Key Insights

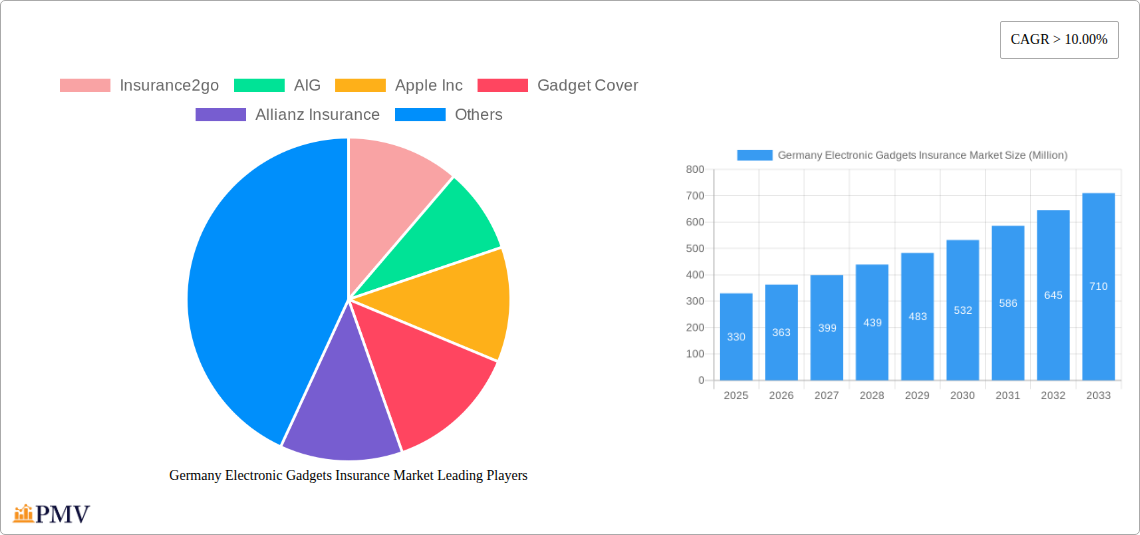

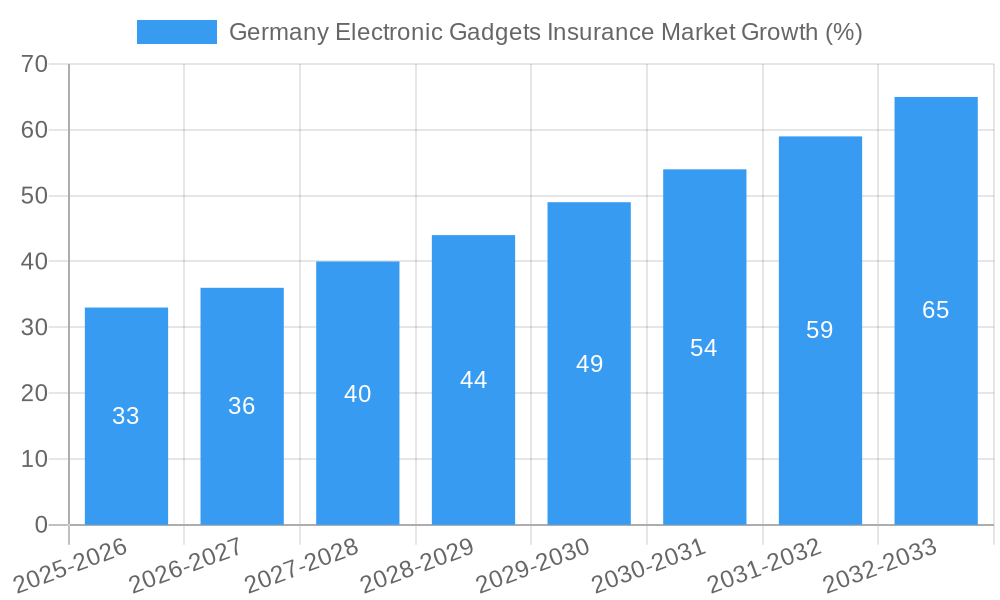

The German electronic gadgets insurance market is experiencing robust growth, driven by increasing smartphone and other electronic device ownership, rising consumer awareness of protection against accidental damage and theft, and the expanding availability of convenient online insurance options. The market's Compound Annual Growth Rate (CAGR) exceeding 10% from 2019 to 2024 suggests a significant upward trajectory. This growth is fueled by several key factors, including the increasing affordability of insurance plans, particularly for younger demographics, targeted marketing campaigns highlighting the value proposition of gadget insurance, and the proliferation of bundled insurance offers with mobile phone contracts and other electronics purchases. The market is segmented by device type (smartphones, laptops, tablets, wearables), insurance type (comprehensive, accidental damage, theft), and distribution channel (online, offline).

Major players like Allianz Insurance, AIG, and Assurant Inc., alongside specialized providers like Insurance2go and Gadget Cover, are competing for market share through innovative product offerings, competitive pricing, and targeted customer service. While the precise market size for 2025 is unavailable, projecting from the stated CAGR and assuming a 2024 market size of €300 million (a reasonable estimate based on similar markets), the 2025 market size could be approximately €330 million. The market's continued expansion into 2033 is expected, with increasing penetration among older demographics and expansion into new device categories, such as smart home devices, driving future growth. However, potential restraints include economic downturns that may affect consumer spending on non-essential insurance products and the increasing prevalence of manufacturer warranties potentially reducing the perceived need for third-party insurance.

Germany Electronic Gadgets Insurance Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Germany Electronic Gadgets Insurance Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. This report is crucial for understanding market dynamics, competitive landscapes, and future growth potential within the German electronic gadgets insurance sector. The report analyzes key players such as Insurance2go, AIG, Apple Inc, Gadget Cover, Allianz Insurance, Assurant Inc, Sunrise, Switched on Insurance, Tinhat, and AT&T Inc. (List not exhaustive).

Germany Electronic Gadgets Insurance Market Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the German electronic gadgets insurance market, examining market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. We analyze market share distribution among key players, identifying dominant firms and assessing their strategic moves. The report quantifies M&A deal values and assesses their impact on market dynamics. The xx% market share held by the top three players highlights a moderately concentrated market. Further analysis reveals a dynamic innovation ecosystem driven by technological advancements in gadget protection and insurance technology. The regulatory framework, while relatively stable, faces potential changes related to data privacy and consumer protection laws. The increasing availability of extended warranties and self-insurance options represents a significant challenge to market growth, creating a competitive landscape with diverse solutions. M&A activity is moderate, with deal values in the range of xx Million, mainly focused on enhancing technological capabilities and expanding customer bases.

Germany Electronic Gadgets Insurance Market Industry Trends & Insights

This section explores the key trends shaping the Germany Electronic Gadgets Insurance Market. The market is experiencing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing smartphone and smart device penetration, rising consumer awareness of gadget insurance, and the increasing value of electronic devices. Technological disruptions, such as the rise of IoT devices and wearable technology, are further fueling demand for specialized insurance solutions. Consumer preferences are shifting towards comprehensive coverage plans that include accidental damage, theft, and extended warranties. Market penetration for electronic gadgets insurance stands at xx% in 2025, projected to reach xx% by 2033. This growth is influenced by competitive dynamics, with players focusing on personalized offerings, digital platforms, and enhanced customer service to capture market share.

Dominant Markets & Segments in Germany Electronic Gadgets Insurance Market

This section identifies the leading segments and regions within the German electronic gadgets insurance market. The largest segment is expected to be Smartphone Insurance, followed by Laptop/Tablet Insurance, and Smartwatch/Wearable Insurance.

- Key Drivers for Smartphone Insurance Dominance:

- High smartphone penetration rates in Germany.

- Increased vulnerability of smartphones to damage and theft.

- Relatively high repair costs for smartphones.

- Aggressive marketing and competitive pricing strategies by insurers. The strong economic conditions in Germany and well-developed infrastructure contribute to this sector's growth. Furthermore, the availability of multiple providers offering diverse products and competitive pricing also contributes to dominance in this sector.

Germany Electronic Gadgets Insurance Market Product Innovations

Recent innovations focus on tailored insurance plans based on device value and usage, alongside digital platforms for streamlined claims processing and real-time support. Telematics integration, allowing for risk assessment based on user behavior, and the emergence of AI-powered claims handling are also transforming the market. These innovations reflect a focus on providing user-friendly and efficient solutions that enhance customer experience and reduce processing times, aligning with the market's growing demand for convenience and transparency.

Report Segmentation & Scope

The Germany Electronic Gadgets Insurance Market is segmented by device type (smartphones, laptops, tablets, smartwatches, etc.), coverage type (comprehensive, accidental damage, theft), distribution channel (online, offline), and customer demographic. Growth projections vary across segments, with the smartphone insurance segment exhibiting the highest growth rate, followed by the laptop and tablet segment. Competitive dynamics also differ across segments; for instance, the smartphone insurance segment exhibits intense competition due to its larger market size.

Key Drivers of Germany Electronic Gadgets Insurance Market Growth

The growth of the Germany Electronic Gadgets Insurance Market is driven by several factors. The increasing affordability and penetration of electronic gadgets are key, alongside rising consumer awareness of the financial risks associated with device loss or damage. Technological advancements, such as the development of sophisticated insurance platforms, contribute to enhanced user experience. Moreover, favorable regulatory environments and government initiatives promoting digital insurance adoption further accelerate market growth.

Challenges in the Germany Electronic Gadgets Insurance Market Sector

The market faces challenges such as increasing competition from extended warranties and self-insurance options, potentially limiting market growth. The complex regulatory landscape and data privacy concerns associated with digital insurance platforms represent significant hurdles. Fluctuating economic conditions also impact consumer spending and insurance adoption rates. These factors combined create a complex and dynamic market environment requiring a flexible and agile approach for market participants.

Leading Players in the Germany Electronic Gadgets Insurance Market Market

- Insurance2go

- AIG

- Apple Inc

- Gadget Cover

- Allianz Insurance

- Assurant Inc

- Sunrise

- Switched on Insurance

- Tinhat

- AT&T Inc

(List not exhaustive)

Key Developments in Germany Electronic Gadgets Insurance Market Sector

- May 2022: American International Group, Inc. (AIG) named one of DiversityInc's Top 50 Companies for Diversity for the fifth consecutive year, reflecting a commitment to inclusivity within the industry.

- April 2022: Assurant Inc. integrated Nationwide's Insurance Verification Digital Product into its HOIVerifySM tracking solution, enhancing efficiency and customer convenience in policy verification.

Strategic Germany Electronic Gadgets Insurance Market Market Outlook

The Germany Electronic Gadgets Insurance Market is poised for significant growth, driven by increasing gadget adoption and evolving consumer preferences. Strategic opportunities lie in developing innovative insurance products catering to niche segments, leveraging technology to enhance customer experience, and expanding into new distribution channels. Focus on personalization, data analytics, and sustainable business practices will further strengthen market positions and drive future growth.

Germany Electronic Gadgets Insurance Market Segmentation

-

1. Coverage Type

- 1.1. Physical Damage

- 1.2. Electronic Damage

- 1.3. Data Protection

- 1.4. Virus Protection

- 1.5. Theft Protection

-

2. Device Type

- 2.1. Laptops

- 2.2. Mobile Devices

- 2.3. Cameras

- 2.4. Computers

- 2.5. Tablets

-

3. End User

- 3.1. Corporate

- 3.2. Individual

Germany Electronic Gadgets Insurance Market Segmentation By Geography

- 1. Germany

Germany Electronic Gadgets Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Digitization & Demand for Electronic Gadgets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Electronic Gadgets Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 5.1.1. Physical Damage

- 5.1.2. Electronic Damage

- 5.1.3. Data Protection

- 5.1.4. Virus Protection

- 5.1.5. Theft Protection

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. Laptops

- 5.2.2. Mobile Devices

- 5.2.3. Cameras

- 5.2.4. Computers

- 5.2.5. Tablets

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Corporate

- 5.3.2. Individual

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Insurance2go

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AIG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Apple Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gadget Cover

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Allianz Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Assurant Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunrise

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Switched on Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tinhat

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 At&T Inc **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Insurance2go

List of Figures

- Figure 1: Germany Electronic Gadgets Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Electronic Gadgets Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 3: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 7: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 8: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by End User 2019 & 2032

- Table 9: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Electronic Gadgets Insurance Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Germany Electronic Gadgets Insurance Market?

Key companies in the market include Insurance2go, AIG, Apple Inc, Gadget Cover, Allianz Insurance, Assurant Inc, Sunrise, Switched on Insurance, Tinhat, At&T Inc **List Not Exhaustive.

3. What are the main segments of the Germany Electronic Gadgets Insurance Market?

The market segments include Coverage Type, Device Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Digitization & Demand for Electronic Gadgets.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2022, for the fifth consecutive year, American International Group, Inc. has been named one of DiversityInc's Top 50 Companies for Diversity, the leading assessment of diversity management in corporate America. AIG has elevated its rank every year since first reaching the Top 50 in 2018 and improved from 37th to 32nd place in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Electronic Gadgets Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Electronic Gadgets Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Electronic Gadgets Insurance Market?

To stay informed about further developments, trends, and reports in the Germany Electronic Gadgets Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence