Key Insights

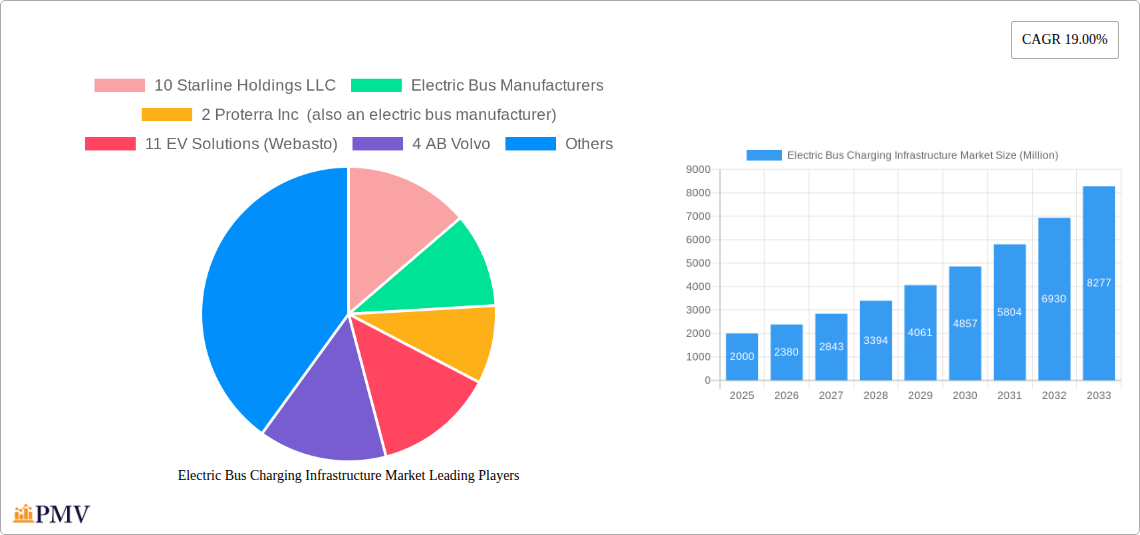

The electric bus charging infrastructure market is experiencing robust growth, driven by the global shift towards sustainable transportation and the increasing adoption of electric buses in public transit systems. A compound annual growth rate (CAGR) of 19% from 2019 to 2024 suggests a significant market expansion. This growth is fueled by several factors, including government incentives promoting electric vehicle adoption, stringent emission regulations aimed at reducing air pollution in urban areas, and the decreasing cost of both electric buses and charging infrastructure. The market is segmented by charging type, with plug-in charging currently dominating, but overhead charging is expected to gain traction due to its faster charging capabilities and suitability for depot-based charging solutions. Key players in the market include established automotive manufacturers like BYD Auto Co Ltd and Volvo, alongside specialized charging infrastructure providers such as ChargePoint Inc and ABB Ltd. Geographic distribution sees North America and Europe leading the market currently, but the Asia-Pacific region, particularly China and India, is poised for substantial growth due to rapidly expanding public transport networks and government initiatives.

Electric Bus Charging Infrastructure Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, driven by further technological advancements in charging technology, improved battery performance in electric buses, and the increasing demand for efficient and reliable charging solutions in dense urban environments. While the initial investment costs for infrastructure development may pose a restraint in some regions, the long-term benefits of reduced operational costs and environmental advantages are expected to outweigh these challenges. The market is likely to witness increased competition among established players and emerging startups, leading to innovation in charging technologies and business models. The focus will increasingly be on smart charging solutions, integrating renewable energy sources, and developing robust grid management systems to support the growing demand for electric bus charging. This will drive further specialization and potentially consolidation within the market.

Electric Bus Charging Infrastructure Market Company Market Share

This in-depth report provides a comprehensive analysis of the Electric Bus Charging Infrastructure Market, covering market size, growth drivers, competitive landscape, and future outlook from 2019 to 2033. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering invaluable insights for stakeholders across the electric vehicle ecosystem. The report specifically focuses on charging types (Plug-in and Overhead) and identifies key players shaping the market's trajectory.

Electric Bus Charging Infrastructure Market Structure & Competitive Dynamics

This section analyzes the market's competitive intensity, examining market concentration, innovation ecosystems, regulatory landscapes, product substitutes, end-user trends, and mergers and acquisitions (M&A) activity. The global electric bus charging infrastructure market is characterized by a moderately concentrated landscape, with several major players and a growing number of smaller, specialized companies. Key metrics like market share and M&A deal values are analyzed.

Market Concentration: The market exhibits a mix of large multinational corporations and smaller, specialized firms. The top five players currently hold an estimated xx% market share, indicating a moderately concentrated landscape. This concentration is expected to remain relatively stable during the forecast period, with potential shifts driven by technological advancements and M&A activity.

Innovation Ecosystems: Significant innovation is occurring across multiple areas, including charging technology (faster charging speeds, wireless charging), energy storage solutions, and smart grid integration. Collaborative partnerships between charging infrastructure suppliers and electric bus manufacturers are driving innovation. These partnerships are crucial for optimizing charging infrastructure design and functionality.

Regulatory Frameworks: Government regulations and incentives play a crucial role in shaping market growth. Policies promoting electric bus adoption and supporting the development of charging infrastructure, including subsidies and tax breaks, are key drivers. Variability in regulatory frameworks across different regions influences market expansion.

Product Substitutes: While currently limited, alternative technologies such as wireless charging and battery swapping systems could potentially emerge as substitutes in the future. However, Plug-in and overhead charging currently dominate the market due to their relative maturity and cost-effectiveness.

End-User Trends: The increasing adoption of electric buses by public transportation authorities and private fleet operators is a major driver of market growth. Demand for reliable, efficient, and cost-effective charging solutions is driving innovation and shaping market dynamics.

M&A Activities: The electric bus charging infrastructure market has witnessed several significant M&A deals in recent years, with deal values exceeding xx Million. These activities demonstrate the consolidation trend within the industry, fostering growth and innovation. Consolidation also enables companies to expand their geographic reach and enhance product offerings.

Electric Bus Charging Infrastructure Market Industry Trends & Insights

This section delves into the factors shaping the market's growth trajectory, including technological advancements, evolving consumer preferences, and competitive dynamics. The market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Growing adoption of electric buses: Driven by environmental concerns and government regulations promoting sustainable transportation, electric bus adoption is rapidly increasing globally.

- Technological advancements: Innovations in battery technology, charging infrastructure, and smart grid integration are enhancing efficiency and reducing costs.

- Government support and incentives: Government policies promoting electric vehicle adoption, including subsidies and tax benefits, are stimulating market growth.

- Falling battery costs: The declining cost of batteries is making electric buses more economically viable, further fueling demand.

- Improved charging infrastructure: The expansion of charging infrastructure networks is addressing range anxiety and improving convenience for electric bus operators.

- Increased private sector investment: Growing private sector interest is driving investment in the development and deployment of charging infrastructure.

Market penetration of electric bus charging infrastructure is currently at xx% and is expected to reach xx% by 2033, signifying significant growth potential.

Dominant Markets & Segments in Electric Bus Charging Infrastructure Market

This section identifies the leading regions, countries, and segments within the electric bus charging infrastructure market. The analysis reveals that [Region Name, e.g., North America/Europe/Asia-Pacific] is currently the dominant market, holding a significant market share.

Dominant Market: [Specify dominant region/country with detailed analysis – approximately 300 words, explaining factors like government policies, existing infrastructure, and electric bus adoption rates].

Dominant Segment: Charging Type:

Plug-in Charging: This segment currently holds the largest market share due to its maturity and cost-effectiveness. Key drivers include widespread availability, ease of implementation, and compatibility with existing electric bus models. However, the limited charging speeds of some Plug-in Chargers relative to newer technologies pose a future challenge. Market size for plug-in charging is projected to be xx Million in 2025 and xx Million by 2033.

Overhead Charging: This segment is experiencing significant growth, driven by its ability to provide fast and efficient charging for electric buses. [Elaborate on the benefits of overhead charging (e.g., higher charging speeds, reduced downtime), limitations (e.g., infrastructure costs, installation complexities), growth prospects, and market size projection (xx Million in 2025 and xx Million by 2033) – approximately 300 words].

Electric Bus Charging Infrastructure Market Product Innovations

Recent product innovations focus on enhancing charging speed, efficiency, and reliability. The introduction of high-power chargers (e.g., >150 kW) and smart charging technologies (e.g., load balancing, energy management) are transforming the market. The integration of renewable energy sources into charging infrastructure is also gaining traction, promoting sustainability and reducing operating costs. Wireless charging technology is still under development but presents significant potential for future market disruption. These advancements address key user needs for faster charging times and reduced operational costs.

Report Segmentation & Scope

The report segments the market by charging type: Plug-in Charging and Overhead Charging.

Plug-in Charging: This segment encompasses various charging levels and technologies, from slower Level 2 chargers to fast DC chargers. Growth is driven by the widespread adoption of electric buses and the existing infrastructure. Competitive dynamics are shaped by factors such as charging speed, cost, and reliability.

Overhead Charging: This segment focuses on pantograph-based charging systems that enable rapid charging of electric buses at designated stops. Market growth is fuelled by the need for fast turnaround times in bus operations. Competitive dynamics center on charging efficiency, infrastructure cost, and system integration. Both segments are expected to experience substantial growth throughout the forecast period.

Key Drivers of Electric Bus Charging Infrastructure Market Growth

Several key factors are driving market growth. These include the rising adoption of electric buses due to environmental concerns and government regulations, coupled with technological advancements leading to improved charging efficiency and reduced costs. Significant investments from both the public and private sectors further fuel expansion. Government incentives and subsidies play a vital role, incentivizing the transition to electric transportation.

Challenges in the Electric Bus Charging Infrastructure Market Sector

Despite significant growth potential, several challenges persist. High initial infrastructure costs, coupled with the need for grid upgrades in some regions, pose significant barriers. Interoperability issues between different charging systems and the need for standardized charging protocols represent further obstacles. Supply chain disruptions and the availability of skilled labor can also impact market growth. Addressing these challenges requires collaboration between stakeholders across the industry.

Leading Players in the Electric Bus Charging Infrastructure Market

- 10 Starline Holdings LLC

- 2 Proterra Inc

- 11 EV Solutions (Webasto)

- 4 AB Volvo

- 3 ChargePoint Inc

- 1 BYD Auto Co Ltd

- 1 ABB Ltd

- 8 Heliox Energy

- 6 ALSTOM

- 5 Zhengzhou Yutong Bus Co Ltd

- 7 SemaConnect Inc

- 2 Mercedes-Benz AG

- 3 Traton SE

- 4 Siemens AG

- 7 NFI Group Inc

- 5 Schneider Electric SE

- 6 IVECO S p A

- 9 Vital EV Solutions

- Electric Charging Infrastructure Suppliers

Key Developments in Electric Bus Charging Infrastructure Market Sector

November 2022: ABB E-Mobility secured USD 214 Million in pre-IPO funding, bolstering its growth strategy and potential M&A activities. This significant investment highlights the confidence in the sector's future.

September 2022: ABB E-Mobility established a new manufacturing facility in South Carolina, creating over 100 jobs and increasing annual production capacity to 10,000 chargers. This expansion signifies a major commitment to the North American market and demonstrates the growing demand for electric bus charging infrastructure.

August 2022: Siemens and MAHLE Group partnered to develop wireless charging systems for electric vehicles, promising a potential future shift in charging technology. This collaboration points towards a significant technological leap in the electric vehicle industry, potentially impacting the electric bus charging market down the line.

Strategic Electric Bus Charging Infrastructure Market Outlook

The electric bus charging infrastructure market presents significant opportunities for growth and investment. Continued expansion of electric bus fleets, coupled with technological advancements and supportive government policies, will drive substantial market expansion over the next decade. Strategic partnerships between charging infrastructure providers and electric bus manufacturers will be key to success, enabling the optimization of charging infrastructure and enhancing the overall customer experience. The increasing focus on sustainability and the need for efficient transportation solutions will ensure sustained growth in the market.

Electric Bus Charging Infrastructure Market Segmentation

-

1. Charging Type

- 1.1. Plug-in Charging

- 1.2. Overhead Charging

Electric Bus Charging Infrastructure Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Bus Charging Infrastructure Market Regional Market Share

Geographic Coverage of Electric Bus Charging Infrastructure Market

Electric Bus Charging Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Electric Buses

- 3.3. Market Restrains

- 3.3.1. High Upfront Investment

- 3.4. Market Trends

- 3.4.1. Governmental Efforts to Increase in the Number of Electric Buses Will Boost Overhead Charging Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 5.1.1. Plug-in Charging

- 5.1.2. Overhead Charging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 6. North America Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 6.1.1. Plug-in Charging

- 6.1.2. Overhead Charging

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 7. Europe Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 7.1.1. Plug-in Charging

- 7.1.2. Overhead Charging

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 8. Asia Pacific Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 8.1.1. Plug-in Charging

- 8.1.2. Overhead Charging

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 9. Rest of the World Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 9.1.1. Plug-in Charging

- 9.1.2. Overhead Charging

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 10 Starline Holdings LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Electric Bus Manufacturers

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 2 Proterra Inc (also an electric bus manufacturer)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 11 EV Solutions (Webasto)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 4 AB Volvo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 3 ChargePoint Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 1 BYD Auto Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 1 ABB Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 8 Heliox Energy

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 6 ALSTOM

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 5 Zhengzhou Yutong Bus Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 7 SemaConnect Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 2 Mercedes-Benz AG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 3 Traton SE

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 4 Siemens AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 7 NFI Group Inc

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 5 Schneider Electric SE

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 6 IVECO S p A

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 9 Vital EV Solutions

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Electric Charging Infrastructure Suppliers

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 10 Starline Holdings LLC

List of Figures

- Figure 1: Global Electric Bus Charging Infrastructure Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 3: North America Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 4: North America Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 7: Europe Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 8: Europe Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 11: Asia Pacific Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 12: Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 15: Rest of the World Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 16: Rest of the World Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 2: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 4: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 9: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 17: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 24: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: South America Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Middle East and Africa Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Bus Charging Infrastructure Market?

The projected CAGR is approximately 19.00%.

2. Which companies are prominent players in the Electric Bus Charging Infrastructure Market?

Key companies in the market include 10 Starline Holdings LLC, Electric Bus Manufacturers, 2 Proterra Inc (also an electric bus manufacturer), 11 EV Solutions (Webasto), 4 AB Volvo, 3 ChargePoint Inc, 1 BYD Auto Co Ltd, 1 ABB Ltd, 8 Heliox Energy, 6 ALSTOM, 5 Zhengzhou Yutong Bus Co Ltd, 7 SemaConnect Inc, 2 Mercedes-Benz AG, 3 Traton SE, 4 Siemens AG, 7 NFI Group Inc, 5 Schneider Electric SE, 6 IVECO S p A, 9 Vital EV Solutions, Electric Charging Infrastructure Suppliers.

3. What are the main segments of the Electric Bus Charging Infrastructure Market?

The market segments include Charging Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Electric Buses.

6. What are the notable trends driving market growth?

Governmental Efforts to Increase in the Number of Electric Buses Will Boost Overhead Charging Type.

7. Are there any restraints impacting market growth?

High Upfront Investment.

8. Can you provide examples of recent developments in the market?

November 2022: ABB E-Mobility, the electric vehicle charging solutions subsidiary of ABB Ltd., successfully raised CHF 200 million (USD 214 million) in a pre-IPO private placement led by a group of minority investors. The capital infusion will play a crucial role in supporting the company's growth strategy, which includes pursuing both organic and inorganic opportunities, such as potential mergers and acquisitions. The transaction is expected to be finalized in the fourth quarter of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Bus Charging Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Bus Charging Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Bus Charging Infrastructure Market?

To stay informed about further developments, trends, and reports in the Electric Bus Charging Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence