Key Insights

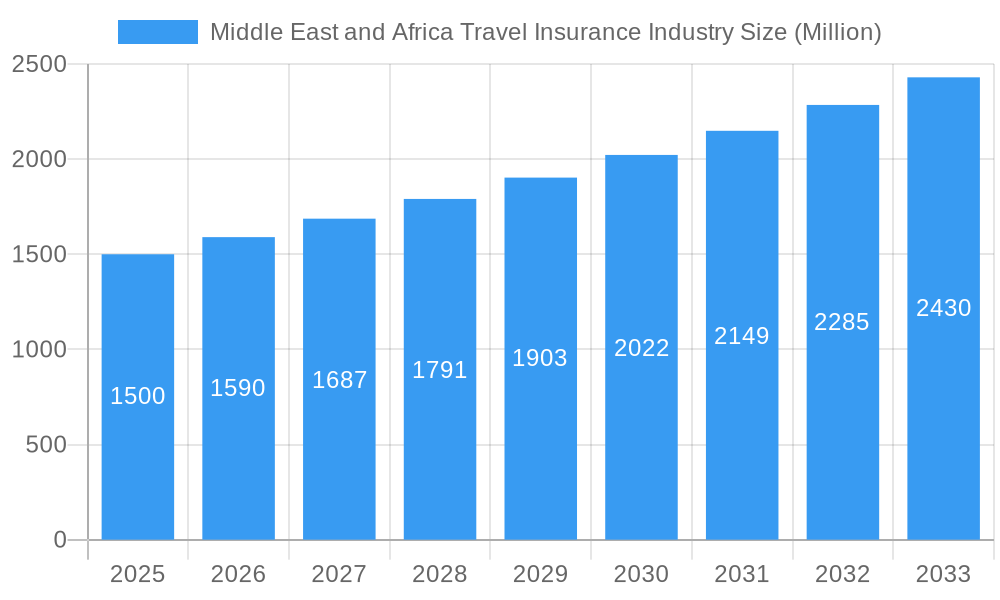

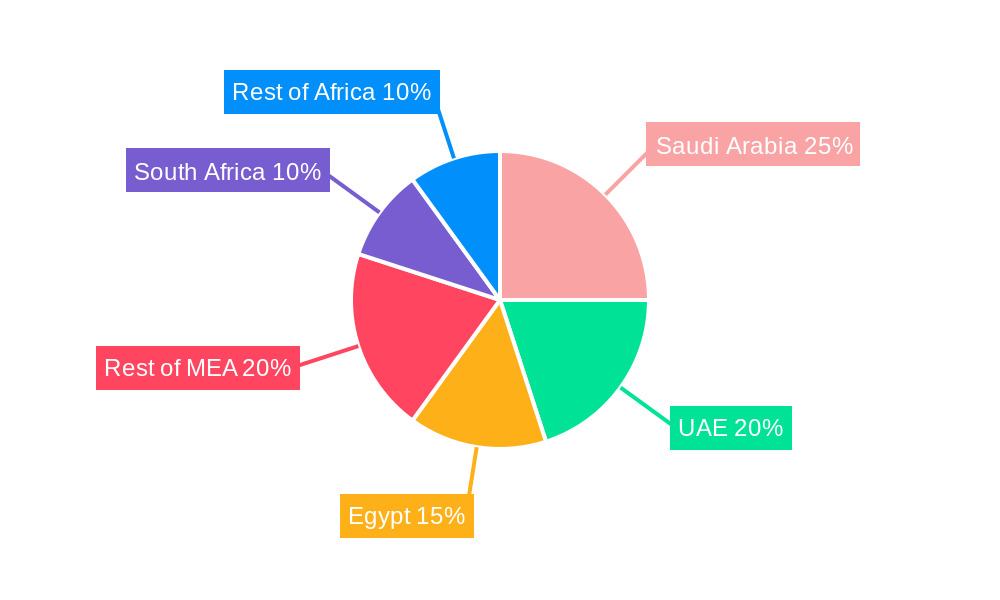

The Middle East and Africa (MEA) travel insurance market exhibits robust growth potential, driven by rising disposable incomes, increased outbound tourism, and a growing awareness of the importance of travel protection. The market's Compound Annual Growth Rate (CAGR) exceeding 6% indicates a significant expansion over the forecast period (2025-2033). Key market segments include single-trip and annual multi-trip policies, distributed through various channels such as insurance companies, intermediaries, banks, and brokers. Saudi Arabia, the UAE, and Egypt represent major contributors to the overall market size, reflecting their significant tourism sectors and comparatively higher per capita incomes. Growth is further fueled by increasing demand from diverse traveler demographics, including senior citizens, education travelers, and families, who prioritize comprehensive travel insurance coverage. While a lack of comprehensive insurance awareness in certain regions presents a restraint, government initiatives promoting tourism and financial inclusion are expected to mitigate this challenge. The competitive landscape is characterized by a mix of both international and regional players, with companies like AIG, AXA, and local insurers such as Tawuniya and Qatar Insurance Company vying for market share through innovative product offerings and expanded distribution networks. The market's expansion is projected to continue, particularly with increased digitalization and the adoption of online insurance platforms, offering convenience and wider accessibility to travel insurance products across the MEA region.

Middle East and Africa Travel Insurance Industry Market Size (In Billion)

The forecast for the MEA travel insurance market suggests a continued upward trajectory, influenced by factors such as infrastructure development supporting tourism, the rising popularity of adventure and experiential travel, and government regulations mandating or incentivizing travel insurance for certain types of trips. The segmentation by end-user offers valuable insights into specific consumer needs and preferences, enabling insurers to tailor their products and marketing strategies accordingly. Moreover, the inclusion of the African continent, particularly key markets like South Africa and Kenya, adds another dimension to the market's growth potential, acknowledging the increasing outbound travel from these regions and the opportunities for regional insurance providers. Further growth will be driven by improved digital infrastructure and enhanced financial literacy across the region, broadening the market's reach and further boosting overall market penetration.

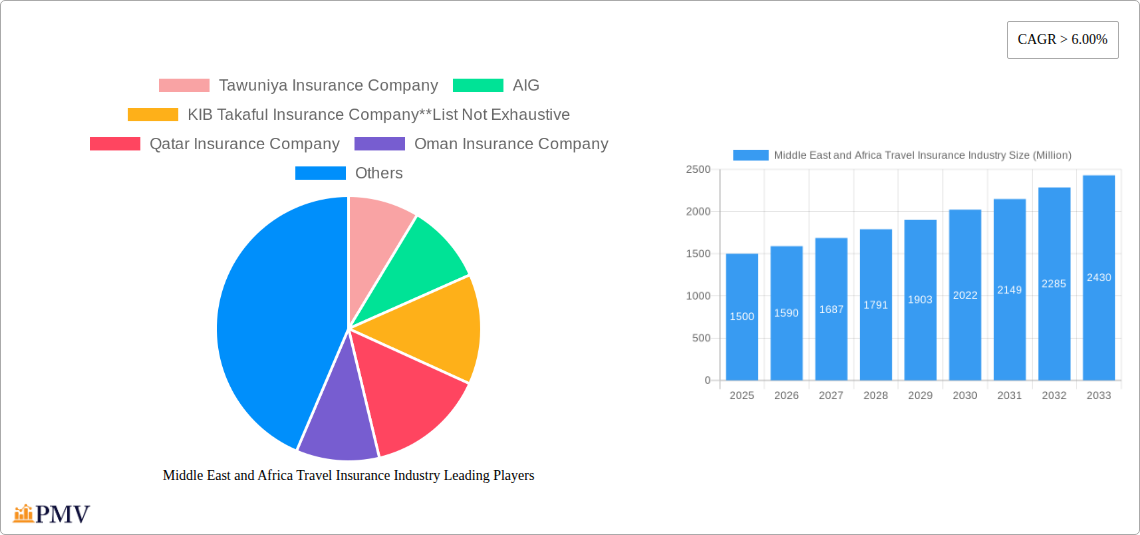

Middle East and Africa Travel Insurance Industry Company Market Share

Middle East & Africa Travel Insurance Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa travel insurance market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report delves into market structure, competitive dynamics, growth drivers, and future prospects. The report projects a market valued at xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Middle East and Africa Travel Insurance Industry Market Structure & Competitive Dynamics

The Middle East and Africa travel insurance market exhibits a moderately concentrated structure, with several major players commanding significant market share. Tawuniya Insurance Company, AIG, KIB Takaful Insurance Company, Qatar Insurance Company, Oman Insurance Company, RSA, AXA Insurance, Union Insurance, Doha Insurance Company, and Chubb are key players, though the market also includes numerous smaller, regional insurers. Market share data for 2024 indicates that the top five players collectively hold approximately xx% of the market. Innovation within the sector is driven by technological advancements, particularly in digital platforms and data analytics for risk assessment. The regulatory framework varies across countries, impacting product offerings and pricing strategies. The market is susceptible to economic fluctuations and global events, with travel restrictions significantly affecting demand. The industry has witnessed notable M&A activity; for instance, the Gulf Insurance Group's acquisition of AXA operations in 2021 valued at xx Million signifies consolidation trends.

- Market Concentration: Moderately Concentrated

- Top 5 Players Market Share (2024): xx%

- M&A Activity (2021): Gulf Insurance Group acquisition of AXA operations (xx Million)

- Innovation Focus: Digital platforms, data analytics

- Regulatory Framework: Varied across countries

Middle East and Africa Travel Insurance Industry Trends & Insights

The Middle East and Africa travel insurance market is experiencing robust growth, fueled by rising disposable incomes, increasing outbound tourism, and a growing awareness of travel-related risks. The market is undergoing digital transformation, with online platforms and mobile applications facilitating easier access to insurance products. Consumer preferences are shifting towards comprehensive coverage and value-added services, such as emergency medical evacuation and baggage loss protection. Competitive pressures are driving innovation and improved service offerings. The market penetration rate remains relatively low compared to developed economies, indicating substantial untapped potential. This presents significant opportunities for insurers to expand their reach through strategic partnerships, product diversification, and targeted marketing campaigns. The rising adoption of travel insurance among senior citizens and family travelers is also driving segment growth.

Dominant Markets & Segments in Middle East and Africa Travel Insurance Industry

- Leading Regions/Countries: The United Arab Emirates and Saudi Arabia dominate the market due to higher tourism activity and strong economic growth. Egypt and Qatar also represent significant markets.

- Dominant Insurance Type: Annual multi-trip travel insurance is gaining traction due to the increased frequency of international travel.

- Leading Distribution Channel: Insurance companies directly hold the largest market share, while insurance intermediaries and banks also play important roles in distribution.

- Primary End-Users: Family travelers and education travelers represent fast-growing segments.

Key Drivers:

- Economic Growth: Rising disposable incomes in several MEA countries.

- Tourism Growth: Increased outbound travel by residents.

- Government Initiatives: Supportive regulatory frameworks and tourism promotion strategies.

- Technological Advancements: Digital platforms enhancing accessibility and efficiency.

Middle East and Africa Travel Insurance Industry Product Innovations

Recent innovations include the integration of technology to improve customer experience through digital platforms and mobile apps. This also allows for improved risk assessment and personalized product offerings. The market is witnessing a trend towards incorporating value-added services like concierge services and emergency assistance, enhancing the overall customer experience. The launch of specialized insurance products caters to niche markets, such as camel transport insurance in Saudi Arabia, demonstrating market adaptation and responsiveness to emerging needs.

Report Segmentation & Scope

This report segments the Middle East and Africa travel insurance market by country (Saudi Arabia, United Arab Emirates, Egypt, Kuwait, Qatar, Rest of Middle East & Africa), insurance type (Single-Trip, Annual Multi-Trip), distribution channel (Insurance Companies, Insurance Intermediaries, Banks, Insurance Brokers, Others), and end-user (Senior Citizens, Education Travelers, Family Travelers, Others). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics.

Key Drivers of Middle East and Africa Travel Insurance Industry Growth

The market is primarily propelled by rising disposable incomes, increased outbound tourism, government initiatives to boost the tourism sector, and technological advancements. The development of digital platforms improves accessibility and efficiency, expanding market reach. Specific examples include the growing popularity of online travel agencies (OTAs) offering integrated travel insurance options.

Challenges in the Middle East and Africa Travel Insurance Industry Sector

The industry faces challenges such as regulatory variations across countries, limited insurance awareness among some demographics, and competition from other financial products. The economic impact of global events and regional instability can also influence demand fluctuations. Furthermore, the relatively low insurance penetration rates require focused marketing efforts to increase awareness.

Leading Players in the Middle East and Africa Travel Insurance Industry Market

- Tawuniya Insurance Company

- AIG

- KIB Takaful Insurance Company

- Qatar Insurance Company

- Oman Insurance Company

- RSA

- AXA Insurance

- Union Insurance

- Doha Insurance Company

- Chubb

Key Developments in Middle East and Africa Travel Insurance Industry Sector

- September 2021: Gulf Insurance Group completes acquisition of AXA operations in the region.

- April 2022: Saudi Arabia launches the world's first camel transport insurance.

Strategic Middle East and Africa Travel Insurance Industry Market Outlook

The Middle East and Africa travel insurance market holds significant untapped potential. Future growth will be driven by increasing tourism, technological advancements, and rising awareness of travel-related risks. Strategic opportunities exist for insurers to leverage digital technologies, expand product offerings, and capitalize on the growth of specific segments like family and education travelers. The continued expansion of the tourism sector within the region presents significant opportunities for further growth and market expansion.

Middle East and Africa Travel Insurance Industry Segmentation

-

1. Type

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-Trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Companies

- 2.2. Insurance Intermediaries

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Others

-

3. End-User

- 3.1. Senior Citizens

- 3.2. Education Travelers

- 3.3. Family Travelers

- 3.4. Others

Middle East and Africa Travel Insurance Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Travel Insurance Industry Regional Market Share

Geographic Coverage of Middle East and Africa Travel Insurance Industry

Middle East and Africa Travel Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. A Tech Savvy Demography Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Travel Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-Trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Companies

- 5.2.2. Insurance Intermediaries

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Senior Citizens

- 5.3.2. Education Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tawuniya Insurance Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AIG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KIB Takaful Insurance Company**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Qatar Insurance Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oman Insurance Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RSA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AXA Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Union Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Doha Insurance Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chubb

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tawuniya Insurance Company

List of Figures

- Figure 1: Middle East and Africa Travel Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Travel Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Travel Insurance Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Middle East and Africa Travel Insurance Industry?

Key companies in the market include Tawuniya Insurance Company, AIG, KIB Takaful Insurance Company**List Not Exhaustive, Qatar Insurance Company, Oman Insurance Company, RSA, AXA Insurance, Union Insurance, Doha Insurance Company, Chubb.

3. What are the main segments of the Middle East and Africa Travel Insurance Industry?

The market segments include Type, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

A Tech Savvy Demography Drives the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

April 2022 - Saudi Arabia has launched the world's first travel insurance to cover accidents that take place when transporting camels, Saudi Press Agency (SPA) reported. The Saudi Camel Club said it has collaborated with the Swiss Finance House to insure against road accidents and deaths that take place while camels are being picked up or dropped off. An insurance platform allows owners to subscribe to insurance for their camels remotely, and then receive an insurance policy online.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Travel Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Travel Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Travel Insurance Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Travel Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence