Key Insights

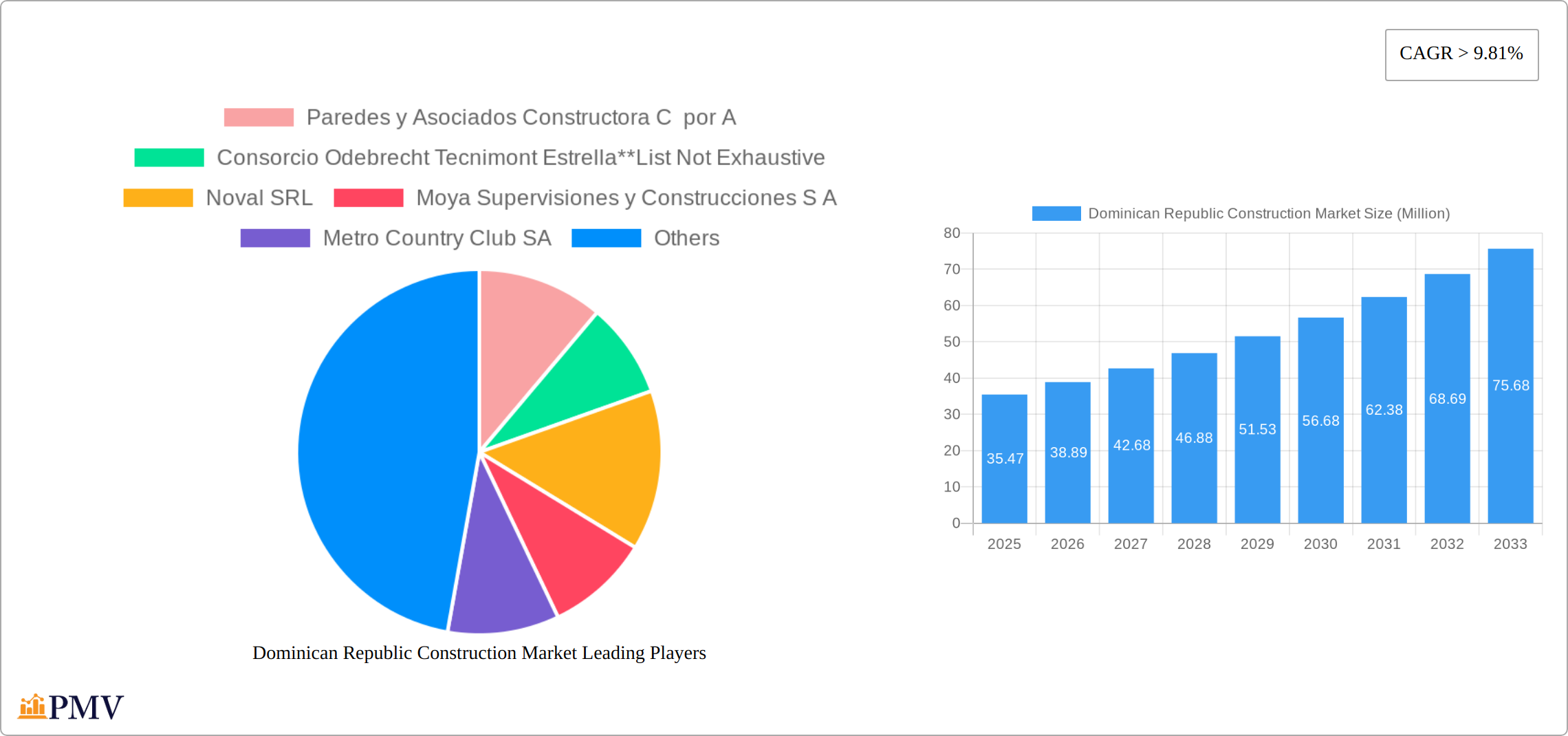

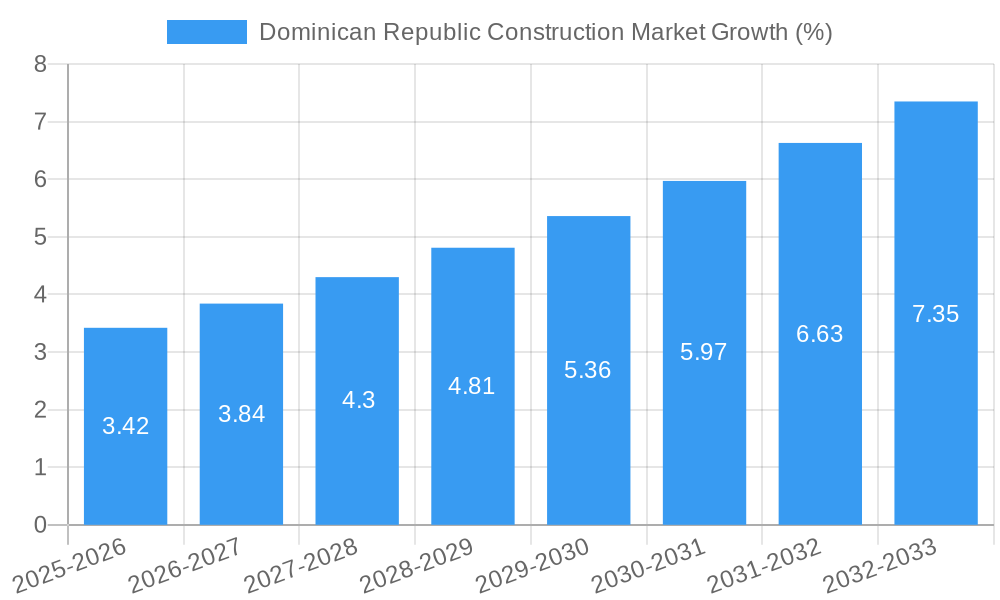

The Dominican Republic construction market, valued at $35.47 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 9.81% from 2025 to 2033. This dynamic market is driven by several factors, including sustained growth in tourism, increasing urbanization, and government initiatives focused on infrastructure development. The residential sector is a significant contributor, fueled by population growth and rising demand for housing. Commercial construction, encompassing office spaces, retail outlets, and hospitality projects, also demonstrates strong momentum, aligning with the tourism sector's expansion. Furthermore, the industrial and infrastructure sectors, particularly transportation networks and energy projects, are anticipated to contribute significantly to market expansion over the forecast period. Key players like Paredes y Asociados Constructora C por A and Consorcio Odebrecht Tecnimont Estrella, among others, are actively shaping the market landscape. However, challenges such as fluctuations in material costs and economic volatility might pose potential restraints to this otherwise positive outlook.

The market segmentation reveals a diverse landscape, with residential construction likely holding the largest market share, followed by commercial and infrastructure projects. Growth will be influenced by government policies related to construction regulations, environmental considerations, and the availability of skilled labor. The ongoing tourism boom in the Dominican Republic will act as a sustained catalyst for new construction projects, pushing the growth trajectory upward. Continuous monitoring of economic indicators and infrastructure development plans will provide further insight into this dynamic market's future performance. Specific data on individual segment sizes and market shares within the sectors requires further market research, but the overall trend remains strongly positive.

Dominican Republic Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Dominican Republic construction market, covering the period 2019-2033, with a focus on market size, segmentation, competitive landscape, and future growth prospects. The report offers actionable insights for investors, industry professionals, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The base year for this analysis is 2025, with estimations extending to 2033.

Dominican Republic Construction Market Market Structure & Competitive Dynamics

The Dominican Republic construction market exhibits a moderately concentrated structure, with several large players alongside numerous smaller firms. Market share is currently distributed amongst these players, with the top five companies holding an estimated xx% of the market in 2025. Innovation within the sector is primarily driven by the adoption of advanced technologies in construction management and materials, alongside government initiatives promoting sustainable building practices. The regulatory framework, while generally supportive of growth, faces ongoing challenges regarding permitting processes and bureaucratic efficiency. Product substitutes, particularly in materials, are increasingly competitive, placing pressure on pricing strategies. End-user demand is diverse, encompassing residential, commercial, industrial, and infrastructure projects, with significant fluctuations based on economic conditions. M&A activity in the sector has been moderate in recent years, with deal values averaging around USD xx Million annually. Significant transactions include (but are not limited to) consolidations within the residential and infrastructure segments.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025).

- Innovation: Focused on technology adoption (BIM, advanced materials) and sustainable construction.

- Regulatory Framework: Supportive but faces challenges related to permitting and bureaucratic efficiency.

- M&A Activity: Moderate, with average annual deal values around USD xx Million.

Dominican Republic Construction Market Industry Trends & Insights

The Dominican Republic construction market is experiencing robust growth, driven by sustained economic expansion, increasing urbanization, tourism development, and government investments in infrastructure. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Key market drivers include rising disposable incomes leading to increased demand for housing and commercial spaces, tourism-related construction projects, and the government's focus on improving infrastructure, including transportation networks and energy facilities. Technological disruptions, such as the wider adoption of Building Information Modeling (BIM) and prefabrication techniques, are gradually transforming construction practices and enhancing efficiency. Consumer preferences are shifting towards sustainable and energy-efficient buildings, creating opportunities for companies specializing in green construction technologies. Competitive dynamics are shaped by pricing pressures, the availability of skilled labor, and access to financing. Market penetration of sustainable building materials is currently estimated at xx% and projected to increase to xx% by 2033.

Dominant Markets & Segments in Dominican Republic Construction Market

The Dominican Republic construction market is witnessing significant growth across various segments. While all sectors contribute substantially, the Infrastructure (Transportation) sector holds a dominant position, driven by substantial government investment in road networks, port facilities, and other crucial infrastructure projects. This sector's dominance is further reinforced by significant public-private partnerships (PPPs) such as the Ámbar divided highway project. The residential sector also demonstrates significant growth, fueled by an expanding middle class and a growing demand for affordable and upscale housing.

- Infrastructure (Transportation):

- Key Drivers: Government investment, PPP initiatives (e.g., Ámbar divided highway), tourism development.

- Dominance Analysis: Highest market share due to large-scale government projects. Significant contribution from ongoing road expansion and modernization projects across the country.

- Residential:

- Key Drivers: Rising middle class, increased urbanization, demand for affordable and luxury housing.

- Dominance Analysis: Consistent demand driven by population growth and economic development. Focus on suburban development and high-rise construction in urban areas.

- Commercial:

- Key Drivers: Growth in tourism, business process outsourcing (BPO) sector, and rising retail activity.

- Dominance Analysis: Growth in office spaces, shopping malls, and hotels related to tourism expansion.

- Industrial:

- Key Drivers: Foreign direct investment, manufacturing sector expansion, and the development of industrial parks.

- Dominance Analysis: Growth primarily driven by manufacturing and logistics sector expansion.

- Energy and Utilities:

- Key Drivers: Government initiatives to improve energy infrastructure and increase energy security.

- Dominance Analysis: Relatively smaller market size but significant growth potential due to government investment in renewable energy projects.

Dominican Republic Construction Market Product Innovations

Recent product innovations in the Dominican Republic construction market encompass the adoption of prefabricated building components, advanced construction materials (e.g., high-performance concrete), and Building Information Modeling (BIM) software for improved project management. These advancements enhance efficiency, reduce construction time, and improve overall building quality. The market is also witnessing increased use of sustainable building materials and techniques, aligning with global trends toward environmentally responsible construction. These innovations are improving competitiveness by reducing costs, improving project delivery, and providing enhanced building performance.

Report Segmentation & Scope

This report segments the Dominican Republic construction market by sector: Residential, Commercial, Industrial, Infrastructure (Transportation), and Energy and Utilities. Each segment's analysis includes historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). Market size, growth projections, and competitive dynamics are analyzed for each segment, providing a comprehensive overview of the market's structure and trends. The Infrastructure segment is currently the largest and fastest growing due to significant government investment, while the residential sector shows steady growth driven by increasing urbanization and rising disposable income. The Commercial sector exhibits moderate growth tied to tourism and business expansion. Industrial and Energy & Utilities segments have growth potential tied to government initiatives and foreign investment.

Key Drivers of Dominican Republic Construction Market Growth

The Dominican Republic construction market's growth is propelled by several key factors:

- Strong Economic Growth: Sustained economic expansion fuels increased investment in infrastructure and real estate.

- Government Investment: Significant public spending on infrastructure projects drives market expansion.

- Tourism Development: Expansion of the tourism sector creates demand for hotels, resorts, and related infrastructure.

- Urbanization: Rising urbanization leads to increased demand for housing and commercial spaces.

- Technological Advancements: Adoption of innovative construction techniques and materials enhances efficiency and productivity.

Challenges in the Dominican Republic Construction Market Sector

The Dominican Republic construction market faces several challenges:

- Regulatory Hurdles: Bureaucratic processes and permitting delays can impede project timelines and increase costs. This impacts project delivery timelines and potentially discourages foreign investments.

- Supply Chain Issues: Fluctuations in material prices and availability can affect project budgets and schedules. Import-related issues lead to unpredictable pricing and supply consistency, impacting project planning.

- Skilled Labor Shortages: A shortage of skilled labor can limit project capacity and increase labor costs. This affects project timelines and increases overall costs.

- Competitive Pressures: Intense competition among construction firms can lead to price wars and reduced profit margins.

Leading Players in the Dominican Republic Construction Market Market

- Paredes y Asociados Constructora C por A

- Consorcio Odebrecht Tecnimont Estrella

- Noval SRL

- Moya Supervisiones y Construcciones S A

- Metro Country Club SA

- Constructora Rizek y Asociados SRL

- Abi Karram Morilla Ingenieros Arquitectos S A

- Constructora Samredo S A

- Therrestra SAS

- Contratistas Civiles y Mecanicos SA

Key Developments in Dominican Republic Construction Market Sector

- August 2023: Guyana and the Dominican Republic signed a MoU to explore building a 50,000 bpd refinery, potentially involving significant Dominican Republic government investment. This indicates a potential influx of future projects and opportunities in the energy sector.

- May 2023: The DGAPP launched the USD 391 Million Ámbar divided highway project, highlighting substantial investment in infrastructure and creating opportunities for construction companies. This is a substantial infrastructure project expected to stimulate further development in the region.

- March 2023: Cemento PANAM’s 1.23 Mt/yr grinding plant project, awarded to Sinoma Construction, signifies growth in the industrial sector and signals investment in the cement industry. This project showcases the international interest and investment in the Dominican Republic’s industrial growth.

Strategic Dominican Republic Construction Market Market Outlook

The Dominican Republic construction market presents significant long-term growth potential. Continued economic expansion, government infrastructure investments, and private sector development will drive demand across all market segments. Opportunities exist for companies specializing in sustainable construction, prefabrication, and advanced construction technologies. Strategic partnerships with government agencies and private investors will be crucial for success in this dynamic market. The increasing focus on sustainable and resilient infrastructure projects will also provide lucrative avenues for innovation and investment.

Dominican Republic Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

Dominican Republic Construction Market Segmentation By Geography

- 1. Dominica

Dominican Republic Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Rise in commercial construction projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Dominican Republic Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Dominica

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Paredes y Asociados Constructora C por A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Consorcio Odebrecht Tecnimont Estrella**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Noval SRL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Moya Supervisiones y Construcciones S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metro Country Club SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constructora Rizek y Asociados SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abi Karram Morilla Ingenieros Arquitectos S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Constructora Samredo S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Therrestra SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Contratistas Civiles y Mecanicos SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Paredes y Asociados Constructora C por A

List of Figures

- Figure 1: Dominican Republic Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Dominican Republic Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Dominican Republic Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Dominican Republic Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Dominican Republic Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Dominican Republic Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Dominican Republic Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Dominican Republic Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dominican Republic Construction Market?

The projected CAGR is approximately > 9.81%.

2. Which companies are prominent players in the Dominican Republic Construction Market?

Key companies in the market include Paredes y Asociados Constructora C por A, Consorcio Odebrecht Tecnimont Estrella**List Not Exhaustive, Noval SRL, Moya Supervisiones y Construcciones S A, Metro Country Club SA, Constructora Rizek y Asociados SRL, Abi Karram Morilla Ingenieros Arquitectos S A, Constructora Samredo S A, Therrestra SAS, Contratistas Civiles y Mecanicos SA.

3. What are the main segments of the Dominican Republic Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Rise in commercial construction projects.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

August 2023: Guyana signed a memorandum of understanding (MoU) with the Dominican Republic to explore the construction of a 50,000 barrel per day (bpd) refinery in Guyana. As per the terms of the agreement, the Dominican Republic Government could own at least a 51% stake in the refinery project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dominican Republic Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dominican Republic Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dominican Republic Construction Market?

To stay informed about further developments, trends, and reports in the Dominican Republic Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence