Key Insights

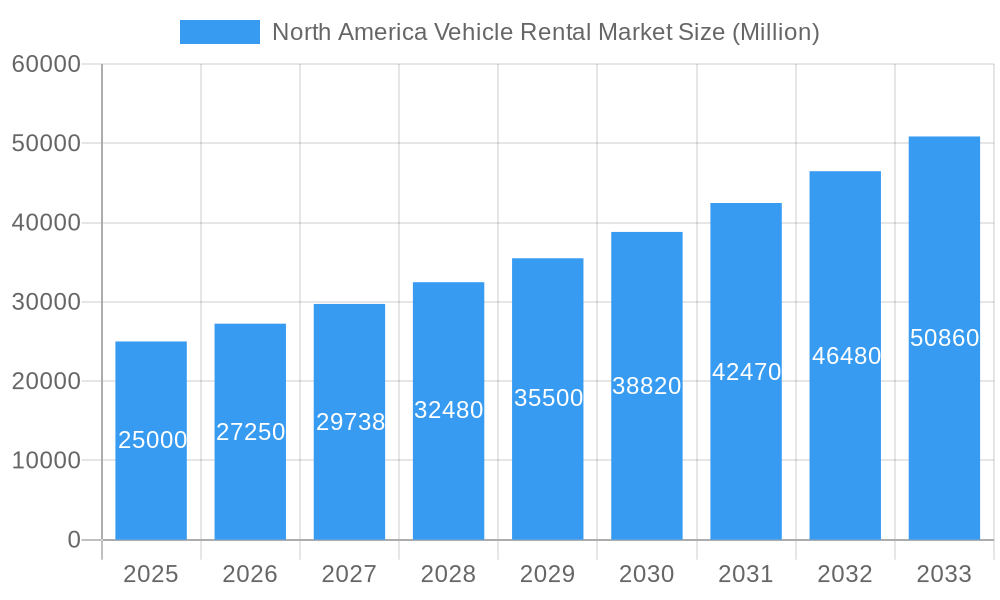

The North America vehicle rental market, valued at approximately $48.55 billion in 2025, is poised for significant expansion. This growth is propelled by the increasing demand for flexible transportation solutions, driven by the resurgence of leisure and business travel, particularly among younger consumers. The proliferation of online booking platforms enhances convenience and accessibility, simplifying the rental process. The market is segmented by vehicle type (luxury, economy, MPV, others), application (local, outstation, others), rental duration (short-term, long-term), booking type (online, offline), and geography (United States, Canada, Rest of North America). The dominance of online bookings highlights a clear digital transformation, further supported by the robust expansion of the North American tourism sector. Key industry players include Enterprise Holdings Inc., Hertz Corporation, and Avis Budget Group Inc., alongside specialized emerging competitors. Short-term rentals and online booking channels are anticipated to exhibit the strongest growth, reflecting evolving consumer preferences.

North America Vehicle Rental Market Market Size (In Billion)

With a projected Compound Annual Growth Rate (CAGR) of 6.6% through 2033, the market anticipates substantial expansion. Potential headwinds include volatile fuel prices, economic downturns affecting travel expenditure, and the increasing adoption of ride-sharing services. To navigate these challenges, rental companies are focusing on fleet diversification, technological advancements such as mobile booking applications, and customer loyalty programs. Geographic expansion into untapped regions and strategic alliances with hospitality and airline partners are also expected. The market's trajectory is intrinsically linked to regional economic health and the sustained appeal of tourism. Continuous innovation in service offerings tailored to evolving consumer needs will be paramount for sustained competitive advantage.

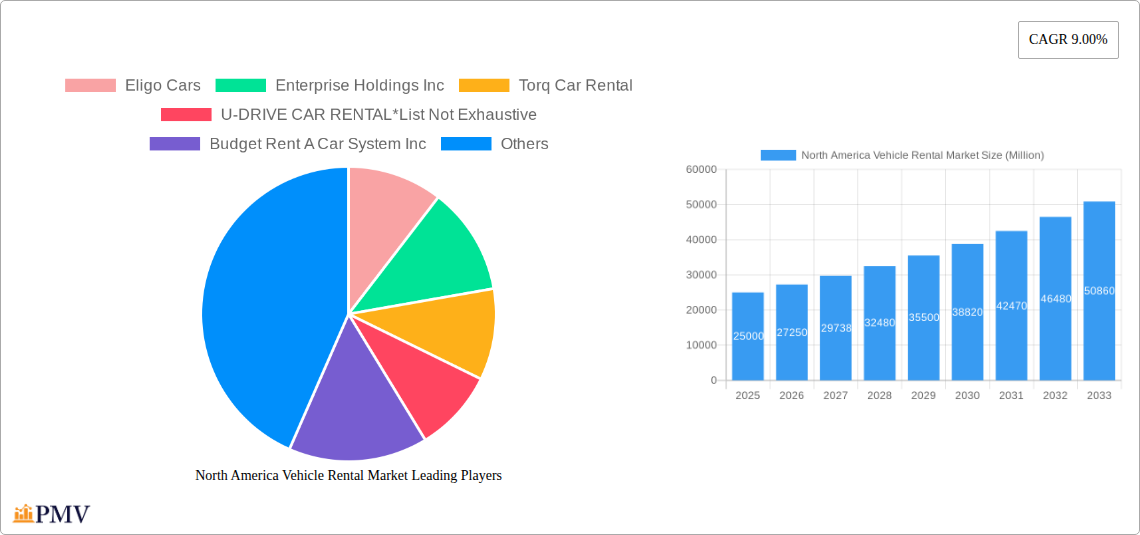

North America Vehicle Rental Market Company Market Share

This comprehensive report offers an in-depth analysis of the North America vehicle rental market from 2019 to 2033, providing critical insights into market dynamics, competitive landscapes, and future growth prospects. It empowers businesses with actionable intelligence for strategic planning. The report features detailed segmentation by vehicle type, application, rental duration, booking type, and country (United States, Canada, Rest of North America), delivering a granular understanding of market trends and potential. The base year for this analysis is 2025, with projections for 2025 and forecasts extending to 2033.

North America Vehicle Rental Market Market Structure & Competitive Dynamics

The North American vehicle rental market is characterized by a moderately concentrated structure with a few dominant players and numerous smaller independent operators. Market share is heavily influenced by brand recognition, fleet size, geographic reach, and service offerings. Key players like Enterprise Holdings Inc., Hertz Corporation, and Avis Budget Group Inc. hold significant market share, leveraging economies of scale and established brand equity. However, the market also displays a dynamic competitive landscape, with smaller players focusing on niche segments or geographic areas. The innovation ecosystem is vibrant, with ongoing developments in technology, fleet electrification, and customer experience enhancing the overall rental experience.

The regulatory framework governing the vehicle rental industry varies across North American jurisdictions, impacting operational costs and market entry barriers. The rise of ride-sharing services presents a significant substitute, impacting the overall demand for traditional vehicle rentals, particularly in urban areas. End-user trends, such as increasing preference for online bookings and technological advancements like connected car features and EV options, continuously reshape the competitive landscape. M&A activities have been significant, with notable examples including Hertz's USD 4.2 Billion deal to acquire 100,000 Tesla EVs (June 2022) and Enterprise Holdings' acquisition of Walker Vehicle Rentals (October 2021). These deals showcase a shift towards electric fleets and expansion into commercial vehicle rentals. The average M&A deal value in recent years sits around xx Million, illustrating the substantial investment occurring within the sector.

North America Vehicle Rental Market Industry Trends & Insights

The North America vehicle rental market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing tourism, and a surge in business travel. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is further fueled by technological disruptions, such as the integration of mobile applications for seamless booking and management of rentals, and the emergence of shared mobility platforms. Consumer preferences are shifting towards convenience, transparency, and personalized services. This includes a growing demand for online booking options, diverse vehicle choices, and value-added services like insurance and roadside assistance. The competitive dynamics are intense, with companies focusing on differentiation through technology, customer service, and sustainability initiatives. Market penetration of online bookings is expected to reach xx% by 2033, driven by ease of use and wider availability of smartphone applications. The adoption of electric vehicles (EVs) in rental fleets is also gaining momentum, although facing challenges related to infrastructure and charging availability.

Dominant Markets & Segments in North America Vehicle Rental Market

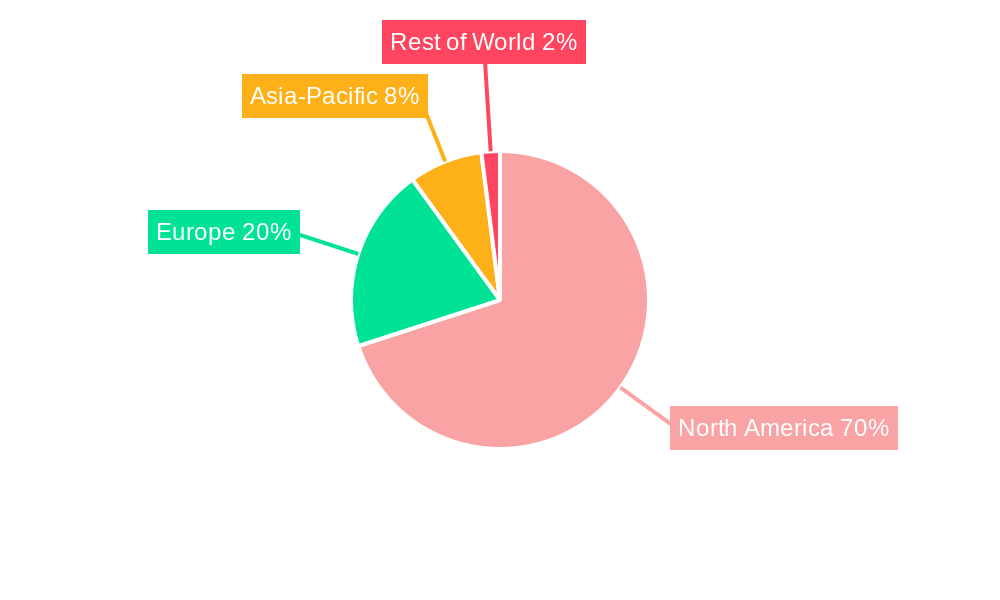

By Country: The United States dominates the North American vehicle rental market, accounting for the largest market share due to its extensive road network, large population, and thriving tourism industry. Canada holds a significant share, while the Rest of North America comprises a smaller portion. Key drivers for the US dominance include robust economic activity, well-developed infrastructure, and a high volume of both domestic and international travel. Canada's market is driven by similar factors, though on a smaller scale.

By Vehicle Type: Economy cars constitute the largest segment, driven by price sensitivity and suitability for individual travelers and short trips. However, the luxury car segment is witnessing substantial growth driven by rising disposable incomes and a preference for upscale travel experiences. The MPV segment is also expanding, catering to families and groups.

By Application Type: Local usage accounts for the largest segment, driven by everyday needs and short-term rentals. However, the outstation segment is expanding at a faster rate, propelled by rising domestic and international tourism.

By Rental Duration: Short-term rentals are the dominant segment, driven by both leisure and business travel needs. However, the long-term rental segment is witnessing steady growth, particularly in urban areas, attributed to demand for flexible transportation solutions.

By Booking Type: Online bookings are growing rapidly, driven by convenience and ease of access. While offline bookings still hold a considerable share, this is expected to decrease in the future, as online platforms continue to improve.

North America Vehicle Rental Market Product Innovations

The North American vehicle rental market is witnessing significant product innovation, primarily driven by technological advancements. The integration of telematics, connected car features, and mobile applications enhances customer experience and operational efficiency. The adoption of electric vehicles (EVs) is gaining traction, addressing environmental concerns and offering cost advantages. Rental companies are also introducing subscription models and flexible rental plans to cater to evolving consumer preferences. These innovations offer competitive advantages by improving customer satisfaction and driving operational efficiency.

Report Segmentation & Scope

This report segments the North American vehicle rental market in various ways, offering a detailed analysis across different factors:

By Vehicle Type: Economy Cars, Luxury Cars, Multi-Purpose Vehicles (MPVs), and Others. Each segment's growth projections, market size, and competitive dynamics are analyzed.

By Application Type: Local Usage, Outstation, and Others. The report details the market size and growth of each category.

By Rental Duration: Short-term and Long-term rentals. This section details the market trends and future prospects for each.

By Booking Type: Online Booking and Offline Booking. The analysis examines the evolving preference between online and offline booking channels.

By Country: United States, Canada, and Rest of North America. The report provides a regional analysis of market dynamics and growth potential.

Key Drivers of North America Vehicle Rental Market Growth

The growth of the North American vehicle rental market is fueled by several key drivers. Rising disposable incomes and increased tourism lead to higher demand for vehicle rentals. Technological advancements, such as the development of user-friendly mobile applications and the integration of connected car features, enhance the overall customer experience and drive market expansion. Government initiatives promoting sustainable transportation are encouraging the adoption of electric vehicles in rental fleets. The expansion of the business travel sector also contributes significantly to the growth of the market.

Challenges in the North America Vehicle Rental Market Sector

The North American vehicle rental market faces several challenges, including rising fuel costs, increasing insurance premiums, and intense competition from ride-sharing services. Stringent regulatory requirements related to vehicle safety and emissions compliance also pose significant hurdles. Supply chain disruptions and fluctuations in vehicle prices can impact profitability. Moreover, the ongoing transition towards electric vehicles presents challenges related to charging infrastructure development and battery technology limitations. These factors, collectively, impact the profitability and growth trajectory of the sector.

Leading Players in the North America Vehicle Rental Market Market

- Eligo Cars

- Enterprise Holdings Inc

- Torq Car Rental

- U-DRIVE CAR RENTAL

- Budget Rent A Car System Inc

- Hertz Corporation

- Sixt SE

- Europcar Mobility Group

- Dollar Rent A Car Inc

- Avis Budget Group Inc

Key Developments in North America Vehicle Rental Market Sector

June 2022: Hertz announced a USD 4.2 Billion deal to purchase 100,000 Tesla EVs, significantly impacting the EV adoption rate within the rental car industry.

September 2021: Enterprise Holdings collaborated with Microsoft to integrate connected car technology, enhancing the customer rental experience.

October 2021: Enterprise Holdings acquired Walker Vehicle Rentals, expanding its presence in the commercial vehicle rental market.

Strategic North America Vehicle Rental Market Market Outlook

The North America vehicle rental market presents significant growth potential in the coming years. The increasing adoption of electric vehicles, coupled with advancements in connected car technology and shared mobility solutions, will reshape market dynamics. Companies focusing on sustainability initiatives, customer-centric services, and technological innovation will likely gain a competitive advantage. Expansion into niche segments, such as luxury rentals and commercial vehicle rentals, also presents promising avenues for growth. The market's future trajectory hinges on adapting to technological advancements and addressing environmental concerns.

North America Vehicle Rental Market Segmentation

-

1. Vehicle Type

- 1.1. Luxury Cars

- 1.2. Economy Cars

- 1.3. Multi Purpose Vehicles (MPV)

- 1.4. Others

-

2. Application Type

- 2.1. Local Usage

- 2.2. Outstation

- 2.3. Others

-

3. Rental Duration

- 3.1. Short term

- 3.2. Long term

-

4. Booking type

- 4.1. Online booking

- 4.2. Offline booking

North America Vehicle Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Vehicle Rental Market Regional Market Share

Geographic Coverage of North America Vehicle Rental Market

North America Vehicle Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Construction Industry

- 3.3. Market Restrains

- 3.3.1. High Maintenance Cost of Construction Equipment

- 3.4. Market Trends

- 3.4.1. Short term Rental Segment of Market Expected to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vehicle Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Luxury Cars

- 5.1.2. Economy Cars

- 5.1.3. Multi Purpose Vehicles (MPV)

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Local Usage

- 5.2.2. Outstation

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Rental Duration

- 5.3.1. Short term

- 5.3.2. Long term

- 5.4. Market Analysis, Insights and Forecast - by Booking type

- 5.4.1. Online booking

- 5.4.2. Offline booking

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Eligo Cars

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enterprise Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Torq Car Rental

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 U-DRIVE CAR RENTAL*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Budget Rent A Car System Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hertz Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sixt SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Europcar Mobility Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dollar Rent A Car Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Avis Budget Group Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Eligo Cars

List of Figures

- Figure 1: North America Vehicle Rental Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Vehicle Rental Market Share (%) by Company 2025

List of Tables

- Table 1: North America Vehicle Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America Vehicle Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: North America Vehicle Rental Market Revenue billion Forecast, by Rental Duration 2020 & 2033

- Table 4: North America Vehicle Rental Market Revenue billion Forecast, by Booking type 2020 & 2033

- Table 5: North America Vehicle Rental Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Vehicle Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: North America Vehicle Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 8: North America Vehicle Rental Market Revenue billion Forecast, by Rental Duration 2020 & 2033

- Table 9: North America Vehicle Rental Market Revenue billion Forecast, by Booking type 2020 & 2033

- Table 10: North America Vehicle Rental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Vehicle Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Vehicle Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Vehicle Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vehicle Rental Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the North America Vehicle Rental Market?

Key companies in the market include Eligo Cars, Enterprise Holdings Inc, Torq Car Rental, U-DRIVE CAR RENTAL*List Not Exhaustive, Budget Rent A Car System Inc, Hertz Corporation, Sixt SE, Europcar Mobility Group, Dollar Rent A Car Inc, Avis Budget Group Inc.

3. What are the main segments of the North America Vehicle Rental Market?

The market segments include Vehicle Type, Application Type, Rental Duration, Booking type.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.55 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Construction Industry.

6. What are the notable trends driving market growth?

Short term Rental Segment of Market Expected to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

High Maintenance Cost of Construction Equipment.

8. Can you provide examples of recent developments in the market?

In June 2022, Hertz Company announced a USD 4.2 billion deal to purchase 100,000 Tesla fully electric vehicles (EVs) by the end of 2022 set off a race among rental car agencies. Hertz did not state the overall number of vehicles in its fleet so it's unknown how many Teslas are available in the more than 30 markets currently offering EVs, which now also include the first of the 65,000 Polestar 2s - an EV brand jointly owned by Volvo and its Chinese parent Geely which has planned to go public through a SPAC deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vehicle Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vehicle Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vehicle Rental Market?

To stay informed about further developments, trends, and reports in the North America Vehicle Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence