Key Insights

The global Mild Hybrid Vehicles (MHV) market is experiencing robust expansion, driven by increasing environmental regulations and a growing consumer preference for fuel-efficient and lower-emission transportation. The market size was USD 227.5 billion in 2024, poised for significant growth with a projected Compound Annual Growth Rate (CAGR) of 20.9% over the forecast period of 2025-2033. This surge is underpinned by advancements in hybrid technology, making mild-hybrid systems a more accessible and cost-effective alternative to full hybrids and electric vehicles for many consumers. The integration of mild-hybrid powertrains in a wider range of vehicle types, from passenger cars to commercial vehicles, further fuels this growth. The ability of MHVs to improve fuel economy and reduce CO2 emissions without the significant cost premium associated with full electrification makes them a crucial stepping stone in the automotive industry's transition towards sustainable mobility.

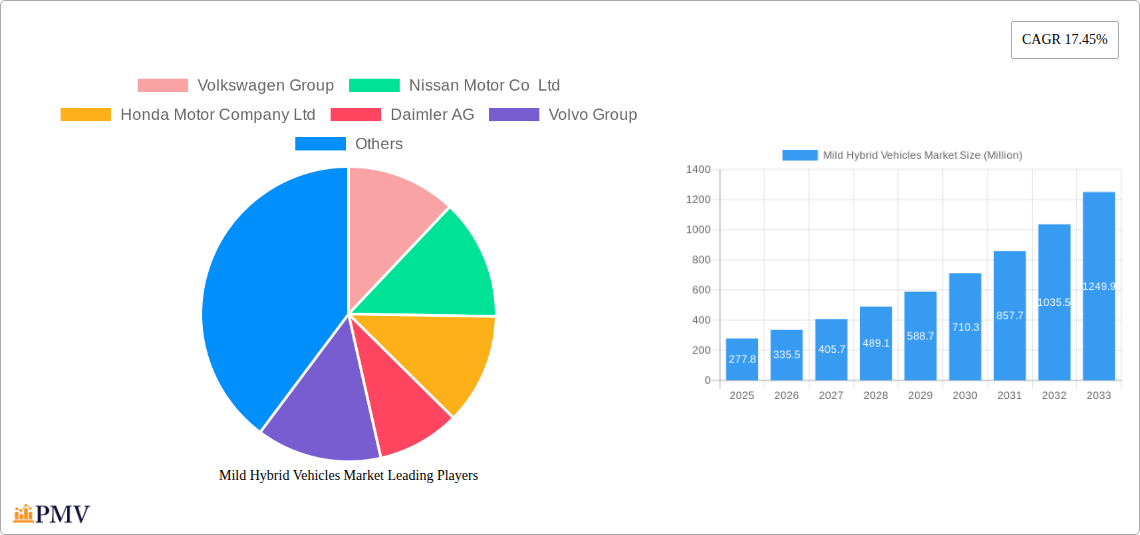

Mild Hybrid Vehicles Market Market Size (In Million)

Key market drivers include stringent emission standards enacted by governments worldwide, pushing manufacturers to adopt more efficient powertrain technologies. The increasing focus on corporate sustainability goals and the growing awareness of climate change among consumers also play a pivotal role. Furthermore, technological innovations leading to enhanced performance and reduced cost of mild-hybrid components are making these vehicles more attractive. While the market is characterized by intense competition among established automotive giants and emerging players, particularly in the Asia Pacific region, the overall outlook remains exceptionally positive. The expanding infrastructure and government incentives for greener vehicles are expected to further accelerate market penetration, making mild hybrid technology a dominant force in the automotive landscape for the foreseeable future.

Mild Hybrid Vehicles Market Company Market Share

This comprehensive report delivers an in-depth analysis of the global mild hybrid vehicles market, exploring its intricate structure, dynamic trends, and future outlook. With a focus on 48V mild hybrid technology and its integration into passenger cars and commercial vehicles, this study provides critical insights for stakeholders navigating the evolving automotive landscape. We examine market growth drivers, technological advancements, dominant regions, and leading players, offering actionable intelligence for strategic decision-making. The report covers the study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, encompassing historical data from 2019 to 2024. Anticipated market valuation for 2025 is USD 55.7 billion, with projections reaching USD 145.2 billion by 2033, exhibiting a robust CAGR of 12.7%.

Mild Hybrid Vehicles Market Market Structure & Competitive Dynamics

The mild hybrid vehicles market is characterized by a moderate to high degree of concentration, with a few dominant global automakers holding significant market share. Innovation ecosystems are thriving, driven by intense competition and a growing demand for fuel-efficient and eco-friendly vehicles. Regulatory frameworks, particularly stringent emission standards in major markets like Europe and Asia, are acting as significant catalysts for mild hybrid adoption. Product substitutes, primarily battery electric vehicles (BEVs) and conventional internal combustion engine (ICE) vehicles, present ongoing challenges and opportunities. End-user trends reveal a strong consumer preference for vehicles offering improved fuel economy without the range anxiety associated with full hybrids or BEVs. Mergers & Acquisitions (M&A) activities are prevalent as companies seek to bolster their electrification portfolios and secure technological advancements. Notable M&A deals in recent years have focused on battery technology, powertrain integration, and software development, contributing to market consolidation and fostering collaborative innovation. The market share for mild hybrids is projected to increase substantially, becoming a crucial stepping stone towards full electrification.

Mild Hybrid Vehicles Market Industry Trends & Insights

The mild hybrid vehicles market is witnessing a transformative growth trajectory, propelled by a confluence of factors including escalating environmental concerns, stringent government regulations on CO2 emissions, and a burgeoning consumer appetite for enhanced fuel efficiency and reduced running costs. The core appeal of mild hybrid technology lies in its ability to deliver tangible improvements in fuel economy and lower emissions compared to traditional internal combustion engine vehicles, all while maintaining a competitive price point and offering a familiar driving experience without the need for extensive charging infrastructure. This makes it an attractive interim solution for many consumers and a strategic product offering for automakers aiming to meet fleet-wide emission targets. Technological advancements, particularly in the realm of 48V mild hybrid systems, are further fueling this growth. Innovations such as more efficient electric motor-generators, advanced battery management systems, and seamless integration with existing powertrain architectures are enhancing performance and cost-effectiveness. The increasing adoption of electric power steering, electric superchargers, and mild hybrid powertrains for engine start-stop functions are key technological disruptions that are enhancing the capabilities and appeal of mild hybrid vehicles. Consumer preferences are increasingly shifting towards sustainable mobility solutions, with consumers actively seeking vehicles that balance environmental responsibility with practicality and affordability. The 48V mild hybrid segment, in particular, is gaining traction due to its optimal balance of cost and performance, making it a sweet spot for a broad consumer base. The competitive dynamics within the market are intense, with established automotive giants and emerging players vying for market share through continuous product development, strategic partnerships, and aggressive marketing campaigns. The market penetration of mild hybrid vehicles is projected to witness a significant surge, moving from approximately 15% in 2024 to an estimated 35% by 2033. The projected CAGR for the mild hybrid vehicles market from 2025 to 2033 stands at an impressive 12.7%. This sustained growth is indicative of the technology's strong market fit and its integral role in the global transition towards cleaner mobility.

Dominant Markets & Segments in Mild Hybrid Vehicles Market

The global mild hybrid vehicles market is experiencing robust growth across key regions, with Asia-Pacific emerging as a dominant force, driven by stringent emission norms and a rapidly expanding automotive sector. Within Asia-Pacific, China and India are pivotal markets, showcasing substantial adoption rates for mild hybrid vehicles, particularly in the passenger car segment. The increasing disposable income, growing environmental consciousness, and supportive government policies promoting cleaner transportation are key drivers behind this dominance. Europe also represents a significant market, owing to its pioneering role in implementing stringent CO2 emission regulations, which incentivize the adoption of fuel-efficient technologies like mild hybrids. North America, while historically slower in adopting hybrid technologies, is now witnessing a noticeable shift, with manufacturers increasingly incorporating mild hybrid powertrains into their popular models, especially trucks and SUVs.

Capacity Type Dominance: The 48V and Above capacity type segment is expected to witness substantial growth, outpacing the Less than 48V segment. This is due to the enhanced performance benefits, greater fuel savings, and improved driving experience offered by higher voltage mild hybrid systems, making them increasingly preferred by both consumers and manufacturers. The Less than 48V systems, while cost-effective, offer more incremental efficiency gains.

Vehicle Type Dominance: The Passenger Car segment currently dominates the mild hybrid vehicles market and is projected to maintain its leadership position throughout the forecast period. This is attributed to the widespread consumer demand for fuel-efficient and environmentally friendly personal transportation. However, the Commercial Vehicle segment is poised for significant expansion, fueled by fleet operators seeking to reduce operational costs through improved fuel economy and meet corporate sustainability goals. The integration of mild hybrid technology into light commercial vehicles, delivery vans, and even some heavy-duty applications is a growing trend.

Key drivers for dominance in these segments include:

- Economic Policies: Government incentives, tax rebates for fuel-efficient vehicles, and subsidies for hybrid technology development are crucial in shaping market preferences.

- Infrastructure Development: While charging infrastructure is more critical for BEVs, the ease of integration of mild hybrids into existing refueling networks makes them more accessible.

- Consumer Awareness: Growing awareness about climate change and the benefits of reduced emissions is influencing purchasing decisions, especially in developed and rapidly developing economies.

- Technological Advancements: Continuous improvements in mild hybrid technology, leading to better performance and affordability, are driving segment growth.

- Regulatory Push: Increasingly stringent emission standards are compelling manufacturers to offer a higher proportion of electrified vehicles, with mild hybrids serving as a crucial intermediate step.

The market share for 48V mild hybrids in the passenger car segment is projected to grow from approximately 70% in 2025 to over 80% by 2033, underscoring its strategic importance. In the commercial vehicle segment, the adoption of mild hybrid technology is expected to see a faster growth rate, albeit from a smaller base, with its market share projected to increase from around 10% in 2025 to over 25% by 2033.

Mild Hybrid Vehicles Market Product Innovations

Product innovation in the mild hybrid vehicles market is primarily focused on enhancing efficiency, performance, and cost-effectiveness. Manufacturers are developing lighter and more powerful electric motor-generators, advanced lithium-ion battery packs with improved energy density and faster charging capabilities, and sophisticated energy management systems. These innovations aim to maximize energy recovery during deceleration and optimize power delivery for improved acceleration and reduced fuel consumption. Competitive advantages are being gained through seamless integration of mild hybrid systems into existing vehicle architectures, minimizing design complexity and manufacturing costs. The development of proprietary software for precise control of the electric and internal combustion engine components is also a key area of innovation, allowing for tailored driving experiences and optimized performance across diverse driving conditions.

Report Segmentation & Scope

This report segments the Mild Hybrid Vehicles Market based on two primary criteria: Capacity Type and Vehicle Type.

Capacity Type: The market is segmented into Less than 48V and 48V and Above. The 48V and Above segment is anticipated to experience more significant growth due to its superior performance benefits and greater contribution to fuel efficiency. While the Less than 48V segment offers cost advantages, the higher voltage systems are increasingly becoming the preferred choice for automakers seeking to meet stringent emission standards and consumer expectations. Growth projections for the 48V and Above segment are estimated at a CAGR of 13.5% from 2025 to 2033, with a market size of USD 42.3 billion in 2025, expanding to USD 120.5 billion by 2033. The Less than 48V segment is projected to grow at a CAGR of 9.8%, with a market size of USD 13.4 billion in 2025, reaching USD 24.7 billion by 2033.

Vehicle Type: The market is further divided into Passenger Car and Commercial Vehicle. The Passenger Car segment is the larger of the two and is expected to continue its dominance, driven by global demand for fuel-efficient personal mobility. The Commercial Vehicle segment, encompassing light commercial vehicles, vans, and trucks, is poised for substantial growth as businesses increasingly prioritize cost savings and sustainability. Market size for Passenger Cars is estimated at USD 48.5 billion in 2025 and projected to reach USD 125.8 billion by 2033, with a CAGR of 12.7%. For Commercial Vehicles, the market size is USD 7.2 billion in 2025, growing to USD 19.4 billion by 2033, with a CAGR of 13.2%.

Key Drivers of Mild Hybrid Vehicles Market Growth

Several key factors are driving the expansion of the mild hybrid vehicles market:

- Stringent Emission Regulations: Governments worldwide are implementing increasingly stringent emissions standards (e.g., Euro 7 in Europe, CAFE standards in the US), pushing automakers to adopt more fuel-efficient technologies like mild hybrids to reduce their fleet-wide CO2 output.

- Growing Consumer Demand for Fuel Efficiency: Rising fuel prices and environmental consciousness are leading consumers to seek vehicles with better fuel economy, making mild hybrids an attractive proposition.

- Technological Advancements in 48V Systems: Continuous improvements in 48V mild hybrid technology, including more efficient motor-generators and advanced battery management, are enhancing performance and reducing costs, making them more competitive.

- Cost-Effectiveness: Mild hybrids offer a significant improvement in fuel efficiency and emissions reduction at a lower cost compared to full hybrids or battery-electric vehicles, providing a more accessible pathway to electrification for a broader consumer base.

- Government Incentives and Subsidies: Many governments offer tax credits, rebates, or other incentives for the purchase of fuel-efficient vehicles, further stimulating the adoption of mild hybrids.

Challenges in the Mild Hybrid Vehicles Market Sector

Despite the positive growth trajectory, the mild hybrid vehicles market faces several challenges:

- Competition from Battery Electric Vehicles (BEVs): As BEV technology advances and charging infrastructure expands, BEVs are becoming a more viable and attractive option for consumers, posing a direct competitive threat to mild hybrids.

- Perceived Performance Limitations: Some consumers may perceive mild hybrids as offering only marginal improvements over conventional vehicles, especially when compared to the instantaneous torque and silent operation of BEVs.

- Cost of Integration: While generally more affordable than full hybrids, the initial cost of integrating mild hybrid technology into vehicle platforms can still be a factor for some manufacturers and consumers.

- Supply Chain Volatility: The automotive industry, including the supply chain for hybrid components like batteries and electric motors, remains susceptible to disruptions, impacting production and pricing.

- Evolving Regulatory Landscape: While regulations are driving growth, sudden shifts or the acceleration of full electrification mandates could necessitate faster transitions, potentially impacting the long-term strategy for mild hybrids.

Leading Players in the Mild Hybrid Vehicles Market Market

- Volkswagen Group

- Nissan Motor Co Ltd

- Honda Motor Company Ltd

- Daimler AG

- Volvo Group

- Hyundai Motor Company

- Kia Motors Corporation

- BMW AG

- Audi AG

- Toyota Motor Corporation

- BYD Co Lt

- Mitsubishi Motors Corporation

- Suzuki Motor Corporation

- Ford Motor Company

Key Developments in Mild Hybrid Vehicles Market Sector

- May 2023: Toyota South Africa announced that the Fortuner and Hilux will be launched with mild-hybrid powertrains. The SUV duo is likely to be underpinned by the automaker's TNGA platform and could also make its way to the Indian market to make its global debut in 2024.

- May 2023: Chinese manufacturer GAC launched the Trumpchi E9 hybrid MPV. There are three trims on offer. Base Pro trim costs CNY 329,800 (USD 45,170). Mid-spec Max trim costs CNY 369,800 (USD 50,648).

Strategic Mild Hybrid Vehicles Market Market Outlook

The strategic outlook for the mild hybrid vehicles market remains robust, with the technology poised to play a pivotal role in the automotive industry's transition towards sustainable mobility. Mild hybrids are expected to bridge the gap between conventional internal combustion engine vehicles and full electrification, offering a pragmatic and cost-effective solution for achieving emission reduction targets and meeting evolving consumer demands for fuel efficiency. Strategic opportunities lie in further optimizing 48V architectures for enhanced performance and cost, expanding their application across a wider range of vehicle types including commercial fleets, and leveraging technological advancements in areas like advanced driver-assistance systems (ADAS) that can be powered by the mild hybrid system. Continued investment in research and development to improve battery technology and electric motor efficiency will be crucial for maintaining competitive advantage. Collaboration between automakers, technology providers, and governments will be instrumental in fostering wider adoption and ensuring a smooth transition towards a cleaner automotive future. The market's projected growth signifies its enduring relevance and strategic importance in the global electrification journey.

Mild Hybrid Vehicles Market Segmentation

-

1. Capacity Type

- 1.1. Less than 48V

- 1.2. 48V and Above

-

2. Vehicle Type

- 2.1. Passenger Car

- 2.2. Commercial Vehicle

Mild Hybrid Vehicles Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Mild Hybrid Vehicles Market Regional Market Share

Geographic Coverage of Mild Hybrid Vehicles Market

Mild Hybrid Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fuel Efficiency and Emissions Reduction; Government Regulations and Incentives

- 3.3. Market Restrains

- 3.3.1. Competing Alternative Technologies

- 3.4. Market Trends

- 3.4.1. 48V and Above Mild Hybrid Vehicles Continue to Capture the Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mild Hybrid Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity Type

- 5.1.1. Less than 48V

- 5.1.2. 48V and Above

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Car

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Capacity Type

- 6. North America Mild Hybrid Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity Type

- 6.1.1. Less than 48V

- 6.1.2. 48V and Above

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Car

- 6.2.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Capacity Type

- 7. Europe Mild Hybrid Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity Type

- 7.1.1. Less than 48V

- 7.1.2. 48V and Above

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Car

- 7.2.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Capacity Type

- 8. Asia Pacific Mild Hybrid Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity Type

- 8.1.1. Less than 48V

- 8.1.2. 48V and Above

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Car

- 8.2.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Capacity Type

- 9. Rest of the World Mild Hybrid Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity Type

- 9.1.1. Less than 48V

- 9.1.2. 48V and Above

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Car

- 9.2.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Capacity Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Volkswagen Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nissan Motor Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honda Motor Company Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Daimler AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Volvo Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hyundai Motor Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kia Motors Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BMW AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Audi AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Toyota Motor Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BYD Co Lt

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Mitsubishi Motors Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Suzuki Motor Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Ford Motor Company

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Volkswagen Group

List of Figures

- Figure 1: Global Mild Hybrid Vehicles Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Mild Hybrid Vehicles Market Revenue (undefined), by Capacity Type 2025 & 2033

- Figure 3: North America Mild Hybrid Vehicles Market Revenue Share (%), by Capacity Type 2025 & 2033

- Figure 4: North America Mild Hybrid Vehicles Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 5: North America Mild Hybrid Vehicles Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Mild Hybrid Vehicles Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Mild Hybrid Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Mild Hybrid Vehicles Market Revenue (undefined), by Capacity Type 2025 & 2033

- Figure 9: Europe Mild Hybrid Vehicles Market Revenue Share (%), by Capacity Type 2025 & 2033

- Figure 10: Europe Mild Hybrid Vehicles Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 11: Europe Mild Hybrid Vehicles Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Mild Hybrid Vehicles Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Mild Hybrid Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Mild Hybrid Vehicles Market Revenue (undefined), by Capacity Type 2025 & 2033

- Figure 15: Asia Pacific Mild Hybrid Vehicles Market Revenue Share (%), by Capacity Type 2025 & 2033

- Figure 16: Asia Pacific Mild Hybrid Vehicles Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Mild Hybrid Vehicles Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Mild Hybrid Vehicles Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Mild Hybrid Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Mild Hybrid Vehicles Market Revenue (undefined), by Capacity Type 2025 & 2033

- Figure 21: Rest of the World Mild Hybrid Vehicles Market Revenue Share (%), by Capacity Type 2025 & 2033

- Figure 22: Rest of the World Mild Hybrid Vehicles Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 23: Rest of the World Mild Hybrid Vehicles Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Rest of the World Mild Hybrid Vehicles Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Mild Hybrid Vehicles Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Capacity Type 2020 & 2033

- Table 2: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Capacity Type 2020 & 2033

- Table 5: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: US Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Capacity Type 2020 & 2033

- Table 11: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: UK Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Capacity Type 2020 & 2033

- Table 18: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: China Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: India Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Capacity Type 2020 & 2033

- Table 25: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Mild Hybrid Vehicles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: Brazil Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: South Africa Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Other Countries Mild Hybrid Vehicles Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mild Hybrid Vehicles Market?

The projected CAGR is approximately 21.5%.

2. Which companies are prominent players in the Mild Hybrid Vehicles Market?

Key companies in the market include Volkswagen Group, Nissan Motor Co Ltd, Honda Motor Company Ltd, Daimler AG, Volvo Group, Hyundai Motor Company, Kia Motors Corporation, BMW AG, Audi AG, Toyota Motor Corporation, BYD Co Lt, Mitsubishi Motors Corporation, Suzuki Motor Corporation, Ford Motor Company.

3. What are the main segments of the Mild Hybrid Vehicles Market?

The market segments include Capacity Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Fuel Efficiency and Emissions Reduction; Government Regulations and Incentives.

6. What are the notable trends driving market growth?

48V and Above Mild Hybrid Vehicles Continue to Capture the Major Market Share.

7. Are there any restraints impacting market growth?

Competing Alternative Technologies.

8. Can you provide examples of recent developments in the market?

May 2023: Toyota South Africa announced that the Fortuner and Hilux will be launched with mild-hybrid powertrains. The SUV duo is likely to be underpinned by the automaker's TNGA platform and could also make its way to the Indian market to make its global debut in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mild Hybrid Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mild Hybrid Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mild Hybrid Vehicles Market?

To stay informed about further developments, trends, and reports in the Mild Hybrid Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence