Key Insights

The European premium chocolate market, valued at €13.71 billion in the base year 2025, is projected for substantial growth. Forecasted to expand at a compound annual growth rate (CAGR) of 6.73% from 2025 to 2033, this trajectory is propelled by escalating disposable incomes in key European economies, especially Western Europe. The increasing consumer demand for gourmet and artisanal chocolates, alongside a heightened consciousness regarding ethically sourced cocoa and sustainable practices, is significantly influencing purchasing decisions. The preference for indulgent yet healthier options, such as dark chocolate with high cocoa content, is also a notable growth driver. Furthermore, premium chocolate's intrinsic association with gifting and celebratory occasions sustains consistent market demand. The market is segmented by product type, including dark premium chocolate and white/milk premium chocolates, and by distribution channels, encompassing supermarkets/hypermarkets, convenience stores, online retail, and other channels. Online retail is experiencing particularly robust expansion, mirroring evolving consumer purchasing behaviors.

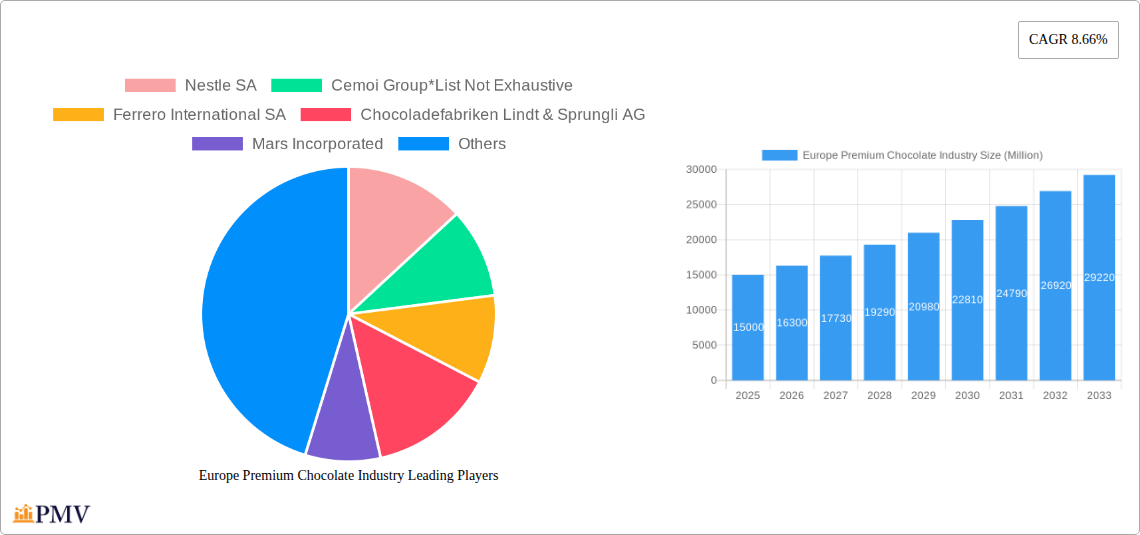

Europe Premium Chocolate Industry Market Size (In Billion)

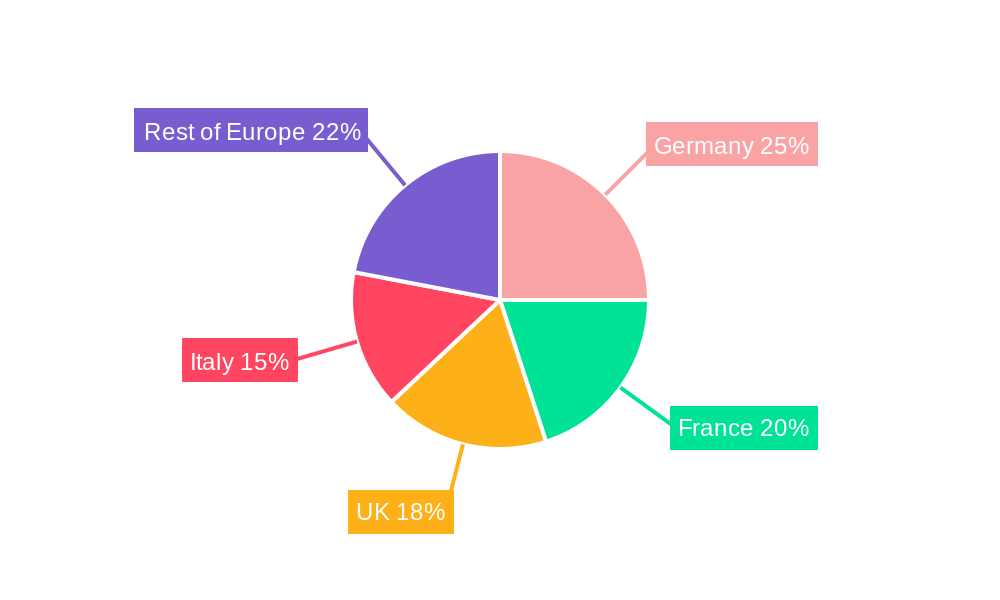

Despite promising growth, the market confronts specific challenges. Volatility in cocoa prices, a primary raw material, presents a potential risk to manufacturer profitability. Intensifying competition, from both established global entities and emerging artisanal brands, necessitates ongoing innovation and strategic brand differentiation. Economic downturns could also temper consumer expenditure on premium products. Nevertheless, the long-term outlook for the European premium chocolate sector remains optimistic, underpinned by persistent consumer appetite and innovative product development aligning with evolving preferences. Germany, France, the United Kingdom, and Italy are anticipated to continue as the dominant national markets within Europe.

Europe Premium Chocolate Industry Company Market Share

Europe Premium Chocolate Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe premium chocolate industry, offering invaluable insights for businesses, investors, and stakeholders. The study period spans 2019-2033, with 2025 as the base and estimated year. The report meticulously examines market size, growth drivers, competitive dynamics, and future projections, ensuring a complete understanding of this lucrative sector. With a predicted market value of xx Million in 2025, and a projected CAGR of xx% from 2025 to 2033, this report is an essential resource for navigating the complexities of the European premium chocolate market.

Europe Premium Chocolate Industry Market Structure & Competitive Dynamics

The European premium chocolate market exhibits a moderately concentrated structure, dominated by multinational giants like Nestle SA, Ferrero International SA, and Mondelez International Inc., but with significant opportunities for smaller, specialized players. Market share data reveals Nestle SA holds approximately xx% market share in 2025, followed by Ferrero International SA with xx%, and Mondelez International Inc. holding xx%. The industry’s innovation ecosystem is vibrant, with ongoing R&D focusing on sustainable sourcing, unique flavor profiles, and innovative packaging. Regulatory frameworks, particularly those concerning labeling, ingredient sourcing, and ethical production, are increasingly stringent, influencing business strategies. Product substitutes, such as gourmet confectionery and artisan sweets, pose a moderate competitive threat. Consumer trends indicate a growing preference for ethically sourced, sustainable, and health-conscious premium chocolate. M&A activity has been moderately active in the past five years, with deal values totaling approximately xx Million. Key recent mergers and acquisitions include [Insert specific M&A examples if available; otherwise, state "Specific M&A deals are not publicly available for this report."].

Europe Premium Chocolate Industry Industry Trends & Insights

The European premium chocolate market is experiencing robust growth driven by several factors. Rising disposable incomes, especially in emerging European markets, coupled with a growing preference for indulgence and premium products, fuels market expansion. Technological advancements in chocolate processing and packaging contribute to product innovation and improved efficiency. Consumer preferences are increasingly shifting towards dark chocolate, driven by health-consciousness and the perception of its higher antioxidant content. Moreover, a strong focus on sustainability and ethical sourcing is influencing consumer choices and shaping brand strategies. The market's competitive dynamics are characterized by intense competition amongst established players and the emergence of niche brands focusing on specific consumer segments (e.g., vegan, organic). The market experienced a CAGR of xx% from 2019 to 2024 and is projected to reach a market penetration of xx% by 2033.

Dominant Markets & Segments in Europe Premium Chocolate Industry

Leading Region: Western Europe, particularly countries like Germany, France, and the UK, dominate the premium chocolate market due to high per capita consumption, established retail infrastructure, and strong brand presence.

Leading Country: Germany, with its large population and high chocolate consumption, emerges as the leading national market. Key drivers include strong consumer purchasing power, a mature retail sector, and robust brand loyalty.

Leading Product Type: Dark premium chocolate accounts for the largest market share due to the growing health-conscious consumer base seeking antioxidants and intense flavor.

Leading Distribution Channel: Supermarkets/hypermarkets remain the dominant distribution channel due to high consumer reach and established distribution networks. However, online retail stores are exhibiting rapid growth, driven by convenience and expanding e-commerce penetration.

The dominance of these segments is primarily driven by strong consumer demand, effective distribution networks, and established brand equity. Economic factors, such as disposable incomes, and well-developed retail infrastructure significantly contribute to market leadership in these segments. Conversely, the smaller segment share held by convenience stores, for example, might be explained by the limited shelf space dedicated to premium products in many convenience formats.

Europe Premium Chocolate Industry Product Innovations

Recent product innovations in the premium chocolate sector focus on enhancing flavor profiles, incorporating novel ingredients (e.g., superfoods, unique spices), and employing sustainable packaging solutions. Technological advancements like 3D printing are being explored for personalized chocolate creations, while blockchain technology is improving supply chain traceability and enhancing brand transparency. These innovations cater to evolving consumer preferences for unique experiences and ethically sourced products, improving the market fit of premium chocolate brands.

Report Segmentation & Scope

This report segments the European premium chocolate market based on product type (Dark Premium Chocolate, White/Milk Premium Chocolates) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Other Distribution Channels). Each segment's growth projection, market size (in Million), and competitive dynamics are analyzed in detail for both the historical (2019-2024) and forecast (2025-2033) periods. Dark premium chocolate displays high growth potential owing to the health trend, and online retail channels are expected to experience significant growth due to the expansion of e-commerce. The competitive landscape within each segment varies, with established brands leading in the supermarket channel while niche brands are more prominent in the online segment.

Key Drivers of Europe Premium Chocolate Industry Growth

The growth of the European premium chocolate market is fueled by several interconnected factors. Rising disposable incomes allow for increased discretionary spending on premium goods. The preference for premium, ethically sourced chocolate reflects evolving consumer values. Technological advancements, such as improved processing techniques and sustainable packaging, boost production efficiency and appeal to eco-conscious consumers. Favorable regulatory environments support sustainable practices, and increased marketing efforts emphasize the premium nature of these products.

Challenges in the Europe Premium Chocolate Industry Sector

The European premium chocolate industry faces several challenges, including the volatility of cocoa prices and supply chain disruptions. Stringent regulatory requirements regarding ingredient sourcing and labeling can increase production costs. Intense competition from established and emerging brands necessitates continuous innovation and effective branding to maintain market share. These factors contribute to the overall cost of premium chocolate production, potentially impacting price points and market accessibility. The predicted impact on profit margins from 2025 to 2033 is projected to be xx%.

Leading Players in the Europe Premium Chocolate Industry Market

- Nestle SA

- Cemoi Group

- Ferrero International SA

- Chocoladefabriken Lindt & Sprungli AG

- Mars Incorporated

- Pierre Marcolini Group

- Mondelez International Inc

- Yildiz Holding

- Valrhona Inc

- Neuhaus NV

Key Developments in Europe Premium Chocolate Industry Sector

- Sept 2021: Ferrero’s entry into the UK premium chocolate bar market signifies a significant market expansion strategy.

- Feb 2022: Venchi's focus on sustainable packaging demonstrates a growing industry trend towards environmentally responsible practices.

- May 2022: Guylian's partnership with Fairtrade reflects the increasing importance of ethical sourcing and sustainability. These developments highlight a market shift towards ethical and sustainable practices, influencing consumer choice and brand positioning.

Strategic Europe Premium Chocolate Industry Market Outlook

The European premium chocolate market presents significant growth opportunities for companies focusing on sustainable sourcing, innovative product development, and targeted marketing strategies. Expanding into niche segments (e.g., vegan, organic chocolate) presents further market potential. Investment in technological advancements, such as improved processing and packaging, is crucial for enhancing product quality and reducing environmental impact. Brands that effectively communicate their ethical and sustainable commitments will garner a strong competitive advantage in the years to come.

Europe Premium Chocolate Industry Segmentation

-

1. Product Type

- 1.1. Dark Premium Chocolate

- 1.2. White/ Milk Premium Chocolates

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Europe

- 3.1. United Kingdom

- 3.2. France

- 3.3. Germany

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Switzerland

- 3.8. Rest of Europe

Europe Premium Chocolate Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Premium Chocolate Industry Regional Market Share

Geographic Coverage of Europe Premium Chocolate Industry

Europe Premium Chocolate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players

- 3.3. Market Restrains

- 3.3.1. Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein

- 3.4. Market Trends

- 3.4.1. Health Beneficial Premium Chocolates on Rise

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Premium Chocolate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dark Premium Chocolate

- 5.1.2. White/ Milk Premium Chocolates

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Europe

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Russia

- 5.3.7. Switzerland

- 5.3.8. Rest of Europe

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestle SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cemoi Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ferrero International SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chocoladefabriken Lindt & Sprungli AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mars Incorporated

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pierre Marcolini Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondelez International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yildiz Holding

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valrhona Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Neuhaus NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nestle SA

List of Figures

- Figure 1: Europe Premium Chocolate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Premium Chocolate Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Premium Chocolate Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Premium Chocolate Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Premium Chocolate Industry Revenue billion Forecast, by Europe 2020 & 2033

- Table 4: Europe Premium Chocolate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Premium Chocolate Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Europe Premium Chocolate Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Premium Chocolate Industry Revenue billion Forecast, by Europe 2020 & 2033

- Table 8: Europe Premium Chocolate Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Premium Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Premium Chocolate Industry?

The projected CAGR is approximately 6.73%.

2. Which companies are prominent players in the Europe Premium Chocolate Industry?

Key companies in the market include Nestle SA, Cemoi Group*List Not Exhaustive, Ferrero International SA, Chocoladefabriken Lindt & Sprungli AG, Mars Incorporated, Pierre Marcolini Group, Mondelez International Inc, Yildiz Holding, Valrhona Inc, Neuhaus NV.

3. What are the main segments of the Europe Premium Chocolate Industry?

The market segments include Product Type, Distribution Channel, Europe.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players.

6. What are the notable trends driving market growth?

Health Beneficial Premium Chocolates on Rise.

7. Are there any restraints impacting market growth?

Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein.

8. Can you provide examples of recent developments in the market?

May 2022: The premium chocolate brand Guylian from Belgium partnered with Fairtrade to convert all of its cocoa in line with the growing ethical movement worldwide. Guylian claimed that it is shifting its focus to sustainability as part of a rebranding strategy that includes a transition to more sustainable production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Premium Chocolate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Premium Chocolate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Premium Chocolate Industry?

To stay informed about further developments, trends, and reports in the Europe Premium Chocolate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence