Key Insights

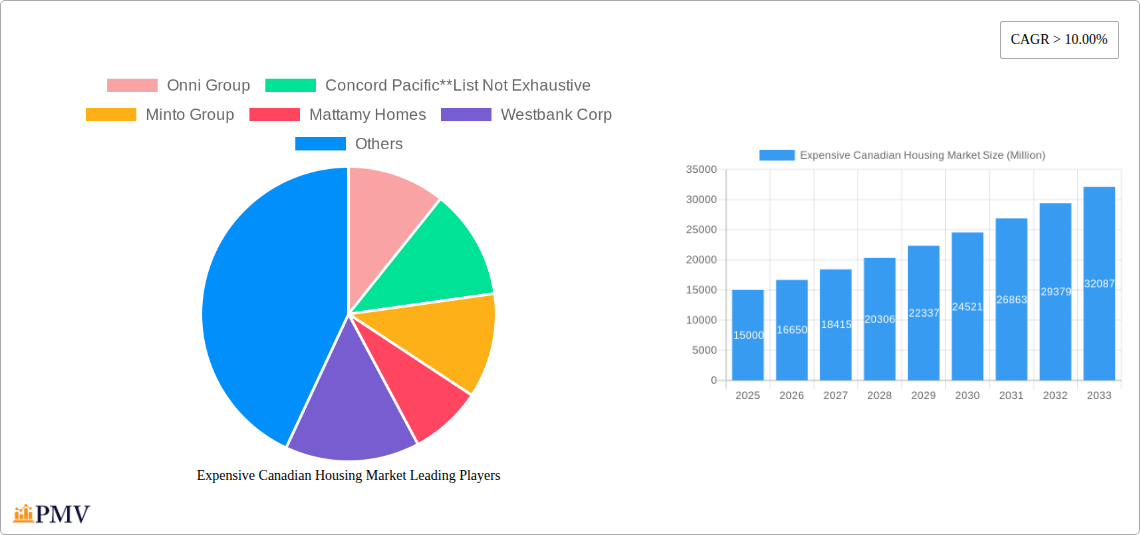

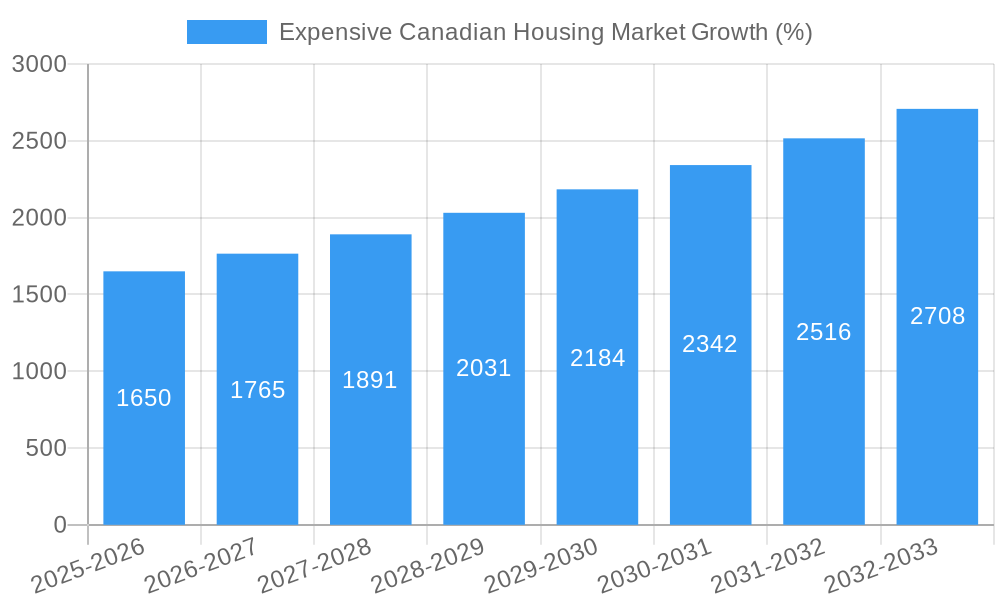

The Canadian luxury housing market, encompassing high-end apartments, condominiums, villas, and landed houses, is experiencing robust growth, driven by a confluence of factors. A strong economy, particularly in major cities like Toronto, Vancouver, and Montreal, fuels high demand from both domestic and international high-net-worth individuals. Limited land availability in prime urban areas further restricts supply, contributing to escalating prices. Immigration trends, particularly skilled worker immigration, also contribute to increased demand for premium housing. While rising interest rates act as a restraint, the overall market remains resilient due to the enduring appeal of owning luxury properties as both a lifestyle choice and a valuable investment. The market segmentation reveals that apartments and condominiums in major urban centers hold the largest share, followed by villas and landed houses, primarily located in affluent suburban areas. Major developers like Onni Group, Concord Pacific, Minto Group, and Mattamy Homes are key players shaping the market through their luxury projects. The market's projected CAGR of over 10% indicates significant growth potential over the forecast period (2025-2033), although variations across different cities and property types are expected.

The future of the Canadian luxury housing market hinges on several key considerations. Continued economic stability and sustained immigration levels will be crucial to maintaining high demand. Government policies regarding foreign investment and housing regulations will also play a significant role in shaping market dynamics. The potential impact of technological advancements in construction and real estate transactions, such as smart home technology and online property platforms, should also be considered. Furthermore, environmental concerns and sustainability initiatives are expected to increasingly influence the development and construction of luxury housing projects. A careful consideration of these factors is crucial for investors and developers seeking to navigate this dynamic and lucrative market successfully.

Expensive Canadian Housing Market: 2019-2033 Forecast & Analysis

This comprehensive report provides an in-depth analysis of the expensive Canadian housing market, offering invaluable insights for investors, developers, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth potential across key segments and cities. The report leverages extensive data analysis to project market values in Millions (M).

Expensive Canadian Housing Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the Canadian luxury housing market, examining market concentration, innovation, regulation, and mergers and acquisitions (M&A) activity. The market is characterized by a relatively concentrated group of large players, with some exhibiting significant regional dominance. Onni Group, Concord Pacific, Minto Group, Mattamy Homes, Westbank Corp, The Daniels Corporation, Valencia Residential, Amacon, Brookfield Residential, and Oxford Properties Group are key players, although market share data varies significantly by region and housing type. Innovation is driven by technological advancements in construction and design, as well as evolving consumer preferences for sustainable and smart homes. Regulatory frameworks, including zoning laws and building codes, significantly impact development costs and project timelines. Substitution effects are limited, given the unique nature of luxury housing. M&A activity is relatively frequent, driven by companies seeking to expand their market reach and product portfolios. For example, recent deals valued at over $XX M have been observed, shaping the competitive landscape. The market is projected to have a [XX]% concentration ratio in 2025.

- Market Concentration: High in major cities, more fragmented in smaller markets.

- Innovation: Focus on sustainable building practices, smart home technology, and unique architectural designs.

- Regulatory Framework: Significant influence on development costs and timelines.

- M&A Activity: Deal values exceeding $XX M annually (2019-2024 average).

Expensive Canadian Housing Market Industry Trends & Insights

The Canadian luxury housing market experienced [XX]% CAGR from 2019-2024. Several factors are driving this growth, including rising household incomes in major urban centers, limited housing supply, and increasing demand for high-end properties. Technological disruptions, such as the use of Building Information Modeling (BIM) and prefabrication techniques, are improving efficiency and reducing construction times. Consumer preferences are shifting towards sustainable and smart homes, influencing the types of properties being developed. The competitive landscape is dynamic, with continuous innovation and M&A activity shaping market shares. Market penetration of smart home technologies is projected to reach [XX]% by 2033. Growth is anticipated to slow slightly in the forecast period, with a projected CAGR of [XX]% (2025-2033), due to economic uncertainties and potential interest rate hikes.

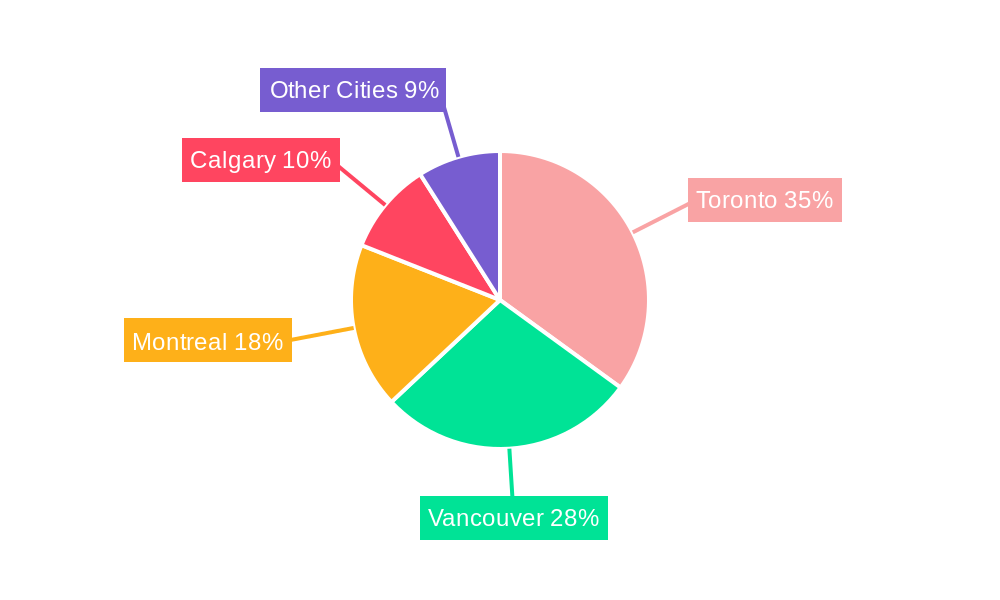

Dominant Markets & Segments in Expensive Canadian Housing Market

The most dominant markets are located in major Canadian cities. Toronto, Vancouver, and Montreal consistently represent the highest-value segments due to strong economic performance, limited land availability, and high demand from both domestic and international buyers.

Dominant Cities:

- Toronto: High demand driven by strong employment growth and immigration.

- Vancouver: Limited supply and strong international demand contribute to high prices.

- Montreal: Growing popularity as a sophisticated and affordable (relatively) alternative to Toronto and Vancouver.

Dominant Housing Types:

- Apartments and Condominiums: High demand, particularly in urban centers, driving high prices in luxury segments.

- Villas and Landed Houses: Strong demand in suburban areas and affluent neighborhoods.

Key Drivers:

- Strong economic performance in major cities.

- Limited land availability.

- High demand from both domestic and international buyers.

- Favorable government policies (although with limitations).

Expensive Canadian Housing Market Product Innovations

Significant innovations include the integration of smart home technologies, sustainable building materials (e.g., cross-laminated timber), and the use of advanced construction techniques like modular construction to accelerate project completion and minimize costs. These innovations enhance the appeal of luxury properties, offering buyers increased convenience, energy efficiency, and environmental responsibility. The market is increasingly receptive to these advanced offerings, driving further innovation and competition.

Report Segmentation & Scope

This report segments the market by housing type (Apartments and Condominiums; Villas and Landed Houses) and by city (Toronto, Montreal, Vancouver, Calgary, Other Cities). Each segment is analyzed separately, providing detailed insights into market size, growth projections, and competitive dynamics. For instance, the Toronto condominium market is projected to reach $XX M in 2025, with a CAGR of [XX]% during the forecast period. The Vancouver villas and landed houses segment is expected to grow at [XX]%, reaching $XX M by 2033. Competitive dynamics vary across segments and cities.

Key Drivers of Expensive Canadian Housing Market Growth

Strong economic growth in major Canadian cities, limited land availability, and increasing demand for luxury housing are key drivers of market growth. Government policies, although complex and subject to change, play a significant role. Technological advancements in construction and design also contribute to market expansion. Furthermore, the influx of high-net-worth individuals into these markets fuels demand.

Challenges in the Expensive Canadian Housing Market Sector

The high cost of land and construction, stringent regulatory requirements leading to lengthy approval processes, and increasing interest rates pose significant challenges. Supply chain disruptions have also led to construction delays and increased material costs impacting profitability. Increased competition amongst developers also pressures pricing and margins. These factors cumulatively contribute to reducing the overall affordability and increasing risk within the sector.

Leading Players in the Expensive Canadian Housing Market Market

- Onni Group

- Concord Pacific

- Minto Group

- Mattamy Homes

- Westbank Corp

- The Daniels Corporation

- Valencia Residential

- Amacon

- Brookfield Residential

- Oxford Properties Group

Key Developments in Expensive Canadian Housing Market Sector

- 2022 Q4: Increased interest rates impacting buyer affordability.

- 2023 Q1: Onni Group launches a new luxury condominium project in Vancouver.

- 2023 Q2: Concord Pacific merges with a smaller developer, expanding its market share.

- 2024 Q3: Government introduces new regulations impacting building permits.

Strategic Expensive Canadian Housing Market Market Outlook

The Canadian luxury housing market is expected to witness continued growth, albeit at a moderated pace. Strategic opportunities exist in developing sustainable and smart homes, catering to evolving consumer preferences. Focusing on specific niche markets and leveraging technological advancements will be crucial for success. Maintaining a diversified portfolio and carefully navigating regulatory challenges are vital aspects of a successful long-term strategy.

Expensive Canadian Housing Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Cities

- 2.1. Toronto

- 2.2. Montreal

- 2.3. Vancouver

- 2.4. Calgary

- 2.5. Other Cities

Expensive Canadian Housing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Expensive Canadian Housing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Remote and Hybrid Work Model

- 3.3. Market Restrains

- 3.3.1. Lack of Privacy

- 3.4. Market Trends

- 3.4.1. Pandemic Accelerated Luxury Home Sales in Major Canadian Markets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Toronto

- 5.2.2. Montreal

- 5.2.3. Vancouver

- 5.2.4. Calgary

- 5.2.5. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Villas and Landed Houses

- 6.2. Market Analysis, Insights and Forecast - by Cities

- 6.2.1. Toronto

- 6.2.2. Montreal

- 6.2.3. Vancouver

- 6.2.4. Calgary

- 6.2.5. Other Cities

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Villas and Landed Houses

- 7.2. Market Analysis, Insights and Forecast - by Cities

- 7.2.1. Toronto

- 7.2.2. Montreal

- 7.2.3. Vancouver

- 7.2.4. Calgary

- 7.2.5. Other Cities

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Villas and Landed Houses

- 8.2. Market Analysis, Insights and Forecast - by Cities

- 8.2.1. Toronto

- 8.2.2. Montreal

- 8.2.3. Vancouver

- 8.2.4. Calgary

- 8.2.5. Other Cities

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Villas and Landed Houses

- 9.2. Market Analysis, Insights and Forecast - by Cities

- 9.2.1. Toronto

- 9.2.2. Montreal

- 9.2.3. Vancouver

- 9.2.4. Calgary

- 9.2.5. Other Cities

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Villas and Landed Houses

- 10.2. Market Analysis, Insights and Forecast - by Cities

- 10.2.1. Toronto

- 10.2.2. Montreal

- 10.2.3. Vancouver

- 10.2.4. Calgary

- 10.2.5. Other Cities

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Dubai Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Abu Dhabi Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Sharjah Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Other Cities Expensive Canadian Housing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Onni Group

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Concord Pacific**List Not Exhaustive

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Minto Group

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Mattamy Homes

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Westbank Corp

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 The Daniels Corporation

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Valencia Residential

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Amacon

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Brookfield Residential

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Oxford Properties Group

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Onni Group

List of Figures

- Figure 1: Global Expensive Canadian Housing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Dubai Expensive Canadian Housing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Dubai Expensive Canadian Housing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Abu Dhabi Expensive Canadian Housing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Abu Dhabi Expensive Canadian Housing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Sharjah Expensive Canadian Housing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Sharjah Expensive Canadian Housing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Other Cities Expensive Canadian Housing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Other Cities Expensive Canadian Housing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Expensive Canadian Housing Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Expensive Canadian Housing Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Expensive Canadian Housing Market Revenue (Million), by Cities 2024 & 2032

- Figure 13: North America Expensive Canadian Housing Market Revenue Share (%), by Cities 2024 & 2032

- Figure 14: North America Expensive Canadian Housing Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Expensive Canadian Housing Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America Expensive Canadian Housing Market Revenue (Million), by Type 2024 & 2032

- Figure 17: South America Expensive Canadian Housing Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Expensive Canadian Housing Market Revenue (Million), by Cities 2024 & 2032

- Figure 19: South America Expensive Canadian Housing Market Revenue Share (%), by Cities 2024 & 2032

- Figure 20: South America Expensive Canadian Housing Market Revenue (Million), by Country 2024 & 2032

- Figure 21: South America Expensive Canadian Housing Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Expensive Canadian Housing Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Expensive Canadian Housing Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Expensive Canadian Housing Market Revenue (Million), by Cities 2024 & 2032

- Figure 25: Europe Expensive Canadian Housing Market Revenue Share (%), by Cities 2024 & 2032

- Figure 26: Europe Expensive Canadian Housing Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Expensive Canadian Housing Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Expensive Canadian Housing Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East & Africa Expensive Canadian Housing Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East & Africa Expensive Canadian Housing Market Revenue (Million), by Cities 2024 & 2032

- Figure 31: Middle East & Africa Expensive Canadian Housing Market Revenue Share (%), by Cities 2024 & 2032

- Figure 32: Middle East & Africa Expensive Canadian Housing Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East & Africa Expensive Canadian Housing Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific Expensive Canadian Housing Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Asia Pacific Expensive Canadian Housing Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Asia Pacific Expensive Canadian Housing Market Revenue (Million), by Cities 2024 & 2032

- Figure 37: Asia Pacific Expensive Canadian Housing Market Revenue Share (%), by Cities 2024 & 2032

- Figure 38: Asia Pacific Expensive Canadian Housing Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific Expensive Canadian Housing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Expensive Canadian Housing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Expensive Canadian Housing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Expensive Canadian Housing Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 4: Global Expensive Canadian Housing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Expensive Canadian Housing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Expensive Canadian Housing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Expensive Canadian Housing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Expensive Canadian Housing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Expensive Canadian Housing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Expensive Canadian Housing Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 15: Global Expensive Canadian Housing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Expensive Canadian Housing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Expensive Canadian Housing Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 21: Global Expensive Canadian Housing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Expensive Canadian Housing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global Expensive Canadian Housing Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 27: Global Expensive Canadian Housing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Expensive Canadian Housing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global Expensive Canadian Housing Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 39: Global Expensive Canadian Housing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Turkey Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Israel Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: GCC Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: North Africa Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Middle East & Africa Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Expensive Canadian Housing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 47: Global Expensive Canadian Housing Market Revenue Million Forecast, by Cities 2019 & 2032

- Table 48: Global Expensive Canadian Housing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: ASEAN Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Oceania Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Expensive Canadian Housing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Expensive Canadian Housing Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Expensive Canadian Housing Market?

Key companies in the market include Onni Group, Concord Pacific**List Not Exhaustive, Minto Group, Mattamy Homes, Westbank Corp, The Daniels Corporation, Valencia Residential, Amacon, Brookfield Residential, Oxford Properties Group.

3. What are the main segments of the Expensive Canadian Housing Market?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Remote and Hybrid Work Model.

6. What are the notable trends driving market growth?

Pandemic Accelerated Luxury Home Sales in Major Canadian Markets.

7. Are there any restraints impacting market growth?

Lack of Privacy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Expensive Canadian Housing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Expensive Canadian Housing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Expensive Canadian Housing Market?

To stay informed about further developments, trends, and reports in the Expensive Canadian Housing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence