Key Insights

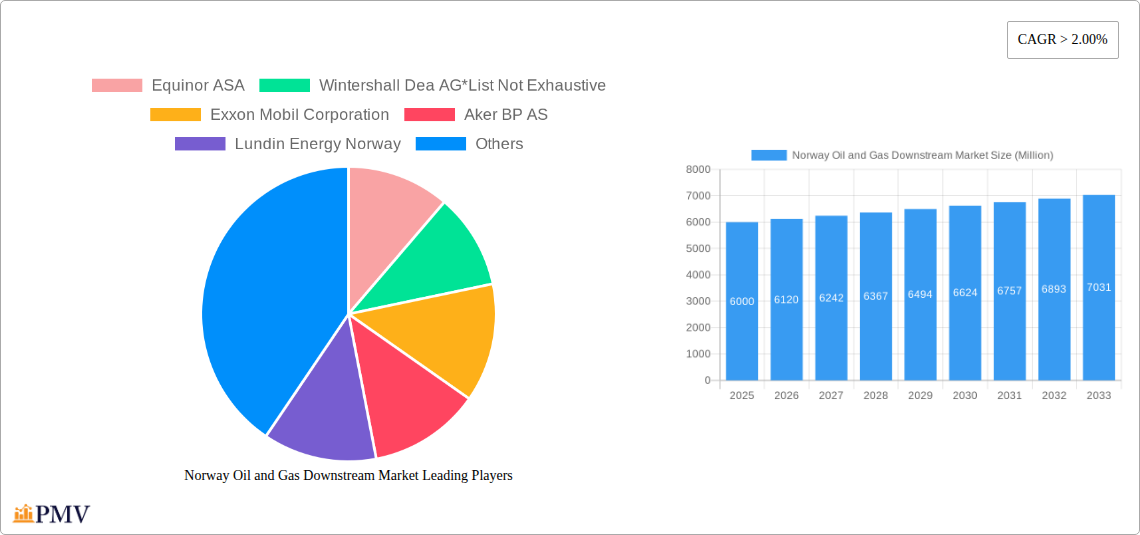

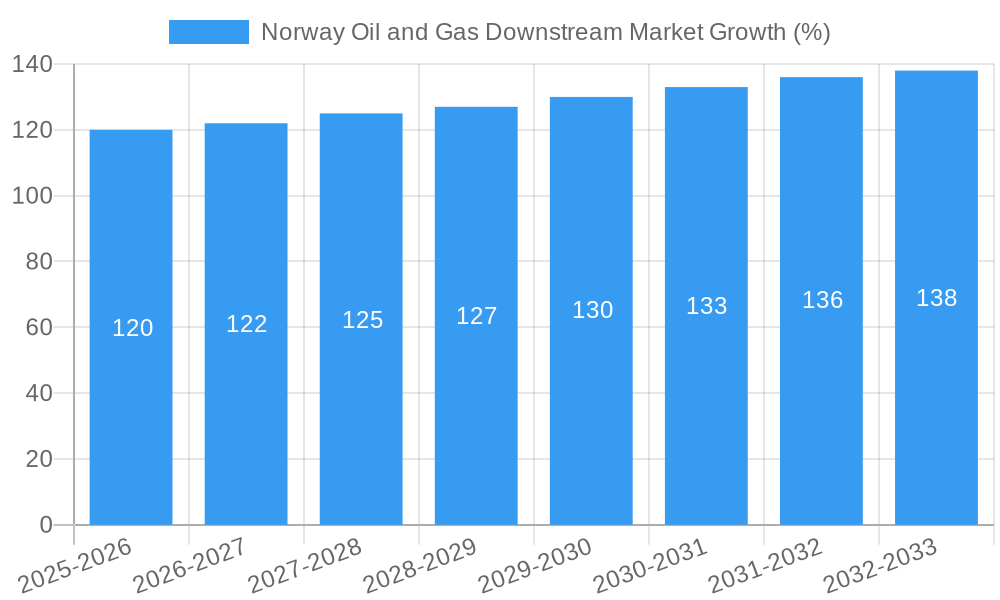

The Norway oil and gas downstream market, encompassing refineries and petrochemical plants, presents a robust growth trajectory. Driven by increasing domestic energy demand and strategic investments in refining and petrochemical infrastructure, the market exhibits a Compound Annual Growth Rate (CAGR) exceeding 2.00%, projecting significant expansion from 2025 to 2033. Key players like Equinor ASA, Wintershall Dea AG, Exxon Mobil Corporation, Aker BP AS, Lundin Energy Norway, Royal Dutch Shell PLC, and Total S.A. are actively shaping the market landscape through capacity expansions, technological upgrades, and strategic partnerships. While specific market size figures for 2019-2024 are not provided, extrapolating from the stated CAGR and considering the relatively stable nature of this mature market, a reasonable estimation of the 2025 market size could be in the range of $5-7 billion, representing a substantial contribution to the Norwegian economy. The focus on sustainability and environmental regulations is expected to influence investment decisions, prompting the adoption of cleaner technologies and emissions reduction strategies within the downstream sector.

The forecast period of 2025-2033 shows continued growth, albeit potentially at a slightly moderated pace compared to previous years. This moderation could be attributed to global economic uncertainties and evolving energy policies. However, Norway's established infrastructure, skilled workforce, and strategic location continue to provide a competitive advantage. The ongoing demand for refined products and petrochemicals within Norway and neighboring European markets is expected to propel market expansion. Further growth will depend on successful integration of renewable energy sources into the downstream operations, governmental support for industry modernization, and adaptability to fluctuating global oil prices. The market segmentation between refineries and petrochemical plants provides opportunities for specialized investments and tailored operational strategies.

Norway Oil and Gas Downstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Norway oil and gas downstream market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth prospects. It leverages historical data (2019-2024) to provide a robust foundation for future projections.

Norway Oil and Gas Downstream Market Market Structure & Competitive Dynamics

This section analyzes the market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the Norwegian oil and gas downstream sector. The market is characterized by a relatively concentrated structure, with key players holding significant market share. Equinor ASA, for instance, commands a substantial portion, estimated at xx%, followed by other significant players like Exxon Mobil Corporation, Aker BP AS, and Royal Dutch Shell PLC. The combined market share of the top five players is approximately xx%.

- Market Concentration: High, with a few major players dominating.

- Innovation Ecosystems: Moderate, with increasing focus on green technologies and digitalization.

- Regulatory Frameworks: Stringent environmental regulations and safety standards.

- Product Substitutes: Growing adoption of renewable energy sources and biofuels poses a moderate competitive threat.

- End-User Trends: Demand for refined petroleum products is expected to remain steady, with some shifts towards cleaner alternatives.

- M&A Activities: The past five years have seen xx M&A deals valued at approximately USD xx Million, primarily driven by consolidation and expansion efforts.

Norway Oil and Gas Downstream Market Industry Trends & Insights

The Norwegian oil and gas downstream market is experiencing a period of transformation, driven by several key factors. Market growth is projected at a CAGR of xx% from 2025 to 2033, reaching a market size of USD xx Million by 2033. This growth is primarily fueled by increasing domestic demand for refined petroleum products and petrochemicals. However, the market is also facing challenges from evolving consumer preferences toward cleaner energy sources and stricter environmental regulations. Technological disruptions, including the adoption of green technologies, are reshaping the competitive landscape, necessitating innovative strategies for sustained growth. Market penetration of renewable energy sources in the petrochemical sector is gradually increasing, currently at xx% and projected to reach xx% by 2033.

Dominant Markets & Segments in Norway Oil and Gas Downstream Market

The Norwegian oil and gas downstream market is dominated by the Refineries segment, primarily due to the presence of the Mongstad refinery, the sole oil refinery in Norway. Petrochemical plants also contribute significantly, but the refinery segment holds a larger market share, estimated at approximately xx%.

- Refineries:

- Key Drivers: High domestic demand for refined petroleum products, strategic location for export, and existing infrastructure.

- Dominance Analysis: The Mongstad refinery plays a crucial role, contributing significantly to the national energy security and supply chain.

- Petrochemical Plants:

- Key Drivers: Growing demand for petrochemicals in various industries, access to raw materials, and government support for investments in green technologies.

- Dominance Analysis: While smaller than the refineries segment, petrochemical plants are experiencing growth spurred by investments in green technologies and diversifying into sustainable product lines.

Norway Oil and Gas Downstream Market Product Innovations

Recent product innovations focus on enhancing efficiency, reducing emissions, and improving sustainability. This includes advancements in refining technologies, leading to higher yields of valuable products and minimizing waste. In the petrochemical sector, the shift towards green technologies, as evidenced by INOVYN's "Electra" project, represents a significant step towards reducing carbon footprint and enhancing the environmental profile of products. These innovations are crucial for securing market competitiveness and responding to evolving consumer expectations.

Report Segmentation & Scope

This report segments the market by process type: Refineries and Petrochemical Plants.

Refineries: This segment covers the production of various refined petroleum products, including gasoline, diesel, jet fuel, and petrochemicals. Growth is projected at a CAGR of xx% from 2025 to 2033, driven by steady demand and strategic investments in efficiency improvements. Competitive dynamics are shaped by the dominance of Mongstad and stringent environmental regulations.

Petrochemical Plants: This segment analyzes the production of ethylene, propylene, and other essential petrochemicals. Growth is projected at a CAGR of xx% during the forecast period, fueled by rising demand in the downstream industries and the increasing adoption of sustainable technologies. Competition is moderate, with several players focusing on cost leadership and innovation.

Key Drivers of Norway Oil and Gas Downstream Market Growth

Several factors are driving growth in the Norwegian oil and gas downstream market. These include:

- Steady Domestic Demand: Consistent demand for refined petroleum products fuels refinery operations.

- Strategic Location: Norway's position allows for efficient export of refined products.

- Government Support: Investments in infrastructure and green technologies bolster growth.

- Technological Advancements: Innovations in refining and petrochemical processes improve efficiency and sustainability.

Challenges in the Norway Oil and Gas Downstream Market Sector

The sector faces several challenges, including:

- Environmental Regulations: Stricter regulations necessitate investments in emission reduction technologies.

- Geopolitical Factors: Global events can impact crude oil prices and market stability.

- Competition from Renewables: Growing adoption of renewable energy sources poses a long-term competitive threat.

- Supply Chain Disruptions: Events like the Mongstad refinery fire highlight the vulnerability of supply chains.

Leading Players in the Norway Oil and Gas Downstream Market Market

- Equinor ASA

- Wintershall Dea AG

- Exxon Mobil Corporation

- Aker BP AS

- Lundin Energy Norway

- Royal Dutch Shell PLC

- TotalEnergies SE

Key Developments in Norway Oil and Gas Downstream Market Sector

- October 2022: INOVYN's "Electra" project in Rafnes receives USD 1.41 Million in funding from Enova to electrify vinyl chloride production, showcasing a commitment to green technologies.

- July 2022: A fire at the Mongstad refinery highlights operational risks and the importance of safety measures.

Strategic Norway Oil and Gas Downstream Market Market Outlook

The Norwegian oil and gas downstream market holds significant potential for growth, despite challenges. Strategic opportunities lie in investing in green technologies, optimizing refinery operations, and diversifying into sustainable product lines. The focus on energy transition and environmental sustainability will shape future growth, requiring a balanced approach between meeting existing demand and transitioning towards cleaner energy solutions.

Norway Oil and Gas Downstream Market Segmentation

-

1. Process Type

- 1.1. Refineries

- 1.2. Petrochemical Plants

Norway Oil and Gas Downstream Market Segmentation By Geography

- 1. Norway

Norway Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Refining Capacity to Remain Stagnant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Refineries

- 5.1.2. Petrochemical Plants

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wintershall Dea AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aker BP AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lundin Energy Norway

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Total S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Norway Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 3: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 6: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Oil and Gas Downstream Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Norway Oil and Gas Downstream Market?

Key companies in the market include Equinor ASA, Wintershall Dea AG*List Not Exhaustive, Exxon Mobil Corporation, Aker BP AS, Lundin Energy Norway, Royal Dutch Shell PLC, Total S A.

3. What are the main segments of the Norway Oil and Gas Downstream Market?

The market segments include Process Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems.

6. What are the notable trends driving market growth?

Refining Capacity to Remain Stagnant.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

October 2022: INOVYN's petrochemical site in Rafnes, Norway, takes the next step in developing and implementing green technology. As a subsidiary of INEOS, INOVYN will develop and install a new world-leading technology to electrify the production of vinyl chloride on the Rafnes site, replacing fossil fuel with renewable electricity. The project is called "Electra." A decision was made on 23 August 2022 by Enova to support Electra with an investment of USD 1.41 Million, subject to the decision by INEOS to proceed with the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Norway Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence