Key Insights

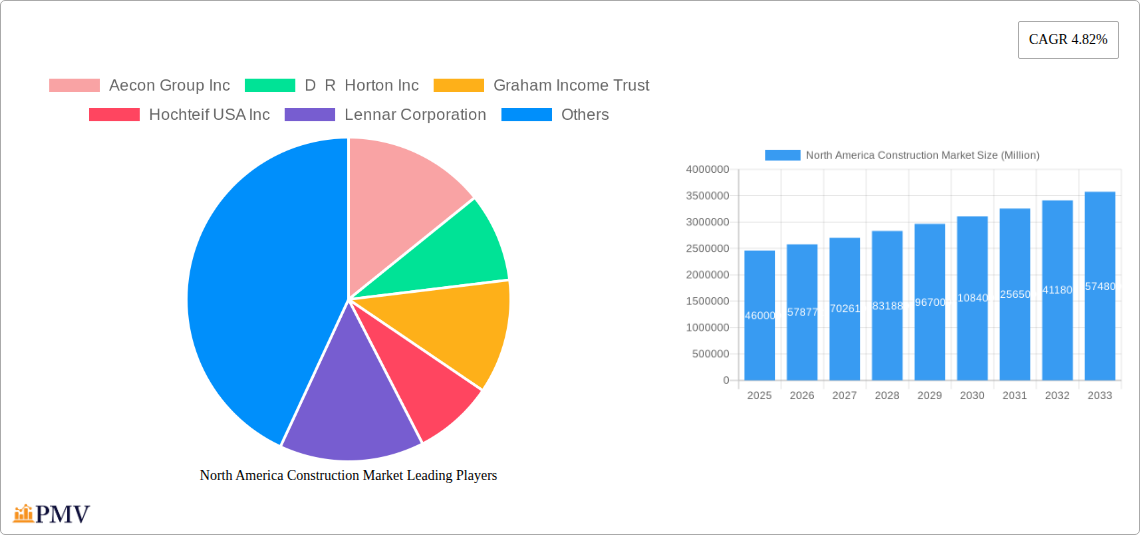

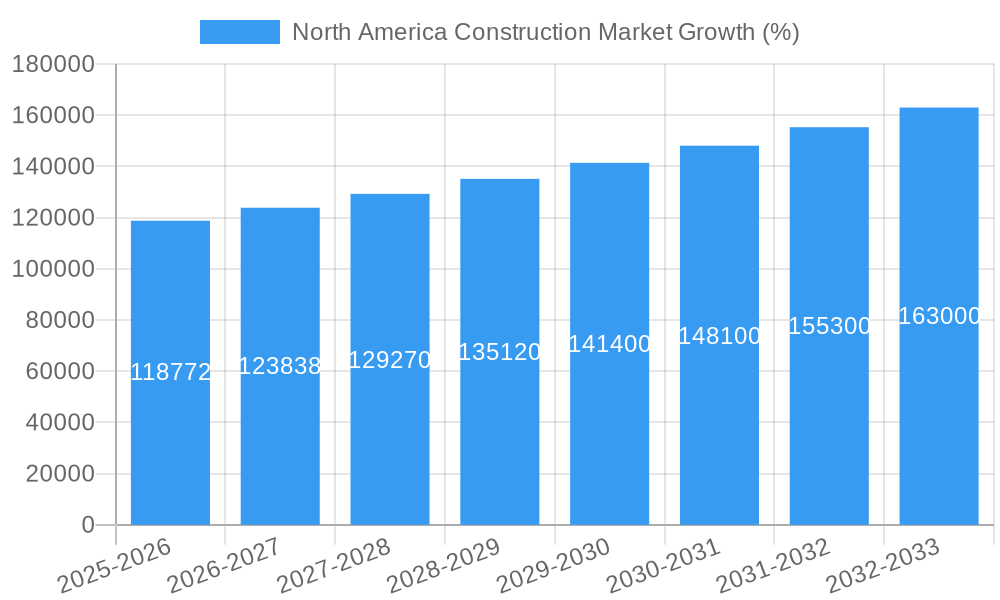

The North American construction market, valued at $2.46 trillion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.82% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, significant investments in infrastructure projects, particularly in transportation networks and energy utilities, across the United States and Canada are stimulating demand. Secondly, the ongoing recovery in the residential sector, spurred by population growth and favorable mortgage rates in certain periods, is further boosting construction activity. Commercial construction, while potentially subject to economic fluctuations, also contributes significantly to overall market growth, particularly in urban centers experiencing population and business expansion. Finally, the increasing need for renovations and additions to existing buildings provides a steady stream of projects across all construction types. The market is segmented by country (US, Canada), sector (Commercial, Residential, Industrial, Infrastructure, Energy & Utilities), and construction type (Additions, Demolition, New Constructions), allowing for granular analysis and investment targeting.

However, challenges persist. Supply chain disruptions, particularly in the availability of building materials, pose ongoing risks to project timelines and costs. Labor shortages, coupled with rising labor costs, present significant constraints on the industry's capacity to meet demand. Furthermore, regulatory hurdles and permitting delays can sometimes impede project progression. Despite these challenges, the long-term outlook for the North American construction market remains positive, driven by substantial government spending on infrastructure and a persistent need for new housing and commercial spaces. Companies like Aecon Group Inc., D R Horton Inc., and Lennar Corporation are key players navigating this dynamic landscape, demonstrating the industry's scale and competitive intensity. The market's growth trajectory suggests significant opportunities for investors and stakeholders alike.

North America Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America construction market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into market structure, competitive dynamics, industry trends, leading segments, and key players, offering actionable insights for industry professionals, investors, and stakeholders. The report covers Canada and the United States, analyzing various construction sectors and types. The total market size is projected to reach xx Million by 2033.

North America Construction Market Structure & Competitive Dynamics

This section analyzes the North American construction market's competitive landscape, focusing on market concentration, innovation, regulatory frameworks, and M&A activities. The market is moderately concentrated, with a handful of large players commanding significant market share. However, numerous smaller firms also contribute to the overall market activity.

- Market Concentration: The top 10 companies hold an estimated xx% market share, with the remaining share distributed among smaller firms. Further analysis reveals variations in market concentration across different construction sectors and geographical locations.

- Innovation Ecosystems: The industry is witnessing growing adoption of Building Information Modeling (BIM), prefabrication, and sustainable building materials, driving innovation.

- Regulatory Frameworks: Building codes, environmental regulations, and labor laws significantly influence the market dynamics, creating both challenges and opportunities.

- Product Substitutes: The rise of modular construction and 3D printing poses some level of substitution to traditional construction methods.

- End-User Trends: Increasing demand for sustainable and energy-efficient buildings is a key end-user trend driving market growth.

- M&A Activities: The construction sector is experiencing consistent M&A activity, with deal values averaging xx Million in recent years. These mergers and acquisitions often aim to expand geographical reach, enhance service offerings, and gain market share. Key M&A activities over the past five years are documented in Appendix A.

North America Construction Market Industry Trends & Insights

The North American construction market exhibits robust growth, driven by several factors. The projected Compound Annual Growth Rate (CAGR) from 2025 to 2033 is estimated to be xx%. Market penetration of sustainable construction practices is increasing, projected to reach xx% by 2033. Several trends shape the market:

- Infrastructure Development: Government investments in infrastructure projects, such as transportation and utilities, significantly drive market growth. This includes substantial government funding for highway modernization, bridge repairs and expansion of public transportation systems.

- Residential Construction Boom: The increasing population and changing demographics fuel the demand for residential construction, especially in urban areas.

- Technological Disruptions: The adoption of Building Information Modeling (BIM), prefabrication, and advanced construction technologies, such as robotics and drones, are enhancing efficiency and productivity.

- Sustainable Construction: Growing awareness of environmental issues is pushing the demand for green buildings and sustainable construction practices.

- Economic Growth: Overall economic stability and growth play a major role in construction market expansion, impacting both private and public sector projects.

- Urbanization: The ongoing process of urbanization contributes to greater demand in construction activities for residential, commercial, and infrastructure needs in expanding city limits.

Dominant Markets & Segments in North America Construction Market

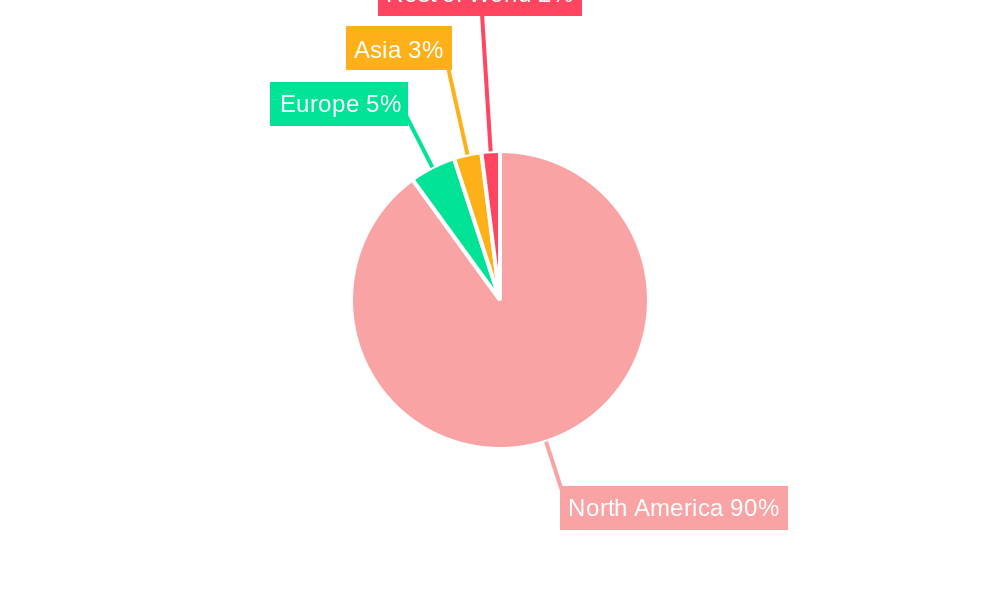

The United States dominates the North American construction market, accounting for a larger share of the overall market value compared to Canada. However, Canada experiences consistent growth, driven by its robust infrastructure development plans.

- By Country: The United States holds the largest market share (xx%), followed by Canada (xx%).

- By Sector: Residential construction holds the largest segmental share, followed closely by commercial and infrastructure construction.

- By Construction Type: New constructions constitute the most dominant type of construction activity, although additions and demolition and renovation also make up considerable market segments.

Key Drivers for Dominant Segments:

- Residential Construction: Driven by population growth, urbanization, and favorable mortgage rates.

- Commercial Construction: Fueled by economic expansion and the need for modern office spaces, retail establishments, and industrial facilities.

- Infrastructure (Transportation) Construction: Supported by significant government investments in roads, bridges, and public transportation systems.

North America Construction Market Product Innovations

Recent innovations focus on enhancing efficiency, sustainability, and safety. Prefabrication, modular construction, and the integration of Building Information Modeling (BIM) are gaining traction. These advancements offer advantages like reduced construction time, improved quality control, and minimized waste. The market is also witnessing a rise in the use of advanced materials, such as high-performance concrete and sustainable wood products, to improve building performance and reduce the environmental impact.

Report Segmentation & Scope

This report segments the North American construction market by country (United States and Canada), sector (Commercial, Residential, Industrial, Infrastructure, Energy and Utilities), and construction type (Additions, Demolition, New Constructions). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. This provides a granular understanding of the market structure and identifies key opportunities within each segment.

Key Drivers of North America Construction Market Growth

Several factors drive the growth of the North American construction market: robust economic growth, increasing investments in infrastructure projects, rising demand for housing, technological advancements (BIM, prefabrication, sustainable materials), and supportive government policies aimed at stimulating the construction industry. Government incentives such as tax breaks for green building projects further enhance growth.

Challenges in the North America Construction Market Sector

The North American construction market faces challenges including labor shortages, rising material costs, supply chain disruptions (affecting material availability and costs), regulatory complexities, and intense competition. These factors negatively affect project timelines and profitability, leading to potential delays and cost overruns. The shortage of skilled labor has been a major concern for the industry, with estimated shortfalls amounting to xx Million worker hours annually.

Leading Players in the North America Construction Market Market

- Aecon Group Inc

- D R Horton Inc

- Graham Income Trust

- Hochtief USA Inc

- Lennar Corporation

- PulteGroup Inc

- Kiewit Corporation

- Tutor Perini Corporation

- PCL Construction Group Inc

- Toll Brothers Inc

- Kajima U S A Inc

- The Whiting-Turner Contracting Company

- Hensel Phelps Construction Co

- SNC-Lavalin Construction Inc

- NVR Inc

Key Developments in North America Construction Market Sector

- June 2023: AXA XL launched the Sustainability Circle, a network promoting sustainable construction practices.

- April 2023: Greystar opened a modular construction facility, focusing on sustainable and affordable housing.

Strategic North America Construction Market Outlook

The North American construction market presents significant growth opportunities. Continued investment in infrastructure, the rise of sustainable building practices, and the adoption of innovative construction technologies will drive market expansion. Companies that embrace digitalization, prioritize sustainability, and address labor shortages will be best positioned for success. The market is projected to experience consistent growth over the forecast period, driven by positive economic indicators and sustained demand across major construction segments.

North America Construction Market Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

-

2. Construction Type

- 2.1. Additions

- 2.2. Demolition and New Constructions

North America Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.82% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend

- 3.3. Market Restrains

- 3.3.1. Interests and Financing; Increase in Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction Segment Holds the Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. Additions

- 5.2.2. Demolition and New Constructions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. United States North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Aecon Group Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 D R Horton Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Graham Income Trust

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hochteif USA Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lennar Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 PulteGroup Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kiewit Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tutor Perini Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PCL Construction Group Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Toll Brothers Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Kajima U S A Inc **List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Whiting-Turner Contracting Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Hensel Phelps Construction Co

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 SNC-Lavalin Construction Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 NVR Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Aecon Group Inc

List of Figures

- Figure 1: North America Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Construction Market Share (%) by Company 2024

List of Tables

- Table 1: North America Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: North America Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: North America Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: North America Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 12: North America Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Construction Market?

The projected CAGR is approximately 4.82%.

2. Which companies are prominent players in the North America Construction Market?

Key companies in the market include Aecon Group Inc, D R Horton Inc, Graham Income Trust, Hochteif USA Inc, Lennar Corporation, PulteGroup Inc, Kiewit Corporation, Tutor Perini Corporation, PCL Construction Group Inc, Toll Brothers Inc, Kajima U S A Inc **List Not Exhaustive, The Whiting-Turner Contracting Company, Hensel Phelps Construction Co, SNC-Lavalin Construction Inc, NVR Inc.

3. What are the main segments of the North America Construction Market?

The market segments include Sector, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend.

6. What are the notable trends driving market growth?

Residential Construction Segment Holds the Major Share in the Market.

7. Are there any restraints impacting market growth?

Interests and Financing; Increase in Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

June 2023: AXA XL's North American construction insurance business launched the Sustainability Circle. It is a network comprising 21 leaders in the sustainable construction industry. The goal of the initiative is to assist clients achieve their sustainability goals and enhance their construction risk management efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Construction Market?

To stay informed about further developments, trends, and reports in the North America Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence