Key Insights

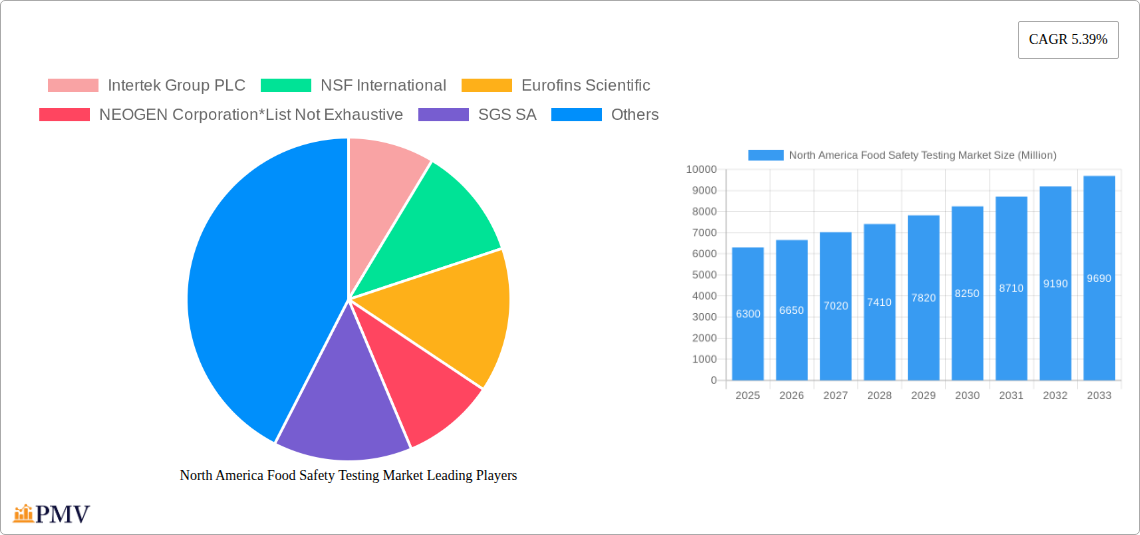

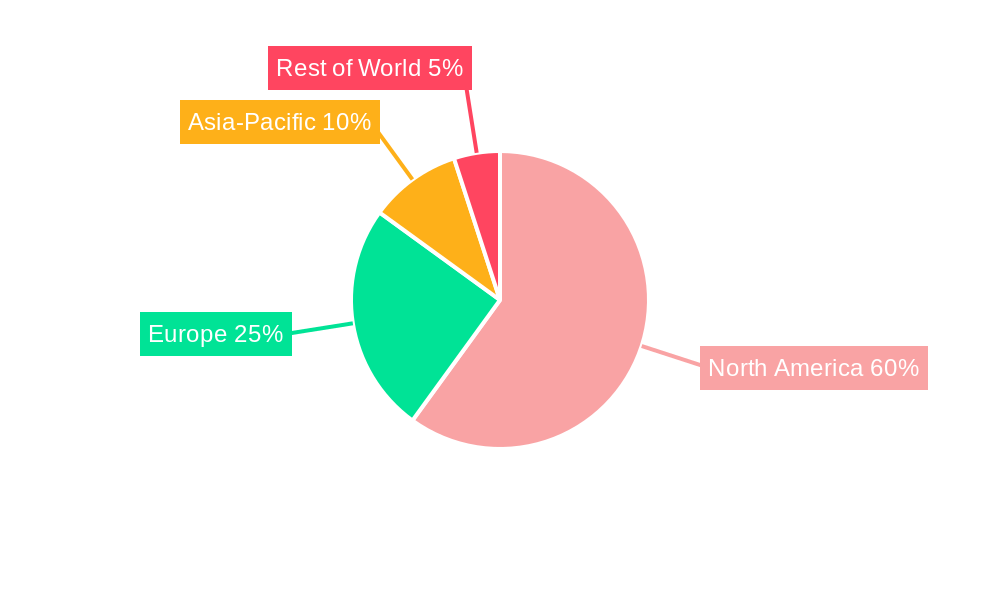

The North American food safety testing market, valued at $6.30 billion in 2025, is projected to experience robust growth, driven by increasing consumer demand for safe and high-quality food products, stringent government regulations, and the rising prevalence of foodborne illnesses. The market's Compound Annual Growth Rate (CAGR) of 5.39% from 2025 to 2033 indicates a significant expansion over the forecast period. Key drivers include heightened consumer awareness regarding food safety, the increasing adoption of advanced testing technologies like LC-MS/MS and HPLC, and the growing need for efficient and reliable testing across the entire food supply chain. The market is segmented by contaminant type (pathogen, pesticide residue, mycotoxin, and other contaminants), technology (HPLC-based, LC-MS/MS-based, immunoassay-based, and other technologies), and application (pet food, animal feed, and human food). The dominance of specific segments will likely shift over time as technologies improve and regulatory landscapes evolve. The increasing adoption of rapid and accurate testing methods, alongside the growing focus on preventative measures, will be instrumental in market expansion.

Within the North American region, the United States is expected to maintain its leading position due to its large food and beverage industry and robust regulatory framework. Canada and Mexico will also contribute significantly to regional growth, driven by increasing food production and rising consumer awareness. The competitive landscape is characterized by the presence of both large multinational corporations like Intertek, Eurofins, and SGS, and smaller specialized laboratories. These companies are continually investing in research and development to enhance testing capabilities and expand their service offerings. This competition fuels innovation and ensures the market offers diverse testing options, catering to the specific needs of different food producers and regulatory bodies. The presence of established players ensures market stability and reliability, whilst emerging players drive innovation and competition, further benefiting the market's overall development.

North America Food Safety Testing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America food safety testing market, covering the period from 2019 to 2033. It offers actionable insights for stakeholders, including manufacturers, suppliers, regulators, and investors, seeking to understand the market dynamics, competitive landscape, and future growth prospects. The report is meticulously researched and includes detailed segmentation, market size estimations, and growth projections, offering a robust forecast for the years 2025-2033. The base year for this report is 2025, with historical data spanning 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

North America Food Safety Testing Market Structure & Competitive Dynamics

The North American food safety testing market is characterized by a moderately concentrated landscape with several multinational players and a significant number of smaller regional laboratories. Key players, including Intertek Group PLC, NSF International, Eurofins Scientific, NEOGEN Corporation, SGS SA, Merieux Nutrisciences, AGQ Labs, Bureau Veritas, ALS Limited, and TUV SUD, dominate the market, each possessing a distinct market share. However, the market exhibits healthy competitive dynamics, driven by innovation in testing technologies, strategic mergers and acquisitions (M&A), and the increasing demand for stringent food safety standards.

Market concentration is estimated at xx% in 2025, with the top five players holding a combined share of approximately xx%. M&A activity has been significant, with deals valued at an estimated xx Million in the last five years. These activities reflect a trend of consolidation and expansion among larger players seeking to broaden their service offerings and geographical reach. The regulatory framework, primarily governed by the FDA and USDA in the US and CFIA in Canada, significantly impacts market dynamics. Changes in regulations concerning food safety standards and testing methodologies influence the adoption of new technologies and services, shaping the market landscape. The presence of substitute technologies and the continuous evolution of end-user preferences in the food industry further complicate the market dynamics. The report explores these intricacies to provide a complete picture of the competitive landscape.

North America Food Safety Testing Market Industry Trends & Insights

The North America food safety testing market is experiencing robust growth, driven by several key factors. The increasing prevalence of foodborne illnesses, stringent government regulations, heightened consumer awareness about food safety, and the rapid expansion of the food and beverage industry are major catalysts for market expansion. The CAGR for the market during the forecast period (2025-2033) is projected to be xx%, indicating substantial growth potential. Technological advancements, such as the adoption of advanced analytical techniques like LC-MS/MS, are revolutionizing the industry, improving accuracy, speed, and efficiency of testing. Market penetration of these advanced technologies is increasing steadily, with an estimated xx% adoption rate in 2025. Consumer preferences for safer, higher-quality food products are driving the demand for comprehensive food safety testing, creating a positive feedback loop for market growth. Competitive dynamics, characterized by ongoing innovation, strategic partnerships, and expansion strategies by key players, are shaping the market’s trajectory.

Dominant Markets & Segments in North America Food Safety Testing Market

Leading Region: The United States holds the largest market share within North America due to its larger food and beverage industry, stringent regulations, and higher consumer spending on food safety.

Dominant Segment (By Contaminant Type): Pathogen testing dominates the market due to the serious health risks associated with foodborne pathogens.

Dominant Segment (By Technology): LC-MS/MS-based testing is gaining traction due to its high sensitivity and specificity.

Dominant Segment (By Application): The food segment holds a larger share than pet food and animal feed due to the broader applications and regulatory requirements in the food industry.

Key Drivers for Dominance:

- Stringent Regulatory Frameworks: The US and Canada have robust regulatory frameworks ensuring food safety, pushing demand for testing services.

- Developed Infrastructure: Advanced laboratory infrastructure and skilled workforce support the expansion of the testing industry.

- Strong Economic Conditions: High consumer spending power leads to increased consumption of processed and packaged foods, further increasing the demand for testing.

The report thoroughly analyzes the market share and growth potential for each segment, factoring in regional variations and competitive dynamics.

North America Food Safety Testing Market Product Innovations

Recent years have witnessed significant product innovations in food safety testing, driven by advancements in analytical techniques and automation. The introduction of rapid testing methods, portable diagnostic tools, and improved sample preparation techniques has enhanced efficiency and reduced turnaround time. These innovations cater to the increasing demand for faster and more accurate results, improving the overall response time to potential food safety threats. The integration of advanced data analytics and artificial intelligence is also enhancing test interpretation and prediction capabilities. The market is witnessing a shift towards automated and high-throughput systems, reducing manual labor and improving cost-effectiveness.

Report Segmentation & Scope

The report segments the North America food safety testing market across three key parameters:

By Contaminant Type: Pathogen Testing, Pesticide and Residue Testing, Mycotoxin Testing, Other Contaminant Testing. Each segment exhibits unique growth trajectories and competitive landscapes, with pathogen testing showing particularly robust growth.

By Technology: HPLC-based, LC-MS/MS-based, Immunoassay-based, Other Technologies. LC-MS/MS-based testing is anticipated to witness high growth due to its superior sensitivity and specificity.

By Application: Pet Food and Animal Feed, Food. The food application segment holds a larger market share, driven by stringent regulations and consumer demand.

The report provides detailed market size estimations and growth projections for each segment, along with an analysis of the competitive dynamics within each category.

Key Drivers of North America Food Safety Testing Market Growth

Several factors contribute to the market's growth. Stringent government regulations mandating food safety testing, increasing consumer awareness of foodborne illnesses, and the growing demand for safer, higher-quality food products are driving forces. Technological advancements, such as the development of faster and more sensitive testing methods, are also fueling market growth. Additionally, the expansion of the food processing and retail industries is increasing the demand for testing services.

Challenges in the North America Food Safety Testing Market Sector

The industry faces several challenges, including the high cost of advanced testing technologies, the need for skilled personnel to operate sophisticated equipment, and the complexity of regulatory compliance. Supply chain disruptions can impact the availability of testing kits and reagents. Furthermore, intense competition among numerous players can create downward pressure on pricing and profit margins. These factors influence market dynamics and need to be considered for effective business strategies.

Leading Players in the North America Food Safety Testing Market Market

- Intertek Group PLC

- NSF International

- Eurofins Scientific

- NEOGEN Corporation

- SGS SA

- Merieux Nutrisciences

- AGQ Labs

- Bureau Veritas

- ALS Limited

- TUV SUD

Key Developments in North America Food Safety Testing Market Sector

- May 2022: Bureau Veritas opened its third US microbiological laboratory in Reno, Nevada, expanding its pathogen testing capabilities.

- 2021: NSF International launched 455 GMP standards for testing dietary supplements, cosmetics, and OTC products, enhancing safety and quality standards.

- 2019: SGS opened a new food microbiological testing laboratory in Fairfield, New Jersey, expanding its service offerings in the US.

Strategic North America Food Safety Testing Market Outlook

The North America food safety testing market holds significant future potential, driven by ongoing technological advancements, tightening regulations, and growing consumer demand for safer food products. Strategic opportunities exist for companies to invest in innovative technologies, expand their service offerings, and pursue strategic partnerships to enhance market share. The focus on rapid testing methods, automation, and data analytics will further shape the market’s trajectory, offering significant prospects for growth and innovation.

North America Food Safety Testing Market Segmentation

-

1. Contaminant Type

- 1.1. Pathogen Testing

- 1.2. Pesticide and Residue Testing

- 1.3. Mycotoxin Testing

- 1.4. Other Contaminant Testing

-

2. Technology

- 2.1. HPLC-based

- 2.2. LC-MS/MS-based

- 2.3. Immunoassay-based

- 2.4. Other Technologies

-

3. Application

- 3.1. Pet Food and Animal Feed

- 3.2. Meat and Poultry

- 3.3. Dairy

- 3.4. Fruits and Vegetables

- 3.5. Processed Food

- 3.6. Crops

- 3.7. Other Foods

North America Food Safety Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Food Safety Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. Growing Consumer Interest in Food Safety and Quality

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 5.1.1. Pathogen Testing

- 5.1.2. Pesticide and Residue Testing

- 5.1.3. Mycotoxin Testing

- 5.1.4. Other Contaminant Testing

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. HPLC-based

- 5.2.2. LC-MS/MS-based

- 5.2.3. Immunoassay-based

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Pet Food and Animal Feed

- 5.3.2. Meat and Poultry

- 5.3.3. Dairy

- 5.3.4. Fruits and Vegetables

- 5.3.5. Processed Food

- 5.3.6. Crops

- 5.3.7. Other Foods

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 6. United States North America Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Intertek Group PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NSF International

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Eurofins Scientific

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 NEOGEN Corporation*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SGS SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Merieux Nutrisciences

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AGQ Labs

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bureau Veritas

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ALS Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TUV SUD

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Intertek Group PLC

List of Figures

- Figure 1: North America Food Safety Testing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Food Safety Testing Market Share (%) by Company 2024

List of Tables

- Table 1: North America Food Safety Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Food Safety Testing Market Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 3: North America Food Safety Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Food Safety Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: North America Food Safety Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Food Safety Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Food Safety Testing Market Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 12: North America Food Safety Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 13: North America Food Safety Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: North America Food Safety Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Food Safety Testing Market?

The projected CAGR is approximately 5.39%.

2. Which companies are prominent players in the North America Food Safety Testing Market?

Key companies in the market include Intertek Group PLC, NSF International, Eurofins Scientific, NEOGEN Corporation*List Not Exhaustive, SGS SA, Merieux Nutrisciences, AGQ Labs, Bureau Veritas, ALS Limited, TUV SUD.

3. What are the main segments of the North America Food Safety Testing Market?

The market segments include Contaminant Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

Growing Consumer Interest in Food Safety and Quality.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

In May 2022, Bureau Veritas, a global leader in testing, inspection, and certification (TIC) services, opened its third US microbiological laboratory in Reno, Nevada. To safeguard the safety of food and agricultural commodities, the new laboratory provides quick pathogen testing as well as microbiological indicator investigations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Food Safety Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Food Safety Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Food Safety Testing Market?

To stay informed about further developments, trends, and reports in the North America Food Safety Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence