Key Insights

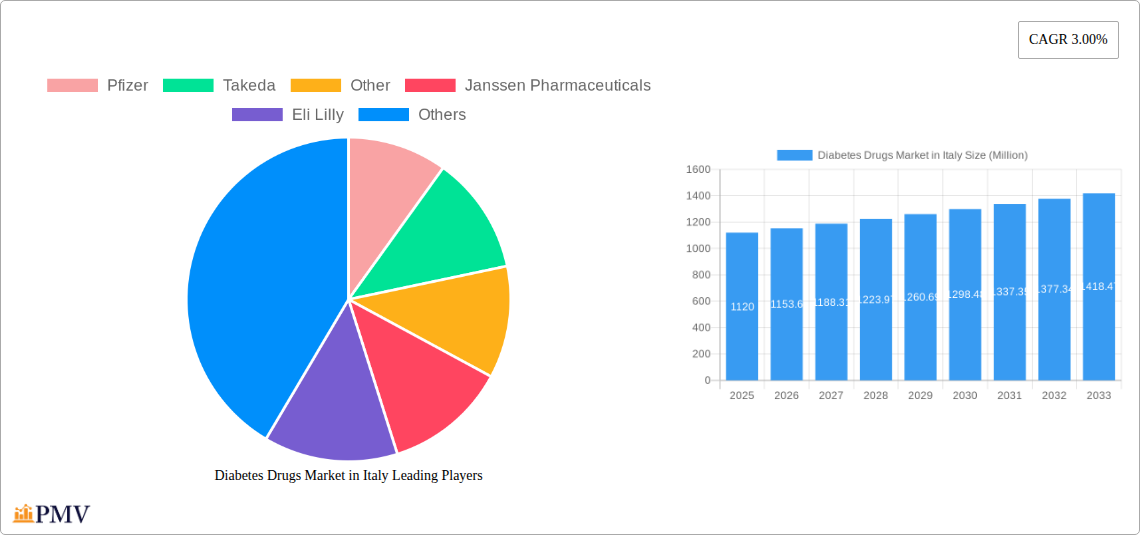

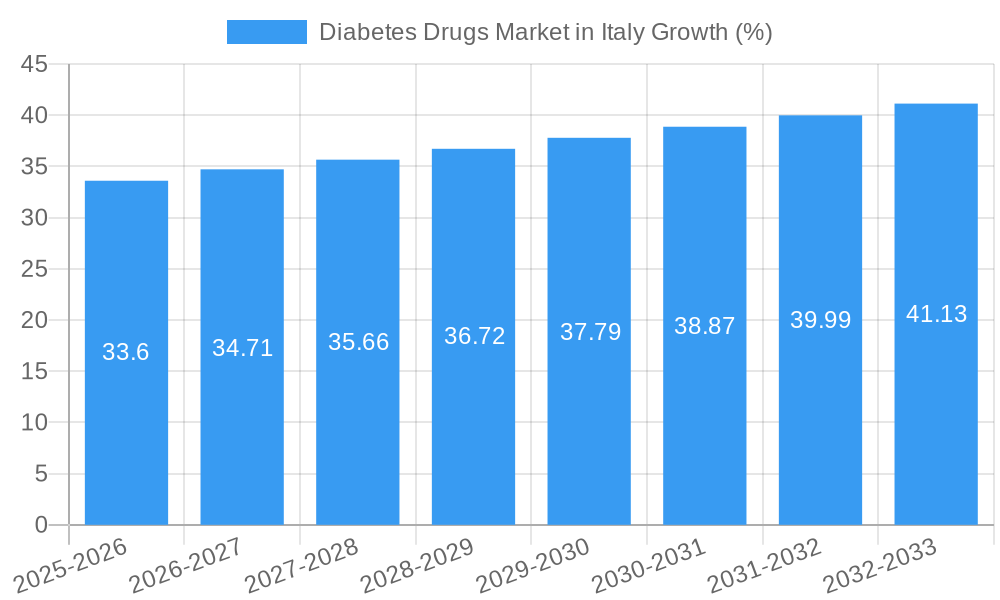

The Italian diabetes drugs market, valued at €1.12 billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.00% from 2025 to 2033. This growth is fueled by several key factors. The rising prevalence of diabetes in Italy, driven by an aging population and increasing lifestyle-related diseases like obesity and sedentary lifestyles, significantly contributes to market expansion. Furthermore, advancements in diabetes treatment, including the development of newer and more effective drugs such as GLP-1 receptor agonists and SGLT-2 inhibitors, are driving increased adoption and higher market value. The market is segmented across various drug classes, with insulin (including biosimilars and various formulations like basal, bolus, and combinations) holding a substantial share, followed by oral anti-diabetic drugs such as metformin, sulfonylureas, and DPP-4 inhibitors. Competition is intense, with major pharmaceutical players like Novo Nordisk, Sanofi Aventis, Eli Lilly, and AstraZeneca vying for market dominance. The increasing focus on personalized medicine and improved access to advanced treatments further shapes the market landscape. However, factors like pricing pressures from generics and reimbursement challenges could pose some constraints on market growth. The market’s future hinges on the continued success of innovative therapies, the effectiveness of public health initiatives aiming to manage diabetes prevalence, and the regulatory environment surrounding drug pricing and accessibility.

The Italian market is characterized by a mature pharmaceutical landscape with established distribution networks. However, future market dynamics will depend on factors like the continued success of newer drug classes, the effectiveness of government healthcare initiatives to manage the diabetic population, and the evolving reimbursement policies. The increasing demand for convenient treatment options like once-weekly injections and innovative combination therapies is also expected to shape the market's trajectory. Companies are strategically focusing on expanding their product portfolios, securing favorable reimbursement agreements, and investing in research and development to maintain a competitive edge. The growth trajectory is expected to remain positive, although the CAGR may fluctuate slightly depending on the evolving regulatory landscape and the success of novel therapies in clinical trials. Growth will likely be more pronounced in segments offering improved efficacy, convenience, and reduced side effects compared to older treatment options.

Diabetes Drugs Market in Italy: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Diabetes Drugs Market in Italy, covering market size, segmentation, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period extends from 2025 to 2033, encompassing historical data from 2019 to 2024. This report is crucial for industry stakeholders, investors, and researchers seeking actionable insights into this dynamic market.

Diabetes Drugs Market in Italy Market Structure & Competitive Dynamics

The Italian diabetes drugs market exhibits a moderately concentrated structure, dominated by multinational pharmaceutical giants. Key players such as Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Merck & Co, AstraZeneca, Sanofi Aventis, Bristol Myers Squibb, Novo Nordisk A/S, Boehringer Ingelheim, and Astellas compete intensely, driving innovation and shaping market dynamics. Market share analysis reveals that Pfizer and Novo Nordisk A/S hold significant portions, with Pfizer holding approximately xx% and Novo Nordisk holding approximately xx%. The "Other" category encompasses numerous smaller players and generic drug manufacturers contributing to the overall market competitiveness.

The Italian regulatory framework, while stringent, encourages innovation through streamlined approval processes for novel therapies. This framework, coupled with a growing diabetic population and increasing healthcare expenditure, fuels market expansion. The market is characterized by ongoing M&A activity, reflecting strategic consolidation and diversification efforts by leading players. Recent deals have involved xx Million in value, primarily focusing on enhancing product portfolios and expanding market reach. The presence of biosimilar insulin, driving down prices, adds to the intensity of the competition. The market also faces challenges from the potential entry of new generic drugs and the emergence of innovative treatment modalities. The increasing demand for advanced therapies alongside the stringent regulatory landscape encourages investment in research and development creating a dynamic innovation ecosystem.

- Market Concentration: Moderately concentrated, with major players holding significant shares.

- Innovation Ecosystem: Active R&D, driven by regulatory incentives and unmet needs.

- Regulatory Framework: Stringent but supportive of innovation.

- Product Substitutes: Biosimilars exert competitive pressure.

- End-User Trends: Growing preference for convenient and effective therapies.

- M&A Activity: Ongoing consolidation among market leaders (Recent deals valued at xx Million).

Diabetes Drugs Market in Italy Industry Trends & Insights

The Italian diabetes drugs market is experiencing robust growth, driven by several factors. The rising prevalence of type 1 and type 2 diabetes, fueled by lifestyle changes and an aging population, is a major catalyst. This trend is further accelerated by increased awareness of the disease and improved diagnosis rates. The market is expected to witness a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is strongly influenced by technological advancements in diabetes management, including the introduction of innovative drug delivery systems and the development of novel therapeutic agents. Consumer preferences are shifting toward more convenient therapies, with a growing demand for oral medications and once-weekly or monthly injectables. The market penetration of GLP-1 receptor agonists and SGLT-2 inhibitors has been remarkably high, showcasing their effectiveness and patient acceptance. Competitive dynamics are characterized by continuous innovation, strategic partnerships, and the entrance of biosimilar insulins, leading to price reductions and increased accessibility of diabetes medication.

The rising prevalence of comorbidities associated with diabetes, such as cardiovascular diseases and kidney failure, further boosts market demand for medications that address these complications. Government initiatives promoting diabetes prevention and management programs also positively contribute to market growth. The increasing adoption of telemedicine and remote patient monitoring technologies enhances treatment adherence and improves patient outcomes. The growing demand for patient-centric treatment approaches also encourages innovation in drug delivery systems and medication management technologies. Market penetration of innovative insulin analogs remains high, surpassing xx% in 2024.

Dominant Markets & Segments in Diabetes Drugs Market in Italy

The Italian diabetes drugs market is geographically concentrated across the country, with no single region dominating significantly. However, regions with higher population density and prevalence of diabetes are likely to show stronger demand. Among the various segments, the following demonstrate significant dominance:

Insulins: The insulin segment, including basal/long-acting (Basaglar, Tresiba), bolus/fast-acting (Apidra), and biosimilar insulins (Insuman), holds a substantial market share, driven by the high prevalence of type 1 diabetes and the increasing number of patients with type 2 diabetes requiring insulin therapy. The biosimilar insulin market is growing rapidly due to lower costs.

SGLT-2 Inhibitors: This segment, exemplified by drugs like Suglat (Ipragliflozin) and Jardiance (Empagliflozin), has witnessed remarkable growth, owing to their efficacy in both glycemic control and cardiovascular risk reduction. The market expansion is driven by the approval for use in children and heart failure.

GLP-1 Receptor Agonists: This segment, including drugs like Lyxumia (Lixisenatide) and Xultophy (Insulin Degludec and Liraglutide), is gaining momentum due to its effectiveness in weight management and improved cardiovascular outcomes, increasing patient preference.

DPP-4 Inhibitors: This segment, illustrated by Galvus (Vildagliptin), maintains a stable market presence.

Other segments including Oral Anti-diabetic drugs (Metformin, Biguanides, Sulfonylureas, Meglitinides), Combination drugs, and Non-Insulin Injectable drugs, holds considerable market share but with varying levels of growth and competition within each segment. Metformin, the cornerstone of type 2 diabetes treatment, remains prevalent, while the use of Sulfonylureas and Alpha-Glucosidase inhibitors has declined slightly.

Key Drivers: The economic policies supporting healthcare access and the country's healthcare infrastructure play significant roles in influencing market growth. The Italian government's initiatives promoting diabetes prevention and management are crucial drivers of this growth.

Diabetes Drugs Market in Italy Product Innovations

The Italian diabetes drugs market witnesses continuous innovation in drug delivery systems, formulations, and therapeutic mechanisms. Technological advancements focus on improving patient convenience, such as once-weekly or monthly injections and improved oral formulations. This aligns perfectly with the market's growing demand for convenient and effective therapies. The market is witnessing a rise in combination therapies, aiming to offer improved glycemic control and address comorbidities.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Italian diabetes drugs market, categorized as follows:

Insulins: Basal/Long-Acting, Bolus/Fast-Acting, Biosimilar Insulins, with projections for each. Competition is fierce within biosimilars, while innovation continues in the long and fast acting insulins. Market sizes are estimated at xx Million for each sub-segment in 2025.

Oral Anti-diabetic drugs: Biguanides (Metformin), Sulfonylureas, Meglitinides, with different growth trajectories reflecting their usage and newer alternatives. Market sizes are estimated at xx Million for each sub-segment in 2025.

SGLT-2 Inhibitors: A fast-growing segment with significant market size projections for 2025.

DPP-4 Inhibitors: A moderately growing segment maintaining a significant presence. Market size in 2025 is predicted to be xx Million.

Combination drugs: Insulin Combinations and Oral Combinations. Market sizes for each are projected at xx Million and xx Million respectively in 2025.

Non-Insulin Injectable drugs: GLP-1 Receptor Agonists, Amylin Analogues, each with distinct growth potential and market sizes estimated at xx Million and xx Million in 2025, respectively.

Key Drivers of Diabetes Drugs Market in Italy Growth

The Italian diabetes drugs market growth is fueled by several key factors. The increasing prevalence of diabetes, driven by lifestyle changes and an aging population, forms the core driver. Technological advancements in drug delivery systems and novel therapeutic agents contribute significantly. Government initiatives promoting diabetes prevention and management programs, alongside rising healthcare expenditure, further enhance market expansion.

Challenges in the Diabetes Drugs Market in Italy Sector

The Italian diabetes drugs market faces challenges like stringent regulatory pathways, potentially delaying new product launches. Supply chain disruptions and fluctuating raw material prices can impact drug availability and pricing. The intense competition among established players and the emergence of biosimilars put pressure on profitability. Pricing pressures from government regulations and healthcare reimbursement policies remain significant obstacles.

Leading Players in the Diabetes Drugs Market in Italy Market

- Pfizer

- Takeda

- Other

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- Merck and Co

- AstraZeneca

- Sanofi Aventis

- Bristol Myers Squibb

- Novo Nordisk A/S

- Boehringer Ingelheim

- Sanofi Aventis

- Astellas

Key Developments in Diabetes Drugs Market in Italy Sector

December 2023: Boehringer Ingelheim and Eli Lilly received EC approval for Jardiance® (empagliflozin) in children aged 10+, expanding its market reach and potential.

March 2022: Eli Lilly and Boehringer Ingelheim gained EU approval for Jardiance (empagliflozin) for heart failure, significantly broadening its application and market value.

February 2022: Bayer received EU marketing authorization for Kerendia (finerenone) to treat chronic kidney disease in adults with type 2 diabetes, creating a new treatment option.

Strategic Diabetes Drugs Market in Italy Market Outlook

The Italian diabetes drugs market holds significant future potential, driven by the persistent rise in diabetes prevalence and continuous advancements in treatment modalities. Strategic opportunities exist in developing innovative combination therapies, personalized medicine approaches, and improving patient access to advanced therapies. Focusing on convenient drug delivery systems and addressing the unmet needs of the growing diabetic population will be key to success. The market is poised for substantial growth, with potential for further consolidation and strategic partnerships.

Diabetes Drugs Market in Italy Segmentation

-

1. Drug Class

- 1.1. Insulins

- 1.2. Oral Anti-diabetic Drugs

- 1.3. Non-Insulin Injectable Drugs

- 1.4. Combination Drugs

Diabetes Drugs Market in Italy Segmentation By Geography

- 1. Italy

Diabetes Drugs Market in Italy REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Oral anti-diabetic drugs are expected to register highest growth rate in the Italy Diabetes Drugs Market over the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Diabetes Drugs Market in Italy Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Insulins

- 5.1.2. Oral Anti-diabetic Drugs

- 5.1.3. Non-Insulin Injectable Drugs

- 5.1.4. Combination Drugs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Pfizer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Takeda

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Other

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Merck and Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AstraZeneca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sanofi Aventis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bristol Myers Squibb

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novo Nordisk A/S

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Boehringer Ingelheim

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sanofi Aventis

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Astellas

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Pfizer

List of Figures

- Figure 1: Diabetes Drugs Market in Italy Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Diabetes Drugs Market in Italy Share (%) by Company 2024

List of Tables

- Table 1: Diabetes Drugs Market in Italy Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Diabetes Drugs Market in Italy Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 3: Diabetes Drugs Market in Italy Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Diabetes Drugs Market in Italy Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Diabetes Drugs Market in Italy Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 6: Diabetes Drugs Market in Italy Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diabetes Drugs Market in Italy?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Diabetes Drugs Market in Italy?

Key companies in the market include Pfizer, Takeda, Other, Janssen Pharmaceuticals, Eli Lilly, Novartis, Merck and Co, AstraZeneca, Sanofi Aventis, Bristol Myers Squibb, Novo Nordisk A/S, Boehringer Ingelheim, Sanofi Aventis, Astellas.

3. What are the main segments of the Diabetes Drugs Market in Italy?

The market segments include Drug Class .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.12 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Oral anti-diabetic drugs are expected to register highest growth rate in the Italy Diabetes Drugs Market over the forecast period.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

December 2023: Boehringer Ingelheim and Eli Lilly have received approval from the European Commission (EC) for Jardiance® (empagliflozin) 10mg and 25mg tablets in children aged 10 years and above for the treatment of insufficiently controlled type 2 diabetes mellitus (T2D) as an adjunct to diet and exercise

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diabetes Drugs Market in Italy," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diabetes Drugs Market in Italy report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diabetes Drugs Market in Italy?

To stay informed about further developments, trends, and reports in the Diabetes Drugs Market in Italy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence