Key Insights

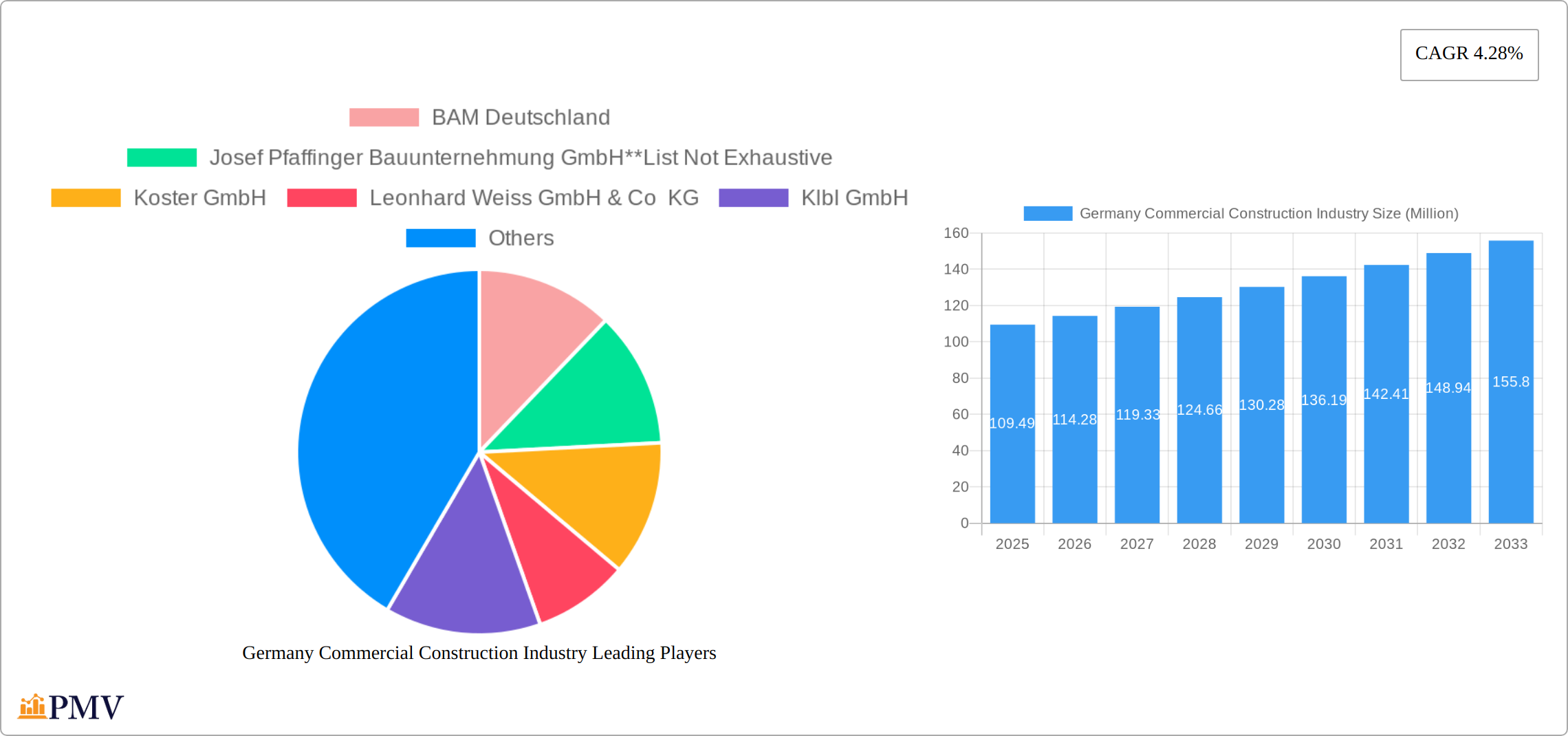

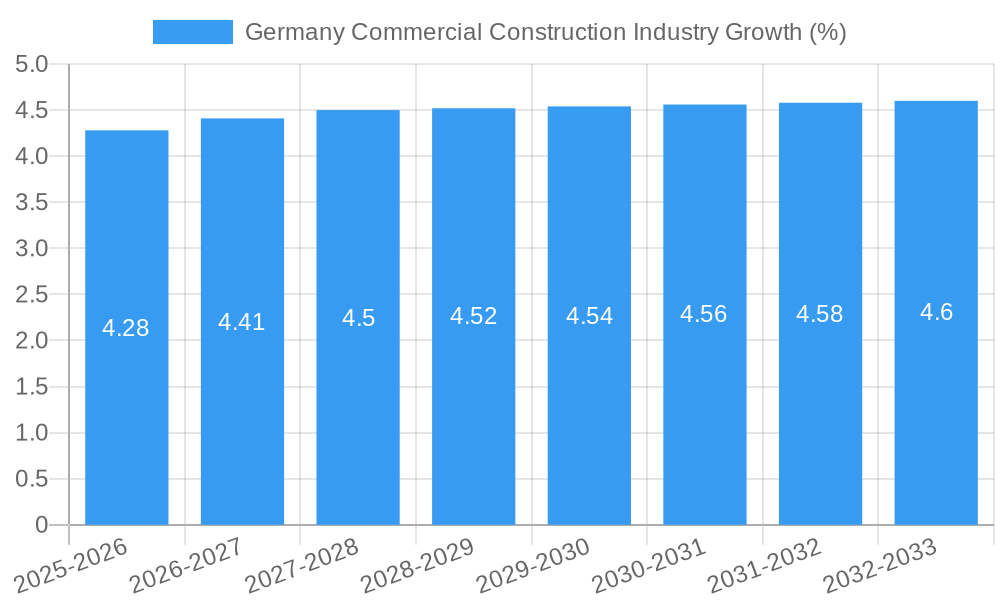

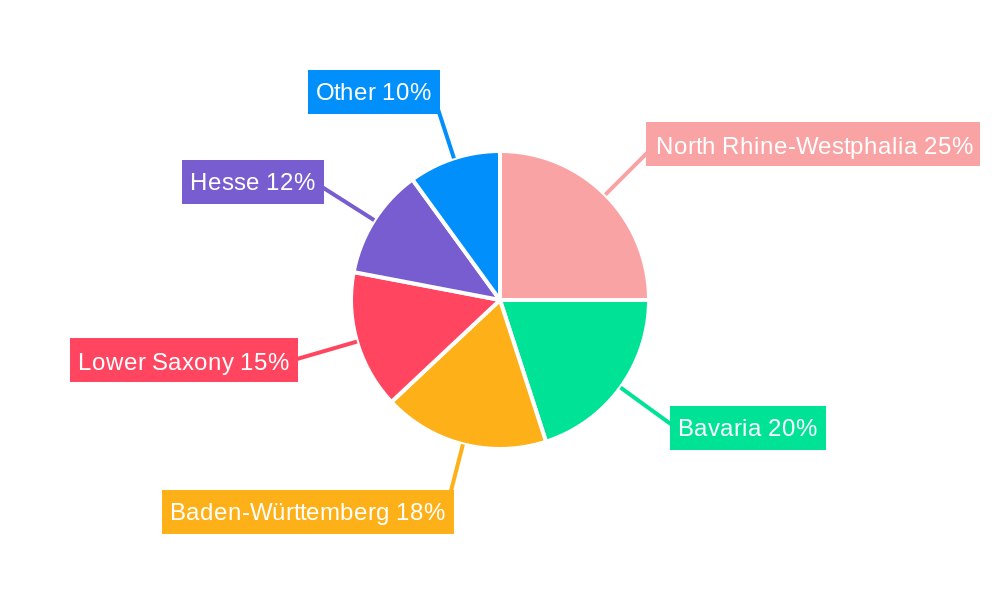

The German commercial construction industry, valued at €109.49 million in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.28% from 2025 to 2033. This growth is driven by several factors. Firstly, increasing urbanization and population density in major cities like Berlin, Munich, and Frankfurt necessitate the construction of new office spaces, retail outlets, and hospitality facilities. Secondly, government investments in infrastructure projects and a robust economy are fueling demand for commercial building construction. Furthermore, the ongoing trend towards sustainable and green building practices is influencing construction methods and materials, creating new opportunities for specialized contractors. The market is segmented by type, with office building construction likely holding the largest share followed by retail and hospitality. Key players such as BAM Deutschland, Strabag AG, and Goldbeck Ost GmbH, along with numerous mid-sized and regional firms, compete in this dynamic market. Regional variations exist, with North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse representing significant market segments due to their strong economic activity and established industrial bases. While growth is expected, potential restraints include fluctuations in the availability of skilled labor, increasing material costs, and potential economic downturns impacting investment levels.

The forecast period (2025-2033) anticipates continued expansion, albeit at a potentially moderated pace compared to previous years. This moderation could result from global economic uncertainties or shifts in investment priorities. Nevertheless, the long-term outlook for the German commercial construction sector remains positive, driven by the country's stable economy, ongoing infrastructure development, and consistent demand for modern commercial spaces. The industry's focus on sustainability and technological advancements will further shape its trajectory in the coming years, attracting investment in innovative construction technologies and eco-friendly materials. This necessitates companies to adapt to evolving regulations and consumer preferences to maintain a competitive edge.

Germany Commercial Construction Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Germany commercial construction industry, covering market structure, competitive dynamics, industry trends, and future growth prospects from 2019 to 2033. The report incorporates key data and insights for strategic decision-making, focusing on market segments, leading players, and significant industry developments. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period covers 2019-2024. This report is crucial for investors, industry professionals, and strategic planners seeking a comprehensive understanding of this dynamic market.

Germany Commercial Construction Industry Market Structure & Competitive Dynamics

The German commercial construction market is characterized by a moderately concentrated structure, with several large players dominating the landscape. Key players include BAM Deutschland, Josef Pfaffinger Bauunternehmung GmbH, Koster GmbH, Leonhard Weiss GmbH & Co KG, Klbl GmbH, Strabag AG, AUG PRIEN Bauunternehmung (GmbH & Co KG), Goldbeck Ost GmbH Niederlassung Sachsen-Plauen, Gottlob Brodbeck GmbH & Co KG, and Dechant hoch- und ingenieurbau gmbh. However, a significant number of smaller and medium-sized enterprises (SMEs) also contribute to the overall market volume.

Market share is highly dynamic, influenced by project wins, M&A activity, and economic conditions. Strabag AG and BAM Deutschland hold significant market share, estimated at xx% and xx% respectively (2025). The competitive landscape is further shaped by innovation ecosystems, particularly in sustainable construction practices and digital technologies. The regulatory framework, including building codes and environmental regulations, significantly impacts the market. Product substitutes, such as modular construction methods, are gaining traction, posing both a challenge and an opportunity for traditional players. End-user trends, such as demand for green buildings and flexible workspaces, drive innovation and market segmentation. M&A activity is moderate, with deal values fluctuating based on market conditions. Recent transactions have focused on expanding geographical reach and service offerings. The total value of M&A deals in the historical period (2019-2024) is estimated at approximately €xx Million.

Germany Commercial Construction Industry Industry Trends & Insights

The German commercial construction market exhibits a complex interplay of growth drivers, technological disruptions, and evolving consumer preferences. Historical data suggests a CAGR of xx% (2019-2024), with projections indicating a CAGR of xx% during the forecast period (2025-2033). Market penetration of sustainable building materials and technologies is steadily increasing, driven by both environmental concerns and government incentives. Technological disruptions, including Building Information Modeling (BIM) and digital construction platforms, are improving efficiency and productivity. Consumer preferences are shifting towards sustainable, energy-efficient, and technologically advanced buildings. These trends are influencing the competitive dynamics, with companies investing in technological advancements and sustainable practices to gain a competitive edge. The market shows a strong correlation with macroeconomic indicators, with growth positively impacted by increased investment in infrastructure and real estate. The growing hospitality sector is significantly contributing to demand for commercial construction, evidenced by recent expansion plans of companies like Premier Inn.

Dominant Markets & Segments in Germany Commercial Construction Industry

While data specifics on regional dominance are not available for this report, we can provide segment analysis. The German commercial construction market is segmented by building type: Office Building Construction, Retail Construction, Hospitality Construction, Institutional Construction, and Other Types. While the exact market share for each segment is unavailable, we can analyse the key drivers contributing to their dominance.

- Office Building Construction: Key drivers include strong demand from the corporate sector, particularly in major cities, and government policies promoting urban regeneration.

- Retail Construction: Growth is influenced by e-commerce trends, the rise of experiential retail, and urban planning initiatives.

- Hospitality Construction: Driven by increasing tourism and business travel, as illustrated by the recent expansion of Premier Inn.

- Institutional Construction: This segment is largely dependent on government spending and public investments in infrastructure.

- Other Types: This segment encompasses various building types, including industrial and logistics facilities, which are expanding due to e-commerce growth and supply chain changes.

Each segment faces its own set of challenges and opportunities, influenced by factors such as economic conditions, technological advancements, and regulatory changes. The exact market size for each segment for 2025 requires further research.

Germany Commercial Construction Industry Product Innovations

The German commercial construction industry is witnessing significant product innovation, particularly in sustainable building materials, prefabrication techniques, and digital technologies. The adoption of Building Information Modeling (BIM) is transforming design and construction processes, improving efficiency, and reducing errors. The increasing use of sustainable materials, such as cross-laminated timber (CLT) and recycled materials, reflects growing environmental awareness and regulatory pressures. These innovations offer competitive advantages by reducing construction time, costs, and environmental impact, creating a demand for skilled professionals adept at managing these new technologies.

Report Segmentation & Scope

This report segments the German commercial construction market primarily by building type:

Office Building Construction: This segment encompasses the construction of office buildings, including high-rise structures and smaller office spaces. Growth projections for this segment are tied to economic growth and demand for office space. Competitive dynamics are influenced by factors like location, building design, and sustainability features. Market size for 2025 is estimated at €xx Million.

Retail Construction: This segment includes the construction of shopping malls, retail stores, and other commercial spaces. Growth is expected to be moderate, influenced by e-commerce trends and changing consumer behavior. Market size for 2025 is estimated at €xx Million.

Hospitality Construction: This includes hotels, restaurants, and other hospitality facilities. The expansion of international hotel chains like Premier Inn indicates strong growth potential. Market size for 2025 is estimated at €xx Million.

Institutional Construction: This segment covers hospitals, schools, government buildings, and other public institutions. Growth depends on government spending and public policy. Market size for 2025 is estimated at €xx Million.

Other Types: This encompasses various commercial building types not categorized above, including industrial and logistics facilities. Growth is influenced by e-commerce, industrial activity and supply chain developments. Market size for 2025 is estimated at €xx Million.

Key Drivers of Germany Commercial Construction Industry Growth

Several factors are driving the growth of the German commercial construction industry. Strong economic growth provides a solid foundation for increased investment in infrastructure and real estate. Government policies promoting sustainable building practices and urban regeneration are also stimulating demand. Technological advancements, including BIM and prefabrication, are increasing efficiency and productivity, thereby driving growth. The increasing demand for modern and energy-efficient buildings is shaping the market. Finally, the rise in tourism and the expansion of international hotel chains are contributing to the growth of hospitality construction.

Challenges in the Germany Commercial Construction Industry Sector

The German commercial construction sector faces several challenges, including skilled labor shortages, rising material costs, and stringent environmental regulations. Supply chain disruptions, particularly in the wake of global events, have negatively impacted project timelines and budgets. Increased regulatory scrutiny necessitates compliance costs, potentially delaying projects. The growing complexity of building projects and the need for specialized expertise also poses a challenge. These factors collectively impact overall profitability and project completion timelines.

Leading Players in the Germany Commercial Construction Industry Market

- BAM Deutschland

- Josef Pfaffinger Bauunternehmung GmbH

- Koster GmbH

- Leonhard Weiss GmbH & Co KG

- Klbl GmbH

- Strabag AG

- AUG PRIEN Bauunternehmung (GmbH & Co KG)

- Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- Gottlob Brodbeck GmbH & Co KG

- Dechant hoch- und ingenieurbau gmbh

Key Developments in Germany Commercial Construction Industry Sector

August 2023: Schuttflix secured €45 Million (USD 47.37 Million) in funding to enhance its technology, expand into new markets, and improve sustainability efforts. This signifies increased investment in digitalization within the sector.

April 2023: Premier Inn's acquisition of six hotels and plans to add 1,000-1,500 rooms in Germany underscore the growth of the hospitality segment and the potential for M&A activity. The company's significant investment signals confidence in the German market.

Strategic Germany Commercial Construction Industry Market Outlook

The future of the German commercial construction industry appears promising, with continued growth driven by economic expansion, technological innovation, and a focus on sustainability. Strategic opportunities lie in leveraging digital technologies to improve efficiency, investing in sustainable building practices, and specializing in niche segments like green building or modular construction. Addressing the challenge of skilled labor shortages through workforce development initiatives will also be crucial for sustained growth. The market presents attractive opportunities for companies that can adapt to changing technologies, address environmental concerns, and meet the evolving needs of end-users.

Germany Commercial Construction Industry Segmentation

-

1. Type

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Other Types

Germany Commercial Construction Industry Segmentation By Geography

- 1. Germany

Germany Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Green buildings is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North Rhine-Westphalia Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BAM Deutschland

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Koster GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leonhard Weiss GmbH & Co KG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Klbl GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Strabag AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AUG PRIEN Bauunternehmung (GmbH & Co KG)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gottlob Brodbeck GmbH & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dechant hoch- und ingenieurbau gmbh

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BAM Deutschland

List of Figures

- Figure 1: Germany Commercial Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Commercial Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North Rhine-Westphalia Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Bavaria Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Baden-Württemberg Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Lower Saxony Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Hesse Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Commercial Construction Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Germany Commercial Construction Industry?

Key companies in the market include BAM Deutschland, Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive, Koster GmbH, Leonhard Weiss GmbH & Co KG, Klbl GmbH, Strabag AG, AUG PRIEN Bauunternehmung (GmbH & Co KG), Goldbeck Ost GmbH Niederlassung Sachsen-Plauen, Gottlob Brodbeck GmbH & Co KG, Dechant hoch- und ingenieurbau gmbh.

3. What are the main segments of the Germany Commercial Construction Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Increasing Investments in Green buildings is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

August 2023: Gutersloh-based Schuttflix, a German digital marketplace and delivery platform for bulk construction supplies, announced that it had secured EUR 45 million (USD 47.37 million) in a fresh round of funding. Schuttflix says it will use the funds to enhance its technology, expand into new markets, diversify services, form partnerships, attract top talent, invest in marketing, prioritize customer support, and contribute to sustainability efforts in the construction sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Germany Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence