Key Insights

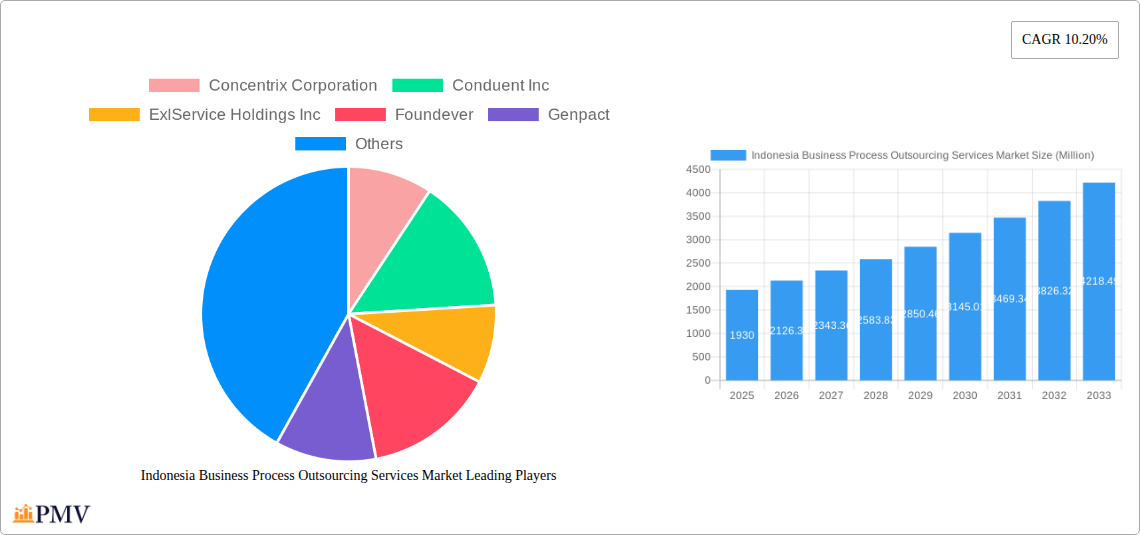

The Indonesia Business Process Outsourcing (BPO) services market is experiencing robust growth, projected to reach $1.93 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 10.20% from 2019 to 2033. This expansion is fueled by several key drivers. Firstly, Indonesia's burgeoning digital economy and increasing internet penetration create a massive pool of skilled and semi-skilled labor, making it an attractive outsourcing destination for businesses seeking cost-effective solutions. Secondly, government initiatives promoting digital transformation and investments in infrastructure are further bolstering the sector's growth. The rising adoption of cloud-based technologies and automation tools within Indonesian businesses also contributes to the increasing demand for BPO services, particularly in areas such as customer service, back-office operations, and data analytics. While challenges such as infrastructure limitations in certain regions and competition from other emerging markets exist, the overall market outlook remains positive due to the country's large and young population, and its strategic geographic location. The market is segmented by service type (e.g., customer service, back-office processing, IT outsourcing), industry vertical (e.g., finance, healthcare, manufacturing), and deployment model (onshore, nearshore, offshore). Key players such as Concentrix Corporation, Conduent Inc., and Teleperformance are actively shaping the market landscape through strategic partnerships, acquisitions, and investments in advanced technologies.

The forecast period of 2025-2033 promises continued growth, driven by sustained economic development and the increasing adoption of digital technologies across various sectors. Competitive pressures are likely to intensify as more companies enter the market, leading to increased service innovation and price optimization. Focus on specialized services and advanced technological capabilities will be crucial for success. Growth will likely be uneven across regions, with major urban centers attracting a larger share of BPO investments and skilled labor. A focus on employee training and development will be essential to maintain a competitive edge in the global BPO market. Further expansion is expected across various BPO service types, including data analytics, human resource outsourcing, and knowledge process outsourcing, catering to the growing demands of Indonesian and international businesses alike.

Indonesia Business Process Outsourcing (BPO) Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia Business Process Outsourcing (BPO) services market, covering the period 2019-2033. It offers valuable insights into market size, growth drivers, competitive landscape, and future trends, empowering businesses to make informed strategic decisions. The report meticulously analyzes market structure, competitive dynamics, industry trends, leading players, and key developments, providing a holistic understanding of this dynamic sector. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year, and the forecast period encompassing 2025-2033. The historical period covered is 2019-2024.

Indonesia Business Process Outsourcing Services Market Market Structure & Competitive Dynamics

The Indonesian BPO market exhibits a moderately concentrated structure, with several multinational corporations and local players vying for market share. The market's competitive intensity is influenced by factors such as pricing strategies, service differentiation, and technological innovation. The presence of a robust innovation ecosystem, fueled by government initiatives and private sector investments, fosters the development of advanced BPO solutions. However, the regulatory framework plays a significant role, impacting operational costs and market access. Product substitutes, such as automation technologies, present both challenges and opportunities, while end-user trends, including the increasing adoption of cloud-based solutions, are reshaping market dynamics. Mergers and acquisitions (M&A) activities are becoming increasingly prevalent, with deal values fluctuating based on market conditions. While precise market share data for individual players is proprietary, the report estimates the top 5 players collectively hold approximately xx% of the market, indicating a reasonably concentrated structure. The average M&A deal value in the last 5 years is estimated at xx Million USD.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystem: Strong, driven by government initiatives and private investments.

- Regulatory Framework: Influences operational costs and market entry.

- Product Substitutes: Automation technologies present a competitive pressure.

- End-User Trends: Shift towards cloud-based solutions.

- M&A Activity: Significant activity, with deal values influenced by market conditions.

Indonesia Business Process Outsourcing Services Market Industry Trends & Insights

The Indonesian BPO market exhibits robust growth, driven by factors such as increasing foreign investment, the rise of digital technologies, and government initiatives promoting digital transformation. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, exceeding the global average. Market penetration is rapidly increasing, as businesses across various sectors recognize the cost-effectiveness and operational efficiency offered by BPO services. Technological disruptions, such as the rise of artificial intelligence (AI) and automation, are fundamentally changing the nature of BPO services, creating opportunities for innovation and specialized skill sets. Consumer preferences are also evolving, with a greater emphasis on personalized and seamless customer experiences. This trend necessitates BPO providers to adapt their service offerings and invest in advanced technologies. Competitive dynamics are intensifying, with an increased focus on differentiation, specialization, and strategic partnerships.

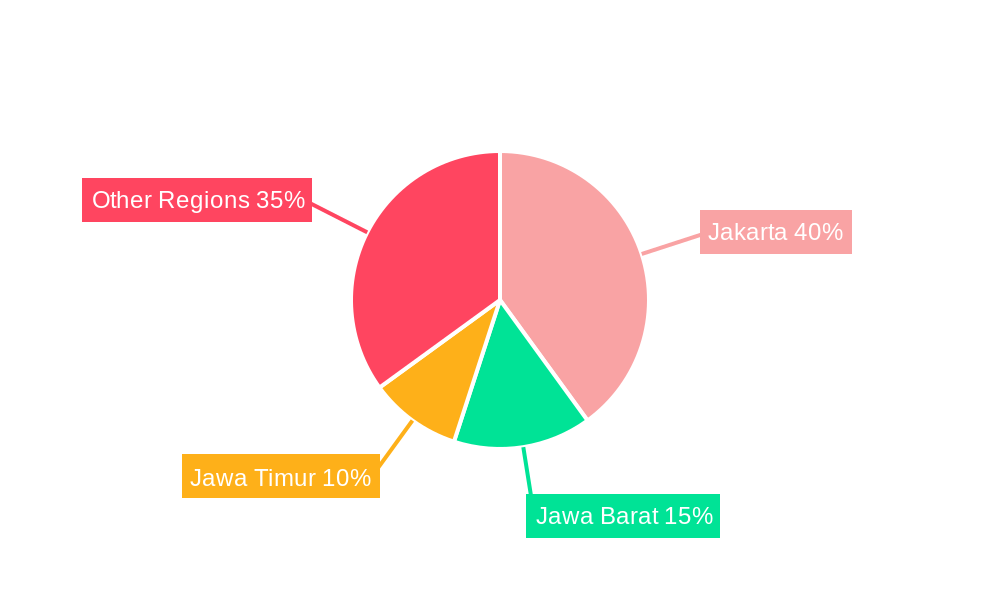

Dominant Markets & Segments in Indonesia Business Process Outsourcing Services Market

The report identifies Jakarta as the leading market for BPO services in Indonesia. This dominance is fueled by several key factors:

- Economic Policies: Government support for digitalization and infrastructure development.

- Infrastructure: Robust telecommunications infrastructure and access to a skilled workforce.

- Talent Pool: Large pool of English-speaking professionals.

- Strategic Location: Geographical proximity to other key Asian markets.

Jakarta's concentration of businesses, advanced infrastructure, and skilled workforce contribute significantly to its dominance in the BPO sector. Other regions are experiencing growth, but Jakarta's advantages solidify its position as the leading hub. The market is segmented by industry verticals (e.g., financial services, healthcare, IT, telecom), service types (e.g., customer service, back-office processing, data analytics), and deployment models (e.g., onshore, nearshore, offshore). However, more detailed segment-specific data is proprietary and not fully public. The report offers a detailed analysis of the growth projections and market size of these segments based on secondary and primary research.

Indonesia Business Process Outsourcing Services Market Product Innovations

Recent product innovations in the Indonesian BPO market center around AI-powered solutions, focusing on automation of repetitive tasks, improved customer interaction through chatbots and AI-driven analytics, and enhanced data security. These innovations offer competitive advantages by streamlining operations, improving efficiency, and providing better customer experiences. The market fit for these solutions is excellent, driven by the increasing demand for cost-effective and scalable BPO solutions.

Report Segmentation & Scope

The report segments the Indonesia BPO market by service type (e.g., customer service, back-office processing, data analytics, knowledge process outsourcing (KPO)), industry vertical (e.g., BFSI, healthcare, IT, telecom, manufacturing), deployment model (onshore, nearshore, offshore), and company size (small, medium, large). Each segment is analyzed in detail, including growth projections, market size estimates, and competitive dynamics. Precise growth rates vary by segment due to specific industry trends and adoption rates of technology. However, all segments indicate strong growth potential within the forecast period.

Key Drivers of Indonesia Business Process Outsourcing Services Market Growth

Several factors fuel the growth of the Indonesian BPO market:

- Government Initiatives: Policies promoting digitalization and investment in infrastructure.

- Cost Advantages: Lower labor costs compared to developed countries.

- Growing Digital Economy: The increasing adoption of technology across various sectors.

- Availability of Skilled Workforce: A large pool of English-speaking professionals.

- Strategic Location: Proximity to key Asian markets.

These factors collectively create a favorable environment for BPO growth in Indonesia. The government's commitment to digital transformation, coupled with a growing pool of skilled labor and cost advantages, makes Indonesia an attractive destination for BPO services.

Challenges in the Indonesia Business Process Outsourcing Services Market Sector

Despite the strong growth potential, several challenges hinder the sector's growth:

- Infrastructure Gaps: While improving, infrastructure in certain areas remains a limitation.

- Talent Acquisition & Retention: Competition for skilled workers is intensifying.

- Cybersecurity Concerns: The increasing reliance on technology necessitates robust security measures.

- Regulatory Compliance: Navigating complex regulations requires continuous effort.

- Competition from other Asian Hubs: The rise of other regional competitors.

These challenges necessitate proactive strategies from BPO providers to ensure sustainable growth.

Leading Players in the Indonesia Business Process Outsourcing Services Market Market

- Concentrix Corporation

- Conduent Inc

- ExlService Holdings Inc

- Foundever

- Genpact

- KPSG

- Majorel

- Relia Inc

- Teleperformance

- TELUS

- Transcom

- Transcosmos Inc

- TTEC Holdings Inc

- VADS BERHAD

- WNS (Holdings) Lt

Key Developments in Indonesia Business Process Outsourcing Services Market Sector

- April 2024: Microsoft pledged a USD 1.7 Billion investment over four years to boost Indonesia's digital evolution, focusing on upskilling 840,000 Indonesians for cloud and AI roles. This significantly strengthens the talent pool for BPO services.

- January 2023: TTEC Holdings Inc. partnered with Google Cloud to leverage AI-powered Contact Center-as-a-Service, improving customer engagement and service delivery, highlighting the adoption of advanced technologies within the sector.

Strategic Indonesia Business Process Outsourcing Services Market Market Outlook

The Indonesian BPO market presents significant growth opportunities, driven by ongoing digital transformation, government support, and a growing skilled workforce. Strategic investments in technology, talent development, and infrastructure will be crucial for BPO providers to capitalize on the market's potential. Focusing on specialized services, leveraging AI and automation, and establishing strong partnerships will be key success factors in this competitive landscape. The long-term outlook for the Indonesian BPO market remains exceptionally positive, with consistent growth anticipated throughout the forecast period.

Indonesia Business Process Outsourcing Services Market Segmentation

-

1. Process

- 1.1. HR

- 1.2. Sales and Marketing

- 1.3. Customer Care

- 1.4. Others

-

2. End User

- 2.1. BFSI

- 2.2. Telecom and IT

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Others

Indonesia Business Process Outsourcing Services Market Segmentation By Geography

- 1. Indonesia

Indonesia Business Process Outsourcing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations

- 3.3. Market Restrains

- 3.3.1. Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations

- 3.4. Market Trends

- 3.4.1. Customer Care to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Business Process Outsourcing Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. HR

- 5.1.2. Sales and Marketing

- 5.1.3. Customer Care

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. BFSI

- 5.2.2. Telecom and IT

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Concentrix Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Conduent Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExlService Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Foundever

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Genpact

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KPSG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Majorel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Relia Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Teleperformance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TELUS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Transcom

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Transcosmos Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TTEC Holdings Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 VADS BERHAD

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 WNS (Holdings) Lt

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Concentrix Corporation

List of Figures

- Figure 1: Indonesia Business Process Outsourcing Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Business Process Outsourcing Services Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Process 2019 & 2032

- Table 4: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Process 2019 & 2032

- Table 5: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by End User 2019 & 2032

- Table 7: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Process 2019 & 2032

- Table 10: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Process 2019 & 2032

- Table 11: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by End User 2019 & 2032

- Table 13: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Business Process Outsourcing Services Market?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the Indonesia Business Process Outsourcing Services Market?

Key companies in the market include Concentrix Corporation, Conduent Inc, ExlService Holdings Inc, Foundever, Genpact, KPSG, Majorel, Relia Inc, Teleperformance, TELUS, Transcom, Transcosmos Inc, TTEC Holdings Inc, VADS BERHAD, WNS (Holdings) Lt.

3. What are the main segments of the Indonesia Business Process Outsourcing Services Market?

The market segments include Process , End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations.

6. What are the notable trends driving market growth?

Customer Care to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations.

8. Can you provide examples of recent developments in the market?

April 2024 - Microsoft pledged a USD 1.7 billion investment over the next four years, underlining its commitment to bolster Indonesia's digital evolution. A key emphasis of this investment will be on upskilling 840,000 Indonesians, equipping them for roles in the burgeoning cloud and AI domains. This move resonates with Indonesia's broader vision outlined in the "Golden Indonesia 2045" initiative, which aspires to position the nation as a frontrunner in Southeast Asia's digital economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Business Process Outsourcing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Business Process Outsourcing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Business Process Outsourcing Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Business Process Outsourcing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence