Key Insights

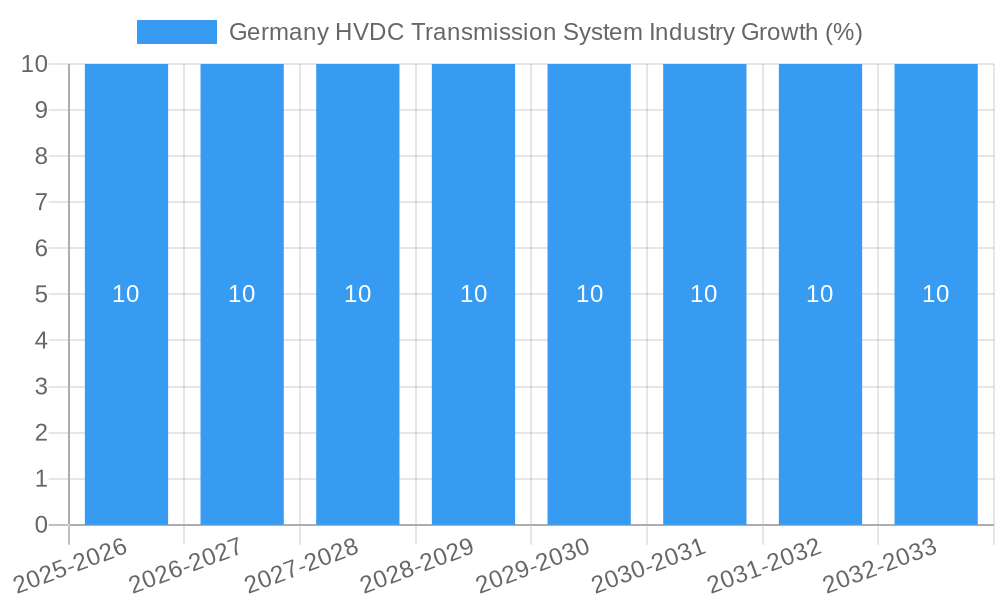

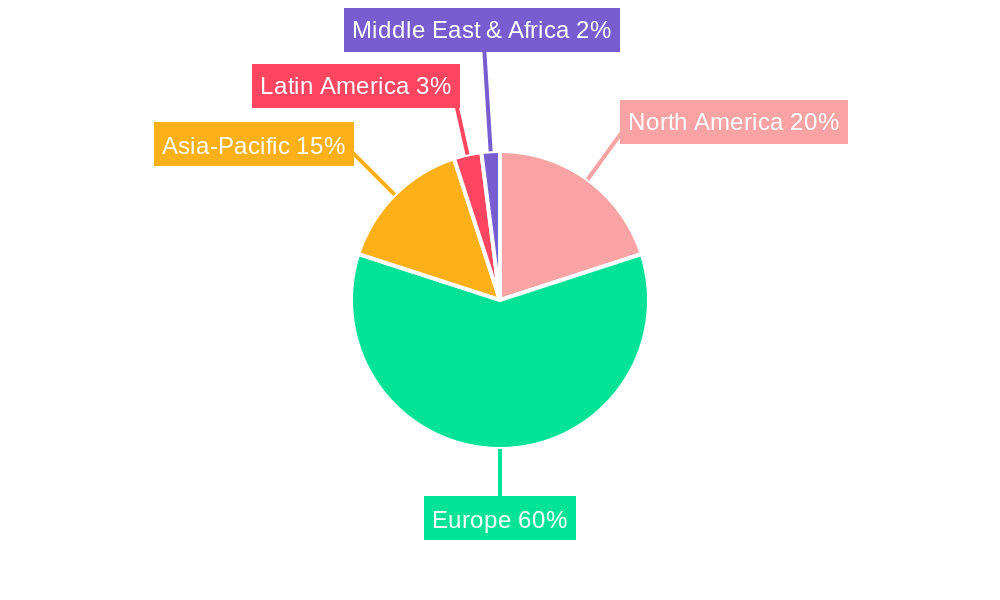

The Germany HVDC Transmission System Industry is poised for significant growth, with a projected market size expected to reach over $500 million by 2025, and a Compound Annual Growth Rate (CAGR) exceeding 10%. This robust expansion is driven by the increasing demand for efficient and reliable power transmission solutions across the nation. Key drivers include the integration of renewable energy sources into the grid, the need for long-distance power transmission, and governmental initiatives promoting energy efficiency. The market is segmented by transmission type, including Submarine HVDC Transmission Systems, HVDC Overhead Transmission Systems, and HVDC Underground Transmission Systems, each catering to specific geographical and operational needs. Additionally, the market is divided by components such as Converter Stations and Transmission Medium (Cables), with Converter Stations holding a significant share due to their critical role in the conversion of AC to DC and vice versa.

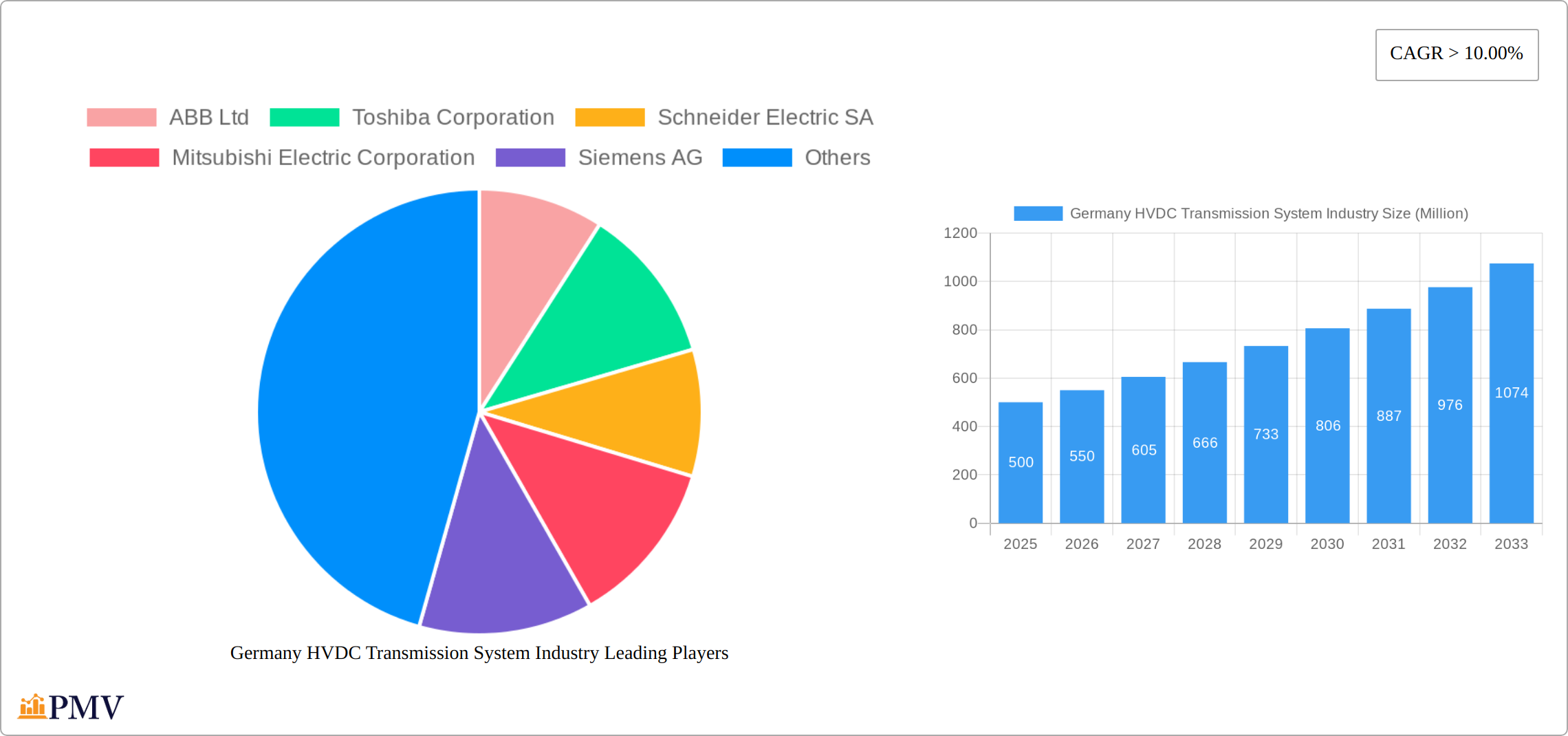

Regionally, North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse are pivotal areas for the HVDC transmission market in Germany. These regions are witnessing substantial investments in infrastructure to support the growing energy demands. Major players such as ABB Ltd, Toshiba Corporation, Schneider Electric SA, Mitsubishi Electric Corporation, Siemens AG, Hitachi Ltd, and General Electric Company are actively involved in advancing technology and expanding their market presence. Trends such as the adoption of advanced materials for cables and the development of more efficient converter stations are shaping the industry's future. However, challenges like high initial costs and technical complexities in installation and maintenance could restrain growth. The forecast period from 2025 to 2033 is expected to witness continued innovation and strategic collaborations to overcome these hurdles and further propel the market forward.

Germany HVDC Transmission System Industry Market Structure & Competitive Dynamics

The Germany HVDC Transmission System Industry exhibits a highly competitive landscape with a few major players dominating the market. Market concentration is moderate, with companies like ABB Ltd, Siemens AG, and General Electric Company holding significant market shares. In 2025, ABB Ltd is estimated to have a market share of approximately 25%, Siemens AG around 20%, and General Electric Company about 15%. The innovation ecosystem in Germany is robust, supported by government initiatives and research institutions focused on enhancing HVDC technology. Regulatory frameworks are stringent, ensuring safety and reliability, but also posing challenges to new entrants.

Product substitutes like HVAC systems are less efficient for long-distance power transmission, making HVDC systems the preferred choice for grid interconnectors. End-user trends show a growing preference for renewable energy integration, driving demand for HVDC systems. Mergers and acquisitions are frequent, with notable deals including the acquisition of Alstom's energy business by General Electric for approximately $14 Billion in 2015. These M&A activities have led to increased market consolidation and technological advancements.

- Market Concentration: Moderate, with key players holding significant shares.

- Innovation Ecosystem: Supported by government and research institutions.

- Regulatory Frameworks: Stringent, ensuring safety and reliability.

- Product Substitutes: HVAC systems less efficient for long distances.

- End-User Trends: Increased demand for renewable energy integration.

- M&A Activities: Frequent, with deals like GE's acquisition of Alstom's energy business.

Germany HVDC Transmission System Industry Industry Trends & Insights

The Germany HVDC Transmission System Industry is experiencing significant growth, driven by the need for efficient power transmission across long distances and the integration of renewable energy sources. The market is expected to grow at a CAGR of approximately 6.5% from 2025 to 2033. Technological disruptions, such as the development of Voltage Source Converters (VSC) and advancements in cable technology, are enhancing the efficiency and reliability of HVDC systems. Consumer preferences are shifting towards sustainable energy solutions, further boosting the demand for HVDC systems.

Competitive dynamics within the industry are intense, with companies continuously investing in R&D to develop more efficient and cost-effective solutions. Market penetration of HVDC systems in Germany is currently around 30%, with a projected increase to 45% by 2033. The integration of renewable energy sources like wind and solar power into the grid is a key driver, as HVDC systems are well-suited for transmitting power over long distances with minimal losses.

The German government's commitment to achieving 65% renewable energy by 2030 is a significant growth catalyst. Additionally, the ongoing digitalization of the energy sector is enabling better monitoring and control of HVDC systems, further enhancing their appeal. Despite these positive trends, challenges such as high initial costs and complex project execution remain, requiring innovative financing models and streamlined project management to overcome.

Dominant Markets & Segments in Germany HVDC Transmission System Industry

The Submarine HVDC Transmission System segment is currently the dominant market in Germany, driven by the country's extensive offshore wind energy projects. This segment is expected to grow at a CAGR of 7.2% from 2025 to 2033, reaching a market size of approximately $3.5 Billion by the end of the forecast period. Key drivers include:

- Economic Policies: Government incentives for renewable energy projects.

- Infrastructure: Development of offshore wind farms and interconnections.

The HVDC Overhead Transmission System segment, while smaller, is also significant, particularly for long-distance power transmission within Germany. This segment is projected to grow at a CAGR of 5.8%, with a market size of around $2.2 Billion by 2033. The HVDC Underground Transmission System segment, although less dominant, is gaining traction due to its suitability for urban areas and environmental considerations, with a projected CAGR of 6.1%.

By Component, Converter Stations are a crucial part of HVDC systems, with a market size of approximately $1.8 Billion in 2025, expected to grow to $2.5 Billion by 2033 at a CAGR of 6.3%. The Transmission Medium (Cables) segment is also vital, with a current market size of $1.5 Billion, projected to reach $2.1 Billion by 2033, growing at a CAGR of 5.9%.

The dominance of Submarine HVDC Transmission Systems is largely due to Germany's commitment to offshore wind energy, with projects like the NordLink and NordBalt interconnections driving demand. The need for efficient power transmission from offshore to onshore grids is a significant factor in the segment's growth. Additionally, the technical advantages of HVDC systems, such as lower transmission losses and the ability to control power flow, make them the preferred choice for these applications.

Germany HVDC Transmission System Industry Product Innovations

Recent product innovations in the Germany HVDC Transmission System Industry include the development of advanced Voltage Source Converters (VSC) that offer improved efficiency and control capabilities. Companies like Siemens AG have introduced modular multi-level converters (MMC) that enhance system reliability and reduce harmonic distortion. These innovations are well-suited to the German market, where the integration of renewable energy sources and the need for long-distance power transmission are key priorities. The focus on developing more compact and environmentally friendly solutions is also driving market fit, as these systems align with Germany's sustainability goals.

Report Segmentation & Scope

The Germany HVDC Transmission System Industry is segmented by Transmission Type and Component. By Transmission Type, the market includes Submarine HVDC Transmission System, HVDC Overhead Transmission System, and HVDC Underground Transmission System. The Submarine segment is expected to grow at a CAGR of 7.2%, reaching $3.5 Billion by 2033, driven by offshore wind projects. The Overhead segment is projected to grow at a CAGR of 5.8%, with a market size of $2.2 Billion by 2033, suitable for long-distance transmission. The Underground segment, with a CAGR of 6.1%, is gaining traction for urban applications.

By Component, the market is divided into Converter Stations and Transmission Medium (Cables). Converter Stations are projected to grow at a CAGR of 6.3%, reaching $2.5 Billion by 2033, essential for power conversion. The Transmission Medium segment is expected to grow at a CAGR of 5.9%, with a market size of $2.1 Billion by 2033, crucial for efficient power transmission.

Key Drivers of Germany HVDC Transmission System Industry Growth

The Germany HVDC Transmission System Industry is driven by several key factors. Technological advancements, such as the development of Voltage Source Converters (VSC) and high-capacity cables, are enhancing system efficiency and reliability. The integration of renewable energy sources, particularly offshore wind, is a significant driver, as HVDC systems are ideal for transmitting power over long distances with minimal losses. Economic factors, including government incentives and investments in renewable energy infrastructure, are also boosting market growth. Additionally, regulatory support for sustainable energy solutions and grid modernization is fueling the demand for HVDC systems in Germany.

Challenges in the Germany HVDC Transmission System Industry Sector

The Germany HVDC Transmission System Industry faces several challenges. Regulatory hurdles, such as stringent environmental and safety standards, can increase project costs and timelines. Supply chain issues, particularly for specialized components like high-voltage cables, can lead to delays and cost overruns. Competitive pressures from alternative technologies like HVAC systems, although less efficient for long distances, pose a threat. Additionally, the high initial investment required for HVDC projects can be a barrier, with costs estimated at $500,000 to $1 Million per kilometer of transmission line. These challenges require innovative solutions and strategic planning to overcome.

Leading Players in the Germany HVDC Transmission System Industry Market

- ABB Ltd

- Toshiba Corporation

- Schneider Electric SA

- Mitsubishi Electric Corporation

- Siemens AG

- Hitachi Ltd

- General Electric Company

Key Developments in Germany HVDC Transmission System Industry Sector

- January 2023: Siemens AG announced the successful commissioning of the NordLink HVDC interconnection, enhancing power exchange between Germany and Norway.

- March 2022: ABB Ltd launched a new series of HVDC converter stations designed to improve efficiency and reduce environmental impact.

- June 2021: General Electric Company completed the acquisition of Alstom's energy business, strengthening its position in the HVDC market.

Strategic Germany HVDC Transmission System Industry Market Outlook

The Germany HVDC Transmission System Industry is poised for significant growth, driven by the country's commitment to renewable energy and grid modernization. The market is expected to see increased demand for HVDC systems as offshore wind projects continue to expand. Strategic opportunities include the development of more efficient and environmentally friendly technologies, such as advanced converter stations and high-capacity cables. The integration of digital solutions for better system monitoring and control will also be a key growth accelerator. Companies that focus on innovation and sustainability are likely to gain a competitive edge in this dynamic market.

Germany HVDC Transmission System Industry Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Overhead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

Germany HVDC Transmission System Industry Segmentation By Geography

- 1. Germany

Germany HVDC Transmission System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Domestic Oil and Gas Production4.; Investments in Oil and Gas Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Growth of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Submarine HVDC Transmission System to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Overhead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. North Rhine-Westphalia Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schneider Electric SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hitachi Lt

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Germany HVDC Transmission System Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany HVDC Transmission System Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany HVDC Transmission System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Region 2019 & 2032

- Table 3: Germany HVDC Transmission System Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 4: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Transmission Type 2019 & 2032

- Table 5: Germany HVDC Transmission System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 6: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Component 2019 & 2032

- Table 7: Germany HVDC Transmission System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Region 2019 & 2032

- Table 9: Germany HVDC Transmission System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Country 2019 & 2032

- Table 11: North Rhine-Westphalia Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North Rhine-Westphalia Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 13: Bavaria Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Bavaria Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 15: Baden-Württemberg Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Baden-Württemberg Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 17: Lower Saxony Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Lower Saxony Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 19: Hesse Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Hesse Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 21: Germany HVDC Transmission System Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 22: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Transmission Type 2019 & 2032

- Table 23: Germany HVDC Transmission System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Component 2019 & 2032

- Table 25: Germany HVDC Transmission System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany HVDC Transmission System Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Germany HVDC Transmission System Industry?

Key companies in the market include ABB Ltd, Toshiba Corporation, Schneider Electric SA, Mitsubishi Electric Corporation, Siemens AG, Hitachi Lt, General Electric Company.

3. What are the main segments of the Germany HVDC Transmission System Industry?

The market segments include Transmission Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Domestic Oil and Gas Production4.; Investments in Oil and Gas Infrastructure Development.

6. What are the notable trends driving market growth?

Submarine HVDC Transmission System to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growth of Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in kilovolts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany HVDC Transmission System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany HVDC Transmission System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany HVDC Transmission System Industry?

To stay informed about further developments, trends, and reports in the Germany HVDC Transmission System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence