Key Insights

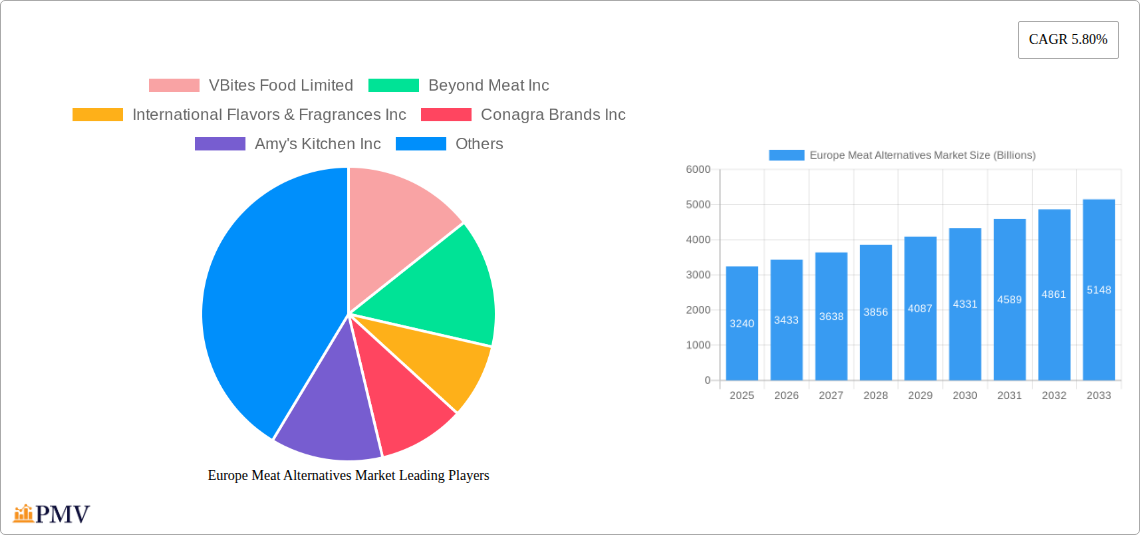

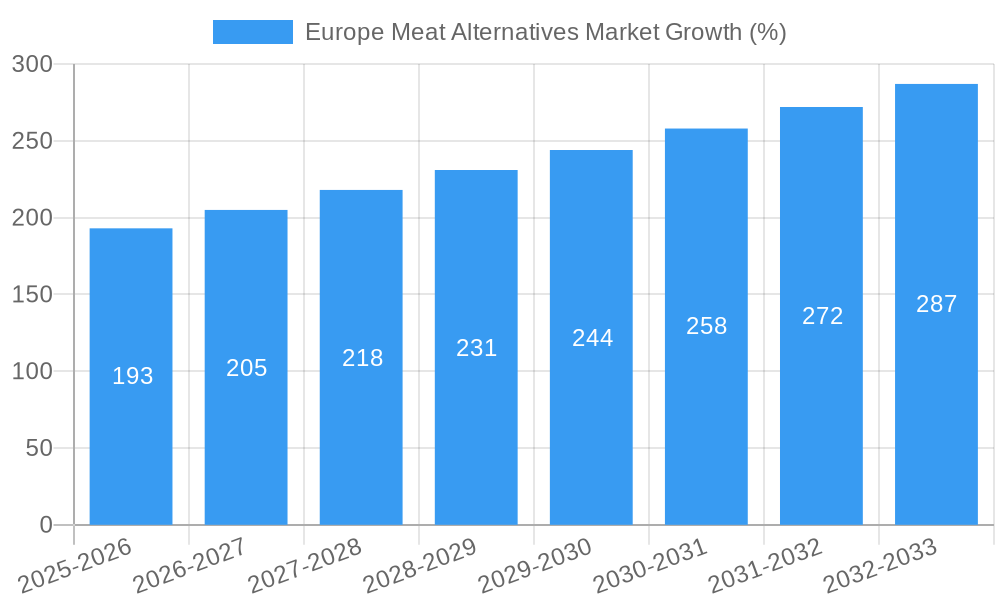

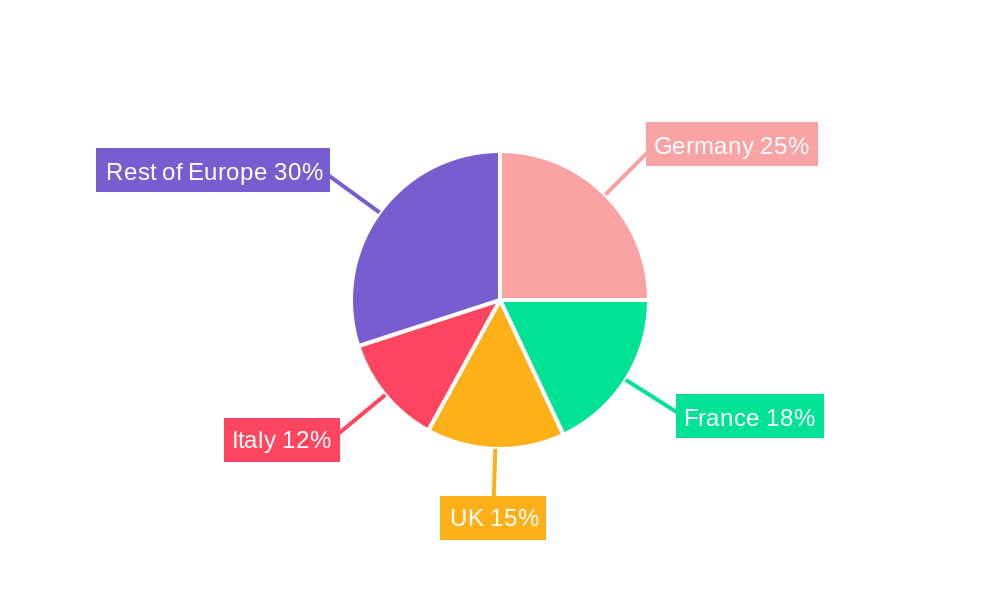

The European meat alternatives market, valued at €3.24 billion in 2025, is projected to experience robust growth, driven by increasing consumer awareness of health and environmental concerns associated with traditional meat consumption. This shift in consumer preferences, coupled with the rising popularity of vegan and vegetarian lifestyles, is fueling demand for plant-based protein sources like tempeh, tofu, textured vegetable protein, and other meat substitutes. The market's segmentation reveals a dynamic landscape, with the off-trade channel (supermarkets, retailers) likely dominating distribution, although on-trade (restaurants, food service) is also experiencing growth as more establishments incorporate plant-based options into their menus. Key players like Beyond Meat, Vbites, and Amy's Kitchen are driving innovation and expanding product offerings to cater to diverse consumer needs and preferences, further stimulating market expansion. Germany, France, the UK, and Italy are expected to be major contributors to the overall European market size due to their established vegetarian and vegan communities and higher disposable incomes.

The market's 5.80% CAGR from 2025 to 2033 suggests a continued upward trajectory. This growth will be influenced by factors such as technological advancements leading to more realistic and appealing meat alternatives, increased investment in research and development by major food companies, and supportive government policies promoting sustainable food choices. However, challenges remain, including price sensitivity among consumers, overcoming ingrained cultural preferences for traditional meats, and ensuring consistent product quality and availability across various distribution channels. Overcoming these hurdles through strategic marketing, product innovation, and competitive pricing will be crucial for sustained market growth throughout the forecast period.

Europe Meat Alternatives Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the burgeoning Europe Meat Alternatives Market, offering invaluable insights for investors, industry players, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends accurately. The report's value surpasses Billions in its detailed analysis covering market segmentation, competitive dynamics, and growth drivers.

Europe Meat Alternatives Market Structure & Competitive Dynamics

The Europe meat alternatives market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, a dynamic landscape is emerging due to increased innovation, growing consumer demand, and strategic mergers and acquisitions (M&A). The market is influenced by stringent regulatory frameworks related to food safety and labeling, necessitating compliance for all participants. This dynamic is further fueled by the rise of substitute products (e.g., lab-grown meat) and evolving end-user trends favoring plant-based diets. M&A activities are contributing to market consolidation and expansion, with several deals totaling Billions in value recorded in the past few years.

- Market Concentration: The top 5 players account for approximately xx% of the market share (estimated 2025).

- Innovation Ecosystems: Active R&D efforts focusing on taste, texture, and nutritional profile improvements are driving market innovation.

- Regulatory Frameworks: EU regulations on food labeling and ingredient sourcing are key factors influencing market structure.

- Product Substitutes: The emergence of lab-grown meat is creating a potential disruptive force.

- End-User Trends: Growing awareness of health benefits and environmental concerns is driving demand.

- M&A Activities: The total value of M&A deals in the past five years is estimated at Billions. Deals have primarily focused on expanding product portfolios and geographical reach.

Europe Meat Alternatives Market Industry Trends & Insights

The Europe meat alternatives market is experiencing significant growth, driven by a confluence of factors. The rising adoption of vegetarian and vegan lifestyles is a major catalyst, supplemented by growing consumer awareness of the health and environmental benefits associated with plant-based diets. Technological advancements, such as improved processing techniques and novel protein sources, are enhancing product quality and expanding market offerings. A notable trend is the increasing sophistication of meat alternatives, with manufacturers constantly innovating to mimic the taste and texture of traditional meat products. Competitive dynamics are characterized by intense rivalry, with established players and new entrants vying for market share through product innovation, marketing campaigns, and strategic partnerships. The market’s Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, leading to a market size of Billions by 2033. Market penetration currently stands at xx% and is expected to rise to xx% by 2033.

Dominant Markets & Segments in Europe Meat Alternatives Market

The German and UK markets currently dominate the European meat alternatives sector, driven by high consumer adoption rates and robust regulatory frameworks that support the industry. Within product types, Tofu holds the largest market share, followed closely by Textured Vegetable Protein (TVP). The Off-Trade distribution channel accounts for the majority of sales, with supermarkets and retailers representing the primary sales outlets.

Key Drivers for Germany & UK Dominance:

- High Consumer Awareness: Significant consumer base with knowledge and acceptance of meat alternatives.

- Strong Retail Infrastructure: Well-established supermarket chains and efficient distribution networks.

- Supportive Regulatory Environment: Clear labeling regulations and favorable policies supporting plant-based products.

Segment Analysis:

- Tofu: High market share due to established consumer preference and versatile culinary applications.

- Textured Vegetable Protein (TVP): Cost-effectiveness and functional properties contribute to its widespread use.

- Tempeh: Growing popularity driven by its nutritional profile and unique texture.

- Other Meat Substitutes: This segment demonstrates high potential for future growth with innovation in ingredient sourcing and processing techniques.

- Off-Trade: The established distribution channels provide greater market access compared to on-trade.

- On-Trade: The on-trade sector is growing, with plant-based options increasing in restaurants and food service establishments.

Europe Meat Alternatives Market Product Innovations

Recent innovations focus on replicating the texture and taste of meat products using novel protein sources and advanced processing techniques. The introduction of plant-based proteins, like SUPRO® TEX by IFF, highlights the growing trend towards improved flavor profiles and functional properties. These advancements are enhancing the appeal of meat alternatives to a broader consumer base.

Report Segmentation & Scope

This report offers detailed segmentation of the Europe meat alternatives market based on product type (Tempeh, Textured Vegetable Protein, Tofu, Other Meat Substitutes) and distribution channel (Off-Trade, On-Trade). Each segment includes growth projections, market size estimations, and an analysis of competitive dynamics. Growth projections are provided for each segment for the forecast period 2025-2033, reflecting the anticipated market expansion. Competitive analysis within each segment focuses on key players, market share distribution, and competitive strategies.

Key Drivers of Europe Meat Alternatives Market Growth

Several factors are propelling the growth of the Europe meat alternatives market. These include rising consumer demand for healthier and more sustainable food options, increased awareness of environmental concerns related to meat production, the development of innovative products mimicking the taste and texture of meat, and favorable government policies and initiatives. Technological advancements in protein extraction and formulation are also significantly contributing to market expansion.

Challenges in the Europe Meat Alternatives Market Sector

Despite the significant growth potential, the Europe meat alternatives market faces several challenges. These include maintaining consistent product quality and affordability, overcoming consumer perceptions about taste and texture, managing the complexity of supply chains, and navigating stringent regulatory frameworks. Furthermore, intense competition from both established and emerging players creates pressure on pricing and profitability. These challenges, if not effectively addressed, could hinder the market's potential.

Leading Players in the Europe Meat Alternatives Market Market

- VBites Food Limited

- Beyond Meat Inc

- International Flavors & Fragrances Inc

- Conagra Brands Inc

- Amy's Kitchen Inc

- Associated British Foods PLC

- Monde Nissin Corporation

- Plant Meat Limited

- Vitasoy International Holdings Ltd

- House Foods Group Inc

- JBS SA

- The Tofoo Co Ltd

Key Developments in Europe Meat Alternatives Market Sector

- September 2023: House Foods Group Inc. acquired 100% of Keystone Natural Holdings, LLC, expanding its tofu and plant-based food presence in North America and Europe.

- July 2023: Beyond Meat launched Beyond Nuggets and Beyond Tenders in over 1,600 REWE stores across Germany, expanding its product portfolio and market reach.

- March 2023: International Flavors & Fragrances Inc. introduced SUPRO® TEX, a new plant-based protein with high-process tolerance and neutral flavor, boosting product development capabilities for the industry.

Strategic Europe Meat Alternatives Market Outlook

The future of the Europe meat alternatives market appears highly promising. Continued innovation in product development, increasing consumer awareness of health and environmental benefits, and supportive regulatory frameworks will all contribute to robust growth. Strategic opportunities lie in expanding product diversification, enhancing distribution networks, and forging strategic alliances to expand market reach and build brand recognition. The market’s potential is immense, with significant opportunities for companies that can effectively adapt to the ever-evolving consumer preferences and technological advancements.

Europe Meat Alternatives Market Segmentation

-

1. Type

- 1.1. Tempeh

- 1.2. Textured Vegetable Protein

- 1.3. Tofu

- 1.4. Other Meat Substitutes

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Europe Meat Alternatives Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Meat Alternatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tempeh

- 5.1.2. Textured Vegetable Protein

- 5.1.3. Tofu

- 5.1.4. Other Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 VBites Food Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Beyond Meat Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 International Flavors & Fragrances Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Conagra Brands Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Amy's Kitchen Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Associated British Foods PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Monde Nissin Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Plant Meat Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Vitasoy International Holdings Lt

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 House Foods Group Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 JBS SA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 The Tofoo Co Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 VBites Food Limited

List of Figures

- Figure 1: Europe Meat Alternatives Market Revenue Breakdown (Billions, %) by Product 2024 & 2032

- Figure 2: Europe Meat Alternatives Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Meat Alternatives Market Revenue Billions Forecast, by Region 2019 & 2032

- Table 2: Europe Meat Alternatives Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Europe Meat Alternatives Market Revenue Billions Forecast, by Type 2019 & 2032

- Table 4: Europe Meat Alternatives Market Volume K Units Forecast, by Type 2019 & 2032

- Table 5: Europe Meat Alternatives Market Revenue Billions Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Meat Alternatives Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 7: Europe Meat Alternatives Market Revenue Billions Forecast, by Region 2019 & 2032

- Table 8: Europe Meat Alternatives Market Volume K Units Forecast, by Region 2019 & 2032

- Table 9: Europe Meat Alternatives Market Revenue Billions Forecast, by Country 2019 & 2032

- Table 10: Europe Meat Alternatives Market Volume K Units Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: France Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 14: France Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: Europe Meat Alternatives Market Revenue Billions Forecast, by Type 2019 & 2032

- Table 26: Europe Meat Alternatives Market Volume K Units Forecast, by Type 2019 & 2032

- Table 27: Europe Meat Alternatives Market Revenue Billions Forecast, by Distribution Channel 2019 & 2032

- Table 28: Europe Meat Alternatives Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Meat Alternatives Market Revenue Billions Forecast, by Country 2019 & 2032

- Table 30: Europe Meat Alternatives Market Volume K Units Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 35: France Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 36: France Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Meat Alternatives Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Europe Meat Alternatives Market?

Key companies in the market include VBites Food Limited, Beyond Meat Inc, International Flavors & Fragrances Inc, Conagra Brands Inc, Amy's Kitchen Inc, Associated British Foods PLC, Monde Nissin Corporation, Plant Meat Limited, Vitasoy International Holdings Lt, House Foods Group Inc, JBS SA, The Tofoo Co Ltd.

3. What are the main segments of the Europe Meat Alternatives Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.24 Billions as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

September 2023: House Food Groups Inc. acquired 100% of Keystone Natural Holdings, LLC (“KNH”), a leading manufacturer of tofu and plant-based foods in North America. The acquisition is meant to assist the company's expansion in United States and Europe with tofu as their core product.July 2023: Beyond Meat expanded its range in Germany with two new plant-based chicken-style products: Beyond Nuggets and Beyond Tenders in over 1,600 REWE stores across Germany.March 2023: International Flavors & Fragrances Inc. launched its new plant-based protein SUPRO® TEX which offers endless product design and formulation opportunities with its high-process tolerance, neutral flavor and color. SUPRO® TEX is based on soy protein.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billions and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Meat Alternatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Meat Alternatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Meat Alternatives Market?

To stay informed about further developments, trends, and reports in the Europe Meat Alternatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence