Key Insights

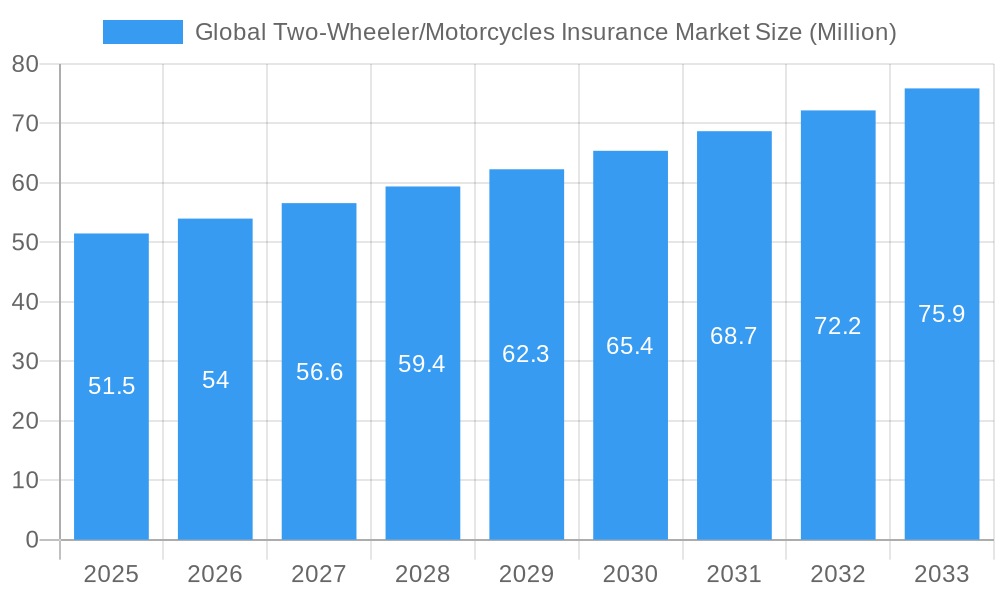

The global two-wheeler/motorcycle insurance market, valued at $51.5 million in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 4.50% from 2025 to 2033. This expansion is fueled by several key factors. Rising two-wheeler ownership, particularly in developing economies with burgeoning middle classes, significantly contributes to market growth. Increasing urbanization and the resulting need for personal transportation further bolster demand. Government regulations mandating insurance coverage for two-wheelers in many regions also drive market expansion. Furthermore, the increasing affordability and accessibility of insurance policies, coupled with innovative digital distribution channels and technologically advanced insurance products (like telematics-based offerings), are creating a more favorable market environment. The market also benefits from rising awareness regarding road safety and the financial protection offered by insurance policies.

Global Two-Wheeler/Motorcycles Insurance Market Market Size (In Million)

However, challenges exist. Fluctuations in fuel prices and economic downturns can impact consumer spending on insurance. Competition among established players and new entrants intensifies pricing pressures. Furthermore, the high rate of uninsured two-wheelers in certain regions presents a significant barrier to market penetration. Addressing these challenges requires insurance companies to develop cost-effective, customized products, enhance customer service, and leverage data analytics to improve risk assessment and underwriting processes. Successful strategies will involve targeting specific demographic segments with tailored insurance solutions and actively engaging in public awareness campaigns to promote the benefits of two-wheeler insurance. The market segmentation will likely be defined by policy type (comprehensive, third-party liability, etc.), distribution channel (online, offline), and geographic region. Key players like Bajaj Allianz General Insurance, GEICO, ACKO, Tata AIG, and Allstate are actively competing and innovating within this dynamic market landscape.

Global Two-Wheeler/Motorcycles Insurance Market Company Market Share

Global Two-Wheeler/Motorcycles Insurance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Global Two-Wheeler/Motorcycles Insurance Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth potential. The report leverages extensive market research and data analysis to deliver actionable insights into this dynamic market.

Global Two-Wheeler/Motorcycles Insurance Market Market Structure & Competitive Dynamics

The global two-wheeler/motorcycle insurance market exhibits a moderately concentrated structure, with key players like Bajaj Allianz General Insurance, GEICO, ACKO, Tata AIG, Allstate Insurance Company, Farmers Insurance, Dairyland, Aviva, and Global Insurance commanding significant market share. However, the presence of numerous smaller players and the continuous entry of new entrants contribute to a competitive landscape. Innovation ecosystems are driven by technological advancements in telematics, AI-powered risk assessment, and digital distribution channels. Regulatory frameworks vary significantly across regions, impacting product offerings and pricing strategies. Product substitutes, such as self-insurance, are limited due to the mandatory insurance requirements in many jurisdictions. End-user trends towards increased adoption of electric vehicles and connected technology are reshaping the market. Recent M&A activities, such as Aviva's acquisition of a 25% stake in Dabur Invest Corp. in September 2022, reflect the strategic consolidation efforts within the industry. The total M&A deal value in the past 5 years is estimated at xx Million. Market share data for leading players is available within the full report.

- Market Concentration: Moderately concentrated, with a few dominant players and several smaller competitors.

- Innovation Ecosystems: Focused on telematics, AI, and digital distribution.

- Regulatory Frameworks: Vary significantly across geographical regions.

- M&A Activities: Significant activity in recent years, driven by strategic consolidation and expansion. The average deal value in the last 3 years is estimated at xx Million.

Global Two-Wheeler/Motorcycles Insurance Market Industry Trends & Insights

The global two-wheeler/motorcycle insurance market is experiencing robust growth, driven primarily by rising two-wheeler ownership, particularly in emerging economies. The increasing penetration of smartphones and the adoption of digital insurance platforms are further fueling market expansion. Technological disruptions, such as the implementation of telematics-based insurance products, are creating new opportunities for insurers to offer personalized and risk-based pricing. Changing consumer preferences, including a growing demand for customized insurance solutions and seamless digital experiences, are also reshaping the market landscape. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Competitive dynamics remain intense, with insurers focusing on product innovation, strategic partnerships, and aggressive marketing campaigns to gain a competitive edge. The overall market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Dominant Markets & Segments in Global Two-Wheeler/Motorcycles Insurance Market

Asia-Pacific, particularly India and Southeast Asia, represents the dominant market for two-wheeler/motorcycle insurance, driven by a large and expanding two-wheeler population and favorable economic conditions.

- Key Drivers in Asia-Pacific:

- Rapid growth in two-wheeler ownership.

- Increasing disposable incomes.

- Favorable government policies promoting insurance penetration.

- Expanding middle class.

- Development of robust digital infrastructure.

The dominance of the Asia-Pacific region is attributed to several key factors: the high density of two-wheelers, burgeoning middle class with increased disposable income, rapid urbanization, and supportive government policies that promote insurance penetration. Other regions such as North America and Europe also hold significant market share, though their growth rates are comparatively slower. Detailed segment analysis within the full report reveals additional drivers and insights into specific market segments.

Global Two-Wheeler/Motorcycles Insurance Market Product Innovations

Recent innovations in the two-wheeler/motorcycle insurance sector are heavily focused on leveraging technology to enhance customer experience and risk assessment. Telematics devices are being integrated into insurance policies, offering usage-based pricing and personalized risk profiling. Insurers are also exploring the use of artificial intelligence (AI) and machine learning (ML) for fraud detection, claims processing, and underwriting. The introduction of add-on features, such as roadside assistance and accidental damage coverage, further enhances the value proposition for consumers. The introduction of insurance plans specifically for electric vehicle batteries, as seen with ACKO’s April 2023 launch, highlights the adaptability of insurers to emerging technologies and market needs.

Report Segmentation & Scope

This report segments the two-wheeler/motorcycle insurance market based on various criteria, including:

By Vehicle Type: Scooters, motorcycles, mopeds, etc. Growth projections for each segment are included in the full report, along with market size estimates and competitive landscape analysis.

By Distribution Channel: Online, offline, and bancassurance. Each channel's dynamics, including market size and growth projections, is detailed in the full report.

By Insurance Type: Third-party liability, comprehensive, and others. The report provides in-depth analysis of the competitive landscape and growth projections for each type.

By Region: North America, Europe, Asia-Pacific, Middle East & Africa, and South America. Growth projections are provided for each region, including market size estimations and competitive dynamics.

Key Drivers of Global Two-Wheeler/Motorcycles Insurance Market Growth

The growth of the two-wheeler/motorcycle insurance market is fueled by several key drivers:

Rising Two-Wheeler Ownership: The increasing affordability and convenience of two-wheelers, particularly in developing countries, drive significant growth in the number of insured vehicles.

Government Regulations: Mandatory insurance requirements in many jurisdictions are a major driver of market growth.

Technological Advancements: Telematics, AI, and digital distribution channels are revolutionizing the industry, improving efficiency, and creating new opportunities.

Economic Growth: Rising disposable incomes in many emerging economies contribute to increased demand for insurance products.

Challenges in the Global Two-Wheeler/Motorcycles Insurance Market Sector

Despite its growth potential, the two-wheeler/motorcycle insurance market faces several challenges:

High Claim Frequency: The high frequency of accidents involving two-wheelers puts pressure on insurers' profitability.

Fraudulent Claims: The prevalence of fraudulent claims increases operational costs and impacts the industry's sustainability.

Data Security Concerns: The increasing reliance on digital platforms raises concerns about data security and privacy.

Leading Players in the Global Two-Wheeler/Motorcycles Insurance Market Market

- Bajaj Allianz General Insurance

- GEICO

- ACKO

- Tata AIG

- Allstate Insurance Company

- Farmers Insurance

- Dairyland

- Aviva

- Global Insurance

- Other Companies (List Not Exhaustive)

Key Developments in Global Two-Wheeler/Motorcycles Insurance Market Sector

September 2022: Aviva announced the acquisition of a 25% stake in Dabur Invest Corp., a joint venture in India, becoming the majority shareholder and increasing its control. This strategic move expands Aviva's presence in a key growth market.

April 2023: ACKO launched an insurance plan specifically for electric vehicle batteries, facilitating EV adoption and creating a new revenue stream. This innovative product caters to emerging market needs and positions ACKO as a leader in EV insurance.

Strategic Global Two-Wheeler/Motorcycles Insurance Market Market Outlook

The future of the two-wheeler/motorcycle insurance market is bright, driven by sustained growth in two-wheeler ownership, technological advancements, and increasing consumer demand for innovative insurance solutions. Strategic opportunities abound for insurers who can leverage technology to enhance customer experience, optimize risk assessment, and offer personalized products. Companies focusing on digitalization, data analytics, and strategic partnerships are well-positioned to capitalize on the market's growth potential. The market is poised for continued expansion, particularly in emerging economies, presenting substantial opportunities for both established and new players.

Global Two-Wheeler/Motorcycles Insurance Market Segmentation

-

1. Policy Type

- 1.1. Zero Depreciation

- 1.2. Third Party Motor Insurance

- 1.3. Comprehensive Motor Insurance

-

2. Distribution Channels

- 2.1. Online

- 2.2. Offline

Global Two-Wheeler/Motorcycles Insurance Market Segmentation By Geography

- 1. Europe

- 2. North America

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Global Two-Wheeler/Motorcycles Insurance Market Regional Market Share

Geographic Coverage of Global Two-Wheeler/Motorcycles Insurance Market

Global Two-Wheeler/Motorcycles Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mandatory Insurance Requirements and Sales of Two Wheelers Drives the Market; High Repair Costs of Vehicles Drives the Insurance Market

- 3.3. Market Restrains

- 3.3.1. Mandatory Insurance Requirements and Sales of Two Wheelers Drives the Market; High Repair Costs of Vehicles Drives the Insurance Market

- 3.4. Market Trends

- 3.4.1. Online Sales of Insurance Policies are Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Two-Wheeler/Motorcycles Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 5.1.1. Zero Depreciation

- 5.1.2. Third Party Motor Insurance

- 5.1.3. Comprehensive Motor Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.3.2. North America

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 6. Europe Global Two-Wheeler/Motorcycles Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 6.1.1. Zero Depreciation

- 6.1.2. Third Party Motor Insurance

- 6.1.3. Comprehensive Motor Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 7. North America Global Two-Wheeler/Motorcycles Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 7.1.1. Zero Depreciation

- 7.1.2. Third Party Motor Insurance

- 7.1.3. Comprehensive Motor Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 8. Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 8.1.1. Zero Depreciation

- 8.1.2. Third Party Motor Insurance

- 8.1.3. Comprehensive Motor Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 9. Latin America Global Two-Wheeler/Motorcycles Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 9.1.1. Zero Depreciation

- 9.1.2. Third Party Motor Insurance

- 9.1.3. Comprehensive Motor Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 10. Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 10.1.1. Zero Depreciation

- 10.1.2. Third Party Motor Insurance

- 10.1.3. Comprehensive Motor Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bajaj Allianz General Insurance

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GEICO

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ACKO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tata AIG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Allstate Insurance Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Farmers Insurance

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dairyland

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aviva

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Global Insurance

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Other Companies**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bajaj Allianz General Insurance

List of Figures

- Figure 1: Global Global Two-Wheeler/Motorcycles Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Global Two-Wheeler/Motorcycles Insurance Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Europe Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Policy Type 2025 & 2033

- Figure 4: Europe Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Policy Type 2025 & 2033

- Figure 5: Europe Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 6: Europe Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Policy Type 2025 & 2033

- Figure 7: Europe Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 8: Europe Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Distribution Channels 2025 & 2033

- Figure 9: Europe Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 10: Europe Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Distribution Channels 2025 & 2033

- Figure 11: Europe Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Europe Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 13: Europe Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Policy Type 2025 & 2033

- Figure 16: North America Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Policy Type 2025 & 2033

- Figure 17: North America Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 18: North America Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Policy Type 2025 & 2033

- Figure 19: North America Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 20: North America Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Distribution Channels 2025 & 2033

- Figure 21: North America Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 22: North America Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Distribution Channels 2025 & 2033

- Figure 23: North America Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 25: North America Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Policy Type 2025 & 2033

- Figure 28: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Policy Type 2025 & 2033

- Figure 29: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 30: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Policy Type 2025 & 2033

- Figure 31: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 32: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Distribution Channels 2025 & 2033

- Figure 33: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 34: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Distribution Channels 2025 & 2033

- Figure 35: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Policy Type 2025 & 2033

- Figure 40: Latin America Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Policy Type 2025 & 2033

- Figure 41: Latin America Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 42: Latin America Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Policy Type 2025 & 2033

- Figure 43: Latin America Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 44: Latin America Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Distribution Channels 2025 & 2033

- Figure 45: Latin America Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 46: Latin America Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Distribution Channels 2025 & 2033

- Figure 47: Latin America Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Latin America Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Policy Type 2025 & 2033

- Figure 52: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Policy Type 2025 & 2033

- Figure 53: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 54: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Policy Type 2025 & 2033

- Figure 55: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 56: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Distribution Channels 2025 & 2033

- Figure 57: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 58: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Distribution Channels 2025 & 2033

- Figure 59: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Global Two-Wheeler/Motorcycles Insurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 2: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 3: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 4: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Distribution Channels 2020 & 2033

- Table 5: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 8: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 9: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 10: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Distribution Channels 2020 & 2033

- Table 11: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 14: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 15: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 16: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Distribution Channels 2020 & 2033

- Table 17: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 20: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 21: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 22: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Distribution Channels 2020 & 2033

- Table 23: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 26: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 27: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 28: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Distribution Channels 2020 & 2033

- Table 29: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 32: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 33: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 34: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Distribution Channels 2020 & 2033

- Table 35: Global Two-Wheeler/Motorcycles Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Two-Wheeler/Motorcycles Insurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Two-Wheeler/Motorcycles Insurance Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Global Two-Wheeler/Motorcycles Insurance Market?

Key companies in the market include Bajaj Allianz General Insurance, GEICO, ACKO, Tata AIG, Allstate Insurance Company, Farmers Insurance, Dairyland, Aviva, Global Insurance, Other Companies**List Not Exhaustive.

3. What are the main segments of the Global Two-Wheeler/Motorcycles Insurance Market?

The market segments include Policy Type, Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Mandatory Insurance Requirements and Sales of Two Wheelers Drives the Market; High Repair Costs of Vehicles Drives the Insurance Market.

6. What are the notable trends driving market growth?

Online Sales of Insurance Policies are Driving the Market Growth.

7. Are there any restraints impacting market growth?

Mandatory Insurance Requirements and Sales of Two Wheelers Drives the Market; High Repair Costs of Vehicles Drives the Insurance Market.

8. Can you provide examples of recent developments in the market?

September 2022: Aviva announced that it had acquired 25% stakes in the Dabur Invest Corp., a joint venture in India. The transaction allowed Aviva to become the majority shareholder, increasing its economic and operational control.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Two-Wheeler/Motorcycles Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Two-Wheeler/Motorcycles Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Two-Wheeler/Motorcycles Insurance Market?

To stay informed about further developments, trends, and reports in the Global Two-Wheeler/Motorcycles Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence