Key Insights

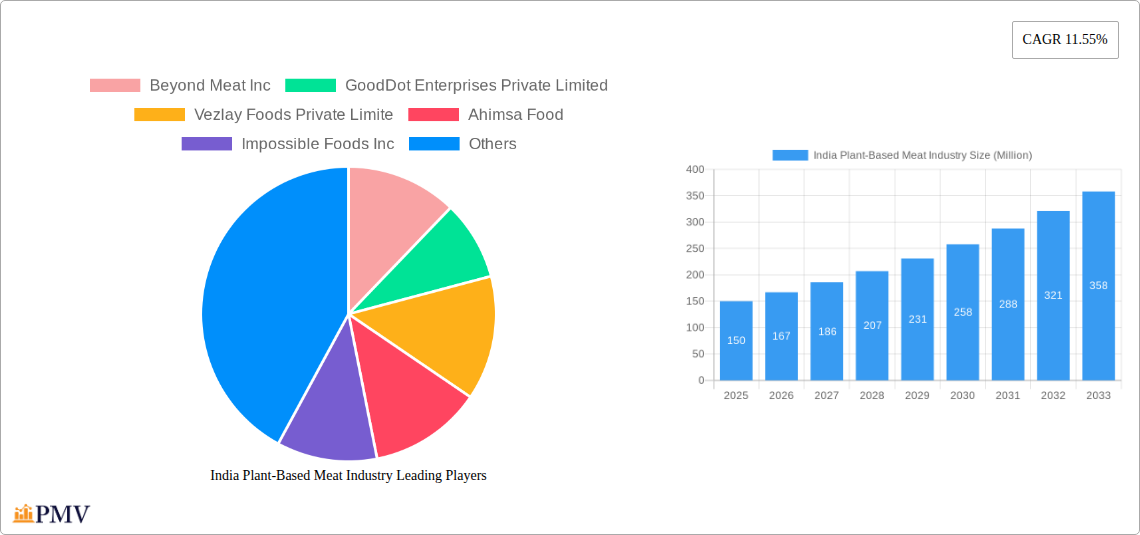

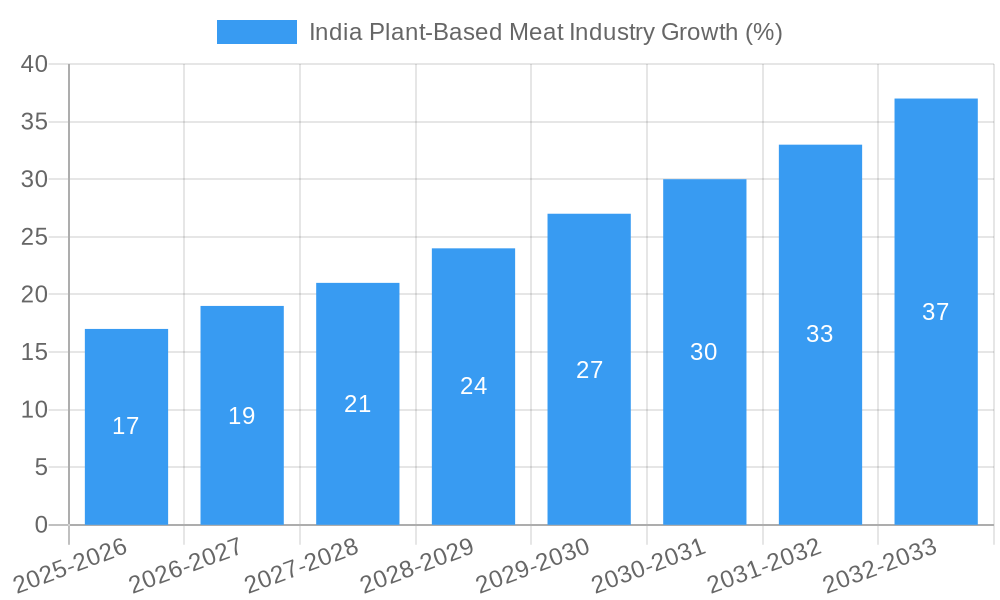

The Indian plant-based meat industry is experiencing robust growth, driven by increasing consumer awareness of health benefits, environmental concerns, and ethical considerations surrounding meat consumption. The rising prevalence of vegetarianism and veganism, particularly among younger demographics, significantly fuels this market expansion. Furthermore, the growing middle class with increased disposable income is driving demand for premium and convenient food options, including plant-based alternatives. While precise market sizing for India is unavailable in the provided data, considering a global CAGR of 11.55% and the burgeoning Indian market's potential, a reasonable estimation for the 2025 market size in India could be between $100 and $200 million, acknowledging the significant influence of factors like product innovation and consumer adoption. This estimate considers the rapid expansion observed in other developing nations with similar socio-economic conditions. Key market segments include tofu, tempeh, textured vegetable protein, and other meat substitutes, distributed through both off-trade (retail) and on-trade (food service) channels. The application of these products ranges from meat substitutes to dairy alternatives, indicating a diversified and evolving market. Challenges include overcoming consumer perceptions about taste and texture, ensuring affordability for a price-sensitive market, and establishing robust supply chains. However, innovative product development, strategic partnerships, and focused marketing campaigns are poised to address these challenges and drive further growth in the coming years.

The competitive landscape features both domestic and international players, with established brands like Beyond Meat and Impossible Foods alongside burgeoning Indian companies such as GoodDot and Vezlay Foods. These companies are crucial in shaping the market through their investments in research and development, product diversification, and expansion strategies. The Asia-Pacific region, particularly India, presents a substantial growth opportunity due to the large population base and evolving consumer preferences. Future growth will depend on factors including government support for sustainable food systems, technological advancements in plant-based protein production, and successful marketing efforts to increase consumer acceptance. The forecast period (2025-2033) projects continued expansion, with the market expected to be significantly larger by 2033, driven by ongoing market trends and consumer adoption.

This comprehensive report provides an in-depth analysis of the burgeoning India plant-based meat industry, offering crucial insights for investors, industry players, and strategic decision-makers. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report unveils the market's structure, competitive dynamics, growth drivers, and challenges. The report segments the market by Type (Tofu, Tempeh, Textured Vegetable Protein, Other Meat Substitutes), Distribution Channel (Off-Trade, On-Trade), and Application (Meat Substitutes, Dairy Alternatives). With a projected market value reaching xx Million by 2033, understanding this market is crucial for future success.

India Plant-Based Meat Industry Market Structure & Competitive Dynamics

The Indian plant-based meat market is characterized by a moderately fragmented structure, with a mix of established international players like Beyond Meat Inc and Impossible Foods Inc, and rapidly growing domestic companies such as GoodDot Enterprises Private Limited, Vezlay Foods Private Limited, and Ahimsa Food. Market concentration is relatively low, presenting opportunities for new entrants. However, the entry of established global players signifies increasing competition. The innovation ecosystem is vibrant, with companies focusing on developing diverse product offerings and improving taste and texture. Regulatory frameworks, though still developing, are supportive of plant-based alternatives. The market also faces competition from traditional meat products and other protein sources. M&A activity remains limited, with only a few reported deals, such as the October 2022 partnership between Allana Consumer Products and Beyond Meat Inc., valued at an estimated xx Million. End-user trends point to increasing health consciousness and demand for sustainable and ethical food choices, driving the adoption of plant-based meat products.

- Market Share: Beyond Meat and Impossible Foods currently hold a combined xx% market share, while domestic players account for the remaining xx%.

- M&A Activity: The Allana Consumer Products-Beyond Meat deal highlights the potential for strategic partnerships and increased market penetration. Further M&A activity is predicted, potentially leading to market consolidation.

- Innovation Ecosystem: Focus is on improving product taste, texture, and nutritional value, including exploring novel protein sources and production techniques.

- Regulatory Framework: The government's focus on sustainable food systems and reducing meat consumption supports the industry's growth.

India Plant-Based Meat Industry Industry Trends & Insights

The Indian plant-based meat industry is experiencing robust growth, driven by several factors. Increasing consumer awareness of health benefits, coupled with rising disposable incomes, is fueling demand for plant-based alternatives. This is further reinforced by the growing adoption of vegetarian and vegan lifestyles among a significant portion of the population. The market is witnessing technological advancements in product development, focusing on replicating the taste and texture of meat. The CAGR (Compound Annual Growth Rate) during the forecast period (2025-2033) is estimated at xx%, with market penetration projected to reach xx% by 2033. Competitive dynamics are characterized by both intense competition and collaboration, with companies focusing on both innovation and distribution partnerships. The industry also faces challenges such as consumer perceptions, price sensitivity, and the need to enhance product availability.

Dominant Markets & Segments in India Plant-Based Meat Industry

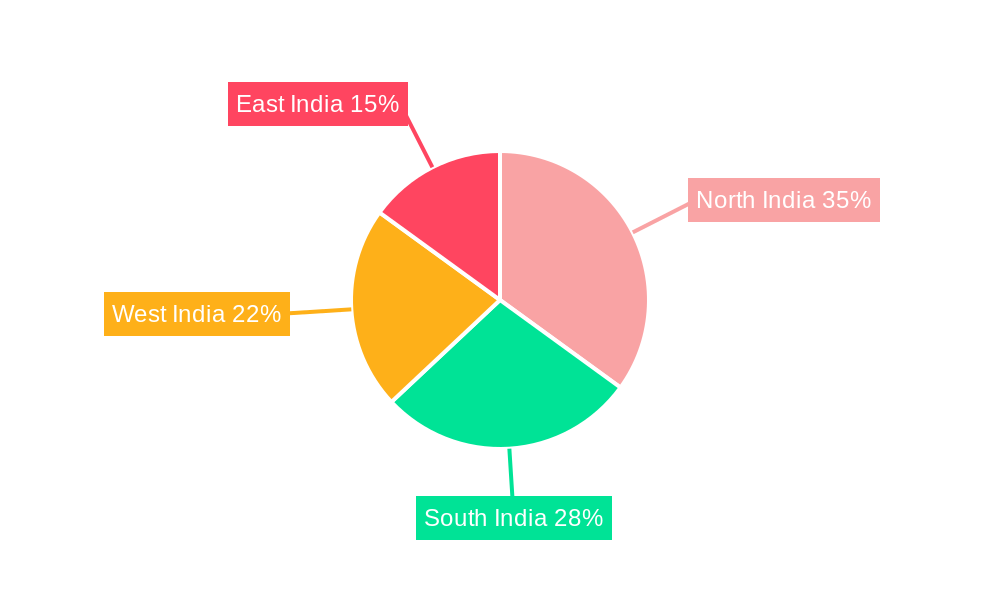

The plant-based meat market exhibits strong growth across various regions in India, with the metropolitan areas displaying the highest demand due to increased awareness and access to diverse products. The "Other Meat Substitutes" segment is the fastest growing, owing to its flexibility and innovation potential. The On-Trade channel (restaurants, cafes) is expanding rapidly, driven by the growing adoption of plant-based options in menus. Meat substitutes dominate the applications segment, significantly exceeding dairy alternatives, which are still in their nascent stages.

- Key Drivers for the "Other Meat Substitutes" segment:

- Increasing consumer demand for variety and innovative flavors.

- Technological advancements enabling the creation of novel and appealing products.

- Strategic partnerships and marketing efforts by major players.

- Key Drivers for the On-Trade channel:

- Growing awareness of plant-based options among restaurant owners and consumers.

- Increasing demand for convenience and ready-to-eat options.

- Partnerships between plant-based companies and foodservice providers.

- Key Drivers for the Meat Substitutes application:

- Rising awareness of health concerns associated with meat consumption.

- Desire for healthier and sustainable alternatives.

- Increased affordability of plant-based meat substitutes.

India Plant-Based Meat Industry Product Innovations

The Indian plant-based meat market is witnessing a surge in product innovations, with companies focusing on improving the taste, texture, and nutritional value of their products. Technological advancements are enabling the development of meat alternatives that closely resemble their conventional counterparts. The emphasis is on creating versatile products that can be used in various culinary applications. These innovations are crucial for gaining acceptance among a wider consumer base and boosting market growth. Examples include Impossible Foods' new plant-based chicken line-up and Beyond Meat's range of burgers, meatballs, and sausages.

Report Segmentation & Scope

The report segments the India plant-based meat market by:

Type: Tofu, Tempeh, Textured Vegetable Protein, and Other Meat Substitutes. The "Other Meat Substitutes" segment is expected to witness the highest growth due to its variety and innovative potential.

Distribution Channel: Off-Trade (retail stores, supermarkets) and On-Trade (restaurants, cafes, hotels). The On-Trade channel is projected to have higher growth due to increasing adoption by foodservice providers.

Application: Meat Substitutes and Dairy Alternatives. Meat substitutes constitute the majority of the market currently.

Each segment's growth projection, market size, and competitive landscape are detailed within the full report.

Key Drivers of India Plant-Based Meat Industry Growth

Several factors are driving the growth of the India plant-based meat market. These include:

- Rising health consciousness: Growing awareness of health risks associated with meat consumption.

- Increasing vegetarian and vegan population: A significant portion of the Indian population follows vegetarian or vegan diets.

- Technological advancements: Innovations in product development are leading to tastier and more appealing alternatives.

- Government support for sustainable food systems: Policies promoting sustainable agriculture and reducing meat consumption are supportive of the industry.

Challenges in the India Plant-Based Meat Industry Sector

Despite its growth potential, the India plant-based meat industry faces several challenges:

- Price sensitivity: Plant-based meat products are often more expensive than conventional meat.

- Limited consumer awareness: A large segment of the population remains unaware of plant-based meat alternatives.

- Supply chain limitations: The infrastructure and logistics for distributing plant-based products are still developing.

- Competition from traditional meat and other protein sources: Plant-based meat competes with well-established and widely accessible protein sources. The impact of these challenges is an estimated xx% reduction in potential market growth during the forecast period.

Leading Players in the India Plant-Based Meat Industry Market

- Beyond Meat Inc

- GoodDot Enterprises Private Limited

- Vezlay Foods Private Limited

- Ahimsa Food

- Impossible Foods Inc

- Morinaga Milk Industry Co Ltd

- Ai' Premium Tofu Mfg Co LLC

- Imagine Foods Pvt Ltd

Key Developments in India Plant-Based Meat Industry Sector

- June 2022: Coffee chain Tata Starbucks partnered with Imagine Meats to sell vegan food in India.

- October 2022: Allana Consumer Products partnered with Beyond Meat Inc. to distribute its products in India.

- February 2023: Impossible Foods introduced a new plant-based chicken product line-up.

These developments indicate the growing interest of major players in the Indian market and highlight the increasing acceptance of plant-based products.

Strategic India Plant-Based Meat Industry Market Outlook

The Indian plant-based meat market presents significant growth opportunities. Future success hinges on overcoming challenges related to price, awareness, and supply chain infrastructure. Companies that invest in product innovation, build strong distribution networks, and effectively target consumer segments will be well-positioned to capitalize on this market's potential. The market is expected to experience substantial growth, driven by increasing consumer demand for healthier and more sustainable food options. Strategic partnerships and investments in technological advancements will be critical for driving future growth.

India Plant-Based Meat Industry Segmentation

-

1. Type

- 1.1. Tempeh

- 1.2. Textured Vegetable Protein

- 1.3. Tofu

- 1.4. Other Meat Substitutes

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

India Plant-Based Meat Industry Segmentation By Geography

- 1. India

India Plant-Based Meat Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Plant-Based Meat Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tempeh

- 5.1.2. Textured Vegetable Protein

- 5.1.3. Tofu

- 5.1.4. Other Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China India Plant-Based Meat Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan India Plant-Based Meat Industry Analysis, Insights and Forecast, 2019-2031

- 8. India India Plant-Based Meat Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea India Plant-Based Meat Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan India Plant-Based Meat Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia India Plant-Based Meat Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific India Plant-Based Meat Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Beyond Meat Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 GoodDot Enterprises Private Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Vezlay Foods Private Limite

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Ahimsa Food

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Impossible Foods Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Morinaga Milk Industry Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ai' Premium Tofu Mfg Co LLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Imagine Foods Pvt Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Beyond Meat Inc

List of Figures

- Figure 1: India Plant-Based Meat Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Plant-Based Meat Industry Share (%) by Company 2024

List of Tables

- Table 1: India Plant-Based Meat Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Plant-Based Meat Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Plant-Based Meat Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: India Plant-Based Meat Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Plant-Based Meat Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China India Plant-Based Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan India Plant-Based Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India India Plant-Based Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea India Plant-Based Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan India Plant-Based Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia India Plant-Based Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific India Plant-Based Meat Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Plant-Based Meat Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: India Plant-Based Meat Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: India Plant-Based Meat Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Plant-Based Meat Industry?

The projected CAGR is approximately 11.55%.

2. Which companies are prominent players in the India Plant-Based Meat Industry?

Key companies in the market include Beyond Meat Inc, GoodDot Enterprises Private Limited, Vezlay Foods Private Limite, Ahimsa Food, Impossible Foods Inc, Morinaga Milk Industry Co Ltd, Ai' Premium Tofu Mfg Co LLC, Imagine Foods Pvt Ltd.

3. What are the main segments of the India Plant-Based Meat Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

February 2023: Impossible Foods’ introduced a new plant-based chicken products line-up.October 2022: Allana Consumer Products has partnered with Beyond Meat Inc.to distribute Beyond plant based Meat's range of beyond burger, meatballs, sausages, minced meat throughout the India.June 2022: Coffee chain Tata Starbucks has tied up with plant-based food company Imagine Meats to sell vegan food in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Plant-Based Meat Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Plant-Based Meat Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Plant-Based Meat Industry?

To stay informed about further developments, trends, and reports in the India Plant-Based Meat Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence