Key Insights

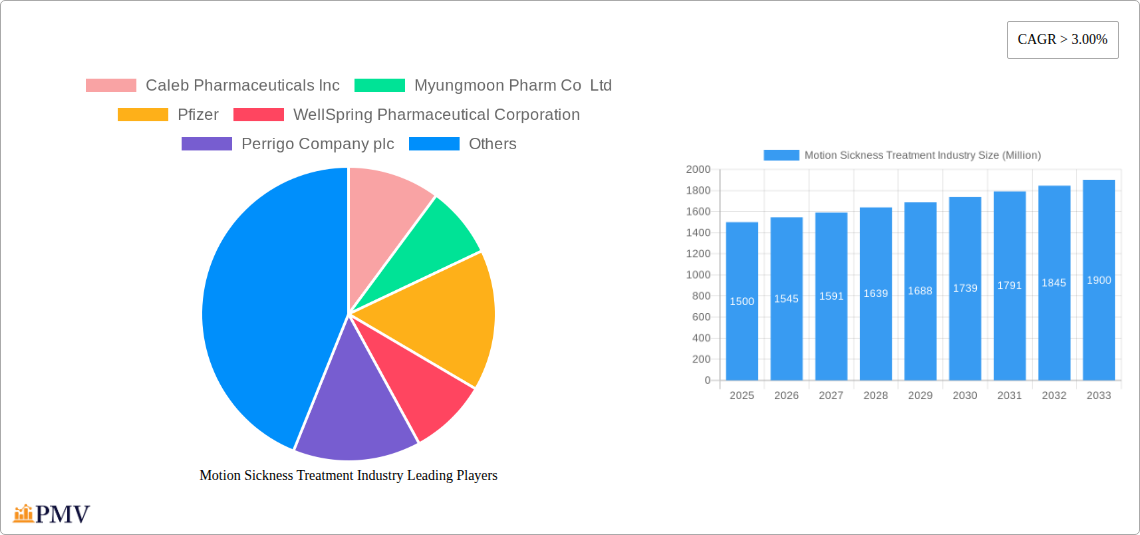

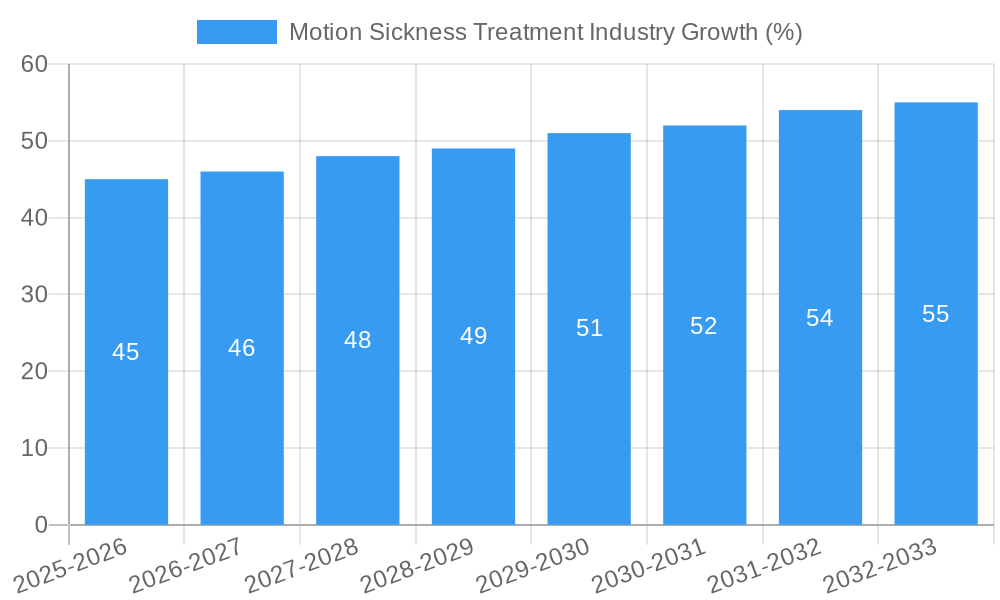

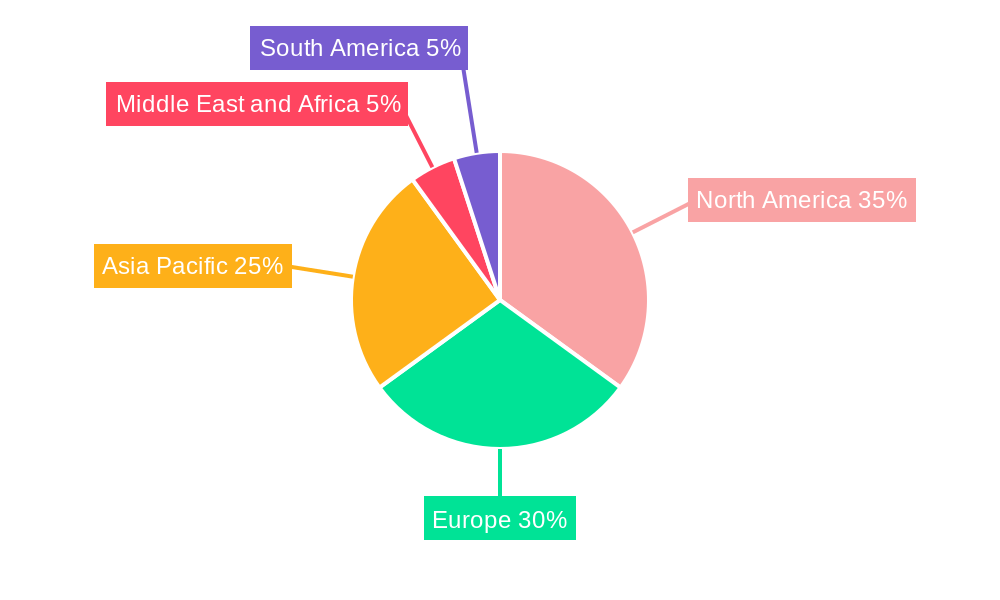

The global motion sickness treatment market is experiencing robust growth, driven by rising travel frequency, increased awareness of effective treatments, and a growing elderly population more susceptible to motion sickness. The market's Compound Annual Growth Rate (CAGR) exceeding 3.00% indicates a steady expansion, projected to continue through 2033. Key treatment segments include anticholinergics and antihistamines, with anticholinergics likely holding a larger market share due to their efficacy in preventing nausea and vomiting. Distribution channels are diverse, encompassing retail pharmacies, online platforms, and other specialized outlets. Retail pharmacies currently dominate, but the online segment is poised for significant growth fueled by increasing e-commerce adoption and convenient access to medication. Leading companies like Pfizer, Perrigo, and Lupin are major players, leveraging their established distribution networks and brand recognition to maintain market share. Regional variations exist, with North America and Europe currently holding the largest market shares due to higher healthcare spending and prevalence of motion sickness. However, the Asia-Pacific region is expected to witness significant growth in the forecast period driven by rising disposable incomes and increased tourism. Growth restraints include potential side effects associated with some medications, the availability of alternative remedies (e.g., acupressure wristbands), and varying levels of healthcare access across different regions.

The market's future hinges on several factors. Continued innovation in treatment methodologies, including the development of more targeted and effective drugs with fewer side effects, will be crucial. Expansion into emerging markets will require strategic partnerships and targeted marketing campaigns to address varying cultural factors and healthcare systems. The increasing popularity of over-the-counter (OTC) motion sickness remedies will likely influence market dynamics, potentially impacting the sales of prescription medications. Furthermore, the growing focus on personalized medicine may lead to customized treatment plans tailored to individual needs, further shaping market segmentation and growth trajectories. The successful navigation of these factors will be instrumental in determining the overall future trajectory of the motion sickness treatment market.

Motion Sickness Treatment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Motion Sickness Treatment industry, offering valuable insights for stakeholders, investors, and industry professionals. With a focus on market dynamics, competitive landscapes, and future growth projections, this report covers the period from 2019 to 2033, utilizing 2025 as the base and estimated year. The report encompasses a market size of xx Million in 2025, projecting a significant growth trajectory during the forecast period (2025-2033). Key segments analyzed include treatment types (Anticholinergics, Antihistamines, Other Treatment Types) and distribution channels (Retail Pharmacies, Online Pharmacies, Other Distribution Channels). Leading players like Pfizer, Lupin Limited, and others are profiled, showcasing their strategic initiatives and market share.

Motion Sickness Treatment Industry Market Structure & Competitive Dynamics

The Motion Sickness Treatment market exhibits a moderately concentrated structure, with a few large multinational pharmaceutical companies holding significant market share. The industry is characterized by a dynamic innovation ecosystem, driven by ongoing research and development efforts to develop more effective and safer treatments. Regulatory frameworks, particularly those governing drug approvals (e.g., FDA in the US), significantly influence market entry and product lifecycle. Product substitutes, such as over-the-counter remedies and alternative therapies, exert competitive pressure. End-user trends, including increasing awareness of motion sickness and a preference for convenient treatment options, are shaping market growth. Mergers and acquisitions (M&A) activities have played a role in market consolidation, with deal values in recent years reaching xx Million. For example, a recent M&A deal involved xx (company name) acquiring xx (company name) for xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Ecosystem: Active R&D efforts focused on novel drug formulations and delivery systems.

- Regulatory Framework: Stringent drug approval processes influence market entry and product lifecycle.

- Product Substitutes: Over-the-counter medications and alternative therapies create competitive pressure.

- End-User Trends: Increasing awareness of motion sickness and demand for convenient treatment options.

- M&A Activity: Consolidation through acquisitions, with deal values averaging xx Million in recent years.

Motion Sickness Treatment Industry Industry Trends & Insights

The Motion Sickness Treatment market is experiencing robust growth, driven by several factors. The rising prevalence of motion sickness, particularly among travelers and individuals with specific medical conditions, fuels demand for effective treatments. Technological advancements in drug delivery systems, such as transdermal patches and improved formulations, contribute to enhanced efficacy and patient compliance. Consumer preferences are shifting towards convenient, non-drowsy options, driving innovation in product development. The competitive landscape remains dynamic, with established players and emerging companies vying for market share. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, with market penetration increasing from xx% in 2025 to xx% by 2033. This growth is further fueled by increasing healthcare expenditure globally and the rising adoption of online pharmacies. However, challenges such as stringent regulations and pricing pressures persist.

Dominant Markets & Segments in Motion Sickness Treatment Industry

The North American region dominates the Motion Sickness Treatment market, driven by high healthcare expenditure, robust pharmaceutical infrastructure, and a relatively high prevalence of motion sickness. Within this region, the United States holds the largest market share. In terms of treatment types, Antihistamines currently hold the largest market segment, due to their widespread availability and relatively lower cost. However, the "Other Treatment Types" segment is expected to witness substantial growth driven by innovation in non-pharmacological approaches and the introduction of newer drugs. Online pharmacies are emerging as a significant distribution channel, driven by factors such as increased internet penetration and convenience.

- Key Drivers of Regional Dominance (North America):

- High healthcare expenditure

- Developed pharmaceutical infrastructure

- High prevalence of motion sickness

- Key Drivers of Segment Dominance (Antihistamines):

- Widespread availability

- Relatively lower cost

- Key Drivers of Segment Dominance (Online Pharmacies):

- Increased internet penetration

- Convenience and accessibility

Motion Sickness Treatment Industry Product Innovations

Recent innovations in the Motion Sickness Treatment industry focus on developing more effective and tolerable medications, with a greater emphasis on non-drowsy formulations. Transdermal patches, offering convenient and sustained drug delivery, are gaining popularity. Moreover, research into alternative therapies, such as acupressure wristbands and virtual reality-based interventions, is generating interest, presenting new treatment modalities. These developments cater to the increasing consumer demand for effective and convenient motion sickness relief, enhancing market competitiveness.

Report Segmentation & Scope

This report segments the Motion Sickness Treatment market based on treatment type (Anticholinergics, Antihistamines, Other Treatment Types) and distribution channel (Retail Pharmacies, Online Pharmacies, Other Distribution Channels). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The Anticholinergic segment is expected to grow at a xx% CAGR, while the Antihistamine segment shows a xx% CAGR. The growth of online pharmacies will significantly impact the distribution channel segment. Competitive dynamics vary across segments, with some characterized by intense competition and others by niche players.

Key Drivers of Motion Sickness Treatment Industry Growth

Several factors are driving the growth of the Motion Sickness Treatment market. Increasing prevalence of motion sickness, particularly among travelers and those with underlying medical conditions, is a primary driver. Technological advancements in drug delivery systems, such as transdermal patches, lead to better efficacy and compliance. Growing awareness of motion sickness and the availability of a wider range of treatment options are also fueling market growth. Finally, the increasing adoption of online pharmacies provides convenient access to medication.

Challenges in the Motion Sickness Treatment Industry Sector

The Motion Sickness Treatment industry faces several challenges. Stringent regulatory hurdles for drug approval and market entry pose significant barriers to new players. Supply chain disruptions can impact product availability and pricing. Furthermore, intense competition among established pharmaceutical companies and the emergence of new therapies create pricing pressures and limit profit margins. The overall impact of these challenges results in an estimated xx Million loss annually.

Leading Players in the Motion Sickness Treatment Industry Market

- Caleb Pharmaceuticals Inc (If a valid link exists, replace with actual link)

- Myungmoon Pharm Co Ltd

- Pfizer

- WellSpring Pharmaceutical Corporation

- Perrigo Company plc

- Lupin Limited

- Reliefband Technologies Inc

- Baxter International Inc

- CVS Health

- Prestige Consumer Healthcare Inc

- DM Pharma

Key Developments in Motion Sickness Treatment Industry Sector

- August 2022: The United States Food and Drug Administration approved an abbreviated new drug application (ANDA) of Lupin for its meclizine hydrochloride tablets, used to prevent and control nausea, vomiting, and dizziness caused by motion sickness and vertigo. This broadened Lupin's product portfolio and increased competition in the market.

- September 2022: Heron Therapeutics, Inc. received USFDA approval for APONVIE (aprepitant) injectable emulsion for intravenous use for the prevention of postoperative nausea and vomiting (PONV) in adults. This approval expanded treatment options for PONV, potentially impacting the broader motion sickness treatment market indirectly.

Strategic Motion Sickness Treatment Industry Market Outlook

The Motion Sickness Treatment market holds significant future potential. Continued innovation in drug formulations, coupled with the rising prevalence of motion sickness and increasing healthcare expenditure, will drive market growth. Strategic opportunities exist in developing convenient, non-drowsy treatment options and exploring alternative therapies. Expansion into emerging markets and the strategic use of digital platforms for marketing and sales will further enhance market penetration and competitiveness. The market is poised for substantial growth, with projected revenues exceeding xx Million by 2033.

Motion Sickness Treatment Industry Segmentation

-

1. Treatment Type

- 1.1. Anticholinergics

- 1.2. Antihistamines

- 1.3. Other Treatment Types

-

2. Distribution Channel

- 2.1. Retail Pharmacies

- 2.2. Online Pharmacies

- 2.3. Other Distribution Channels

Motion Sickness Treatment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Motion Sickness Treatment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Number of Travellers and Virtual Reality Exposure Across the Globe; Rise in Adoption of Prescription Motion Sickness Drugs

- 3.3. Market Restrains

- 3.3.1. Reluctance in Emerging Countries due to Higher Cost of Prescription Drugs; Excessive Reliance on the OTC and Traditional Medicines

- 3.4. Market Trends

- 3.4.1. Anticholinergic Treatment Segment is Expected to Hold the Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 5.1.1. Anticholinergics

- 5.1.2. Antihistamines

- 5.1.3. Other Treatment Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Retail Pharmacies

- 5.2.2. Online Pharmacies

- 5.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6. North America Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6.1.1. Anticholinergics

- 6.1.2. Antihistamines

- 6.1.3. Other Treatment Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Retail Pharmacies

- 6.2.2. Online Pharmacies

- 6.2.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Treatment Type

- 7. Europe Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Treatment Type

- 7.1.1. Anticholinergics

- 7.1.2. Antihistamines

- 7.1.3. Other Treatment Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Retail Pharmacies

- 7.2.2. Online Pharmacies

- 7.2.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Treatment Type

- 8. Asia Pacific Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Treatment Type

- 8.1.1. Anticholinergics

- 8.1.2. Antihistamines

- 8.1.3. Other Treatment Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Retail Pharmacies

- 8.2.2. Online Pharmacies

- 8.2.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Treatment Type

- 9. Middle East and Africa Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Treatment Type

- 9.1.1. Anticholinergics

- 9.1.2. Antihistamines

- 9.1.3. Other Treatment Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Retail Pharmacies

- 9.2.2. Online Pharmacies

- 9.2.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Treatment Type

- 10. South America Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Treatment Type

- 10.1.1. Anticholinergics

- 10.1.2. Antihistamines

- 10.1.3. Other Treatment Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Retail Pharmacies

- 10.2.2. Online Pharmacies

- 10.2.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Treatment Type

- 11. North America Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Motion Sickness Treatment Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Caleb Pharmaceuticals Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Myungmoon Pharm Co Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Pfizer

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 WellSpring Pharmaceutical Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Perrigo Company plc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Lupin Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Reliefband Technologies Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Baxter International Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 CVS Health

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Prestige Consumer Healthcare Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 DM Pharma

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Caleb Pharmaceuticals Inc

List of Figures

- Figure 1: Global Motion Sickness Treatment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Motion Sickness Treatment Industry Revenue (Million), by Treatment Type 2024 & 2032

- Figure 13: North America Motion Sickness Treatment Industry Revenue Share (%), by Treatment Type 2024 & 2032

- Figure 14: North America Motion Sickness Treatment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: North America Motion Sickness Treatment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: North America Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Motion Sickness Treatment Industry Revenue (Million), by Treatment Type 2024 & 2032

- Figure 19: Europe Motion Sickness Treatment Industry Revenue Share (%), by Treatment Type 2024 & 2032

- Figure 20: Europe Motion Sickness Treatment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe Motion Sickness Treatment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Motion Sickness Treatment Industry Revenue (Million), by Treatment Type 2024 & 2032

- Figure 25: Asia Pacific Motion Sickness Treatment Industry Revenue Share (%), by Treatment Type 2024 & 2032

- Figure 26: Asia Pacific Motion Sickness Treatment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Asia Pacific Motion Sickness Treatment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Asia Pacific Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Motion Sickness Treatment Industry Revenue (Million), by Treatment Type 2024 & 2032

- Figure 31: Middle East and Africa Motion Sickness Treatment Industry Revenue Share (%), by Treatment Type 2024 & 2032

- Figure 32: Middle East and Africa Motion Sickness Treatment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East and Africa Motion Sickness Treatment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East and Africa Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Motion Sickness Treatment Industry Revenue (Million), by Treatment Type 2024 & 2032

- Figure 37: South America Motion Sickness Treatment Industry Revenue Share (%), by Treatment Type 2024 & 2032

- Figure 38: South America Motion Sickness Treatment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: South America Motion Sickness Treatment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: South America Motion Sickness Treatment Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Motion Sickness Treatment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 3: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 32: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 38: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 39: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 47: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 56: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 57: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 62: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 63: Global Motion Sickness Treatment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Motion Sickness Treatment Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motion Sickness Treatment Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Motion Sickness Treatment Industry?

Key companies in the market include Caleb Pharmaceuticals Inc, Myungmoon Pharm Co Ltd, Pfizer, WellSpring Pharmaceutical Corporation, Perrigo Company plc, Lupin Limited, Reliefband Technologies Inc, Baxter International Inc, CVS Health, Prestige Consumer Healthcare Inc, DM Pharma.

3. What are the main segments of the Motion Sickness Treatment Industry?

The market segments include Treatment Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Number of Travellers and Virtual Reality Exposure Across the Globe; Rise in Adoption of Prescription Motion Sickness Drugs.

6. What are the notable trends driving market growth?

Anticholinergic Treatment Segment is Expected to Hold the Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Reluctance in Emerging Countries due to Higher Cost of Prescription Drugs; Excessive Reliance on the OTC and Traditional Medicines.

8. Can you provide examples of recent developments in the market?

September 2022: Heron Therapeutics, Inc. received USFDA approval for APONVIE (aprepitant) injectable emulsion for intravenous use for the prevention of postoperative nausea and vomiting (PONV) in adults.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motion Sickness Treatment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motion Sickness Treatment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motion Sickness Treatment Industry?

To stay informed about further developments, trends, and reports in the Motion Sickness Treatment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence