Key Insights

The global neobanking market is experiencing explosive growth, driven by the increasing adoption of digital banking services and a rising demand for personalized financial solutions. A 24.60% CAGR from 2019-2033 suggests a substantial market expansion. Key drivers include the convenience and accessibility of mobile-first banking platforms, the integration of innovative financial technologies like AI-powered personal finance management tools, and a younger generation's preference for digital-only financial services. The market's success hinges on factors such as robust cybersecurity measures to build customer trust and regulatory compliance within the rapidly evolving fintech landscape. The shift towards open banking initiatives also fuels innovation, enabling seamless data sharing and third-party integrations. Competition amongst established neobanks like Monzo, Chime, Starling Bank, and Revolut, as well as newer entrants, is fierce, driving product innovation and improved customer experiences.

Global Neobanking Market Market Size (In Billion)

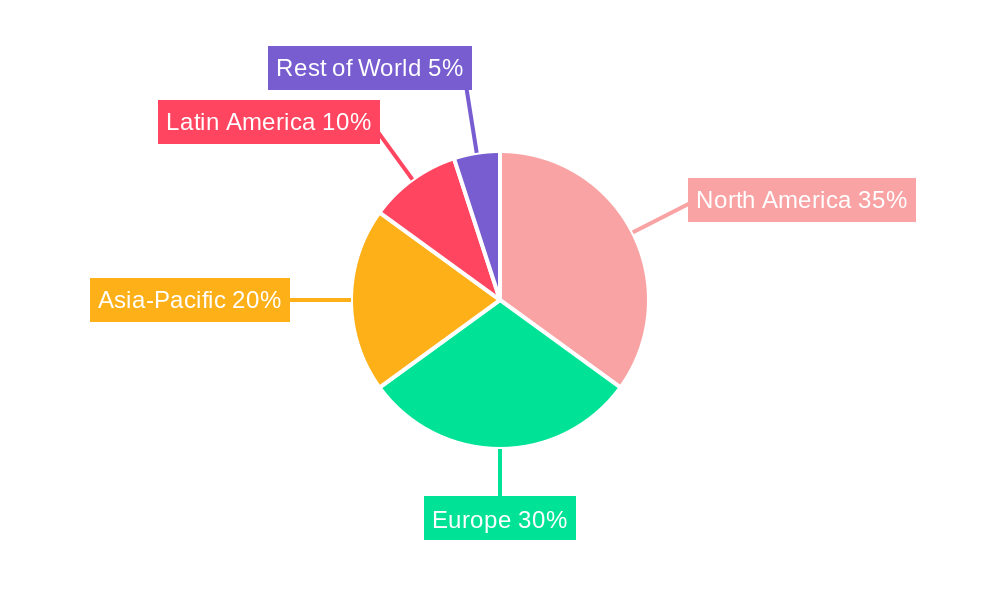

The market segmentation likely includes offerings tailored to different customer demographics (e.g., individual consumers, small businesses) and service types (e.g., personal accounts, business accounts, lending). Geographical variations exist; North America and Europe currently hold significant market share, but emerging economies in Asia and Latin America represent significant growth opportunities. While challenges remain, such as regulatory hurdles and the need to manage customer expectations regarding security and customer service, the overall trajectory indicates a highly promising and dynamic market poised for substantial future growth. The continued penetration of smartphones and internet access in under-served regions will further accelerate market expansion in the years to come. Therefore, strategic investments in technology, customer acquisition, and regulatory compliance will be pivotal for success within the neobanking sector.

Global Neobanking Market Company Market Share

Global Neobanking Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global neobanking market, offering valuable insights into market structure, competitive dynamics, industry trends, and future growth prospects. With a study period spanning 2019-2033 (base year 2025, estimated year 2025, forecast period 2025-2033, historical period 2019-2024), this report is an essential resource for industry stakeholders, investors, and market researchers.

Global Neobanking Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the global neobanking market, examining market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure with several key players vying for market share. The report will quantify market share for leading players like Monzo Bank Ltd, Chime Financial Inc, Starling Banks, MoneyLion, Sofi, N26, Judo Bank, Tinkoff Bank, Nubank, and Revolut (list not exhaustive). Innovation ecosystems are crucial, with continuous development of new features and services driving competition. Regulatory frameworks vary significantly across different regions, impacting market entry and operations. The increasing popularity of mobile-first financial services creates competitive pressure from traditional banks and fintech startups alike. M&A activity has been significant, with deal values reaching xx Million in recent years, further shaping the market structure.

- Market Concentration: Analysis of market share held by top 10 players.

- Innovation Ecosystems: Assessment of technological advancements and their impact on market competition.

- Regulatory Frameworks: Comparative analysis of regulations across key regions.

- Product Substitutes: Identification and analysis of alternative financial services.

- End-User Trends: Examination of evolving consumer preferences and demands.

- M&A Activities: Review of significant mergers and acquisitions, including deal values and strategic implications.

Global Neobanking Market Industry Trends & Insights

This section delves into the key trends shaping the global neobanking market, including market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is experiencing significant growth, projected to reach xx Million by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Key growth drivers include the increasing adoption of smartphones and mobile banking, a preference for user-friendly digital interfaces, and the demand for personalized financial services. Technological disruptions such as Open Banking and AI-powered features are significantly altering the competitive landscape. Market penetration is expected to increase as neobanks expand their product offerings and geographical reach. Competitive dynamics are intense, with neobanks focusing on innovation, customer experience, and strategic partnerships to gain a competitive edge.

Dominant Markets & Segments in Global Neobanking Market

This section identifies the leading regions, countries, and market segments within the global neobanking market. The report will detail the factors contributing to market dominance in each segment. Analysis will reveal which geographic locations are driving growth and the underlying reasons. The report will incorporate details of economic policies, regulatory frameworks, and technological infrastructure supporting neobank adoption.

- Key Drivers of Regional Dominance: (Specific bullet points for each leading region/country will be provided)

- Economic factors

- Technological infrastructure

- Government regulations

- Consumer behavior

Global Neobanking Market Product Innovations

This section examines recent product developments, applications, and competitive advantages in the neobanking market. Recent innovations include personalized financial management tools, AI-powered chatbots for customer service, and seamless integration with other financial services. These innovations enhance user experience, improve efficiency, and create new revenue streams. The focus is on technological trends and market fit, highlighting the competitive advantages gained through product differentiation and innovation.

Report Segmentation & Scope

This report segments the global neobanking market based on various criteria, including but not limited to:

- By Business Model: This segment analyzes the performance of different neobanking business models, such as direct-to-consumer, embedded finance, and partnerships. Growth projections, market sizes, and competitive dynamics will be detailed for each model.

- By Product/Service Offering: This section categorizes neobanks based on the services they offer (e.g., current accounts, savings accounts, loans, investment products). It will analyze the market size and growth projections for each offering.

- By Geography: This section provides a regional breakdown of the market, covering key regions and countries, analyzing market size, growth rates, and competitive landscapes in each region.

Key Drivers of Global Neobanking Market Growth

The growth of the global neobanking market is driven by several factors: increasing smartphone penetration and internet access, rising demand for convenient and user-friendly banking services, supportive regulatory frameworks in some regions encouraging innovation and competition, and advancements in technology, particularly in artificial intelligence and machine learning, allowing for personalized financial services and improved fraud detection.

Challenges in the Global Neobanking Market Sector

Despite the significant growth potential, the global neobanking market faces several challenges: stringent regulatory compliance requirements across different jurisdictions, ensuring robust cybersecurity measures to protect user data, maintaining profitability while offering competitive pricing and maintaining customer loyalty and combating fierce competition from established banks and other fintech players.

Leading Players in the Global Neobanking Market Market

- Monzo Bank Ltd

- Chime Financial Inc

- Starling Banks

- MoneyLion

- Sofi

- N26

- Judo Bank

- Tinkoff Bank

- Nubank

- Revolut (List Not Exhaustive)

Key Developments in Global Neobanking Market Sector

- October 2022: Rajasthan-based Kitzone Neo Bank launches India's first assured cashback debit cards, along with mini-ATM and POS terminal services.

- September 2022: N26 becomes the first neobank to integrate with Bizum in Spain, allowing users with Spanish IBANs to send, receive, and request money via the popular mobile payment service.

Strategic Global Neobanking Market Market Outlook

The future of the global neobanking market is bright, driven by continued technological advancements, expanding regulatory support in key markets, and growing consumer adoption of digital financial services. Strategic opportunities lie in expanding into underserved markets, developing innovative product offerings tailored to specific customer segments, and forming strategic partnerships to enhance market reach and capabilities. The market is poised for continued expansion and consolidation, with significant growth opportunities for innovative and well-capitalized players.

Global Neobanking Market Segmentation

-

1. Account Type

- 1.1. Bussiness Account

- 1.2. Savings Account

-

2. Services

- 2.1. Mobile- Banking

- 2.2. Payments

- 2.3. Money- Transfers

- 2.4. Savings Account

- 2.5. Loans

- 2.6. Others

-

3. Application

- 3.1. Personal

- 3.2. Enterprise

- 3.3. Other Application

Global Neobanking Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. South America

Global Neobanking Market Regional Market Share

Geographic Coverage of Global Neobanking Market

Global Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 58.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Digitalization of Banking Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Bussiness Account

- 5.1.2. Savings Account

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Mobile- Banking

- 5.2.2. Payments

- 5.2.3. Money- Transfers

- 5.2.4. Savings Account

- 5.2.5. Loans

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal

- 5.3.2. Enterprise

- 5.3.3. Other Application

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. North America Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 6.1.1. Bussiness Account

- 6.1.2. Savings Account

- 6.2. Market Analysis, Insights and Forecast - by Services

- 6.2.1. Mobile- Banking

- 6.2.2. Payments

- 6.2.3. Money- Transfers

- 6.2.4. Savings Account

- 6.2.5. Loans

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Personal

- 6.3.2. Enterprise

- 6.3.3. Other Application

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 7. Europe Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 7.1.1. Bussiness Account

- 7.1.2. Savings Account

- 7.2. Market Analysis, Insights and Forecast - by Services

- 7.2.1. Mobile- Banking

- 7.2.2. Payments

- 7.2.3. Money- Transfers

- 7.2.4. Savings Account

- 7.2.5. Loans

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Personal

- 7.3.2. Enterprise

- 7.3.3. Other Application

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 8. Asia Pacific Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 8.1.1. Bussiness Account

- 8.1.2. Savings Account

- 8.2. Market Analysis, Insights and Forecast - by Services

- 8.2.1. Mobile- Banking

- 8.2.2. Payments

- 8.2.3. Money- Transfers

- 8.2.4. Savings Account

- 8.2.5. Loans

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Personal

- 8.3.2. Enterprise

- 8.3.3. Other Application

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 9. Middle East Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 9.1.1. Bussiness Account

- 9.1.2. Savings Account

- 9.2. Market Analysis, Insights and Forecast - by Services

- 9.2.1. Mobile- Banking

- 9.2.2. Payments

- 9.2.3. Money- Transfers

- 9.2.4. Savings Account

- 9.2.5. Loans

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Personal

- 9.3.2. Enterprise

- 9.3.3. Other Application

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 10. South America Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 10.1.1. Bussiness Account

- 10.1.2. Savings Account

- 10.2. Market Analysis, Insights and Forecast - by Services

- 10.2.1. Mobile- Banking

- 10.2.2. Payments

- 10.2.3. Money- Transfers

- 10.2.4. Savings Account

- 10.2.5. Loans

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Personal

- 10.3.2. Enterprise

- 10.3.3. Other Application

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Monzo Bank Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chime Financial Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Starling Banks

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MoneyLion

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sofi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 N

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Judo Bank

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tinkoff Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nubank

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Revolut**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Monzo Bank Ltd

List of Figures

- Figure 1: Global Global Neobanking Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 3: North America Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 4: North America Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 5: North America Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 6: North America Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 11: Europe Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 12: Europe Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 13: Europe Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 14: Europe Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 19: Asia Pacific Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 20: Asia Pacific Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 21: Asia Pacific Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 22: Asia Pacific Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Asia Pacific Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 27: Middle East Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 28: Middle East Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 29: Middle East Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 30: Middle East Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 31: Middle East Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 35: South America Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 36: South America Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 37: South America Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 38: South America Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 39: South America Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 2: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 3: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Neobanking Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 6: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 7: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 10: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 11: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 14: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 15: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 18: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 19: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 22: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 23: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Neobanking Market?

The projected CAGR is approximately 58.6%.

2. Which companies are prominent players in the Global Neobanking Market?

Key companies in the market include Monzo Bank Ltd, Chime Financial Inc, Starling Banks, MoneyLion, Sofi, N, Judo Bank, Tinkoff Bank, Nubank, Revolut**List Not Exhaustive.

3. What are the main segments of the Global Neobanking Market?

The market segments include Account Type, Services, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Digitalization of Banking Activities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2022, India's First Assured Cashback Debit Cards are being introduced by Rajasthan-based Kitzone Neo Bank, which is also providing the Mini ATM and Pos Terminal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Neobanking Market?

To stay informed about further developments, trends, and reports in the Global Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence