Key Insights

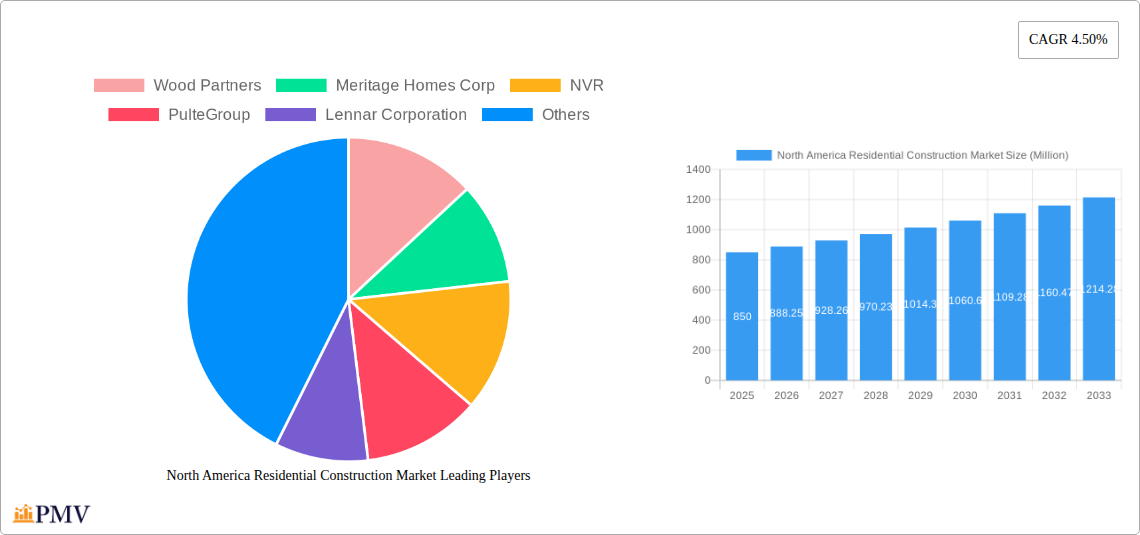

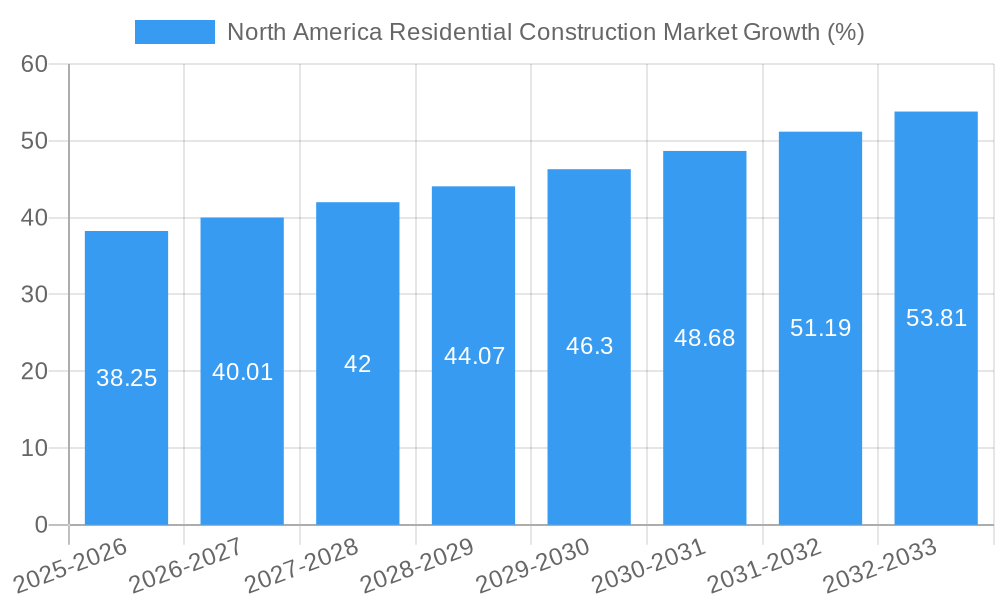

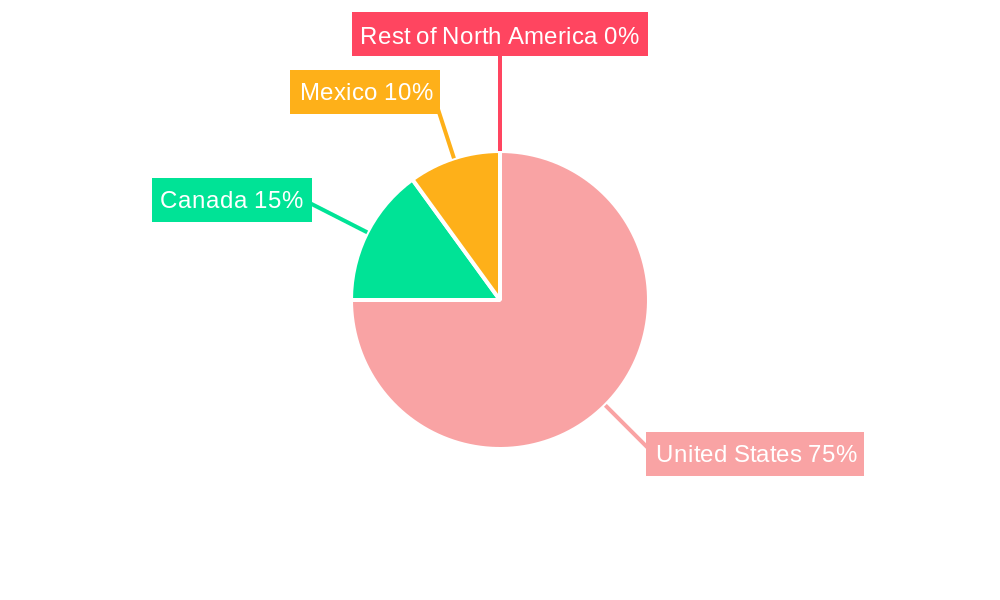

The North American residential construction market, valued at $850 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.5% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, a growing population and increasing urbanization, particularly in major metropolitan areas across the US, Canada, and Mexico, are creating significant demand for new housing. Secondly, improving economic conditions and low-interest rates (though subject to fluctuation) are making mortgages more accessible, stimulating homeownership. Furthermore, the ongoing trend towards suburban living and the desire for larger living spaces are contributing to the market's expansion. However, the market faces certain constraints. Rising construction material costs, labor shortages, and regulatory hurdles pose challenges to sustained growth. The market is segmented by property type (single-family and multi-family), construction type (new construction and renovation), and region (United States, Canada, and Mexico). The US dominates the market share, followed by Canada and then Mexico. Key players like Lennar Corporation, D.R. Horton, PulteGroup, and Toll Brothers, along with prominent apartment developers such as Wood Partners and Mill Creek Residential, are actively shaping the market landscape through innovation and strategic expansion.

The segmentation reveals interesting trends. The multi-family segment is experiencing rapid growth driven by increasing rental demand in urban centers. Simultaneously, the single-family segment remains substantial, reflecting the enduring preference for homeownership. Within construction type, new construction projects account for a larger share, but renovation projects also contribute significantly, indicating a focus on upgrading existing housing stock. Regional variations exist, with the United States exhibiting the highest growth potential due to its larger population and diverse housing needs. Looking ahead, strategic partnerships, technological advancements in construction techniques, and a focus on sustainable building practices will likely further shape the market trajectory over the forecast period. The market's long-term outlook remains positive, despite the challenges, suggesting considerable opportunities for established players and new entrants alike.

North America Residential Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America residential construction market, covering the period from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study offers invaluable insights for investors, builders, developers, and industry stakeholders seeking to navigate this dynamic sector. The report leverages extensive data analysis and industry expertise to deliver actionable intelligence and strategic recommendations. The market is segmented by property type (single-family, multi-family), construction type (new construction, renovation), and region (United States, Canada, Mexico). Key players analyzed include Wood Partners, Meritage Homes Corp, NVR, PulteGroup, Lennar Corporation, Mill Creek Residential, Clayton Properties Group, Toll Brothers Building Company, Alliance Residential, Taylor Morrison, D R Horton, LGI Homes, Century Communities, The Michaels Organization, KB Home, and LMC Residential. This list is not exhaustive. The report projects a total market value of xx Million by 2033.

North America Residential Construction Market Structure & Competitive Dynamics

The North American residential construction market exhibits a moderately concentrated structure, with several large players holding significant market share. However, a substantial number of smaller and regional builders also contribute significantly to the overall market volume. The industry's competitive landscape is shaped by factors such as economies of scale, access to financing, land acquisition capabilities, and brand recognition. Innovation plays a key role, with companies constantly seeking to improve building techniques, materials, and designs to enhance efficiency, sustainability, and affordability. Regulatory frameworks, particularly building codes and zoning regulations, vary across regions and significantly impact operational costs and project timelines. The market also witnesses ongoing mergers and acquisitions (M&A) activity, with larger firms consolidating their market position through acquisitions of smaller competitors. Recent M&A deal values have ranged from USD 2.4 Million (Pulte Homes land acquisition) to USD xx Million for larger transactions. Market share data reveals that the top five companies account for approximately xx% of the total market, leaving the remaining share distributed among hundreds of smaller players. End-user preferences for sustainable and smart home features are increasingly driving innovation, pushing companies towards the adoption of advanced technologies and environmentally friendly building materials.

North America Residential Construction Market Industry Trends & Insights

The North American residential construction market is characterized by fluctuating growth patterns influenced by macroeconomic factors such as interest rates, employment levels, and consumer confidence. Recent years have witnessed periods of both expansion and contraction, with the market demonstrating resilience despite external headwinds. The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) is estimated at xx%, while the forecast period (2025-2033) projects a CAGR of xx%. Technological advancements, including Building Information Modeling (BIM) and prefabrication, are enhancing efficiency and reducing construction time. A notable shift in consumer preferences is towards sustainable and energy-efficient homes, prompting builders to adopt green building practices and integrate smart home technologies. This has resulted in a market penetration rate of xx% for green building practices in 2024, projected to increase to xx% by 2033. Increasing urbanization and population growth, particularly in major metropolitan areas, are key growth drivers, fostering demand for both single-family and multi-family dwellings. However, challenges such as labor shortages, rising material costs, and supply chain disruptions continue to impact market dynamics and profitability. The competitive landscape is further intensified by increasing consolidation within the industry, with larger players actively pursuing acquisition strategies.

Dominant Markets & Segments in North America Residential Construction Market

The United States remains the dominant market within North America, accounting for approximately xx% of the total market value. This is driven by a robust economy, high population density in urban areas, and considerable government investment in infrastructure projects. Canada and Mexico represent significant but smaller markets, with growth primarily driven by increasing urbanization and government initiatives to improve housing affordability.

By Property Type: The single-family segment constitutes a larger share of the market compared to the multi-family segment, primarily owing to strong demand for individual homeownership. However, the multi-family segment is experiencing relatively faster growth due to increasing urbanization and the demand for rental housing.

By Construction Type: New construction remains the dominant segment, driven by population growth and rising household incomes. However, the renovation sector is also exhibiting considerable growth potential as homeowners invest in upgrading their existing properties.

Key Drivers: Key drivers across all segments include favorable government policies supporting housing development, infrastructure investments that improve connectivity, and a growing young population seeking housing.

North America Residential Construction Market Product Innovations

The residential construction sector is witnessing a wave of product innovations centered around sustainability, energy efficiency, and smart home technology. Advanced building materials such as cross-laminated timber (CLT) and insulated concrete forms (ICFs) are gaining traction due to their superior performance characteristics. Prefabrication and modular construction techniques are improving construction speed and efficiency. The integration of smart home technologies, including energy management systems and security systems, is enhancing both the functionality and appeal of residential properties. This trend is aligned with increasing consumer preference for technologically advanced and sustainable homes.

Report Segmentation & Scope

This report provides a detailed segmentation of the North American residential construction market along the following parameters:

By Property Type: Single-family homes constitute a larger market share, driven by a preference for individual ownership. The multi-family segment, encompassing apartments and condominiums, is projected to experience faster growth due to urbanization and increasing rental demand. Growth projections vary significantly based on regional economic conditions and government incentives.

By Construction Type: New construction dominates the market, fueled by rising populations and improving economic conditions. The renovation segment, characterized by remodeling and upgrading existing homes, is expected to exhibit steady growth, driven by homeowners' investment in improving their properties. Competitive intensity is higher in the new construction segment due to a larger number of players.

By Region: The United States remains the largest market, with significant growth potential in specific regions. Canada’s market is relatively stable with opportunities in urban areas. Mexico presents a high-growth opportunity but faces challenges regarding regulations and infrastructure.

Key Drivers of North America Residential Construction Market Growth

Several key factors are driving the growth of the North American residential construction market. Favorable government policies promoting homeownership and infrastructure development stimulate construction activity. The increasing urbanization trend leads to higher demand for residential units in urban centers. Growing household incomes enable more people to afford homeownership or rental properties, further driving market expansion. Technological advancements in construction materials and techniques enhance efficiency and reduce costs.

Challenges in the North America Residential Construction Market Sector

The North American residential construction market faces several challenges. Labor shortages and rising labor costs create significant operational headwinds. Supply chain disruptions and increasing material prices impact construction costs and project timelines. Stringent building codes and regulations impose additional compliance burdens, adding to project costs. High interest rates can make financing more expensive, impacting consumer demand and developer investment. These challenges significantly impact profitability and overall market growth.

Leading Players in the North America Residential Construction Market Market

- Wood Partners

- Meritage Homes Corp

- NVR

- PulteGroup

- Lennar Corporation

- Mill Creek Residential

- Clayton Properties Group

- Toll Brothers Building Company

- Alliance Residential

- Taylor Morrison

- D R Horton

- LGI Homes

- Century Communities

- The Michaels Organization

- KB Home

- LMC Residential

Key Developments in North America Residential Construction Market Sector

December 2022: D.R. Horton announces plans to build homes in southeast Columbus for USD 215 Million, signaling significant investment in the market.

December 2022: Lennar Corp. halts plans to spin off its multifamily subsidiary, Quarterra, due to unfavorable market conditions, reflecting the impact of economic uncertainty.

December 2022: Pulte Homes purchases a 17-acre site in south Fort Myers for USD 2.4 Million to develop a 52-home community, indicating continued investment in new construction projects.

Strategic North America Residential Construction Market Outlook

The North American residential construction market is poised for continued growth, driven by long-term trends such as population growth, urbanization, and increasing demand for sustainable housing. Strategic opportunities exist for companies to capitalize on technological advancements, improve operational efficiency, and expand into underserved markets. Focusing on sustainable building practices and incorporating smart home technologies will be crucial for attracting consumers and gaining a competitive edge. The market's long-term outlook remains positive, despite short-term challenges.

North America Residential Construction Market Segmentation

-

1. Property Type

- 1.1. Single Family

- 1.2. Multi-family

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

North America Residential Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend

- 3.3. Market Restrains

- 3.3.1. Interests and Financing; Increase in Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1 800

- 3.4.2 000 Housing Units Must Be Built Annually in Mexico to Keep Up with Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Single Family

- 5.1.2. Multi-family

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. United States North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Wood Partners

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Meritage Homes Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NVR

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PulteGroup

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lennar Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mill Creek Residential

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Clayton Properties Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toll Brothers Building Company**List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Alliance Residential

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Taylor Morrison

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 D R Horton

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 LGI Homes

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Century Communities

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 The Michaels Organization

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 KB Home

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 LMC Residential

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Wood Partners

List of Figures

- Figure 1: North America Residential Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Residential Construction Market Share (%) by Company 2024

List of Tables

- Table 1: North America Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Residential Construction Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: North America Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: North America Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Residential Construction Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 11: North America Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 12: North America Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Residential Construction Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the North America Residential Construction Market?

Key companies in the market include Wood Partners, Meritage Homes Corp, NVR, PulteGroup, Lennar Corporation, Mill Creek Residential, Clayton Properties Group, Toll Brothers Building Company**List Not Exhaustive, Alliance Residential, Taylor Morrison, D R Horton, LGI Homes, Century Communities, The Michaels Organization, KB Home, LMC Residential.

3. What are the main segments of the North America Residential Construction Market?

The market segments include Property Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend.

6. What are the notable trends driving market growth?

800. 000 Housing Units Must Be Built Annually in Mexico to Keep Up with Demand.

7. Are there any restraints impacting market growth?

Interests and Financing; Increase in Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2022: In southeast Columbus, D.R. Horton intends to build homes for USD 215 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Residential Construction Market?

To stay informed about further developments, trends, and reports in the North America Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence