Key Insights

The Iranian telecommunications market, valued at approximately $XX million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 2.21% from 2025 to 2033. This growth is driven by several factors. Increasing smartphone penetration and data consumption are key drivers, fueled by a young and tech-savvy population eager to access online services. The expansion of 4G and emerging 5G networks further enhances connectivity and fuels demand for higher bandwidth services like streaming video and online gaming. The rise of Over-the-Top (OTT) platforms and PayTV services also contributes significantly to market expansion. However, the market faces challenges. Economic sanctions and fluctuations in the Iranian Rial can impact investment and infrastructure development. Government regulations and licensing requirements can also create hurdles for market players. Furthermore, competition among established players like MTN Irancell, TCI, and MCI, alongside emerging players like Rightel and Shatel, necessitates continuous innovation and competitive pricing strategies. Segmentation reveals a strong focus on wireless data and messaging, reflecting the dominant mobile-first culture. Voice services maintain a significant share, but the trend clearly favors data-centric services.

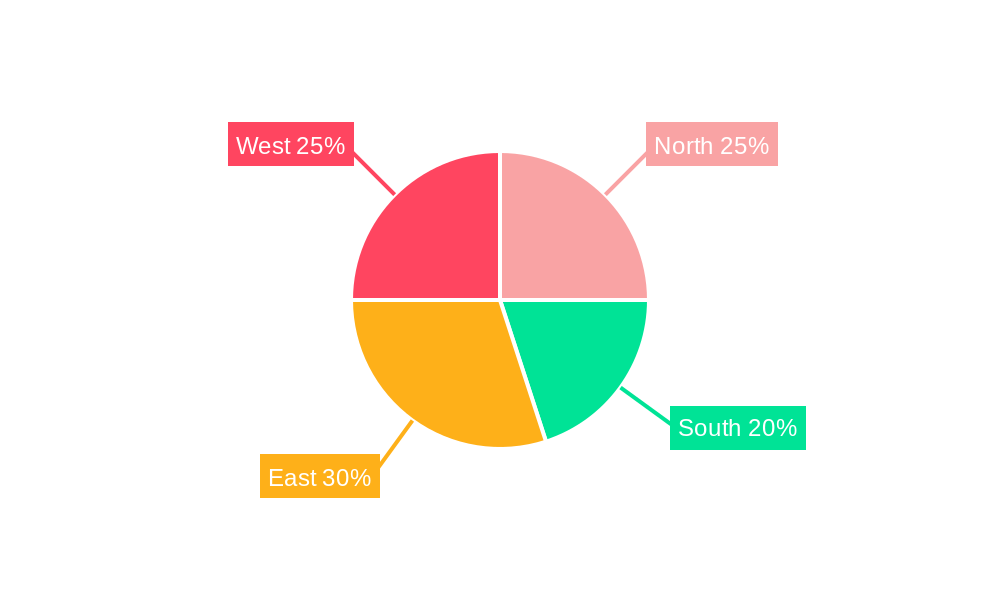

The competitive landscape features both international giants like ZTE, Huawei, and Ericsson, and domestic players. These companies are strategically investing in network infrastructure upgrades and service diversification to capture market share. Regional variations within Iran exist; population density and economic development levels across the North, South, East, and West regions influence service adoption rates and revenue generation. The forecast period (2025-2033) suggests continued growth, albeit at a moderate pace, contingent upon economic stability, regulatory changes, and continued technological advancements within the sector. The increasing adoption of mobile financial services and the potential for growth in the Internet of Things (IoT) represent additional future opportunities within the market.

Iran Telecom Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Iranian telecom industry, covering market structure, competitive dynamics, industry trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The forecast period extends from 2025-2033, while historical data covers 2019-2024. Key players such as MTN Irancell, Mobile Communications Iran (MCI), Telecommunication Company of Iran (TCI), Huawei, ZTE, Ericsson, and others are analyzed in detail.

Iran Telecom Industry Market Structure & Competitive Dynamics

The Iranian telecom market exhibits a complex interplay of established players and emerging competitors. Market concentration is moderate, with a few dominant players like MTN Irancell and MCI holding significant market share (estimated at xx% and xx% respectively in 2025). However, a fragmented landscape exists, with several smaller players vying for market share, especially in niche segments like OTT services. The regulatory framework, while aiming to foster competition, presents challenges with licensing and spectrum allocation. The industry witnesses consistent M&A activity, although deal values are not publicly disclosed in all cases. Recent deals have mostly been focused on infrastructure expansion and technology upgrades. Substitutes include VoIP services, and consumer preferences are shifting towards higher data consumption and bundled packages. The innovation ecosystem remains relatively nascent compared to global standards, hindering the rapid adoption of cutting-edge technologies.

- Market Concentration: Moderate, with a few dominant players.

- M&A Activity: Consistent, primarily for infrastructure and technology upgrades. Estimated total deal value for 2019-2024 is approximately xx Million.

- Regulatory Framework: Complex, impacting licensing and spectrum allocation.

- Innovation Ecosystem: Developing, with limitations on technology adoption.

Iran Telecom Industry Industry Trends & Insights

The Iranian telecom industry is characterized by robust growth, driven primarily by increasing smartphone penetration, rising internet usage, and a young, tech-savvy population. The Compound Annual Growth Rate (CAGR) for the overall market is estimated to be xx% during the forecast period (2025-2033). This growth is fueled by government initiatives promoting digitalization and expanding broadband access. However, economic sanctions and fluctuations in the national currency create uncertainties. Technological disruptions, such as the increasing adoption of 5G technology and the rise of OTT services, are reshaping the industry landscape. Consumer preferences are shifting towards higher data packages and bundled services that offer value for money. Competitive dynamics are intense, with companies competing on price, coverage, and service quality. The market penetration of smartphones is above xx% in 2025 with an estimated increase in penetration to xx% by 2033.

Dominant Markets & Segments in Iran Telecom Industry

The dominant segment within the Iranian telecom industry is Wireless Data and Messaging Services, driven by the ever-increasing demand for mobile internet access. Within this, data packages and internet access are experiencing exceptional growth.

Key Drivers for Wireless Data and Messaging Services:

- Rising smartphone penetration.

- Increasing internet usage among the youth population.

- Government initiatives promoting digital inclusion.

- Introduction of affordable data packages.

Dominance Analysis: The high growth in data consumption is primarily attributed to the proliferation of social media platforms and online streaming services. The competitive landscape is extremely dynamic in this segment with intense competition on pricing and data packages among the operators.

OTT and PayTV Services: This segment is experiencing significant growth, but faces challenges from regulatory oversight.

Voice Services: While still significant, voice services are experiencing slower growth compared to data services. The increasing use of OTT communication applications like WhatsApp and Telegram is posing a challenge to traditional voice revenue.

Iran Telecom Industry Product Innovations

Recent product innovations focus on enhancing data speeds and coverage, particularly with the rollout of 5G technology in select areas. Companies are also investing in value-added services, such as bundled packages combining data, voice, and OTT services, to enhance customer experience and increase ARPU (Average Revenue Per User). The market is also witnessing the emergence of innovative fintech solutions integrated into mobile platforms. This focus on bundled packages and customized plans is crucial for achieving a competitive edge in this intensely competitive market.

Report Segmentation & Scope

This report segments the Iranian telecom industry by service type: Wireless (Data and Messaging Services, including Internet and Handset Data packages with discounts), OTT and PayTV Services, and Voice Services. Growth projections are provided for each segment, alongside market size estimations for 2025 and beyond. Competitive dynamics within each segment are also analyzed, highlighting key players and their strategies.

Key Drivers of Iran Telecom Industry Growth

The Iranian telecom industry's growth is fueled by several factors: the increasing adoption of smartphones and mobile internet, government initiatives promoting digital inclusion, the expansion of 4G and 5G networks, and the growing popularity of OTT services. Economic growth, although subject to external factors, also contributes positively to increased telecom spending. Regulatory reforms aimed at promoting competition further boost industry development. The ongoing expansion of FTTH infrastructure will accelerate growth in fixed-line broadband penetration and support further mobile network growth.

Challenges in the Iran Telecom Industry Sector

The industry faces challenges including economic sanctions impacting equipment procurement and technology imports, fluctuations in the national currency affecting operational costs, and regulatory hurdles slowing down infrastructure development. Supply chain disruptions and competition from international players further complicate the industry’s ability to grow sustainably and achieve long-term strategic goals. The estimated impact of these challenges on revenue growth is approximately xx Million annually.

Leading Players in the Iran Telecom Industry Market

- ZTE

- Rightel

- Taliya Communications

- Shatel

- Orange

- Telesat

- Huawei

- Mobile Communications Iran (MCI)

- Telecommunication Company of Iran (TCI)

- MTN Irancell

- Ericsson

Key Developments in Iran Telecom Industry Sector

- February 2022: Iran's Ministry of ICT launched a project to deploy FTTH infrastructure for over 20 Million homes and businesses by August 2025. This significantly boosts broadband access and contributes to overall industry growth.

- May 2022: MCI expanded 5G coverage to Kish Island, enhancing high-speed connectivity services for customers. This is a key step in modernizing the country's mobile infrastructure.

Strategic Iran Telecom Industry Market Outlook

The Iranian telecom market holds significant future potential, driven by continued smartphone penetration, increasing data consumption, and the expansion of high-speed broadband networks. Strategic opportunities exist in investing in 5G infrastructure, developing innovative value-added services, and leveraging the growth of the OTT sector. However, navigating regulatory complexities and addressing economic challenges will be crucial for sustained success. The market is projected to reach xx Million in revenue by 2033, presenting significant opportunities for both established players and new entrants.

Iran Telecom Industry Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Iran Telecom Industry Segmentation By Geography

- 1. Iran

Iran Telecom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for 5G; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. High Costs And Limited Commercialization

- 3.4. Market Trends

- 3.4.1. Rising Demand for Wireless Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Telecom Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North Iran Telecom Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Telecom Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Telecom Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Telecom Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ZTE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rightel

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Taliya Communications

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Shatel*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Orange

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Telesat

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Huawei

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mobile Communications Iran (MCI)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Telecommunication Company of Iran (TCI)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 MTN Irancell

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Ericsson

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 ZTE

List of Figures

- Figure 1: Iran Telecom Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Telecom Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Telecom Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Telecom Industry Revenue Million Forecast, by Services 2019 & 2032

- Table 3: Iran Telecom Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Iran Telecom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North Iran Telecom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South Iran Telecom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East Iran Telecom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West Iran Telecom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Iran Telecom Industry Revenue Million Forecast, by Services 2019 & 2032

- Table 10: Iran Telecom Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Telecom Industry?

The projected CAGR is approximately 2.21%.

2. Which companies are prominent players in the Iran Telecom Industry?

Key companies in the market include ZTE, Rightel, Taliya Communications, Shatel*List Not Exhaustive, Orange, Telesat, Huawei, Mobile Communications Iran (MCI), Telecommunication Company of Iran (TCI), MTN Irancell, Ericsson.

3. What are the main segments of the Iran Telecom Industry?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for 5G; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

Rising Demand for Wireless Services.

7. Are there any restraints impacting market growth?

High Costs And Limited Commercialization.

8. Can you provide examples of recent developments in the market?

February 2022: Iran's Ministry of ICT launched a new project to deploy fiber-to-the-home (FTTH) infrastructure for more than 20 million homes and businesses by August 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Telecom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Telecom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Telecom Industry?

To stay informed about further developments, trends, and reports in the Iran Telecom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence