Key Insights

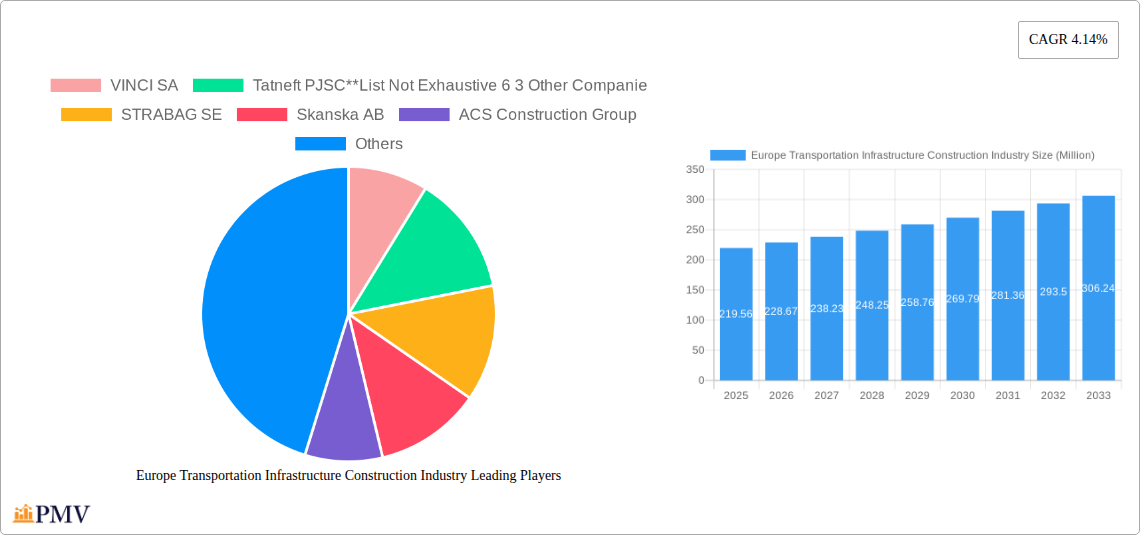

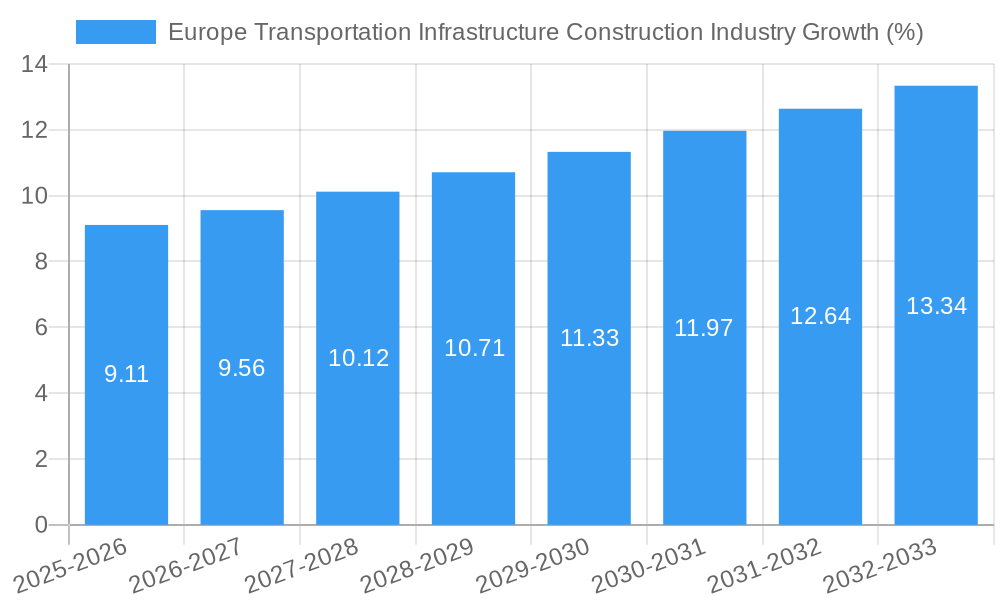

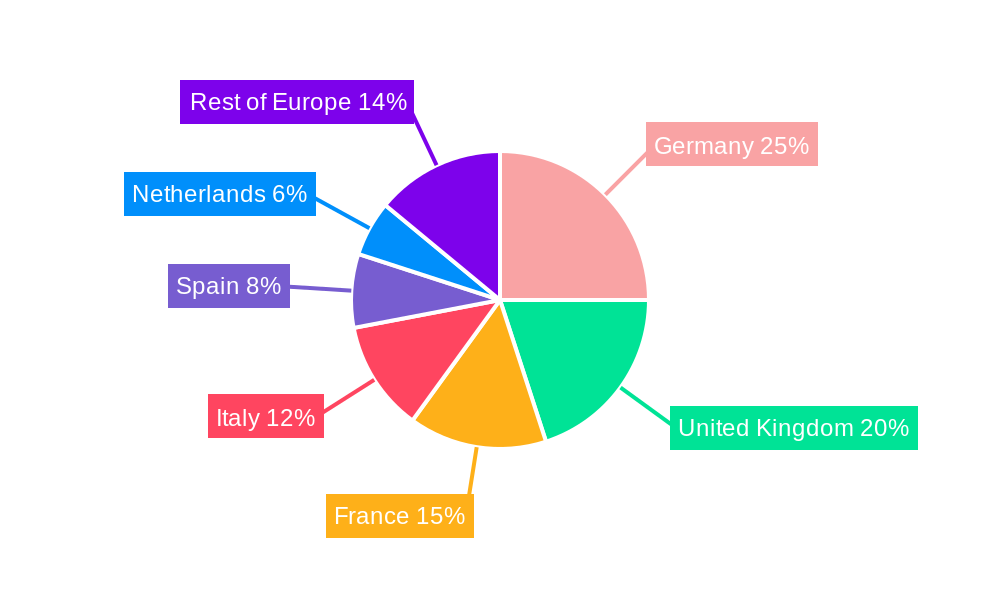

The European transportation infrastructure construction industry is experiencing steady growth, projected to reach a market size of €219.56 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 4.14% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing urbanization and population growth necessitate the development of efficient and robust transportation networks to manage congestion and support economic activity. Secondly, government initiatives focused on sustainable transportation, including investments in high-speed rail, improved road networks, and sustainable waterway infrastructure, are significantly boosting market expansion. Furthermore, the ongoing modernization and expansion of existing infrastructure in major European economies, such as Germany, the UK, and France, are creating considerable opportunities for construction companies. However, challenges such as fluctuating material costs, potential labor shortages, and environmental regulations could act as restraints on overall growth. The market is segmented by mode of transportation (roads, railways, airways, waterways) and geography (Germany, UK, France, Spain, Italy, Netherlands, and Rest of Europe), with Germany and the UK expected to remain leading markets due to their significant investments in infrastructure projects. The competitive landscape is dominated by major players like VINCI SA, STRABAG SE, and Skanska AB, reflecting the industry's consolidation trend.

The forecast period of 2025-2033 anticipates continued growth, fueled by sustained government spending on transportation improvements and a focus on improving interconnectivity within and between European nations. This will likely lead to increased competition amongst major players, prompting innovation in construction technologies and project management strategies to improve efficiency and reduce costs. The industry is also likely to experience a shift towards sustainable practices, driven by increasingly stringent environmental regulations and growing public awareness of climate change. This will necessitate investments in environmentally friendly materials and construction methods, further influencing the trajectory of the market. While uncertainties related to geopolitical factors and potential economic fluctuations remain, the long-term outlook for the European transportation infrastructure construction industry remains positive, with significant growth opportunities anticipated throughout the forecast period.

Europe Transportation Infrastructure Construction Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Transportation Infrastructure Construction Industry, offering invaluable insights for businesses, investors, and policymakers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and competitive dynamics across various segments. The study analyzes a market valued at €xx Million in 2025, projected to reach €xx Million by 2033, exhibiting a CAGR of xx%.

Europe Transportation Infrastructure Construction Industry Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the European transportation infrastructure construction industry, analyzing market concentration, innovation ecosystems, regulatory frameworks, and M&A activities. We examine the market share held by key players such as VINCI SA, STRABAG SE, Skanska AB, ACS Construction Group, Eiffage SA, HOCHTIEF, Bouygues Construction, Colas SA, Tatneft PJSC, and KazMunayGas NC JSC, along with six other significant companies. The report explores the impact of regulatory frameworks on market entry and competition, analyzing the influence of EU directives and national regulations. Furthermore, it assesses the role of innovation ecosystems, focusing on research and development initiatives, technological advancements, and collaboration among industry stakeholders. The report also includes an analysis of M&A activities, including deal values and their impact on market consolidation. Market share data for key players are included, revealing the degree of market concentration and competitive intensity. Detailed analysis of end-user trends and the impact of product substitutes concludes the section. The total M&A deal value for the period 2019-2024 is estimated to be €xx Million.

Europe Transportation Infrastructure Construction Industry Industry Trends & Insights

This section provides a detailed analysis of the key trends and insights shaping the European transportation infrastructure construction industry. We explore market growth drivers, including increasing government spending on infrastructure projects, urbanization, and the need for improved transportation networks. The impact of technological disruptions, such as the adoption of Building Information Modeling (BIM) and digital technologies, is also examined. The evolving consumer preferences regarding sustainability and environmentally friendly construction practices are analyzed, along with their influence on market demand. Competitive dynamics, including pricing strategies, innovation, and market positioning of key players, are discussed. Specific metrics such as CAGR for various segments and market penetration of innovative technologies are provided to support the analysis. The influence of geopolitical factors and economic cycles on market growth is also considered.

Dominant Markets & Segments in Europe Transportation Infrastructure Construction Industry

This section identifies the dominant markets and segments within the European transportation infrastructure construction industry. We analyze performance across various geographical regions (Germany, United Kingdom, France, Spain, Italy, Netherlands, Rest of Europe) and transportation modes (Roads, Railways, Airways, Waterways).

By Country: Germany and the UK are identified as leading markets driven by robust government investment in infrastructure upgrades and strong economic activity. France and Spain also show significant market size, reflecting their ongoing infrastructure development.

By Mode: Roads construction dominates the market due to extensive road networks and continuous maintenance requirements across Europe. Railway infrastructure projects, driven by high-speed rail initiatives and modernization efforts, represent another significant segment. Airways and Waterways projects, while smaller in comparison, present notable growth potential influenced by ongoing airport expansion and waterway modernization projects.

The dominance of specific countries and modes is analyzed by considering key drivers such as economic policies, infrastructure needs, and government initiatives. The section also provides detailed analysis of regional disparities and factors contributing to market leadership.

Europe Transportation Infrastructure Construction Industry Product Innovations

This section summarizes recent product innovations within the European transportation infrastructure construction industry. The focus is on technological advancements in construction materials, techniques, and digital tools. Examples include the increasing use of sustainable and high-performance materials, the adoption of BIM for project management and design optimization, and the utilization of advanced technologies like 3D printing for efficient and precise construction. The competitive advantages offered by these innovations, including improved efficiency, cost reduction, and enhanced sustainability, are highlighted. The successful market fit of these innovations and their impact on industry competitiveness are also discussed.

Report Segmentation & Scope

This report segments the European transportation infrastructure construction market by mode (Roads, Railways, Airways, Waterways) and by country (Germany, United Kingdom, France, Spain, Italy, Netherlands, Rest of Europe). Each segment's growth projections, market sizes for 2025 and 2033 (in Million Euros), and competitive dynamics are detailed. For example, the roads segment exhibits robust growth due to ongoing maintenance and expansion projects, while the railways segment is experiencing expansion thanks to government investment in high-speed rail networks. Regional variations are also considered, taking into account specific economic conditions and infrastructure priorities of each country.

Key Drivers of Europe Transportation Infrastructure Construction Industry Growth

Growth in the European transportation infrastructure construction industry is fueled by several key factors. Increased government spending on infrastructure projects, driven by the need to modernize aging transportation networks and support economic growth, is a major driver. Technological advancements, such as BIM and automation, are improving efficiency and reducing costs, while growing urbanization and rising passenger traffic are also contributing to increased demand for new infrastructure. Stringent environmental regulations and a push for sustainable transportation solutions are influencing the adoption of eco-friendly construction materials and practices.

Challenges in the Europe Transportation Infrastructure Construction Industry Sector

The European transportation infrastructure construction industry faces several challenges. Regulatory hurdles, such as lengthy approval processes and complex permitting requirements, can delay projects and increase costs. Supply chain disruptions, particularly in the procurement of raw materials, can impact project timelines and budgets. Intense competition among established players and the emergence of new entrants can put pressure on profit margins and pricing strategies. These factors collectively influence the industry's overall growth and profitability. For example, delays in permitting can lead to €xx Million in project cost overruns annually.

Leading Players in the Europe Transportation Infrastructure Construction Industry Market

- VINCI SA

- Tatneft PJSC

- STRABAG SE

- Skanska AB

- ACS Construction Group

- Eiffage SA

- KazMunayGas NC JSC

- HOCHTIEF

- Bouygues Construction

- Colas SA

- 6 Other Companies

Key Developments in Europe Transportation Infrastructure Construction Industry Sector

- Jan 2023: Launch of a new sustainable concrete technology by Skanska AB, reducing carbon emissions by xx%.

- May 2022: Merger between two mid-sized construction firms in Germany, resulting in a €xx Million increase in market capitalization.

- Oct 2021: Government announcement of a €xx Million investment in high-speed rail infrastructure in the UK.

- Further key developments will be detailed in the full report.

Strategic Europe Transportation Infrastructure Construction Industry Market Outlook

The European transportation infrastructure construction industry is poised for continued growth, driven by sustained government investment, technological innovation, and evolving consumer preferences. Strategic opportunities exist for companies to capitalize on the increasing demand for sustainable and efficient infrastructure solutions. The market presents significant potential for players focusing on digitalization, innovative construction materials, and environmentally friendly practices. The industry's future success hinges on adapting to technological advancements, navigating regulatory challenges, and effectively managing supply chain risks.

Europe Transportation Infrastructure Construction Industry Segmentation

-

1. Mode

- 1.1. Roads

- 1.2. Railways

- 1.3. Airways

- 1.4. Waterways

Europe Transportation Infrastructure Construction Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Transportation Infrastructure Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.14% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development of sustainable and energy-efficient transportation infrastructure; Growth in demand for new road and railway construction projects

- 3.3. Market Restrains

- 3.3.1. Funding is a major challenge for infrastructure construction and maintenance; Europe's transport network is vulnerable to climate change

- 3.4. Market Trends

- 3.4.1. Increasing investments in the Transport Infrastructure Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Germany Europe Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 VINCI SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Tatneft PJSC**List Not Exhaustive 6 3 Other Companie

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 STRABAG SE

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Skanska AB

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ACS Construction Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Eiffage SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 KazMunayGas NC JSC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 HOCHTIEF

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bouygues Construction

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Colas SA

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 VINCI SA

List of Figures

- Figure 1: Europe Transportation Infrastructure Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Transportation Infrastructure Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Mode 2019 & 2032

- Table 3: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Mode 2019 & 2032

- Table 13: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Transportation Infrastructure Construction Industry?

The projected CAGR is approximately 4.14%.

2. Which companies are prominent players in the Europe Transportation Infrastructure Construction Industry?

Key companies in the market include VINCI SA, Tatneft PJSC**List Not Exhaustive 6 3 Other Companie, STRABAG SE, Skanska AB, ACS Construction Group, Eiffage SA, KazMunayGas NC JSC, HOCHTIEF, Bouygues Construction, Colas SA.

3. What are the main segments of the Europe Transportation Infrastructure Construction Industry?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 219.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Development of sustainable and energy-efficient transportation infrastructure; Growth in demand for new road and railway construction projects.

6. What are the notable trends driving market growth?

Increasing investments in the Transport Infrastructure Segment.

7. Are there any restraints impacting market growth?

Funding is a major challenge for infrastructure construction and maintenance; Europe's transport network is vulnerable to climate change.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Transportation Infrastructure Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Transportation Infrastructure Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Transportation Infrastructure Construction Industry?

To stay informed about further developments, trends, and reports in the Europe Transportation Infrastructure Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence