Key Insights

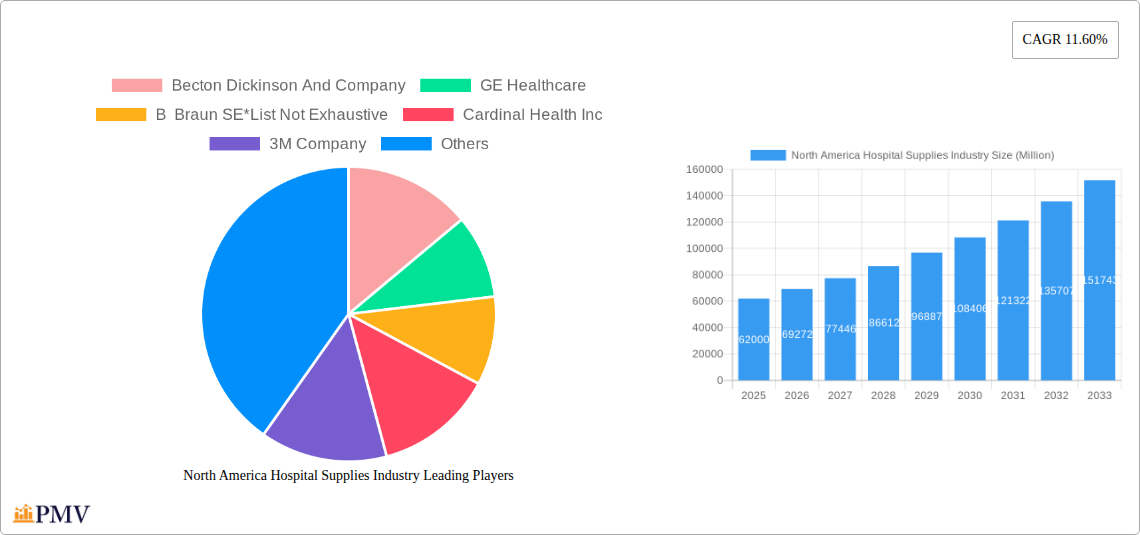

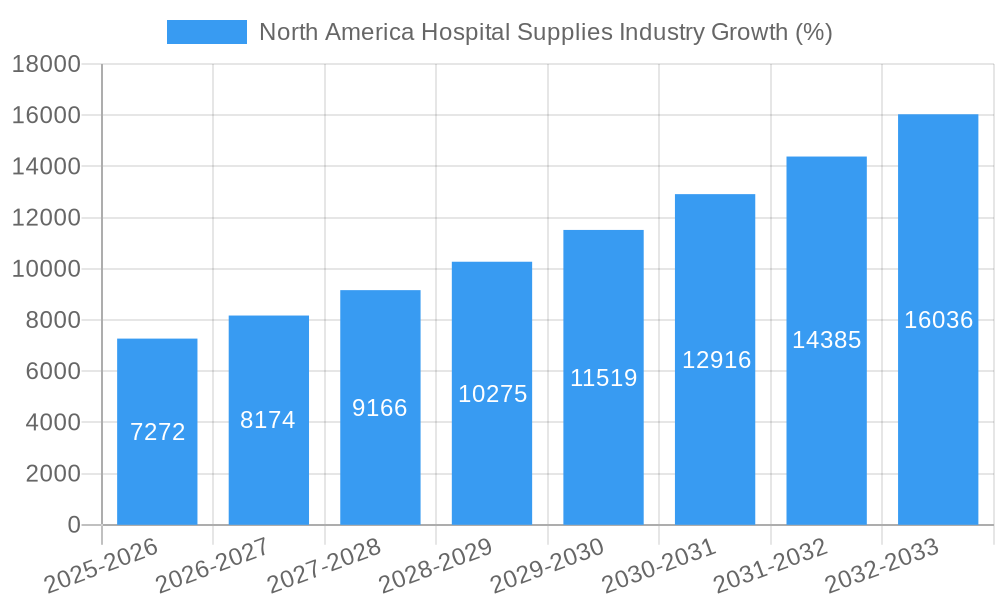

The North American hospital supplies market, valued at $62 billion in 2025, is projected to experience robust growth, driven by a confluence of factors. An aging population necessitating increased healthcare services, coupled with rising prevalence of chronic diseases like diabetes and cardiovascular conditions, fuels demand for a wide range of hospital supplies. Technological advancements in medical devices, such as minimally invasive surgical instruments and advanced diagnostic tools, are further boosting market expansion. Furthermore, increasing government initiatives focused on improving healthcare infrastructure and enhancing patient care contribute significantly to market growth. The segment encompassing patient examination devices and operating room equipment is expected to dominate, reflecting the fundamental needs of hospitals and surgical centers. The consistent rise in healthcare expenditure and the growing adoption of advanced medical technologies within hospitals will continue to drive market expansion throughout the forecast period.

However, certain challenges exist. Stringent regulatory approvals for new medical devices and supplies can hinder market entry for new players. Fluctuations in raw material costs and supply chain disruptions, particularly felt acutely post-pandemic, present potential obstacles to sustained growth. Nevertheless, the overall outlook remains positive, with the market projected to maintain a Compound Annual Growth Rate (CAGR) of 11.6% from 2025 to 2033. This growth is underpinned by the expanding healthcare sector, continuous technological innovation, and ongoing investments in improving healthcare infrastructure within North America. The market's segmentation, encompassing products like patient examination devices, operating room equipment, mobility aids, sterilization equipment, and disposable supplies, reflects the diverse needs within the healthcare ecosystem and promises multifaceted growth opportunities.

North America Hospital Supplies Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the North America hospital supplies industry, encompassing market size, growth projections, competitive landscape, and key trends. Covering the period from 2019 to 2033, with a base year of 2025, this report offers actionable insights for industry stakeholders, investors, and strategic decision-makers. The study period (2019-2024) forms the historical baseline, while the forecast period (2025-2033) projects future market dynamics, incorporating the estimated year (2025). The market is segmented by product category, offering granular insights into market shares and growth potential. Leading companies like Becton Dickinson And Company, GE Healthcare, B Braun SE, Cardinal Health Inc, 3M Company, Medtronic PLC, Johnson & Johnson, Stryker Corporation, and Baxter International are analyzed for their competitive strategies and market positioning. The report's value lies in its in-depth analysis and projection of market value in Millions.

North America Hospital Supplies Industry Market Structure & Competitive Dynamics

The North American hospital supplies market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller players and emerging companies fosters a dynamic competitive landscape. Innovation ecosystems are robust, driven by continuous advancements in medical technology and a regulatory framework focused on safety and efficacy. Product substitutes exist, particularly in the disposable supplies segment, influencing pricing and market share. End-user trends indicate a growing preference for advanced, technologically sophisticated products, emphasizing efficiency and improved patient outcomes. M&A activity is prevalent, reflecting consolidation trends within the industry. For example, the acquisition of Alvarado Hospital Medical Center (as detailed below) highlights the ongoing consolidation. The estimated total value of M&A deals within the last five years exceeds xx Million, with the average deal value around xx Million. Key market share metrics highlight the dominance of the top players and the competitive pressure amongst them, but we observed increased competition from emerging players in the technological advancements segments.

North America Hospital Supplies Industry Industry Trends & Insights

The North American hospital supplies market exhibits robust growth, driven by several key factors. The aging population, increasing prevalence of chronic diseases, technological advancements leading to more sophisticated medical equipment, and rising healthcare expenditure contribute significantly. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, with projections indicating a CAGR of xx% during the forecast period (2025-2033). Market penetration of technologically advanced products, such as minimally invasive surgical equipment and advanced imaging systems, is gradually increasing. Furthermore, consumer preferences lean toward safe, efficient, and cost-effective products, pushing manufacturers to innovate and enhance their offerings. However, the market remains subject to cyclical changes and industry-specific regulations that influence growth. Competitive dynamics shape product development, pricing strategies, and market expansion. Increased investment in R&D will lead to a higher CAGR.

Dominant Markets & Segments in North America Hospital Supplies Industry

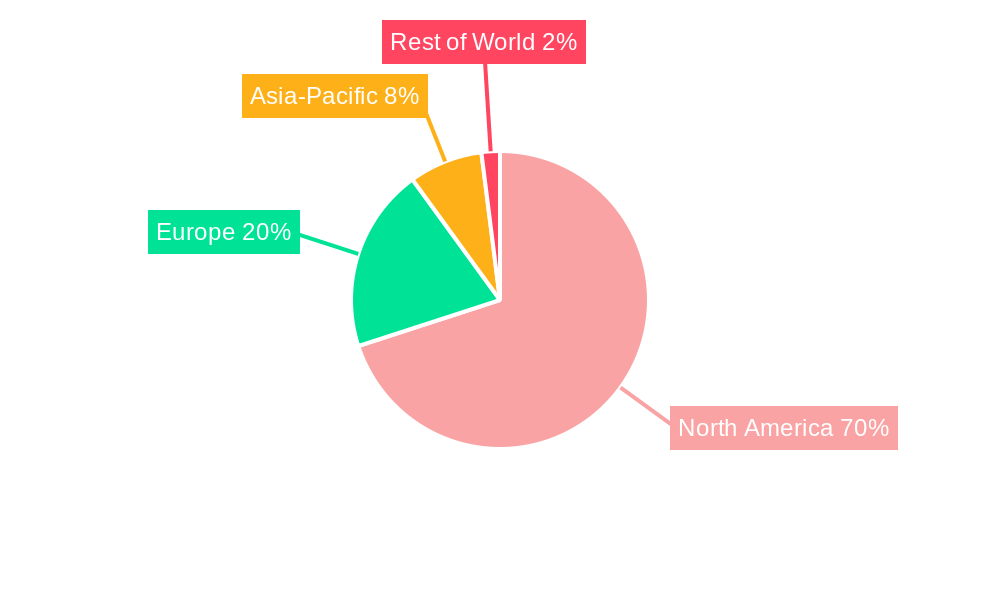

While precise regional dominance requires further specification, the report indicates that the largest segments are Disposable Hospital Supplies, followed by Patient Examination Devices and Operating Room Equipment. The US holds the largest market share in North America, attributable to factors such as advanced healthcare infrastructure, a large aging population, and high healthcare spending per capita.

Key Drivers of Segment Dominance:

- Disposable Hospital Supplies: High consumption rates due to infection control protocols and single-use preferences.

- Patient Examination Devices: Increasing demand for diagnostic tools and improved patient monitoring technologies.

- Operating Room Equipment: Ongoing investments in sophisticated surgical technologies and procedures.

Dominance Analysis: Each segment's dominance is further analyzed in the report, considering factors like regulatory approvals, technological advancements, pricing strategies, and market penetration. Specific regions within the US contribute disproportionately to segment-wise growth.

North America Hospital Supplies Industry Product Innovations

Recent years have witnessed significant product innovation, characterized by the introduction of minimally invasive surgical instruments, advanced imaging equipment, and smart hospital solutions. These innovations aim to improve patient outcomes, enhance surgical precision, and streamline workflow within healthcare facilities. Companies are integrating advanced technologies like artificial intelligence and machine learning to enhance product functionalities and develop more efficient equipment. The focus on sustainability is also prompting the development of eco-friendly disposable supplies, aligning with environmental concerns. The market fit of these innovations varies across segments, with some experiencing quicker adoption than others.

Report Segmentation & Scope

The report segments the North American hospital supplies market primarily By Product:

- Patient Examination Devices: This segment is projected to show a xx% CAGR during the forecast period, driven by increasing demand for advanced diagnostic tools.

- Operating Room Equipment: This segment is expected to maintain strong growth, driven by technological advancements in minimally invasive surgery.

- Mobility Aids and Transportation Equipment: Growth is anticipated due to the aging population and increasing demand for patient mobility solutions.

- Sterilization and Disinfectant Equipment: Demand remains high due to stringent infection control protocols.

- Disposable Hospital Supplies: This segment accounts for the largest market share, driven by high consumption rates and safety regulations.

- Syringes and Needles: This segment is characterized by stable growth, driven by consistent demand in healthcare settings.

- Other Products: This category encompasses a variety of supplies and equipment with varied growth rates depending on the product type.

Each segment's competitive dynamics are also analyzed in the report.

Key Drivers of North America Hospital Supplies Industry Growth

Several factors fuel the growth of this industry. First, the aging population necessitates increased healthcare services, driving demand for supplies. Secondly, technological advancements in medical devices constantly improve healthcare, leading to the adoption of new and sophisticated products. Finally, supportive regulatory frameworks encourage innovation and adoption of new technologies. These three interconnected trends propel continuous growth in the North American hospital supplies industry.

Challenges in the North America Hospital Supplies Industry Sector

The industry faces several challenges, including stringent regulatory approvals, which can delay product launches and increase costs. Supply chain disruptions caused by geopolitical events or natural disasters can affect the availability of raw materials and finished goods, impacting production and pricing. Furthermore, intense competition and pricing pressures exerted by numerous players make maintaining profitability challenging for individual companies. The estimated combined impact of these factors results in a xx% reduction in projected market growth.

Leading Players in the North America Hospital Supplies Industry Market

- Becton Dickinson And Company

- GE Healthcare

- B Braun SE

- Cardinal Health Inc

- 3M Company

- Medtronic PLC

- Johnson & Johnson

- Stryker Corporation

- Baxter International

Key Developments in North America Hospital Supplies Industry Sector

- September 2023: UC San Diego Health's acquisition of Alvarado Hospital Medical Center is expected to reshape the Southern California healthcare landscape, impacting demand for hospital supplies in the region.

- March 2022: Datasea's launch of ultrasonic sound sterilization equipment and entry into the US market indicate a shift toward innovative sterilization technologies, potentially impacting the Sterilization and Disinfectant Equipment segment.

Strategic North America Hospital Supplies Industry Market Outlook

The North American hospital supplies market is poised for sustained growth, driven by continuous technological advancements, increasing healthcare expenditure, and a growing aging population. Strategic opportunities exist for companies focusing on innovation in areas such as minimally invasive surgery, telemedicine, and AI-driven diagnostics. Furthermore, companies prioritizing sustainable practices and efficient supply chains will gain a competitive edge. The future of the market lies in adapting to changing healthcare trends and offering cost-effective yet technologically advanced solutions that enhance patient care.

North America Hospital Supplies Industry Segmentation

-

1. Product

- 1.1. Patient Examination Devices

- 1.2. Operating Room Equipment

- 1.3. Mobility Aids and Transportation Equipment

- 1.4. Sterilization and Disinfectant Equipment

- 1.5. Disposable Hospital Supplies

- 1.6. Syringes and Needles

- 1.7. Other Products

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Hospital Supplies Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Hospital Supplies Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Spending On Healthcare; Increasing Prevalence of Infectious Diseases

- 3.3. Market Restrains

- 3.3.1. Emergence of Home Care Services; Drop in Private Health Insurance

- 3.4. Market Trends

- 3.4.1. Disposable Hospital Supplies Segment is Projected to Have Significant Growth Rate During the Forecast Period of the Study

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Patient Examination Devices

- 5.1.2. Operating Room Equipment

- 5.1.3. Mobility Aids and Transportation Equipment

- 5.1.4. Sterilization and Disinfectant Equipment

- 5.1.5. Disposable Hospital Supplies

- 5.1.6. Syringes and Needles

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Patient Examination Devices

- 6.1.2. Operating Room Equipment

- 6.1.3. Mobility Aids and Transportation Equipment

- 6.1.4. Sterilization and Disinfectant Equipment

- 6.1.5. Disposable Hospital Supplies

- 6.1.6. Syringes and Needles

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Patient Examination Devices

- 7.1.2. Operating Room Equipment

- 7.1.3. Mobility Aids and Transportation Equipment

- 7.1.4. Sterilization and Disinfectant Equipment

- 7.1.5. Disposable Hospital Supplies

- 7.1.6. Syringes and Needles

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Patient Examination Devices

- 8.1.2. Operating Room Equipment

- 8.1.3. Mobility Aids and Transportation Equipment

- 8.1.4. Sterilization and Disinfectant Equipment

- 8.1.5. Disposable Hospital Supplies

- 8.1.6. Syringes and Needles

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United States North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Becton Dickinson And Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 GE Healthcare

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 B Braun SE*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cardinal Health Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 3M Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Medtronic PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Johnson & Johnson

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Stryker Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Baxter International

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Becton Dickinson And Company

List of Figures

- Figure 1: North America Hospital Supplies Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Hospital Supplies Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Hospital Supplies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Hospital Supplies Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Hospital Supplies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Hospital Supplies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Hospital Supplies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Hospital Supplies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Hospital Supplies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 11: North America Hospital Supplies Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: North America Hospital Supplies Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 17: North America Hospital Supplies Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hospital Supplies Industry?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the North America Hospital Supplies Industry?

Key companies in the market include Becton Dickinson And Company, GE Healthcare, B Braun SE*List Not Exhaustive, Cardinal Health Inc, 3M Company, Medtronic PLC, Johnson & Johnson, Stryker Corporation, Baxter International.

3. What are the main segments of the North America Hospital Supplies Industry?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 62.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Spending On Healthcare; Increasing Prevalence of Infectious Diseases.

6. What are the notable trends driving market growth?

Disposable Hospital Supplies Segment is Projected to Have Significant Growth Rate During the Forecast Period of the Study.

7. Are there any restraints impacting market growth?

Emergence of Home Care Services; Drop in Private Health Insurance.

8. Can you provide examples of recent developments in the market?

September 2023: UC San Diego Health's request has been approved by the Regents of the University of California for acquiring Alvarado Hospital Medical Center from Prime Healthcare. The acquisition of the 302-bed medical campus is expected to be completed in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hospital Supplies Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hospital Supplies Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hospital Supplies Industry?

To stay informed about further developments, trends, and reports in the North America Hospital Supplies Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence