Key Insights

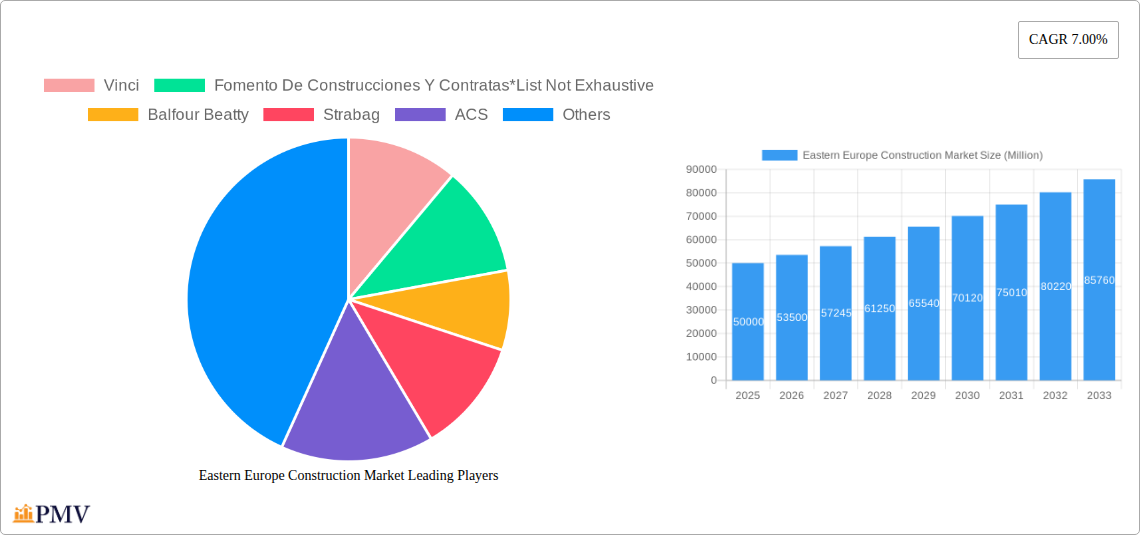

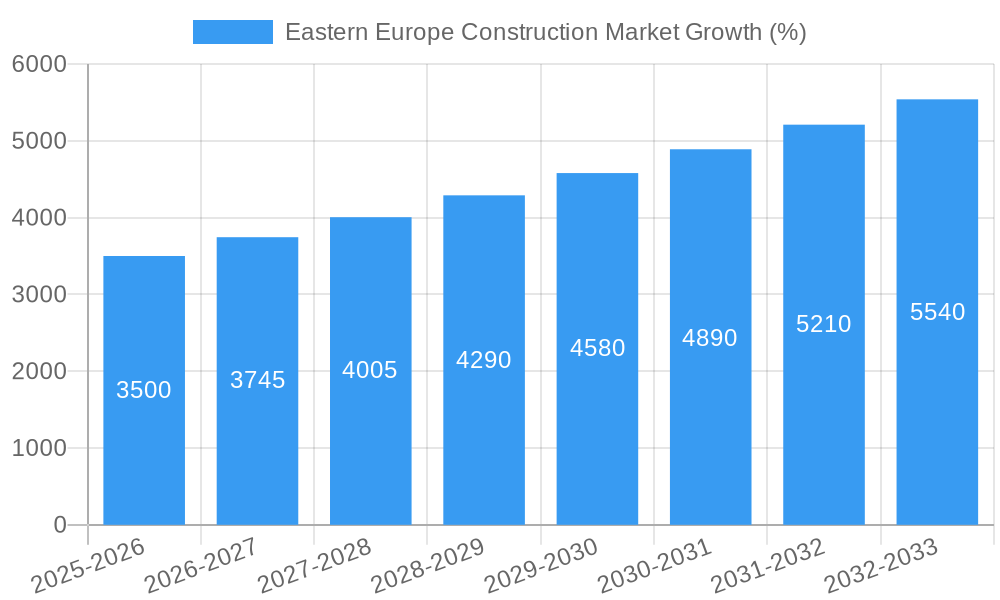

The Eastern European construction market, while experiencing robust growth, presents a complex landscape influenced by several factors. The overall market size, though not explicitly stated for Eastern Europe, can be reasonably estimated based on the provided global CAGR of 7% and the known Western European market size. Assuming a proportionate representation of Eastern Europe within the broader European market, and considering its distinct economic and infrastructural needs, a conservative estimate places the 2025 Eastern European construction market value at approximately €50 billion. This figure is driven by substantial investment in infrastructure development, particularly in transportation networks (roads, railways, airports) fueled by EU funding and national government initiatives to improve connectivity and logistics. Furthermore, a growing residential sector, driven by urbanization and population shifts, significantly contributes to market expansion. However, this growth is tempered by economic volatility in certain regions, geopolitical uncertainties impacting investment confidence, and, in some cases, a shortage of skilled labor which can lead to project delays and cost overruns.

The market's segmentation reveals a dynamic interplay of various sectors. Infrastructure projects, particularly transportation, dominate, accounting for a projected 40% of the total market value in 2025. Residential construction constitutes approximately 30%, reflecting the ongoing urbanization trend and housing demand in rapidly growing cities. Commercial and industrial construction sectors each account for approximately 15%, driven by burgeoning business activities and industrial development. Energy and utilities projects, though smaller in proportion, are experiencing significant growth due to the ongoing energy transition and modernization of existing systems. Key players in the market include both international giants like Vinci and local construction firms, showcasing a competitive landscape. Looking ahead, the market is expected to maintain a healthy growth trajectory, with continued investment in infrastructure modernization and a focus on sustainable construction practices playing a crucial role in shaping its future.

Eastern Europe Construction Market: 2019-2033 Outlook - A Comprehensive Report

This in-depth report provides a comprehensive analysis of the Eastern European construction market, covering the period from 2019 to 2033. It offers invaluable insights into market structure, competitive dynamics, industry trends, dominant segments, and key growth drivers, equipping stakeholders with actionable intelligence for strategic decision-making. The report leverages extensive data analysis and expert insights to forecast market growth and identify lucrative opportunities within this dynamic sector. The base year for this analysis is 2025, with estimates for 2025 and a forecast extending to 2033. The historical period covered is 2019-2024.

Eastern Europe Construction Market Structure & Competitive Dynamics

The Eastern European construction market exhibits a moderately concentrated structure, with several multinational giants and regional players vying for market share. Key players include Vinci, Fomento De Construcciones Y Contratas, Balfour Beatty, Strabag, ACS, Royal Bam Group NV, Bouygues, Eiffage, Skanska, and Acciona. However, the market also encompasses a significant number of smaller, local firms. Market concentration is estimated at xx%, with the top five players holding a combined market share of approximately yy%.

The regulatory landscape significantly influences market dynamics, with varying building codes and permitting processes across different countries. Innovation ecosystems are developing, with a growing focus on sustainable construction practices and digital technologies. M&A activity has been moderate in recent years, with total deal values estimated at approximately $xx Million during the period 2019-2024. Notable transactions included [insert details of significant M&A deals, if available, otherwise state "Data unavailable"]. End-user trends reflect increasing demand for sustainable and energy-efficient buildings, driving innovation in materials and construction techniques. Product substitution is primarily driven by the adoption of more sustainable and cost-effective materials.

Eastern Europe Construction Market Industry Trends & Insights

The Eastern European construction market is experiencing robust growth, driven by factors such as increasing urbanization, rising disposable incomes, government infrastructure investments, and a burgeoning real estate sector. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), reaching a value of $xx Million by 2033. Technological disruptions, such as Building Information Modeling (BIM) and the adoption of prefabricated construction methods, are enhancing efficiency and productivity. Consumer preferences are shifting towards sustainable and smart buildings, influencing the demand for eco-friendly materials and technologies. Competitive dynamics are characterized by increasing consolidation, technological advancements, and the emergence of specialized contractors. Market penetration of green building technologies is growing steadily, with xx% of new constructions incorporating sustainable features in 2024.

Dominant Markets & Segments in Eastern Europe Construction Market

The Eastern European construction market is characterized by varied growth dynamics across different countries and sectors. While precise dominance varies by sector, Poland and Russia frequently emerge as leading markets due to their size and ongoing infrastructure projects.

- Residential: Strong population growth and urbanization are fueling demand in major cities.

- Commercial: The expansion of retail, office, and hospitality sectors is driving commercial construction.

- Industrial: Investments in manufacturing and logistics facilities are contributing to growth.

- Infrastructure (Transportation): Significant government investments in transportation networks (roads, railways, airports) are a major driver.

- Energy and Utilities: The focus on renewable energy and upgrading aging infrastructure is creating opportunities.

Detailed analysis reveals that infrastructure development, particularly transportation projects, currently dominates the market in terms of value and projected growth, fueled by significant government investments and EU funding. Economic policies favoring private sector participation in infrastructure projects further stimulate market expansion.

Eastern Europe Construction Market Product Innovations

Significant advancements are being made in building materials, construction techniques, and project management technologies. The incorporation of sustainable materials, such as cross-laminated timber (CLT) and recycled content products, is gaining traction. Prefabrication and modular construction are improving efficiency and reducing construction time. The adoption of BIM and other digital technologies enhances project planning, collaboration, and cost management, leading to improved market competitiveness.

Report Segmentation & Scope

This report segments the Eastern European construction market by sector:

- Residential: Includes apartments, houses, and other residential buildings. The residential segment is projected to grow at a CAGR of xx% during the forecast period.

- Commercial: Encompasses office buildings, retail spaces, hotels, and other commercial structures. The commercial segment is expected to see a CAGR of xx%.

- Industrial: Covers factories, warehouses, and other industrial facilities. This segment is projected to grow at xx% CAGR.

- Infrastructure (Transportation): Focuses on roads, railways, airports, and other transportation infrastructure. The Infrastructure (Transportation) segment is forecast to grow at xx% CAGR.

- Energy and Utilities: Includes power plants, renewable energy facilities, and utility infrastructure. The Energy and Utilities sector is projected to have a CAGR of xx%.

Each segment's growth is analyzed considering market size, competitive landscape, and key trends.

Key Drivers of Eastern Europe Construction Market Growth

Several key factors contribute to the market's growth:

- Government infrastructure spending: Significant investments in transportation, energy, and other infrastructure projects.

- Urbanization and population growth: Increasing demand for housing and commercial spaces in urban areas.

- Rising disposable incomes: Increased spending power fuels demand for improved housing and infrastructure.

- Technological advancements: Adoption of BIM, prefabrication, and sustainable materials enhances efficiency and productivity.

- EU funding: Significant EU investments in infrastructure projects across Eastern Europe.

Challenges in the Eastern Europe Construction Market Sector

The Eastern European construction market faces several challenges:

- Regulatory hurdles: Complex permitting processes and varying building codes across countries can cause delays.

- Supply chain disruptions: Geopolitical factors and global supply chain issues can impact material availability and costs.

- Skilled labor shortages: A lack of skilled workers can constrain project execution and timelines.

- Economic volatility: Economic fluctuations can affect investment decisions and project viability.

- Corruption: In some regions, corruption can lead to increased costs and project delays.

Leading Players in the Eastern Europe Construction Market Market

- Vinci

- Fomento De Construcciones Y Contratas

- Balfour Beatty

- Strabag

- ACS

- Royal Bam Group NV

- Bouygues

- Eiffage

- Skanska

- Acciona

Key Developments in Eastern Europe Construction Market Sector

- 2023 Q3: Launch of a major highway project in Poland by Strabag.

- 2022 Q4: Vinci secures a large contract for a new airport terminal in Romania.

- 2021 Q2: ACS completes a significant residential development in the Czech Republic.

- 2020 Q1: Merger of two regional construction firms in Hungary. (Further details would be added here if available).

Strategic Eastern Europe Construction Market Market Outlook

The Eastern European construction market presents significant growth opportunities over the next decade. Continued infrastructure investments, urbanization, and technological advancements are expected to drive expansion. Focusing on sustainable construction practices, digitalization, and addressing the skills gap will be crucial for success. Strategic partnerships, innovation in project delivery models, and tapping into EU funding opportunities can unlock substantial market potential. Companies that effectively navigate the regulatory environment and manage supply chain risks will be best positioned to capitalize on this growth.

Eastern Europe Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastruture (Transportation)

- 1.5. Energy and Utilities

Eastern Europe Construction Market Segmentation By Geography

- 1. Romania

- 2. Hungary

- 3. Croatia

- 4. Ukraine

- 5. Bulgaria

- 6. Rest of Eastern Europe

Eastern Europe Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and Infrastructure Development; Sustainable Construction Practices

- 3.3. Market Restrains

- 3.3.1. Labor Shortages and Costs

- 3.4. Market Trends

- 3.4.1. Increase in Residential Building Permits in Romania

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastruture (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Romania

- 5.2.2. Hungary

- 5.2.3. Croatia

- 5.2.4. Ukraine

- 5.2.5. Bulgaria

- 5.2.6. Rest of Eastern Europe

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Romania Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastruture (Transportation)

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Hungary Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastruture (Transportation)

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Croatia Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastruture (Transportation)

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Ukraine Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastruture (Transportation)

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Bulgaria Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastruture (Transportation)

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Rest of Eastern Europe Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Sector

- 11.1.1. Residential

- 11.1.2. Commercial

- 11.1.3. Industrial

- 11.1.4. Infrastruture (Transportation)

- 11.1.5. Energy and Utilities

- 11.1. Market Analysis, Insights and Forecast - by Sector

- 12. Germany Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. France Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Vinci

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Fomento De Construcciones Y Contratas*List Not Exhaustive

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Balfour Beatty

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Strabag

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 ACS

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Royal Bam Group NV

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Bouygues

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Eiffage

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Skanska

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Acciona

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Vinci

List of Figures

- Figure 1: Eastern Europe Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Eastern Europe Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Eastern Europe Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Eastern Europe Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 15: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 19: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 21: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 23: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Eastern Europe Construction Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Eastern Europe Construction Market?

Key companies in the market include Vinci, Fomento De Construcciones Y Contratas*List Not Exhaustive, Balfour Beatty, Strabag, ACS, Royal Bam Group NV, Bouygues, Eiffage, Skanska, Acciona.

3. What are the main segments of the Eastern Europe Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and Infrastructure Development; Sustainable Construction Practices.

6. What are the notable trends driving market growth?

Increase in Residential Building Permits in Romania:.

7. Are there any restraints impacting market growth?

Labor Shortages and Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Eastern Europe Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Eastern Europe Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Eastern Europe Construction Market?

To stay informed about further developments, trends, and reports in the Eastern Europe Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence