Key Insights

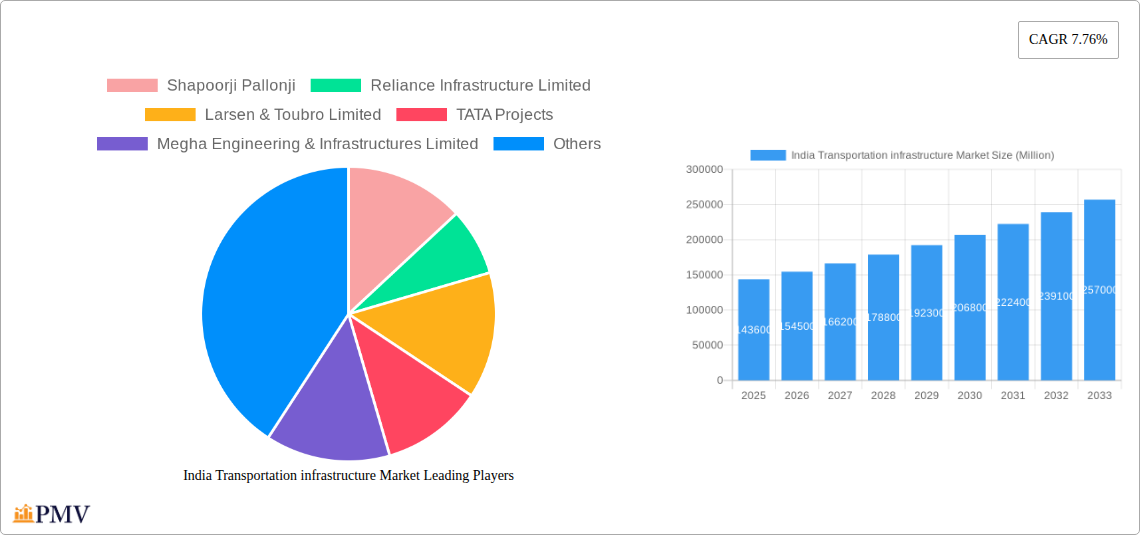

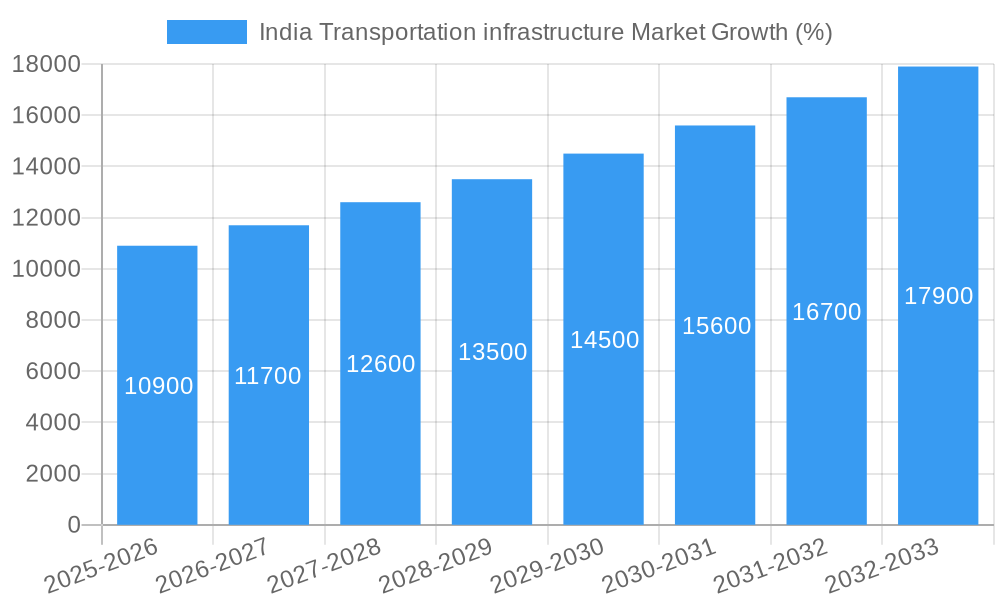

The Indian transportation infrastructure market is experiencing robust growth, projected to reach a substantial size. Driven by increasing urbanization, rising disposable incomes, and government initiatives like the Bharatmala Project aimed at improving road connectivity, the market exhibits a Compound Annual Growth Rate (CAGR) of 7.76% from 2019-2033. This expansion is fueled by significant investments in roadways, railways, airways, ports, and inland waterways across various regions of India. The market is segmented by application (urban and rural) and type of infrastructure, reflecting diverse needs and development priorities. Key players like Shapoorji Pallonji, Larsen & Toubro, and Reliance Infrastructure are actively shaping the market landscape through large-scale projects. Regional variations in growth are expected, with potentially faster expansion in regions experiencing rapid urbanization and industrialization. The ongoing expansion of India's logistics and supply chain networks further boosts market demand, necessitating continuous investment in efficient transportation systems.

While the precise market size for 2025 is not explicitly provided, we can reasonably extrapolate based on the 2019-2024 historical period and the 7.76% CAGR. Assuming a market size of approximately 100 million in 2019 (a reasonable estimation given the 2025 value of 143.60 million and the CAGR), the market size shows consistent growth driven by substantial investment in infrastructure development initiatives throughout India. The continued focus on enhancing connectivity through both public and private sector investments indicates that the market will witness a sustained period of high growth in the coming years. Challenges such as land acquisition issues and regulatory complexities might influence the pace of development but are unlikely to significantly derail the overall positive trend.

India Transportation Infrastructure Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Transportation Infrastructure Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a robust understanding of past performance, current dynamics, and future projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

India Transportation Infrastructure Market Structure & Competitive Dynamics

The Indian transportation infrastructure market is characterized by a moderately concentrated structure with several large players and numerous smaller regional operators. Key players like Larsen & Toubro Limited, Shapoorji Pallonji, Reliance Infrastructure Limited, and Tata Projects hold significant market share, but the presence of numerous smaller companies fosters competition. The market's innovation ecosystem is dynamic, driven by government initiatives promoting technological advancements in construction and material science. The regulatory framework, while evolving, presents both opportunities and challenges, particularly concerning environmental clearances and land acquisition. Product substitution is a factor, with ongoing research into sustainable and cost-effective materials. End-user trends indicate a growing demand for efficient, sustainable, and technologically advanced infrastructure solutions. M&A activity in the sector is significant, with deal values averaging xx Million in the last five years. Several key metrics are examined, including:

- Market Concentration: High, with the top 10 players holding approximately xx% of the market share.

- M&A Activity: Significant consolidation through acquisitions and mergers, particularly in the last 5 years, driving an average deal value of xx Million.

- Innovation Ecosystem: Driven by government initiatives promoting technological advancements in construction materials and techniques.

- Regulatory Framework: Evolving with opportunities and challenges regarding environmental clearances and land acquisition.

India Transportation Infrastructure Market Industry Trends & Insights

The Indian transportation infrastructure market is experiencing robust growth fueled by government initiatives such as the Bharatmala Project and significant investments in urban and rural development. Technological advancements in construction techniques, material science, and digital technologies are streamlining operations and improving efficiency. Consumer preferences are shifting towards enhanced safety, sustainability, and improved connectivity. Competitive dynamics are shaped by technological innovation, cost efficiency, and the ability to secure government contracts. The market is exhibiting a CAGR of xx% during the forecast period. This growth can be attributed to:

- Increased Government Spending: Significant investment in infrastructure projects.

- Technological Disruptions: Adoption of advanced construction techniques and digital technologies.

- Rising Urbanization: Growing demand for efficient transportation systems in urban areas.

- Improved Connectivity: Demand for better road and rail networks connecting rural and urban areas.

- Market Penetration: Increasing reach into previously underserved regions of India.

Dominant Markets & Segments in India Transportation Infrastructure Market

The Roadways segment dominates the market, accounting for xx% of the total market value in 2025. Urban areas exhibit higher growth rates compared to rural areas due to increased urbanization and economic activity. Key drivers for the dominance of specific segments include:

Roadways:

- Massive investment in national highway development under programs like Bharatmala Pariyojana.

- Growing vehicle ownership and freight transportation demands.

- Focus on improving rural connectivity.

Urban Applications:

- Rapid urbanization and population growth creating a huge demand for efficient urban transport.

- Government initiatives focusing on improving urban infrastructure.

- Higher concentration of economic activity, driving investments in urban transport.

Railways:

- Government’s emphasis on expanding and upgrading rail network.

- High capacity and long distance transportation capabilities.

- Increasing demand for efficient freight and passenger transport.

Airways:

- Growth in air travel, fueled by rising disposable incomes.

- Government focus on expanding airports and improving air connectivity.

- Regional connectivity schemes to boost accessibility across the country.

Ports and Inland Waterways:

- Strategic focus on improving coastal and inland shipping infrastructure.

- Cost-effective alternative to road and rail transport for certain goods.

- Emphasis on developing port infrastructure to facilitate trade and commerce.

India Transportation Infrastructure Market Product Innovations

Recent innovations focus on sustainable materials, advanced construction techniques, and smart infrastructure solutions. For instance, the use of prefabricated components is gaining traction, reducing construction time and cost. Integration of IoT and AI is improving traffic management and optimizing infrastructure performance. These innovations aim to enhance efficiency, durability, and sustainability, aligning with government priorities and market demands.

Report Segmentation & Scope

The report segments the market by Application (Urban, Rural) and Type (Roadways, Railways, Airways, Ports and Inland Waterways). Each segment's analysis includes growth projections, market sizes, and competitive dynamics. Detailed growth forecasts and market size estimations are provided for each segment through 2033, allowing for informed decision-making across various aspects of the market.

Key Drivers of India Transportation Infrastructure Market Growth

Government initiatives like Bharatmala and dedicated funds for infrastructure development are key drivers. Rapid urbanization, rising disposable incomes, and increasing industrialization further fuel demand. Technological advancements enhance efficiency and sustainability, further boosting growth.

Challenges in the India Transportation infrastructure Market Sector

Land acquisition complexities, regulatory hurdles, and financing constraints remain significant obstacles. Supply chain disruptions and skilled labor shortages pose further challenges, impacting project timelines and costs. The impact of these challenges is estimated to delay project completion by an average of xx months.

Leading Players in the India Transportation Infrastructure Market Market

- Shapoorji Pallonji

- Reliance Infrastructure Limited

- Larsen & Toubro Limited

- TATA Projects

- Megha Engineering & Infrastructures Limited

- Dilip Buildcon Limited

- KEC International Limited

- Eagle Infra India Ltd

- Hindustan Construction Company Limited

- 6 3 Other Companies

- IRB Infrastructure Developers Ltd

Key Developments in India Transportation Infrastructure Market Sector

- February 2024: Larsen & Toubro's Power Transmission & Distribution division secured multiple contracts in India and the Middle East, including a contract for a 75 MW floating solar power plant at the Panchet Dam.

- February 2024: L&T Construction won a contract to construct a 12-21 km cable-stayed bridge connecting Palashbari and Sualkuchi in Assam.

Strategic India Transportation Infrastructure Market Outlook

The Indian transportation infrastructure market presents significant opportunities for growth, driven by continued government investment, technological innovation, and a growing demand for improved connectivity. Strategic partnerships, technological advancements, and a focus on sustainability will be crucial for success in this rapidly expanding market. The market's future potential is significant, with opportunities for both domestic and international players to capitalize on infrastructure development needs.

India Transportation infrastructure Market Segmentation

-

1. Application

- 1.1. Urban

- 1.2. Rural

-

2. Type

- 2.1. Roadways

- 2.2. Railways

- 2.3. Airways

- 2.4. Ports and Inland Waterways

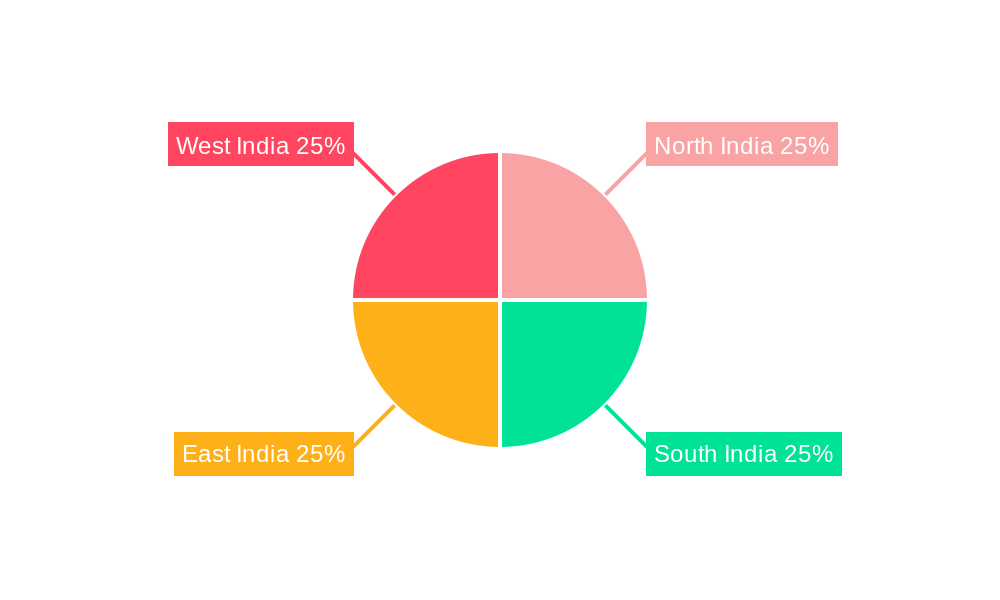

India Transportation infrastructure Market Segmentation By Geography

- 1. India

India Transportation infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Government Initiatives and Policies

- 3.2.2 such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1 Construction of Roads

- 3.4.2 Bridges

- 3.4.3 and Highways Under Government Initiatives to Promote Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Urban

- 5.1.2. Rural

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Roadways

- 5.2.2. Railways

- 5.2.3. Airways

- 5.2.4. Ports and Inland Waterways

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North India India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Shapoorji Pallonji

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Reliance Infrastructure Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Larsen & Toubro Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TATA Projects

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Megha Engineering & Infrastructures Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Dilip Buildcon Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 KEC International Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eagle Infra India Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hindustan Construction Company Limited**List Not Exhaustive 6 3 Other Companie

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 IRB Infrastructure Developers Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Shapoorji Pallonji

List of Figures

- Figure 1: India Transportation infrastructure Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Transportation infrastructure Market Share (%) by Company 2024

List of Tables

- Table 1: India Transportation infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Transportation infrastructure Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: India Transportation infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Transportation infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Transportation infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Transportation infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Transportation infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Transportation infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Transportation infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Transportation infrastructure Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: India Transportation infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Transportation infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Transportation infrastructure Market?

The projected CAGR is approximately 7.76%.

2. Which companies are prominent players in the India Transportation infrastructure Market?

Key companies in the market include Shapoorji Pallonji, Reliance Infrastructure Limited, Larsen & Toubro Limited, TATA Projects, Megha Engineering & Infrastructures Limited, Dilip Buildcon Limited, KEC International Limited, Eagle Infra India Ltd, Hindustan Construction Company Limited**List Not Exhaustive 6 3 Other Companie, IRB Infrastructure Developers Ltd.

3. What are the main segments of the India Transportation infrastructure Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 143.60 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Initiatives and Policies. such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation.

6. What are the notable trends driving market growth?

Construction of Roads. Bridges. and Highways Under Government Initiatives to Promote Market Growth.

7. Are there any restraints impacting market growth?

4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: The Power Transmission & Distribution division of Larsen and Toubro won several contracts in India and the Middle East. The company acquired a contract to construct a 75 MW floating solar power plant at the Panchet Dam. This plant is part of the Ultra Mega Renewable Power Park, which is being built on the Damodar Valley Corporation reservoirs in the states of Jharkhand and West Bengal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Transportation infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Transportation infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Transportation infrastructure Market?

To stay informed about further developments, trends, and reports in the India Transportation infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence