Key Insights

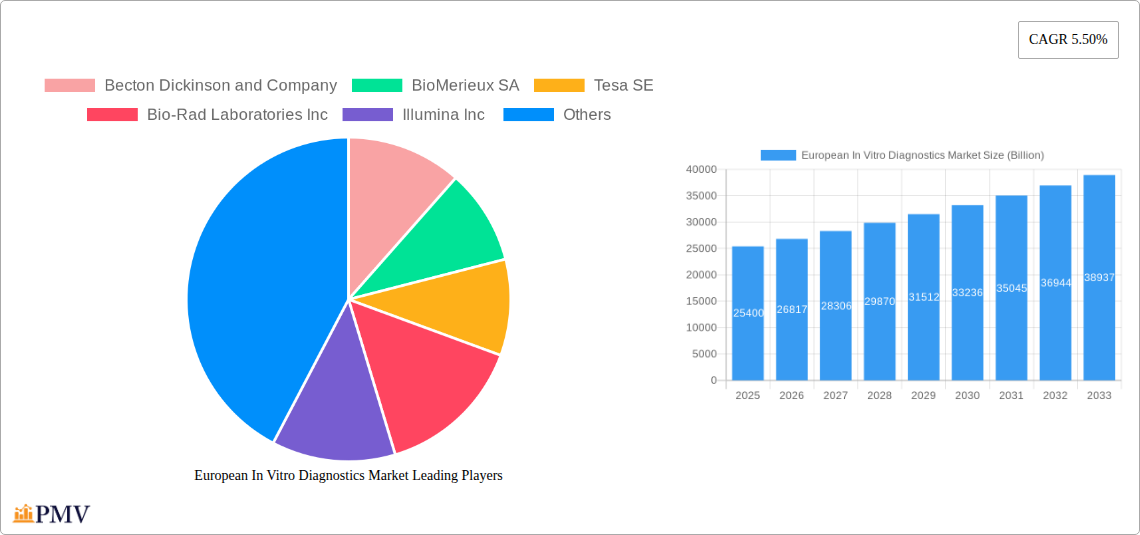

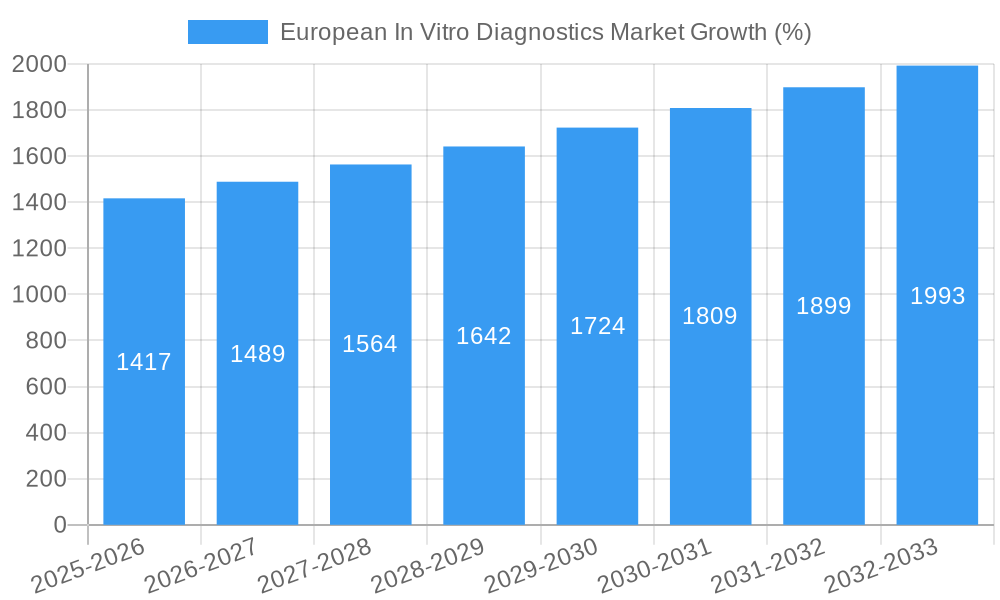

The European In Vitro Diagnostics (IVD) market, valued at €25.4 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising prevalence of chronic diseases like diabetes, cancer, and cardiovascular ailments fuels demand for accurate and timely diagnostic testing. Technological advancements in molecular diagnostics, particularly next-generation sequencing (NGS), are enhancing diagnostic capabilities, leading to earlier disease detection and personalized medicine approaches. Furthermore, increasing investments in healthcare infrastructure and the growing adoption of point-of-care testing (POCT) contribute to market expansion. The market's segmentation reveals strong performance across various test types, with clinical chemistry, molecular diagnostics, and hematology leading the way. Instrument sales constitute a significant portion of the market, though reagent sales are expected to grow at a faster rate due to increasing test volumes. Disposable IVD devices dominate the usability segment, reflecting the preference for convenience and infection control. Major players like Roche Diagnostics, Siemens Healthcare, and Abbott Laboratories are driving innovation and competition, shaping the market landscape.

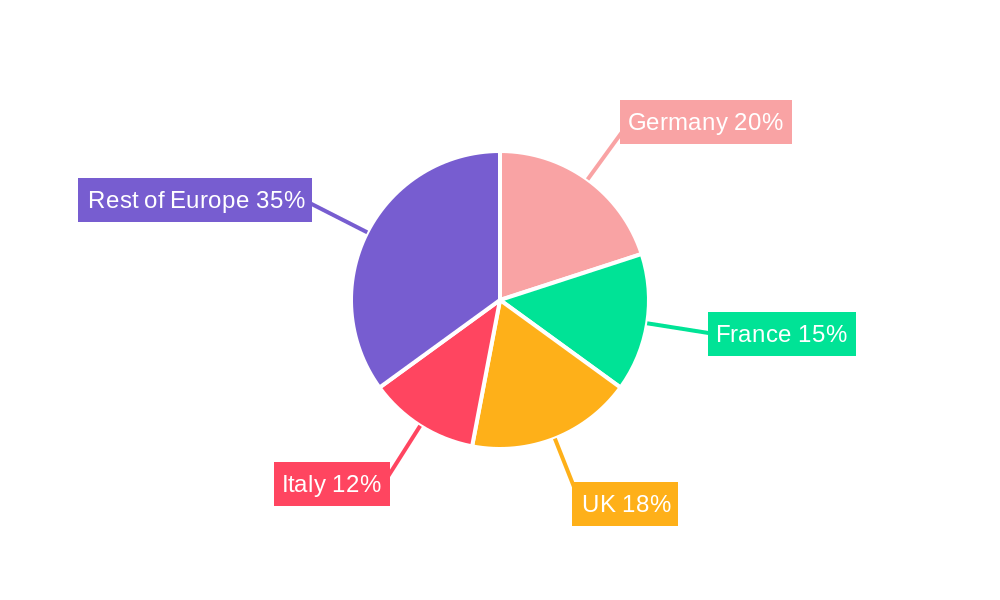

However, the market faces challenges. Stringent regulatory approvals and reimbursement policies can hinder market penetration for new technologies. Price pressures from healthcare payers and the need for skilled professionals to operate advanced diagnostic equipment present ongoing hurdles. Despite these, the long-term outlook remains positive. The market is likely to benefit from growing geriatric populations, rising healthcare expenditure, and the continued development of innovative diagnostic solutions. The projected Compound Annual Growth Rate (CAGR) of 5.50% suggests a significant increase in market value over the forecast period (2025-2033), reinforcing the European IVD market's position as a key sector in global healthcare. This growth will likely be unevenly distributed across different segments and geographies, with Germany, France, and the UK representing significant national markets within Europe.

European In Vitro Diagnostics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the European In Vitro Diagnostics (IVD) market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). The market is segmented by test type, product, usability, application, and end-user, offering granular insights for strategic decision-making. The report also profiles key players, analyzes competitive dynamics, and identifies emerging trends shaping this dynamic market valued at Billion.

European In Vitro Diagnostics Market Structure & Competitive Dynamics

The European IVD market exhibits a moderately consolidated structure, with a few major players holding significant market share. The market is characterized by intense competition, driven by innovation, technological advancements, and strategic mergers and acquisitions (M&A). Regulatory frameworks, such as those overseen by the European Medicines Agency (EMA), play a pivotal role in shaping market access and product development. The presence of substitute products and evolving end-user preferences further contribute to the complexity of the market landscape.

- Market Concentration: The top 10 players account for approximately xx% of the market share in 2025. High market concentration in certain segments (e.g., molecular diagnostics) is a notable trend.

- Innovation Ecosystems: Collaboration between diagnostic companies, research institutions, and healthcare providers fuels innovation in the IVD sector. Significant investments in R&D drive the development of advanced diagnostic technologies.

- Regulatory Frameworks: Stringent regulatory requirements for IVD products impact market entry and product lifecycle management. Compliance with CE marking regulations is crucial for market access.

- Product Substitutes: The emergence of point-of-care testing (POCT) and alternative diagnostic methods poses a competitive challenge to traditional IVD products.

- End-User Trends: Increasing demand for faster, more accurate, and cost-effective diagnostic tests is reshaping market dynamics.

- M&A Activities: The IVD industry has witnessed significant M&A activity in recent years, with deals valued at over Billion in the past five years. These mergers and acquisitions often aim to expand product portfolios, enhance technological capabilities, and strengthen market positions. Examples include [Specific examples with deal values if available, otherwise indicate a lack of accessible data].

European In Vitro Diagnostics Market Industry Trends & Insights

The European IVD market is poised for robust growth, driven by factors such as the increasing prevalence of chronic diseases (diabetes, cancer, cardiovascular diseases), aging population, rising healthcare expenditure, and technological advancements in diagnostic technologies. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of Billion by 2033.

Technological disruptions, such as the adoption of molecular diagnostics, automation, and artificial intelligence (AI) in diagnostic procedures, are significantly impacting market growth. Consumer preferences are shifting toward non-invasive diagnostic tests and personalized medicine approaches. The competitive landscape is characterized by intense rivalry among major players, with a focus on product differentiation and strategic partnerships. Market penetration of advanced diagnostic technologies varies across different segments and geographic regions, with molecular diagnostics and POCT showing significant growth potential.

Dominant Markets & Segments in European In Vitro Diagnostics Market

Germany, France, and the UK represent the largest markets within the European IVD sector. The dominance of these countries is attributable to factors such as well-established healthcare infrastructure, advanced medical technology adoption, and higher healthcare spending per capita. Other countries with significant market potential include Italy, Spain, and the Nordic countries.

Test Type: Molecular diagnostics is experiencing the highest growth, driven by advancements in next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies. Clinical chemistry remains a significant segment, while immunoassays and hematology maintain strong market positions.

Product: Reagents account for a larger portion of the market compared to instruments, reflecting the higher consumption rates and recurring revenue streams.

Usability: Disposable IVD devices are preferred due to their convenience and cost-effectiveness in certain settings. Reusable devices maintain a presence, particularly in high-throughput laboratories.

Application: Infectious disease diagnostics is a large segment, driven by the need for rapid and accurate detection of pathogens. Cancer/oncology, cardiology, and diabetes diagnostics also show significant growth, reflecting the prevalence of these diseases.

End User: Diagnostic laboratories are a major consumer of IVD products, followed by hospitals and clinics.

Key Drivers:

- Strong Healthcare Infrastructure: Well-developed healthcare systems in many European countries support the widespread adoption of advanced diagnostic technologies.

- High Healthcare Expenditure: Increased healthcare spending fuels investment in diagnostic technologies.

- Government Initiatives: Policies promoting preventative healthcare and disease management drive the demand for diagnostic services.

- Technological Advancements: Continuous improvements in diagnostic technologies lead to better diagnostic accuracy and efficiency.

European In Vitro Diagnostics Market Product Innovations

Recent product developments focus on improving diagnostic accuracy, speed, and ease of use. Miniaturization, automation, and integration of AI/machine learning are key technological trends. Point-of-care testing (POCT) devices are gaining traction, enabling rapid diagnostics in various settings. The development of new assays for emerging infectious diseases and personalized medicine applications is also driving innovation. These innovations are enhancing the market fit of IVD products by addressing the needs for faster diagnosis, improved patient outcomes, and efficient healthcare resource utilization.

Report Segmentation & Scope

The report provides a comprehensive segmentation of the European IVD market, including:

- Test Type: Clinical Chemistry, Molecular Diagnostics, Hematology, Immuno Diagnostics, Other Test Types. Each segment provides market size estimations, growth projections, and competitive dynamics.

- Product: Instrument, Reagents, Other Products. The report analyzes the market share and growth potential of each product category.

- Usability: Disposable IVD Devices, Reusable IVD Devices. Market sizes and trends for each category are included.

- Application: Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, Other Applications. Each application segment is analyzed in terms of market size and growth prospects.

- End User: Diagnostic Laboratories, Hospitals and Clinics, Other End Users. The report details the market share and growth trends of each end-user group.

Key Drivers of European In Vitro Diagnostics Market Growth

The European IVD market growth is fueled by several key drivers:

- Technological Advancements: Innovations in molecular diagnostics, automation, and AI are enhancing diagnostic capabilities.

- Rising Prevalence of Chronic Diseases: The increasing incidence of chronic diseases is driving demand for diagnostic services.

- Aging Population: The aging population in Europe increases the demand for diagnostic testing.

- Stringent Regulatory Frameworks: While posing challenges, regulatory efforts also ensure safety and reliability of diagnostic devices, fostering consumer confidence.

Challenges in the European In Vitro Diagnostics Market Sector

The European IVD market faces certain challenges:

- Stringent Regulatory Approvals: The lengthy and complex regulatory approval process for new IVD products can delay market entry.

- High R&D Costs: The substantial investment required for research and development of advanced diagnostic technologies can limit market entry for smaller companies.

- Price Competition: Intense competition among manufacturers can lead to price pressures and reduced profit margins.

- Supply Chain Disruptions: Global events can disrupt supply chains, affecting the availability of IVD products.

Leading Players in the European In Vitro Diagnostics Market Market

- Becton Dickinson and Company (Becton Dickinson)

- BioMerieux SA (BioMérieux)

- Tesa SE

- Bio-Rad Laboratories Inc (Bio-Rad Laboratories)

- Illumina Inc (Illumina)

- Siemens Healthcare (Siemens Healthineers)

- Hologic Inc (Hologic)

- Thermo Fisher Scientific Inc (Thermo Fisher Scientific)

- Abbott Laboratories (Abbott)

- Diasorin S p A (Diasorin)

- Danaher Corporation (Beckman Coulter Inc) (Danaher)

- Sysmex Corporation (Sysmex)

- QIAGEN (QIAGEN)

- Roche Diagnostics (Roche)

Key Developments in European In Vitro Diagnostics Market Sector

- March 2023: MGI Tech Co., Ltd. received the CE mark for the DNBSeq-G99 sequencer.

- December 2022: BioMérieux SA received the CE mark for the Vidas Kube automated immunoassay system.

- September 2022: Noul Co., Ltd. received the CE-IVD mark for miLab Cartridge CER and miLab Cartridge BCM.

Strategic European In Vitro Diagnostics Market Outlook

The European IVD market is expected to experience sustained growth, driven by technological advancements, the increasing prevalence of chronic diseases, and favorable regulatory environments. Strategic opportunities exist for companies that can leverage innovative technologies, expand into emerging markets, and develop strategic partnerships. Focus on personalized medicine, point-of-care diagnostics, and digital health solutions will be crucial for success in this evolving market. The market's future is bright, with continued expansion and innovation anticipated in the coming years, leading to a market size of Billion by 2033.

European In Vitro Diagnostics Market Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Hematology

- 1.4. Immuno Diagnostics

- 1.5. Other Test Types

-

2. Product

- 2.1. Instrument

- 2.2. Reagents

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Devices

- 3.2. Reusable IVD Devices

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Autoimmune Disease

- 4.6. Nephrology

- 4.7. Other Applications

-

5. End User

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End Users

European In Vitro Diagnostics Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

European In Vitro Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Prevalence of Chronic Diseases; Increasing Demand for Point-of-care Diagnostics; Technological Advancements in In-Vitro Diagnostics Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations; Cumbersome Reimbursement Procedures

- 3.4. Market Trends

- 3.4.1. The Instrument Segment is Expected to Hold a Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Hematology

- 5.1.4. Immuno Diagnostics

- 5.1.5. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagents

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Devices

- 5.3.2. Reusable IVD Devices

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Autoimmune Disease

- 5.4.6. Nephrology

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End Users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.6.2. United Kingdom

- 5.6.3. France

- 5.6.4. Italy

- 5.6.5. Spain

- 5.6.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Germany European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 6.1.1. Clinical Chemistry

- 6.1.2. Molecular Diagnostics

- 6.1.3. Hematology

- 6.1.4. Immuno Diagnostics

- 6.1.5. Other Test Types

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Instrument

- 6.2.2. Reagents

- 6.2.3. Other Products

- 6.3. Market Analysis, Insights and Forecast - by Usability

- 6.3.1. Disposable IVD Devices

- 6.3.2. Reusable IVD Devices

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Infectious Disease

- 6.4.2. Diabetes

- 6.4.3. Cancer/Oncology

- 6.4.4. Cardiology

- 6.4.5. Autoimmune Disease

- 6.4.6. Nephrology

- 6.4.7. Other Applications

- 6.5. Market Analysis, Insights and Forecast - by End User

- 6.5.1. Diagnostic Laboratories

- 6.5.2. Hospitals and Clinics

- 6.5.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 7. United Kingdom European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 7.1.1. Clinical Chemistry

- 7.1.2. Molecular Diagnostics

- 7.1.3. Hematology

- 7.1.4. Immuno Diagnostics

- 7.1.5. Other Test Types

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Instrument

- 7.2.2. Reagents

- 7.2.3. Other Products

- 7.3. Market Analysis, Insights and Forecast - by Usability

- 7.3.1. Disposable IVD Devices

- 7.3.2. Reusable IVD Devices

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Infectious Disease

- 7.4.2. Diabetes

- 7.4.3. Cancer/Oncology

- 7.4.4. Cardiology

- 7.4.5. Autoimmune Disease

- 7.4.6. Nephrology

- 7.4.7. Other Applications

- 7.5. Market Analysis, Insights and Forecast - by End User

- 7.5.1. Diagnostic Laboratories

- 7.5.2. Hospitals and Clinics

- 7.5.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 8. France European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 8.1.1. Clinical Chemistry

- 8.1.2. Molecular Diagnostics

- 8.1.3. Hematology

- 8.1.4. Immuno Diagnostics

- 8.1.5. Other Test Types

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Instrument

- 8.2.2. Reagents

- 8.2.3. Other Products

- 8.3. Market Analysis, Insights and Forecast - by Usability

- 8.3.1. Disposable IVD Devices

- 8.3.2. Reusable IVD Devices

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Infectious Disease

- 8.4.2. Diabetes

- 8.4.3. Cancer/Oncology

- 8.4.4. Cardiology

- 8.4.5. Autoimmune Disease

- 8.4.6. Nephrology

- 8.4.7. Other Applications

- 8.5. Market Analysis, Insights and Forecast - by End User

- 8.5.1. Diagnostic Laboratories

- 8.5.2. Hospitals and Clinics

- 8.5.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 9. Italy European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 9.1.1. Clinical Chemistry

- 9.1.2. Molecular Diagnostics

- 9.1.3. Hematology

- 9.1.4. Immuno Diagnostics

- 9.1.5. Other Test Types

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Instrument

- 9.2.2. Reagents

- 9.2.3. Other Products

- 9.3. Market Analysis, Insights and Forecast - by Usability

- 9.3.1. Disposable IVD Devices

- 9.3.2. Reusable IVD Devices

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Infectious Disease

- 9.4.2. Diabetes

- 9.4.3. Cancer/Oncology

- 9.4.4. Cardiology

- 9.4.5. Autoimmune Disease

- 9.4.6. Nephrology

- 9.4.7. Other Applications

- 9.5. Market Analysis, Insights and Forecast - by End User

- 9.5.1. Diagnostic Laboratories

- 9.5.2. Hospitals and Clinics

- 9.5.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 10. Spain European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 10.1.1. Clinical Chemistry

- 10.1.2. Molecular Diagnostics

- 10.1.3. Hematology

- 10.1.4. Immuno Diagnostics

- 10.1.5. Other Test Types

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Instrument

- 10.2.2. Reagents

- 10.2.3. Other Products

- 10.3. Market Analysis, Insights and Forecast - by Usability

- 10.3.1. Disposable IVD Devices

- 10.3.2. Reusable IVD Devices

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Infectious Disease

- 10.4.2. Diabetes

- 10.4.3. Cancer/Oncology

- 10.4.4. Cardiology

- 10.4.5. Autoimmune Disease

- 10.4.6. Nephrology

- 10.4.7. Other Applications

- 10.5. Market Analysis, Insights and Forecast - by End User

- 10.5.1. Diagnostic Laboratories

- 10.5.2. Hospitals and Clinics

- 10.5.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 11. Rest of Europe European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Test Type

- 11.1.1. Clinical Chemistry

- 11.1.2. Molecular Diagnostics

- 11.1.3. Hematology

- 11.1.4. Immuno Diagnostics

- 11.1.5. Other Test Types

- 11.2. Market Analysis, Insights and Forecast - by Product

- 11.2.1. Instrument

- 11.2.2. Reagents

- 11.2.3. Other Products

- 11.3. Market Analysis, Insights and Forecast - by Usability

- 11.3.1. Disposable IVD Devices

- 11.3.2. Reusable IVD Devices

- 11.4. Market Analysis, Insights and Forecast - by Application

- 11.4.1. Infectious Disease

- 11.4.2. Diabetes

- 11.4.3. Cancer/Oncology

- 11.4.4. Cardiology

- 11.4.5. Autoimmune Disease

- 11.4.6. Nephrology

- 11.4.7. Other Applications

- 11.5. Market Analysis, Insights and Forecast - by End User

- 11.5.1. Diagnostic Laboratories

- 11.5.2. Hospitals and Clinics

- 11.5.3. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Test Type

- 12. Germany European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 13. France European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Becton Dickinson and Company

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 BioMerieux SA

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Tesa SE

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Bio-Rad Laboratories Inc

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Illumina Inc

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Siemens Healthcare

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Hologic Inc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Thermo Fisher Scientific Inc

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Abbott Laboratories

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Diasorin S p A

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Danaher Corporation (Beckman Coulter Inc)

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Sysmex Corporation

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.13 QIAGEN

- 19.2.13.1. Overview

- 19.2.13.2. Products

- 19.2.13.3. SWOT Analysis

- 19.2.13.4. Recent Developments

- 19.2.13.5. Financials (Based on Availability)

- 19.2.14 Roche Diagnostics

- 19.2.14.1. Overview

- 19.2.14.2. Products

- 19.2.14.3. SWOT Analysis

- 19.2.14.4. Recent Developments

- 19.2.14.5. Financials (Based on Availability)

- 19.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: European In Vitro Diagnostics Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: European In Vitro Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: European In Vitro Diagnostics Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: European In Vitro Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 4: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 5: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 6: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 7: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 8: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 9: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 10: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 11: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 12: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 13: European In Vitro Diagnostics Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 14: European In Vitro Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 15: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 16: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Germany European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Germany European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: France European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: France European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Italy European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Italy European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Netherlands European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: Netherlands European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Sweden European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: Sweden European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 32: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 33: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 34: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 35: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 36: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 37: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 38: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 39: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 40: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 41: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 42: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 44: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 45: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 46: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 47: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 48: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 49: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 50: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 51: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 52: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 53: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 54: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 56: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 57: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 58: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 59: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 60: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 61: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 62: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 63: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 64: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 65: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 66: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 68: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 69: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 70: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 71: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 72: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 73: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 74: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 75: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 76: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 77: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 78: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 79: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 80: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 81: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 82: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 83: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 84: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 85: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 86: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 87: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 88: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 89: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 90: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 91: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 92: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 93: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 94: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 95: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 96: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 97: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 98: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 99: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 100: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 101: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 102: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European In Vitro Diagnostics Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the European In Vitro Diagnostics Market?

Key companies in the market include Becton Dickinson and Company, BioMerieux SA, Tesa SE, Bio-Rad Laboratories Inc, Illumina Inc , Siemens Healthcare, Hologic Inc, Thermo Fisher Scientific Inc, Abbott Laboratories, Diasorin S p A, Danaher Corporation (Beckman Coulter Inc), Sysmex Corporation, QIAGEN, Roche Diagnostics.

3. What are the main segments of the European In Vitro Diagnostics Market?

The market segments include Test Type, Product, Usability, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.4 Billion as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Chronic Diseases; Increasing Demand for Point-of-care Diagnostics; Technological Advancements in In-Vitro Diagnostics Devices.

6. What are the notable trends driving market growth?

The Instrument Segment is Expected to Hold a Major Share in the Market.

7. Are there any restraints impacting market growth?

Stringent Regulations; Cumbersome Reimbursement Procedures.

8. Can you provide examples of recent developments in the market?

In March 2023, MGI Tech Co., Ltd. received the CE mark for the DNBSeq-G99 sequencer with an aim to precise sequencing of genetic substances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European In Vitro Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European In Vitro Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European In Vitro Diagnostics Market?

To stay informed about further developments, trends, and reports in the European In Vitro Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence