Key Insights

The Italian bottled water market, valued at approximately €X million in 2025, is projected to experience steady growth, driven by factors such as increasing health consciousness among consumers, rising disposable incomes, and the growing popularity of functional and flavored waters. The market's Compound Annual Growth Rate (CAGR) of 2.18% from 2019 to 2024 indicates a consistent demand for bottled water, despite the presence of readily available tap water in many areas. This suggests a strong preference for the perceived purity, convenience, and taste associated with bottled water. Significant growth is anticipated within the flavored/functional bottled water segment, mirroring global trends toward healthier beverage options. The off-trade channel (supermarkets, convenience stores, etc.) dominates the distribution landscape, but the on-trade (restaurants, bars, hotels) segment also presents a noteworthy market opportunity, particularly for premium brands. Key players like Acqua Minerale San Benedetto, Nestle, and Ferrarelle are leveraging brand recognition and diverse product portfolios to maintain their market share. The competitive landscape is dynamic, with both established players and smaller regional brands vying for consumer attention. While environmental concerns related to plastic waste pose a potential restraint, innovative packaging solutions and a growing focus on sustainability within the industry are expected to mitigate this impact.

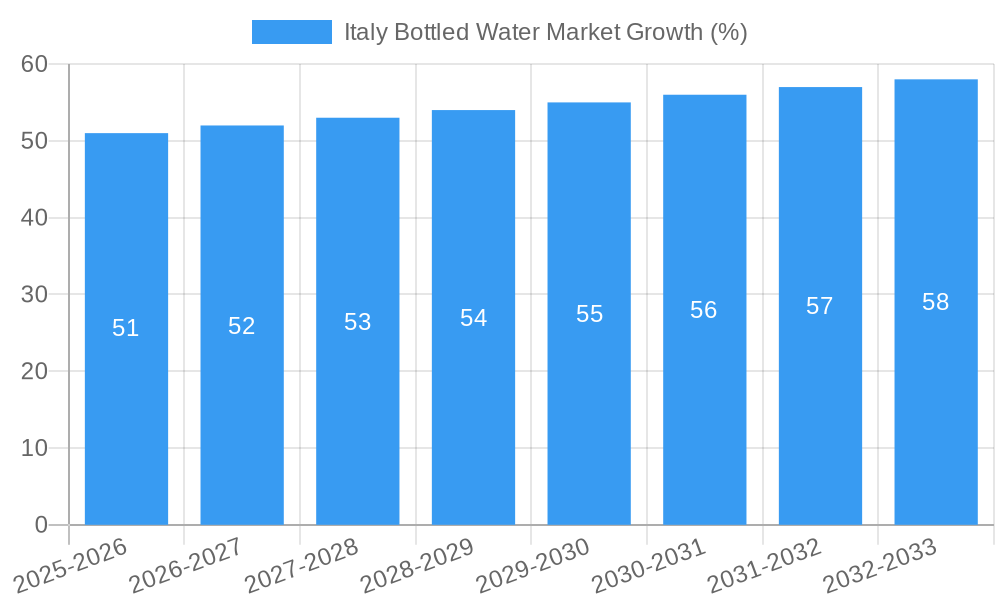

The forecast period (2025-2033) anticipates continued growth, albeit at a moderate pace. This projection considers factors like potential economic fluctuations and changing consumer preferences. The continued expansion of the flavored/functional segment, coupled with strategic marketing initiatives focusing on health and wellness, is expected to fuel further market development. The competitive landscape will likely see further consolidation, with larger players potentially acquiring smaller regional brands. Innovation in packaging materials, including sustainable alternatives, will play a crucial role in maintaining the market's long-term trajectory. Regional variations in consumption patterns will also influence growth, with densely populated areas and tourist destinations exhibiting stronger demand.

Italy Bottled Water Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italy bottled water market, encompassing market size, segmentation, competitive landscape, and future growth projections from 2019 to 2033. With a focus on key players like Acqua Minerale San Benedetto SpA, Nestle SA, and Ferrarelle SpA, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and the forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. This report offers actionable insights into market trends, growth drivers, challenges, and opportunities, providing a clear picture of this dynamic market.

Italy Bottled Water Market Market Structure & Competitive Dynamics

The Italian bottled water market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Acqua Minerale San Benedetto SpA and Nestle SA are prominent examples, often engaging in intense competition, impacting pricing strategies and product innovation. The market is characterized by a dynamic innovation ecosystem, with companies investing in sustainable packaging, functional waters, and enhanced distribution networks. Regulatory frameworks, including those concerning water sourcing and labeling, significantly influence market operations. Substitute products, such as tap water and other beverages, present competitive pressure. End-user trends, particularly towards healthier and more sustainable options, are shaping product development and marketing strategies. M&A activity has been moderate in recent years, with deal values fluctuating depending on market conditions and strategic objectives. For instance, while precise deal values aren't publicly available for all transactions, the market has witnessed several smaller acquisitions and partnerships aimed at expanding distribution or product portfolios. Market share data for major players shows a competitive landscape with the top 5 companies holding approximately xx% of the market, leaving xx% distributed among smaller players and regional brands.

Italy Bottled Water Market Industry Trends & Insights

The Italy bottled water market displays a robust growth trajectory, driven by factors such as rising health consciousness, increasing disposable incomes, and evolving consumer preferences towards premium and functional bottled water. The market's CAGR from 2019 to 2024 is estimated at xx%, showcasing substantial growth. Technological advancements in packaging, such as the introduction of sustainable and recyclable materials (as seen with Acqua Minerale San Benedetto’s Ecogreen bottle), are contributing significantly to market expansion. The market penetration of flavored and functional bottled water continues to rise, driven by consumer demand for healthier and more convenient hydration options. Competitive dynamics remain intense, pushing companies to innovate in product offerings, marketing strategies, and distribution channels. The increasing prevalence of online sales channels, as highlighted by SOLÉ Natural Italian Mineral Water's partnership with online retailers, signals a shift in consumer purchasing behavior. Furthermore, the growing awareness of sustainability concerns is influencing consumer choices, and companies are actively responding with eco-friendly packaging solutions.

Dominant Markets & Segments in Italy Bottled Water Market

Leading Region: Northern Italy dominates the market due to factors like higher population density and stronger purchasing power.

Leading Segment (Type): Still bottled water holds the largest market share, reflecting widespread preference for this type of water. However, the flavored/functional segment is experiencing the fastest growth, driven by consumer demand for innovative and health-conscious beverages. The carbonated segment maintains a substantial presence, though its growth rate might be slower compared to other segments.

Leading Segment (Distribution Channel): The off-trade channel (retail stores, supermarkets) accounts for a larger proportion of sales, driven by convenience and the wider availability of products. The on-trade channel (restaurants, bars) shows steady growth, particularly amongst premium brands.

The dominance of Northern Italy is attributed to a higher population density and greater disposable income in the region, compared to Southern Italy, leading to higher consumption rates of bottled water. Furthermore, well-developed retail infrastructure and increased purchasing power drive this segment. The strong performance of still bottled water showcases consumer preference for a natural and less processed hydration choice. The growth of the flavored and functional water segment indicates changing consumer demands for beverages that offer health benefits beyond basic hydration. Finally, although off-trade is the primary distribution, the on-trade segment exhibits growth potential as the hospitality sector thrives.

Italy Bottled Water Market Product Innovations

Recent years have witnessed significant innovation in the Italian bottled water market, particularly in packaging and product diversification. The shift towards sustainable packaging, exemplified by the launch of Acqua Minerale San Benedetto's Ecogreen bottle and Coop Italia's recycled plastic bottle, reflects industry efforts to meet evolving consumer demands for environmentally conscious products. This trend toward sustainable solutions addresses growing consumer concerns about environmental impact and creates a competitive advantage for companies that embrace sustainable practices.

Report Segmentation & Scope

This report comprehensively segments the Italian bottled water market based on product type and distribution channel.

Product Type:

- Still Bottled Water: This segment accounts for the largest market share and shows consistent growth driven by wide consumer appeal.

- Carbonated Bottled Water: This segment holds a significant share, with growth driven by continued demand for sparkling water variants.

- Flavored/Functional Bottled Water: This segment exhibits the fastest growth rate, reflecting rising consumer interest in healthier, more functional beverages.

Distribution Channel:

- Off-Trade: This segment dominates the market due to its extensive reach and widespread product availability in various retail outlets.

- On-Trade: This segment shows steady growth potential, benefiting from the increasing preference for bottled water in restaurants and hospitality establishments.

Each segment includes analysis of market size, growth projections, and competitive dynamics.

Key Drivers of Italy Bottled Water Market Growth

Several factors contribute to the growth of the Italy bottled water market. Rising health awareness encourages consumers to prioritize hydration, boosting demand. Increased disposable incomes allow consumers to spend more on premium bottled water brands. Technological advancements in packaging are creating sustainable and innovative solutions, appealing to environmentally conscious consumers. Favorable regulatory frameworks and streamlined distribution networks further support market expansion. The growing popularity of flavored and functional waters further stimulates market growth.

Challenges in the Italy Bottled Water Market Sector

The Italian bottled water market faces challenges including intense competition, fluctuating raw material costs, and the growing pressure to adopt sustainable practices. Regulations concerning water sourcing and packaging can impact operational costs. Supply chain disruptions, particularly during periods of economic uncertainty, can affect product availability and pricing. The increasing popularity of tap water and other beverages necessitates continuous innovation and effective marketing strategies to maintain market share.

Leading Players in the Italy Bottled Water Market Market

- Acqua Minerale San Benedetto SpA

- Nestle SA

- CoGeDi International SpA

- Ferrarelle SpA

- Sant'Anna di Vinadio

- Lauretana SpA

- Rocchetta

- Refresco Group BV (Spumador SpA)

- Acqua Lete

- Fonti di Vinadio SpA

Key Developments in Italy Bottled Water Market Sector

January 2022: SOLÉ Natural Italian Mineral Water launched a three-pronged sales and marketing program, including partnerships with Beverage Universe and Amazon. This significantly expands its online presence and distribution reach.

April 2021: Acqua Minerale San Benedetto launched the Ecogreen 1l Easy Bottle, a carbon-neutral product using recycled PET. This demonstrates a significant commitment to sustainability and likely improves brand image.

March 2021: Coop Italia launched a proprietary mineral water bottle made entirely from recycled plastic. This initiative strengthens their sustainable brand positioning and caters to the growing demand for environmentally responsible products.

Strategic Italy Bottled Water Market Market Outlook

The Italian bottled water market holds significant growth potential driven by increasing health consciousness, a growing preference for premium and functional waters, and a sustained focus on sustainable packaging solutions. Strategic opportunities exist in expanding into niche segments, enhancing online distribution, and investing in innovative packaging technologies. Companies that effectively leverage sustainable practices, cater to evolving consumer preferences, and adapt to technological changes are well-positioned for continued success in this competitive market.

Italy Bottled Water Market Segmentation

-

1. Type

- 1.1. Carbonated Bottled Water

- 1.2. Still Bottled Water

- 1.3. Flavored/Functional Bottled Water

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarket/Hypermarket

- 2.2.2. Convenience Stores

- 2.2.3. Home and Office Delivery

- 2.2.4. Online Retail Stores

- 2.2.5. Other Off-Trade Channels

Italy Bottled Water Market Segmentation By Geography

- 1. Italy

Italy Bottled Water Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Growth in Foodservice Expenditure and Tourism

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbonated Bottled Water

- 5.1.2. Still Bottled Water

- 5.1.3. Flavored/Functional Bottled Water

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarket/Hypermarket

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Home and Office Delivery

- 5.2.2.4. Online Retail Stores

- 5.2.2.5. Other Off-Trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Acqua Minerale San Benedetto SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CoGeDi International SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ferrarelle SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sant'Anna di Vinadio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lauretana SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rocchetta

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Refresco Group BV (Spumador SpA)*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Acqua Lete

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fonti di Vinadio SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Acqua Minerale San Benedetto SpA

List of Figures

- Figure 1: Italy Bottled Water Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Bottled Water Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Bottled Water Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Italy Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Italy Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Italy Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Italy Bottled Water Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Italy Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Italy Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Bottled Water Market?

The projected CAGR is approximately 2.18%.

2. Which companies are prominent players in the Italy Bottled Water Market?

Key companies in the market include Acqua Minerale San Benedetto SpA, Nestle SA, CoGeDi International SpA, Ferrarelle SpA, Sant'Anna di Vinadio, Lauretana SpA, Rocchetta, Refresco Group BV (Spumador SpA)*List Not Exhaustive, Acqua Lete, Fonti di Vinadio SpA.

3. What are the main segments of the Italy Bottled Water Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Growth in Foodservice Expenditure and Tourism.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

In January 2022, SOLÉ Natural Italian Mineral Water launched a three-pronged sales and marketing program. It features an exclusive partnership with online beverage retailer Beverage Universe and Amazon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Bottled Water Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Bottled Water Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Bottled Water Market?

To stay informed about further developments, trends, and reports in the Italy Bottled Water Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence