Key Insights

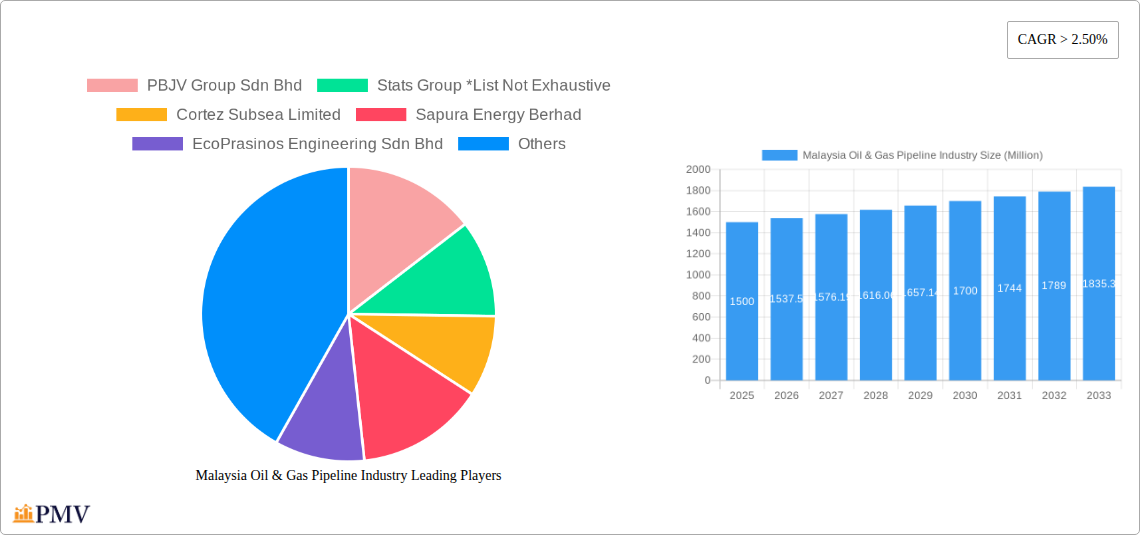

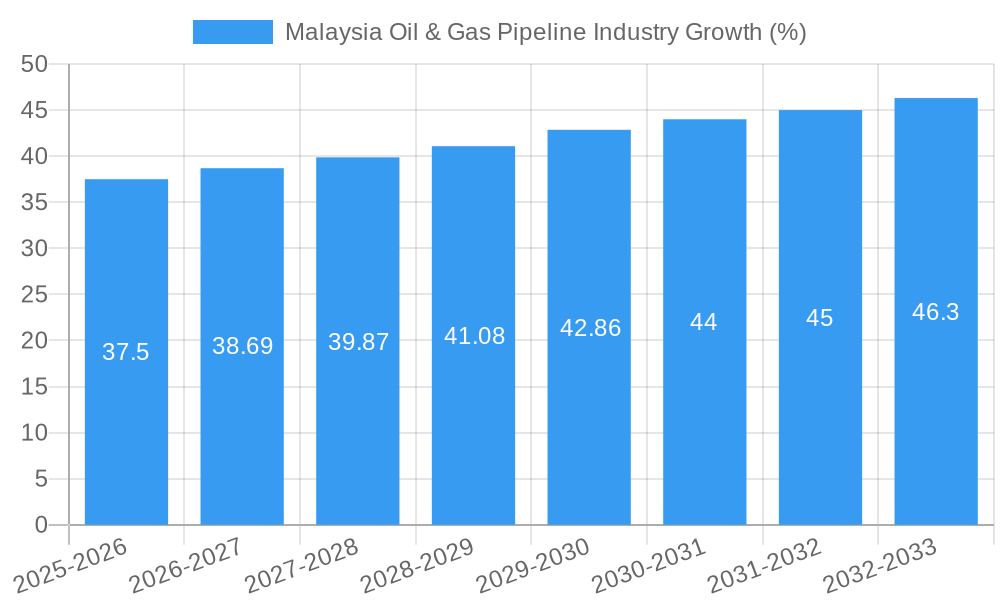

The Malaysian oil and gas pipeline industry, valued at approximately $X million in 2025 (estimated based on provided CAGR and market trends), is projected to experience robust growth, exceeding a 2.50% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Malaysia's ongoing energy demand necessitates efficient and reliable pipeline infrastructure for transporting crude oil and natural gas across onshore and offshore locations. Secondly, government initiatives promoting energy security and infrastructure development are actively supporting the industry's growth. Furthermore, rising investments in upstream oil and gas exploration and production activities contribute to increased pipeline capacity requirements. The market segmentation reveals significant activity in both onshore and offshore deployment, with both crude oil and gas pipelines playing crucial roles. Key players like Petronas, Sapura Energy, and international contractors are driving this expansion, leveraging their expertise in engineering, procurement, and construction (EPC) to meet the demands of this growing sector.

However, the industry also faces certain restraints. Fluctuations in global oil and gas prices can impact investment decisions, while environmental regulations and concerns related to pipeline safety and environmental impact represent challenges to be addressed. Technological advancements, particularly in pipeline monitoring and maintenance, are creating new opportunities and driving efficiency improvements within the sector. This includes the adoption of advanced materials, automation, and data analytics, ultimately impacting both operational costs and environmental performance. The future growth trajectory of the Malaysian oil and gas pipeline industry hinges on effective management of these challenges and continued investment in infrastructure modernization. A strategic approach incorporating sustainable practices and technological innovation will be essential to ensure the sector's long-term viability and contribution to Malaysia's energy landscape. We project a market size significantly exceeding the initial estimate by 2033, driven by these factors and potential new energy infrastructure projects.

Malaysia Oil & Gas Pipeline Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Malaysian oil and gas pipeline industry, covering market structure, competitive dynamics, key trends, and future growth prospects from 2019 to 2033. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is crucial for businesses, investors, and stakeholders seeking to understand and navigate this dynamic sector. Millions are used for all values throughout this report.

Malaysia Oil & Gas Pipeline Industry Market Structure & Competitive Dynamics

The Malaysian oil and gas pipeline industry exhibits a moderately concentrated market structure, with several major players alongside numerous smaller companies. Market share is largely held by Petronas, with other significant players contributing to the overall competition. The industry is characterized by a complex interplay of factors, including regulatory frameworks, technological innovation, and the presence of substitute products such as LNG transportation. End-user trends, largely driven by domestic energy demand and export opportunities, play a significant role in shaping the market landscape.

Recent M&A activity has been moderate, with deal values fluctuating yearly. For instance, in 2022, the total value of M&A transactions within the sector reached approximately xx Million, while xx Million was recorded in 2021. These activities indicate a dynamic competitive environment with companies seeking to enhance their capabilities and market position. Innovation ecosystems are fostering the development of advanced pipeline technologies, such as smart pipelines and improved leak detection systems.

- Market Concentration: Moderately concentrated, with Petronas holding a significant share.

- Innovation Ecosystems: Focus on smart pipeline technologies and leak detection.

- Regulatory Framework: Significant impact on investment decisions and operational practices.

- Product Substitutes: LNG transportation presents a competitive alternative for gas delivery.

- End-User Trends: Domestic energy consumption and export opportunities drive demand.

- M&A Activity: Moderate activity, with deal values varying yearly, ranging from xx Million to xx Million in recent years.

Malaysia Oil & Gas Pipeline Industry Industry Trends & Insights

The Malaysian oil and gas pipeline industry is experiencing notable growth, driven primarily by increasing domestic energy consumption and planned infrastructure upgrades. Technological advancements are also shaping the sector, particularly within pipeline construction, monitoring, and maintenance. This translates into improved efficiency, reduced operational costs, and enhanced safety. The market is witnessing a growing adoption of smart pipeline technologies, providing real-time data analysis and proactive maintenance capabilities. The CAGR for the period 2025-2033 is estimated at xx%, reflecting the steady growth trajectory of the industry. Market penetration of advanced pipeline technologies is expected to increase to xx% by 2033 from the current xx%.

Consumer preferences are shifting toward reliable and sustainable energy solutions, leading to heightened scrutiny of pipeline safety and environmental impact. Competitive dynamics remain intense, with major players constantly striving to improve efficiency, reduce costs, and adopt innovative solutions. This pressure pushes the market towards enhanced safety and environmental responsibility.

Dominant Markets & Segments in Malaysia Oil & Gas Pipeline Industry

The offshore segment dominates the Malaysian oil and gas pipeline market, driven by the extensive offshore oil and gas reserves in the country. Onshore pipelines play a significant role in connecting offshore facilities to onshore processing and distribution networks. However, the offshore segment consistently leads due to Malaysia's significant offshore petroleum activity.

- Onshore Segment: Plays a critical role in connecting offshore facilities to processing and distribution points. Key drivers include existing infrastructure and proximity to processing facilities.

- Offshore Segment: Dominates the market due to extensive offshore reserves, requiring extensive subsea pipeline networks. Key drivers include the vast offshore oil and gas reserves and ongoing exploration efforts.

- Crude Oil Pipelines: Support crude oil transportation, driven by production levels and export demand.

- Gas Pipelines: Critical for transporting natural gas to processing plants and distribution networks, driven by growing natural gas demand.

The dominant region is primarily located along the coastal areas of the country, due to the concentration of both onshore and offshore oil and gas operations. Key drivers include proximity to oil and gas fields, and existing infrastructure.

Malaysia Oil & Gas Pipeline Industry Product Innovations

Recent innovations in pipeline technology focus on enhanced leak detection systems, incorporating smart sensors and advanced data analytics. This results in improved pipeline integrity management, minimizing environmental risks and preventing costly repairs. Furthermore, the use of robust materials and advanced construction techniques contributes to prolonged pipeline lifespan and reduced maintenance requirements. These innovations align with market demand for safer, more efficient, and environmentally responsible pipeline systems.

Report Segmentation & Scope

This report segments the Malaysian oil and gas pipeline industry based on Location of Deployment (Onshore, Offshore) and Type (Crude Oil Pipeline, Gas Pipeline). Each segment provides growth projections, market size estimations, and detailed competitive analysis.

Location of Deployment: The onshore segment demonstrates steady growth, driven by domestic consumption and logistical efficiency. The offshore segment, characterized by higher capital expenditure, shows robust growth linked to extensive offshore reserves.

Type: The crude oil pipeline segment reflects the level of crude oil production and export activity. The gas pipeline segment aligns with increasing demand for natural gas, driving expansion and modernization.

Key Drivers of Malaysia Oil & Gas Pipeline Industry Growth

Several factors fuel the growth of the Malaysian oil and gas pipeline industry. Technological advancements leading to more efficient and safer pipelines are key. Government investments in infrastructure development are also significant drivers, alongside rising domestic energy consumption and export-oriented policies. Furthermore, the ongoing exploration and development of new oil and gas reserves in both onshore and offshore areas contribute to expanding pipeline networks.

Challenges in the Malaysia Oil & Gas Pipeline Industry Sector

The industry faces challenges including stringent regulatory compliance requirements. These necessitate significant investments to meet safety and environmental standards. Furthermore, supply chain disruptions caused by global events can impact project timelines and costs. Intense competition among players necessitates ongoing investments in technology and operational efficiencies to maintain a competitive edge.

Leading Players in the Malaysia Oil & Gas Pipeline Industry Market

- PBJV Group Sdn Bhd

- Stats Group

- Cortez Subsea Limited

- Sapura Energy Berhad

- EcoPrasinos Engineering Sdn Bhd

- Petroliam Nasional Berhad (PETRONAS)

- Yokogawa Kontrol (Malaysia) Sdn Bhd

- Punj Lloyd Limited

- JFE Engineering Corporation

Key Developments in Malaysia Oil & Gas Pipeline Industry Sector

- March 2022: Mubadala Petroleum commences natural gas production from the Pegaga offshore field, utilizing a new 4-kilometer subsea pipeline to the Petronas LNG Complex in Bintulu. This significantly expands gas supply capacity.

- July 2020: Vestigo Petroleum completes a 68-km subsea pipelay for the Tembikai natural gas development, enhancing offshore gas transportation infrastructure.

- June 2020: Sapura Energy secures a USD 180 Million contract to replace the PID1494 pipeline for Brunei Shell Petroleum, showcasing significant pipeline replacement and upgrade activities.

Strategic Malaysia Oil & Gas Pipeline Industry Market Outlook

The Malaysian oil and gas pipeline industry is poised for continued growth, driven by sustained investment in infrastructure, increasing domestic energy demand, and ongoing exploration activities. Strategic opportunities exist in the development of smart pipeline technologies, improved safety and environmental management practices, and leveraging digitalization to enhance efficiency. The future is characterized by continued expansion and modernization of pipeline infrastructure to meet the demands of a growing energy sector.

Malaysia Oil & Gas Pipeline Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Type

- 2.1. Crude Oil Pipeline

- 2.2. Gas Pipeline

Malaysia Oil & Gas Pipeline Industry Segmentation By Geography

- 1. Malaysia

Malaysia Oil & Gas Pipeline Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Natural Gas Pipeline Segment is Expected to Witness Significant Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Oil & Gas Pipeline Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Crude Oil Pipeline

- 5.2.2. Gas Pipeline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 PBJV Group Sdn Bhd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stats Group *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cortez Subsea Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sapura Energy Berhad

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EcoPrasinos Engineering Sdn Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petroliam Nasional Berhad (PETRONAS)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yokogawa Kontrol (Malaysia) Sdn Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Punj Lloyd Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JFE Engineering Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 PBJV Group Sdn Bhd

List of Figures

- Figure 1: Malaysia Oil & Gas Pipeline Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Oil & Gas Pipeline Industry Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 3: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 7: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Oil & Gas Pipeline Industry?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Malaysia Oil & Gas Pipeline Industry?

Key companies in the market include PBJV Group Sdn Bhd, Stats Group *List Not Exhaustive, Cortez Subsea Limited, Sapura Energy Berhad, EcoPrasinos Engineering Sdn Bhd, Petroliam Nasional Berhad (PETRONAS), Yokogawa Kontrol (Malaysia) Sdn Bhd, Punj Lloyd Limited, JFE Engineering Corporation.

3. What are the main segments of the Malaysia Oil & Gas Pipeline Industry?

The market segments include Location of Deployment, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Natural Gas Pipeline Segment is Expected to Witness Significant Development.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

In March 2022, the Abu Dhabi-based Mubadala Petroleum began producing natural gas from the Pegaga offshore field in Malaysia. It has the capacity to produce about 550 million standard cubic feet of gas per day in addition to the condensate. Gas produced will be directed through a new 4-kilometer, 38-inch subsea pipeline tying into an existing offshore gas network and subsequently to the onshore Petronas LNG Complex in Bintulu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Oil & Gas Pipeline Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Oil & Gas Pipeline Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Oil & Gas Pipeline Industry?

To stay informed about further developments, trends, and reports in the Malaysia Oil & Gas Pipeline Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence