Key Insights

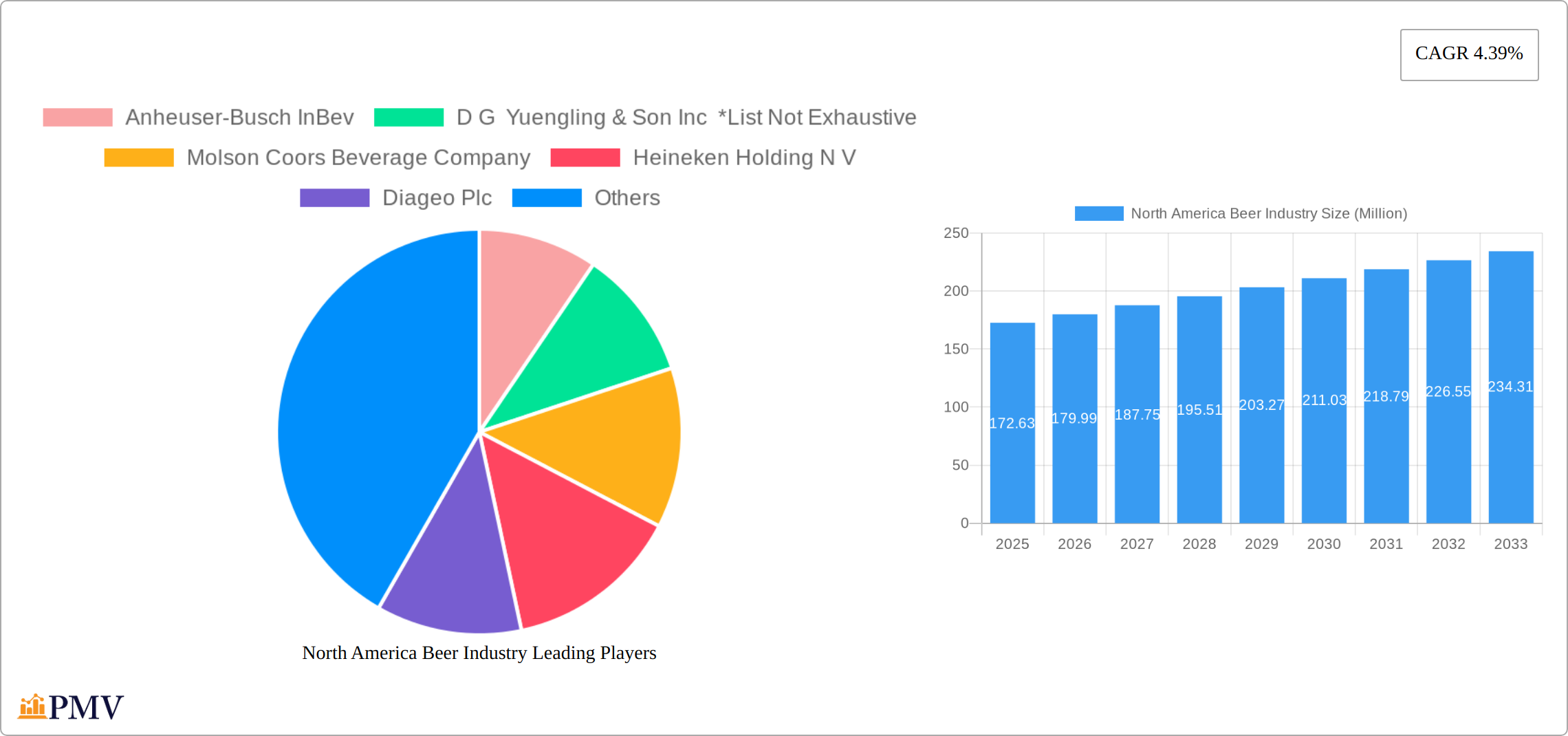

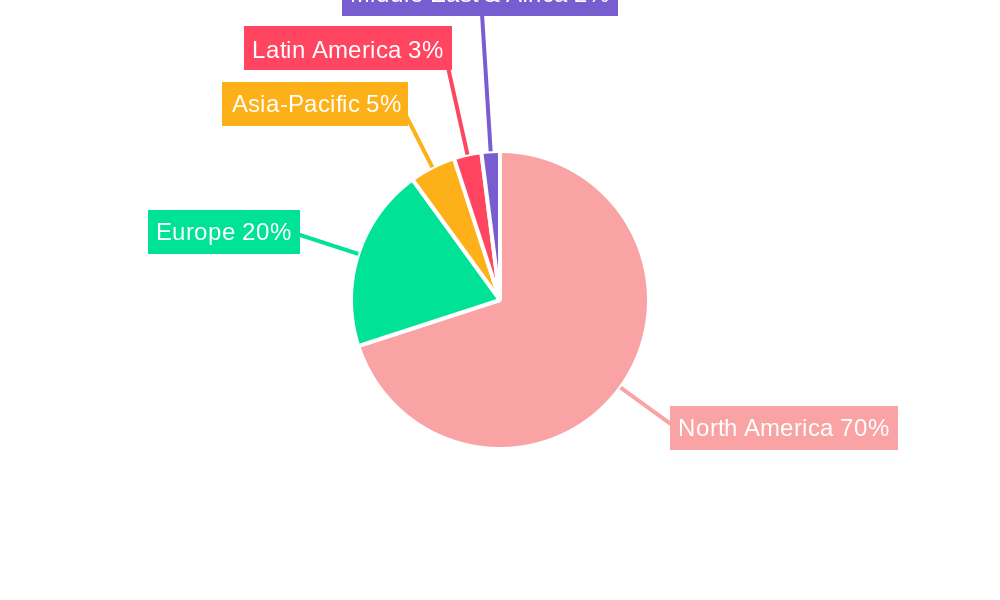

The North America Beer Industry is poised for significant growth, with a projected market size of $172.63 million by 2025, growing at a Compound Annual Growth Rate (CAGR) of 4.39% from 2025 to 2033. This growth is driven by a robust demand for diverse beer types such as Lager, Ale, and others, with Lager holding a substantial market share due to its widespread popularity. Distribution channels are split between On-Trade and Off-Trade, with Off-Trade channels gaining traction due to increased consumer preference for home consumption. Key players such as Anheuser-Busch InBev, Molson Coors Beverage Company, and Heineken Holding N.V. continue to innovate and expand their product portfolios to cater to evolving consumer tastes. The United States leads the regional market, followed by Canada and Mexico, with the rest of North America showing steady growth.

Trends within the industry include a rising interest in craft and specialty beers, which is pushing companies to explore unique flavors and brewing techniques. This shift is particularly evident in the United States, where consumers are increasingly seeking out premium and artisanal beer options. Despite the overall positive outlook, the industry faces challenges such as stringent regulations and increasing competition from non-alcoholic beverages. However, strategic partnerships and marketing initiatives by major companies are helping to mitigate these restraints. Over the forecast period from 2025 to 2033, the North America Beer Industry is expected to continue its growth trajectory, driven by innovation, consumer trends, and effective distribution strategies.

North America Beer Industry Market Structure & Competitive Dynamics

The North America beer industry exhibits a highly competitive landscape, characterized by a mix of large multinational corporations and agile craft breweries. Market concentration is significant, with leading players like Anheuser-Busch InBev and Molson Coors Beverage Company holding substantial market shares. Anheuser-Busch InBev, for instance, commands approximately 40% of the market, while Molson Coors secures about 25%. The innovation ecosystem is vibrant, driven by technological advancements in brewing techniques and packaging solutions. Regulatory frameworks vary across the region, with the United States having a more relaxed stance on craft brewing compared to Canada, which has stringent alcohol regulations. Product substitutes such as wine and spirits pose a threat, yet the trend towards premium and craft beers continues to grow among consumers. Mergers and acquisitions are pivotal, with deals like Royal Unibrew's acquisition of Amsterdam Brewery for $xx Million reflecting strategic expansion efforts. The industry also sees a rise in end-user trends towards health-conscious and low-alcohol options, influencing product development and marketing strategies.

North America Beer Industry Industry Trends & Insights

The North American beer industry is experiencing robust growth, projected to maintain a compound annual growth rate (CAGR) of 3.5% from 2025 to 2033. This expansion is fueled by several key factors. Technological advancements, including AI-driven brewing optimization and blockchain-enabled supply chain transparency, are significantly impacting efficiency and consumer trust. A notable shift in consumer preferences towards craft and specialty beers continues, with craft beer market penetration reaching 13% in the United States. This demand for unique flavors and locally-sourced products is pressuring traditional brewers to innovate aggressively, leading to increased mergers and acquisitions of craft breweries. The competitive landscape is highly dynamic, with major players like Heineken and Diageo strategically broadening their portfolios to include non-alcoholic and low-alcohol options, directly addressing the growing health and wellness consciousness. Furthermore, rising disposable incomes in key markets and favorable regulatory environments in specific states contribute to the overall market expansion. Finally, sustainability is emerging as a crucial differentiator, with breweries actively investing in eco-friendly production methods and sustainable packaging to meet consumer demand for environmentally responsible products. This holistic approach is driving innovation and growth across all segments.

Dominant Markets & Segments in North America Beer Industry

The United States stands as the dominant market within the North America beer industry, driven by a robust consumer base and a thriving craft beer scene. Key drivers include:

- Economic policies that support small businesses and local production.

- Advanced infrastructure facilitating distribution and accessibility.

- A cultural affinity for beer, particularly craft and premium varieties.

In terms of type, Lager remains the most popular segment, accounting for approximately 80% of the market share due to its widespread appeal and ease of production. The On-Trade distribution channel, encompassing bars and restaurants, is significant in driving sales, particularly in urban areas where social consumption is high. However, the Off-Trade channel, including supermarkets and liquor stores, is witnessing growth due to changing consumer habits and the convenience of purchasing.

Canada and Mexico also play crucial roles, with Canada's market being influenced by its craft brewing culture and Mexico's by the popularity of brands like Modelo. The Rest of North America, while smaller in comparison, offers untapped potential for expansion, especially in regions with growing economies and increasing beer consumption trends.

North America Beer Industry Product Innovations

Product innovation is a cornerstone of the North American beer industry's success, focusing heavily on enhanced flavor profiles and catering to evolving consumer preferences. Recent noteworthy developments include a surge in flavored beers, the expansion of non-alcoholic and low-alcohol options, and the creative use of unique barrel aging techniques. A prime example is Goose Island Beer Company's 2022 edition of Bourbon County Stout, aged in a blend of barrels from prestigious distilleries. These innovations not only satisfy the demand for diverse and high-quality beers but also leverage cutting-edge technologies such as precision fermentation and eco-friendly packaging to enhance efficiency and sustainability, maintaining a competitive edge in the market.

Report Segmentation & Scope

This report segments the North American beer industry across key parameters: type, distribution channel, and country. The type segment encompasses Lager, Ale, and Others. Lager, possessing a broad consumer base, is predicted to grow at a CAGR of 3% during the forecast period. Ale, while currently holding a smaller market share, demonstrates a higher projected growth rate of 4.5%, reflecting the increasing popularity of craft beers. The distribution channel is categorized into On-Trade and Off-Trade, with Off-Trade expected to expand at a CAGR of 4%, primarily driven by consumer convenience. Geographically, the analysis covers the United States, Canada, Mexico, and the Rest of North America. The United States maintains the largest market share (xx Million), followed by Canada and Mexico.

Key Drivers of North America Beer Industry Growth

Key drivers of growth in the North America beer industry include technological advancements, such as automated brewing systems and data analytics for consumer insights, which enhance production efficiency and market understanding. Economically, rising disposable incomes and a robust tourism sector contribute to increased beer consumption. Regulatory factors, like relaxed laws on craft brewing in the U.S., foster innovation and market entry for new players. These drivers collectively propel the industry forward, creating a dynamic environment for growth and development.

Challenges in the North America Beer Industry Sector

The North America beer industry faces several challenges, including stringent regulatory hurdles that vary by country, impacting production and distribution. Supply chain issues, exacerbated by global events like pandemics, lead to increased costs and delays. Competitive pressures are intense, with craft breweries challenging established brands, which necessitates continuous innovation and marketing efforts. These challenges result in a quantifiable impact, such as a potential decrease in profit margins by 2-3% annually due to rising operational costs.

Leading Players in the North America Beer Industry Market

- Anheuser-Busch InBev

- D G Yuengling & Son Inc *List Not Exhaustive

- Molson Coors Beverage Company

- Heineken Holding N V

- Diageo Plc

- Constellation Brands Inc

- Suntory Beverage & Food Limited

- FIFCO USA

- Carlsberg Group

- Boston Beer Company

Key Developments in North America Beer Industry Sector

- November 2022: Goose Island Beer Company's Canadian branch successfully launched the 2022 edition of its highly anticipated Bourbon County Stout, following its initial release in the United States on Black Friday. The beer, aged in a carefully curated selection of bourbon barrels from renowned distilleries (Buffalo Trace, Heaven Hill, and Wild Turkey), exemplifies the industry's commitment to product diversification and enhanced market appeal.

- July 2022: Royal Unibrew's acquisition of Amsterdam Brewery Co. Ltd. in Toronto signifies a strategic move to expand its presence in the Canadian and US markets. This acquisition not only increases production capacity but also promises to streamline logistics, leading to reduced shipping costs and a smaller carbon footprint.

- March 2022: Modelo's introduction of Modelo Oro premium light beer highlights the ongoing competition in the high-end beverage market. This launch reinforces Modelo's market leadership and demonstrates a commitment to continuous innovation and flavor expansion.

Strategic North America Beer Industry Market Outlook

The strategic outlook for the North America beer industry is promising, with significant growth accelerators such as the increasing popularity of craft and premium beers and the expansion of distribution channels. Future market potential lies in tapping into emerging markets within the region and leveraging technology for personalized consumer experiences. Strategic opportunities include sustainability initiatives, product diversification, and exploring untapped segments like non-alcoholic beers, which are poised to drive long-term growth and market resilience.

North America Beer Industry Segmentation

-

1. Type

- 1.1. Lager

- 1.2. Ale

- 1.3. Others

-

2. Distribution Channel

- 2.1. On-Trade

- 2.2. Off-Trade

North America Beer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Beer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Growing Demand for Beer Across the United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Beer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lager

- 5.1.2. Ale

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Beer Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Beer Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Beer Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Beer Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Anheuser-Busch InBev

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 D G Yuengling & Son Inc *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Molson Coors Beverage Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Heineken Holding N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Diageo Plc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Constellation Brands Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Suntory Beverage & Food Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 FIFCO USA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Carlsberg Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Boston Beer Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Anheuser-Busch InBev

List of Figures

- Figure 1: North America Beer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Beer Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Beer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Beer Industry Volume liter Forecast, by Region 2019 & 2032

- Table 3: North America Beer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Beer Industry Volume liter Forecast, by Type 2019 & 2032

- Table 5: North America Beer Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: North America Beer Industry Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America Beer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Beer Industry Volume liter Forecast, by Region 2019 & 2032

- Table 9: North America Beer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Beer Industry Volume liter Forecast, by Country 2019 & 2032

- Table 11: United States North America Beer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Beer Industry Volume (liter ) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Beer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Beer Industry Volume (liter ) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Beer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Beer Industry Volume (liter ) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Beer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Beer Industry Volume (liter ) Forecast, by Application 2019 & 2032

- Table 19: North America Beer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Beer Industry Volume liter Forecast, by Type 2019 & 2032

- Table 21: North America Beer Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: North America Beer Industry Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 23: North America Beer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Beer Industry Volume liter Forecast, by Country 2019 & 2032

- Table 25: United States North America Beer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Beer Industry Volume (liter ) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Beer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Beer Industry Volume (liter ) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Beer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Beer Industry Volume (liter ) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Beer Industry?

The projected CAGR is approximately 4.39%.

2. Which companies are prominent players in the North America Beer Industry?

Key companies in the market include Anheuser-Busch InBev, D G Yuengling & Son Inc *List Not Exhaustive, Molson Coors Beverage Company, Heineken Holding N V, Diageo Plc, Constellation Brands Inc, Suntory Beverage & Food Limited, FIFCO USA, Carlsberg Group, Boston Beer Company.

3. What are the main segments of the North America Beer Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Growing Demand for Beer Across the United States.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

In November 2022, Goose Island Beer Company's Canada branch announced the launch of the 2022 edition of Bourbon County Stout. It was officially introduced in the United States on Black Friday. The 2022 Original Bourbon County Stout was aged in a mix of bourbon barrels from Buffalo Trace, Heaven Hill, and Wild Turkey distilleries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Beer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Beer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Beer Industry?

To stay informed about further developments, trends, and reports in the North America Beer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence