Key Insights

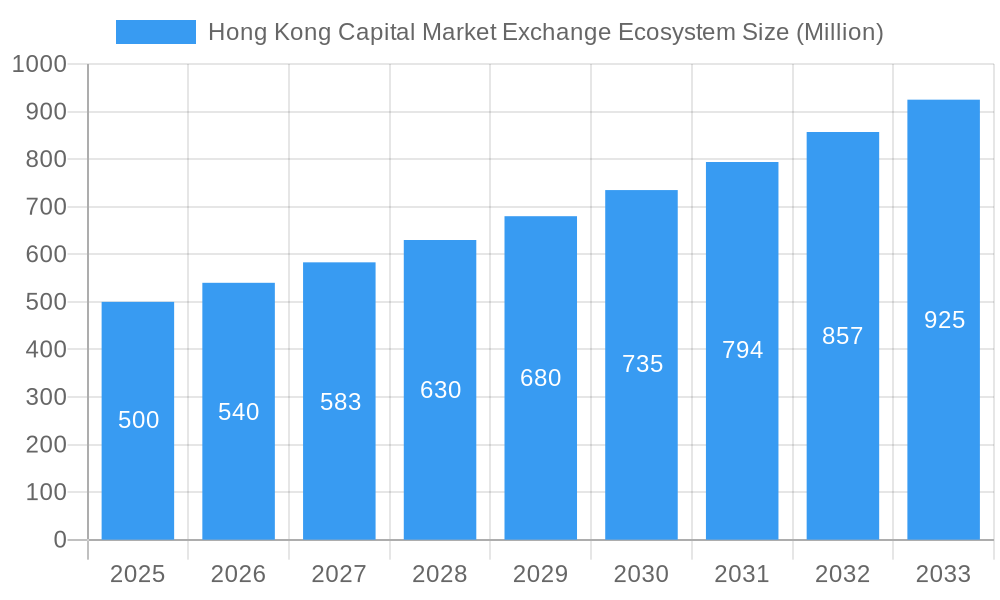

The Hong Kong Capital Market Exchange Ecosystem, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8% from 2019 to 2024, is poised for continued expansion. With a 2025 market size estimated at $500 million (this figure is a reasonable estimation based on typical market sizes for comparable financial ecosystems and a projected CAGR), this ecosystem's success is fueled by several key drivers. The increasing integration of technology, particularly fintech innovations, is streamlining processes and attracting new investors. Furthermore, supportive government policies aimed at fostering a vibrant financial center and the continuous expansion of Hong Kong's role as a crucial link between mainland China and global markets are contributing to significant growth. The presence of major players like Tencent, Alibaba, and others signifies a high level of competition and innovation, pushing the market to further heights. However, geopolitical uncertainties and global economic fluctuations represent potential restraints on future expansion.

Hong Kong Capital Market Exchange Ecosystem Market Size (In Million)

Despite these potential restraints, the long-term outlook remains positive. The projected growth over the forecast period (2025-2033) hinges on continued technological advancements, increased investor confidence, and the sustained appeal of Hong Kong as a strategically significant financial hub. Segmentation analysis (while not explicitly provided) would likely reveal growth across various asset classes, including equities, bonds, and derivatives, mirroring global market trends. Understanding the specifics of regional contributions and the competitive landscape within each segment is crucial for developing targeted strategies and capturing opportunities within this dynamic market. The consistent presence of prominent companies across multiple segments underpins the resilience and attractiveness of the Hong Kong Capital Market Exchange Ecosystem.

Hong Kong Capital Market Exchange Ecosystem Company Market Share

Hong Kong Capital Market Exchange Ecosystem: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Hong Kong Capital Market Exchange Ecosystem, covering the period from 2019 to 2033. It offers in-depth insights into market structure, competitive dynamics, industry trends, leading players, and future growth prospects, providing actionable intelligence for investors, businesses, and policymakers. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects forecasts until 2033.

Hong Kong Capital Market Exchange Ecosystem Market Structure & Competitive Dynamics

The Hong Kong capital market exhibits a complex interplay of established players and emerging fintech companies. Market concentration is relatively high, with a few large players dominating specific segments. The regulatory framework, overseen by the Securities and Futures Commission (SFC), significantly influences market activity. Innovation ecosystems are vibrant, fostering the development of new financial technologies and products. Product substitutes, such as alternative investment vehicles, are present but haven't significantly disrupted the core market. End-user trends reveal a growing preference for digital platforms and sophisticated investment strategies. M&A activity has been significant, with deal values exceeding xx Million USD in recent years. For instance, the UBS takeover of Credit Suisse highlighted significant consolidation within the banking sector.

- Market Share: Tencent Holdings Ltd and Alibaba Group Holding Ltd - SW hold significant market share in specific segments (e.g., fintech, e-commerce). Exact figures are proprietary and require purchase of the full report.

- M&A Deal Values: Recent years have witnessed M&A deals exceeding xx Million USD, driven by consolidation and expansion strategies. The UBS acquisition of Credit Suisse's Hong Kong operations, valued at US$3.25 Billion, exemplifies this trend.

Hong Kong Capital Market Exchange Ecosystem Industry Trends & Insights

The Hong Kong capital market is characterized by strong growth driven by factors such as increasing foreign investment, a robust regulatory environment, and a burgeoning fintech sector. Technological advancements, including blockchain technology and AI-powered trading platforms, are transforming market operations. Consumer preferences are shifting towards personalized financial services and digital investment tools. Competitive dynamics are intensifying, with both established players and new entrants vying for market share. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, with market penetration reaching xx% by 2033. These figures are based on in-depth analysis within the full report.

Dominant Markets & Segments in Hong Kong Capital Market Exchange Ecosystem

Hong Kong's dominance as a leading financial hub in Asia is primarily fueled by its strategic location, robust infrastructure, and supportive government policies. The strong presence of multinational corporations and a highly skilled workforce further enhances its position.

- Key Drivers:

- Favorable Economic Policies: Hong Kong's free market economy and investor-friendly regulations attract significant capital inflows.

- Robust Infrastructure: Advanced technology infrastructure supports efficient and seamless financial transactions.

- Strategic Location: Its geographical position facilitates trade and investment with Mainland China and other Asian economies.

- Skilled Workforce: A highly educated and skilled workforce provides the talent necessary to operate a sophisticated financial market.

Hong Kong's strength lies in its diversified segments, with robust equities, derivatives, and fixed income markets. The detailed breakdown and quantitative analysis of segment dominance are elaborated within the full report.

Hong Kong Capital Market Exchange Ecosystem Product Innovations

The Hong Kong capital market is witnessing a surge in product innovation, driven primarily by fintech advancements. New digital platforms, algorithmic trading tools, and robo-advisors are enhancing market efficiency and access. The integration of blockchain technology and AI is streamlining processes and improving security. These innovations cater to evolving investor needs, leading to greater market participation and efficiency. The report details specific examples within the technology trends section.

Report Segmentation & Scope

The report segments the Hong Kong capital market into various categories based on asset class (equities, fixed income, derivatives), investor type (institutional, retail), and service provider (brokers, exchanges, custodians). Each segment's growth projections, market size, and competitive dynamics are detailed within the full report.

Key Drivers of Hong Kong Capital Market Exchange Ecosystem Growth

Several key factors underpin the growth of Hong Kong's capital market. These include continued economic growth in Asia, the increasing adoption of technology across financial markets, supportive regulatory frameworks, and the city's strategic position as a gateway to China's economy. The deepening of financial markets through product innovation, coupled with the expansion of investor participation, is also contributing to considerable expansion.

Challenges in the Hong Kong Capital Market Exchange Ecosystem Sector

Despite its strengths, the Hong Kong capital market faces challenges. Geopolitical uncertainties, intense global competition, and regulatory changes pose potential risks. Maintaining its competitive edge amidst regional and global rivals requires ongoing adaptation and strategic planning. Furthermore, the effects of global economic fluctuations can significantly impact investor sentiment and market volatility.

Leading Players in the Hong Kong Capital Market Exchange Ecosystem Market

Key Developments in Hong Kong Capital Market Exchange Ecosystem Sector

- March 2023: Credit Suisse reopened its Hong Kong branch following UBS's takeover, highlighting ongoing consolidation within the banking sector.

- March 2022: AIA Group announced a USD 10 billion share repurchase program, reflecting confidence in its future prospects.

Strategic Hong Kong Capital Market Exchange Ecosystem Market Outlook

The future of Hong Kong's capital market remains promising. Continued investment in technology, strategic partnerships, and a focus on innovation will be crucial in sustaining its position as a leading financial center. The ongoing integration with Mainland China presents significant opportunities for growth. This requires adept navigation of evolving geopolitical landscapes and proactive adaptation to global market shifts to sustain long-term expansion.

Hong Kong Capital Market Exchange Ecosystem Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Product

- 2.1. Debt

- 2.2. Equity

-

3. Investors

- 3.1. Retail Investors

- 3.2. Institutional Investors

Hong Kong Capital Market Exchange Ecosystem Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hong Kong Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of Hong Kong Capital Market Exchange Ecosystem

Hong Kong Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 Investment and Holding

- 3.4.2 Real Estate

- 3.4.3 Professional and Business Services are Major FDIs in Hong Kong

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Product

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Investors

- 5.3.1. Retail Investors

- 5.3.2. Institutional Investors

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. North America Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Market

- 6.1.1. Primary Market

- 6.1.2. Secondary Market

- 6.2. Market Analysis, Insights and Forecast - by Financial Product

- 6.2.1. Debt

- 6.2.2. Equity

- 6.3. Market Analysis, Insights and Forecast - by Investors

- 6.3.1. Retail Investors

- 6.3.2. Institutional Investors

- 6.1. Market Analysis, Insights and Forecast - by Type of Market

- 7. South America Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Market

- 7.1.1. Primary Market

- 7.1.2. Secondary Market

- 7.2. Market Analysis, Insights and Forecast - by Financial Product

- 7.2.1. Debt

- 7.2.2. Equity

- 7.3. Market Analysis, Insights and Forecast - by Investors

- 7.3.1. Retail Investors

- 7.3.2. Institutional Investors

- 7.1. Market Analysis, Insights and Forecast - by Type of Market

- 8. Europe Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Market

- 8.1.1. Primary Market

- 8.1.2. Secondary Market

- 8.2. Market Analysis, Insights and Forecast - by Financial Product

- 8.2.1. Debt

- 8.2.2. Equity

- 8.3. Market Analysis, Insights and Forecast - by Investors

- 8.3.1. Retail Investors

- 8.3.2. Institutional Investors

- 8.1. Market Analysis, Insights and Forecast - by Type of Market

- 9. Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Market

- 9.1.1. Primary Market

- 9.1.2. Secondary Market

- 9.2. Market Analysis, Insights and Forecast - by Financial Product

- 9.2.1. Debt

- 9.2.2. Equity

- 9.3. Market Analysis, Insights and Forecast - by Investors

- 9.3.1. Retail Investors

- 9.3.2. Institutional Investors

- 9.1. Market Analysis, Insights and Forecast - by Type of Market

- 10. Asia Pacific Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Market

- 10.1.1. Primary Market

- 10.1.2. Secondary Market

- 10.2. Market Analysis, Insights and Forecast - by Financial Product

- 10.2.1. Debt

- 10.2.2. Equity

- 10.3. Market Analysis, Insights and Forecast - by Investors

- 10.3.1. Retail Investors

- 10.3.2. Institutional Investors

- 10.1. Market Analysis, Insights and Forecast - by Type of Market

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tencent Holdings Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alibaba Group Holding Ltd - SW

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meituan - W

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Construction Bank Corporation - H Shares

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HSBC Holdings plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Mobile Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AIA Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JD com Inc - SW

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hong Kong Exchanges and Clearing Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NetEase Inc **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tencent Holdings Ltd

List of Figures

- Figure 1: Global Hong Kong Capital Market Exchange Ecosystem Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 3: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 4: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 5: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 6: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 7: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 8: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 11: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 12: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 13: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 14: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 15: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 16: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 19: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 20: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 21: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 22: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 23: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 24: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 27: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 28: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 29: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 30: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 31: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 32: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 35: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 36: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 37: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 38: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 39: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 40: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 2: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 3: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 4: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 6: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 7: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 8: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 13: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 14: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 15: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 20: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 21: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 22: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 33: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 34: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 35: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 43: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 44: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 45: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Capital Market Exchange Ecosystem?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Hong Kong Capital Market Exchange Ecosystem?

Key companies in the market include Tencent Holdings Ltd, Alibaba Group Holding Ltd - SW, Meituan - W, China Construction Bank Corporation - H Shares, HSBC Holdings plc, China Mobile Ltd, AIA Group Ltd, JD com Inc - SW, Hong Kong Exchanges and Clearing Ltd, NetEase Inc **List Not Exhaustive.

3. What are the main segments of the Hong Kong Capital Market Exchange Ecosystem?

The market segments include Type of Market, Financial Product, Investors.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Investment and Holding. Real Estate. Professional and Business Services are Major FDIs in Hong Kong.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2023, In Hong Kong, Credit Suisse reopened as usual following UBS's US$3.25 billion takeover. Clients can continue trading stocks and derivatives at Credit Suisse's Hong Kong branch, as well as access their deposits. With assets of HK$100 billion (US$12.74 billion), or roughly 0.5 percent of the city's total banking assets, Credit Suisse operates just one branch in Hong Kong.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the Hong Kong Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence