Key Insights

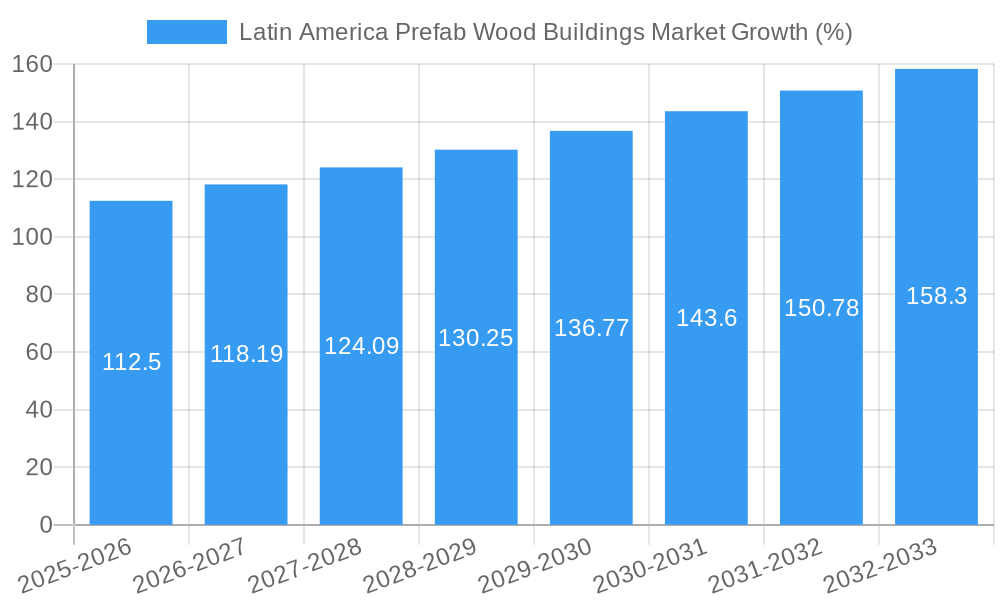

The Latin America prefab wood buildings market is experiencing robust growth, fueled by a compound annual growth rate (CAGR) exceeding 4.50% from 2019 to 2024. This expansion is driven by several key factors. Increasing urbanization and the resulting housing shortage across major Latin American economies like Brazil, Mexico, and Argentina are creating significant demand for cost-effective and rapidly deployable housing solutions. Prefabricated wood buildings offer a compelling alternative to traditional construction methods, providing faster construction times, reduced labor costs, and sustainable building practices. Furthermore, government initiatives promoting sustainable construction and affordable housing are bolstering market growth. The market is segmented by application, with residential construction accounting for the largest share, followed by commercial and industrial segments. Leading players like BrasilCasas, Modulbox, and others are contributing to market growth through innovation in design, technology, and efficient supply chains. The market is expected to see continued expansion through 2033, driven by ongoing urbanization, increasing environmental awareness, and the improved affordability and efficiency of prefab wood construction.

The market's growth is, however, not without challenges. Supply chain disruptions, particularly concerning lumber availability and pricing, pose a potential restraint. Furthermore, regulatory hurdles and building code variations across different Latin American countries can create complexities for market participants. Despite these challenges, the overall outlook for the Latin American prefab wood buildings market remains positive, with substantial opportunities for growth across various application segments and geographies. The market's trajectory will likely be shaped by ongoing technological advancements, evolving consumer preferences towards sustainable building materials, and continued economic growth within the region. Further market penetration is anticipated across the less-developed regions of Latin America, where the need for affordable housing is particularly acute.

Latin America Prefab Wood Buildings Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America Prefab Wood Buildings Market, offering valuable insights for businesses, investors, and industry professionals. Covering the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033, this report meticulously examines market structure, competitive dynamics, industry trends, and growth drivers. The market is segmented by application: Residential, Commercial, and Industrial. The report projects a market value of xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Latin America Prefab Wood Buildings Market Structure & Competitive Dynamics

The Latin American prefab wood buildings market exhibits a moderately fragmented structure, with a handful of major players and numerous smaller regional companies. Key players include BrasilCasas, Modulbox, Dextra, Techno Fast, Pampa Corporation, Easywood, Impresa Modular, Casas Brazil, Brasmerc, E2E Chile, Green Magic Homes, VMD, and All In Wall. However, the market is witnessing increased consolidation, as evidenced by several recent M&A activities. For instance, in 2022, there were xx M&A deals totaling approximately xx Million in value. These deals primarily involved smaller companies being acquired by larger players seeking to expand their geographical reach and product portfolios.

Market share is largely concentrated among the established players, with BrasilCasas and Modulbox holding a significant portion. The market's competitive landscape is characterized by intense price competition, particularly in the residential segment. Innovation is driven primarily by technological advancements in wood processing, design software, and construction techniques. Regulatory frameworks vary across Latin American countries, influencing material standards and construction permits, creating both opportunities and challenges for businesses. Substitute products, such as steel and concrete structures, pose a significant competitive threat, although the increasing demand for sustainable building materials is favoring prefab wood structures. End-user trends indicate a growing preference for environmentally friendly and cost-effective construction solutions, which is bolstering market growth.

Latin America Prefab Wood Buildings Market Industry Trends & Insights

The Latin American prefab wood buildings market is experiencing robust growth, driven by several key factors. The increasing urbanization and population growth in the region are creating a substantial demand for affordable and rapidly deployable housing solutions. Government initiatives promoting sustainable construction practices and affordable housing projects are further stimulating market expansion. The market is also witnessing significant technological advancements, including the adoption of Building Information Modeling (BIM) and prefabrication techniques, streamlining construction processes and improving efficiency. Consumer preferences are shifting towards energy-efficient and aesthetically appealing designs, creating opportunities for innovative products and services. The growing adoption of modular construction methods enhances efficiency and reduces construction time, leading to a higher market penetration rate. The market's CAGR is projected to be xx% from 2025 to 2033. Competitive dynamics remain intense, with companies focusing on product differentiation, cost optimization, and strategic partnerships to maintain a strong market position.

Dominant Markets & Segments in Latin America Prefab Wood Buildings Market

The residential segment currently dominates the Latin American prefab wood buildings market, accounting for approximately xx% of the total market share in 2025. This is largely due to the high demand for affordable housing in rapidly growing urban areas.

- Key Drivers for Residential Segment Dominance:

- Rapid urbanization and population growth.

- Government initiatives promoting affordable housing.

- Rising disposable incomes in certain segments of the population.

- Increased awareness of sustainable building practices.

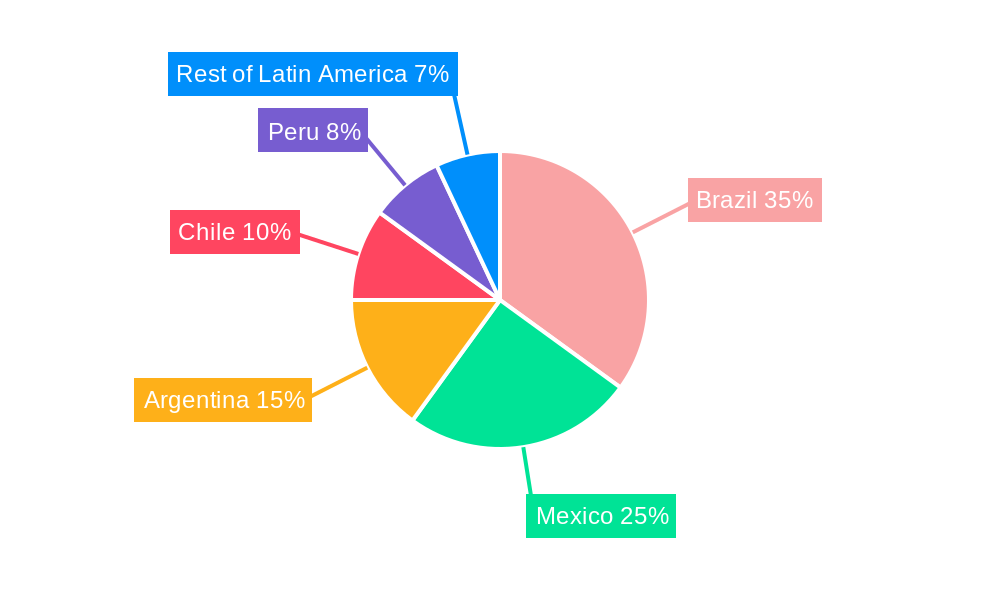

The Brazilian market holds the largest share within the region, driven by its large population and robust construction sector. Mexico and Colombia are also significant markets, showcasing substantial growth potential due to ongoing infrastructure development and supportive government policies. However, the commercial and industrial segments are expected to witness accelerated growth in the coming years, driven by the rising demand for sustainable and efficient commercial spaces, and the increasing adoption of prefabricated structures in industrial applications. This growth is especially prominent in regions with robust economic growth and favorable regulatory environments.

Latin America Prefab Wood Buildings Market Product Innovations

Recent innovations in the Latin American prefab wood buildings market focus on sustainable and high-performance materials, integrating advanced technologies like cross-laminated timber (CLT) and mass timber construction methods. These innovations offer improved structural integrity, fire resistance, and energy efficiency. Prefabricated modules are increasingly designed with flexibility and customization options to cater to diverse architectural styles and end-user needs. This responsiveness to market demand enhances competitiveness and expands market reach.

Report Segmentation & Scope

This report segments the Latin American prefab wood buildings market by application:

Residential: This segment encompasses the construction of single-family homes, multi-family dwellings, and other residential buildings using prefabricated wood components. Growth is projected to remain strong, driven by affordability and speed of construction.

Commercial: This segment includes the construction of offices, retail spaces, restaurants, and other commercial structures using prefabricated wood systems. Growth is fueled by the increasing demand for sustainable and energy-efficient commercial buildings.

Industrial: This segment involves the use of prefabricated wood in industrial facilities such as warehouses, factories, and workshops. The segment is experiencing gradual growth driven by cost-effectiveness and faster construction times compared to traditional methods.

Key Drivers of Latin America Prefab Wood Buildings Market Growth

Several factors contribute to the growth of the Latin American prefab wood buildings market. These include:

- Technological advancements: Innovations in wood processing, design software, and construction techniques are boosting efficiency and reducing construction times.

- Government policies: Government initiatives promoting sustainable construction and affordable housing projects create favorable conditions for market expansion.

- Economic growth: Strong economic growth in several Latin American countries fuels increased construction activity and boosts demand.

- Sustainability concerns: The growing awareness of environmental sustainability is driving increased adoption of eco-friendly building materials such as wood.

Challenges in the Latin America Prefab Wood Buildings Market Sector

Despite strong growth potential, challenges persist:

- Regulatory hurdles: Variations in building codes and regulations across countries create complexities for businesses operating regionally.

- Supply chain issues: The availability and cost of timber and other building materials can impact project costs and timelines.

- Competitive pressures: The presence of alternative construction materials like steel and concrete generates competitive pressure, impacting market share.

- Skilled labor shortage: A lack of skilled labor specialized in prefabricated wood construction can delay projects and impact quality.

Leading Players in the Latin America Prefab Wood Buildings Market Market

- BrasilCasas

- Modulbox

- Dextra

- Techno Fast

- Pampa Corporation

- Easywood

- Impresa Modular

- Casas Brazil

- Brasmerc

- E2E Chile

- Green Magic Homes

- VMD

- All In Wall

Key Developments in Latin America Prefab Wood Buildings Market Sector

- January 2023: Modulbox launched a new line of sustainable prefab homes incorporating recycled materials.

- June 2022: BrasilCasas acquired a smaller regional competitor, expanding its market presence in Southern Brazil.

- October 2021: A new government initiative in Colombia provided incentives for the use of sustainable building materials in affordable housing projects.

Strategic Latin America Prefab Wood Buildings Market Outlook

The Latin American prefab wood buildings market holds significant future potential. Continued urbanization, economic growth, and increasing awareness of sustainable building practices will fuel substantial market expansion. Strategic opportunities exist for companies focused on innovation, technological advancements, and addressing the specific needs of individual countries within the region. Companies that effectively navigate regulatory hurdles and optimize their supply chains will be well-positioned to capitalize on this growing market.

Latin America Prefab Wood Buildings Market Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Argentina

- 2.4. Colombia

- 2.5. Chile

- 2.6. Rest of Latin America

Latin America Prefab Wood Buildings Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Argentina

- 4. Colombia

- 5. Chile

- 6. Rest of Latin America

Latin America Prefab Wood Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Plan Towards Urban Rail Development

- 3.3. Market Restrains

- 3.3.1. Italy’s Fragmented Approach to Tenders

- 3.4. Market Trends

- 3.4.1. Increase of Urbanization in Chile Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Argentina

- 5.2.4. Colombia

- 5.2.5. Chile

- 5.2.6. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Argentina

- 5.3.4. Colombia

- 5.3.5. Chile

- 5.3.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Brazil Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Argentina

- 6.2.4. Colombia

- 6.2.5. Chile

- 6.2.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Mexico Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Argentina

- 7.2.4. Colombia

- 7.2.5. Chile

- 7.2.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Argentina Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Argentina

- 8.2.4. Colombia

- 8.2.5. Chile

- 8.2.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Colombia Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Mexico

- 9.2.3. Argentina

- 9.2.4. Colombia

- 9.2.5. Chile

- 9.2.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Chile Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Brazil

- 10.2.2. Mexico

- 10.2.3. Argentina

- 10.2.4. Colombia

- 10.2.5. Chile

- 10.2.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Latin America Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Residential

- 11.1.2. Commercial

- 11.1.3. Industrial

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Brazil

- 11.2.2. Mexico

- 11.2.3. Argentina

- 11.2.4. Colombia

- 11.2.5. Chile

- 11.2.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Brazil Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 13. Argentina Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 14. Mexico Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 15. Peru Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 16. Chile Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Latin America Latin America Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 BrasilCasas

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Modulbox

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Dextra

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Techno Fast

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Pampa Corporation

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Easywood

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Impresa Modular**List Not Exhaustive

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Casas Brazil

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Brasmerc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 E2E Chile

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Green Magic Homes

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 VMD

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 All In Wall

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.1 BrasilCasas

List of Figures

- Figure 1: Latin America Prefab Wood Buildings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Prefab Wood Buildings Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Prefab Wood Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Prefab Wood Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Prefab Wood Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Prefab Wood Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Prefab Wood Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Prefab Wood Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Latin America Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Prefab Wood Buildings Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Latin America Prefab Wood Buildings Market?

Key companies in the market include BrasilCasas, Modulbox, Dextra, Techno Fast, Pampa Corporation, Easywood, Impresa Modular**List Not Exhaustive, Casas Brazil, Brasmerc, E2E Chile, Green Magic Homes, VMD, All In Wall.

3. What are the main segments of the Latin America Prefab Wood Buildings Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Investment Plan Towards Urban Rail Development.

6. What are the notable trends driving market growth?

Increase of Urbanization in Chile Driving the Market.

7. Are there any restraints impacting market growth?

Italy’s Fragmented Approach to Tenders.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Prefab Wood Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Prefab Wood Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Prefab Wood Buildings Market?

To stay informed about further developments, trends, and reports in the Latin America Prefab Wood Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence