Key Insights

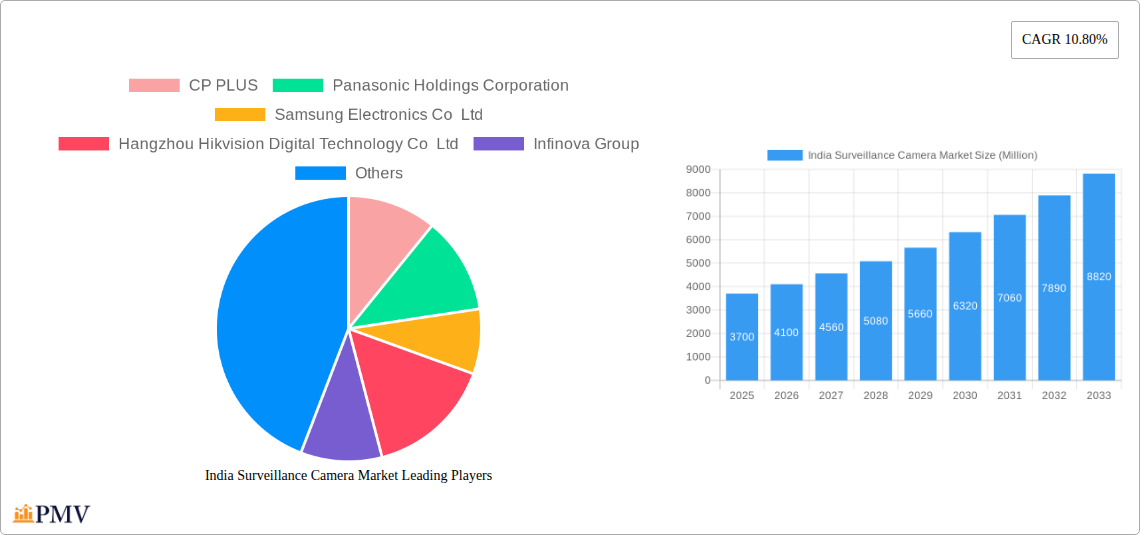

The India surveillance camera market, valued at $3.70 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 10.80% from 2025 to 2033. This expansion is fueled by several key factors. Increasing urbanization and infrastructure development are creating a greater need for security solutions across residential, commercial, and public spaces. Furthermore, rising concerns about crime and safety, coupled with advancements in technology such as AI-powered analytics and improved image quality in cameras, are driving adoption. Government initiatives promoting smart city projects and enhancing public safety infrastructure further contribute to market growth. The market is segmented by camera type (IP, analog, etc.), application (residential, commercial, industrial, etc.), and technology (HD, 4K, etc.). Major players like CP PLUS, Panasonic, Samsung, Hikvision, and Dahua are competing fiercely, offering a diverse range of products and services to meet the varying needs of customers. Competitive pricing strategies and strategic partnerships are key competitive advantages in this dynamic market.

While the market enjoys strong growth drivers, certain challenges exist. High initial investment costs for advanced surveillance systems can act as a restraint, particularly for smaller businesses and residential consumers. Data privacy concerns and the need for robust cybersecurity measures are also emerging as important considerations. However, the ongoing technological advancements and the increasing affordability of surveillance solutions are expected to mitigate these challenges to some extent. The market's future growth will largely depend on the successful integration of advanced technologies like cloud storage, facial recognition, and improved data analytics capabilities into surveillance systems. The continuous expansion of India's digital infrastructure and the growing awareness of security solutions will also play a significant role in shaping the market's trajectory.

India Surveillance Camera Market: A Comprehensive Report (2019-2033)

This detailed report provides an in-depth analysis of the India surveillance camera market, covering market structure, competitive dynamics, industry trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and policymakers. The market is currently valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

India Surveillance Camera Market Structure & Competitive Dynamics

The Indian surveillance camera market exhibits a moderately concentrated structure, with several key players holding significant market share. The market is characterized by intense competition, driven by both domestic and international manufacturers. The regulatory landscape is evolving, with recent emphasis on data security and preference for domestically produced solutions. Product substitution is minimal, with the market largely defined by CCTV, IP cameras, and other related security systems. End-user trends reveal a rising demand for advanced features like AI-powered analytics, cloud integration, and robust cybersecurity measures. M&A activity has been moderate, with deal values averaging xx Million in recent years. Key players are actively engaging in strategic partnerships and collaborations to enhance their market position and expand their product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share.

- Innovation Ecosystem: Growing, with emphasis on AI, IoT, and cloud-based technologies.

- Regulatory Framework: Evolving, emphasizing data security and preference for indigenous technologies.

- M&A Activity: Moderate, with recent deal values averaging xx Million.

- Product Substitutes: Minimal, with focus on improving existing technologies.

- End-User Trends: Increasing preference for advanced analytics and security features.

India Surveillance Camera Market Industry Trends & Insights

The India surveillance camera market is experiencing robust growth fueled by factors like increasing government initiatives for smart cities, rising concerns about security, and growing adoption of advanced technologies such as AI and cloud computing. Technological disruptions, including the introduction of 4G/5G-enabled cameras and improved image analytics, are driving market innovation. Consumer preferences are shifting towards user-friendly interfaces, cost-effective solutions, and advanced features like facial recognition and license plate recognition. Competitive dynamics are marked by intense price competition, product differentiation, and strategic alliances. The market penetration of IP cameras is steadily increasing, while the adoption of AI-powered solutions is gaining momentum. The overall market growth is anticipated to be influenced by macroeconomic conditions and government policies.

Dominant Markets & Segments in India Surveillance Camera Market

The metropolitan areas of India, particularly those undergoing rapid urbanization and infrastructure development, are witnessing the highest demand for surveillance cameras. This is driven by the increasing need for enhanced security in public spaces, commercial establishments, and residential complexes.

- Key Drivers in Metropolitan Areas:

- Government initiatives for smart city development.

- Rising crime rates and security concerns.

- Expanding infrastructure projects.

- Increased private sector investment in security systems.

The government sector is a significant driver for the surveillance camera market, while the private sector, encompassing various industries like banking, retail, and manufacturing, presents considerable opportunities. Detailed dominance analysis reveals a consistent upward trajectory in demand across all key segments.

India Surveillance Camera Market Product Innovations

Recent product innovations focus on incorporating advanced analytics, improved image quality, and enhanced security features. The integration of AI and IoT functionalities in cameras is becoming a defining trend. New products emphasize ease of use, cost-effectiveness, and seamless integration with existing security systems. The market is increasingly catering to specific requirements such as smart home security, traffic management, and public safety.

Report Segmentation & Scope

This report segments the India surveillance camera market based on product type (IP cameras, CCTV cameras, etc.), technology (analog, IP, etc.), application (residential, commercial, government, etc.), and region. Growth projections, market sizes, and competitive dynamics are presented for each segment. Market size data is provided for each segment for the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). Competitive landscape analysis for each segment is presented including market share and key player strategies.

Key Drivers of India Surveillance Camera Market Growth

Several factors fuel the growth of the India surveillance camera market. These include:

- Government initiatives: Smart city projects, increased emphasis on public safety, and regulations promoting domestic manufacturing.

- Rising security concerns: Increasing crime rates and terrorist threats drive demand for advanced security solutions.

- Technological advancements: The emergence of AI-powered analytics, IoT integration, and cloud-based solutions enhances surveillance capabilities.

- Urbanization and infrastructure development: Rapid urbanization creates a higher need for security measures.

Challenges in the India Surveillance Camera Market Sector

The India surveillance camera market faces several challenges.

- Data privacy concerns: Regulations and public awareness around data security and privacy need to be addressed.

- High initial investment costs: The cost of implementing advanced surveillance systems can be prohibitive for some customers.

- Cybersecurity threats: The increasing reliance on network-connected cameras raises vulnerabilities to cyberattacks.

- Supply chain disruptions: Global supply chain uncertainties impact the availability and cost of components.

Leading Players in the India Surveillance Camera Market

- CP PLUS

- Panasonic Holdings Corporation

- Samsung Electronics Co Ltd

- Hangzhou Hikvision Digital Technology Co Ltd

- Infinova Group

- Zicom

- Shenzhen TVT Digital Technology Co Ltd

- Sony Corporation

- Vantage Security

- Dahua Technology Co Ltd

Key Developments in India Surveillance Camera Market Sector

- April 2024: India's government implemented a regulation phasing out Chinese-made surveillance cameras by October 2024 due to security concerns. Over one million Chinese-made cameras are estimated to be in use. This development is expected to significantly boost demand for domestically produced cameras.

- January 2024: Consistent Infosystems launched a new series of "Made in India" surveillance cameras, including 4G-enabled models, expanding its presence in the security and surveillance sector. This aligns with the government's push for domestic manufacturing.

Strategic India Surveillance Camera Market Outlook

The India surveillance camera market holds significant growth potential, driven by the aforementioned factors and opportunities presented by expanding infrastructure, increasing adoption of smart city technologies, and a growing emphasis on public safety and security. Strategic opportunities exist for companies that can offer cost-effective, innovative, and secure solutions catering to specific market needs. The market is expected to see continued growth and evolution, with a focus on advanced technologies and domestic manufacturing.

India Surveillance Camera Market Segmentation

-

1. Type

- 1.1. Analog-based

- 1.2. IP-based

-

2. End-user Industry

- 2.1. Government

- 2.2. Banking

- 2.3. Healthcare

- 2.4. Transportation and Logistics

- 2.5. Industrial

- 2.6. Other En

India Surveillance Camera Market Segmentation By Geography

- 1. India

India Surveillance Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Public Safety and Security Concerns; Rapid Urbanization and Population Growth

- 3.3. Market Restrains

- 3.3.1. Increasing Public Safety and Security Concerns; Rapid Urbanization and Population Growth

- 3.4. Market Trends

- 3.4.1. IP-based Camera Type is Expected to Register Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Surveillance Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog-based

- 5.1.2. IP-based

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Government

- 5.2.2. Banking

- 5.2.3. Healthcare

- 5.2.4. Transportation and Logistics

- 5.2.5. Industrial

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CP PLUS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Panasonic Holdings Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Infinova Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zicom

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shenzhen TVT Digital Technology Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sony Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vantage Security

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dahua Technology Co Ltd*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CP PLUS

List of Figures

- Figure 1: India Surveillance Camera Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Surveillance Camera Market Share (%) by Company 2024

List of Tables

- Table 1: India Surveillance Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Surveillance Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: India Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: India Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: India Surveillance Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Surveillance Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: India Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: India Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: India Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: India Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: India Surveillance Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Surveillance Camera Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Surveillance Camera Market?

The projected CAGR is approximately 10.80%.

2. Which companies are prominent players in the India Surveillance Camera Market?

Key companies in the market include CP PLUS, Panasonic Holdings Corporation, Samsung Electronics Co Ltd, Hangzhou Hikvision Digital Technology Co Ltd, Infinova Group, Zicom, Shenzhen TVT Digital Technology Co Ltd, Sony Corporation, Vantage Security, Dahua Technology Co Ltd*List Not Exhaustive.

3. What are the main segments of the India Surveillance Camera Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Public Safety and Security Concerns; Rapid Urbanization and Population Growth.

6. What are the notable trends driving market growth?

IP-based Camera Type is Expected to Register Significant Growth Rate.

7. Are there any restraints impacting market growth?

Increasing Public Safety and Security Concerns; Rapid Urbanization and Population Growth.

8. Can you provide examples of recent developments in the market?

April 2024: India is bolstering the security of its government institutions by introducing a regulation that phases out Chinese-made surveillance cameras. This decision reflects mounting apprehensions over the security vulnerabilities linked to these devices. Current figures indicate that India boasts a surveillance camera count exceeding two million. Alarmingly, an estimated one million of these cameras are of Chinese origin, heightening fears of data breaches and unauthorized intrusions. In response, the Indian government has set a deadline of October 2024 to enforce this new regulation.January 2024: Consistent Infosystems has expanded its Security & Surveillance product line by launching a new series of Made in India surveillance cameras. This move bolsters its robust offerings in the IT, electronic, and home entertainment sectors. The latest lineup includes a diverse set of cameras: the Smart Wireless 4G PT Camera, 4G Solar Camera, Wireless Pan-Tilt Wifi 3MP/4MP Mini Wi-Fi P2P Plug and Play, 4G Color Camera, and the 4G Dome CCTV Camera, providing a comprehensive surveillance solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Surveillance Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Surveillance Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Surveillance Camera Market?

To stay informed about further developments, trends, and reports in the India Surveillance Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence