Key Insights

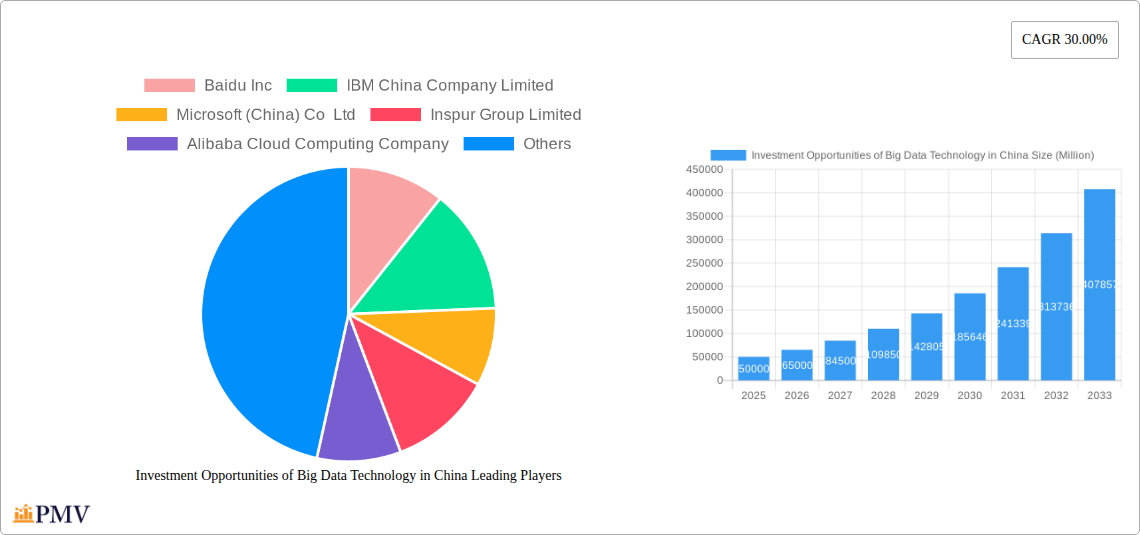

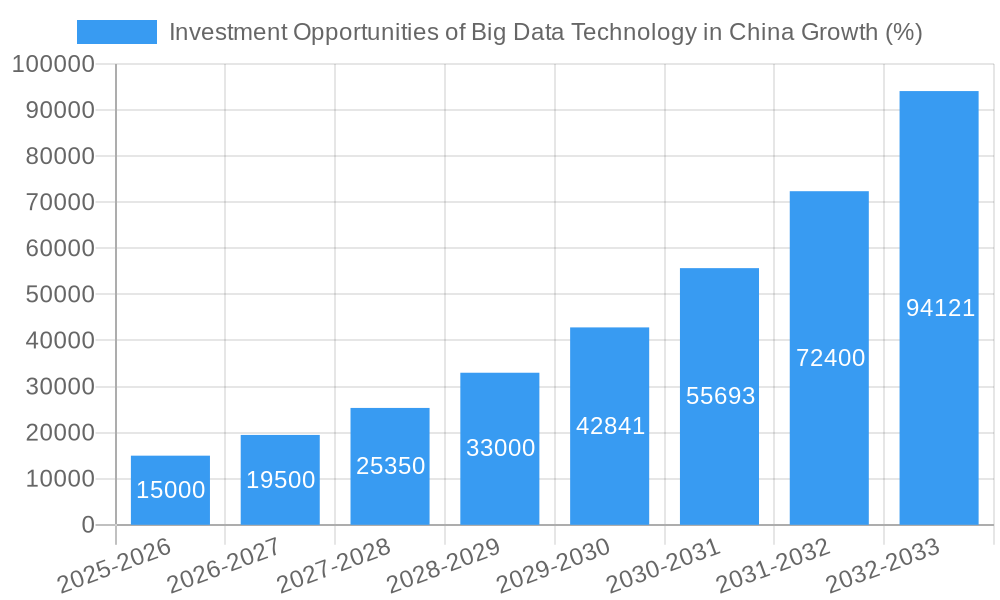

The Chinese big data market presents substantial investment opportunities, fueled by a robust 30% CAGR (2019-2033) and a large market size. While the exact 2025 market value isn't provided, considering the historical period (2019-2024) and projected growth, a reasonable estimate places it at approximately $50 billion USD (this is an estimation based on industry trends and the provided CAGR, not a claim of precise data). Key drivers include the government's digital transformation initiatives, rapid advancements in artificial intelligence (AI) and machine learning (ML), expanding e-commerce and fintech sectors, and growing demand for improved operational efficiency across various industries. Significant trends shaping this market include cloud adoption for big data processing, increasing reliance on advanced analytics for better decision-making, and the development of specialized solutions tailored to specific sectors like BFSI (Banking, Financial Services, and Insurance), healthcare, and manufacturing.

However, challenges remain. Data security concerns and the need for robust data privacy regulations are significant restraints. Furthermore, the relatively high cost of implementing and maintaining big data infrastructure, along with a potential skills gap in data science and analytics, pose hurdles to market penetration. Despite these restraints, the substantial market size, rapid growth, and government support strongly suggest a positive outlook for investors. The diverse segmentations—by enterprise size (large and SMEs), solution type (customer analytics, fraud detection, etc.), end-user industry, and deployment (on-premise and cloud)—offer a range of investment opportunities, allowing for targeted strategies based on specific risk tolerances and return expectations. Companies like Baidu, Alibaba Cloud, and Tencent are leading players, indicating a competitive but dynamic landscape ripe for both established and emerging players.

This comprehensive report provides a detailed analysis of the burgeoning Big Data technology market in China, offering invaluable insights for investors, businesses, and industry stakeholders. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report meticulously examines market size, growth drivers, competitive dynamics, and key investment opportunities, presenting a wealth of data-driven projections and actionable intelligence. The market is segmented by enterprise size, solution type, end-user industry, and deployment model, providing a granular understanding of this dynamic landscape. The report value exceeds 1 Million.

Investment Opportunities of Big Data Technology in China: Market Structure & Competitive Dynamics

The Chinese Big Data market is characterized by a dynamic interplay of established tech giants and innovative startups. Market concentration is moderately high, with key players like Alibaba Cloud, Huawei, and Baidu holding significant market share (estimated at xx% combined in 2025). However, a vibrant ecosystem of smaller companies fuels innovation and competition. The regulatory landscape, while evolving, generally supports the growth of the Big Data sector, although data privacy regulations present ongoing challenges. Product substitutes, such as traditional data analysis methods, are losing ground to the efficiency and scale of Big Data solutions. End-user trends indicate a strong preference for cloud-based solutions, driving significant investment in cloud infrastructure. M&A activity is robust, with deal values exceeding xx Million in 2024, reflecting the strategic importance of Big Data capabilities. Key M&A activities in recent years include (specific examples with values to be added based on data availability, e.g., "Acquisition of X company by Y company for xx Million USD in 2023").

Investment Opportunities of Big Data Technology in China: Industry Trends & Insights

The Chinese Big Data market is experiencing robust growth, driven by the government's digitalization initiatives, rising adoption of cloud computing, and increasing demand for data-driven insights across various sectors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological disruptions, such as the rise of Artificial Intelligence (AI) and the Internet of Things (IoT), are fueling innovation and expanding the applications of Big Data. Consumer preferences are shifting towards personalized experiences and data-driven services, further propelling market growth. Intense competition among major players is driving innovation and price optimization, benefiting end-users. Market penetration is high in sectors like BFSI and retail, with increasing adoption in other industries like healthcare and manufacturing.

Dominant Markets & Segments in Investment Opportunities of Big Data Technology in China

By Enterprise Size: The Large Enterprise segment dominates, driven by higher budgets and more complex data needs. However, the Small & Medium Enterprise (SME) segment shows significant growth potential.

By Solution: Customer Analytics and Fraud Detection & Management are currently leading segments, reflecting the priority placed on customer relationship management and risk mitigation. Operation Intelligence and Predictive Maintenance are showing strong growth.

By End-user Industry: The BFSI sector is the largest adopter of Big Data solutions, followed by the retail and government sectors. The healthcare and manufacturing sectors are emerging as key growth areas.

By Deployment: Cloud deployment is the dominant model, driven by its scalability, cost-effectiveness, and ease of access. However, On-Premise deployment continues to hold a share, particularly in sectors with stringent data security requirements.

The dominance of these segments is primarily driven by the strong economic policies promoting digital transformation in China, the extensive digital infrastructure in major cities, and government initiatives aimed at boosting technological advancements. Specific regional dominance will be further detailed in the report.

Investment Opportunities of Big Data Technology in China: Product Innovations

Recent product innovations highlight the increasing sophistication of Big Data solutions in China. The focus is on developing AI-powered analytics platforms, edge computing capabilities for real-time data processing, and advanced data security features to address regulatory concerns. These innovations are tailored to address the specific needs of various industries, creating competitive advantages for companies that can deliver tailored, high-value solutions. For example, the innovative upgrades by Alibaba Cloud, and Huawei's new NetEngine AR5710 and CloudCampus 3.0 solutions are significant examples of this trend.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Chinese Big Data market across various dimensions:

By Enterprise Size: Large Enterprise and Small & Medium Enterprise, with detailed growth projections and competitive analysis for each.

By Solution: Customer Analytics, Fraud Detection & Management, Operation Intelligence, Predictive Maintenance, Asset Management, and Other Solutions, each with market size estimations and growth forecasts.

By End-user Industry: BFSI, Healthcare, Retail, Manufacturing and Automotive, Aerospace & Defense, IT & Telecommunication, Government, and Other End-user Industries, detailing market dynamics and competitive landscapes.

By Deployment: On-Premise and Cloud, providing insights into adoption trends and future growth potential.

Key Drivers of Investment Opportunities of Big Data Technology in China Growth

The growth of the Chinese Big Data market is driven by several key factors: the government's "Digital China" initiative, significant investments in 5G and cloud infrastructure, increasing adoption of AI and IoT technologies, and the growing demand for data-driven decision-making across various sectors. These factors create a fertile ground for investment in Big Data solutions, promising substantial returns.

Challenges in the Investment Opportunities of Big Data Technology in China Sector

Despite the significant growth opportunities, the Chinese Big Data market faces challenges, including strict data privacy regulations, the need for robust cybersecurity measures, and the potential for intellectual property theft. Supply chain disruptions and intense competition also impact market dynamics. These challenges need careful consideration for effective investment strategies.

Leading Players in the Investment Opportunities of Big Data Technology in China Market

- Baidu Inc

- IBM China Company Limited

- Microsoft (China) Co Ltd

- Inspur Group Limited

- Alibaba Cloud Computing Company

- Huawei Technologies Co

- Neusoft Corporation

- JD com Inc

- SAP China

- Lenovo (Beijing) Limited

Key Developments in Investment Opportunities of Big Data Technology in China Sector

November 2022: Alibaba announced the Innovative upgrade, and Greener 11.11 runs wholly on Alibaba Cloud, with Alibaba Cloud's dedicated processing unit powering 11.11 for the Apsara Cloud operating system. This significantly improved computing and storage efficiency.

October 2022: Huawei Technologies Co. unveiled its 4-in-1 hyper-converged enterprise gateway NetEngine AR5710 and CloudCampus 3.0 + Simplified Solution, launching products for large enterprises and SMEs to simplify campus networks and maximize digital productivity.

Strategic Investment Opportunities of Big Data Technology in China Market Outlook

The future of the Chinese Big Data market looks exceptionally promising. Continued government support, technological advancements, and expanding digital adoption across various sectors create a significant growth trajectory. Strategic investment opportunities exist in cloud-based solutions, AI-powered analytics, and specialized solutions for emerging industries like healthcare and manufacturing. Companies with strong technological capabilities and a deep understanding of the Chinese market are well-positioned to capture significant market share.

Investment Opportunities of Big Data Technology in China Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. Cloud

-

2. Enterprise Size

- 2.1. Large Enterprise

- 2.2. Small & Medium Enterprise

-

3. Solution

- 3.1. Customer Analytics

- 3.2. Fraud Detection and Management

- 3.3. Operation Intelligence

- 3.4. Predictive Maintenance

- 3.5. Asset Management

- 3.6. Other Solutions

-

4. End-user Industry

- 4.1. BFSI

- 4.2. Healthcare

- 4.3. Retail

- 4.4. Manufacturing and Automotive

- 4.5. Aerospace & Defense

- 4.6. IT & Telecommunication

- 4.7. Government

- 4.8. Other End-user Industries

Investment Opportunities of Big Data Technology in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Investment Opportunities of Big Data Technology in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 30.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 6.1 Data Explosion

- 3.3. Market Restrains

- 3.3.1. 7.1 Lack of General Awareness And Expertise7.2 Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Need for Customer Analytics to Increase Exponentially Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Investment Opportunities of Big Data Technology in China Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.2.1. Large Enterprise

- 5.2.2. Small & Medium Enterprise

- 5.3. Market Analysis, Insights and Forecast - by Solution

- 5.3.1. Customer Analytics

- 5.3.2. Fraud Detection and Management

- 5.3.3. Operation Intelligence

- 5.3.4. Predictive Maintenance

- 5.3.5. Asset Management

- 5.3.6. Other Solutions

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. BFSI

- 5.4.2. Healthcare

- 5.4.3. Retail

- 5.4.4. Manufacturing and Automotive

- 5.4.5. Aerospace & Defense

- 5.4.6. IT & Telecommunication

- 5.4.7. Government

- 5.4.8. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Investment Opportunities of Big Data Technology in China Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-Premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.2.1. Large Enterprise

- 6.2.2. Small & Medium Enterprise

- 6.3. Market Analysis, Insights and Forecast - by Solution

- 6.3.1. Customer Analytics

- 6.3.2. Fraud Detection and Management

- 6.3.3. Operation Intelligence

- 6.3.4. Predictive Maintenance

- 6.3.5. Asset Management

- 6.3.6. Other Solutions

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. BFSI

- 6.4.2. Healthcare

- 6.4.3. Retail

- 6.4.4. Manufacturing and Automotive

- 6.4.5. Aerospace & Defense

- 6.4.6. IT & Telecommunication

- 6.4.7. Government

- 6.4.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. South America Investment Opportunities of Big Data Technology in China Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-Premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.2.1. Large Enterprise

- 7.2.2. Small & Medium Enterprise

- 7.3. Market Analysis, Insights and Forecast - by Solution

- 7.3.1. Customer Analytics

- 7.3.2. Fraud Detection and Management

- 7.3.3. Operation Intelligence

- 7.3.4. Predictive Maintenance

- 7.3.5. Asset Management

- 7.3.6. Other Solutions

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. BFSI

- 7.4.2. Healthcare

- 7.4.3. Retail

- 7.4.4. Manufacturing and Automotive

- 7.4.5. Aerospace & Defense

- 7.4.6. IT & Telecommunication

- 7.4.7. Government

- 7.4.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Europe Investment Opportunities of Big Data Technology in China Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-Premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.2.1. Large Enterprise

- 8.2.2. Small & Medium Enterprise

- 8.3. Market Analysis, Insights and Forecast - by Solution

- 8.3.1. Customer Analytics

- 8.3.2. Fraud Detection and Management

- 8.3.3. Operation Intelligence

- 8.3.4. Predictive Maintenance

- 8.3.5. Asset Management

- 8.3.6. Other Solutions

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. BFSI

- 8.4.2. Healthcare

- 8.4.3. Retail

- 8.4.4. Manufacturing and Automotive

- 8.4.5. Aerospace & Defense

- 8.4.6. IT & Telecommunication

- 8.4.7. Government

- 8.4.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Middle East & Africa Investment Opportunities of Big Data Technology in China Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-Premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.2.1. Large Enterprise

- 9.2.2. Small & Medium Enterprise

- 9.3. Market Analysis, Insights and Forecast - by Solution

- 9.3.1. Customer Analytics

- 9.3.2. Fraud Detection and Management

- 9.3.3. Operation Intelligence

- 9.3.4. Predictive Maintenance

- 9.3.5. Asset Management

- 9.3.6. Other Solutions

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. BFSI

- 9.4.2. Healthcare

- 9.4.3. Retail

- 9.4.4. Manufacturing and Automotive

- 9.4.5. Aerospace & Defense

- 9.4.6. IT & Telecommunication

- 9.4.7. Government

- 9.4.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Asia Pacific Investment Opportunities of Big Data Technology in China Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-Premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.2.1. Large Enterprise

- 10.2.2. Small & Medium Enterprise

- 10.3. Market Analysis, Insights and Forecast - by Solution

- 10.3.1. Customer Analytics

- 10.3.2. Fraud Detection and Management

- 10.3.3. Operation Intelligence

- 10.3.4. Predictive Maintenance

- 10.3.5. Asset Management

- 10.3.6. Other Solutions

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. BFSI

- 10.4.2. Healthcare

- 10.4.3. Retail

- 10.4.4. Manufacturing and Automotive

- 10.4.5. Aerospace & Defense

- 10.4.6. IT & Telecommunication

- 10.4.7. Government

- 10.4.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Baidu Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM China Company Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microsoft (China) Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inspur Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alibaba Cloud Computing Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huawei Technologies Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Neusoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JD com Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SAP China

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lenovo (Beijing) Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Baidu Inc

List of Figures

- Figure 1: Global Investment Opportunities of Big Data Technology in China Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: China Investment Opportunities of Big Data Technology in China Revenue (Million), by Country 2024 & 2032

- Figure 3: China Investment Opportunities of Big Data Technology in China Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Investment Opportunities of Big Data Technology in China Revenue (Million), by Deployment 2024 & 2032

- Figure 5: North America Investment Opportunities of Big Data Technology in China Revenue Share (%), by Deployment 2024 & 2032

- Figure 6: North America Investment Opportunities of Big Data Technology in China Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 7: North America Investment Opportunities of Big Data Technology in China Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 8: North America Investment Opportunities of Big Data Technology in China Revenue (Million), by Solution 2024 & 2032

- Figure 9: North America Investment Opportunities of Big Data Technology in China Revenue Share (%), by Solution 2024 & 2032

- Figure 10: North America Investment Opportunities of Big Data Technology in China Revenue (Million), by End-user Industry 2024 & 2032

- Figure 11: North America Investment Opportunities of Big Data Technology in China Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 12: North America Investment Opportunities of Big Data Technology in China Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Investment Opportunities of Big Data Technology in China Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Investment Opportunities of Big Data Technology in China Revenue (Million), by Deployment 2024 & 2032

- Figure 15: South America Investment Opportunities of Big Data Technology in China Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: South America Investment Opportunities of Big Data Technology in China Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 17: South America Investment Opportunities of Big Data Technology in China Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 18: South America Investment Opportunities of Big Data Technology in China Revenue (Million), by Solution 2024 & 2032

- Figure 19: South America Investment Opportunities of Big Data Technology in China Revenue Share (%), by Solution 2024 & 2032

- Figure 20: South America Investment Opportunities of Big Data Technology in China Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: South America Investment Opportunities of Big Data Technology in China Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: South America Investment Opportunities of Big Data Technology in China Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Investment Opportunities of Big Data Technology in China Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Investment Opportunities of Big Data Technology in China Revenue (Million), by Deployment 2024 & 2032

- Figure 25: Europe Investment Opportunities of Big Data Technology in China Revenue Share (%), by Deployment 2024 & 2032

- Figure 26: Europe Investment Opportunities of Big Data Technology in China Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 27: Europe Investment Opportunities of Big Data Technology in China Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 28: Europe Investment Opportunities of Big Data Technology in China Revenue (Million), by Solution 2024 & 2032

- Figure 29: Europe Investment Opportunities of Big Data Technology in China Revenue Share (%), by Solution 2024 & 2032

- Figure 30: Europe Investment Opportunities of Big Data Technology in China Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Europe Investment Opportunities of Big Data Technology in China Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Europe Investment Opportunities of Big Data Technology in China Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Investment Opportunities of Big Data Technology in China Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue (Million), by Deployment 2024 & 2032

- Figure 35: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue Share (%), by Deployment 2024 & 2032

- Figure 36: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 37: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 38: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue (Million), by Solution 2024 & 2032

- Figure 39: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue Share (%), by Solution 2024 & 2032

- Figure 40: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue (Million), by Deployment 2024 & 2032

- Figure 45: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue Share (%), by Deployment 2024 & 2032

- Figure 46: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 47: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 48: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue (Million), by Solution 2024 & 2032

- Figure 49: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue Share (%), by Solution 2024 & 2032

- Figure 50: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue (Million), by End-user Industry 2024 & 2032

- Figure 51: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 52: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Investment Opportunities of Big Data Technology in China Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 4: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Solution 2019 & 2032

- Table 5: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Deployment 2019 & 2032

- Table 9: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 10: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Solution 2019 & 2032

- Table 11: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Deployment 2019 & 2032

- Table 17: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 18: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Solution 2019 & 2032

- Table 19: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Deployment 2019 & 2032

- Table 25: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 26: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Solution 2019 & 2032

- Table 27: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 28: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Deployment 2019 & 2032

- Table 39: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 40: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Solution 2019 & 2032

- Table 41: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 42: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Deployment 2019 & 2032

- Table 50: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 51: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Solution 2019 & 2032

- Table 52: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 53: Global Investment Opportunities of Big Data Technology in China Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Investment Opportunities of Big Data Technology in China Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Investment Opportunities of Big Data Technology in China?

The projected CAGR is approximately 30.00%.

2. Which companies are prominent players in the Investment Opportunities of Big Data Technology in China?

Key companies in the market include Baidu Inc, IBM China Company Limited, Microsoft (China) Co Ltd, Inspur Group Limited, Alibaba Cloud Computing Company, Huawei Technologies Co, Neusoft Corporation, JD com Inc *List Not Exhaustive, SAP China, Lenovo (Beijing) Limited.

3. What are the main segments of the Investment Opportunities of Big Data Technology in China?

The market segments include Deployment, Enterprise Size, Solution, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

6.1 Data Explosion: Unstructured. Semi-structured and Complex6.2 Improvement in Algorithm Development6.3 Need for Customer Analytics.

6. What are the notable trends driving market growth?

Need for Customer Analytics to Increase Exponentially Driving the Market Growth.

7. Are there any restraints impacting market growth?

7.1 Lack of General Awareness And Expertise7.2 Data Security Concerns.

8. Can you provide examples of recent developments in the market?

November 2022 - Alibaba announced the Innovative upgrade, and Greener 11.11 runs wholly on Alibaba Cloud, whereas Alibaba Cloud's dedicated processing unit powered 11.11 for the Apsara Cloud operating system. The upgraded infrastructure system significantly improved the efficiency of computing, storage, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Investment Opportunities of Big Data Technology in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Investment Opportunities of Big Data Technology in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Investment Opportunities of Big Data Technology in China?

To stay informed about further developments, trends, and reports in the Investment Opportunities of Big Data Technology in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence