Key Insights

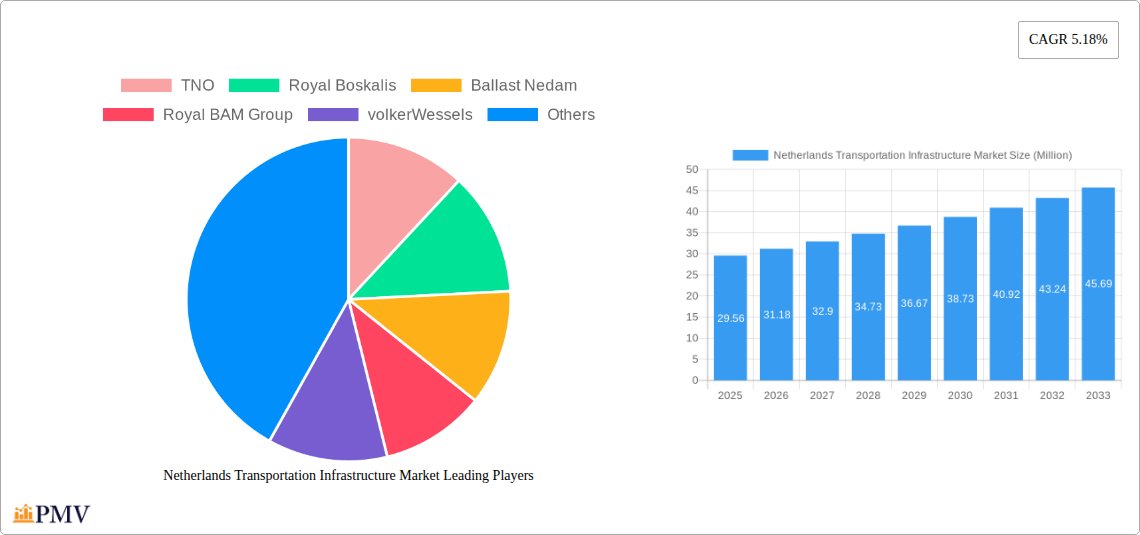

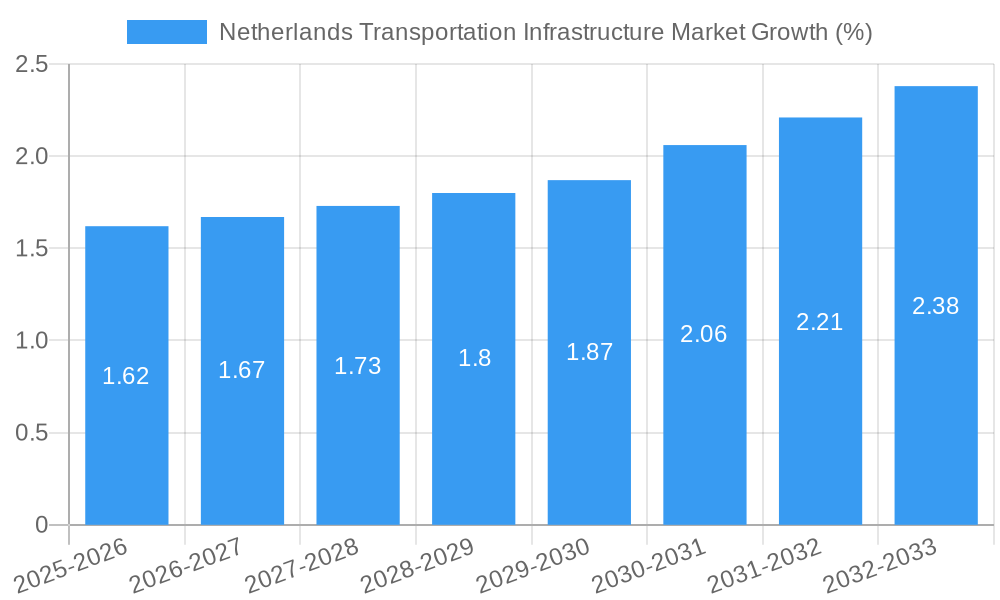

The Netherlands Transportation Infrastructure market, valued at €29.56 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.18% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the Netherlands' commitment to sustainable transportation, coupled with increasing urbanization and population density, necessitates significant investments in upgrading and expanding its road, rail, air, and waterway networks. Government initiatives focused on improving logistics efficiency and reducing congestion, including investments in smart infrastructure and technological advancements, are further driving market growth. Furthermore, the country's strategic geographic location as a major European trade hub necessitates a robust and reliable transportation infrastructure to support its thriving import/export sector. The market is segmented by mode of transportation, with roadways likely holding the largest share due to the high volume of road traffic. However, investments in rail and waterway infrastructure are expected to witness significant growth as the country focuses on environmentally friendly and efficient transportation solutions. Competitive dynamics are shaped by a mix of both large multinational contractors and local players, fostering innovation and competition within the sector.

The projected growth trajectory indicates a substantial increase in market value over the forecast period. While precise figures for each year within the forecast period require more granular data, extrapolating from the CAGR of 5.18%, the market is expected to surpass €40 million by 2030 and continue to expand significantly by 2033. Challenges include securing funding for large-scale infrastructure projects, navigating complex regulatory approvals, and mitigating environmental impact. Nevertheless, the long-term outlook for the Netherlands Transportation Infrastructure market remains positive, driven by ongoing urbanization, economic growth, and a sustained focus on enhancing the country's transport network. Key players like TNO, Royal Boskalis, and others will play crucial roles in shaping this growth through innovation and efficient project execution.

Netherlands Transportation Infrastructure Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Netherlands Transportation Infrastructure Market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and policymakers seeking to understand the market's dynamics, trends, and future potential. With a focus on key segments – Roadways, Railways, Airways, Ports, and Inland Waterways – the report delivers actionable intelligence to navigate the complexities of this crucial sector. The report utilizes data from 2019-2024 as the historical period, 2025 as the base and estimated year, and projects the market from 2025-2033. Expected market values are presented in Millions.

Netherlands Transportation Infrastructure Market Market Structure & Competitive Dynamics

The Netherlands transportation infrastructure market exhibits a moderately concentrated structure, with several large players holding significant market share. Key players include TNO, Royal Boskalis, Ballast Nedam, Royal BAM Group, VolkerWessels, AVG Infra, Dura Vermeer, BESIX, Actividades de Construccion y Servicios SA, and Heijmans. The market is characterized by a dynamic innovation ecosystem driven by government initiatives promoting sustainable infrastructure and technological advancements.

The regulatory framework, largely shaped by Rijkswaterstaat (the Dutch Ministry of Infrastructure and Water Management), plays a crucial role in shaping market access and project development. Product substitutes, such as improved logistics and digital infrastructure, exert some competitive pressure. End-user trends increasingly favor sustainable and resilient infrastructure solutions, prompting companies to adapt their offerings. M&A activity in the sector has been moderate in recent years, with deal values averaging approximately xx Million annually (2019-2024). Market share distribution amongst the leading players is as follows: Royal BAM Group (xx%), VolkerWessels (xx%), Ballast Nedam (xx%), and others (xx%).

Netherlands Transportation Infrastructure Market Industry Trends & Insights

The Netherlands transportation infrastructure market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven primarily by increasing government investments in infrastructure upgrades, particularly focusing on sustainability and digitalization. Market penetration of innovative technologies like smart traffic management systems and autonomous vehicles is steadily increasing, with a projected penetration rate of xx% by 2033. Technological disruptions, such as the adoption of hydrogen-powered construction vehicles (as demonstrated by Dura Vermeer's recent acquisition), are reshaping the industry landscape, leading to greater sustainability and efficiency.

Consumer preferences are shifting towards improved connectivity, safety, and environmental performance. This trend underscores the growing demand for resilient and sustainable infrastructure solutions. Competitive dynamics are intensifying as companies strive to differentiate themselves through innovation, technological expertise, and strong project execution capabilities. The increasing focus on public-private partnerships (PPPs) also influences market growth and the involvement of various stakeholders.

Dominant Markets & Segments in Netherlands Transportation Infrastructure Market

The Roadways segment dominates the Netherlands transportation infrastructure market, accounting for approximately xx% of the total market value in 2025. This dominance stems from the extensive road network across the country and ongoing investments in road expansion, maintenance, and modernization projects.

- Key Drivers for Roadways Dominance:

- Significant government funding allocated for road infrastructure projects.

- Expanding urban areas and increased traffic congestion requiring capacity upgrades.

- Ongoing investments in road safety improvements and smart traffic management systems.

The Railways segment holds the second-largest share, representing xx% of the market in 2025. The consistent growth is supported by planned electrification projects and high-speed rail initiatives. Ports and Inland Waterways also contributes significantly to the market due to the Netherlands’ role as a major European trading hub. Airways demonstrate steady growth but constitute a smaller share compared to the other segments.

Netherlands Transportation Infrastructure Market Product Innovations

Recent innovations in the Netherlands transportation infrastructure market include the adoption of hydrogen-powered construction vehicles, which are projected to contribute significantly to reducing carbon emissions and improving environmental sustainability in the construction sector. This adoption represents a crucial step towards achieving emission-free construction sites by 2025 as targeted by Dura Vermeer. The integration of advanced materials, such as high-performance concrete and composite materials, enhances the durability and lifespan of infrastructure assets. Digitalization and the application of Building Information Modeling (BIM) and IoT (Internet of Things) sensors improve efficiency and enhance data-driven decision-making across projects. This continuous evolution is improving the overall efficiency, sustainability and resilience of infrastructure projects.

Report Segmentation & Scope

This report segments the Netherlands transportation infrastructure market by mode of transport:

Roadways: This segment encompasses road construction, maintenance, and upgrades, including highways, arterial roads, and local roads. Growth is projected at xx% CAGR (2025-2033), driven by ongoing investments and the need for improved road connectivity.

Railways: This segment includes the development and maintenance of railway networks, signaling systems, and rolling stock. Growth is projected at xx% CAGR (2025-2033), driven by government investments and modernization efforts.

Airways: This segment includes airport infrastructure, including runways, terminals, and air traffic control systems. Growth is projected at xx% CAGR (2025-2033), influenced by air passenger traffic growth and airport expansion projects.

Ports and Inland Waterways: This segment covers port infrastructure, including docks, terminals, and inland waterways management. Growth is anticipated at xx% CAGR (2025-2033), influenced by the Netherlands' position as a major trade hub.

Key Drivers of Netherlands Transportation Infrastructure Market Growth

Several factors drive the growth of the Netherlands transportation infrastructure market. Government policies promoting sustainable infrastructure development, such as the commitment to emission reduction targets, are key contributors. Technological advancements, including the adoption of digital technologies and sustainable materials, are boosting efficiency and reducing environmental impacts. Economic growth and increased urbanization are driving the demand for improved transportation infrastructure to support economic activity and population growth.

Challenges in the Netherlands Transportation Infrastructure Market Sector

The Netherlands transportation infrastructure market faces various challenges. The high cost of infrastructure projects and securing funding can hamper development, especially for large-scale projects. Balancing environmental sustainability with economic development and logistical efficiency needs careful management of resources. The integration of new technologies requires overcoming potential compatibility issues and ensuring effective data management for optimal results.

Leading Players in the Netherlands Transportation Infrastructure Market Market

- TNO

- Royal Boskalis

- Ballast Nedam

- Royal BAM Group

- VolkerWessels

- AVG Infra

- Dura Vermeer

- BESIX

- Actividades de Construccion y Servicios SA

- Heijmans

Key Developments in Netherlands Transportation Infrastructure Market Sector

September 2022: Dura Vermeer ordered three hydrogen-powered trucks for road construction projects, aiming for "Emissions to 0." This highlights the shift towards sustainable construction practices.

March 2023: The consortium De Groene Waarden (BESIX, Mobilis, Van Gelder, Mourik Infra, and BESIX Infra Nederland) secured a contract for the A27 highway renewal and widening project. This signifies significant investment in national road infrastructure.

Strategic Netherlands Transportation Infrastructure Market Market Outlook

The Netherlands transportation infrastructure market presents significant opportunities for growth and innovation. Continued investment in sustainable infrastructure, the adoption of smart technologies, and the implementation of efficient public-private partnerships will shape the market's future. Companies focusing on sustainable solutions, technological expertise, and effective project management will be best positioned to capitalize on the opportunities presented by this dynamic market.

Netherlands Transportation Infrastructure Market Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airways

- 1.4. Ports and Inland Waterways

Netherlands Transportation Infrastructure Market Segmentation By Geography

- 1. Netherlands

Netherlands Transportation Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure.

- 3.3. Market Restrains

- 3.3.1. High cost of the construction projects; Limited space availability for new projects

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Transportation Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Transportation Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TNO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Royal Boskalis

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ballast Nedam

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal BAM Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 volkerWessels

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AVG Infra

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dura Vermeer

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BESIX

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Actividades de Construccion y Servicios SA**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Heijmans

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TNO

List of Figures

- Figure 1: Netherlands Transportation Infrastructure Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Transportation Infrastructure Market Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Transportation Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Transportation Infrastructure Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 3: Netherlands Transportation Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Netherlands Transportation Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Netherlands Transportation Infrastructure Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 6: Netherlands Transportation Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Transportation Infrastructure Market?

The projected CAGR is approximately 5.18%.

2. Which companies are prominent players in the Netherlands Transportation Infrastructure Market?

Key companies in the market include TNO, Royal Boskalis, Ballast Nedam, Royal BAM Group, volkerWessels, AVG Infra, Dura Vermeer, BESIX, Actividades de Construccion y Servicios SA**List Not Exhaustive, Heijmans.

3. What are the main segments of the Netherlands Transportation Infrastructure Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure..

6. What are the notable trends driving market growth?

Increasing Demand for Transportation Infrastructure.

7. Are there any restraints impacting market growth?

High cost of the construction projects; Limited space availability for new projects.

8. Can you provide examples of recent developments in the market?

September 2022: Dura Vermeer received order of one of the first three hydrogen trucks. The trucks will be used in various road construction projects in the Netherlands. The trucks refuel with hydrogen and can drive approximately 520 kilometers on a single fill-up. The hydrogen is converted into electricity in the vehicle by a so-called fuel cell. The emissions contain only water vapor and there is no air pollution by substances such as carbon monoxide, nitrogen oxides or particulate matter. One of Dura Vermeer's sustainability ambitions is "Emissions to 0". For this reason, electrical equipment is used on all projects, if available. For example, the company is working towards an emission-free construction site in 2025. The use of the new hydrogen truck is a great step in realizing this ambition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Transportation Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Transportation Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Transportation Infrastructure Market?

To stay informed about further developments, trends, and reports in the Netherlands Transportation Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence