Key Insights

The North American automotive navigation system market, valued at $7.74 billion in 2025, is projected to experience robust growth, driven by increasing vehicle production, rising consumer demand for advanced driver-assistance systems (ADAS), and the integration of navigation with infotainment systems. The market's Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033 indicates a significant expansion, fueled by technological advancements such as cloud-based navigation, improved map accuracy, and the incorporation of real-time traffic updates. The OEM segment currently holds a larger market share compared to the aftermarket, reflecting the trend of integrating navigation systems directly into new vehicles. Passenger vehicles constitute a major portion of the market, although the commercial vehicle segment is expected to witness substantial growth due to increasing demand for fleet management and logistics optimization solutions. The United States dominates the North American market, followed by Canada, with Mexico and the Rest of North America showing promising growth potential. Key players like Denso, Alpine, TomTom, and others are focusing on innovation and strategic partnerships to maintain their competitive edge.

North America Automotive Navigation System Market Market Size (In Billion)

Growth is being fueled by several factors including the increasing adoption of connected cars, the rising demand for enhanced safety features, and the growing preference for user-friendly interfaces. However, factors such as the high initial cost of advanced navigation systems and the increasing availability of alternative navigation solutions (like smartphone apps) might act as restraints. The market segmentation highlights the importance of understanding different customer needs across various vehicle types and sales channels. Future growth will likely depend on the successful integration of navigation with other vehicle technologies, the development of more personalized and intuitive user experiences, and the expansion into emerging markets within North America. The continuous improvement in mapping data accuracy and the increasing availability of high-speed internet connectivity will further accelerate market expansion in the forecast period.

North America Automotive Navigation System Market Company Market Share

North America Automotive Navigation System Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Automotive Navigation System market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, competitive landscape, technological advancements, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report utilizes a robust methodology incorporating historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033) to present a holistic view of this dynamic market. The market is segmented by sales channel (OEM and Aftermarket), vehicle type (Passenger Vehicles and Commercial Cars), and country (United States, Canada, and Rest of North America). Key players analyzed include Denso Corporation, Alps Alpine Co Ltd, TomTom International BV, Aptiv PLC, Harman International, Robert Bosch GmbH, Marelli Holdings Co Ltd, what3words Ltd, Faurecia Clarion Electronics Co Ltd, Pioneer Corporation, Panasonic Holdings Corporation, and Alpine Electronics. The report's total market value in 2025 is estimated at xx Million.

North America Automotive Navigation System Market Structure & Competitive Dynamics

The North American automotive navigation system market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the market is also characterized by a dynamic competitive landscape with intense innovation and consolidation activities. Market leaders leverage their extensive R&D capabilities and established distribution networks to maintain their position. The regulatory landscape, particularly concerning data privacy and safety standards, plays a crucial role in shaping market dynamics. Several substitute technologies, such as smartphone-based navigation apps, pose a challenge to traditional in-vehicle systems. Furthermore, evolving consumer preferences towards integrated infotainment systems and advanced driver-assistance features are driving market transformation.

M&A activity within the sector has been significant, with several large-scale acquisitions aimed at expanding product portfolios and enhancing technological capabilities. While precise M&A deal values are not publicly disclosed for all transactions, it’s estimated that combined deal values for the last 5 years exceed xx Million. This activity reflects the strategic importance of navigation systems within the broader automotive technology ecosystem. Market share analysis reveals that the top five players collectively control approximately xx% of the market. The remaining share is distributed among numerous smaller players, contributing to a complex and competitive market environment.

North America Automotive Navigation System Market Industry Trends & Insights

The North America automotive navigation system market is experiencing substantial growth, driven by several key factors. The increasing adoption of connected cars and the rising demand for advanced driver-assistance systems (ADAS) are major catalysts. Technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML) for improved route optimization and real-time traffic updates, are further enhancing the appeal of these systems. Consumer preferences are shifting towards intuitive and user-friendly interfaces, along with seamless integration with other in-vehicle infotainment features. The market's CAGR during the forecast period (2025-2033) is projected to be xx%, reflecting the sustained growth trajectory. Market penetration currently stands at xx%, but this is expected to rise significantly driven by increasing vehicle production and advanced technological features. The competitive landscape is marked by both cooperation and competition, with strategic alliances and technological innovations shaping the future of navigation solutions. The growing integration of navigation systems with other automotive technologies such as telematics and cloud-based services creates a synergistic effect boosting adoption. Furthermore, the increasing demand for personalized navigation experiences is leading to the development of sophisticated and customized solutions.

Dominant Markets & Segments in North America Automotive Navigation System Market

By Sales Channel: The OEM segment dominates the North America automotive navigation system market, accounting for approximately xx% of the total market share in 2025. This dominance is attributed to the high volume of vehicle production and the integration of navigation systems as standard features in new cars. The aftermarket segment holds a significant but smaller share, primarily driven by upgrades and replacements in existing vehicles. The growth of the aftermarket is expected to lag slightly behind that of the OEM segment.

By Vehicle Type: The passenger vehicle segment holds the largest share of the market due to higher volumes and consumer demand for advanced features. The commercial vehicle segment, however, is showing faster growth due to rising demand for efficient fleet management and enhanced driver safety. Government regulations and efficiency mandates for commercial vehicles are expected to further accelerate this segment's growth.

By Country: The United States is the dominant market, owing to its large automotive industry and high consumer spending on vehicles and technological upgrades. Canada holds a considerable share, while the “Rest of North America” segment represents a smaller but still growing market. Strong economic growth and robust automotive production are major drivers within the U.S. Canada’s market is propelled by similar factors, albeit at a smaller scale. The "Rest of North America" region is projected to exhibit a notable growth rate due to increasing vehicle sales and infrastructure development.

North America Automotive Navigation System Market Product Innovations

Recent product innovations in the North American automotive navigation system market are largely focused on enhancing user experience and integrating advanced technologies. This includes the introduction of AI-powered voice navigation systems, augmented reality (AR) overlays for improved navigation guidance, and seamless integration with smartphone applications and cloud-based services. These advancements aim to offer more accurate, efficient, and personalized navigation experiences, ultimately enhancing driver satisfaction and safety. The integration of these systems with other ADAS features demonstrates a trend towards holistic vehicle control and infotainment ecosystems.

Report Segmentation & Scope

This report segments the North American automotive navigation system market across multiple dimensions:

By Sales Channel: OEM and Aftermarket. The OEM segment is projected to exhibit a xx% CAGR, while the Aftermarket segment is projected to grow at xx% CAGR during the forecast period. Competitive dynamics in the OEM segment are characterized by intense competition among established players, whereas the Aftermarket segment showcases a broader range of players including both established and newer entities.

By Vehicle Type: Passenger Vehicles and Commercial Cars. The Passenger Vehicle segment is expected to maintain its dominance, growing at a xx% CAGR, whereas the Commercial Car segment anticipates faster growth at a xx% CAGR driven by fleet management solutions. Competition within both segments is driven by technological differentiation and integration with broader vehicle platforms.

By Country: United States, Canada, and Rest of North America. The United States is projected to remain the largest market, followed by Canada. The Rest of North America segment shows strong potential for growth. Market size variations are largely influenced by factors including automotive production levels, infrastructure investments, and consumer spending patterns.

Key Drivers of North America Automotive Navigation System Market Growth

The North American automotive navigation system market’s growth is propelled by several key factors. Firstly, the increasing adoption of connected cars and the rise of advanced driver-assistance systems (ADAS) are significant drivers. Secondly, the integration of AI and machine learning for enhanced route optimization and real-time traffic updates boosts demand. Thirdly, the ever-increasing demand for user-friendly interfaces, often incorporating voice control and personalized settings, further drives market expansion. Finally, government regulations promoting driver safety and efficiency are also bolstering the market's growth.

Challenges in the North America Automotive Navigation System Market Sector

Several challenges hinder the North America automotive navigation system market's growth. These include increasing costs associated with the development and integration of advanced technologies, the potential for cybersecurity vulnerabilities, and the need for continuous updates to map data to ensure accuracy. Furthermore, the increasing prevalence of smartphone-based navigation systems poses significant competition. Supply chain disruptions and component shortages can also impact production and market supply. These issues can lead to price fluctuations and delays in product delivery, impacting market growth.

Leading Players in the North America Automotive Navigation System Market Market

Key Developments in North America Automotive Navigation System Market Sector

October 2023: Mapbox, Inc. launched MapGPT, an AI-powered voice navigation system, and Mapbox Autopilot, a map positioning system for self-driving vehicles. This significantly enhances navigation capabilities and supports the autonomous vehicle market.

September 2023: Qualcomm Technologies, Ltd. partnered with Mercedes-Benz AG to integrate Snapdragon Cockpit Platforms into the new Mercedes-Benz E-Class, improving multimedia and navigation capabilities. This collaboration highlights the increasing importance of advanced infotainment systems.

September 2023: BMW Group and Qualcomm Technologies, Inc. expanded their partnership, integrating Snapdragon Digital Chassis solutions into BMW vehicles. This boosts in-car virtual assistance, natural language interaction, and safety features, setting a benchmark for future navigation integration.

Strategic North America Automotive Navigation System Market Outlook

The North America automotive navigation system market presents significant growth potential driven by technological advancements, the increasing demand for connected and autonomous vehicles, and evolving consumer preferences. Strategic opportunities exist for players who can innovate in AI-powered navigation, augmented reality overlays, seamless smartphone integration, and cloud-based services. Companies focused on providing customized and personalized navigation experiences, along with enhanced security features, are well-positioned for success. The ongoing evolution of ADAS and autonomous driving technologies will further fuel market growth and create new opportunities for innovative navigation solutions in the coming years.

North America Automotive Navigation System Market Segmentation

-

1. Sales Channel

- 1.1. Original Equipment Manufacturer (OEM)

- 1.2. Aftermarket

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Cars

North America Automotive Navigation System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

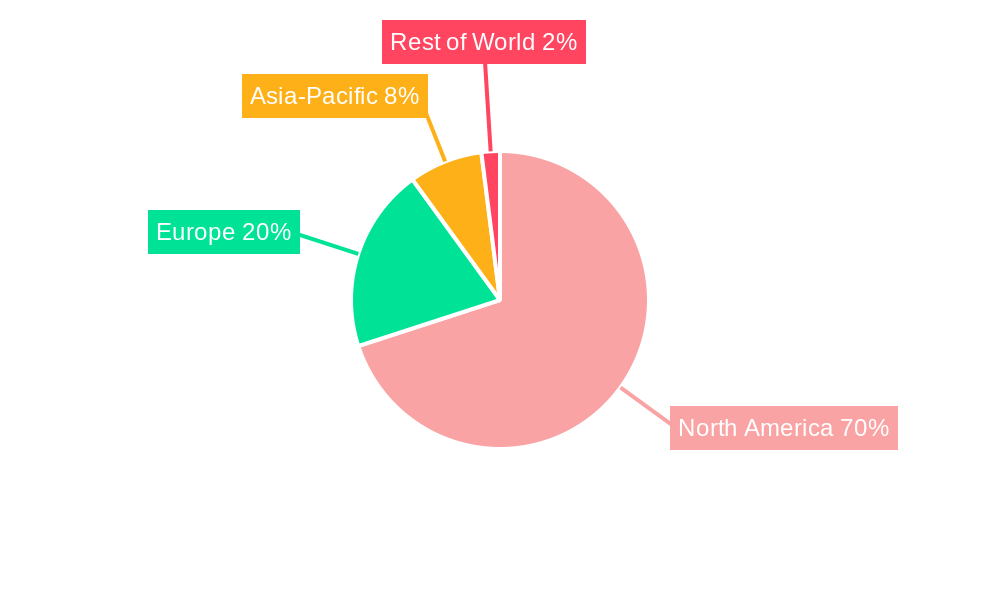

North America Automotive Navigation System Market Regional Market Share

Geographic Coverage of North America Automotive Navigation System Market

North America Automotive Navigation System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Trend Towards In-dash Navigation System

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Navigation System May Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Passenger Car Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel

- 5.1.1. Original Equipment Manufacturer (OEM)

- 5.1.2. Aftermarket

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alps Alpine Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TomTom International BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aptiv PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harman International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Bosch GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Marelli Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 what3words Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Faurecia Clarion Electronics Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pioneer Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Holdings Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Alpine Electronics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: North America Automotive Navigation System Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Automotive Navigation System Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Navigation System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 2: North America Automotive Navigation System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: North America Automotive Navigation System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Automotive Navigation System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: North America Automotive Navigation System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: North America Automotive Navigation System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Automotive Navigation System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Automotive Navigation System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Automotive Navigation System Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Navigation System Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the North America Automotive Navigation System Market?

Key companies in the market include Denso Corporation, Alps Alpine Co Ltd, TomTom International BV, Aptiv PLC, Harman International, Robert Bosch GmbH, Marelli Holdings Co Ltd, what3words Ltd, Faurecia Clarion Electronics Co Ltd, Pioneer Corporation, Panasonic Holdings Corporation, Alpine Electronics.

3. What are the main segments of the North America Automotive Navigation System Market?

The market segments include Sales Channel, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Trend Towards In-dash Navigation System.

6. What are the notable trends driving market growth?

Passenger Car Hold Major Market Share.

7. Are there any restraints impacting market growth?

High Cost of Installing Navigation System May Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

In October 2023, Mapbox, Inc. introduced the MapGPT voice navigation system, that employs generative artificial intelligence (AI), as well as the Mapbox Autopilot Map position information system for self-driving vehicles. The MapGPT system incorporates real-time vehicle, destination, and environmental information into the company's location information service, delivering route and desired facility information.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Navigation System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Navigation System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Navigation System Market?

To stay informed about further developments, trends, and reports in the North America Automotive Navigation System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence