Key Insights

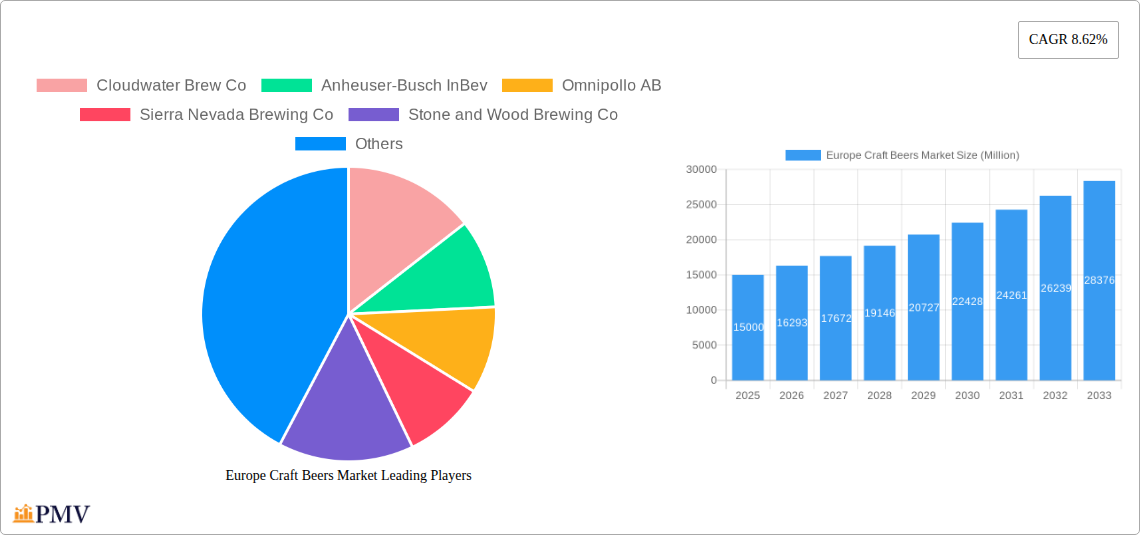

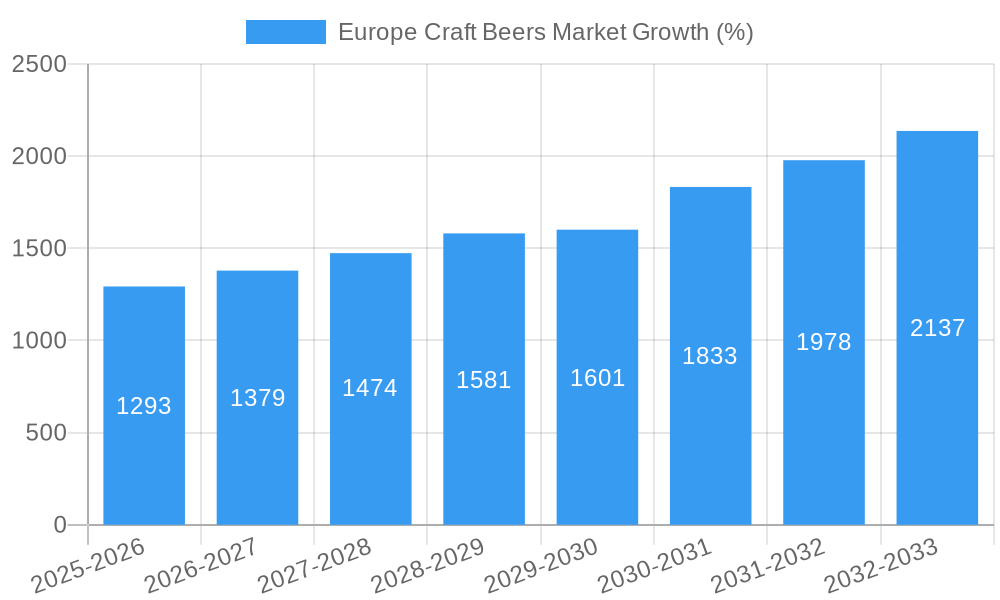

The European craft beer market, currently experiencing robust growth, is projected to maintain a significant upward trajectory throughout the forecast period (2025-2033). A compound annual growth rate (CAGR) of 8.62% indicates a substantial expansion, driven by several key factors. The increasing popularity of craft beers among younger demographics, fueled by a desire for unique and high-quality beverages, is a major catalyst. Furthermore, the rise of craft breweries focusing on innovative brewing techniques and diverse flavor profiles caters to evolving consumer preferences and contributes to market expansion. The growing availability of craft beers through both on-trade (pubs, bars, restaurants) and off-trade (supermarkets, online retailers) channels further enhances market accessibility and fuels sales. While challenges such as increased competition and fluctuating raw material costs exist, the market's resilience is demonstrated by the continued emergence of new breweries and innovative product offerings, suggesting a strong future.

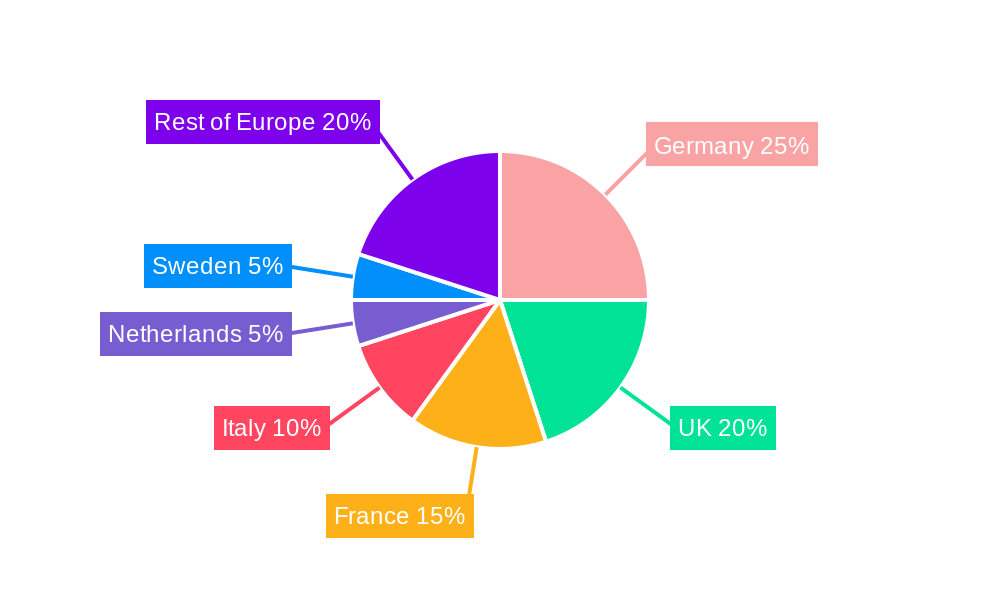

Regional variations within Europe are expected, with Germany, the UK, and other established beer-consuming nations leading the charge. However, smaller markets are also showing promise, as consumer awareness and appreciation for craft beer spreads. The market segmentation by product type highlights the popularity of ales, pilsners, and pale lagers, with specialty beers contributing to growth through experimentation and unique offerings. Key players like Anheuser-Busch InBev, Heineken NV, and smaller independent breweries like Cloudwater Brew Co and Stone Brewing Co are actively shaping the market through brand building, strategic partnerships, and expansions. The overall outlook suggests a dynamic and thriving European craft beer market with considerable potential for further expansion in the coming years. The continued focus on quality, innovation, and diverse distribution channels will be crucial for maintaining this growth trajectory.

Europe Craft Beers Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe craft beers market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report offers historical context, current market analysis, and future projections. The report utilizes data from 2019-2024 as the historical period and provides estimations for 2025. The total market size is predicted to reach xx Million by 2033.

Europe Craft Beers Market Structure & Competitive Dynamics

The European craft beer market is characterized by a complex interplay of established multinational players and innovative smaller breweries. Market concentration is relatively low, with a fragmented landscape dominated by numerous regional and national breweries. However, larger players like Anheuser-Busch InBev and Heineken NV exert significant influence through acquisitions and market share. The innovation ecosystem is vibrant, with continuous experimentation in brewing techniques, ingredients, and product offerings. Regulatory frameworks vary across European countries, influencing production, distribution, and labeling. Product substitutes include mainstream beers, other alcoholic beverages, and non-alcoholic alternatives. End-user trends show a growing preference for premium and specialty craft beers, driving market growth.

Mergers and acquisitions (M&A) activity is prevalent, with larger breweries strategically acquiring smaller craft breweries to expand their portfolios and reach new consumer segments. While precise M&A deal values are not consistently reported for smaller acquisitions, a significant number of deals in the xx Million range have occurred, representing consolidation within the industry. Key players like Anheuser-Busch InBev have consistently used acquisitions to increase market share. Market share data indicates that the top 10 breweries hold approximately xx% of the total market, with the remaining share distributed among a large number of smaller players.

Europe Craft Beers Market Industry Trends & Insights

The European craft beer market exhibits robust growth, driven by several key factors. Rising consumer disposable incomes, increased demand for premium beverages, and a growing interest in diverse and locally produced beers are significant drivers. Technological advancements in brewing processes and packaging enhance production efficiency and product quality. Changing consumer preferences toward healthier options are seen in the increased demand for low-alcohol or alcohol-free craft beers. The market is also witnessing a surge in the popularity of specialty beers, such as IPAs, stouts, and sours, fueled by increased consumer awareness and experimentation.

Competitive dynamics are fierce, with established players facing competition from numerous smaller craft breweries. The Compound Annual Growth Rate (CAGR) for the Europe craft beers market from 2025 to 2033 is estimated at xx%, indicating substantial growth potential. Market penetration of craft beers continues to increase, particularly amongst younger demographics, demonstrating the market's sustained appeal. These factors are expected to contribute to a market value of xx Million by 2033.

Dominant Markets & Segments in Europe Craft Beers Market

The United Kingdom and Germany represent the most significant markets within Europe for craft beers, driven by established brewing traditions, strong consumer demand, and robust distribution networks. Other key markets include Belgium, the Netherlands, and Scandinavian countries.

By Product Type:

- Ales: This segment remains dominant, driven by the broad appeal and diverse styles of ales.

- Pilsners and Pale Lagers: This segment is steadily growing, attracting consumers seeking lighter, more refreshing options.

- Specialty Beers: Experiencing significant growth, fueled by the increasing demand for unique flavors and styles. IPAs, stouts, and sours are particularly popular.

- Other Types: This segment includes a variety of niche beers, which contribute to the overall market diversity.

By Distribution Channel:

- On-trade: Pubs, bars, and restaurants contribute significantly to sales, with craft beers often commanding premium pricing.

- Off-trade: Supermarkets, convenience stores, and online retailers are increasingly important channels, particularly for wider distribution of brands.

The dominance of the UK and Germany stems from several factors: strong consumer spending on premium beverages, well-developed distribution infrastructure, and a favorable regulatory environment. These markets also benefit from a rich history and culture of brewing, fostering a strong consumer base for craft beers. Strong economic conditions and supportive policies enhance the growth within these key markets.

Europe Craft Beers Market Product Innovations

The craft beer market is characterized by ongoing innovation, with brewers continuously experimenting with new ingredients, flavors, and brewing techniques. Technological advancements in brewing processes, such as precision fermentation and advanced filtration, are improving product consistency and quality. The trend towards sustainability is also influencing product innovation, with an increasing focus on using locally sourced ingredients and eco-friendly packaging. New product launches, such as those using unconventional ingredients (e.g., fruit, spices, and other additives), continue to drive market excitement and segment diversification, catering to increasingly sophisticated palates.

Report Segmentation & Scope

This report segments the Europe craft beers market by product type (Ales, Pilsners and Pale Lagers, Specialty Beers, Other Types) and distribution channel (On-trade, Off-trade). Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics. The market size for each segment is projected to increase significantly over the forecast period. For example, the specialty beers segment is anticipated to witness the fastest growth rate due to the growing consumer demand for unique flavors and experiences. The on-trade segment is expected to show significant growth alongside the off-trade segment with a potential for online beer delivery to add to its revenue.

Key Drivers of Europe Craft Beers Market Growth

Several factors contribute to the growth of the European craft beer market. These include rising disposable incomes, increased consumer preference for premium and artisanal products, a growing interest in unique and diverse flavors, and strong support from independent breweries and passionate brewers. Technological advancements also play a role by enhancing the efficiency and quality of brewing processes. Furthermore, favorable regulatory environments in some European countries encourage innovation and market expansion.

Challenges in the Europe Craft Beers Market Sector

The European craft beer market faces challenges such as intense competition, fluctuating raw material costs, and the increasing popularity of other alcoholic and non-alcoholic beverages. Regulatory hurdles, particularly regarding labeling and taxation, can pose obstacles to smaller breweries. Supply chain disruptions can also impact production and distribution. These challenges can limit the growth of some segments within the craft beer industry, such as smaller companies struggling with larger competitor acquisitions.

Leading Players in the Europe Craft Beers Market Market

- Cloudwater Brew Co

- Anheuser-Busch InBev

- Omnipollo AB

- Sierra Nevada Brewing Co

- Stone and Wood Brewing Co

- Molson Coors Beverage Company

- Magic Rock Brewing Co Ltd

- Stone Brewing Co

- D G Yuengling & Son Inc

- Heineken NV

List Not Exhaustive

Key Developments in Europe Craft Beers Market Sector

- August 2022: Mikkeller's collaboration with Warner Bros. Consumer Products resulted in the launch of three unique beers (Syrax Rises, Syrax, and Caraxes), expanding the market with licensed products and unique flavor profiles.

- April 2021: Beavertown Brewery Ltd launched Luchanaut lager and lime, broadening its limited edition range and appealing to consumers seeking diverse flavor options.

- March 2020: The Wild Beer Co's waterless beer innovation showcased a commitment to sustainability, potentially influencing future brewing practices and attracting environmentally conscious consumers.

Strategic Europe Craft Beers Market Market Outlook

The future of the European craft beer market appears bright, with continued growth expected across various segments. Opportunities exist for brewers to leverage technological advancements, embrace sustainable practices, and focus on creating innovative products catering to evolving consumer preferences. Strategic partnerships, collaborations, and acquisitions will continue to shape market dynamics, as larger companies seek to gain a foothold in this rapidly expanding sector. Focus on niche markets, diverse flavor profiles, and sustainable practices will be crucial for both large and small breweries to achieve long-term success.

Europe Craft Beers Market Segmentation

-

1. Product Type

- 1.1. Ales

- 1.2. Pilsners and Pale Lagers

- 1.3. Specialty Beers

- 1.4. Other Types

-

2. Distibution Channel

- 2.1. On-trade

- 2.2. Off-trade

Europe Craft Beers Market Segmentation By Geography

- 1. Germany

- 2. France

- 3. Italy

- 4. Spain

- 5. United Kingdom

- 6. Rest of Europe

Europe Craft Beers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Rising Number of Microbreweries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ales

- 5.1.2. Pilsners and Pale Lagers

- 5.1.3. Specialty Beers

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. Italy

- 5.3.4. Spain

- 5.3.5. United Kingdom

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Ales

- 6.1.2. Pilsners and Pale Lagers

- 6.1.3. Specialty Beers

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Ales

- 7.1.2. Pilsners and Pale Lagers

- 7.1.3. Specialty Beers

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Italy Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Ales

- 8.1.2. Pilsners and Pale Lagers

- 8.1.3. Specialty Beers

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Ales

- 9.1.2. Pilsners and Pale Lagers

- 9.1.3. Specialty Beers

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United Kingdom Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Ales

- 10.1.2. Pilsners and Pale Lagers

- 10.1.3. Specialty Beers

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Ales

- 11.1.2. Pilsners and Pale Lagers

- 11.1.3. Specialty Beers

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Germany Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Craft Beers Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Cloudwater Brew Co

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Anheuser-Busch InBev

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Omnipollo AB

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Sierra Nevada Brewing Co

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Stone and Wood Brewing Co

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Molson Coors Beverage Company

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Magic Rock Brewing Co Ltd

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Stone Brewing Co *List Not Exhaustive

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 D G Yuengling & Son Inc

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Heineken NV

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Cloudwater Brew Co

List of Figures

- Figure 1: Europe Craft Beers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Craft Beers Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Craft Beers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Craft Beers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Craft Beers Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 4: Europe Craft Beers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Craft Beers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Craft Beers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Craft Beers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Craft Beers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Craft Beers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Craft Beers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Craft Beers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Craft Beers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Craft Beers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Craft Beers Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 15: Europe Craft Beers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Craft Beers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Europe Craft Beers Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 18: Europe Craft Beers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Craft Beers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Europe Craft Beers Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 21: Europe Craft Beers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Craft Beers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Europe Craft Beers Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 24: Europe Craft Beers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Craft Beers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Europe Craft Beers Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 27: Europe Craft Beers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Craft Beers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 29: Europe Craft Beers Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 30: Europe Craft Beers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Craft Beers Market?

The projected CAGR is approximately 8.62%.

2. Which companies are prominent players in the Europe Craft Beers Market?

Key companies in the market include Cloudwater Brew Co, Anheuser-Busch InBev, Omnipollo AB, Sierra Nevada Brewing Co, Stone and Wood Brewing Co, Molson Coors Beverage Company, Magic Rock Brewing Co Ltd, Stone Brewing Co *List Not Exhaustive, D G Yuengling & Son Inc, Heineken NV.

3. What are the main segments of the Europe Craft Beers Market?

The market segments include Product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Rising Number of Microbreweries.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

In August 2022, Mikkeller, a Danish brewery, collaborated with Warner Bros. Consumer Products to create three distinct beers that use ingredients such as dragon fruit and Styrian Dragon hops. Syrax Rises, Syrax, and Caraxes are the three new beers. Syrax and Caraxes beers are available, with Syrax Rises in many European countries, including Italy, France, the United Kingdom, Germany, Sweden, Denmark, Norway, and the Netherlands, among others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Craft Beers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Craft Beers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Craft Beers Market?

To stay informed about further developments, trends, and reports in the Europe Craft Beers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence