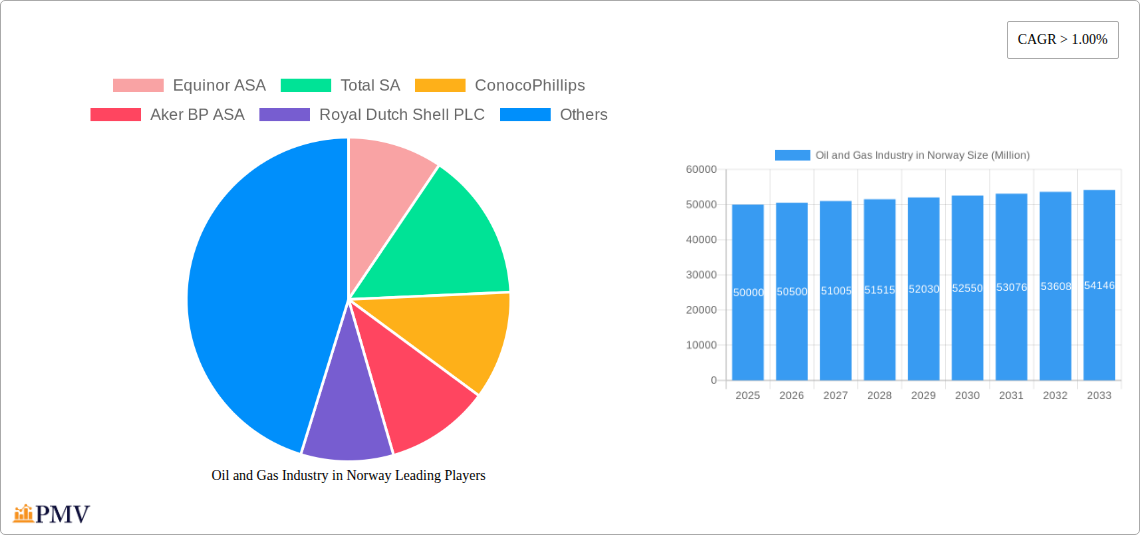

Despite global shifts toward renewable energy, Norway's significant reserves and expertise ensure its continued relevance. The segments, primarily heating and power generation, benefit from strong domestic demand and export opportunities. Major players like Equinor ASA, TotalEnergies, ConocoPhillips, Aker BP ASA, Shell, and Vår Energi AS continue to shape the market landscape through strategic partnerships, technological innovation, and exploration efforts. The forecast period will witness increased emphasis on sustainable practices, potentially leading to the development of new technologies and business models that balance economic growth with environmental stewardship. Norway's commitment to energy security and its position as a key supplier to the European market will sustain robust growth, even within the broader context of a global energy transition.

Oil and Gas Industry in Norway: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Oil and Gas Industry in Norway, covering market structure, competitive dynamics, industry trends, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is crucial for industry professionals, investors, and policymakers seeking actionable insights into this dynamic market.

Oil and Gas Industry in Norway Market Structure & Competitive Dynamics

The Norwegian oil and gas market exhibits a concentrated structure, dominated by major international and national players. Equinor ASA holds a significant market share, followed by TotalEnergies SE, ConocoPhillips, Aker BP ASA, Royal Dutch Shell PLC, and Vår Energi AS. However, the list is not exhaustive, and several smaller independent operators contribute to the overall production and exploration activities. The market is characterized by a strong regulatory framework focusing on environmental sustainability and safety, influencing operational strategies and investment decisions. Mergers and acquisitions (M&A) play a vital role in reshaping the competitive landscape, with deal values varying significantly depending on asset size and strategic importance. For example, while specific M&A deal values for the study period are unavailable (xx Million), the overall trend shows consolidation among players seeking to optimize their portfolios and enhance operational efficiency. This is driven by increasing operational expenditure and the need to secure a larger slice of the decreasing global market share for oil and gas as the shift towards renewables increases. Innovation is also a key driver, with companies investing heavily in enhanced oil recovery (EOR) techniques and exploration of new resources to sustain production and maintain their market share. Substitution of oil and gas with renewables is a significant challenge that is impacting the industry at both national and international levels. The industry is also faced with an aging infrastructure, causing challenges to the extraction and transportation of oil and gas. Finally, end-user trends, driven by the global energy transition, are creating both opportunities and challenges for operators.

- Market Concentration: High, with a few major players dominating the market.

- Innovation Ecosystems: Strong focus on EOR and exploration technologies.

- Regulatory Frameworks: Stringent environmental and safety regulations.

- Product Substitutes: Increasing competition from renewable energy sources.

- End-User Trends: Shift towards cleaner energy sources impacting demand.

- M&A Activities: Ongoing consolidation among operators (xx Million in deal values during 2019-2024).

Oil and Gas Industry in Norway Industry Trends & Insights

The Norwegian oil and gas industry is experiencing a period of transition, characterized by fluctuating oil prices, evolving environmental regulations, and technological advancements. Market growth is projected to remain relatively stable, though at a reduced CAGR compared to previous decades, owing primarily to the increasing global focus on renewable sources of energy. The market is showing an increase in focus on carbon capture and storage (CCS) in order to meet stringent environmental regulations. Technological disruptions, such as advancements in digitalization and automation, are driving efficiency improvements and cost reductions across the value chain. However, the impact of these is countered by the increasing cost of exploration and production, driven by factors including aging infrastructure. Consumer preferences are shifting towards more sustainable energy sources, requiring oil and gas companies to adapt their strategies and invest in lower-carbon technologies. Competitive dynamics remain intense, with companies continuously seeking to optimize their operations, explore new resources, and develop innovative solutions. Market penetration of renewable energy sources is also steadily increasing, posing a long-term challenge for the Norwegian Oil and Gas sector, and leading to a lower overall market growth of approximately xx% CAGR for the forecast period (2025-2033).

Dominant Markets & Segments in Oil and Gas Industry in Norway

Within the Norwegian oil and gas industry, power generation represents a significant segment, driven by the country's reliance on natural gas for electricity production. Heating, while also a considerable application, holds a smaller market share in comparison. This dominance of power generation can be attributed to several key factors:

- Key Drivers for Power Generation:

- Reliable Energy Source: Natural gas offers a relatively stable and reliable energy source for electricity generation.

- Established Infrastructure: Norway possesses a well-developed natural gas infrastructure, facilitating efficient transmission and distribution.

- Government Policies: Supportive government policies and regulations favor natural gas-based power generation.

The dominance of power generation over heating is primarily due to the greater scale of electricity demand compared to the demand for heating fuel in Norway. While both sectors will likely witness moderate growth in the coming years, power generation is expected to maintain its leading position due to its crucial role in the country's energy mix.

Oil and Gas Industry in Norway Product Innovations

Recent innovations within the Norwegian oil and gas industry are centered around enhancing efficiency, improving environmental performance, and extending the lifespan of existing assets. Companies are investing in advanced technologies for digitalization of oilfield operations, improved data analytics to optimize production and reduce risks. New exploration techniques and enhanced oil recovery methods are being deployed to maximize the extraction of hydrocarbons from existing and newly discovered fields. This focus on innovation is driven by the pressure to maintain production in a cost-effective manner whilst also minimizing the industry's environmental impact. Further, the integration of renewables and low carbon solutions into the energy value chain is a further area of innovation.

Report Segmentation & Scope

This report segments the Norwegian oil and gas market based on applications: Heating and Power Generation.

Heating: This segment encompasses the use of natural gas and oil for residential, commercial, and industrial heating purposes. Growth in this segment is projected to be moderate over the forecast period, due to factors such as the increasing adoption of alternative heating sources and government initiatives to promote energy efficiency. Market size for this segment in 2025 is estimated to be xx Million. Competitive dynamics are shaped by the pricing of fossil fuels and the availability of alternative heating technologies.

Power Generation: This segment represents the use of natural gas in power plants for electricity generation. This segment is anticipated to witness steady growth, driven by the country's need for a reliable energy source, however this growth will likely slow compared to previous years, as Norway continues its transition towards more sustainable energy sources. Market size for 2025 is projected to be xx Million. Competitive dynamics in this segment are influenced by the price of natural gas, regulatory framework, and the increasing competition from renewable energy sources.

Key Drivers of Oil and Gas Industry in Norway Growth

Several factors contribute to the growth of the Norwegian oil and gas industry. Technological advancements such as enhanced oil recovery techniques contribute to higher extraction rates from existing fields. Favorable government policies and regulations, focused on maintaining energy security, and a supportive investment environment facilitate exploration and production activities. Finally, Norway's vast reserves of oil and gas provide a robust foundation for continued industry growth. However, the pace of growth is likely to moderate in response to national and international pressures to reduce carbon emissions.

Challenges in the Oil and Gas Industry in Norway Sector

The Norwegian oil and gas industry faces various challenges. Stringent environmental regulations increase operational costs and compliance burdens, impacting profitability. Fluctuating global oil prices create uncertainty and volatility, affecting investment decisions. Supply chain disruptions and the increasing focus on the transition to low-carbon energy sources create both risks and opportunities for those operating within the sector. Furthermore, the aging of the existing infrastructure adds operational challenges and increases the need for significant investments. Finally, global competition and the increasing pressure from renewable energy sources add significant challenges to the sector's long-term stability.

Leading Players in the Oil and Gas Industry in Norway Market

Key Developments in Oil and Gas Industry in Norway Sector

March 2020: Aker BP starts production at the Skogul field, containing an estimated 9.4 Million barrels of oil. This development boosted Norway's oil production capacity and contributed to the country's energy security.

December 2020: ConocoPhillips discovers the Slagugle prospect, estimated to hold 12 to 32 Million Sm3 of recoverable oil equivalent. This discovery signaled the potential for further exploration and production growth in the Norwegian Sea.

February 2021: Equinor discovers hydrocarbons near the Troll field, estimated at 7 to 11 Million Sm3 of recoverable oil equivalent. This discovery further reinforced Norway's position as a significant oil and gas producer.

Strategic Oil and Gas Industry in Norway Market Outlook

The Norwegian oil and gas industry is poised for a period of managed decline. While production is expected to continue, it is likely that this will be at a slower rate than previously, and will be accompanied by significant investment in carbon capture, and a growing focus on renewables in the country's energy value chain. Strategic opportunities exist in the development of carbon capture and storage technologies, the exploration of new resources, and the optimization of existing infrastructure. Companies that can adapt to the changing regulatory landscape, embrace technological innovation, and manage the transition towards a more sustainable energy future will be best positioned for success.

Oil and Gas Industry in Norway Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Oil and Gas Industry in Norway Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oil and Gas Industry in Norway REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; The Adoption and Increasing Deployment of Alternative Renewable Energy

- 3.4. Market Trends

- 3.4.1. Development of New Oilfields to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil and Gas Industry in Norway Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Oil and Gas Industry in Norway Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Oil and Gas Industry in Norway Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Oil and Gas Industry in Norway Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Oil and Gas Industry in Norway Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Oil and Gas Industry in Norway Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Equinor ASA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Total SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ConocoPhillips

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aker BP ASA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Royal Dutch Shell PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vår Energi AS*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Equinor ASA

List of Figures

- Figure 1: Global Oil and Gas Industry in Norway Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Oil and Gas Industry in Norway Volume Breakdown (Tonnes, %) by Region 2024 & 2032

- Figure 3: Norway Oil and Gas Industry in Norway Revenue (Million), by Country 2024 & 2032

- Figure 4: Norway Oil and Gas Industry in Norway Volume (Tonnes), by Country 2024 & 2032

- Figure 5: Norway Oil and Gas Industry in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 6: Norway Oil and Gas Industry in Norway Volume Share (%), by Country 2024 & 2032

- Figure 7: North America Oil and Gas Industry in Norway Revenue (Million), by Production Analysis 2024 & 2032

- Figure 8: North America Oil and Gas Industry in Norway Volume (Tonnes), by Production Analysis 2024 & 2032

- Figure 9: North America Oil and Gas Industry in Norway Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 10: North America Oil and Gas Industry in Norway Volume Share (%), by Production Analysis 2024 & 2032

- Figure 11: North America Oil and Gas Industry in Norway Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 12: North America Oil and Gas Industry in Norway Volume (Tonnes), by Consumption Analysis 2024 & 2032

- Figure 13: North America Oil and Gas Industry in Norway Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 14: North America Oil and Gas Industry in Norway Volume Share (%), by Consumption Analysis 2024 & 2032

- Figure 15: North America Oil and Gas Industry in Norway Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 16: North America Oil and Gas Industry in Norway Volume (Tonnes), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 17: North America Oil and Gas Industry in Norway Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 18: North America Oil and Gas Industry in Norway Volume Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 19: North America Oil and Gas Industry in Norway Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 20: North America Oil and Gas Industry in Norway Volume (Tonnes), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 21: North America Oil and Gas Industry in Norway Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 22: North America Oil and Gas Industry in Norway Volume Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 23: North America Oil and Gas Industry in Norway Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 24: North America Oil and Gas Industry in Norway Volume (Tonnes), by Price Trend Analysis 2024 & 2032

- Figure 25: North America Oil and Gas Industry in Norway Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 26: North America Oil and Gas Industry in Norway Volume Share (%), by Price Trend Analysis 2024 & 2032

- Figure 27: North America Oil and Gas Industry in Norway Revenue (Million), by Country 2024 & 2032

- Figure 28: North America Oil and Gas Industry in Norway Volume (Tonnes), by Country 2024 & 2032

- Figure 29: North America Oil and Gas Industry in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 30: North America Oil and Gas Industry in Norway Volume Share (%), by Country 2024 & 2032

- Figure 31: South America Oil and Gas Industry in Norway Revenue (Million), by Production Analysis 2024 & 2032

- Figure 32: South America Oil and Gas Industry in Norway Volume (Tonnes), by Production Analysis 2024 & 2032

- Figure 33: South America Oil and Gas Industry in Norway Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 34: South America Oil and Gas Industry in Norway Volume Share (%), by Production Analysis 2024 & 2032

- Figure 35: South America Oil and Gas Industry in Norway Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 36: South America Oil and Gas Industry in Norway Volume (Tonnes), by Consumption Analysis 2024 & 2032

- Figure 37: South America Oil and Gas Industry in Norway Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 38: South America Oil and Gas Industry in Norway Volume Share (%), by Consumption Analysis 2024 & 2032

- Figure 39: South America Oil and Gas Industry in Norway Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 40: South America Oil and Gas Industry in Norway Volume (Tonnes), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 41: South America Oil and Gas Industry in Norway Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 42: South America Oil and Gas Industry in Norway Volume Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 43: South America Oil and Gas Industry in Norway Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 44: South America Oil and Gas Industry in Norway Volume (Tonnes), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 45: South America Oil and Gas Industry in Norway Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 46: South America Oil and Gas Industry in Norway Volume Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 47: South America Oil and Gas Industry in Norway Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 48: South America Oil and Gas Industry in Norway Volume (Tonnes), by Price Trend Analysis 2024 & 2032

- Figure 49: South America Oil and Gas Industry in Norway Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 50: South America Oil and Gas Industry in Norway Volume Share (%), by Price Trend Analysis 2024 & 2032

- Figure 51: South America Oil and Gas Industry in Norway Revenue (Million), by Country 2024 & 2032

- Figure 52: South America Oil and Gas Industry in Norway Volume (Tonnes), by Country 2024 & 2032

- Figure 53: South America Oil and Gas Industry in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 54: South America Oil and Gas Industry in Norway Volume Share (%), by Country 2024 & 2032

- Figure 55: Europe Oil and Gas Industry in Norway Revenue (Million), by Production Analysis 2024 & 2032

- Figure 56: Europe Oil and Gas Industry in Norway Volume (Tonnes), by Production Analysis 2024 & 2032

- Figure 57: Europe Oil and Gas Industry in Norway Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 58: Europe Oil and Gas Industry in Norway Volume Share (%), by Production Analysis 2024 & 2032

- Figure 59: Europe Oil and Gas Industry in Norway Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 60: Europe Oil and Gas Industry in Norway Volume (Tonnes), by Consumption Analysis 2024 & 2032

- Figure 61: Europe Oil and Gas Industry in Norway Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 62: Europe Oil and Gas Industry in Norway Volume Share (%), by Consumption Analysis 2024 & 2032

- Figure 63: Europe Oil and Gas Industry in Norway Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 64: Europe Oil and Gas Industry in Norway Volume (Tonnes), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 65: Europe Oil and Gas Industry in Norway Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 66: Europe Oil and Gas Industry in Norway Volume Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 67: Europe Oil and Gas Industry in Norway Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 68: Europe Oil and Gas Industry in Norway Volume (Tonnes), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 69: Europe Oil and Gas Industry in Norway Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 70: Europe Oil and Gas Industry in Norway Volume Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 71: Europe Oil and Gas Industry in Norway Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 72: Europe Oil and Gas Industry in Norway Volume (Tonnes), by Price Trend Analysis 2024 & 2032

- Figure 73: Europe Oil and Gas Industry in Norway Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 74: Europe Oil and Gas Industry in Norway Volume Share (%), by Price Trend Analysis 2024 & 2032

- Figure 75: Europe Oil and Gas Industry in Norway Revenue (Million), by Country 2024 & 2032

- Figure 76: Europe Oil and Gas Industry in Norway Volume (Tonnes), by Country 2024 & 2032

- Figure 77: Europe Oil and Gas Industry in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 78: Europe Oil and Gas Industry in Norway Volume Share (%), by Country 2024 & 2032

- Figure 79: Middle East & Africa Oil and Gas Industry in Norway Revenue (Million), by Production Analysis 2024 & 2032

- Figure 80: Middle East & Africa Oil and Gas Industry in Norway Volume (Tonnes), by Production Analysis 2024 & 2032

- Figure 81: Middle East & Africa Oil and Gas Industry in Norway Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 82: Middle East & Africa Oil and Gas Industry in Norway Volume Share (%), by Production Analysis 2024 & 2032

- Figure 83: Middle East & Africa Oil and Gas Industry in Norway Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 84: Middle East & Africa Oil and Gas Industry in Norway Volume (Tonnes), by Consumption Analysis 2024 & 2032

- Figure 85: Middle East & Africa Oil and Gas Industry in Norway Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 86: Middle East & Africa Oil and Gas Industry in Norway Volume Share (%), by Consumption Analysis 2024 & 2032

- Figure 87: Middle East & Africa Oil and Gas Industry in Norway Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 88: Middle East & Africa Oil and Gas Industry in Norway Volume (Tonnes), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 89: Middle East & Africa Oil and Gas Industry in Norway Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 90: Middle East & Africa Oil and Gas Industry in Norway Volume Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 91: Middle East & Africa Oil and Gas Industry in Norway Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 92: Middle East & Africa Oil and Gas Industry in Norway Volume (Tonnes), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 93: Middle East & Africa Oil and Gas Industry in Norway Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 94: Middle East & Africa Oil and Gas Industry in Norway Volume Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 95: Middle East & Africa Oil and Gas Industry in Norway Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 96: Middle East & Africa Oil and Gas Industry in Norway Volume (Tonnes), by Price Trend Analysis 2024 & 2032

- Figure 97: Middle East & Africa Oil and Gas Industry in Norway Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 98: Middle East & Africa Oil and Gas Industry in Norway Volume Share (%), by Price Trend Analysis 2024 & 2032

- Figure 99: Middle East & Africa Oil and Gas Industry in Norway Revenue (Million), by Country 2024 & 2032

- Figure 100: Middle East & Africa Oil and Gas Industry in Norway Volume (Tonnes), by Country 2024 & 2032

- Figure 101: Middle East & Africa Oil and Gas Industry in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 102: Middle East & Africa Oil and Gas Industry in Norway Volume Share (%), by Country 2024 & 2032

- Figure 103: Asia Pacific Oil and Gas Industry in Norway Revenue (Million), by Production Analysis 2024 & 2032

- Figure 104: Asia Pacific Oil and Gas Industry in Norway Volume (Tonnes), by Production Analysis 2024 & 2032

- Figure 105: Asia Pacific Oil and Gas Industry in Norway Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 106: Asia Pacific Oil and Gas Industry in Norway Volume Share (%), by Production Analysis 2024 & 2032

- Figure 107: Asia Pacific Oil and Gas Industry in Norway Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 108: Asia Pacific Oil and Gas Industry in Norway Volume (Tonnes), by Consumption Analysis 2024 & 2032

- Figure 109: Asia Pacific Oil and Gas Industry in Norway Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 110: Asia Pacific Oil and Gas Industry in Norway Volume Share (%), by Consumption Analysis 2024 & 2032

- Figure 111: Asia Pacific Oil and Gas Industry in Norway Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 112: Asia Pacific Oil and Gas Industry in Norway Volume (Tonnes), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 113: Asia Pacific Oil and Gas Industry in Norway Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 114: Asia Pacific Oil and Gas Industry in Norway Volume Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 115: Asia Pacific Oil and Gas Industry in Norway Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 116: Asia Pacific Oil and Gas Industry in Norway Volume (Tonnes), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 117: Asia Pacific Oil and Gas Industry in Norway Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 118: Asia Pacific Oil and Gas Industry in Norway Volume Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 119: Asia Pacific Oil and Gas Industry in Norway Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 120: Asia Pacific Oil and Gas Industry in Norway Volume (Tonnes), by Price Trend Analysis 2024 & 2032

- Figure 121: Asia Pacific Oil and Gas Industry in Norway Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 122: Asia Pacific Oil and Gas Industry in Norway Volume Share (%), by Price Trend Analysis 2024 & 2032

- Figure 123: Asia Pacific Oil and Gas Industry in Norway Revenue (Million), by Country 2024 & 2032

- Figure 124: Asia Pacific Oil and Gas Industry in Norway Volume (Tonnes), by Country 2024 & 2032

- Figure 125: Asia Pacific Oil and Gas Industry in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 126: Asia Pacific Oil and Gas Industry in Norway Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Region 2019 & 2032

- Table 3: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Production Analysis 2019 & 2032

- Table 5: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Region 2019 & 2032

- Table 15: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Country 2019 & 2032

- Table 17: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Production Analysis 2019 & 2032

- Table 19: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Country 2019 & 2032

- Table 29: United States Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 31: Canada Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 33: Mexico Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 35: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 36: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Production Analysis 2019 & 2032

- Table 37: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 38: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 39: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 40: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 41: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 42: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 43: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 44: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 45: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Country 2019 & 2032

- Table 47: Brazil Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Brazil Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 49: Argentina Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Argentina Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 51: Rest of South America Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of South America Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 53: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 54: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Production Analysis 2019 & 2032

- Table 55: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 56: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 57: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 58: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 59: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 60: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 61: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 62: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 63: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Country 2019 & 2032

- Table 65: United Kingdom Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: United Kingdom Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 67: Germany Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Germany Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 69: France Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: France Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 71: Italy Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Italy Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 73: Spain Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Spain Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 75: Russia Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Russia Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 77: Benelux Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Benelux Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 79: Nordics Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Nordics Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 81: Rest of Europe Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: Rest of Europe Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 83: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 84: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Production Analysis 2019 & 2032

- Table 85: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 86: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 87: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 88: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 89: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 90: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 91: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 92: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 93: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 94: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Country 2019 & 2032

- Table 95: Turkey Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Turkey Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 97: Israel Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Israel Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 99: GCC Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: GCC Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 101: North Africa Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: North Africa Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 103: South Africa Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: South Africa Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 105: Rest of Middle East & Africa Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: Rest of Middle East & Africa Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 107: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 108: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Production Analysis 2019 & 2032

- Table 109: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 110: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 111: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 112: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 113: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 114: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 115: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 116: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 117: Global Oil and Gas Industry in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 118: Global Oil and Gas Industry in Norway Volume Tonnes Forecast, by Country 2019 & 2032

- Table 119: China Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 120: China Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 121: India Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 122: India Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 123: Japan Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 124: Japan Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 125: South Korea Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 126: South Korea Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 127: ASEAN Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 128: ASEAN Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 129: Oceania Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 130: Oceania Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 131: Rest of Asia Pacific Oil and Gas Industry in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 132: Rest of Asia Pacific Oil and Gas Industry in Norway Volume (Tonnes) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Industry in Norway?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Oil and Gas Industry in Norway?

Key companies in the market include Equinor ASA, Total SA, ConocoPhillips, Aker BP ASA, Royal Dutch Shell PLC, Vår Energi AS*List Not Exhaustive.

3. What are the main segments of the Oil and Gas Industry in Norway?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure.

6. What are the notable trends driving market growth?

Development of New Oilfields to Drive the Market.

7. Are there any restraints impacting market growth?

4.; The Adoption and Increasing Deployment of Alternative Renewable Energy.

8. Can you provide examples of recent developments in the market?

In March 2020, the Skogul field located in the central part of the Norwegian North Sea, operated by Aker BP had started production. The field is estimated to contain recoverable resources of 1.5 million standard cubic meters of oil (9.4 million bbls).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Industry in Norway," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Industry in Norway report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Industry in Norway?

To stay informed about further developments, trends, and reports in the Oil and Gas Industry in Norway, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence