Key Insights

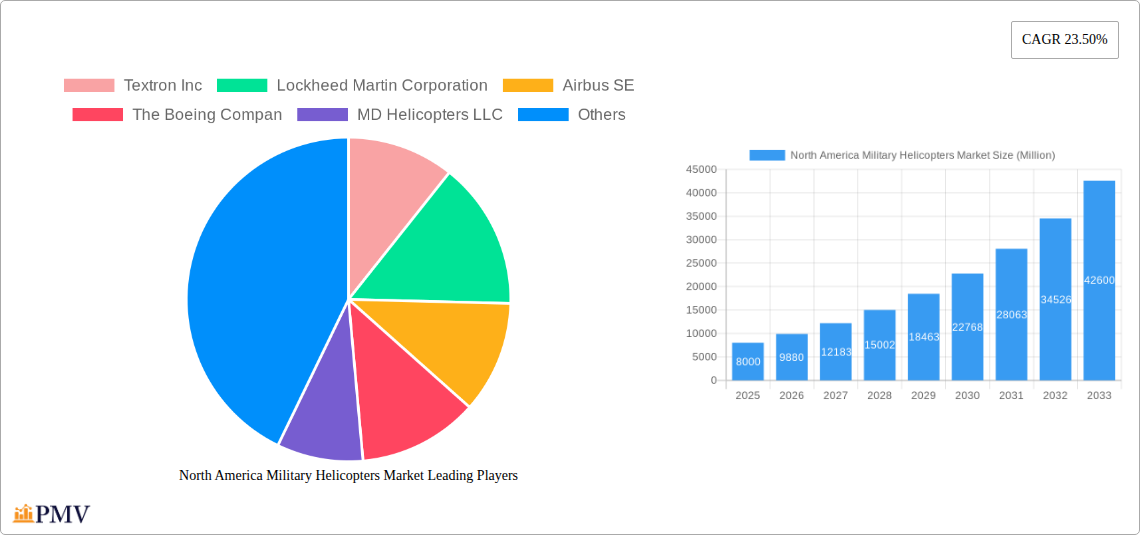

The North American military helicopter market, valued at approximately $8 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 23.5% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing defense budgets across the US, Canada, and Mexico, coupled with modernization efforts to replace aging fleets, are significant contributors. Furthermore, escalating geopolitical tensions and the need for enhanced surveillance and rapid deployment capabilities are driving demand for advanced military helicopters, particularly multi-mission and transport helicopters. Technological advancements, such as improved avionics, sensor integration, and unmanned capabilities, are also stimulating market growth. The market is segmented by body type (multi-mission, transport, and others) and geography (United States, Canada, Mexico, and Rest of North America). The US dominates the market, accounting for a significant majority of the overall value, followed by Canada and Mexico. Key players like Textron, Lockheed Martin, Airbus, Boeing, MD Helicopters, and Leonardo are vying for market share through technological innovation and strategic partnerships.

However, certain restraints could impact market growth. Budgetary constraints, particularly in periods of economic downturn, could curb government spending on defense equipment. Furthermore, the lengthy procurement cycles associated with military hardware acquisition and the potential for delays in project implementation might temper the overall market growth. Nevertheless, the long-term outlook remains positive, driven by continuous technological innovation and the enduring need for robust military helicopter capabilities to safeguard national interests and address evolving geopolitical challenges. The market is expected to reach approximately $35 billion by 2033, solidifying its position as a key segment within the broader North American defense industry.

North America Military Helicopters Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America military helicopters market, covering the period from 2019 to 2033. It offers actionable insights into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future growth prospects. This report is essential for industry stakeholders, investors, and strategic decision-makers seeking a clear understanding of this crucial sector. The base year for this analysis is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024.

North America Military Helicopters Market Structure & Competitive Dynamics

The North American military helicopters market exhibits a moderately concentrated structure, with a few major players holding significant market share. The market's competitive landscape is characterized by intense rivalry among established manufacturers like Boeing, Lockheed Martin, and Textron, alongside emerging players focusing on niche segments. Innovation plays a critical role, driving advancements in areas such as rotorcraft technology, avionics, and engine efficiency. Stringent regulatory frameworks, particularly regarding safety and operational standards, govern market operations. Product substitutes, such as unmanned aerial vehicles (UAVs), pose a competitive threat, though helicopters maintain their dominance for certain missions. End-user trends, heavily influenced by military modernization strategies and budget allocations, directly impact market demand. Significant M&A activity has shaped the market landscape, with deal values reaching xx Million in recent years. Key metrics observed include:

- Market Concentration: xx% market share held by the top 3 players.

- M&A Deal Values: A total of xx Million USD in M&A deals were recorded during 2019-2024.

- Innovation Ecosystem: Strong focus on advanced materials, autonomous flight capabilities, and improved survivability technologies.

- Regulatory Landscape: Compliance with stringent safety and export control regulations crucial for market entry.

North America Military Helicopters Market Industry Trends & Insights

The North America military helicopters market is projected to experience robust growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors, including increasing defense budgets across North America, modernization initiatives to replace aging fleets, and the growing demand for advanced military capabilities. Technological advancements, including the integration of advanced sensors and weapon systems, are significantly enhancing the operational effectiveness and capabilities of modern military helicopters. Consumer preferences, shaped by technological advancements and operational requirements, are tilting towards multi-role helicopters and those equipped with advanced ISR (Intelligence, Surveillance, and Reconnaissance) capabilities. The market’s competitive dynamics continue to be shaped by ongoing investments in research & development, strategic partnerships, and mergers & acquisitions. Market penetration of advanced technologies, such as autonomous flight systems, remains relatively low, but is anticipated to show significant growth in the coming years.

Dominant Markets & Segments in North America Military Helicopters Market

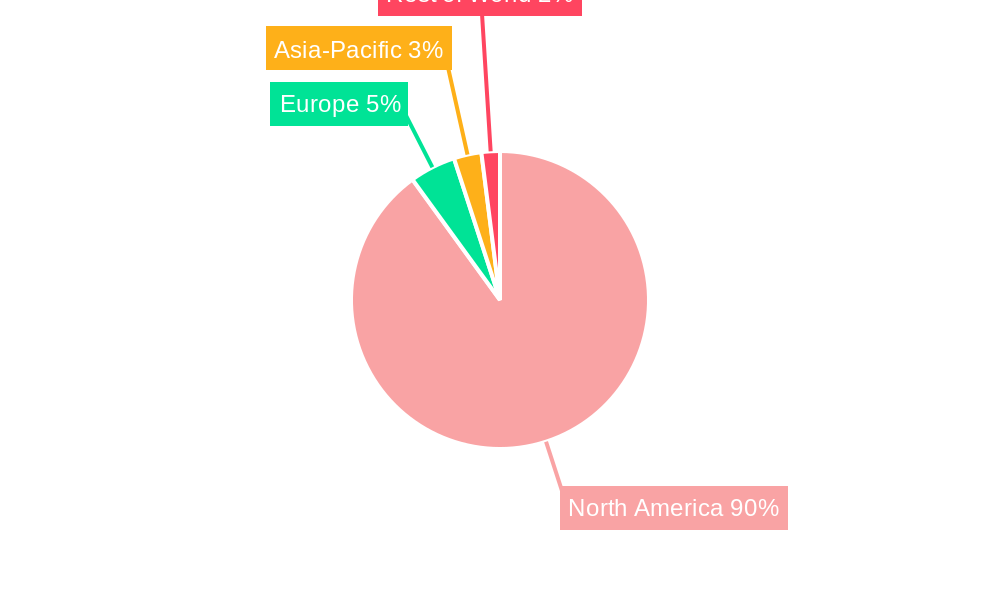

The United States represents the largest and most dominant market within North America, contributing to xx% of the total market value in 2025. This dominance is attributed to substantial defense spending, a large active military force, and a robust domestic manufacturing base.

- United States: Key drivers include substantial defense budgets, modernization programs, and domestic manufacturing capabilities.

- Canada: Military spending and modernization programs contribute to market growth, although at a smaller scale than the United States.

- Mexico: The Mexican market remains relatively smaller due to comparatively lower defense budgets.

- Rest of North America: This segment includes smaller markets, exhibiting limited growth due to various factors.

The Multi-Mission Helicopter segment is the leading body type, driven by its versatility across a wide range of missions, contributing to xx% of the total market. The Transport Helicopter segment also plays a significant role. The Others segment, comprising specialized helicopters like attack and reconnaissance platforms, is expected to witness growth based on specific national defense programs.

North America Military Helicopters Market Product Innovations

Recent innovations in the North American military helicopters market emphasize increased payload capacity, improved operational range, enhanced survivability features (including advanced sensors and countermeasures), and greater integration of autonomous flight technologies. These innovations cater to the evolving demands of modern warfare, focusing on increased operational efficiency and reduced risk to personnel. The trend is towards modular designs enabling customization for various missions, and enhanced human-machine interfaces for improved pilot situational awareness and control.

Report Segmentation & Scope

This report segments the North America military helicopters market based on body type and country.

- Body Type: Multi-Mission Helicopter, Transport Helicopter, Others. Each segment's growth projection, market size (in Million USD), and competitive landscape are analyzed.

- Country: United States, Canada, Mexico, Rest of North America. Each country's market size, growth drivers, and challenges are evaluated.

Key Drivers of North America Military Helicopters Market Growth

Several factors are propelling the growth of the North America military helicopters market. These include:

- Increased Defense Budgets: Significant government investments in military modernization and technological upgrades.

- Aging Helicopter Fleets: The need to replace obsolete platforms with advanced, more capable systems.

- Technological Advancements: The development of advanced technologies such as improved avionics, engines, and sensors.

- Geopolitical Instability: Growing global instability increases demand for military helicopters for various mission purposes.

Challenges in the North America Military Helicopters Market Sector

The market faces several challenges, including:

- High Acquisition Costs: The high price of modern military helicopters constrains budget allocations.

- Supply Chain Disruptions: Global supply chain vulnerabilities impact production schedules and costs.

- Stringent Regulatory Compliance: Meeting stringent safety and export control regulations adds complexity.

- Technological Competition: Competition from emerging technologies, such as drones, poses a potential threat.

Leading Players in the North America Military Helicopters Market

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- MD Helicopters LLC

- Leonardo S.p.A

Key Developments in North America Military Helicopters Market Sector

- December 2022: The US Army awarded a contract to Textron Inc.'s Bell unit for next-generation helicopters under the "Future Vertical Lift" program, indicating significant investment in future helicopter technologies.

- March 2023: Boeing secured a contract to manufacture 184 AH-64E Apache attack helicopters, demonstrating continued demand for attack helicopter capabilities.

- May 2023: The US State Department approved a potential USD 8.5 billion sale of CH-47 Chinook helicopters to Germany, highlighting the strong export market for advanced military helicopters.

Strategic North America Military Helicopters Market Outlook

The North America military helicopters market presents significant opportunities for growth, driven by ongoing modernization efforts, technological advancements, and sustained defense spending. Strategic partnerships, investments in R&D, and a focus on meeting evolving military requirements are key to success in this dynamic market. The increasing adoption of autonomous technologies and the development of more versatile, multi-role platforms are expected to be major growth accelerators.

North America Military Helicopters Market Segmentation

-

1. Body Type

- 1.1. Multi-Mission Helicopter

- 1.2. Transport Helicopter

- 1.3. Others

North America Military Helicopters Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Military Helicopters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Military Helicopters Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Multi-Mission Helicopter

- 5.1.2. Transport Helicopter

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. United States North America Military Helicopters Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Military Helicopters Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Military Helicopters Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Military Helicopters Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Textron Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lockheed Martin Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Airbus SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Boeing Compan

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 MD Helicopters LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Leonardo S p A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Textron Inc

List of Figures

- Figure 1: North America Military Helicopters Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Military Helicopters Market Share (%) by Company 2024

List of Tables

- Table 1: North America Military Helicopters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Military Helicopters Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: North America Military Helicopters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: North America Military Helicopters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States North America Military Helicopters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada North America Military Helicopters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico North America Military Helicopters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America North America Military Helicopters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: North America Military Helicopters Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 10: North America Military Helicopters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North America Military Helicopters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America Military Helicopters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America Military Helicopters Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Military Helicopters Market?

The projected CAGR is approximately 23.50%.

2. Which companies are prominent players in the North America Military Helicopters Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, MD Helicopters LLC, Leonardo S p A.

3. What are the main segments of the North America Military Helicopters Market?

The market segments include Body Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters, engines, and equipment worth USD 8.5 billion to Germany.March 2023: Boeing has been awarded a contract by the US government to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers. The US government announced USD 1.95 million, indicating that the helicopter will be delivered to the US military and overseas buyers - specifically Australia and Egypt - as a part of the paramilitary process to the Foreign Service (FMS) from the US government. Contract completion is expected by the end of 2027.December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Military Helicopters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Military Helicopters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Military Helicopters Market?

To stay informed about further developments, trends, and reports in the North America Military Helicopters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence