Key Insights

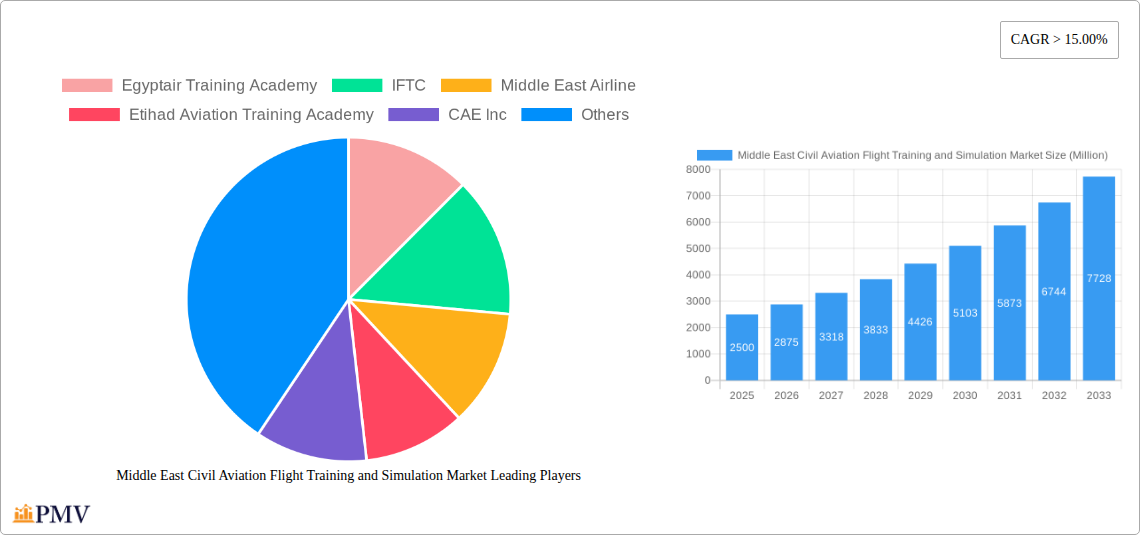

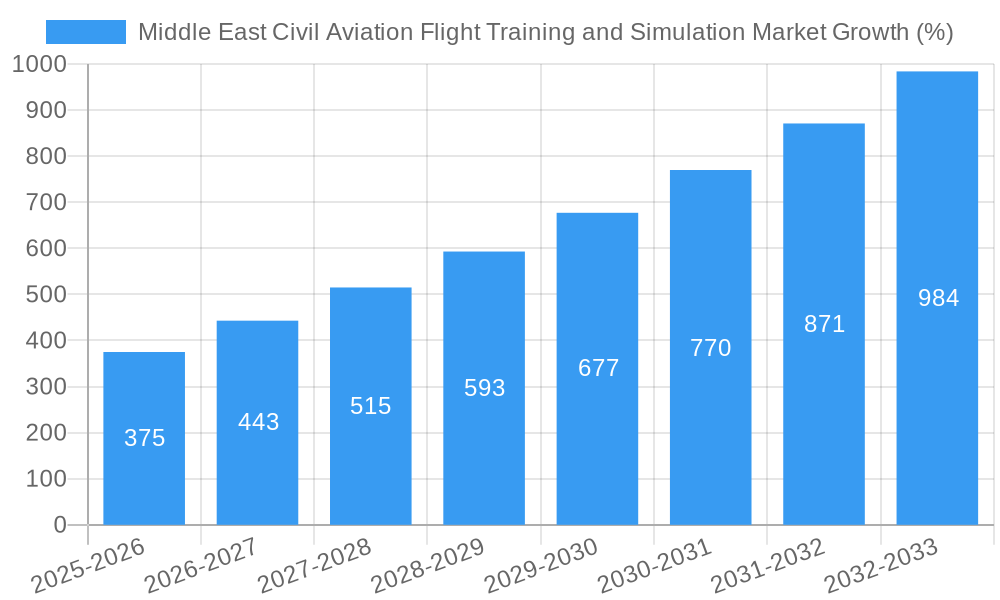

The Middle East Civil Aviation Flight Training and Simulation Market is experiencing robust growth, driven by the region's expanding aviation sector and increasing demand for skilled pilots and aviation professionals. The market's Compound Annual Growth Rate (CAGR) exceeding 15% from 2019-2033 indicates significant expansion potential. Key drivers include substantial investments in new airlines and airport infrastructure across the Middle East, particularly in countries like the UAE, Saudi Arabia, and Qatar. The burgeoning tourism industry and the rise of low-cost carriers are further fueling demand for flight training and simulation services. Growth is segmented across flight schools/ground schools and simulation training, with simulation training anticipated to show faster growth due to its cost-effectiveness and advanced technological capabilities. Established players like Egyptair Training Academy, Emirates Flight Training Academy, and CAE Inc. are well-positioned to benefit from this growth, while the rise of new training centers suggests increased competition. However, market restraints may include the high initial investment costs associated with advanced simulators and training infrastructure, as well as potential economic fluctuations impacting investment in the aviation sector.

The market's strong performance is projected to continue throughout the forecast period (2025-2033), with continued expansion in both flight school and simulation training segments. The significant regional presence of major airlines and their associated training academies will remain a crucial factor in market growth. The strategic location of many Middle Eastern nations as vital transit points for international travel further bolsters this market, necessitating a larger pool of trained aviation professionals. While potential economic slowdowns or geopolitical instability could impact growth, the long-term outlook remains positive given the continued expansion of the aviation industry in the Middle East. Technological advancements in simulation technology are also likely to further stimulate market expansion.

Middle East Civil Aviation Flight Training and Simulation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East Civil Aviation Flight Training and Simulation Market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The market is segmented by training type: Flight School/Ground School and Simulation Training. Key players include Egyptair Training Academy, IFTC, Middle East Airline, Etihad Aviation Training Academy, CAE Inc, Oman Air, Emirates Flight Training Academy, Qatar Airways Group, Jordan Airline Training and Simulation, Gulf Aviation Academy, Prince Sultan Aviation Academy, and Turkish Airlines Flight Training. The report projects a market value of xx Million by 2033, exhibiting a significant CAGR.

Middle East Civil Aviation Flight Training and Simulation Market Structure & Competitive Dynamics

The Middle East Civil Aviation Flight Training and Simulation Market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The market exhibits a dynamic interplay of established players like CAE Inc and emerging regional training academies. Innovation ecosystems are developing, driven by advancements in simulation technologies and the increasing adoption of digital learning platforms. Regulatory frameworks, primarily overseen by national civil aviation authorities, play a crucial role in shaping market access and operational standards. Substitute products, such as online learning modules, are present but do not fully replace the hands-on training and simulation experience. End-user trends show a growing preference for advanced simulation technologies that provide realistic training environments. M&A activities have been relatively infrequent in recent years, with deal values typically ranging from xx Million to xx Million. Key market share metrics (2024 estimates): CAE Inc (18%), Emirates Flight Training Academy (15%), Qatar Airways Group (12%), other players (55%).

Middle East Civil Aviation Flight Training and Simulation Market Industry Trends & Insights

The Middle East Civil Aviation Flight Training and Simulation Market is experiencing robust growth, fueled by factors such as the region's expanding aviation sector, increasing passenger traffic, and a growing demand for skilled pilots and aviation professionals. Technological disruptions, particularly in simulation technologies (e.g., VR/AR integration, AI-powered training systems), are transforming training methodologies and enhancing realism. Consumer preferences are shifting towards more interactive and personalized training experiences. Competitive dynamics are shaped by both established international players and regional training academies, leading to a mix of price competition and differentiation based on technology and training quality. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a strong growth trajectory with a CAGR of xx% during the forecast period (2025-2033). Market penetration of advanced simulation technologies is increasing steadily, with an estimated xx% adoption rate by 2033.

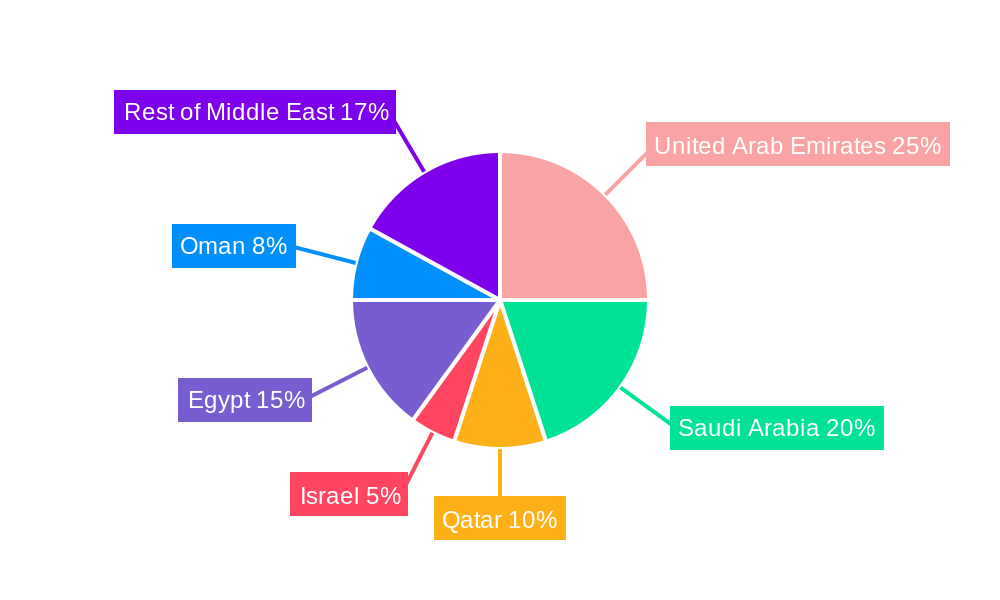

Dominant Markets & Segments in Middle East Civil Aviation Flight Training and Simulation Market

The UAE and Saudi Arabia are currently the dominant markets within the region, driven by their significant investments in aviation infrastructure, rapid growth of their national carriers, and increasing demand for skilled aviation professionals. The Simulation Training segment holds a larger market share compared to Flight School/Ground School due to the increasing demand for realistic and cost-effective training solutions.

- Key Drivers for UAE and Saudi Arabia:

- Substantial investments in airport expansion and modernization.

- Rapid growth of national airlines like Emirates and Saudi Arabian Airlines.

- Government support for the development of aviation training infrastructure.

- Focus on developing national aviation talent pools.

The dominance of these countries is expected to continue, with a projected market share of xx% and xx% respectively by 2033. This is primarily due to continued investment in aviation infrastructure and the expansion of national airlines.

Middle East Civil Aviation Flight Training and Simulation Market Product Innovations

Recent product developments have focused on integrating advanced technologies like virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) into flight simulators and ground school training programs. These innovations aim to enhance training realism, provide personalized learning experiences, and improve training efficiency. The competitive advantage lies in offering highly realistic and immersive training solutions, combined with customized training programs that cater to specific airline needs and regulatory requirements. The market is witnessing a transition towards cloud-based training platforms, allowing for greater flexibility and accessibility.

Report Segmentation & Scope

This report segments the Middle East Civil Aviation Flight Training and Simulation Market primarily by training type:

Flight School/Ground School: This segment encompasses traditional classroom instruction, flight training, and theoretical knowledge acquisition. The market size for this segment is projected to reach xx Million by 2033, with a CAGR of xx%. Competitive dynamics are characterized by both large established institutions and smaller specialized training centers.

Simulation Training: This rapidly growing segment comprises the use of flight simulators and other simulation technologies for practical training. The market is expected to reach xx Million by 2033, growing at a CAGR of xx%. The competitive landscape is characterized by the presence of both international technology providers and regional simulation centers.

Key Drivers of Middle East Civil Aviation Flight Training and Simulation Market Growth

The growth of the Middle East Civil Aviation Flight Training and Simulation Market is driven by several key factors:

- Rapid Expansion of the Aviation Sector: The region's burgeoning air travel market necessitates a large pool of skilled aviation professionals.

- Government Initiatives: Many countries in the region are actively investing in aviation infrastructure and supporting the development of skilled workforce.

- Technological Advancements: The adoption of advanced simulation technologies is enhancing training efficacy and realism.

- Increased Focus on Safety and Compliance: Stringent regulatory requirements necessitate continuous training and upskilling.

Challenges in the Middle East Civil Aviation Flight Training and Simulation Market Sector

The market faces several challenges:

- High Training Costs: The cost of advanced simulation equipment and qualified instructors presents a significant barrier for some training organizations.

- Shortage of Qualified Instructors: A lack of qualified instructors capable of operating and maintaining advanced simulation equipment poses a limitation.

- Regulatory Compliance: Meeting evolving regulatory standards adds complexity and cost to training programs.

Leading Players in the Middle East Civil Aviation Flight Training and Simulation Market Market

- Egyptair Training Academy

- IFTC

- Middle East Airline

- Etihad Aviation Training Academy

- CAE Inc

- Oman Air

- Emirates Flight Training Academy

- Qatar Airways Group

- Jordan Airline Training and Simulation

- Gulf Aviation Academy

- Prince Sultan Aviation Academy

- Turkish Airlines Flight Training

Key Developments in Middle East Civil Aviation Flight Training and Simulation Market Sector

- 2022 Q4: CAE Inc. announced a new partnership with a regional airline to provide advanced simulation training.

- 2023 Q1: Emirates Flight Training Academy opened a new state-of-the-art simulation center.

- 2023 Q2: Qatar Airways Group invested in upgrading its existing simulation facilities with new technology. (Further developments will be added in the final report)

Strategic Middle East Civil Aviation Flight Training and Simulation Market Outlook

The Middle East Civil Aviation Flight Training and Simulation Market is poised for sustained growth, driven by long-term projections of increased air travel and the continuous need for skilled aviation professionals. Strategic opportunities exist for training providers who invest in advanced simulation technologies, develop innovative training programs, and adapt to evolving regulatory requirements. The market will continue to see consolidation through M&A activities, as larger players seek to expand their market share and offer a broader range of training solutions. The focus on sustainability and environmental awareness will also drive innovation in training practices.

Middle East Civil Aviation Flight Training and Simulation Market Segmentation

-

1. Training Type

- 1.1. Flight School/Ground School

-

1.2. Simulation Training

- 1.2.1. Full Flight Simulator (FFS)

- 1.2.2. Fixed Training Devices (FTD)

- 1.2.3. Other Simulator Types

-

2. Geography

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. Qatar

- 2.4. Bahrain

- 2.5. Oman

- 2.6. Kuwait

- 2.7. Rest of Middle East

Middle East Civil Aviation Flight Training and Simulation Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Qatar

- 4. Bahrain

- 5. Oman

- 6. Kuwait

- 7. Rest of Middle East

Middle East Civil Aviation Flight Training and Simulation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Simulator Training Segment held the Largest Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Training Type

- 5.1.1. Flight School/Ground School

- 5.1.2. Simulation Training

- 5.1.2.1. Full Flight Simulator (FFS)

- 5.1.2.2. Fixed Training Devices (FTD)

- 5.1.2.3. Other Simulator Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. Qatar

- 5.2.4. Bahrain

- 5.2.5. Oman

- 5.2.6. Kuwait

- 5.2.7. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Qatar

- 5.3.4. Bahrain

- 5.3.5. Oman

- 5.3.6. Kuwait

- 5.3.7. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Training Type

- 6. United Arab Emirates Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Training Type

- 6.1.1. Flight School/Ground School

- 6.1.2. Simulation Training

- 6.1.2.1. Full Flight Simulator (FFS)

- 6.1.2.2. Fixed Training Devices (FTD)

- 6.1.2.3. Other Simulator Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United Arab Emirates

- 6.2.2. Saudi Arabia

- 6.2.3. Qatar

- 6.2.4. Bahrain

- 6.2.5. Oman

- 6.2.6. Kuwait

- 6.2.7. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Training Type

- 7. Saudi Arabia Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Training Type

- 7.1.1. Flight School/Ground School

- 7.1.2. Simulation Training

- 7.1.2.1. Full Flight Simulator (FFS)

- 7.1.2.2. Fixed Training Devices (FTD)

- 7.1.2.3. Other Simulator Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United Arab Emirates

- 7.2.2. Saudi Arabia

- 7.2.3. Qatar

- 7.2.4. Bahrain

- 7.2.5. Oman

- 7.2.6. Kuwait

- 7.2.7. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Training Type

- 8. Qatar Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Training Type

- 8.1.1. Flight School/Ground School

- 8.1.2. Simulation Training

- 8.1.2.1. Full Flight Simulator (FFS)

- 8.1.2.2. Fixed Training Devices (FTD)

- 8.1.2.3. Other Simulator Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United Arab Emirates

- 8.2.2. Saudi Arabia

- 8.2.3. Qatar

- 8.2.4. Bahrain

- 8.2.5. Oman

- 8.2.6. Kuwait

- 8.2.7. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Training Type

- 9. Bahrain Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Training Type

- 9.1.1. Flight School/Ground School

- 9.1.2. Simulation Training

- 9.1.2.1. Full Flight Simulator (FFS)

- 9.1.2.2. Fixed Training Devices (FTD)

- 9.1.2.3. Other Simulator Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United Arab Emirates

- 9.2.2. Saudi Arabia

- 9.2.3. Qatar

- 9.2.4. Bahrain

- 9.2.5. Oman

- 9.2.6. Kuwait

- 9.2.7. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Training Type

- 10. Oman Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Training Type

- 10.1.1. Flight School/Ground School

- 10.1.2. Simulation Training

- 10.1.2.1. Full Flight Simulator (FFS)

- 10.1.2.2. Fixed Training Devices (FTD)

- 10.1.2.3. Other Simulator Types

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. United Arab Emirates

- 10.2.2. Saudi Arabia

- 10.2.3. Qatar

- 10.2.4. Bahrain

- 10.2.5. Oman

- 10.2.6. Kuwait

- 10.2.7. Rest of Middle East

- 10.1. Market Analysis, Insights and Forecast - by Training Type

- 11. Kuwait Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Training Type

- 11.1.1. Flight School/Ground School

- 11.1.2. Simulation Training

- 11.1.2.1. Full Flight Simulator (FFS)

- 11.1.2.2. Fixed Training Devices (FTD)

- 11.1.2.3. Other Simulator Types

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. United Arab Emirates

- 11.2.2. Saudi Arabia

- 11.2.3. Qatar

- 11.2.4. Bahrain

- 11.2.5. Oman

- 11.2.6. Kuwait

- 11.2.7. Rest of Middle East

- 11.1. Market Analysis, Insights and Forecast - by Training Type

- 12. Rest of Middle East Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Training Type

- 12.1.1. Flight School/Ground School

- 12.1.2. Simulation Training

- 12.1.2.1. Full Flight Simulator (FFS)

- 12.1.2.2. Fixed Training Devices (FTD)

- 12.1.2.3. Other Simulator Types

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. United Arab Emirates

- 12.2.2. Saudi Arabia

- 12.2.3. Qatar

- 12.2.4. Bahrain

- 12.2.5. Oman

- 12.2.6. Kuwait

- 12.2.7. Rest of Middle East

- 12.1. Market Analysis, Insights and Forecast - by Training Type

- 13. United Arab Emirates Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 14. Saudi Arabia Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 15. Qatar Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 16. Israel Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 17. Egypt Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 18. Oman Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Middle East Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Egyptair Training Academy

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 IFTC

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Middle East Airline

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Etihad Aviation Training Academy

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 CAE Inc

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Oman Air

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Emirates Flight Training Academy

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Qatar Airways Group

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Jordan Airline Training and Simulation

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Gulf Aviation Academy

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.11 Prince Sultan Aviation Academy

- 20.2.11.1. Overview

- 20.2.11.2. Products

- 20.2.11.3. SWOT Analysis

- 20.2.11.4. Recent Developments

- 20.2.11.5. Financials (Based on Availability)

- 20.2.12 Turkish Airlines Flight Training

- 20.2.12.1. Overview

- 20.2.12.2. Products

- 20.2.12.3. SWOT Analysis

- 20.2.12.4. Recent Developments

- 20.2.12.5. Financials (Based on Availability)

- 20.2.1 Egyptair Training Academy

List of Figures

- Figure 1: Middle East Civil Aviation Flight Training and Simulation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Civil Aviation Flight Training and Simulation Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2019 & 2032

- Table 3: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Arab Emirates Middle East Civil Aviation Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia Middle East Civil Aviation Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Qatar Middle East Civil Aviation Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Israel Middle East Civil Aviation Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Middle East Civil Aviation Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Oman Middle East Civil Aviation Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Middle East Middle East Civil Aviation Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2019 & 2032

- Table 14: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2019 & 2032

- Table 17: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2019 & 2032

- Table 20: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2019 & 2032

- Table 23: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2019 & 2032

- Table 26: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 27: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2019 & 2032

- Table 29: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2019 & 2032

- Table 32: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Civil Aviation Flight Training and Simulation Market?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the Middle East Civil Aviation Flight Training and Simulation Market?

Key companies in the market include Egyptair Training Academy, IFTC, Middle East Airline, Etihad Aviation Training Academy, CAE Inc, Oman Air, Emirates Flight Training Academy, Qatar Airways Group, Jordan Airline Training and Simulation, Gulf Aviation Academy, Prince Sultan Aviation Academy, Turkish Airlines Flight Training.

3. What are the main segments of the Middle East Civil Aviation Flight Training and Simulation Market?

The market segments include Training Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Simulator Training Segment held the Largest Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Civil Aviation Flight Training and Simulation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Civil Aviation Flight Training and Simulation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Civil Aviation Flight Training and Simulation Market?

To stay informed about further developments, trends, and reports in the Middle East Civil Aviation Flight Training and Simulation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence