Key Insights

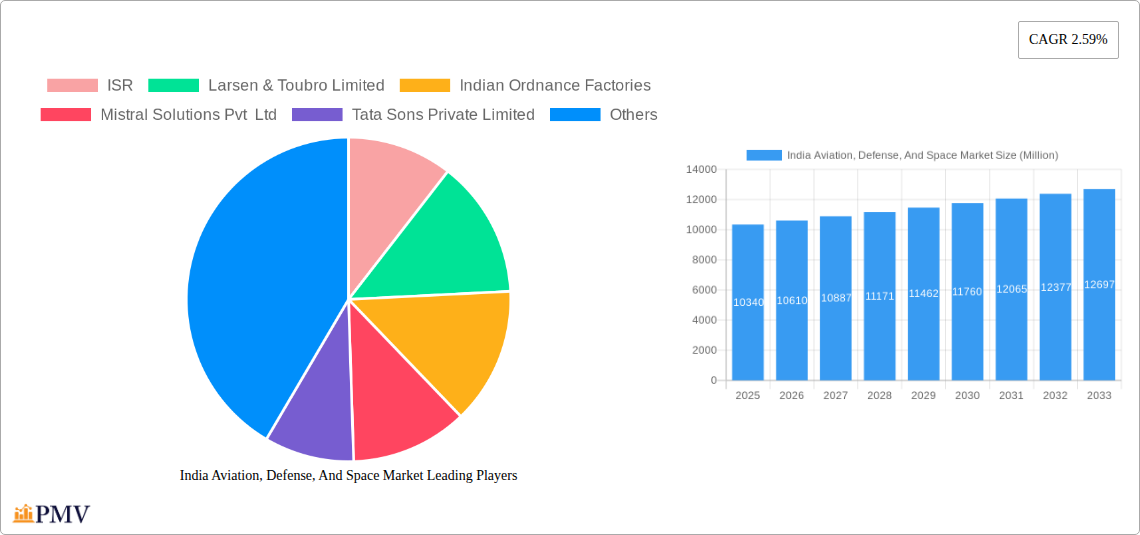

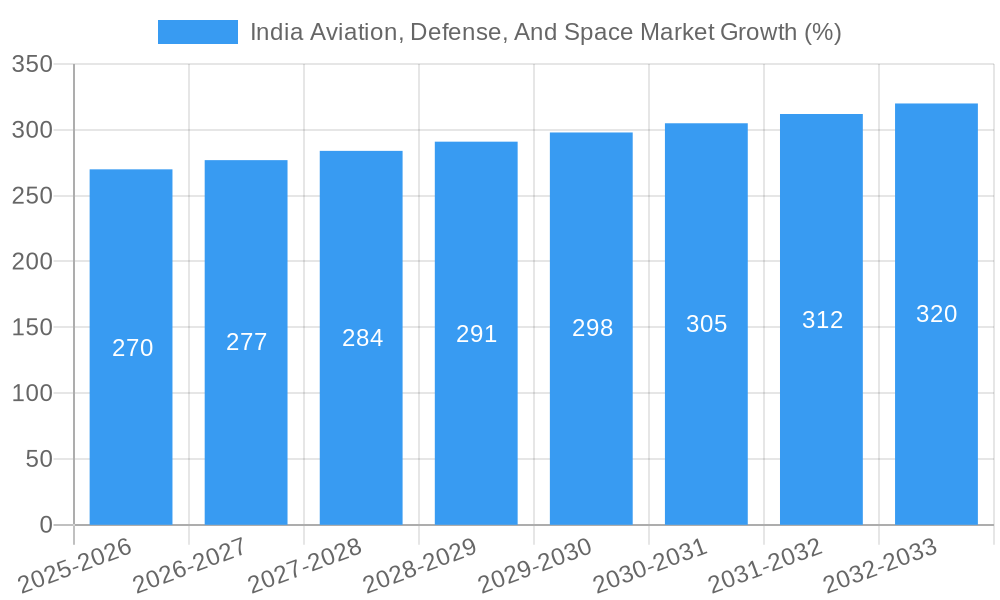

The India Aviation, Defense, and Space market, valued at $10.34 billion in 2025, is projected to experience robust growth, driven by increasing government expenditure on defense modernization, a burgeoning civil aviation sector fueled by rising air travel demand, and a national focus on expanding space exploration capabilities. The 2.59% CAGR from 2025 to 2033 indicates a steady, albeit not explosive, expansion. Key segments include the Air Force (with significant investment in combat aircraft, UAVs, and munitions), the Army (focused on armored vehicles, helicopters, and weapons systems), the Navy (prioritizing naval vessels and aircraft), and the burgeoning Space sector emphasizing satellite launch vehicles. The civil aviation segment also contributes significantly, boosted by expanding domestic and international air travel. Leading players such as HAL, Larsen & Toubro, Bharat Electronics Limited, and Tata Sons are strategically positioned to capitalize on these opportunities. Government initiatives promoting indigenous technology development and Make in India policies are further bolstering market growth. However, potential challenges could include global supply chain disruptions, technological advancements demanding continuous upgrades, and the need for sustained investment in research and development. The market's regional distribution reflects India's diverse geography and economic development levels, with likely higher concentration in the more industrialized regions.

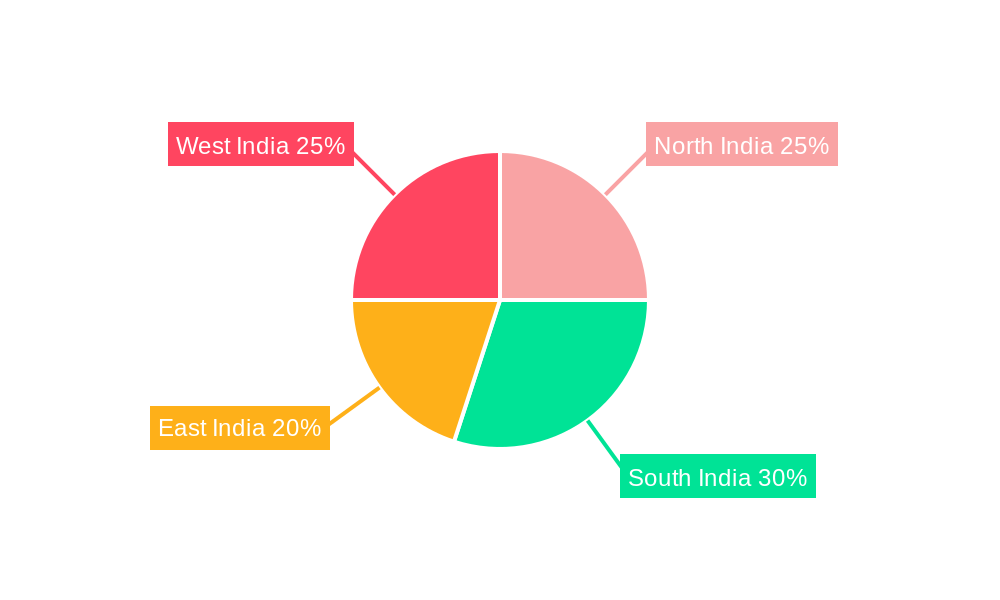

Regional variations in growth are expected, with southern and western India, boasting significant industrial hubs and port infrastructure, potentially exhibiting faster growth than eastern and northern India. This disparity will likely be influenced by infrastructure development, government policies focused on specific regions, and the concentration of major players. The market's structure suggests a combination of large established players and emerging indigenous companies. Competition is likely to intensify as both domestic and international firms vie for market share, necessitating innovation and strategic partnerships to succeed. The long-term outlook remains positive, driven by India's strategic priorities and the country’s growing economic might.

India Aviation, Defense, and Space Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Indian aviation, defense, and space market, covering the period from 2019 to 2033. It delves into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key growth drivers, offering valuable insights for stakeholders across the industry. The report utilizes data from the historical period (2019-2024), with the base year being 2025 and the forecast period extending to 2033. All monetary values are expressed in millions.

India Aviation, Defense, and Space Market Structure & Competitive Dynamics

The Indian aviation, defense, and space market exhibits a complex interplay of established players and emerging companies. Market concentration is moderate, with a few large conglomerates like Tata Sons Private Limited, Adani Group, and Mahindra & Mahindra Limited holding significant shares, particularly in the civil aviation and defense sectors. However, numerous smaller specialized companies, such as Mistral Solutions Pvt Ltd and ISR, contribute significantly to niche segments.

The regulatory framework, influenced by government policies favoring "Make in India" initiatives, significantly impacts market dynamics. This initiative drives domestic manufacturing and technology development, thereby boosting local companies and limiting the market share of foreign players. The innovation ecosystem is evolving rapidly, driven by government investments in R&D and increasing private sector participation in emerging technologies like UAVs and space-based applications. Product substitutes are limited in many defense segments due to stringent quality and performance standards, while competition is more pronounced in the civil aviation sector.

Mergers and acquisitions (M&A) activity is prevalent, with deal values showing a considerable increase in recent years, driven by consolidation and expansion strategies among major players. For instance, xx Million worth of M&A deals were recorded in 2024 across the sector. This trend reflects a drive towards achieving economies of scale and expanding capabilities. Key aspects of the industry dynamics include:

- High government spending on defense modernization and infrastructure.

- Significant investments in the space sector, driving the growth of satellite launch vehicles and related services.

- Increased focus on indigenization and self-reliance in defense manufacturing.

- Growing demand for commercial aircraft, particularly in the domestic market.

- Increasing adoption of advanced technologies, such as AI and machine learning, across all segments.

India Aviation, Defense, and Space Market Industry Trends & Insights

The Indian aviation, defense, and space market is characterized by strong growth potential driven by various factors. The government's commitment to defense modernization and infrastructure development is a major driver, with significant budgetary allocations fueling demand for various systems. Furthermore, increasing air travel and the expansion of the domestic airline network are boosting the civil aviation segment. The space sector, witnessing significant private sector participation, is expected to witness exponential growth over the forecast period.

Technological advancements are creating disruption, particularly in the UAV and satellite technology segments. The emergence of AI-powered solutions and advanced materials is transforming the defense landscape, improving system performance and efficiency. Consumer preferences are shifting towards better safety, connectivity, and cost-effective travel solutions, pushing innovation in both the defense and civil aviation segments. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration growing to approximately xx% by 2033. The competitive landscape is characterized by increasing partnerships and joint ventures, facilitating the sharing of technology and expertise.

Dominant Markets & Segments in India Aviation, Defense, and Space Market

The Indian defense sector dominates the overall market, with the Air Force, Army, and Navy segments witnessing substantial growth. Civil aviation also contributes significantly. Within the defense segment, the demand for combat aircraft (both fixed-wing and helicopters), UAVs, and weapons and munitions shows consistent growth. This is largely due to escalating geopolitical tensions and the government’s resolve to modernize its defense capabilities.

Key Drivers for Defense Dominance:

- Increased defense budgets.

- Focus on indigenous defense manufacturing.

- Geopolitical factors.

- Modernization of armed forces.

Key Drivers for Civil Aviation Growth:

- Rising disposable incomes.

- Expansion of air travel network.

- Government initiatives to improve airport infrastructure.

The space sector is emerging as a significant contributor, driven by government initiatives to enhance space capabilities and the entry of private players. The dominant segment within the space sector is the satellite launch vehicle market, fueled by rising demand for communication, navigation, and remote sensing applications.

India Aviation, Defense, and Space Market Product Innovations

Recent innovations are focused on enhancing the performance, efficiency, and technological sophistication of defense and aerospace systems. This includes the development of advanced UAVs with increased range and payload capacity, the integration of AI and machine learning algorithms for enhanced situational awareness, and the use of lightweight and durable materials to improve the performance and durability of aircraft and spacecraft. These technological advancements align with the growing need for technologically superior and cost-effective solutions within the Indian market.

Report Segmentation & Scope

The report segments the market into the following:

Air Force: Combat and Non-Combat Aircraft (Fixed Wing and Helicopter), UAVs, Weapons and Munitions, MRO. Growth is projected at xx% CAGR. Key players include HAL and BEL.

Army: Armored Vehicles, Helicopters, and UAVs, Weapons and Munitions, MRO. Growth is projected at xx% CAGR. Key players include Indian Ordnance Factories and Kalyani Steels Ltd.

Navy: Naval Vessels, Combat and Non-combat Aircraft, and UAVs, Weapons and Munitions, MRO. Growth is projected at xx% CAGR. Key players include Goa Shipyard Limited.

Space: Satellite Launch Vehicles. Growth is projected at xx% CAGR. Key players include ISRO (Indian Space Research Organisation).

Civil Aviation: Commercial Aircraft, Business Jets, MRO. Growth is projected at xx% CAGR. Key players include Air India, and other airlines and related service providers. Competition is fierce in this sector.

Key Drivers of India Aviation, Defense, and Space Market Growth

Several factors propel the growth of the India Aviation, Defense, and Space Market. These include:

- Government Initiatives: The "Make in India" initiative and increased defense expenditure are significantly boosting the domestic manufacturing base.

- Technological Advancements: The development of advanced technologies in areas such as UAVs, AI, and space-based systems is driving demand and innovation.

- Economic Growth: India's burgeoning economy is creating greater demand for air travel and related services.

- Infrastructure Development: Improvements to airport infrastructure and transportation networks are enhancing connectivity and accessibility.

Challenges in the India Aviation, Defense, and Space Market Sector

Despite the significant growth potential, the sector faces several challenges:

- Regulatory Hurdles: Navigating complex regulatory frameworks can create delays and increase costs for companies.

- Supply Chain Issues: Dependence on imports for certain critical components can impact production timelines and costs.

- Competitive Pressures: Increasing competition from both domestic and international players necessitates continuous innovation and adaptation.

- Skilled Labor Shortage: A shortage of skilled labor is a significant constraint for many companies.

Leading Players in the India Aviation, Defense, and Space Market Market

- ISR

- Larsen & Toubro Limited

- Indian Ordnance Factories

- Mistral Solutions Pvt Ltd

- Tata Sons Private Limited

- Goa Shipyard Limited

- Kalyani Steels Ltd (KSL)

- Hindustan Aeronautics Limited (HAL)

- Hinduja Group

- Mahindra & Mahindra Limited

- Adani Group

- Bharat Electronics Limited (BEL)

Key Developments in India Aviation, Defense, and Space Market Sector

December 2023: The Indian government approved defense acquisition projects worth USD 2.67 Million, including 97 Tejas light combat aircraft and 156 Prachand combat helicopters. 98% of procurement will be sourced domestically. This signals a strong commitment to boosting the domestic defense industry.

February 2023: Air India's order for Boeing aircraft (737 MAX, 787 Dreamliner, and 777X), totaling 190 737 MAXs with options for 50 more, signifies a major boost to the civil aviation sector and international partnerships.

Strategic India Aviation, Defense, and Space Market Outlook

The future of the Indian aviation, defense, and space market appears promising, driven by sustained government support, technological advancements, and increasing private sector participation. Strategic opportunities exist in leveraging emerging technologies, expanding into new segments, and forging strategic partnerships to capitalize on the substantial growth potential. The focus on indigenization and technological self-reliance will further enhance the sector's competitive edge and establish India as a significant player in the global aerospace and defense markets.

India Aviation, Defense, And Space Market Segmentation

-

1. Air Force

- 1.1. Combat a

- 1.2. Weapons and Munitions

- 1.3. MRO

-

2. Army

- 2.1. Armored Vehicles, Helicopters, and UAVs

- 2.2. Weapons and Munitions

- 2.3. MRO

-

3. Navy

- 3.1. Naval Ve

- 3.2. Weapons and Munitions

- 3.3. MRO

-

4. Space

- 4.1. Satellite

- 4.2. Launch Vehicles and Rovers

-

5. Civil Aviation

- 5.1. Commercial Aircraft

- 5.2. Business Jet

- 5.3. MRO

India Aviation, Defense, And Space Market Segmentation By Geography

- 1. India

India Aviation, Defense, And Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Civil Aviation Segment to Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Air Force

- 5.1.1. Combat a

- 5.1.2. Weapons and Munitions

- 5.1.3. MRO

- 5.2. Market Analysis, Insights and Forecast - by Army

- 5.2.1. Armored Vehicles, Helicopters, and UAVs

- 5.2.2. Weapons and Munitions

- 5.2.3. MRO

- 5.3. Market Analysis, Insights and Forecast - by Navy

- 5.3.1. Naval Ve

- 5.3.2. Weapons and Munitions

- 5.3.3. MRO

- 5.4. Market Analysis, Insights and Forecast - by Space

- 5.4.1. Satellite

- 5.4.2. Launch Vehicles and Rovers

- 5.5. Market Analysis, Insights and Forecast - by Civil Aviation

- 5.5.1. Commercial Aircraft

- 5.5.2. Business Jet

- 5.5.3. MRO

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Air Force

- 6. North India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ISR

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Larsen & Toubro Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Indian Ordnance Factories

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mistral Solutions Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tata Sons Private Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Goa Shipyard Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kalyani Steels Ltd (KSL)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hindustan Aeronautics Limited (HAL)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hinduja Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mahindra & Mahindra Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Adani Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Bharat Electronics Limited (BEL)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 ISR

List of Figures

- Figure 1: India Aviation, Defense, And Space Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Aviation, Defense, And Space Market Share (%) by Company 2024

List of Tables

- Table 1: India Aviation, Defense, And Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Aviation, Defense, And Space Market Revenue Million Forecast, by Air Force 2019 & 2032

- Table 3: India Aviation, Defense, And Space Market Revenue Million Forecast, by Army 2019 & 2032

- Table 4: India Aviation, Defense, And Space Market Revenue Million Forecast, by Navy 2019 & 2032

- Table 5: India Aviation, Defense, And Space Market Revenue Million Forecast, by Space 2019 & 2032

- Table 6: India Aviation, Defense, And Space Market Revenue Million Forecast, by Civil Aviation 2019 & 2032

- Table 7: India Aviation, Defense, And Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Aviation, Defense, And Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: North India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: East India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: West India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Aviation, Defense, And Space Market Revenue Million Forecast, by Air Force 2019 & 2032

- Table 14: India Aviation, Defense, And Space Market Revenue Million Forecast, by Army 2019 & 2032

- Table 15: India Aviation, Defense, And Space Market Revenue Million Forecast, by Navy 2019 & 2032

- Table 16: India Aviation, Defense, And Space Market Revenue Million Forecast, by Space 2019 & 2032

- Table 17: India Aviation, Defense, And Space Market Revenue Million Forecast, by Civil Aviation 2019 & 2032

- Table 18: India Aviation, Defense, And Space Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Aviation, Defense, And Space Market?

The projected CAGR is approximately 2.59%.

2. Which companies are prominent players in the India Aviation, Defense, And Space Market?

Key companies in the market include ISR, Larsen & Toubro Limited, Indian Ordnance Factories, Mistral Solutions Pvt Ltd, Tata Sons Private Limited, Goa Shipyard Limited, Kalyani Steels Ltd (KSL), Hindustan Aeronautics Limited (HAL), Hinduja Group, Mahindra & Mahindra Limited, Adani Group, Bharat Electronics Limited (BEL).

3. What are the main segments of the India Aviation, Defense, And Space Market?

The market segments include Air Force, Army, Navy, Space, Civil Aviation.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.34 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Civil Aviation Segment to Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2023: The Indian government announced that they have accorded initial approval for defense acquisition projects worth USD 2.67 million. The project will include the acquisition of 97 Tejas light combat aircraft and 156 Prachand combat helicopters. Moreover, 98% of the total procurement will be sourced from domestic industries, thereby giving a significant boost to the Indian defense industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Aviation, Defense, And Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Aviation, Defense, And Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Aviation, Defense, And Space Market?

To stay informed about further developments, trends, and reports in the India Aviation, Defense, And Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence