Key Insights

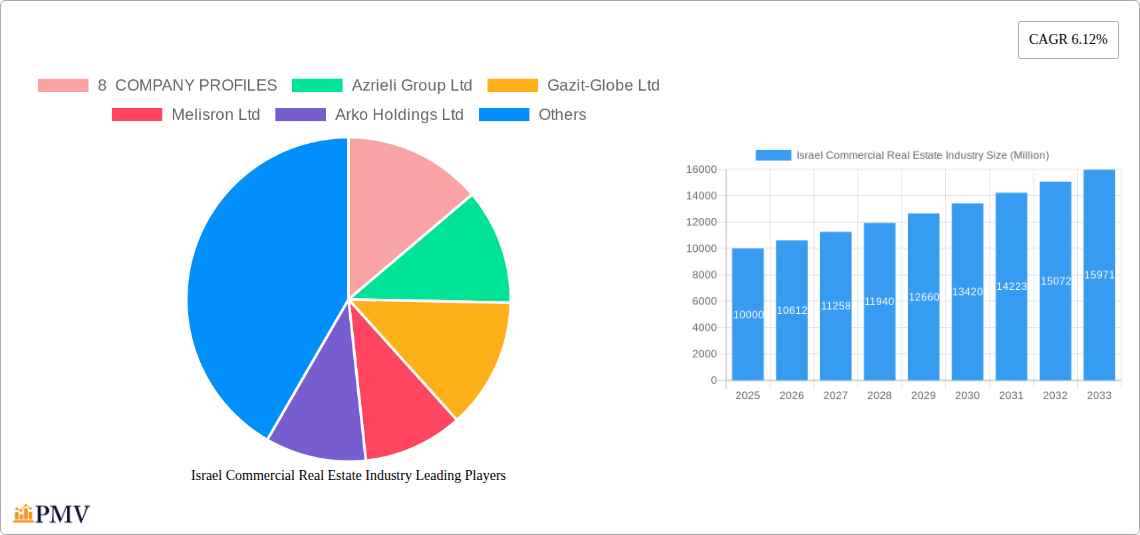

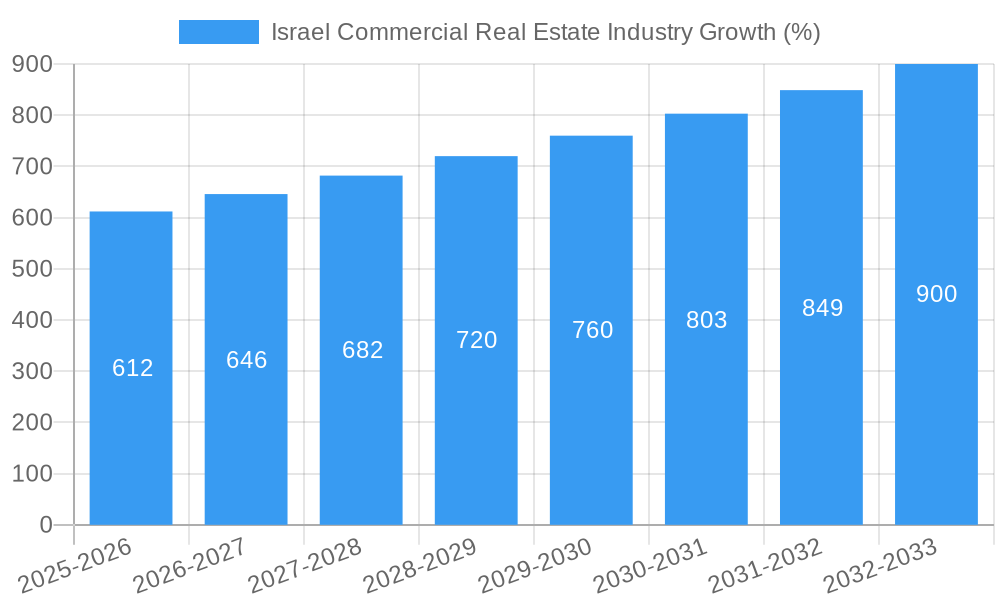

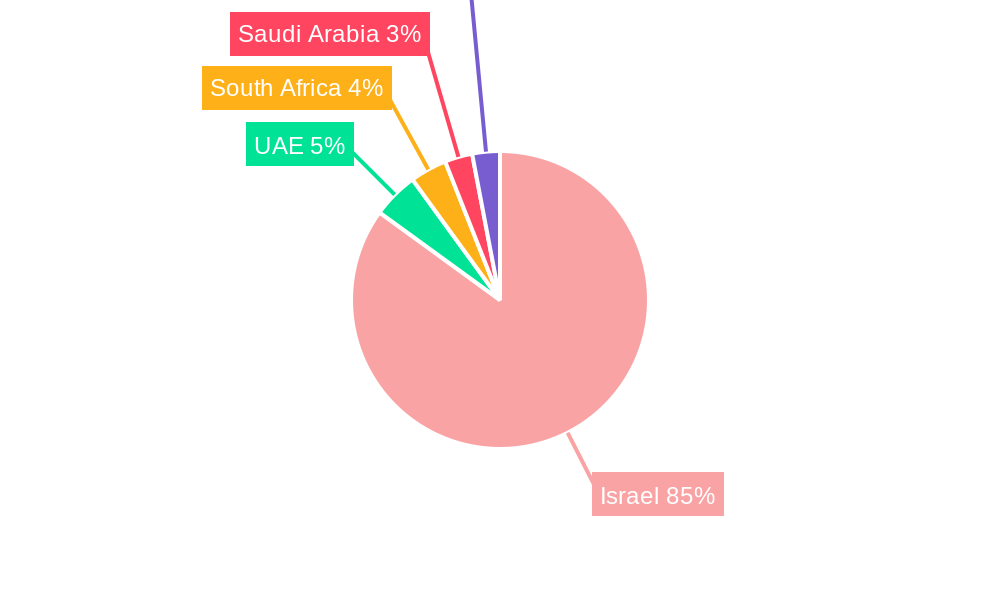

The Israel Commercial Real Estate market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 6.12% and the market size indicated by "XX"), demonstrates robust growth potential. Key drivers include a thriving tech sector fueling demand for office space in major cities like Tel Aviv, Jerusalem, and Haifa, coupled with a burgeoning tourism industry boosting the demand for retail and hospitality properties. Government initiatives aimed at infrastructure development and urban renewal further contribute to this positive market outlook. The market is segmented by property type (Office, Retail, Industrial, Residential) and end-user (Businesses, Government, Individuals), allowing for a nuanced understanding of investment opportunities. While potential restraints such as economic fluctuations and geopolitical uncertainties exist, the strong fundamentals of the Israeli economy and consistent foreign investment suggest continued market expansion. The forecast period (2025-2033) anticipates sustained growth, primarily driven by long-term economic stability and the ongoing appeal of Israel as a strategic business and tourism hub within the Middle East and beyond. Major players like Azrieli Group Ltd, Gazit-Globe Ltd, and Melisron Ltd are well-positioned to capitalize on these market trends. The Middle East & Africa (MEA) region, specifically the UAE, South Africa, and Saudi Arabia, presents additional growth opportunities for Israeli commercial real estate companies seeking expansion beyond domestic markets.

The significant presence of established players, coupled with a relatively concentrated market, suggests opportunities for both large-scale investments and strategic acquisitions. The segments within the commercial real estate market exhibit varied growth trajectories, with the office sector likely experiencing the highest growth due to the tech industry’s influence. The retail and industrial segments will likely see steady growth, reflecting broader economic trends. Understanding the specifics of each segment—including vacancy rates, rental yields, and capital values—will be crucial for investors making informed decisions. The analysis of historical data from 2019-2024, combined with projected figures for the forecast period, offers a comprehensive view for investment strategizing.

Israel Commercial Real Estate Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the Israel commercial real estate industry, covering market structure, competitive dynamics, key trends, and growth projections from 2019 to 2033. It offers invaluable insights for investors, developers, businesses, and government agencies operating within or seeking entry into this dynamic market. The report leverages extensive data analysis and expert perspectives to deliver actionable intelligence, including detailed company profiles of leading players. The Base Year for this report is 2025, with an Estimated Year of 2025 and a Forecast Period spanning 2025-2033. The Historical Period covered is 2019-2024.

Israel Commercial Real Estate Industry Market Structure & Competitive Dynamics

The Israeli commercial real estate market exhibits a moderately concentrated structure, with several large players dominating specific segments. Azrieli Group Ltd, Gazit-Globe Ltd, and Melisron Ltd hold significant market share in the office and retail sectors. However, a number of mid-sized and smaller firms contribute to a competitive landscape. Innovation is driven by technological advancements in property management, construction techniques, and sustainable building practices. The regulatory framework, while generally supportive of investment, faces ongoing evolution to address issues such as zoning laws and environmental regulations. Product substitutes, particularly in the office sector, include co-working spaces and flexible work arrangements. End-user trends shift toward experience-focused retail spaces and sustainable, technologically advanced office environments. M&A activity has been moderate in recent years, with deal values averaging approximately xx Million annually.

- Market Concentration: High in the office and retail segments, moderate in industrial and residential.

- M&A Deal Value (2019-2024 Average): xx Million

- Innovation Focus: Proptech, sustainable construction, smart buildings.

- Regulatory Landscape: Evolving, with potential impact on development costs and timelines.

Israel Commercial Real Estate Industry Industry Trends & Insights

The Israeli commercial real estate market is projected to experience significant growth over the forecast period, driven by several key factors. Strong economic growth, particularly in the tech sector, fuels demand for office space. Increasing tourism and a growing population are driving demand in the retail and residential sectors. Technological disruptions, such as the rise of PropTech, are transforming property management and improving operational efficiency. Consumer preferences are shifting towards sustainable, amenity-rich properties. Competitive dynamics remain intense, particularly among the largest players, with focus on portfolio diversification and strategic partnerships. The Compound Annual Growth Rate (CAGR) for the overall market is estimated at xx% during the forecast period, with market penetration of new technologies increasing steadily. This necessitates agile adaptation and strategic positioning within the industry.

Dominant Markets & Segments in Israel Commercial Real Estate Industry

The Tel Aviv metropolitan area dominates the Israeli commercial real estate market, driven by its strong economic activity, high concentration of businesses, and robust infrastructure. Within the market segments, the office sector demonstrates the highest value, followed by retail and then residential. The industrial sector shows consistent growth driven by expanding logistics and technology sectors. The Government segment is also a significant player in various segments, primarily through leasing and infrastructure development.

- Key Drivers for Tel Aviv Dominance:

- Concentrated economic activity

- Advanced infrastructure

- High population density

- Robust transportation network

- Leading Segments:

- Office: High demand from tech companies and businesses.

- Retail: Driven by tourism and consumer spending.

- Residential: Fueled by population growth and urbanization.

Israel Commercial Real Estate Industry Product Innovations

Recent product innovations include the integration of smart building technologies enhancing energy efficiency, security, and tenant experience. Sustainable building practices are gaining prominence, aligning with global environmental concerns. Flexible office spaces and co-working environments are increasing in popularity, offering adaptability and cost-effectiveness. These innovations improve market fit by providing tenants with modern amenities, increasing property value, and contributing to sustainable practices.

Report Segmentation & Scope

This report segments the market by product type (Office, Retail, Industrial, Residential) and end-user (Businesses, Government, Individuals). Each segment's growth projections, market sizes, and competitive dynamics are analyzed. The Office segment showcases consistent growth owing to the high concentration of tech companies. The retail segment focuses on experience-based shopping and the integration of e-commerce. Industrial properties cater to expanding logistics and manufacturing sectors. Residential buildings cater to the rising population and urbanization trends. Government plays a key role through investments and infrastructure development, impacting all segments.

Key Drivers of Israel Commercial Real Estate Industry Growth

Several factors drive the growth of the Israel commercial real estate industry. A robust and diversified economy, particularly the technology sector, fuels demand for office space. A growing population and increasing urbanization drive demand for residential and retail properties. Government initiatives aimed at promoting infrastructure development and investment further support market expansion. Furthermore, technological advancements are shaping property management and construction practices, enhancing efficiency and sustainability.

Challenges in the Israel Commercial Real Estate Industry Sector

Challenges facing the sector include land scarcity in prime locations, rising construction costs, and regulatory hurdles impacting development timelines. Supply chain disruptions can affect construction projects, while competitive pressures from both domestic and international investors demand strategic adaptation. These factors can influence development profitability and market stability.

Leading Players in the Israel Commercial Real Estate Industry Market

- Azrieli Group Ltd

- Gazit-Globe Ltd

- Melisron Ltd

- Arko Holdings Ltd

- Ashtrom Group Ltd

- Elbit Imaging Ltd

Key Developments in Israel Commercial Real Estate Industry Sector

- 2022 Q4: Completion of the xx Million "XX" office tower in Tel Aviv.

- 2023 Q1: Announcement of a xx Million mixed-use development project in Jerusalem.

- 2023 Q3: Merger between two mid-sized firms creating a new competitor with a portfolio valued at xx Million.

Strategic Israel Commercial Real Estate Industry Market Outlook

The Israeli commercial real estate market presents strong growth potential over the coming years, driven by underlying economic strength and ongoing urbanization. Strategic opportunities exist in developing sustainable and technologically advanced properties catering to evolving tenant demands. Investors seeking exposure to a dynamic and relatively resilient market should carefully consider the factors and trends identified in this report for optimal strategic positioning and maximizing returns.

Israel Commercial Real Estate Industry Segmentation

- 1. Offices

- 2. Industrial

- 3. Retail

- 4. Hotels

- 5. Other Property Types

Israel Commercial Real Estate Industry Segmentation By Geography

- 1. Israel

Israel Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors

- 3.3. Market Restrains

- 3.3.1. Availability of Financing

- 3.4. Market Trends

- 3.4.1. Shortage of Building Land and Labor Availability

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Commercial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offices

- 5.2. Market Analysis, Insights and Forecast - by Industrial

- 5.3. Market Analysis, Insights and Forecast - by Retail

- 5.4. Market Analysis, Insights and Forecast - by Hotels

- 5.5. Market Analysis, Insights and Forecast - by Other Property Types

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Offices

- 6. UAE Israel Commercial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Israel Commercial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Israel Commercial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Israel Commercial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 8 COMPANY PROFILES

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Azrieli Group Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Gazit-Globe Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Melisron Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Arko Holdings Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ashtrom Group Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Elbit Imaging Lt

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 8 COMPANY PROFILES

List of Figures

- Figure 1: Israel Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Israel Commercial Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Israel Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Israel Commercial Real Estate Industry Revenue Million Forecast, by Offices 2019 & 2032

- Table 3: Israel Commercial Real Estate Industry Revenue Million Forecast, by Industrial 2019 & 2032

- Table 4: Israel Commercial Real Estate Industry Revenue Million Forecast, by Retail 2019 & 2032

- Table 5: Israel Commercial Real Estate Industry Revenue Million Forecast, by Hotels 2019 & 2032

- Table 6: Israel Commercial Real Estate Industry Revenue Million Forecast, by Other Property Types 2019 & 2032

- Table 7: Israel Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Israel Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: UAE Israel Commercial Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa Israel Commercial Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Israel Commercial Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of MEA Israel Commercial Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Israel Commercial Real Estate Industry Revenue Million Forecast, by Offices 2019 & 2032

- Table 14: Israel Commercial Real Estate Industry Revenue Million Forecast, by Industrial 2019 & 2032

- Table 15: Israel Commercial Real Estate Industry Revenue Million Forecast, by Retail 2019 & 2032

- Table 16: Israel Commercial Real Estate Industry Revenue Million Forecast, by Hotels 2019 & 2032

- Table 17: Israel Commercial Real Estate Industry Revenue Million Forecast, by Other Property Types 2019 & 2032

- Table 18: Israel Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Commercial Real Estate Industry?

The projected CAGR is approximately 6.12%.

2. Which companies are prominent players in the Israel Commercial Real Estate Industry?

Key companies in the market include 8 COMPANY PROFILES, Azrieli Group Ltd, Gazit-Globe Ltd, Melisron Ltd, Arko Holdings Ltd, Ashtrom Group Ltd, Elbit Imaging Lt.

3. What are the main segments of the Israel Commercial Real Estate Industry?

The market segments include Offices, Industrial, Retail, Hotels, Other Property Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors.

6. What are the notable trends driving market growth?

Shortage of Building Land and Labor Availability.

7. Are there any restraints impacting market growth?

Availability of Financing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Israel Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence