Key Insights

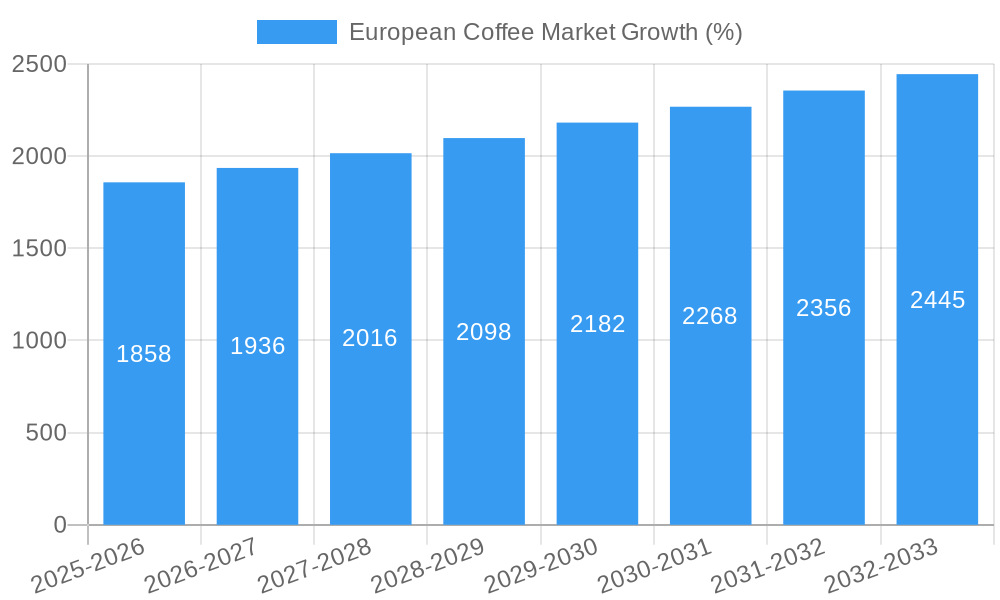

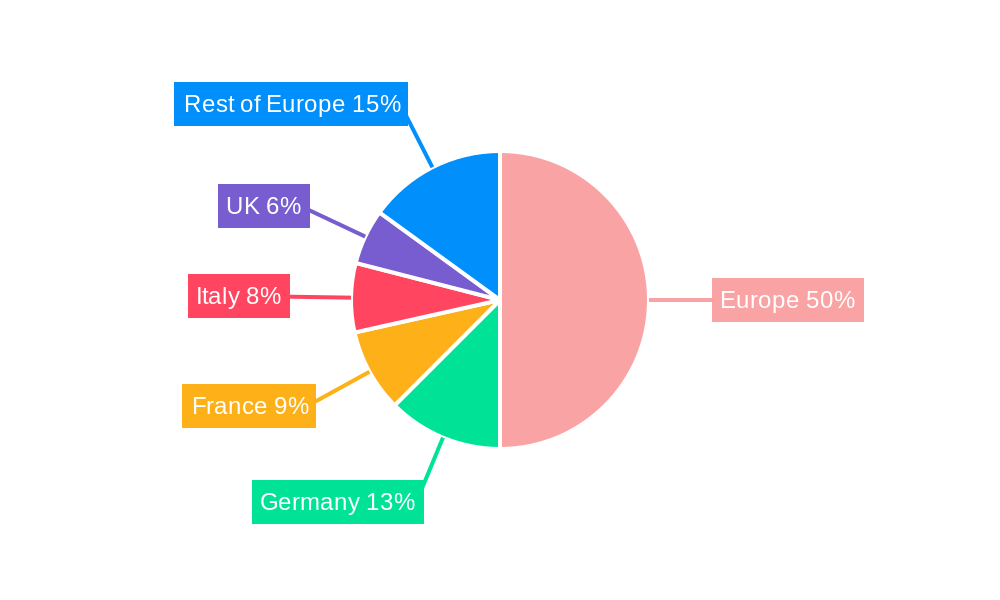

The European coffee market, valued at €47.88 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 3.96% from 2025 to 2033. This growth is fueled by several key factors. Increasing disposable incomes across many European nations are driving higher coffee consumption, particularly among younger demographics embracing specialty coffee shops and premium coffee products. The burgeoning popularity of at-home coffee brewing, coupled with the convenience of coffee pods and capsules, significantly contributes to market expansion. Furthermore, the rising demand for sustainable and ethically sourced coffee is shaping consumer choices, influencing the growth of organic and fair-trade coffee segments. Germany, France, Italy, and the UK remain the largest national markets, driven by strong coffee cultures and established distribution networks. However, growth opportunities are also emerging in smaller European nations as coffee consumption habits evolve.

The competitive landscape is characterized by a mix of established multinational players like Nestlé and JAB Holding Company, and regional brands catering to specific tastes and preferences. Competition centers around product innovation, brand building, and efficient distribution channels. Challenges include fluctuating coffee bean prices, potential supply chain disruptions, and evolving consumer preferences, demanding continuous adaptation to maintain market share. Companies are increasingly investing in marketing strategies emphasizing quality, convenience, and sustainability to resonate with the environmentally conscious consumers. The expansion of online retail channels also presents opportunities for both established and emerging brands to reach wider audiences, contributing to the overall growth of the European coffee market. The forecast period (2025-2033) anticipates continued market growth driven by these trends and factors, with segment-specific growth depending on consumer shifts towards specific products like single-serve options or ethically produced varieties.

European Coffee Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European coffee market, encompassing market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for businesses operating within or seeking to enter this dynamic market. It offers actionable insights and forecasts to help stakeholders make informed strategic decisions.

European Coffee Market Market Structure & Competitive Dynamics

The European coffee market is characterized by a complex interplay of established giants and emerging players. Market concentration is moderate, with a few dominant players controlling a significant share, while numerous smaller regional and niche brands compete fiercely. Innovation ecosystems are robust, driven by consumer demand for diverse products and sustainable practices. Regulatory frameworks, including those concerning food safety, labeling, and sustainability, significantly impact market operations. Product substitutes, such as tea and other beverages, exert competitive pressure. End-user trends toward ethically sourced and sustainably produced coffee are reshaping the market.

Mergers and acquisitions (M&A) activity is frequent, with major players seeking to expand their market share and product portfolios. While precise deal values are confidential, several significant transactions have been observed in recent years. For example, JAB Holding Company's acquisitions have significantly strengthened its position. The average market share of the top 5 players is estimated at xx%.

- Key Market Players: JAB Holding Company, Nestlé SA, J J Darboven GmbH & Co KG, Melitta Group, The Kraft Heinz Company, Krüger GmbH & Co KG, Starbucks Corporation, Strauss Group Ltd, Maxingvest AG (Tchibo), Luigi Lavazza SpA (This list is not exhaustive).

- Innovation Ecosystems: Focus on sustainable sourcing, innovative brewing methods, and personalized coffee experiences.

- Regulatory Framework: Strict regulations governing food safety and labeling, influencing product development and marketing strategies.

- M&A Activity: Frequent acquisitions and mergers drive market consolidation and expansion.

European Coffee Market Industry Trends & Insights

The European coffee market exhibits robust growth, driven by several factors. Rising disposable incomes, changing lifestyles, and increased coffee consumption per capita are key growth drivers. Technological disruptions, such as the rise of single-serve coffee machines and innovative brewing technologies, are transforming consumer preferences and creating new market segments. The market is witnessing a shift towards premiumization, with consumers increasingly willing to pay more for high-quality, specialty coffee. This trend is amplified by growing awareness of ethical sourcing and sustainable practices.

Competitive dynamics are intense, with players constantly innovating to meet evolving consumer demands. The compound annual growth rate (CAGR) for the European coffee market during the forecast period (2025-2033) is projected to be xx%. Market penetration of specific coffee types, such as coffee pods and capsules, continues to increase. The increasing demand for convenient and high-quality coffee is a major driver for this growth.

Dominant Markets & Segments in European Coffee Market

The dominant segments and regions within the European coffee market vary significantly depending on consumer preferences and cultural norms. Germany, Italy, and France remain key markets, contributing substantially to the overall market value.

By Product Type:

- Ground Coffee: Remains a significant segment due to its versatility and affordability.

- Instant Coffee: Maintains a considerable market share due to convenience.

- Whole Bean Coffee: Experiencing growth driven by the rising popularity of specialty coffee.

- Coffee Pods and Capsules: Displays the fastest growth, driven by convenience and ease of use.

By Distribution Channel:

- Off-trade: Supermarkets, hypermarkets, and online retailers are major channels.

- On-trade: Cafés, restaurants, and hotels constitute a crucial channel.

Key drivers of dominance in specific regions include strong coffee cultures, developed retail infrastructure, and economic factors. For example, the growth of the coffee pod segment is partly driven by the increasing availability of compatible machines and the rising popularity of at-home coffee consumption.

European Coffee Market Product Innovations

The European coffee market is witnessing significant product innovation, driven by technological advancements and evolving consumer preferences. Companies are focusing on developing sustainable packaging solutions, such as compostable coffee pods, and exploring new brewing technologies to enhance coffee quality and convenience. The introduction of plant-based milk alternatives in coffee offerings is another area of significant innovation, catering to the growing demand for vegan and dairy-free options. These innovations are geared towards meeting consumer demand for both convenience and sustainability, resulting in improved market fit and a competitive advantage.

Report Segmentation & Scope

This report segments the European coffee market by product type (whole bean, ground coffee, instant coffee, coffee pods and capsules) and distribution channel (on-trade, off-trade). Each segment is analyzed in detail, providing market size, growth projections, and competitive dynamics. The on-trade channel growth projections reflect the performance of cafes, restaurants, and hotels, while the off-trade section provides detailed analysis for the supermarket and online retail segments. Growth forecasts for each segment consider the various market-specific factors, including consumer preferences and technological advancements. The market sizes provided represent the estimated value in Million.

Key Drivers of European Coffee Market Growth

Several factors contribute to the growth of the European coffee market. Technological advancements, such as improved brewing methods and single-serve machines, have made coffee consumption more convenient. Economic factors, including rising disposable incomes, particularly in emerging European economies, have increased consumer spending on premium coffee products. Favorable regulatory frameworks promoting fair trade and sustainable practices also contribute positively to market expansion. The increasing preference for convenience and the growing popularity of specialty coffee are additional significant drivers.

Challenges in the European Coffee Market Sector

The European coffee market faces several challenges. Fluctuating coffee bean prices and supply chain disruptions due to global events can impact profitability and product availability. Intense competition among established players and emerging brands necessitates continuous innovation and efficient cost management. Strict environmental regulations regarding packaging and waste disposal require investments in sustainable practices. These challenges, if not addressed effectively, could hinder market growth and impact the profitability of market players.

Leading Players in the European Coffee Market Market

- JAB Holding Company

- Nestlé SA

- J J Darboven GmbH & Co KG

- Melitta Group

- The Kraft Heinz Company

- Krüger GmbH & Co KG

- Starbucks Corporation

- Strauss Group Ltd

- Maxingvest AG (Tchibo)

- Luigi Lavazza SpA

Key Developments in European Coffee Market Sector

- December 2021: Starbucks introduced its new oat dairy alternative coffee, expanding its espresso segment and catering to growing consumer demand for plant-based options. This move enhanced its brand image as environmentally and health-conscious.

- May 2022: Melitta and OFI's partnership using blockchain technology to enhance coffee traceability met growing consumer demand for transparency and ethical sourcing. This significantly improved brand reputation and trust.

- November 2022: Nescafé Dolce Gusto's launch of Neo coffee pods, with 70% less packaging, showcased commitment to sustainability. This innovative approach is expected to attract environmentally conscious consumers.

Strategic European Coffee Market Market Outlook

The European coffee market presents significant growth opportunities, particularly in the segments of sustainable and ethically sourced coffee, innovative brewing technologies, and personalized coffee experiences. Companies focusing on premiumization, convenience, and sustainability will likely see strong growth. Strategic partnerships, product diversification, and efficient supply chain management will be crucial factors for success. The market's future trajectory hinges on maintaining consumer trust, adapting to evolving preferences, and proactively addressing environmental concerns. The forecast suggests continued market expansion, driven by increasing coffee consumption, and the rising preference for specialty and convenient coffee options.

European Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Specialist Retailers

- 2.2.4. Other Off-trade Channels

European Coffee Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Russia

- 5. Italy

- 6. Spain

- 7. Rest of Europe

European Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. Consumer Preference for Premium Coffee Fuels Growth in Specialty Coffee Shops Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Specialist Retailers

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Italy

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Whole Bean

- 6.1.2. Ground Coffee

- 6.1.3. Instant Coffee

- 6.1.4. Coffee Pods and Capsules

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Specialist Retailers

- 6.2.2.4. Other Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Whole Bean

- 7.1.2. Ground Coffee

- 7.1.3. Instant Coffee

- 7.1.4. Coffee Pods and Capsules

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Specialist Retailers

- 7.2.2.4. Other Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Whole Bean

- 8.1.2. Ground Coffee

- 8.1.3. Instant Coffee

- 8.1.4. Coffee Pods and Capsules

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Specialist Retailers

- 8.2.2.4. Other Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Russia European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Whole Bean

- 9.1.2. Ground Coffee

- 9.1.3. Instant Coffee

- 9.1.4. Coffee Pods and Capsules

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Specialist Retailers

- 9.2.2.4. Other Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Whole Bean

- 10.1.2. Ground Coffee

- 10.1.3. Instant Coffee

- 10.1.4. Coffee Pods and Capsules

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience Stores

- 10.2.2.3. Specialist Retailers

- 10.2.2.4. Other Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Whole Bean

- 11.1.2. Ground Coffee

- 11.1.3. Instant Coffee

- 11.1.4. Coffee Pods and Capsules

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience Stores

- 11.2.2.3. Specialist Retailers

- 11.2.2.4. Other Off-trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Whole Bean

- 12.1.2. Ground Coffee

- 12.1.3. Instant Coffee

- 12.1.4. Coffee Pods and Capsules

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. On-trade

- 12.2.2. Off-trade

- 12.2.2.1. Supermarkets/Hypermarkets

- 12.2.2.2. Convenience Stores

- 12.2.2.3. Specialist Retailers

- 12.2.2.4. Other Off-trade Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Germany European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 14. France European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 JAB Holding Company

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Nestlé SA

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 J J Darboven GmbH & Co KG

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Melitta Group

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 The Kraft Heinz Company

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Krüger GmbH & Co KG

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Starbucks Corporation

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Strauss Group Ltd

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Maxingvest AG (Tchibo)*List Not Exhaustive

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Luigi Lavazza SpA

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 JAB Holding Company

List of Figures

- Figure 1: European Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: European Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: European Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 29: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 30: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Coffee Market?

The projected CAGR is approximately 3.96%.

2. Which companies are prominent players in the European Coffee Market?

Key companies in the market include JAB Holding Company, Nestlé SA, J J Darboven GmbH & Co KG, Melitta Group, The Kraft Heinz Company, Krüger GmbH & Co KG, Starbucks Corporation, Strauss Group Ltd, Maxingvest AG (Tchibo)*List Not Exhaustive, Luigi Lavazza SpA.

3. What are the main segments of the European Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

Consumer Preference for Premium Coffee Fuels Growth in Specialty Coffee Shops Market.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

November 2022: Nescafé Dolce Gusto unveiled its next-generation coffee pods and machines, referred to as Neo. Nestlé's new coffee pods use 70% less packaging than current capsules (by weight) and are paper-based and compostable. Nestlé's Swiss R&D Center for Systems has refined this product over the past five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Coffee Market?

To stay informed about further developments, trends, and reports in the European Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence