Key Insights

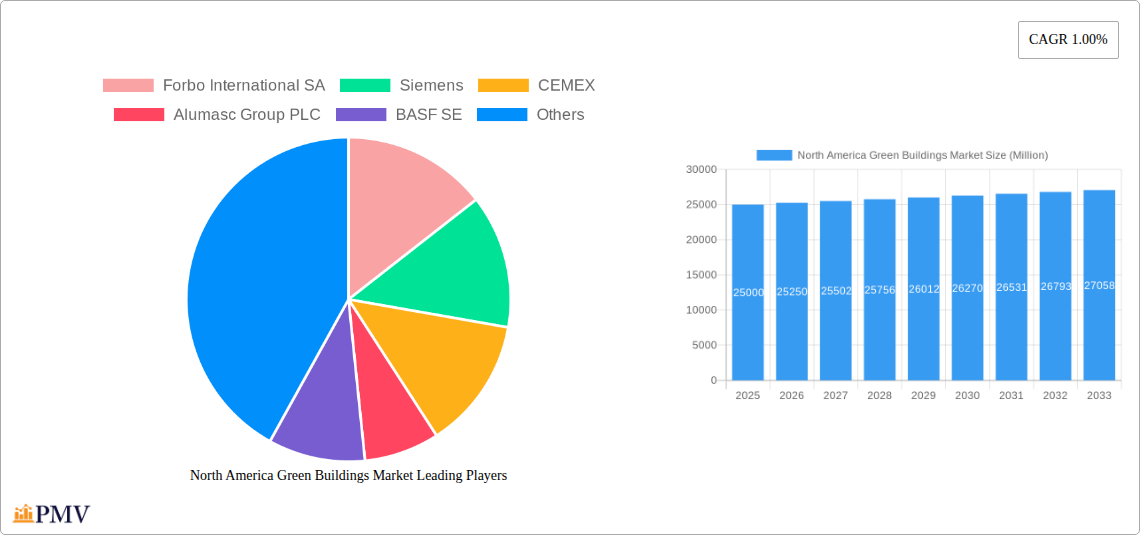

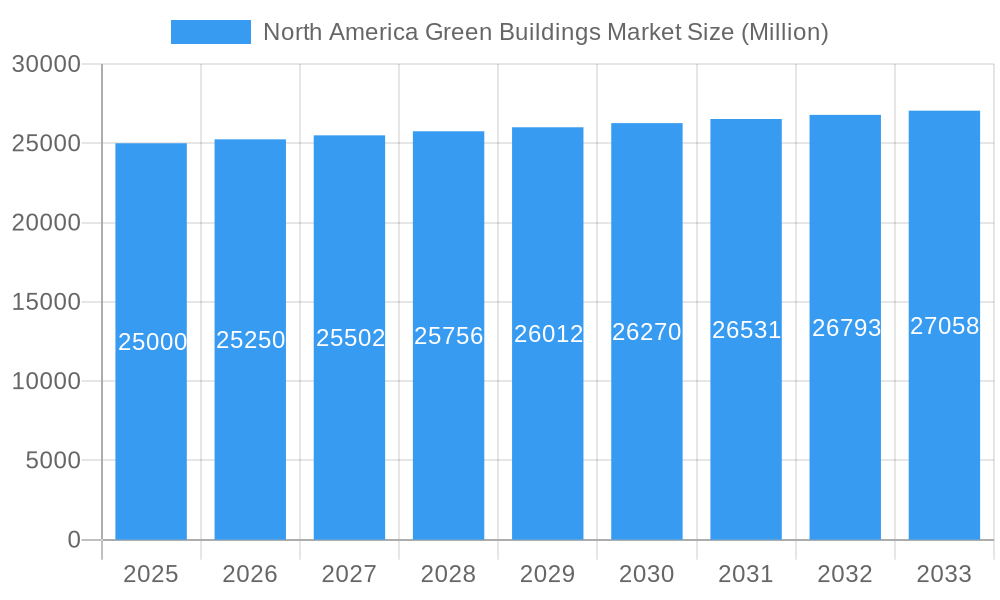

The North American green building market, while currently experiencing a period of moderate growth, presents significant long-term potential. Driven by increasing environmental awareness, stringent government regulations promoting sustainability, and a growing demand for energy-efficient and environmentally responsible construction, the market is poised for expansion. The market segmentation reveals a strong focus on both exterior and interior products, catering to residential, office, retail, and institutional end-users. While the precise market size in 2025 is unavailable, considering the 1.00% CAGR and the substantial investments in sustainable infrastructure across North America, a reasonable estimate would place the market value in the billions of dollars. This estimate is based on the understanding that a CAGR of 1.00% is still positive growth and that the market, even with a slow CAGR, will increase in value steadily. Key growth drivers include advancements in green building technologies (like solar and building systems), increasing government incentives, and corporate sustainability initiatives.

North America Green Buildings Market Market Size (In Billion)

However, the market faces some restraints, including the higher initial costs associated with green building materials and technologies compared to conventional options and a lack of awareness among some stakeholders concerning the long-term benefits of green building practices. To overcome these challenges, focusing on cost-effective solutions and effective educational campaigns is crucial. Furthermore, focusing on market segments exhibiting stronger growth potential, such as the rapidly expanding sustainable commercial real estate sector, is important for achieving optimal market penetration and profitability. The involvement of key players like Forbo International SA, Siemens, CEMEX, and others signals a commitment to developing and delivering innovative green building solutions to meet the growing demand. The forecast period of 2025-2033 presents a significant window of opportunity for market expansion and strategic investments in this evolving sector.

North America Green Buildings Market Company Market Share

North America Green Buildings Market: 2019-2033 Report

This comprehensive report provides an in-depth analysis of the North America green buildings market, offering valuable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth potential. The report forecasts a market valued at xx Million by 2033, presenting a compelling opportunity for growth and innovation in the sustainable construction sector.

North America Green Buildings Market Market Structure & Competitive Dynamics

The North American green building market exhibits a moderately fragmented structure, with a mix of large multinational corporations and smaller specialized firms. Market concentration is relatively low, with no single dominant player holding a significant majority share. Key players like Forbo International SA, Siemens, CEMEX, Alumasc Group PLC, BASF SE, Bauder Limited, Owens Corning SA, PPG Industries, Amvic Inc, and Cold Mix Inc. compete based on product innovation, brand reputation, and market reach. The market is characterized by a dynamic innovation ecosystem, fueled by continuous advancements in green building materials and technologies. Regulatory frameworks, such as LEED certification and local building codes, significantly influence market growth and adoption rates. Product substitutes, such as traditional construction materials, pose a competitive challenge, although the increasing demand for sustainable solutions is steadily eroding their market share. End-user trends reveal a growing preference for green buildings across residential, commercial, and institutional sectors. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values averaging xx Million per transaction.

- Market Share: The top 10 players collectively hold an estimated xx% market share.

- M&A Activity: An average of xx M&A deals have been recorded annually over the past five years, valued at an average of xx Million.

- Regulatory Landscape: The market is influenced by various federal, state, and local regulations promoting energy efficiency and sustainable building practices.

North America Green Buildings Market Industry Trends & Insights

The North American green buildings market is experiencing robust growth, driven by several key factors. Increasing awareness of environmental sustainability, stringent government regulations promoting energy efficiency, and the rising demand for healthy and comfortable indoor environments are significant catalysts. Technological advancements, including the development of innovative green building materials and construction techniques, further fuel market expansion. Consumer preferences are increasingly shifting towards sustainable and eco-friendly housing and commercial spaces, creating a strong market pull. The market exhibits a healthy competitive landscape, characterized by ongoing innovation and a focus on improving energy efficiency and reducing carbon footprint. The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing adoption of sustainable building practices and government initiatives. Market penetration is projected to reach xx% by 2033, indicating significant potential for future growth.

Dominant Markets & Segments in North America Green Buildings Market

The dominant segment within the North American green buildings market varies depending on the specific criteria.

By Product: The exterior products segment, driven by increased demand for energy-efficient windows, roofing, and wall systems, currently holds the largest market share. Interior products are experiencing rapid growth, fueled by the increasing popularity of sustainable flooring, insulation, and indoor air quality solutions. The "Other Products" segment, encompassing building systems and solar systems, is projected to demonstrate the highest growth rate due to technological advancements and government incentives.

By End User: The residential segment represents a significant portion of the market, primarily driven by growing consumer awareness and government initiatives promoting energy-efficient housing. The office sector also exhibits strong growth potential due to the increasing adoption of green building standards in corporate real estate strategies. Institutional projects, including schools and hospitals, are witnessing consistent demand for sustainable and environmentally friendly structures.

Key Drivers:

- Economic Policies: Government incentives, tax credits, and subsidies are boosting the adoption of green building technologies.

- Infrastructure Development: Investments in sustainable infrastructure projects are creating significant demand for green building materials and services.

- Technological Advancements: Innovations in materials and construction techniques are improving the efficiency and cost-effectiveness of green building solutions.

North America Green Buildings Market Product Innovations

Recent product innovations focus on improving energy efficiency, reducing environmental impact, and enhancing occupant comfort. New materials, such as bio-based composites and recycled content products, are gaining popularity. Smart building technologies, integrating energy management systems and environmental monitoring, are being increasingly incorporated into green buildings. These innovations address market needs for sustainable, cost-effective, and high-performing building solutions.

Report Segmentation & Scope

This report segments the North America green buildings market by product type (exterior products, interior products, other products) and end-user (residential, office, retail, institutional, other). Each segment is analyzed in detail, providing market size, growth projections, and competitive dynamics. The report also covers key market drivers, challenges, and future opportunities for each segment.

- Exterior Products: This segment includes roofing, cladding, windows, and doors. It is expected to witness significant growth due to the increasing demand for energy-efficient and durable exterior building materials.

- Interior Products: This segment includes flooring, insulation, and interior wall systems. It is expected to experience steady growth, propelled by the rising awareness regarding indoor air quality and healthy building materials.

- Other Products: This segment encompasses building management systems (BMS), solar panels, and other related technologies. It is projected to exhibit the fastest growth rate during the forecast period.

Key Drivers of North America Green Buildings Market Growth

The North American green buildings market is propelled by several key factors: stringent environmental regulations, increasing consumer awareness of sustainable living, and significant government investments in green infrastructure. Tax incentives and subsidies for green building projects further incentivize adoption. Advancements in energy-efficient technologies and sustainable materials are continuously improving the cost-effectiveness and performance of green buildings.

Challenges in the North America Green Buildings Market Sector

Challenges facing the market include high upfront costs associated with green building construction, limited availability of skilled labor, and supply chain disruptions impacting the availability of sustainable materials. Furthermore, inconsistent implementation of building codes and a lack of standardized assessment methods can impede market growth. These factors result in a slower adoption rate of green building practices, especially in the residential sector.

Leading Players in the North America Green Buildings Market Market

- Forbo International SA

- Siemens

- CEMEX

- Alumasc Group PLC

- BASF SE

- Bauder Limited

- Owens Corning SA

- PPG Industries

- Amvic Inc

- Cold Mix Inc

- 7 Other Companies

Key Developments in North America Green Buildings Market Sector

- May 2023: The Biden Administration announced new building energy standards for federally funded homes, saving families over 35% on electricity consumption. This impacts approximately 170,000 new homes annually.

- June 2023: Canada's 2025 national building code will include technical requirements for existing building stock and GHG emission regulations.

Strategic North America Green Buildings Market Market Outlook

The future of the North American green buildings market is bright. Continued government support, technological innovation, and heightened consumer awareness will drive significant growth. Strategic opportunities lie in developing innovative green building materials, improving energy efficiency technologies, and providing comprehensive sustainability solutions to diverse end-user segments. The market's expansion is poised to be substantial over the forecast period, making it an attractive sector for investment and innovation.

North America Green Buildings Market Segmentation

-

1. Product

- 1.1. Exterior Products

- 1.2. Interior products

- 1.3. Other Pr

-

2. End User

- 2.1. Residential

- 2.2. Office

- 2.3. Retail

- 2.4. Institutional

- 2.5. Other End Users

-

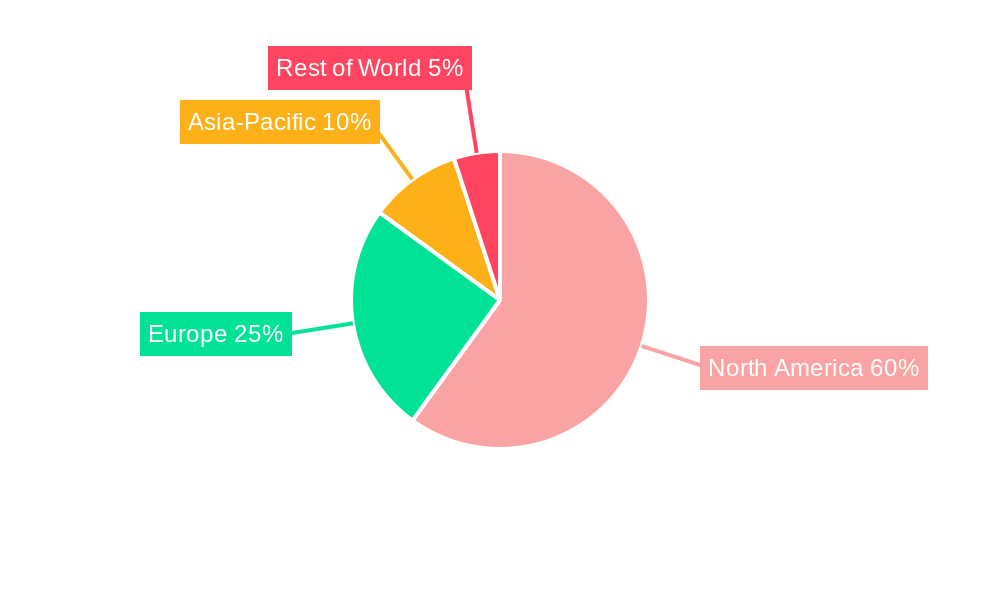

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Green Buildings Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Green Buildings Market Regional Market Share

Geographic Coverage of North America Green Buildings Market

North America Green Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy Efficiency in Construction; Flexibility and Customization Options

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Suitable Land for Construction; Lower Quality Compared to Traditional Construction

- 3.4. Market Trends

- 3.4.1. Leveraging Smart Buildings and IoT Integration for Enhanced Efficiency and Performance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Green Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Exterior Products

- 5.1.2. Interior products

- 5.1.3. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Office

- 5.2.3. Retail

- 5.2.4. Institutional

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Green Buildings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Exterior Products

- 6.1.2. Interior products

- 6.1.3. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Office

- 6.2.3. Retail

- 6.2.4. Institutional

- 6.2.5. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Green Buildings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Exterior Products

- 7.1.2. Interior products

- 7.1.3. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Office

- 7.2.3. Retail

- 7.2.4. Institutional

- 7.2.5. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Green Buildings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Exterior Products

- 8.1.2. Interior products

- 8.1.3. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Office

- 8.2.3. Retail

- 8.2.4. Institutional

- 8.2.5. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Forbo International SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Siemens

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CEMEX

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Alumasc Group PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 BASF SE

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Bauder Limited

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Owens Corning SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 PPG Industries

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Amvic Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Cold Mix Inc **List Not Exhaustive 7 3 Other Companie

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Forbo International SA

List of Figures

- Figure 1: North America Green Buildings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Green Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: North America Green Buildings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: North America Green Buildings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: North America Green Buildings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Green Buildings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Green Buildings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: North America Green Buildings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: North America Green Buildings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Green Buildings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Green Buildings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: North America Green Buildings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: North America Green Buildings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Green Buildings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Green Buildings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 14: North America Green Buildings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: North America Green Buildings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Green Buildings Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Green Buildings Market?

The projected CAGR is approximately 1.00%.

2. Which companies are prominent players in the North America Green Buildings Market?

Key companies in the market include Forbo International SA, Siemens, CEMEX, Alumasc Group PLC, BASF SE, Bauder Limited, Owens Corning SA, PPG Industries, Amvic Inc, Cold Mix Inc **List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the North America Green Buildings Market?

The market segments include Product, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0 Million as of 2022.

5. What are some drivers contributing to market growth?

Energy Efficiency in Construction; Flexibility and Customization Options.

6. What are the notable trends driving market growth?

Leveraging Smart Buildings and IoT Integration for Enhanced Efficiency and Performance.

7. Are there any restraints impacting market growth?

Limited Availability of Suitable Land for Construction; Lower Quality Compared to Traditional Construction.

8. Can you provide examples of recent developments in the market?

June 2023: In 2025, a new version of Canada's national building code will be published, allowing builders to learn about two significant changes. At the Canada Green Building Council's 2023 Building Lasting Change conference in Vancouver, officials addressed the changes drafters of the 2025 code. The two significant changes coming to the code are introducing technical requirements for existing building stock and including GHG emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Green Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Green Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Green Buildings Market?

To stay informed about further developments, trends, and reports in the North America Green Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence