Key Insights

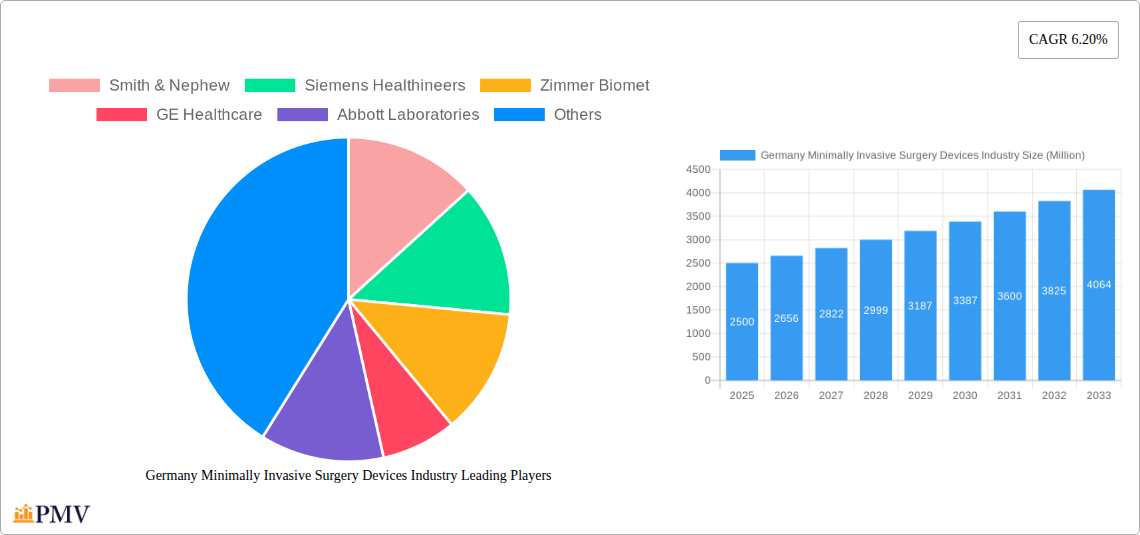

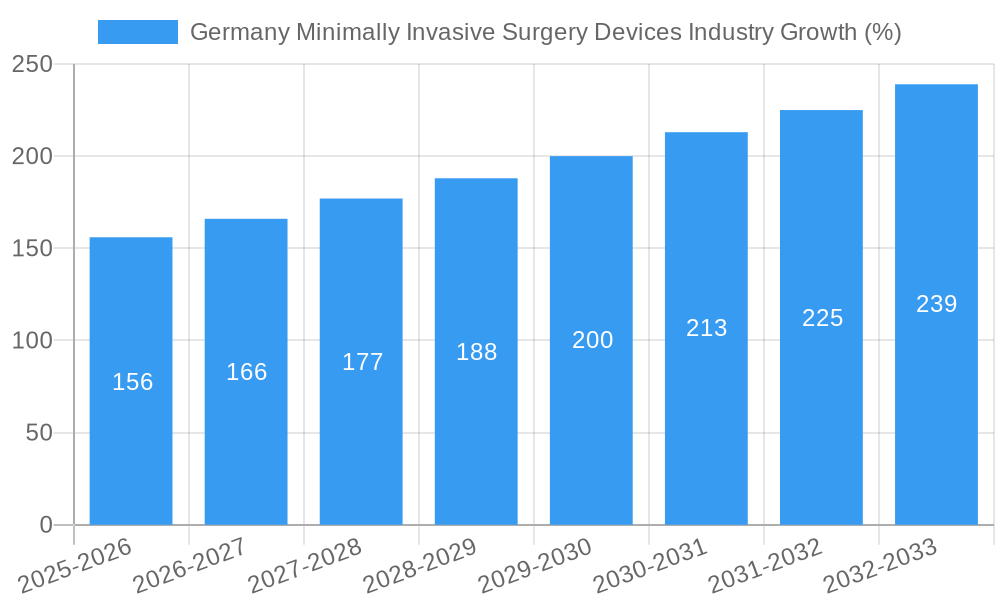

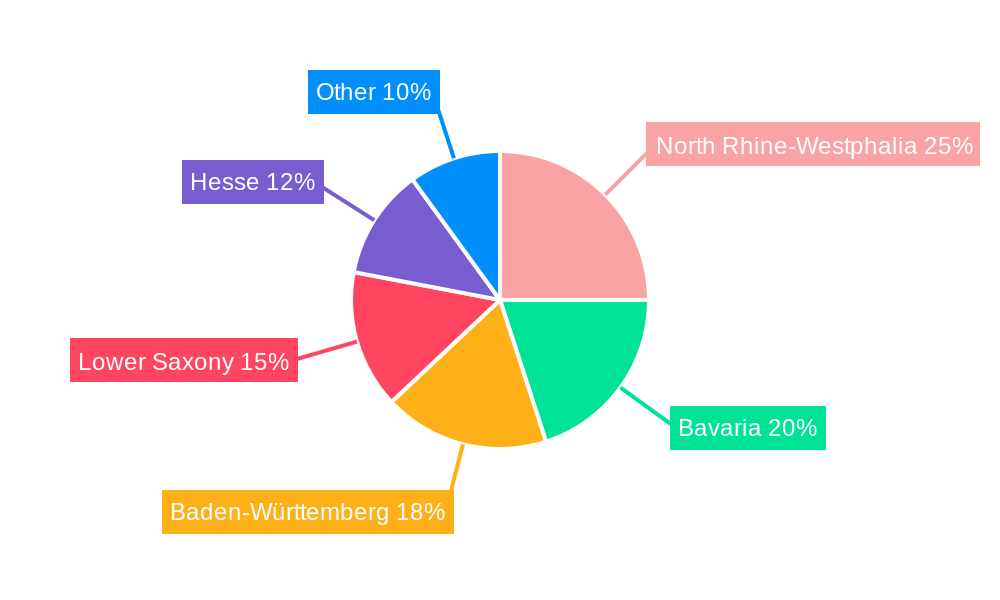

The German minimally invasive surgery (MIS) devices market, valued at approximately €2.5 billion in 2025, is projected to experience robust growth, driven by a rising elderly population, increasing prevalence of chronic diseases requiring MIS procedures, and advancements in robotic surgery and imaging technologies. The market's 6.20% CAGR indicates a significant expansion over the forecast period (2025-2033), reaching an estimated value exceeding €4 billion by 2033. Key growth drivers include government initiatives promoting advanced healthcare infrastructure and a rising preference for minimally invasive techniques due to their shorter recovery times and reduced scarring. The strong presence of leading medical device companies such as Siemens Healthineers, Medtronic, and Zimmer Biomet within Germany further fuels market expansion. Specific segments like robotic-assisted surgical systems and advanced imaging devices are expected to exhibit the highest growth rates, reflecting the increasing adoption of sophisticated surgical techniques. However, high device costs and regulatory hurdles associated with new technology adoption pose challenges to market growth. Regional variations exist, with states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg – having large medical hubs – leading the market, while factors like healthcare spending and the distribution of specialized hospitals will influence growth in other regions like Lower Saxony and Hesse. The competitive landscape is marked by intense competition among multinational players and specialized niche companies.

Market segmentation reveals significant growth potential in various applications. Cardiovascular and orthopedic surgeries are expected to remain key contributors to market revenue, but growth in applications like aesthetic and gynecological procedures is also anticipated. The dominance of handheld instruments, endoscopic devices, and electrosurgical devices is projected to continue, however, a shift towards robotic-assisted systems and advanced imaging tools will drive higher-value segment growth. Strategic partnerships, technological innovations, and expansion of distribution networks are key strategies employed by market players to maintain their competitive edge in this dynamic market.

Germany Minimally Invasive Surgery Devices Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany minimally invasive surgery (MIS) devices market, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. It meticulously examines market size, growth drivers, challenges, competitive dynamics, and future trends, segmented by product type and application.

Germany Minimally Invasive Surgery Devices Industry Market Structure & Competitive Dynamics

The German MIS devices market exhibits a moderately concentrated structure, with a few key players holding significant market share. The market is characterized by a dynamic innovation ecosystem driven by continuous technological advancements and substantial R&D investments by leading companies like Smith & Nephew, Siemens Healthineers, Zimmer Biomet, GE Healthcare, Abbott Laboratories, Medtronic PLC, Koninklijke Philips NV, Intuitive Surgical Inc, Stryker Corporation, and Olympus Corporation. These companies compete based on product innovation, technological superiority, pricing strategies, and distribution networks.

Market share data indicates that the top 5 players collectively account for approximately 65% of the market in 2025. The regulatory framework, primarily governed by the BfArM (Federal Institute for Drugs and Medical Devices), significantly influences market entry and product approvals. The market also witnesses substantial M&A activity, with deal values exceeding €xx Million in the last five years, driven by the pursuit of synergies, technological advancements, and expansion of product portfolios. Substitutes for MIS devices include open surgical techniques, but the preference for minimally invasive procedures due to shorter recovery times and reduced trauma is driving market growth. End-user trends indicate increasing adoption of advanced imaging and robotic-assisted systems.

Germany Minimally Invasive Surgery Devices Industry Industry Trends & Insights

The German MIS devices market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the rising prevalence of chronic diseases requiring MIS procedures, an aging population, increasing healthcare expenditure, and advancements in MIS technology. The market penetration of robotic-assisted surgical systems is steadily increasing, driven by their improved precision, minimally invasive nature and enhanced surgical outcomes. Technological disruptions such as the integration of AI and machine learning in MIS devices are further augmenting market expansion. Consumer preferences are shifting towards less invasive procedures with quicker recovery times, leading to greater demand for sophisticated MIS devices. The competitive landscape remains highly dynamic, characterized by continuous product innovation, strategic partnerships, and competitive pricing strategies. The market penetration of advanced imaging techniques is also contributing to growth, allowing for more precise and effective minimally invasive procedures.

Dominant Markets & Segments in Germany Minimally Invasive Surgery Devices Industry

Dominant Product Segment: Robotic Assisted Surgical Systems are expected to dominate the product segment due to their superior precision, improved visualization, and reduced invasiveness. The market size for Robotic Assisted Surgical Systems is projected to reach €xx Million by 2033.

Dominant Application Segment: Orthopedic procedures constitute the largest application segment, driven by the high incidence of musculoskeletal disorders and the suitability of MIS techniques for joint replacements and spine surgeries. The market size for orthopedic applications is projected to reach €xx Million by 2033.

- Key Drivers for Orthopedic Segment Dominance:

- High incidence of age-related orthopedic conditions.

- Growing adoption of minimally invasive orthopedic procedures.

- Technological advancements in orthopedic implants and instruments.

- Favorable reimbursement policies for orthopedic surgeries.

- Extensive research and development in the orthopedic MIS space.

The cardiovascular application segment is also showcasing significant growth, propelled by technological advances in catheters and imaging techniques. Likewise, the gynecological and urological segments are witnessing growth due to increasing prevalence of related diseases and benefits offered by MIS techniques.

Germany Minimally Invasive Surgery Devices Industry Product Innovations

Recent innovations in MIS devices focus on enhanced precision, improved visualization, and reduced invasiveness. The integration of AI and machine learning is enabling more accurate and personalized surgical procedures. Miniaturization of instruments and development of new materials are also key areas of innovation, leading to smaller incisions, faster recovery times, and reduced risks of complications. These innovations are improving the overall clinical outcomes and patient experience, furthering the adoption of MIS procedures. Companies are focusing on creating devices with enhanced ergonomics and usability to improve surgeon experience as well.

Report Segmentation & Scope

The report segments the Germany MIS devices market comprehensively by product and application.

Product Segmentation: Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic Devices, Monitoring and Visualization Devices, Robotic Assisted Surgical Systems, Ablation Devices, Laser Based Devices, Other MIS Devices. Each segment's growth projections, market size, and competitive dynamics are analyzed in detail.

Application Segmentation: Aesthetic, Cardiovascular, Gastrointestinal, Gynecological and Urological, Orthopedic, Other Applications. Each application's market size, growth drivers, and future outlook are presented separately, with an emphasis on current market leaders and their strategies.

Key Drivers of Germany Minimally Invasive Surgery Devices Industry Growth

Growth in the German MIS devices market is primarily driven by an aging population leading to increased prevalence of chronic diseases, rising healthcare expenditure, technological advancements resulting in improved surgical outcomes and patient experience, and favorable reimbursement policies promoting the adoption of minimally invasive procedures. Government initiatives to enhance healthcare infrastructure and increase accessibility to advanced medical technologies also contribute significantly.

Challenges in the Germany Minimally Invasive Surgery Devices Industry Sector

Challenges to the growth of the German MIS devices market include stringent regulatory approvals, high costs associated with advanced MIS devices limiting accessibility, and intense competition among established players. Supply chain disruptions caused by geopolitical events or global pandemics can also pose significant challenges to the industry. These factors can influence pricing and availability of devices, affecting market growth in the short term.

Leading Players in the Germany Minimally Invasive Surgery Devices Industry Market

- Smith & Nephew

- Siemens Healthineers

- Zimmer Biomet

- GE Healthcare

- Abbott Laboratories

- Medtronic PLC

- Koninklijke Philips NV

- Intuitive Surgical Inc

- Stryker Corporation

- Olympus Corporation

Key Developments in Germany Minimally Invasive Surgery Devices Industry Sector

- 2022-Q4: Launch of a new robotic surgery system by Stryker.

- 2023-Q1: Siemens Healthineers announces a strategic partnership with a leading hospital for MIS training programs.

- 2023-Q2: Approval of a novel endoscopic device by the BfArM.

- (Further developments to be added as per data availability)

Strategic Germany Minimally Invasive Surgery Devices Industry Market Outlook

The German MIS devices market is poised for continued growth, driven by technological innovations, increased adoption of minimally invasive procedures, and expanding healthcare infrastructure. Strategic opportunities exist for companies to invest in R&D, expand their product portfolios, and explore strategic partnerships to capitalize on the growing market. Focus on personalized medicine and the integration of AI and machine learning will further enhance market growth. The focus on digitalization and telehealth will significantly impact the growth opportunities in the future.

Germany Minimally Invasive Surgery Devices Industry Segmentation

-

1. Product

- 1.1. Handheld Instruments

- 1.2. Guiding Devices

- 1.3. Electrosurgical Devices

- 1.4. Endoscopic Devices

- 1.5. Monitoring and Visualization Devices

- 1.6. Robotic Assisted Surgical Systems

- 1.7. Ablation Devices

- 1.8. Laser Based Devices

- 1.9. Other MIS Devices

-

2. Application

- 2.1. Aesthetic

- 2.2. Cardiovascular

- 2.3. Gastrointestinal

- 2.4. Gynecological and Urological

- 2.5. Orthopedic

- 2.6. Other Applications

Germany Minimally Invasive Surgery Devices Industry Segmentation By Geography

- 1. Germany

Germany Minimally Invasive Surgery Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Higher Acceptance Rate of Minimally-invasive Surgeries over Traditional Surgeries in Country; Increasing Prevalence of Lifestyle-related and Chronic Disorders

- 3.3. Market Restrains

- 3.3.1. ; Uncertain Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Orthopedic Surgery Segment is Expected to Exhibit Fastest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Instruments

- 5.1.2. Guiding Devices

- 5.1.3. Electrosurgical Devices

- 5.1.4. Endoscopic Devices

- 5.1.5. Monitoring and Visualization Devices

- 5.1.6. Robotic Assisted Surgical Systems

- 5.1.7. Ablation Devices

- 5.1.8. Laser Based Devices

- 5.1.9. Other MIS Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aesthetic

- 5.2.2. Cardiovascular

- 5.2.3. Gastrointestinal

- 5.2.4. Gynecological and Urological

- 5.2.5. Orthopedic

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Germany Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. North Rhine-Westphalia Germany Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Bavaria Germany Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Baden-Württemberg Germany Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. Lower Saxony Germany Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Hesse Germany Minimally Invasive Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Smith & Nephew

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Siemens Healthineers

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Zimmer Biomet

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 GE Healthcare

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Abbott Laboratories

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Medtronic PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Koninklijke Philips NV

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Intuitive Surgical Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Stryker Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Olympus Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Smith & Nephew

List of Figures

- Figure 1: Germany Minimally Invasive Surgery Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Minimally Invasive Surgery Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 22: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 23: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: Germany Minimally Invasive Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany Minimally Invasive Surgery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Minimally Invasive Surgery Devices Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Germany Minimally Invasive Surgery Devices Industry?

Key companies in the market include Smith & Nephew, Siemens Healthineers, Zimmer Biomet, GE Healthcare, Abbott Laboratories, Medtronic PLC, Koninklijke Philips NV, Intuitive Surgical Inc, Stryker Corporation, Olympus Corporation.

3. What are the main segments of the Germany Minimally Invasive Surgery Devices Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Higher Acceptance Rate of Minimally-invasive Surgeries over Traditional Surgeries in Country; Increasing Prevalence of Lifestyle-related and Chronic Disorders.

6. What are the notable trends driving market growth?

Orthopedic Surgery Segment is Expected to Exhibit Fastest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Uncertain Regulatory Framework.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Minimally Invasive Surgery Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Minimally Invasive Surgery Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Minimally Invasive Surgery Devices Industry?

To stay informed about further developments, trends, and reports in the Germany Minimally Invasive Surgery Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence