Key Insights

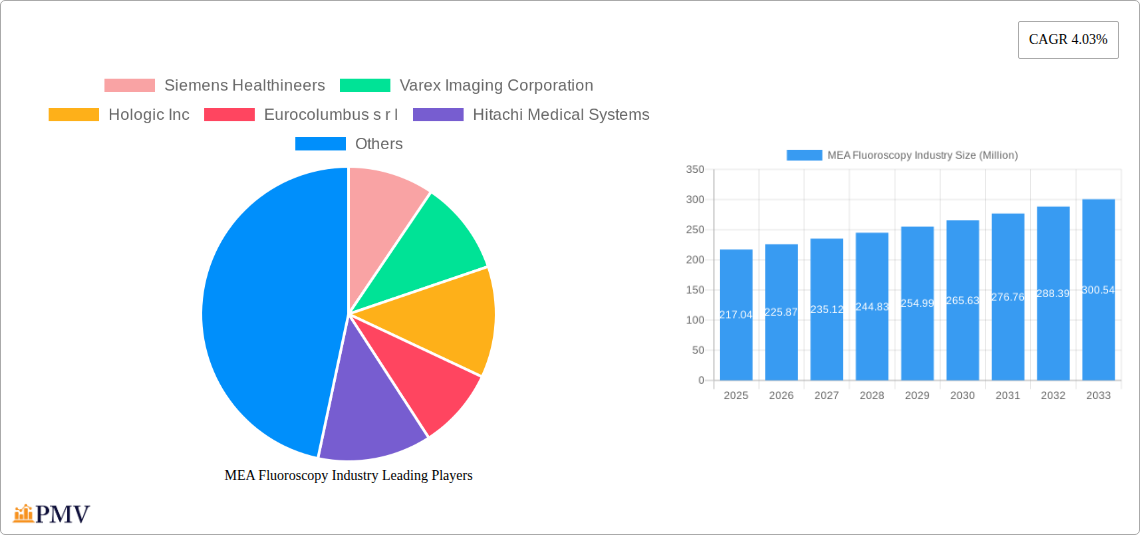

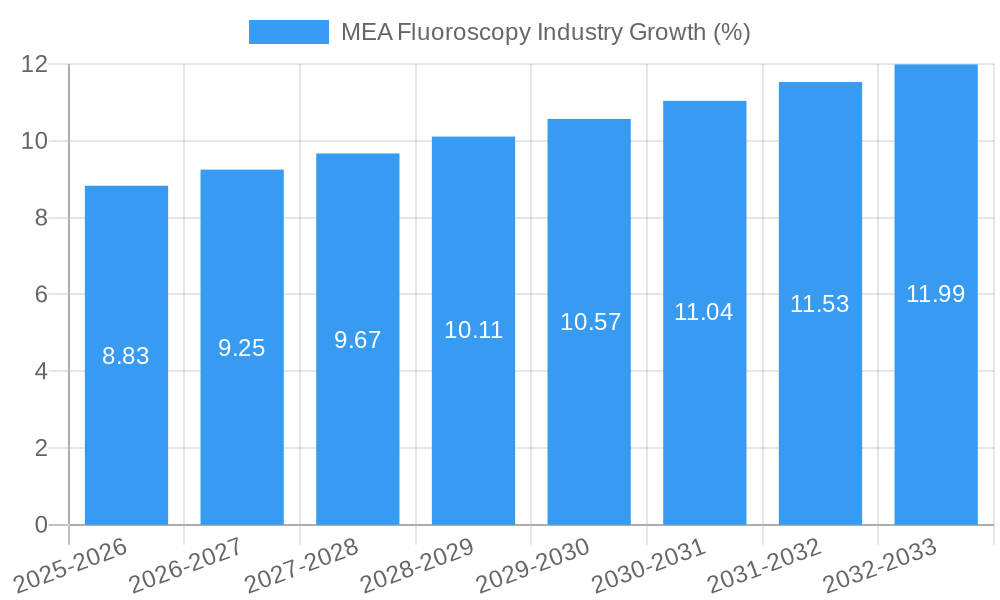

The Middle East and Africa (MEA) fluoroscopy market, valued at $217.04 million in 2025, is projected to experience steady growth, driven by a rising prevalence of chronic diseases requiring minimally invasive procedures, increasing healthcare infrastructure investments, and technological advancements in imaging technology. The market's Compound Annual Growth Rate (CAGR) of 4.03% from 2025 to 2033 indicates a consistent expansion, fueled by the adoption of advanced fluoroscopy systems offering improved image quality, reduced radiation exposure, and enhanced diagnostic capabilities. Key segments driving growth include cardiovascular and orthopedic applications, where fluoroscopy plays a crucial role in guiding minimally invasive surgeries and diagnostic procedures. The demand for mobile fluoroscopy units is also increasing, particularly in remote areas and smaller healthcare facilities, enhancing accessibility to advanced imaging services. While regulatory hurdles and high initial investment costs for advanced systems may pose some restraints, the overall market outlook remains positive, with significant growth potential across various applications and device types in the forecast period.

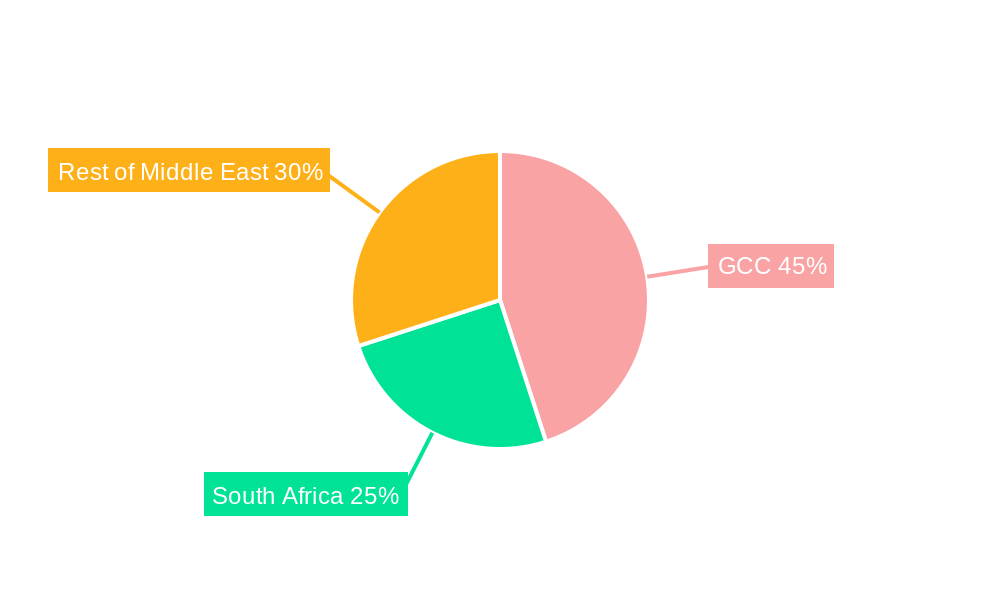

The growth trajectory is further fueled by the increasing adoption of advanced imaging techniques, such as digital fluoroscopy and cone-beam computed tomography (CBCT), which enhance image clarity and reduce patient radiation exposure. Major players like Siemens Healthineers, Varex Imaging, and GE Healthcare are actively investing in R&D and strategic partnerships to expand their market presence and offer innovative solutions. The market segmentation by device type (fixed vs. mobile) and application (orthopedic, cardiovascular, etc.) reveals specific growth opportunities in different healthcare sectors. Regional analysis indicates significant potential in the GCC and South Africa, driven by rising healthcare expenditure and government initiatives promoting healthcare infrastructure development. The consistent growth in minimally invasive procedures and improved patient outcomes across various medical specialties further solidifies the long-term growth potential of the MEA fluoroscopy market.

MEA Fluoroscopy Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa (MEA) fluoroscopy market, covering the period from 2019 to 2033. It offers in-depth insights into market size, segmentation, growth drivers, challenges, competitive landscape, and future outlook, equipping stakeholders with actionable intelligence for strategic decision-making. The report’s base year is 2025, with forecasts extending to 2033. The historical period analyzed is 2019-2024.

MEA Fluoroscopy Industry Market Structure & Competitive Dynamics

This section analyzes the MEA fluoroscopy market's competitive dynamics, focusing on market concentration, innovation, regulatory landscapes, product substitutes, end-user trends, and mergers & acquisitions (M&A). The market is characterized by a moderately consolidated structure with key players like Siemens Healthineers, Philips, and GE Healthcare holding significant market share. However, smaller, specialized players are also present, contributing to a dynamic competitive landscape.

Innovation is driven by advancements in image quality, reduced radiation dose, and integration with other imaging modalities. Regulatory frameworks, varying across MEA countries, impact market access and product approvals. The presence of alternative imaging technologies, like ultrasound and MRI, poses competitive pressure. End-user trends, particularly increasing demand for minimally invasive procedures and improved patient outcomes, significantly influence market growth. M&A activity remains moderate; however, strategic partnerships and collaborations are increasingly common. For example, a xx Million deal between [Company A] and [Company B] in [Year] demonstrates a significant consolidation effort. The overall market share distribution shows a clear concentration amongst the top players, with the top 5 holding approximately xx% of the market.

MEA Fluoroscopy Industry Industry Trends & Insights

The MEA fluoroscopy market is projected to experience substantial growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: rising prevalence of chronic diseases requiring fluoroscopy-guided procedures, increasing healthcare infrastructure development across the region, expanding medical tourism, and growing adoption of advanced imaging technologies. Technological advancements, including deep learning-based image reconstruction and AI-powered image analysis, are revolutionizing fluoroscopy, leading to improved diagnostic accuracy and efficiency. Changing consumer preferences are leaning towards less invasive procedures, driving demand for advanced fluoroscopy systems. Market penetration of advanced fluoroscopy systems is increasing steadily, with a projected penetration rate of xx% by 2033. This steady increase is mainly due to the improvement in healthcare infrastructure and the adoption of minimally invasive procedures.

Dominant Markets & Segments in MEA Fluoroscopy Industry

The MEA fluoroscopy market is diverse, with significant variations in growth patterns across different regions, countries, and application segments.

Dominant Regions/Countries: The report identifies [Country X] as the leading market within the MEA region, driven by factors such as [list bullet points of key drivers for example, robust healthcare infrastructure, government initiatives, high disease prevalence]. [Country Y] and [Country Z] are also significant markets showing strong growth potential.

Dominant Segments:

- Device Type: Mobile fluoroscopy systems are witnessing faster growth compared to fixed systems due to their enhanced portability and suitability for diverse settings. However, fixed fluoroscopy systems still maintain a higher market share due to their advanced capabilities.

- Application: Cardiovascular applications hold the largest market share, driven by the increasing prevalence of cardiovascular diseases. Orthopedic applications also demonstrate substantial growth potential due to the rising incidence of musculoskeletal disorders. Other applications, such as pain management and trauma, neurology, gastrointestinal, urology, and general surgery, contribute significantly to market growth, each influenced by unique trends and developments.

MEA Fluoroscopy Industry Product Innovations

Recent product innovations in the MEA fluoroscopy market are largely centered on enhancing image quality, reducing radiation exposure, and improving workflow efficiency. Manufacturers are incorporating advanced technologies such as flat-panel detectors, digital image processing, and AI-powered image analysis to offer improved diagnostic accuracy and faster turnaround times. These technological advancements are also improving the patient experience by reducing procedure times and radiation exposure. This focus on technological improvement leads to a more competitive environment, where manufacturers are pushing the bounds of image quality and efficiency, ultimately benefiting the end user.

Report Segmentation & Scope

This report segments the MEA fluoroscopy market based on device type (Fixed Fluoroscopes, Mobile Fluoroscopes) and application (Orthopedic, Cardiovascular, Pain Management and Trauma, Neurology, Gastrointestinal, Urology, General Surgery, Other Applications). Each segment's growth projections, market size, and competitive dynamics are analyzed. The growth projections for each segment are influenced by various factors such as technological advancements, prevalence of specific diseases, and healthcare infrastructure development in the respective regions. The competitive dynamics within each segment vary depending on the number of players, market share distribution, and technological capabilities.

Key Drivers of MEA Fluoroscopy Industry Growth

Several factors are driving the growth of the MEA fluoroscopy market. These include:

- Rising prevalence of chronic diseases: The increasing incidence of cardiovascular diseases, musculoskeletal disorders, and other conditions requiring fluoroscopy-guided procedures is a major driver of market growth.

- Government initiatives: Governments in several MEA countries are investing heavily in healthcare infrastructure development, expanding access to advanced imaging technologies.

- Technological advancements: Innovations in image quality, radiation reduction, and workflow efficiency are enhancing the appeal of fluoroscopy systems.

Challenges in the MEA Fluoroscopy Industry Sector

The MEA fluoroscopy market faces several challenges:

- High cost of equipment: The relatively high cost of advanced fluoroscopy systems can limit their accessibility, particularly in resource-constrained settings.

- Regulatory hurdles: Navigating the varying regulatory landscapes across different MEA countries can pose significant challenges for manufacturers and healthcare providers.

- Limited skilled personnel: A shortage of trained professionals skilled in operating and maintaining fluoroscopy equipment may hinder market growth. This shortage impacts the effective utilization of the systems and leads to potential delays in patient care.

Leading Players in the MEA Fluoroscopy Industry Market

- Siemens Healthineers

- Varex Imaging Corporation

- Hologic Inc

- Eurocolumbus s r l

- Hitachi Medical Systems

- Ziehm Imaging GmbH

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- GE Healthcare (GE Company)

- Shimadzu Corporation

Key Developments in MEA Fluoroscopy Industry Sector

- April 2022: Dubai London Hospital opens, incorporating advanced deep-learning reconstruction technology in its radiology department. This highlights the adoption of cutting-edge technologies in the region.

- February 2022: Almoosa Specialist Hospital partners with Siemens Healthineers for a significant multi-modality deal, signifying investment in advanced diagnostic imaging capabilities and further strengthening Siemens' market presence.

Strategic MEA Fluoroscopy Industry Market Outlook

The MEA fluoroscopy market holds substantial growth potential driven by factors such as rising healthcare expenditure, increasing prevalence of chronic diseases, and ongoing technological advancements. Strategic opportunities exist for manufacturers to focus on developing cost-effective, portable fluoroscopy systems tailored to the specific needs of the MEA region. Furthermore, collaborations with healthcare providers to develop innovative service models and training programs will be crucial for successful market penetration and sustainable growth.

MEA Fluoroscopy Industry Segmentation

-

1. Device Type

- 1.1. Fixed Fluoroscopes

- 1.2. Mobile Fluoroscopes

-

2. Application

- 2.1. Orthopedic

- 2.2. Cardiovascular

- 2.3. Pain Management and Trauma

- 2.4. Neurology

- 2.5. Gastrointestinal

- 2.6. Urology

- 2.7. General Surgery

- 2.8. Other Applications

-

3. Geography

-

3.1. Middle-East & Africa

- 3.1.1. GCC

- 3.1.2. South Africa

- 3.1.3. Rest of Middle-East & Africa

-

3.1. Middle-East & Africa

MEA Fluoroscopy Industry Segmentation By Geography

- 1. Middle East

-

2. GCC

- 2.1. South Africa

- 2.2. Rest of Middle East

MEA Fluoroscopy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Minimally-invasive Surgeries; Growing Geriatric Population and Prevalence of Chronic Diseases; Advantages Associated With Fluoroscopy

- 3.3. Market Restrains

- 3.3.1. Side Effects due to Radiation Exposure; Rising Adoption of Refurbished Systems

- 3.4. Market Trends

- 3.4.1. Cardiovascular Segment is Expected to Hold Significant Market Share over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Fixed Fluoroscopes

- 5.1.2. Mobile Fluoroscopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Orthopedic

- 5.2.2. Cardiovascular

- 5.2.3. Pain Management and Trauma

- 5.2.4. Neurology

- 5.2.5. Gastrointestinal

- 5.2.6. Urology

- 5.2.7. General Surgery

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle-East & Africa

- 5.3.1.1. GCC

- 5.3.1.2. South Africa

- 5.3.1.3. Rest of Middle-East & Africa

- 5.3.1. Middle-East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.4.2. GCC

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Middle East MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Fixed Fluoroscopes

- 6.1.2. Mobile Fluoroscopes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Orthopedic

- 6.2.2. Cardiovascular

- 6.2.3. Pain Management and Trauma

- 6.2.4. Neurology

- 6.2.5. Gastrointestinal

- 6.2.6. Urology

- 6.2.7. General Surgery

- 6.2.8. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Middle-East & Africa

- 6.3.1.1. GCC

- 6.3.1.2. South Africa

- 6.3.1.3. Rest of Middle-East & Africa

- 6.3.1. Middle-East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. GCC MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Fixed Fluoroscopes

- 7.1.2. Mobile Fluoroscopes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Orthopedic

- 7.2.2. Cardiovascular

- 7.2.3. Pain Management and Trauma

- 7.2.4. Neurology

- 7.2.5. Gastrointestinal

- 7.2.6. Urology

- 7.2.7. General Surgery

- 7.2.8. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Middle-East & Africa

- 7.3.1.1. GCC

- 7.3.1.2. South Africa

- 7.3.1.3. Rest of Middle-East & Africa

- 7.3.1. Middle-East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Middle East MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. GCC MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 South Africa

- 9.1.2 Rest of Middle East

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Siemens Healthineers

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Varex Imaging Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hologic Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Eurocolumbus s r l

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hitachi Medical Systems

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ziehm Imaging GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Koninklijke Philips NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Canon Medical Systems Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GE Healthcare (GE Company)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Shimadzu Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Siemens Healthineers

List of Figures

- Figure 1: MEA Fluoroscopy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: MEA Fluoroscopy Industry Share (%) by Company 2024

List of Tables

- Table 1: MEA Fluoroscopy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: MEA Fluoroscopy Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 3: MEA Fluoroscopy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: MEA Fluoroscopy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: MEA Fluoroscopy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: MEA Fluoroscopy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: MEA Fluoroscopy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Middle East MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: MEA Fluoroscopy Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 12: MEA Fluoroscopy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 13: MEA Fluoroscopy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: MEA Fluoroscopy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: MEA Fluoroscopy Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 16: MEA Fluoroscopy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: MEA Fluoroscopy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: MEA Fluoroscopy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: South Africa MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Middle East MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Fluoroscopy Industry?

The projected CAGR is approximately 4.03%.

2. Which companies are prominent players in the MEA Fluoroscopy Industry?

Key companies in the market include Siemens Healthineers, Varex Imaging Corporation, Hologic Inc, Eurocolumbus s r l, Hitachi Medical Systems, Ziehm Imaging GmbH, Koninklijke Philips NV, Canon Medical Systems Corporation, GE Healthcare (GE Company), Shimadzu Corporation.

3. What are the main segments of the MEA Fluoroscopy Industry?

The market segments include Device Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 217.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Minimally-invasive Surgeries; Growing Geriatric Population and Prevalence of Chronic Diseases; Advantages Associated With Fluoroscopy.

6. What are the notable trends driving market growth?

Cardiovascular Segment is Expected to Hold Significant Market Share over the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects due to Radiation Exposure; Rising Adoption of Refurbished Systems.

8. Can you provide examples of recent developments in the market?

In April 2022, Dubai London Hospital opened its doors to patients at Jumeirah Beach Road. The hospital is a part of the established Dubai London Clinic and Speciality Hospital and has a radiology department using advanced deep-learning reconstruction technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Fluoroscopy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Fluoroscopy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Fluoroscopy Industry?

To stay informed about further developments, trends, and reports in the MEA Fluoroscopy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence